Rewards Plan

Welcome Bonus

Our Rating

0% Intro

Annual Fee

APR

- Automatic Gold Elite Status

- Free Night Award

- Annual Fee

- Low Rewards On Airline and Car Rental

Rewards Plan

Welcome Bonus

0% Intro

PROS

- Automatic Gold Elite Status

- Free Night Award

CONS

- Annual Fee

- Low Rewards On Airline and Car Rental

APR

20.24% - 29.24% Variable

Annual Fee

$250

0% Intro

N/A

Credit Requirements

Good - Excellent

- Our Verdict

- FAQ

If you frequently stay at Marriott hotels, the Marriott Bonvoy Bevy™ American Express® Card is a travel rewards credit card that could be a great fit for you. This mid-tier card offers a variety of benefits to help you earn more Marriott Bonvoy points on your stays and daily purchases.

The rewards program includes 6X points on purchases at hotels participating in Marriott Bonvoy, 4X points at restaurants worldwide (including takeout and delivery in the U.S.) and U.S. supermarkets (up to $15,000 in combined purchases per year, then 2X points), 2X points on all other purchases.

One of the top perks of the Marriott Bonvoy Bevy™ American Express® Card is automatic Gold Elite status, giving you benefits like free room upgrades, late checkouts, and 15 nights credited toward your next Marriott Bonvoy Elite status level. Plus, cardholders can earn a free night award (up to 50,000 points) every year after spending $15,000.

However, the card does have a $250 annual fee, which is quite high for some people. Additionally, it's not a real travel card since it lacks airline or car rental rewards.

How can cardholders redeem their Marriott Bonvoy points?

Points can be redeemed for award nights, VIP events through Marriott Bonvoy Moments, and transferred to partner airlines for additional benefits, such as a 1:1 match with Delta Airlines, potentially increasing the point value.

What additional benefits does the Marriott Bonvoy Bevy Card offer beyond the rewards program?

Cardholders enjoy complimentary Marriott Bonvoy Gold Elite Status, which includes perks like enhanced room upgrades and 15 Elite Night credits. Additionally, as an American Express co-branded card, it provides access to Amex perks and various travel insurances.

Does the Marriott Bonvoy Bevy Card offer a complimentary free night each year on the account anniversary?

Unlike some hotel credit cards, the Marriott Bonvoy Bevy Card lacks a complimentary free night each year on the account anniversary, which may impact its long-term value for some users.

What are the specific benefits of Marriott Gold Elite Status offered by the Marriott Bonvoy Bevy Card?

Gold Elite Status includes perks like complimentary in-room Wi-Fi, exclusive member rates, enhanced room upgrades, and additional benefits such as 15 Elite Night credits and a Free Night Award after spending $15,000 in a calendar year.

What travel protections are offered by the Marriott Bonvoy Bevy Card?

Cardholders benefit from various travel insurances, including trip delay insurance, baggage insurance, and car rental loss and damage insurance, enhancing the card's value for travelers.

In this Review

Estimating Your Rewards: A Practical Simulation

In the following table, you will find a simulation that provides an overview of the expected rewards for the Marriott Bonvoy Bevy Amex card.

This breakdown is based on both general usage and spending across various categories. By utilizing this table, you can gain a better understanding of the potential benefits that come with using this particular credit card.

It's important to note that the figures presented in this simulation are estimates, and actual rewards may vary depending on individual spending habits and other factors.

| |

|---|---|

Spend Per Category | Marriott Bonvoy Bevy™ American Express® Card |

$10,000 – U.S Supermarkets | 40,000 points |

$4,000 – Restaurants

| 16,000 points |

$5,000 – Airline | 5,000 points |

$5,000 – Hotels | 30,000 points |

$4,000 – Gas | 4,000 points |

Estimated Total Annual Points | 95,000 points |

Pros and Cons

Just like any other credit card, the Marriott Bonvoy Bevy™ has some advantages and disadvantages:

Pros | Cons |

|---|---|

Generous Rewards Program | Annual Fee |

Welcome Bonus | Low Rewards On Airline and Car Rental |

No Foreign Transaction Fee | |

Automatic Gold Elite Status | |

Free Night Award | |

Travel Benefits |

- Generous Rewards Program

The card offers 6X points on purchases at hotels participating in Marriott Bonvoy, 4X points at restaurants worldwide (including takeout and delivery in the U.S.) and U.S. supermarkets (up to $15,000 in combined purchases per year, then 2X points), 2X points on all other purchases.

- Welcome Bonus

New cardholders can earn Earn 155,000 Marriott Bonvoy® bonus points after you use your new Card to make $5,000 in purchases within the first 6 months of Card Membership..

- No Foreign Transaction Fee

The card doesn't charge a fee on purchases abroad.

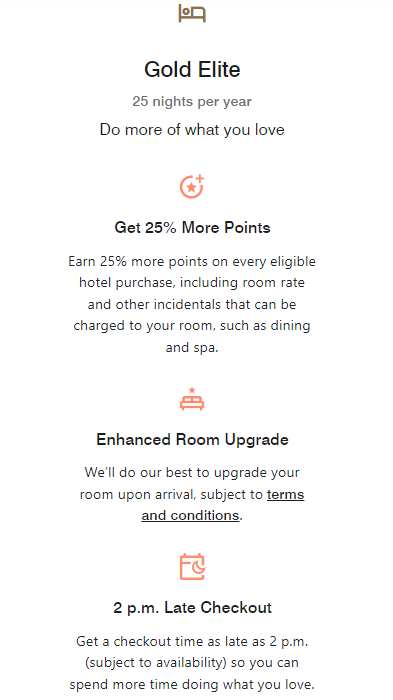

- Automatic Gold Elite Status

Cardholders receive automatic Gold Elite status, which offers perks such as enhanced room upgrade, priority late checkout, and 25% more points on every eligible hotel purchase.

- Free Night Award

Cardholders receive a free night award every year after spending $15,000 on eligible purchases, which can be redeemed at a Marriott property worth up to 50,000 points.

- Travel Benefits

The card offers travel benefits, such as car rental loss and damage insurance, baggage insurance plan, and trip delay insurance.

Editorial Note: Terms apply to American Express benefits and offers. Enrollments may be required for select benefits. Visit americanexpress.com to learn more

- Annual Fee

The card has an annual fee of $250, which may be a bit expensive for the average cardholder.

- Low Rewards On Airline and Car Rental

If you want to take advantage of this card for all of your travel needs, you should know it's missing high rewards ratio on airline, gas and car rentals.

Top Offers

Top Offers From Our Partners

Top Offers

How To Redeem My Points?

You can redeem Marriott Bonvoy Bevy™ American Express® Card points for a variety of travel-related rewards, including hotel stays, flights, car rentals, and more. Here's an overview of the different redemption options and how they stack up:

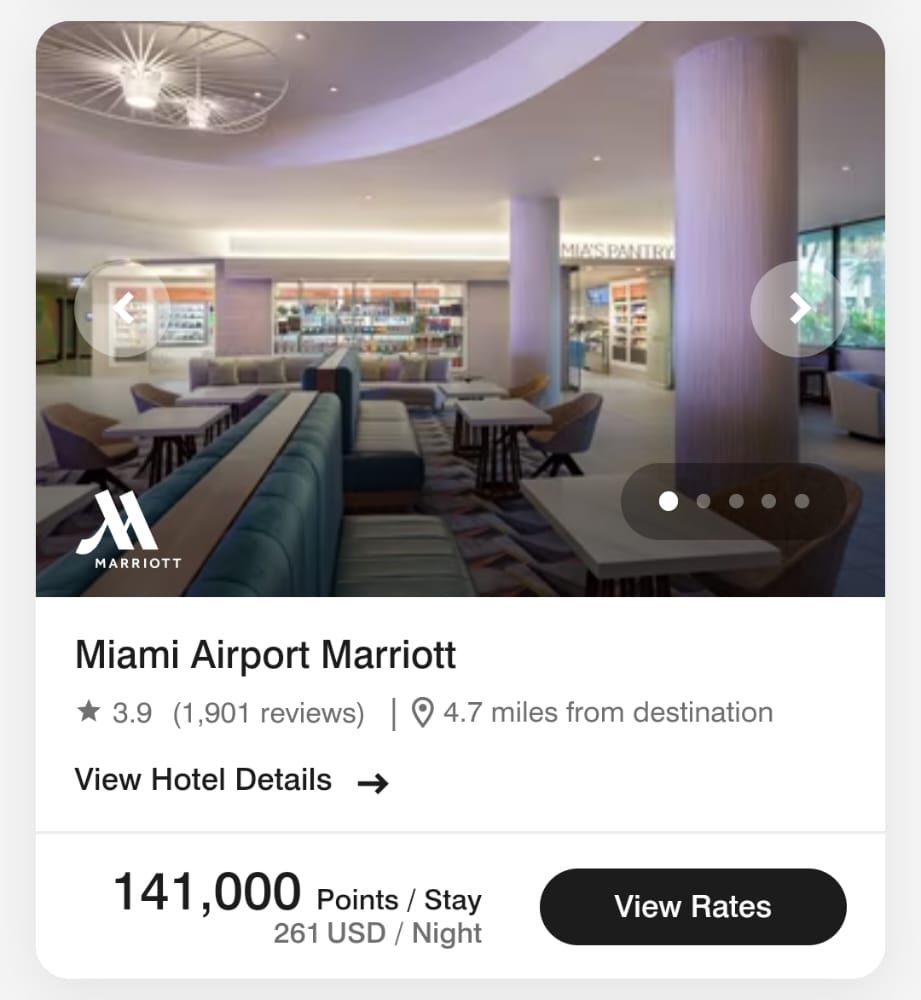

Marriot Hotel stays: You can redeem your points for free or discounted stays at participating Marriott Bonvoy hotels. The number of points required varies depending on the hotel and the time of year, but generally ranges from 5,000 to 100,000 points per night.

- Transfer points to airline: To transfer points to airline frequent flyer programs, you'll need to transfer at least 3,000 points per transaction, with a maximum of 240,000 points per day. The transfer ratio is usually 3:1, which means that you'll need 3 Marriott points for every airline mile. With such a wide range of airline partners and a favorable transfer ratio, you can put your Marriott Bonvoy points to good use by converting them into airline miles for your next trip.

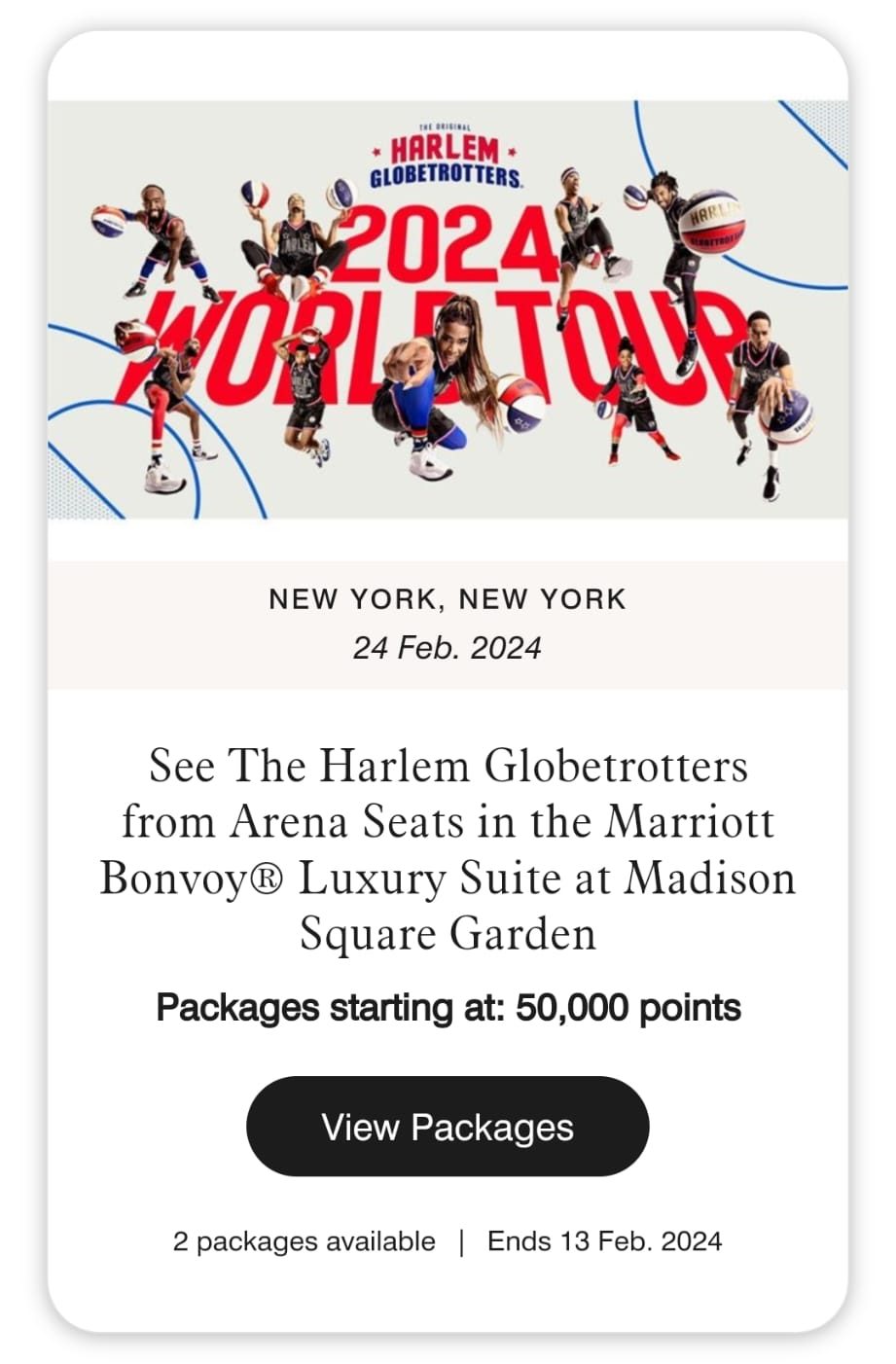

- Marriott Moments: This feature offers a range of destination-specific activities such as tours, sporting events, and culinary experiences in cities where Marriott hotels are located. By using your points to book these experiences, you can enjoy unique and exciting activities that you might not have considered otherwise

- Rent A Car: To make the most of your points and enhance your travel experience, you can use your Marriott Bonvoy points to rent a car. The search tool checks availability with major rental companies like Hertz, Thrifty, and Dollar, so you can easily compare options and find the best deal for you.

- Gift Cards: While gift cards are not the most efficient way to redeem your points, they are still an option if you need to use some of your points. Marriott Bonvoy offers gift cards for popular merchants such as Applebees, Best Buy, Bloomingdales, Macy's, Red Lobster, and Starbucks. Keep in mind that the point value for gift cards can vary, with a $10 Starbucks gift card costing 5,000 points, and larger denomination cards, such as a $100 Starbucks card costing 30,000 points.

Is this Credit Card Your Perfect Match?

The Marriott Bonvoy Bevy™ American Express® Card is a good choice for people who frequently stay at Marriott hotels and want rewards on dining and everyday spending, such as U.S. supermarkets. Here are some specific situations when you may want to consider this card:

You stay at Marriott hotels often: If you frequently stay at Marriott hotels, the Marriott Bonvoy Bevy™ American Express® Card can be a great way to earn rewards for your spending.

You want a card with everyday spending rewards: The card's rewards program allows you to earn points on U.S. supermarkets, which is quite rare for hotel cards

You want a card with automatic elite status: The Marriott Bonvoy Bevy™ American Express® Card offers automatic Marriot Gold Elite status, which includes benefits like priority late checkout, a dedicated elite reservation line, and bonus points on eligible hotel purchases.

You are willing to pay the annual fee: Unlike the Marriott Bonvoy Bold® Credit Card, this card charges a significant annual fee. While the rewards are much better, you should take it into account.

If you're not sure this is the right card for your needs, you can take a look on other cards from Marriot:

Card | Rewards | Bonus | Annual Fee | |

|---|---|---|---|---|

| 1x – 6X

6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

| 3 Free Night Awards after spending $3,000 on eligible purchases within 3 months of account opening.

Earn 3 Free Night Awards

after spending $3,000 on eligible purchases within 3 months of account opening.* Each Free Night Award valued up to 50,000 points – that's a total value of up to 150,000 points! Certain hotels have resort fees.

| $95 | |

| 2X – 6X

6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases

| 180,000 points

185,000 Marriott Bonvoy® bonus points after you use your new Card to make $6,000 in purchases within the first 6 months of Card Membership

| $650 | |

Up to 14X

3X Bonvoy points per $1 spent at over 7,000 hotels participating in Marriott Bonvoy. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. 2X Bonvoy points for every $1 spent on other travel purchases (from airfare to taxis and trains). 1X point for every $1 spent on all other purchases.

| 30,000 Bonus Points

30,000 Bonus Points after spending $1,000 on eligible purchases within the first 3 months from account opening

|

$0 | ||

| Marriott Bonvoy Bevy® American Express® Card | 2x – 6x

6X points on purchases at hotels participating in Marriott Bonvoy, 4X points at restaurants worldwide (including takeout and delivery in the U.S.) and U.S. supermarkets (up to $15,000 in combined purchases per year, then 2X points), 2X points on all other purchases

| 155,000 points

Earn 155,000 Marriott Bonvoy® bonus points after you use your new Card to make $5,000 in purchases within the first 6 months of Card Membership.

| $250 |

How To Apply For The Marriott Bonvoy Bevy™ Card?

Here's how you can apply for the Marriott Bonvoy Bevy™ American Express® Card:

Go to the American Express website: Start by visiting the Marriott Bonvoy Bevy™ American Express® Card page on the American Express website. From there, click on the “Apply Now” button to start the application process.

Fill out the application: Next, you'll be asked to provide your personal information, such as your name, address, and social security number. You'll also need to provide information about your income, employment, and housing status.

Review the terms and conditions and submit application: Before submitting your application, make sure to read through the terms and conditions of the card to ensure that it's the right fit for you. Once you've reviewed the terms and conditions and filled out the application, click on the “Submit” button to submit your application.

Activate your card: If you are approved, you will receive your Marriott Bonvoy Bevy™ American Express® Card in the mail. Once you receive your card, you will need to activate it before you can use it. Follow the instructions provided with the card to activate it.

It's worth noting that the Marriott Bonvoy Bevy™ American Express® Card is a rewards credit card that requires a good to excellent credit score for approval.

Compare Marriott Bonvoy Bevy Card

The Brilliant is more expensive than the Bevy card but offers more premium perks such as dining credit, lounge access, and TSA PreCheck.

The Marriott Bonvoy Bevy is more expensive than the Boundless. Are the extra benefits worth the difference? We don't think so. Here's why.

Both Marriott Bonvoy Bountiful and Bevy offer the same cashback rates but different hotel and travel perks. How do you decide between them?

Top Offers

Top Offers From Our Partners

Top Offers