The Capital One Venture beckons with its straightforward rewards system, while the American Express® Gold Card tempts with a buffet of membership perks and elevated points on dining and groceries.

In this showdown, we'll dissect the features, rewards, and nuances of each card, providing you with a compass to navigate the terrain of travel and lifestyle benefits.

General Comparison: Capital One Venture vs. Amex Gold

As outlined in the table, the Amex Gold Card boasts a superior rewards ratio across the majority of travel categories. Also, the variety of additional benefits makes it a preferred choice for frequent travelers. However, it comes with a higher annual fee when compared to the Venture card.

American Express® Gold Card | Capital One Venture | |

Annual Fee | $250. See Rates and Fees. | $95 |

Rewards | 4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases. Terms Apply. | 2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel |

Welcome bonus | 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership. | 75,000 miles once they spend $4,000 on purchases within 3 months from account opening |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | None. See Rates and Fees. | $0 |

Purchase APR | 21.24% – 29.24% Variable

| 19.99% – 29.99% (Variable) |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Credit Card Points Battle: A Side-by-Side Analysis

The Amex gold card offers better rewards rate on groceries, restaurants and flights, while Capital One Venture X stage the lead with it comes to hotels and gas rewards.

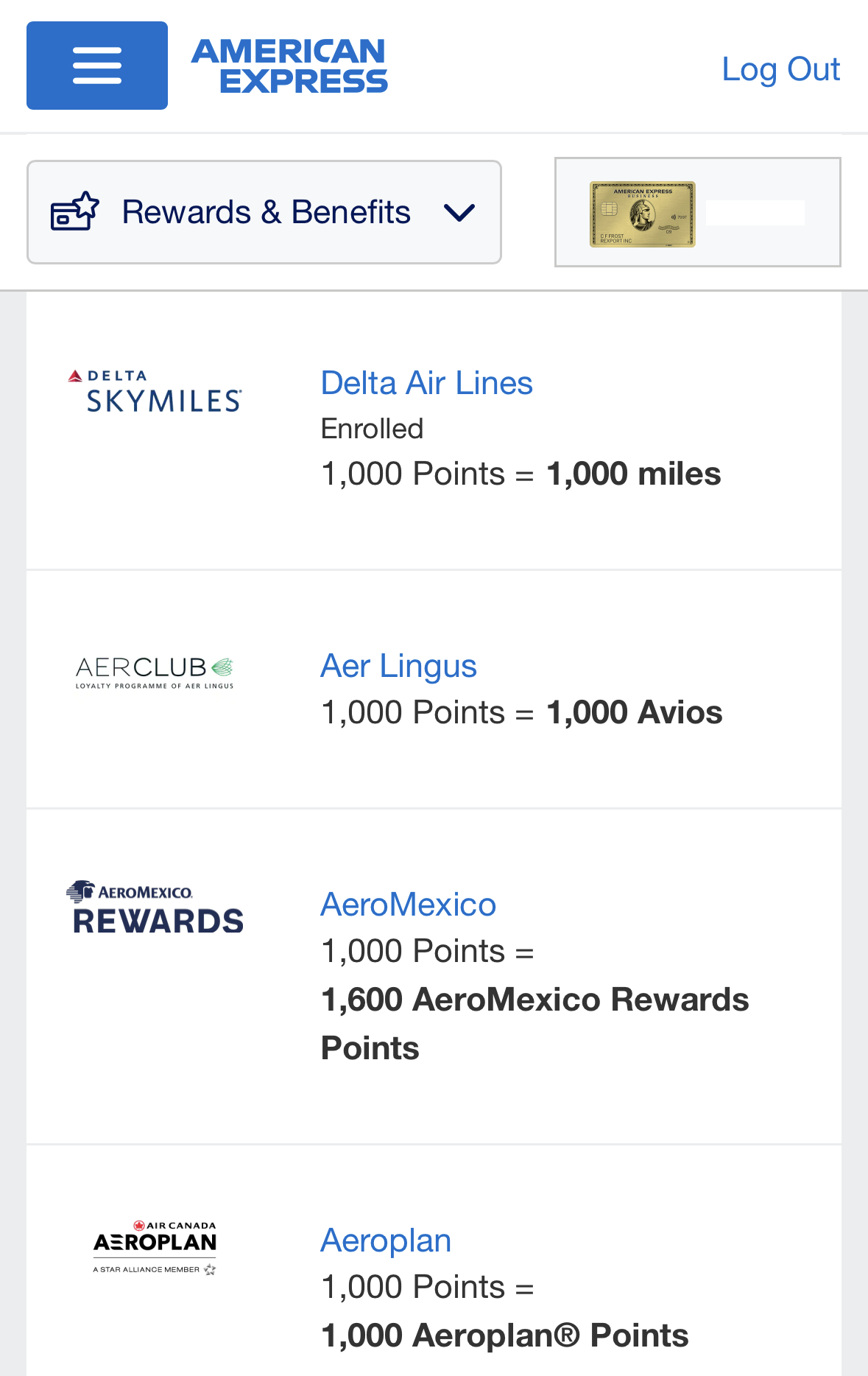

Both Capital One Travel and Chase Ultimate Rewards offer versatile points redemption options for a seamless blend of travel and lifestyle rewards. Users can redeem points for flights, hotels, and car rentals, ensuring a flexible approach to travel planning.

Additionally, the option to transfer points to partnered airlines and hotels enhances the value and choices available. Both platforms enable the use of points to cover various travel expenses, from baggage fees to in-flight purchases, contributing to a more comprehensive travel experience.

Spend Per Category | American Express® Gold Card | Capital One Venture |

$15,000 – U.S Supermarkets | 60,000 points | 30,000 miles |

$5,000 – Restaurants

| 20,000 points | 10,000 miles |

$5,000 – Airline | 15,000 points | 10,000 miles |

$5,000 – Hotels | 5,000 points | 25,000 miles |

$4,000 – Gas | 4,000 points | 8,000 miles |

Estimated Annual Value | 104,000 points (About $624 – $1,664) | 83,000 points ( $830) |

Capital One Venture vs. Amex Gold: Compare Benefits

Both of these cards come with extra types of perks. Besides bonus points and welcome bonuses, cardholders enjoy travel and insurance benefits with these cards.

American Express Gold Card

- Up to $120 Uber Credit: Link your new Gold Card to your Uber account to enjoy an automatic monthly Uber Cash credit of $10, which can be used for Uber rides or UberEats orders, up to a maximum annual value of $120.

- Up to $120 Dining Credit: When you use your Amex Gold Card to pay for dining out at select establishments, including The Cheesecake Factory, Wine.com, Goldbelly, Shake Shack, and Milk Bar locations, you can receive up to $10 in statement credit per month.

- Global Entry or TSA PreCheck® Credit: Unlock smoother travels with a credit of up to $100 for Global Entry or up to $85 for TSA PreCheck.

- Baggage Insurance: When you purchase your entire fare for a Common Carrier Vehicle using your Gold card, you are eligible for baggage insurance.

- Up to $100 Experience Credit: Enjoy a $100 experience credit when you book The Hotel Collection through American Express Travel for a getaway of at least two nights. The value of the experience credit may vary based on your chosen property.

- Car Rental Coverage: When you use your Gold Card to reserve and pay for your entire car rental, you can decline the rental company's collision damage waiver. This coverage protects against theft and damage to the rental vehicle in eligible locations, though certain restrictions and exclusions may apply.

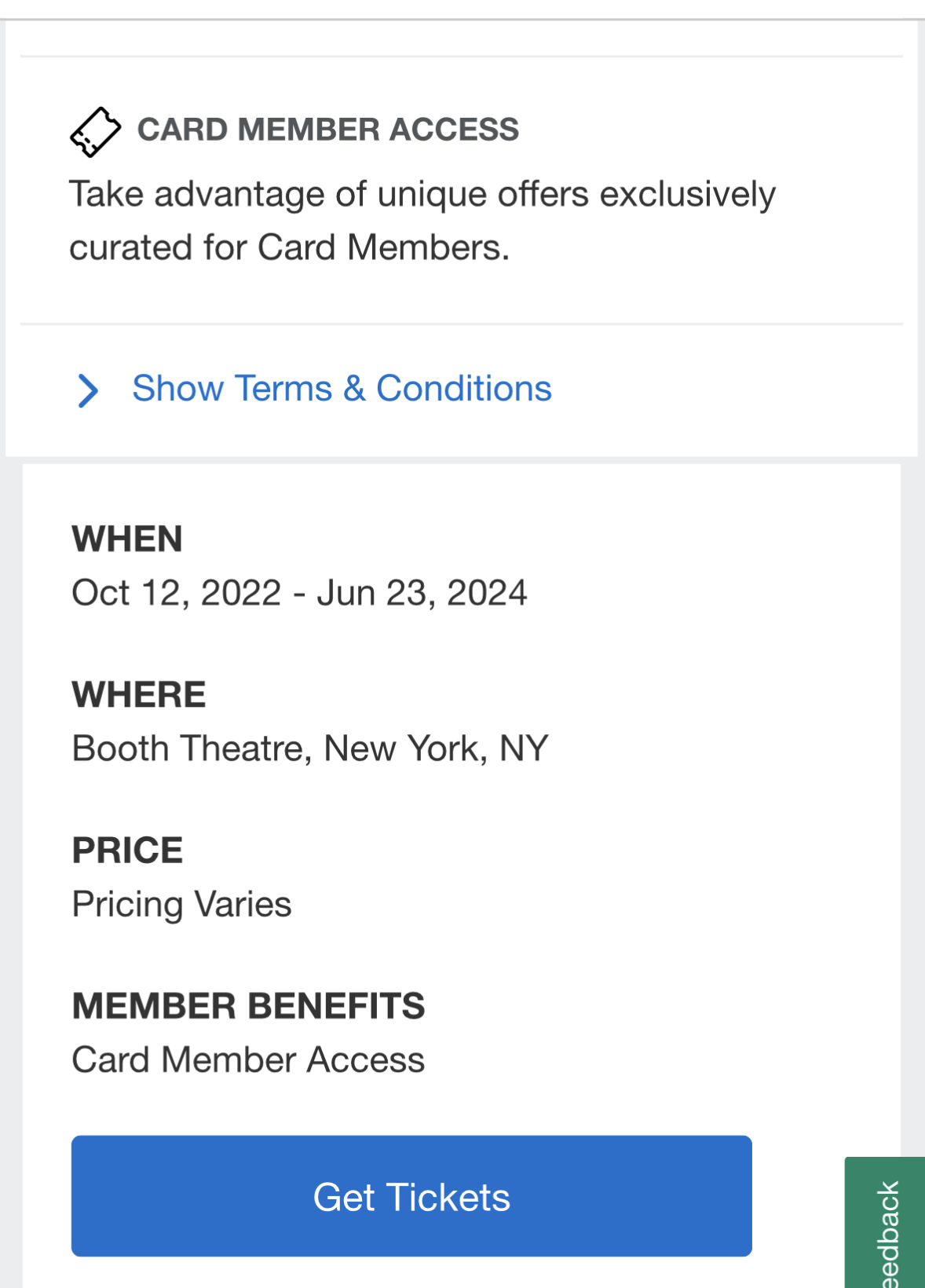

Entertainment benefits: Enjoy exclusive experiences and presale tickets for concerts, sports events, and theater performances through the American Express® Gold Card Entertainment Access program, though availability may vary.

Luxury hotel perks: Access the American Express Fine Hotels & Resorts program as a cardholder, unlocking benefits like room upgrades, complimentary nights, and daily breakfast for two at participating hotels.

High-end concierge service: The Amex Gold Card provides a concierge service for assistance with travel and dining reservations, but availability may limit its ability to fulfill all requests.

Capital One Venture

- Capital One Dining and Entertainment: Enjoy exclusive reservations at award-winning restaurants and access to culinary experiences, as well as exclusive pre-sales, tickets, and more for music, sports, and dining events.

- Capital One Lounges: Cardholders can escape airport crowds by accessing all-inclusive Lounges with unlimited complimentary access for themselves and two guests per visit.

- Hertz Gold Plus Rewards President's Circle® status: Venture X cardholders are eligible for complimentary Hertz President’s Circle status, allowing them to skip the rental counter, choose from a wide selection of cars, and receive guaranteed upgrades.

- Global Entry or TSA PreCheck® Credit: Receive up to a $100 credit for Global Entry or TSA PreCheck®.

- Partner Lounge Network: Enjoy unlimited access for yourself and two guests to over 1,300 lounges worldwide from Priority Pass™ and Plaza Premium Group.

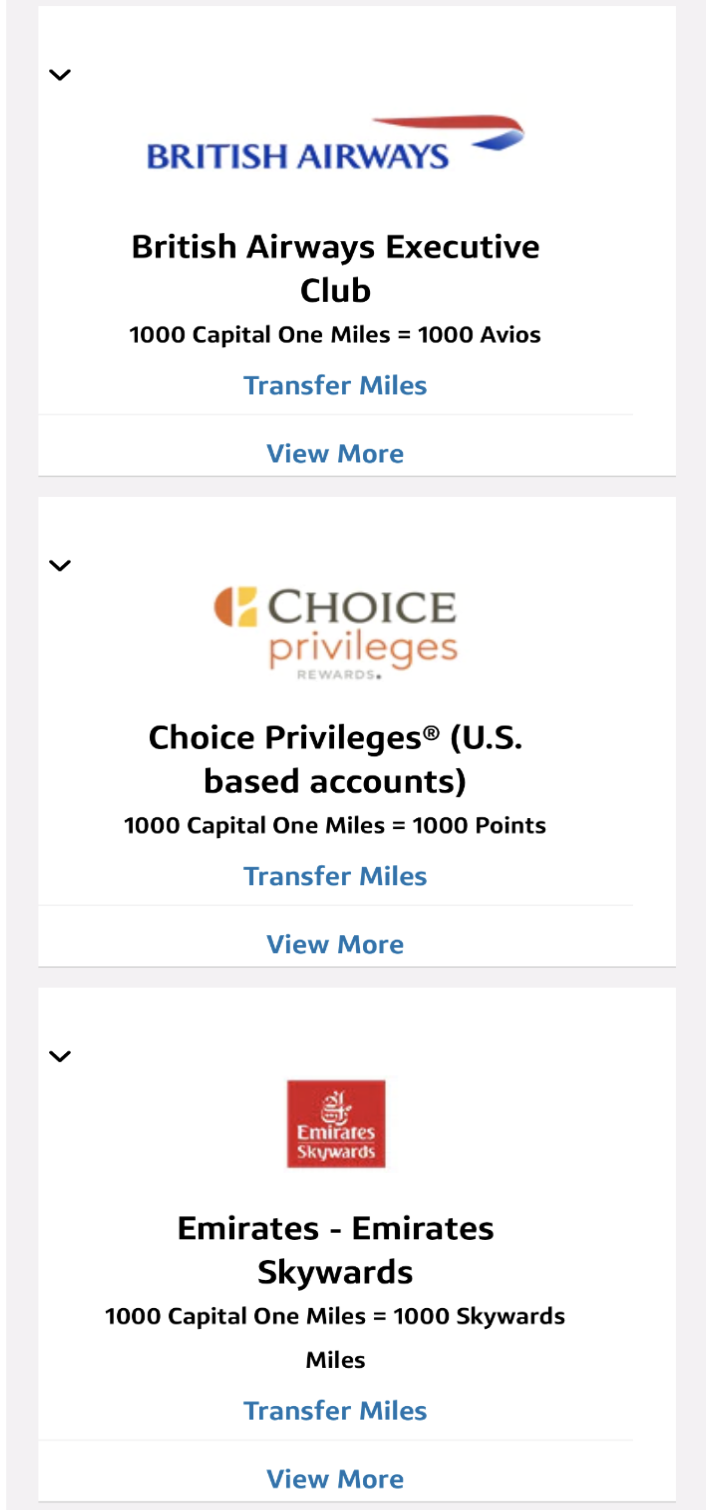

- Miles Redemption: Use your Capital One miles to cover various travel expenses, such as flights, hotels, rental cars, and transfer miles to a choice of 15+ travel loyalty programs.

- Auto Rental Collision Damage Waiver: Enjoy primary coverage against theft and collision damage for most rental cars globally, provided you opt out of the rental company's insurance. Reimbursement extends up to the actual cash value of the vehicle.

- Purchase Protection: Safeguard your new purchases from damage or theft with comprehensive coverage.

Main Drawbacks: How They Compare?

Here's a short comparison of the main disadvantages of each card compared to the other:

American Express Gold Card

- Higher Annual Fee: The American Express Gold Card carries a higher annual fee compared to the Capital One Venture, impacting the overall cost of card ownership.

- Lower Rewards Rate on Hotels: In terms of rewards, the Gold Card offers a lower rate on hotel expenditures, potentially diminishing the value for those who frequently stay in hotels.

- No Lounge Access: Unlike the Capital One Venture, the American Express Gold Card lacks lounge access benefits, which could be a significant drawback for travelers who value airport lounges as part of their experience.

Capital One Venture

- Lower Point Rewards Ratio: Capital One Venture has a less competitive points reward ratio compared to the American Express Gold Card, impacting the overall earning potential for cardholders.

- Limited Redemption Options: Amex offers a broader array of options for utilizing points, providing more flexibility in how cardholders can benefit from their rewards, a feature that Capital One Venture falls short on.

- Reduced Statement Credits: Capital One Venture provides fewer statement credit opportunities, giving cardholders less room for offsetting various expenses compared to the American Express Gold Card.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer the Capital One Venture Card?

You may want to opt for the Venture Card over the Amex Gold Card if:

Lower Annual Fee is a Priority: If you're looking for a rewards card with a more budget-friendly annual fee, the Capital One Venture Card might be the better fit, offering a cost-effective alternative.

When You Might Prefer The Amex Gold Card?

You may want to choose the Amex Gold Card over the Venture Card if:

Leveraging Statement Credits is a Priority: If you value statement credits and intend to make the most of benefits like dining credits, the Amex Gold Card's robust statement credit offerings might be more appealing.

Seeking a Hybrid Travel and Everyday Spending Card: If you desire a card that seamlessly combines travel rewards with everyday spending perks, the Amex Gold Card stands out with elevated points on dining and groceries, catering to both realms.

Desiring Access to Amex Membership Benefits: If exclusive perks, access to special events, and the overall American Express Membership experience are essential, the Amex Gold Card provides a more comprehensive suite of benefits compared to the Venture Card.

Compare The Alternatives

If you're looking for a travel rewards credit card– there are some excellent alternatives you may want to consider:

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | 21.24% – 29.24% APR Variable | 22.49%–29.49% variable | 19.99% – 29.99% (Variable) |

Compare Capital One Venture Card

The Venture X card outshines the Venture card with superior rewards and premium travel perks. Is It worth the annual fee difference?

If you're looking for travel rewards, it's an easy decision. But what about if you're looking to get rewards on everyday spending?

Capital One Venture vs Capital One Quicksilver: Which Card Wins?

While the Chase Sapphire Preferred Card has more benefits, the Capital One Venture card offers unique features. Which travel card is better?

Capital One Venture vs Chase Sapphire Preferred: Which Card Is Best?

The Venture card offers better travel perks and rewards ratio than the VentureOne, but lacks 0% intro APR. Here's our side-by-side comparison

The Capital One Venture is designed for avid travelers, while the Savor card caters to foodies and entertainment lovers. How do they compare?

The Capital One Venture offers a better points rewards ratio and travel benefits than the BofA Travel rewards. Is it worth the annual fee?

BofA Travel Rewards vs. Capital One Venture Card: How They Compare?

The Capital One Venture is a clear winner as it offers a better miles rewards ratio and extra travel benefits. But it charges an annual fee.

Discover it Miles vs. Capital One Venture Card: How They Compare?

The Capital One Venture is a clear winner as it offers higher annual cashback value and better travel perks than the Alaska Visa Signature

Alaska Visa Signature vs Capital One Venture: Side By Side Comparison

Compare American Express Gold Card

If you're looking for everyday spending rewards, the Amex Gold Card offers more. But for travel rewards benefits, there is a clear winner.

The Amex Gold Card may be more appealing if you dine out frequently and value premium travel perks than the Apple card.

While the Amex Gold Card is more expensive than the Blue Cash Preferred, its rewards program and other benefits are more lucrative.

The Autograph is great for travelers who want to stay on budget, while Amex Gold provides premium travel benefits and redemption options.

If you're a dedicated Delta traveler, the Delta SkyMiles Gold may be your top pick, while the Amex Gold offers a broader range of benefits.

The Venture X offers better travel rewards than the Amex Gold but is less appealing if you're looking for everyday spending rewards.

Amex Gold Card vs. Capital One Venture X : Which Premium Card Is Best?

The Amex Gold Card focused on everyday spending and general travel rewards, the Delta SkyMiles Reserve Card offer premium airline benefits.

Amex Gold Card vs. Delta SkyMiles Reserve: Side By Side Comparison

The Freedom Unlimited beckons with its cash-back rewards, but the Amex Gold exudes luxury, boasting robust rewards on dining and groceries.

Chase Freedom Unlimited vs. Amex Gold Card: Which Card Wins?

The Amex Gold Card focuses on everyday spending rewards, while the Delta SkyMiles Platinum is tailored for frequent Delta travelers.

Amex Gold Card vs. Delta SkyMiles Platinum: Side By Side Comparison

The Hilton Honors Surpass wins at estimated cashback, while the Amex Gold card is the winner for everyday spending and extra benefits.

If you're looking for travel rewards, there is a clear winner. But what about if you're looking for rewards on everyday spending?

American Express Gold Card vs Chase Sapphire Reserve: Which Premium Card Is Best?

While the Amex gold card is best for everyday spending, the Chase sapphire preferred may be better as a travel card. Here's our comparison.

American Express Gold Card Vs. Chase Sapphire Preferred: Which Is Best?

Related Posts

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.