Table of Content

Both the American Express® Gold and Capital One Savor are designed for those with excellent or good credit. However, while the Amex card carries an annual fee, the Capital One Savor does not. These cards are well suited to those who enjoy dining out and shopping, as you can earn the most rewards in these categories, making them a great option for everyday spending.

However, there are some crucial differences between the cards. We’ll explore them in more detail to help you decide which would be the best card for you.

General Comparison

|

| |

|---|---|---|

American Express® Gold Card | Capital One Savor | |

Annual Fee | $325. See Rates and Fees. | $95 |

Rewards | 4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases. Terms Apply. | unlimited 4% cash back on dining, entertainment, and popular streaming services, 3% at grocery stores and 1% on all other purchases. |

Welcome bonus | 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. | $300 cash bonus once you spend $3,000 on purchases within 3 months from account opening |

0% Intro APR | N/A | None |

Foreign Transaction Fee | None. See Rates and Fees. | $0 |

Purchase APR | See Pay Over Time APR | N/A

|

Read Review | Read Review |

Compare Rewards: Which Card Gives More?

We’ve looked at various aspects of the two cards, but in order to see which card is best for you, a direct scenario comparison can be helpful. Since both these cards are aimed at everyday spending, we will look at what could be typical monthly spending on the cards to see what rewards you could anticipate if you have similar spending.

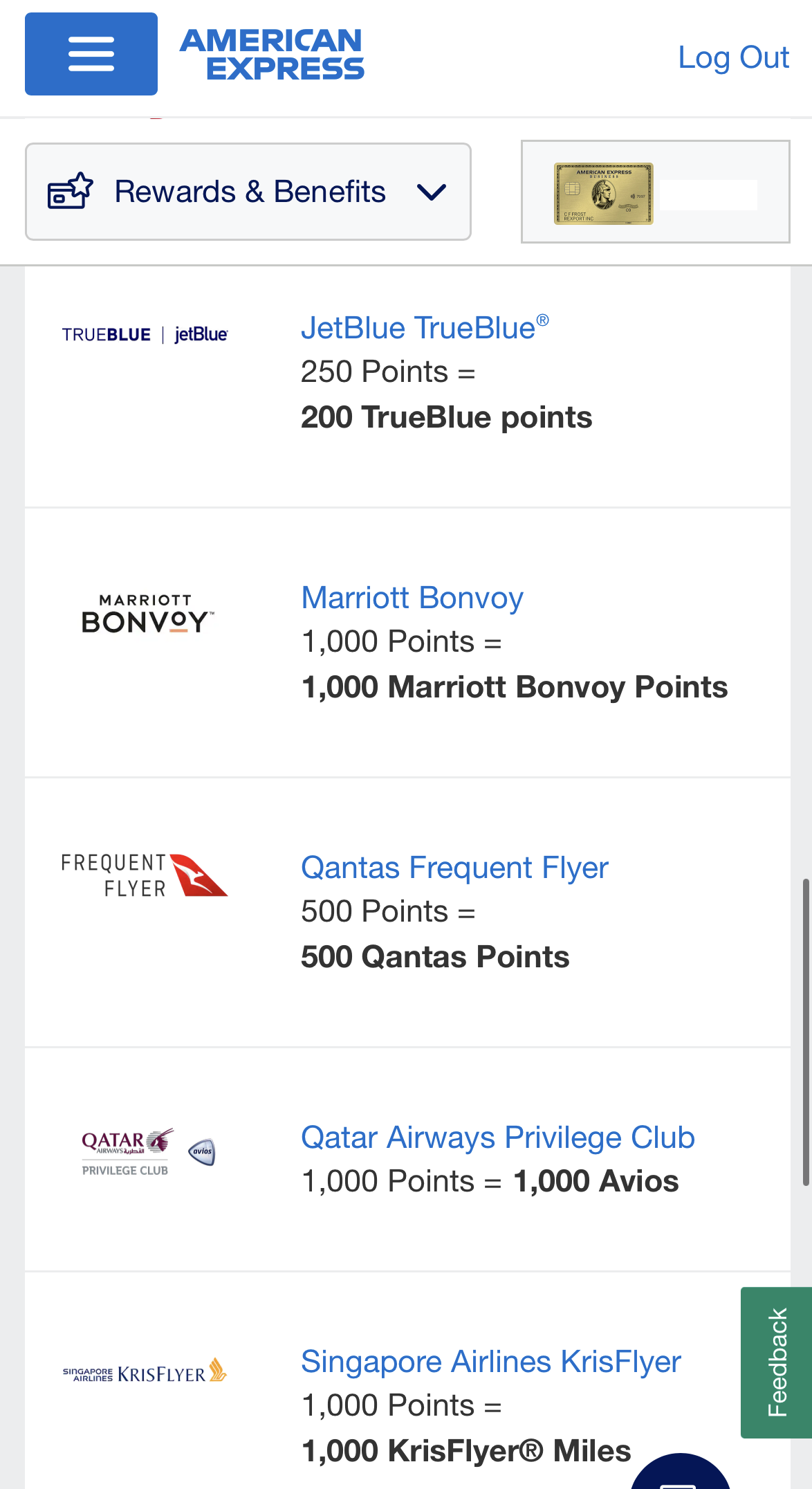

As you can see, you will earn more rewards with the Amex Gold card compared to the Capital One Savor, if you maximize your redemption rewards with Amex. There are many ways to redeem Amex rewards, from booking travel to transfer points to airline and hotel companies.

If your spending habits match the scenario above, you’ll come out ahead each month with the Amex Gold card.

What’s even better? The Amex only requires a good credit score, while Capital One needs an excellent one.

|

| |

|---|---|---|

Spend Per Category | American Express® Gold Card | Capital One Savor |

$15,000 – U.S Supermarkets | 60,000 points | $450 |

$5,000 – Restaurants | 20,000 points | $200 |

$4,000 – Hotels | 4,000 points | $40 |

$3,000 – Airline

| 9,000 points | $30 |

$4,000 – Gas | 4,000 points | $40 |

Total Points | 97,000 points | / |

EstimatedRedemption Value | 1 point ~ 0.6 – 1.6 cents | / |

Estimated Annual Value | $582 – $1,552 | $760 |

Editorial Note: Terms apply to American Express benefits and offers. Enrollments may be required for select benefits. Visit americanexpress.com to learn more

Compare Welcome Bonus And Fees

Both cards have one of the best welcome bonus available. The Amex Gold has an introductory offer of 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. In real terms, these points could carry a value of approximately $1,000 depending on how you redeem them.

The sign up bonus for the Capital One Savor is far more straightforward. You’ll receive a $300 cash bonus once you spend $3,000 on purchases within 3 months from account opening.

So, while you’ll receive more with the Amex card, you will also need to spend more. So, unless you’re planning a major purchase or will use the card for lots of your everyday transactions, the Capital One introductory bonus will be more appealing.

To begin, both cards have no foreign transaction fees, so you can use your card abroad without worrying about incurring hefty charges. You’ll also incur a late fee of up to $40 for either card.

However, there are some crucial fee differences. While the Amex card has a $325 annual fee, the Capital One Savor has no annual fee, which is an immediate saving. Another important difference is that while Capital One charges a 3% balance transfer fee, Amex does not allow balance transfers with its Gold card.

Compare The Perks

American Express Gold Card

- Up to $120 per year in Uber Credit, if you link your Gold Card to your Uber account. Terms Apply.

- Up to $10 of dining credit to each monthly statement when you order from participating partners.

- Preferred Seating at sporting or cultural events

- Signature perks at upscale hotels, which are part of the Amex Hotel Collection and you book through American Express Travel.

- Baggage insurance if it is lost, stolen, or damaged. You’ll need to purchase fares with the card, but you can obtain up to $500 for checked bags and $1,250 for carry on*.

- $100 experience credit – receive a $100 experience credit when you reserve The Hotel Collection through American Express Travel for at least two nights. The specific value of the experience credit may vary depending on the property you choose.

- Flexible payment options: You can pay your bill in full, Plan it to split your larger purchases into monthly payments with a fixed fee or Pay Over Time to carry your balance with interest.

Terms apply to American Express benefits and offers.

Capital One Savor

- Redeem rewards via PayPal or Amazon.com

- Extended warranty on eligible items purchased with your card.

- Automatic travel accident insurance when you purchase fares with the card

- 24 hour travel assistance services. You can obtain an emergency replacement and cash advance if your card is lost or stolen.

- Capital One Shopping tool to automatically apply coupon codes to your orders.

- Complimentary Concierge Services in travel, entertainment, and dining 24/7, 365 days a year.

Compare The Drawbacks

Of course, no credit card is perfect, so it is important to be aware of the potential drawbacks before you make your final card decision.

American Express Gold Card

- No Balance Transfers

There are no balance transfers permitted on the American Express Gold Card. So, if you do want to consolidate your entire credit card debt on one card, this is not possible.

- Excluded Supermarkets

There are some significant supermarket chains that are excluded from earning rewards through the Gold card such as Target and Walmart. If you regularly purchase on one of them, you can consider Target Red Card or the Capital One Walmart card.

Capital One Savor

- Limited Reward Options

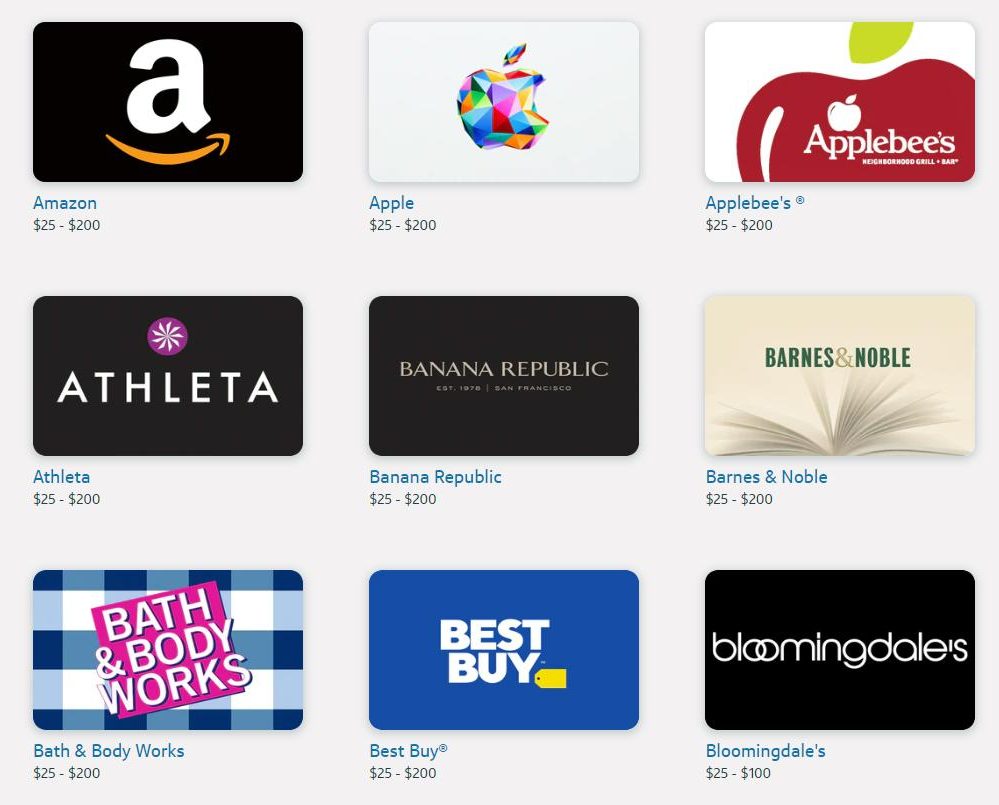

When you come to redeem your rewards, there are limited options. The easiest is statement credit, but otherwise, you can choose gift cards or PayPal and Amazon shopping.

- Limited Cash Back Categories

Although you can earn higher cash back on dining, entertainment, popular streaming services, and grocery store bills, the only other redemption tier is 1% for all other purchases.

This is unusual as many cash back reward cards offer multiple tiers, with some other cards offering rotating categories, so you can maximize your rewards.

Top Offers

Top Offers

Top Offers From Our Partners

Compare Redemption Options

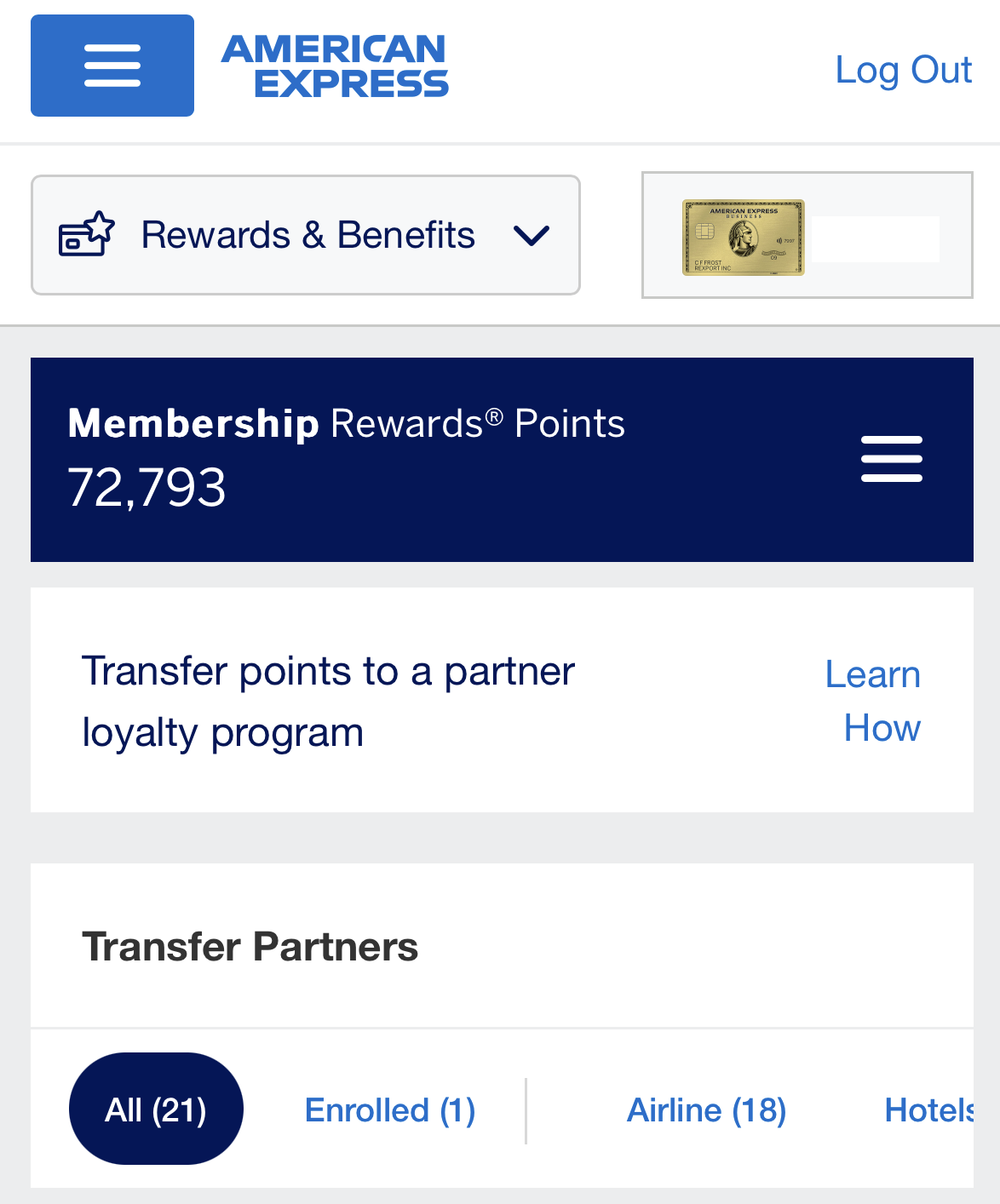

American Express has an aim to make card rewards redemption as easy as possible. You can log into your account at any time to check your points balance.

There is a membership rewards site, where you can explore all the current reward options. The points are worth up to $0.02 each depending on your redemption method. There are usually gift card options, entertainment rewards, merchandise and premium travel.

As we touched on above, Capital One has fewer redemption options. You can redeem your cash back as statement credit or request a check. Your cash back will not expire unless you close your account, so you can accumulate a larger sum or redeem at any point.

You can set up an automatic redemption threshold or choose an annual redemption date to activate a payout. Once your chosen criteria are met, the amount will be released or credited to your account.

You also have the option to redeem your cashback as gift cards or for purchases. Capital One offers the flexibility to redeem rewards through PayPal or Amazon.com, but keep in mind that exchange rates may vary. Generally, redeeming as cashback tends to offer higher value.

How to Maximize Cards Benefits?

If you want to make the best use of your Amex Gold Card, there are some tips to help you:

- Hit the intro spending requirement: You’ll only earn 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership. So, make sure you hit this spending figure within this timeframe.

- Link to your Uber account: You’ll receive up to $10 a month in Uber Credits if you link your Gold card to your Uber account.

- Book Travel with the Card: Amex offers some nice incentives for travelers when they book fares with their card. This includes free baggage insurance for up to $1,250 and signature perks if you stay at venues that are part of the Amex Hotel Collection.

- Use the Dining Partners list: Amex has a list of dining partners and if you dine at these participating restaurants you can qualify for statement credit of up to $10 per month.

Consider the following when it comes to maximizing your Capital one Savor card:

- Pay fares with your card: You’ll qualify for travel accident insurance automatically when you purchase your fares using your card.

- Check the Capital One Shopping tool: This innovative tool automatically applies any available coupon codes to your orders. So, you could save money on your purchases.

- Buy larger purchases with your card: You can receive an extended warranty on eligible items when you purchase them with your card, so you can enjoy additional warranty coverage for free.

Customer Reviews: Which Card Wins?

American Express® Gold Card | Capital One Savor | |

|---|---|---|

App Rating (iOS)

| 4.9 | 4.8 |

App Rating (Android) | 4.2 | 4.7 |

BBB Rating (A-F) | A+ | A |

WalletHub | 4 | 4 |

Contect Options | phone/social | phone/chat |

Availability | 24/7 | 24/7 |

Satisfied customers report the Amex Gold card has high reward earning possibilities. In addition to the 100,000 points introductory offer, you can earn up to 4 points per dollar. Additionally, there are three tiers of rewards, with 3 points per dollar on flights and 1 point per dollar on all other eligible purchases. As we demonstrated in our scenario comparison, this can add up to far more rewards than you would get with other Amex cards.

Negative reviews report some frustration that there are minimal traveler benefits. While the card does offer higher points rate on flights and baggage insurance, you will not access things like airport lounge benefits. Other complaints are centered around the high Over Time penalties and costs. This is billed as a benefit of the card, but the high APR makes this an impractical payment option.

Satisfied customers report the Capital One Savor offers great rewards considering there is no annual fee. The card benefits are tailored to everyday spending, so you don’t need to worry about unusual spending categories or meeting high spend limits to earn your introductory bonus.

Additionally, many reviews praise the simplicity of the rewards system. While there are other redemption options, you can simply automate your cash back so you receive a statement credit or check when your rewards balance hits an amount you specify.

Negative reviews report communication issues. Some reviews detail receiving stock responses to queries such as a request to review a credit limit, which is highly frustrating.

Other reviews highlight communication issues when the cardholder wants to report a dispute situation. There are comments about dealing with foreign call centers where there is a language barrier and agents who cannot fully understand English.

Top Offers

Top Offers From Our Partners

When You Might Want the Amex Gold Card?

The American Express Gold Card is a flexible option that could be good if:

- You will qualify for the introductory bonus. You’ll get 100,000 points and depending on your redemption choices could be worth $1,000 to $1,500.

- You enjoy dining out. Amex has a list of participating partners and if you dine in these restaurants, you could earn $10 statement credit each month. Additionally, you’ll earn 4x points when you pay with your card for any restaurant visits.

- You like luxury perks. With the Amex Gold card you can enjoy preferred seating at cultural and sporting events, signature perks at upscale hotels and other nice touches for those who delight in the finer things in life.

When the Capital One Savor Card Wins?

The Capital One Savor also has some great benefits. It could be a good fit for you if:

- You tend to spend a large percentage of your disposable income on entertainment, groceries, dining out and streaming services, as these categories offer the highest cash back potential.

- You’ll make use of the additional protections offered by the Capital One Savor. There is extended warranty protection if you buy your item with your card. You’ll also automatically receive free travel accident insurance when you book fares with your card.

Bottom Line

Both these cards offer impressive rewards and you can strategically plan purchases to maximize your rewards. However, there are crucial differences that will determine which is the best one for you.

Compare The Alternatives

Both cards are definitely considered as one of the best in the niche. However, there are always recommended alternatives to check out before applying:

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

175,000 points

175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership

|

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | See Pay Over Time APR | 19.99%–28.49% variable

| 19.99% – 28.99% (Variable)

|

Compare Capital One Savor

Higher Cash back and better sign up bonus, or no annual fee with lower rewards ratios?

The Capital One Venture is designed for avid travelers, while the Savor card caters to foodies and entertainment lovers.

How do they compare? Capital One Venture vs. Capital One Savor

The Savor card is ideal for dining out and entertainment, while the Freedom Unlimited is best for travelers and those who need 0% intro APR

Capital One Savor vs. Chase Freedom Unlimited: Side By Side Comparison

The Capital One Savor is better for everyday spending, but the Chase Preferred card is the winner when it comes to travel and protection.

The Savor card is ideal for dining out and entertainment while the Quicksilver is a simple card with a flat rate cashback.

How They Compare? Capital One Savor vs. Capital One Quicksilver

Review Travel Credit Cards

- Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.