Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- Great Sign-Up Bonus

- Flexible Rewards Redemption

- Annual Fee

- Airline Partners Limitations

Rewards Plan

Sign up Bonus

Our Rating

PROS

- Great Sign-Up Bonus

- Flexible Rewards Redemption

CONS

- Annual Fee

- Airline Partners Limitations

APR

19.99% - 29.74% (Variable)

Annual Fee

$95

0% Intro

N/A

Credit Requirements

Good – Excellent

- Our Verdict

- FAQ

The Capital One Venture Rewards Credit Card offers the users some great travel perks and a good flat rate on general purchases. Although it doesn’t have the highest earning rates, there are additional travel benefits.

Earning miles with this card is simple and rewarding. You’ll earn 2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel Plus, you won’t be charged a foreign transaction fee when making purchases outside the U.S. Additional perks include up to $100 in credits for Global Entry or TSA PreCheck®, no foreign transaction fees, and flexible redemption options to make the most of your miles.

When you initially sign-up for this card, you can enjoy 75,000 miles once they spend $4,000 on purchases within 3 months from account opening However, the card has $95 annual fee – so make sure your spending is enough to get benefits that cover the annual fee.

The card lacks an introductory APR and charges a $95 annual fee, making it less appealing for non-travel spending compared to other cash-back cards. So, if you are an occasional traveler and are looking for a way to rack up some travel miles which you can use on your next trip, then this card is the most ideal.

How to maximize rewards?

You can do so in a number of ways, such as spending your accumulated miles directly on travel purchases, or redeem as cash, use at participating retailers, and so on.

Why I haven't got approved?

You might not have met all of the requirements. You can enquire as to where your application fell short. If you cannot proceed, you can look at some of the other available options.

What are the top reasons NOT to get it?

If you don’t travel a lot and want a more versatile type of card in terms of rewards for non-travel purchases then the Capital One Venture card might not be for you.

In This Review..

Pros & Cons

Let’s take a look at the pros and cons of the Venture Rewards card and see if it’s the right one for your wallet or not.

Pros | Cons |

|---|---|

Miles Rewards

| Annual Fee |

Flexible Redemption Options | Airline Partners Limitations |

Sign-Up Bonus | Limited Non-Travel Redemption Value |

No Blackout/Expiration Dates | |

Auto Rental Insurance | |

Travel Benefits |

- Miles Rewards

The Capital One Venture Rewards Card is definitely designed to be a travel rewards card, as this is where their redemption options truly shine.

You can get 2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

- Flexible Redemption Options

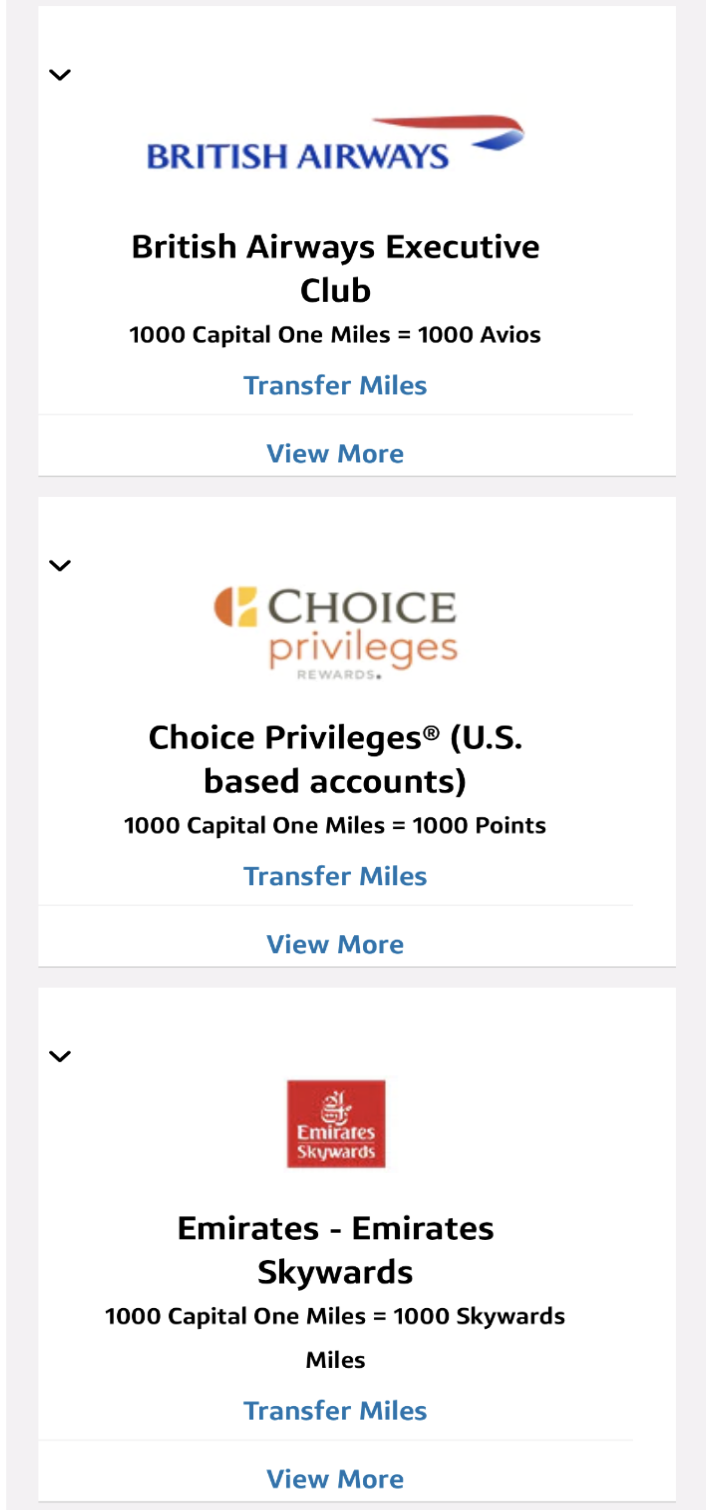

Miles can be easily redeemed for travel through Capital One Travel, transferred to 15+ travel loyalty programs, or applied as a statement credit for eligible travel purchases.

With the Capital One Venture Rewards, the ratio of points used for a statement credit is valued at 1 cent for every point, so 10,000 points are worth a statement credit of $100.

- Sign-Up Bonus

The Capital One Venture Rewards offers a great sign-up bonus of 75,000 miles once they spend $4,000 on purchases within 3 months from account opening

- No Blackout/Expiration Dates

Unlike many other travel rewards card, the Capital one Venture Rewards Card doesn’t restrict cardholders to when and where they can travel throughout the year.

There are also no expiration dates on miles accumulated as long as the account is open, which is can also be a huge benefit to anyone wanting to rack up the miles to use for a large trip down the road

- Auto Rental Insurance

The card offers auto rental insurance, providing coverage for rental car damages when the full price is charged to the card.

- Travel Benefits

Cardholders enjoy perks such as 24-hour travel assistance, travel accident insurance, extended purchase warranties, and security alerts, enhancing the overall travel experience.

Top Offers

Top Offers From Our Partners

- Annual Fee

The Venture Rewards Card does have an annual fee of $95 which is something to take into consideration. This fee is higher compared to other credit cards.

- Airline Partners Limitations

The biggest pitfall to the Capital One Venture Rewards is that while it does have +18 airline partners to choose from, none of them are U.S. based airlines, which will limit certain flights available to those looking to fly domestically in the United States.

- Limited Non-Travel Redemption Value

The value of miles for non-travel redemptions, such as cash back, is less than 1 cent per mile, limiting the overall redemption value.

What Can I Do With Capital One Miles?

Capital One Miles offered various redemption options, including:

Travel Purchases: You could use Capital One Miles to cover travel-related expenses, such as flights, hotels, and rental cars, by making a purchase with your Capital One credit card and then redeeming your miles to offset the charges.

Cash Back: You could redeem your miles for cash back as a statement credit or a check.

Gift Cards: Capital One often allowed the redemption of miles for gift cards from various retailers and restaurants.

Shopping: Some cardholders could use their miles to make purchases directly through the Capital One rewards portal, which included a variety of merchandise.

Charitable Donations: Some rewards programs allow you to donate your miles to charitable organizations.

- Transfer to Travel Partners: Capital One Miles could be transferred to various airline and hotel partners. This allowed you to potentially get more value from your miles by using them for specific partner rewards.

How To Apply For Venture Rewards Card?

- 1.

Visit the Capital One Venture Rewards Credit Card home page, and click on “Apply now”.

- 2.

This takes you to the next page, where you can fill in your “Personal Information” such as your Names, date of birth etc.

- 3.

Next is your contact and financial information. Lastly, ensure you read through the important disclosure page to know your eligibility, fees, costs, rates, etc.

- 4.

Then click on “continue” to complete the process.

How It Compared To Other Capital One Cards?

The Capital One Venture Rewards Credit Card stands out within the Capital One card lineup, offering a strong travel rewards program for individuals with excellent credit. When compared to other Capital One cards, its key differentiator is the emphasis on travel benefits.

Compared to the Capital One VentureOne Rewards Credit Card, which offers no annual fee but a lower rewards rate, the Venture Rewards Card is a better choice for those who spend a lot on travel and want to earn higher rewards. However, if you're looking for a card with no annual fee, the VentureOne may be a more attractive option.

In comparison to the Capital One most premium travel card, the Venture X card, the Venture card offers less enticing travel benefits as the Venture X card offer premium perks such as lounge access, statement credits and better travel insurance.

In comparison to everyday spending cards by Capital One, the Capital One Savor and SavorOne Cash Rewards Credit Card caters to individuals who prioritize dining and entertainment, offering higher rewards in those categories.

How It Compared To Other Mid-Tier Travel Cards?

In the mid-tier travel card landscape, cards like the Chase Sapphire Preferred® Card offer similar annual fees but provide additional perks like a 10% anniversary point bonus and a $50 annual hotel credit. The Chase Sapphire Preferred also boasts a strong rewards program with a diverse array of transfer partners.

Compared to its counterparts, the card's no foreign transaction fees and up to $100 Global Entry or TSA PreCheck® credit stand out as advantageous features. However, other cards such as Wells Fargo Autograph or the Citi Premier card may offer higher rewards ratio than the Venture card.

Is the Capital One Venture Rewards Card Right for You?

The Capital one Venture Rewards Card is a simple, straightforward travel rewards card with a flexible rewards program and hardly any restrictions. If you’re a frequent traveler who isn’t particularly loyal to any one airline or hotel brand, you’ll love the wide variety of options to choose from while enjoying the generous travel perks.

So, if you are an occasional traveler and are looking for a way to rack up some travel miles which you can use on your next trip, then this card is the most ideal. This feature actually justifies its high annual fees that come with the card.

Top Offers

Top Offers

Top Offers From Our Partners

Compare The Alternatives

There are several other travel-focused credit cards that offer higher travel reward rates and bonuses when signing up. Let’s take a look at them and see if one is better suited for you than the Capital One Venture Rewards card.

| |||

|---|---|---|---|

Bank of America® Travel Rewards credit card | Capital One Venture Rewards Credit Card | Chase Sapphire Preferred® Card | |

Annual Fee | $0 | $95 | $95

|

Rewards |

1.5X

1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points

|

2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

|

2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

Welcome bonus |

25,000 points

25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases

|

75,000 miles

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

|

Foreign Transaction Fee | $0 | $0 | $0

|

Purchase APR | 18.24% – 28.24% Variable APR will apply. | 19.99% – 29.74% (Variable)

| 20.99% – 27.99% variable APR

|

FAQ

Yes, once you refuse the insurance offered by the rental company you will automatically get coverage if you fund the entire purchase through this card. Please review the terms and conditions before to make sure you're covered.

There is no limit in place as to how many miles you are able to earn when using the Capital One Venture card to make purchases.

The Capital One Venture card often required a person’s monthly income to be at least $800. Sometimes, you will need to show some proof of income.

If you spent a decent amount of time and money on travel expenses then the Capital One Venture card could be an ideal fit for your needs.

Compare Capital One Venture Card

The Venture X card outshines the Venture card with superior rewards and premium travel perks. Is It worth the annual fee difference?

If you're looking for travel rewards, it's an easy decision. But what about if you're looking to get rewards on everyday spending?

Capital One Venture vs Capital One Quicksilver: Which Card Wins?

While the Chase Sapphire Preferred Card has more benefits, the Capital One Venture card offers unique features. Which travel card is better?

Capital One Venture vs Chase Sapphire Preferred: Which Card Is Best?

While Amex Gold Card offers statements credits and everyday spending benefits, the Venture card is cheaper and include decent travel perks.

The Venture card offers better travel perks and rewards ratio than the VentureOne, but lacks 0% intro APR. Here's our side-by-side comparison

The Capital One Venture is designed for avid travelers, while the Savor card caters to foodies and entertainment lovers. How do they compare?

The Capital One Venture offers a better points rewards ratio and travel benefits than the BofA Travel rewards. Is it worth the annual fee?

BofA Travel Rewards vs. Capital One Venture Card: How They Compare?

The Capital One Venture is a clear winner as it offers a better miles rewards ratio and extra travel benefits. But it charges an annual fee.

Discover it Miles vs. Capital One Venture Card: How They Compare?

The Capital One Venture is a clear winner as it offers higher annual cashback value and better travel perks than the Alaska Visa Signature

Alaska Visa Signature vs Capital One Venture: Side By Side Comparison