Rewards Plan

Sign up Bonus

Credit Rating

0% Intro

Annual Fee

APR

- Lowest Regular APR

- No Balance Transfer Fee

- Lack of rewards

- Excellent Credit Is Required

Rewards Plan

Sign up Bonus

0% Intro

PROS

- Lowest Regular APR

- No Balance Transfer Fee

CONS

- Lack of rewards

- Excellent Credit Is Required

APR

15.50% - 23.50% variable

Annual Fee

None

Balance Transfer Fee

$5 or 3% (whichever is greater)

Credit Requirements

Good - Excellent

- Our Verdict

- Pros & Cons

- FAQ

The appeal of the Simmons Bank Visa Platinum Card lies entirely in its industry leading financing terms where consumers pay a 15.50% – 23.50% variable APR on credit card balances. This is a very rare interest rate since most credit cards charge 14-24% on average which can put you further behind and make paying off your debt feel like a never-ending hamster wheel.

New cardholders also get 0% intro APR for the first 12 months on balance transfers made within 60 days of account opening. However, when it comes to rewards and sign-up bonuses, the Simmons Visa card doesn’t offer much in terms of incentives. While there are some benefits, as mentioned above, the rewards program isn’t particularly standout.

Overall, the Simmons Visa credit card is meant for consumers who need low APR due to a large purchase or a debt payoff plan. The card is not recommended for consumers who want the best rewards program.

- Lowest Regular APR

- No Annual Fee

- 0% APR Introductory Rate

- Global Acceptance

- Lack of Rewards

- Balance Transfer Fee

- Excellent Credit Is Required

In This Review..

Benefits

Let’s take a closer look at the benefits and drawbacks of the Simmon’s Bank Visa Platinum Card – and whether or not it’s right for your wallet…

- Lowest Regular APR

The Simmons Bank Visa Platinum Card has a 15.50% – 23.50% variable APR which is the lowest APR available to the public for any credit card.

This makes it a great credit card for individuals who carry a monthly balance since they’ll be paying a lower interest rate monthly compared to other credit cards.

- No Annual Fee

The no annual fee will save you some money each year but it’s not that uncommon of a benefit for credit cards that focus on financing.

However, you still at least save $15 to $200 that you may have to pay as an annual fee if you went with another credit card.

- 0% APR Introductory Rate

0% Intro APR for 12 months on balance transfers completed within 60 days of account opening date.

If you have a credit card that you are trying to pay down, you can transfer the account and pay no interest on the transfer for 12 months on balance transfers made within 60 days of opening an account.

This introductory promotional rate carries a balance transfer fee of $5 or 3% (whichever is greater).

- Global Acceptance

Use your card anywhere Visa is accepted for purchases including varied network of ATMs.

Top Offers

Top Offers From Our Partners

Drawbacks

Let’s take a look at the drawbacks of the Simmons Bank Visa® Platinum and see if it’s the right one for your wallet or not.

- Lack of Rewards

If you're primarily looking for a credit card with rewards, this one may not meet your expectations, as it doesn't offer any. This is typical for credit cards that are more focused on financing.

Instead of rewards, these cards usually offer benefits like $0 balance transfer fees and lower interest rates, which can help you save money on managing monthly debt.

- Balance Transfer Fee

There is a balance transfer fee required if you want to take advantage of the introductory 12 months on balance transfers made within 60 days of opening an account. The fee is incurred when you transfer debts from one or more credit cards to your Simmons Bank Visa® Platinum Card. This fee is sc name=”balance_transfer_fee_simmons_bank_visa_platinum”].

For example, if you have a $10,000 balance then you’ll be saving $300 in transfer fees.

- Excellent Credit Is Required

The Simmons Bank Visa Platinum card will not be available to most people due to its excellent-credit approval requirement. This is ironic because most debt burdened customers who need access the most to the finance charge savings won’t be apple to qualify for this credit card.

Prior to applying, check your credit score for free to ensure you have a high score that will give you a chance at qualifying.

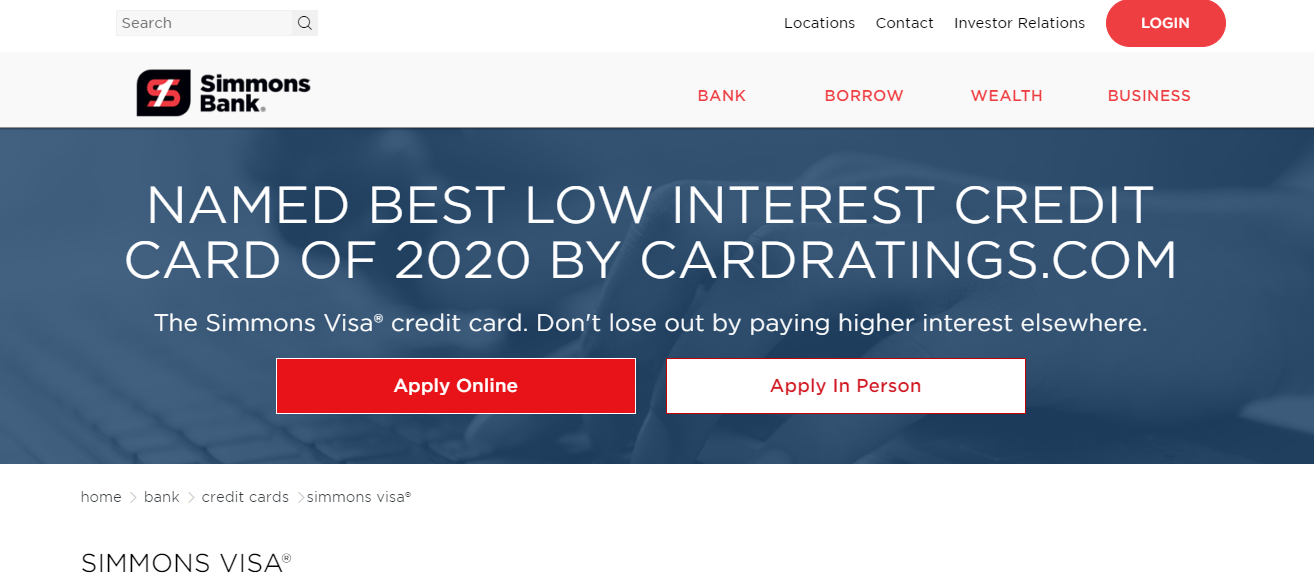

How To Apply For Simmons Bank Visa® Platinum Card?

- 1.

Visit the Simmons Bank Visa Platinum Credit Card homepage and click on “Apply Online.”

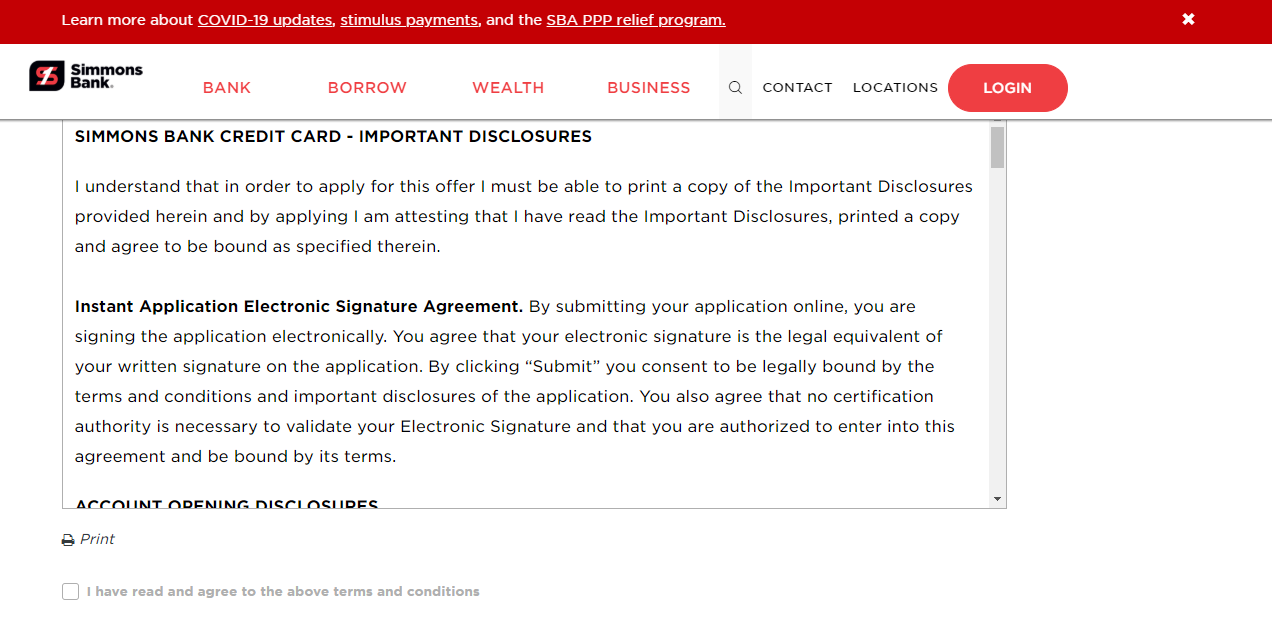

- 2.

Here comes the next page that puts you through some important disclosures; read through and understand the details.

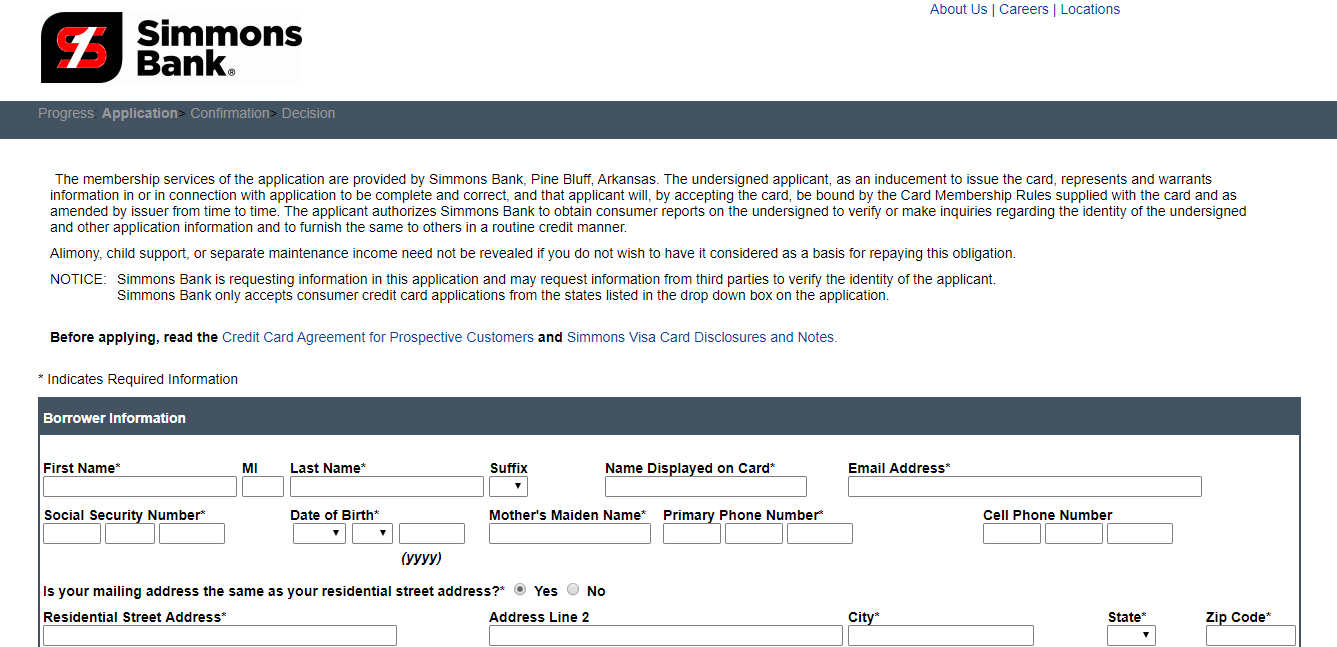

- 3.

Next, fill in your personal details such as your names, email address, SSN, date of birth etc.

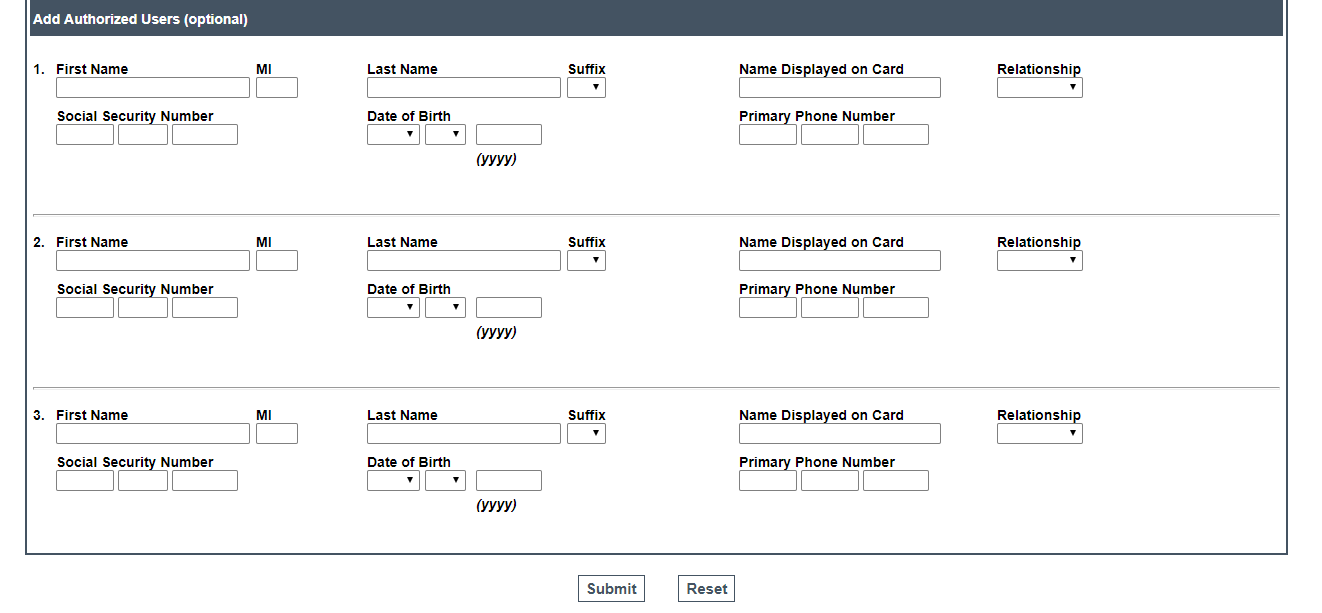

- 4.

You may decide to fill in the details of other authorized users (it is optional); after completing this, click “Submit.”

Is the Simmons Bank Visa® Platinum Card Right for You?

The lack of rewards program makes this credit card boring for the average consumer who does every day spending with their credit card and pays off their monthly balance in full.

But for the average consumer who carries a monthly credit card balance and doesn’t see themselves being able to get out of debt for many years, then this is a great option for saving you money thanks to the industry best, 15.50% – 23.50% variable APR.

Compare The Alternatives

If you're looking for a low interest credit card – the Simmons card is definitely a good option, but there are some good alternatives:

Capital One Savor card | Chase Freedom Unlimited® card | Citi Simplicity® Card | |

Annual Fee | $0

| $0

| $0

|

Rewards |

1% – 8%

unlimited 3% cash back on dining, entertainment, popular streaming services, and grocery store purchases (excluding superstores like Walmart® and Target®). You’ll also earn 1% on all other purchases. Plus, you get 10% cash back on purchases through Uber and Uber Eats, 8% on Capital One Entertainment purchases, and 5% on hotels and rental cars booked through Capital One Travel

|

1.5% – 5%

5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases

|

N/A

None

|

Welcome bonus |

$250

$250 cash bonus once you spend $500 on purchases within the first 3 months from account opening

|

$250

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

|

N/A

None

|

Foreign Transaction Fee | $0

| 3%

| 3%

|

Purchase APR | 19.74% – 29.74% (Variable)

| 19.99 – 28.74% variable

| 18.74% – 29.49% (Variable)

|