Luxury credit cards cater to high-net-worth individuals, offering exclusive perks and premium services. These cards often provide benefits like airport lounge access, elite status in hotel and airline loyalty programs, concierge services, and travel insurance.

They may also feature elevated rewards on travel, dining, and luxury purchases. Annual fees are common, reflecting the card's premium status. However, the approval process is stringent, requiring a strong credit history.

Here are The Smart Investor's best luxury credit cards for November 2025:

Chase Sapphire Reserve®

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Special Perks

- FAQ

This is Chase’s attempt to compete with Amex Platinum and to some extent, it succeeds.

While it may not have all the perks and benefits, there is elevated points earning, making it a good compromise for those who want some luxury perks but also want to rack up serious rewards.

The tiered reward structure is weighted towards purchases made via the Ultimate Rewards travel portal, but Lyft purchases and dining are also generously rewarded.

As with the Amex Platinum, you can get lounge access via Priority Pass and there is annual travel credit you can apply to any travel purchase. Chase also offers the Chase Sapphire Preferred which is a great travel card but lacks many of the travel benefits of the Reserve card.

- APR: 19.99%–28.49% variable

- Annual fee: $550

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: $0

- Rewards Plan: 5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

- Sign Up bonus: Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

- 0% APR Introductory Rate period: N/A

- annual travel credit of $300. For reimbursement of travel-related charges made to your card, you will receive a statement credit of up to $300.

- If your carrier's journey is delayed for more than six hours, you may get up to $500 per ticket in travel reimbursement for lost luggage, up to a total of $3,000 per passenger.

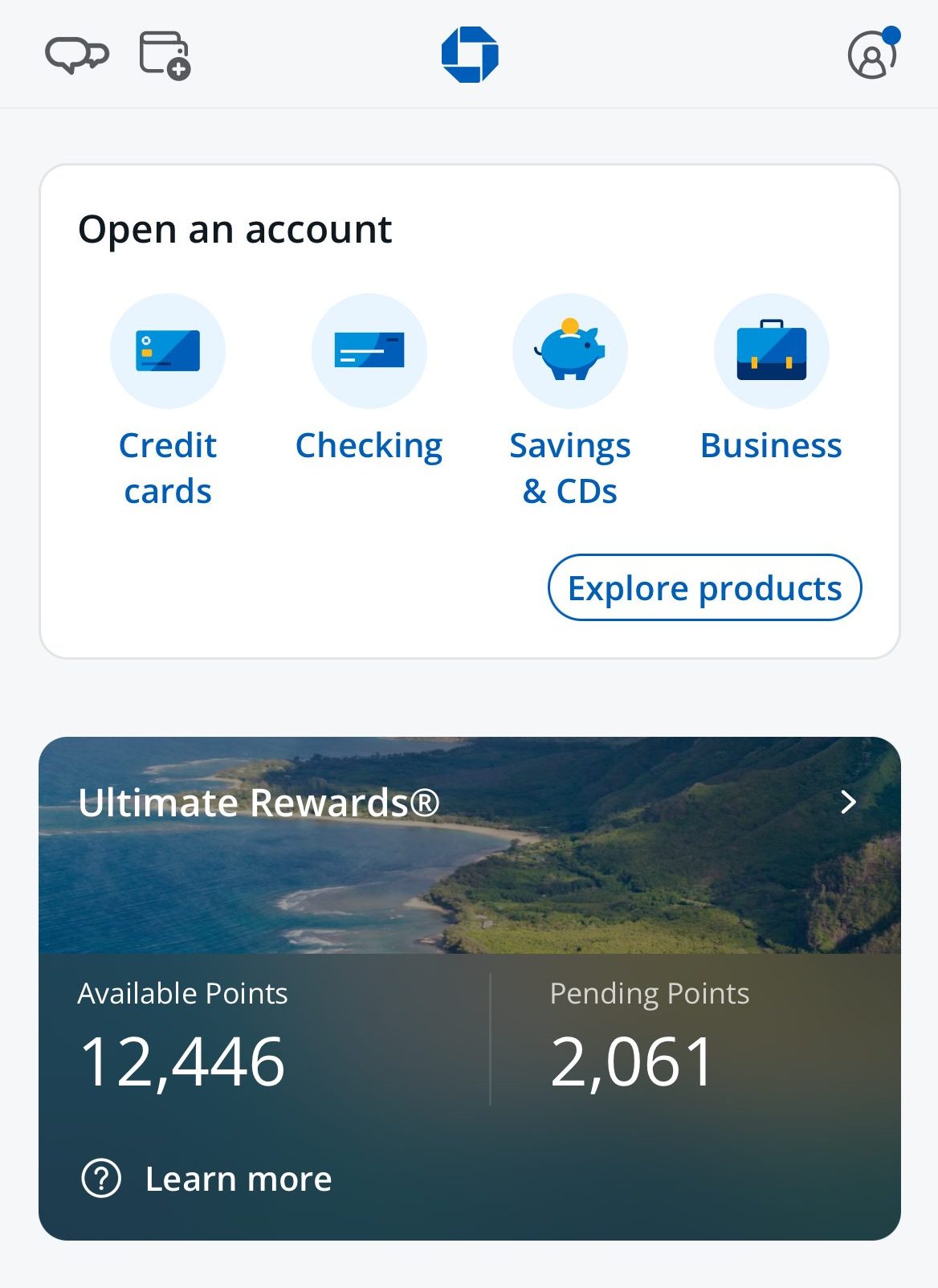

- Access to Chase Unlimited Rewards, where certain categories increase the value of your points. For instance, 50,000 points are worth $750 if you use them for vacation.

- VIP airport lounge access to more than 1,000 lounges spread over more than 500 cities worldwide.

- Once every four years, the Chase Sapphire Reserve card will pay for your TSA Precheck or Global Entry application fee. Typically, this expense ranges from $85 to $100.

- 50% more when you make a reservation through Ultimate Chase Rewards. All travel-related expenses, such as lodging, transportation, and cruises, are covered.

- Exclusive offers like free room upgrades, early check-in, and late check-out at a selection of hand-picked top hotels and resorts around the world.

- No restrictions on when to use the points. Anytime during the year is a good time to redeem them. Neither an expiration date nor usage restrictions exist.

- Insurance for travel interruption or cancellation:

If you use your card to make your reservation, you will be compensated up to $20,000 per trip and $10,000 per person in the event that your trip must be shortened or canceled due to an eligible event.

- What purchases don't earn cash back with the Sapphire Reserve? All purchases will earn you cashback with this card.

- Should You Move to a Sapphire Reserve card? If you travel a lot then this is a great option for you. It's recommended to understand your spending habits and compare the Reserve card with other premium travel cards such as the Amex platinum card.

- Why did Chase deny me? What to Do Next? You might not have met one of its requirements. You will usually find out where you fell short. You might be able to rectify the issue or you might have to look elsewhere.

- How hard is it to get Sapphire Reserve card? It is harder to get this card than some of the other Chase credit cards. However, if you have a credit score of at least 720 then you will be in with a good chance of getting approval.

The Platinum Card® from American Express

The Platinum Card® from American Express

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Special Perks

- Redemption Options

- FAQ

This card is widely regarded as the top choice for luxury credit cards and is considered a flagship premium option. It features a tiered rewards system that offers the most value for Amex Travel purchases, but it also comes with an extensive list of premium perks. One of the standout benefits is access to airport lounges (terms apply).

In addition to the American Express Centurion Lounges, there is also Priority Pass, which provides access to select Virgin Clubhouses, Lufthansa Lounges, Plaza Premium Lounges and Delta SkyClubs when you’re flying these airlines.

There is also statement credit to cover airline incidentals, hotel credit, Saks Fifth Avenue credit, and Global Entry/TSA PreCheck fee reimbursement.

The list of potential statement credit options adds up to far more than the annual fee, before you even consider the cost of lounge membership.

- Up to $200 hotel credit per year when you book select prepaid hotels using your Platinum card via American Express Travel. Enrollment Required.

- Up to $240 or $20 per month in Digital Entertainment Credit when you pay for one or more The New York Times, Peacock, SiriusXM or Audible products with your card. Enrollment Required.

- Up to $155 in Walmart+ credit. When you use your card to pay for your monthly Walmart+ membership, you’ll get the full cost back every month, subject to auto-renewal. Enrollment Required.

- Up to $200 in Airline fee credit per year when you charge incidental travel fees from selected airlines on your card. Enrollment Required.

- Up to $300 back every year for eligible Equinox memberships when you enroll and pay using your card.

- Up to $189 back per year when you use your card to pay for a CLEAR® Plus membership. Enrollment Required.

- Travel: You can use your reward points to book travel purchases through Amex Travel, much like you do with Chase Ultimate Rewards or the Capital One Travel Portal.

- Gift Cards: The Amex Membership Rewards portal offers a variety of gift card choices from a wide range of dining, retail, and travel establishments.

- Statement Credit: You can apply your reward points to a charge you've made on your card as a statement credit.

Transferring Points to Partner Programs: To maximize the flexibility of your points, you can also transfer them to partner programs like miles. - Shopping: A number of online merchants accept Amex Membership Rewards as payment.

- Donations to Charities: Amex lets you use the JustGiving website to redeem points. Choose your favorite cause and donate at the rate of 0.7 cents for each point.

- Products: You can also spend your points to buy products.

- How to maximize rewards on Amex Platinum Card? There is a points-based system. You can redeem the points for a variety of rewards that are showcased on the Amex membership club. These include statement credit, gift cards, paying for certain services etc.

- Top reasons NOT to get the Amex Platinum Card? If you do not travel a lot or you do not spend a lot of money when traveling. If you are looking for a card that covers a wide range of purchases at premium cashback rates. If you're looking for everyday spending rewards, the Amex gold card has an advantage over the Platinum card.

- Is there a limit to rewards? There is a cap on getting the premium rate of cashback on certain types of purchases.

- Can I get car rental insurance with Amex Platinum? Yes, you will get it automatically once you decline the car insurance from the rental company and you pay the full rental charge using this card.

- Does Amex Platinum ask for proof of income? You need to have an income of at least $50,000 usually and might need to provide proof of income.

- Does card rewards points expire? They do not have an expiration date.

- Can I get pre-approved? Yes, you can get pre-approval for this card.

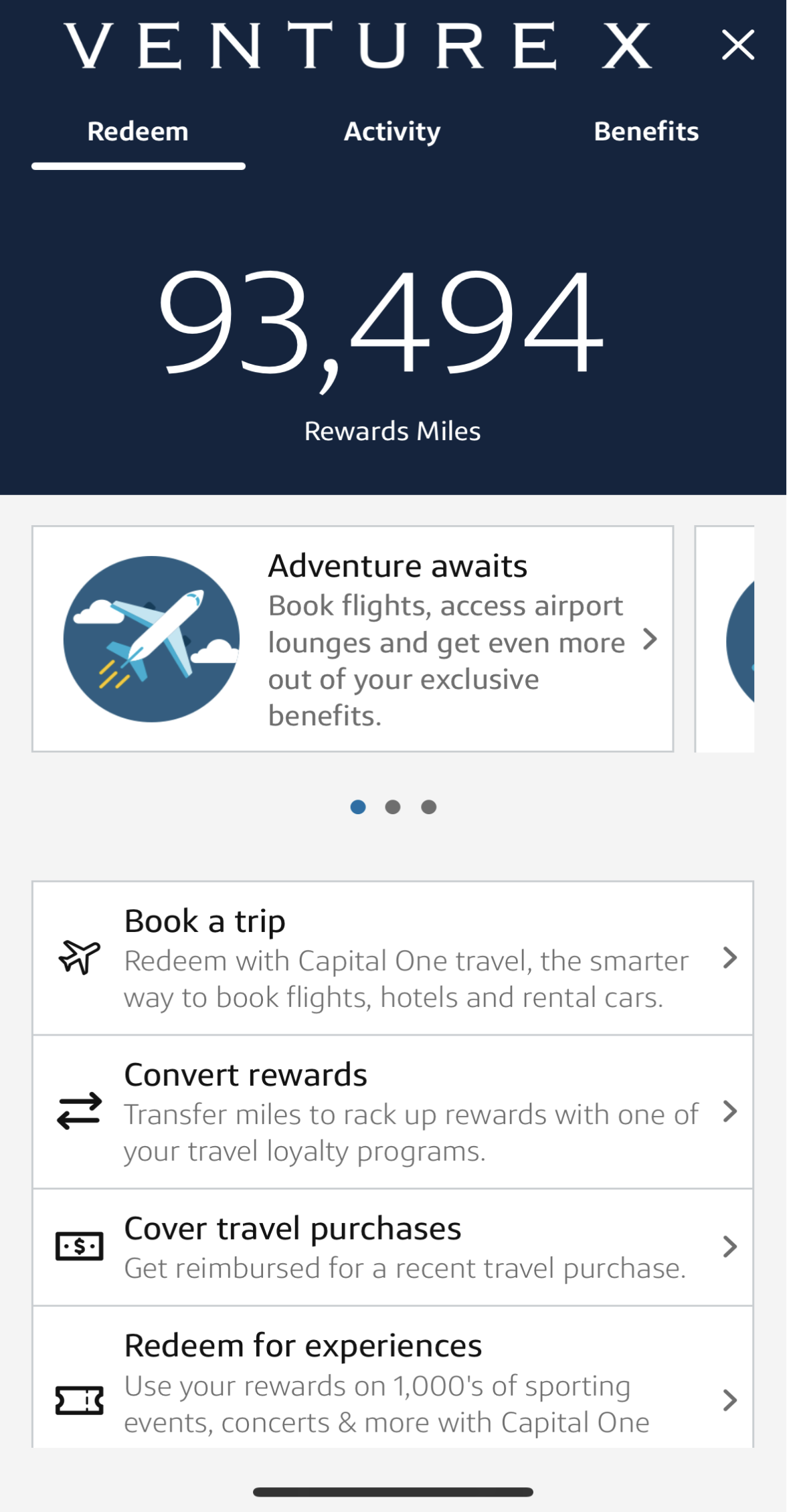

Capital One Venture X Rewards

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Capital One Venture X Rewards Credit Card has a lower annual fee compared to many other luxury credit cards. However, you can still earn superb rewards, particularly on hotels, rental cars, and flights.

The rewards rate is one of the highest on market with 10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases. The sign up bonus includes 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening.

You’ll also receive a miles bonus on your card anniversary, lounge access via Priority Pass, and complimentary Hertz President’s Circle Status. The perks package is rounded out with several insurance coverages, and you can add up to four authorized users to the account with no additional annual fee.

- Rewards Plan: 10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

- APR: 19.99% – 28.99% (Variable)

- Annual fee: $395

- Balance Transfer Fee: 3% for promotional APR offers, none for balances transferred at regular APR

- Foreign Transaction Fee: $0

- Sign Up bonus: 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

- 0% APR Introductory Rate: N/A

- Statement Credit For Travel

- Better Rewards Rate, Sign-Up Bonus

- Capital One Travel Portal

- No Foreign Transaction Fee

- $395 Annual Fee

- No Upgrading or Elite Status

- Smaller Network

What are the income requirements?

Neither issuer specifies a minimum income, but you will need excellent credit for the Venture X. Your income will be a factor for consideration, but it will not be the sole factor. If proof of income is required to support your application, the card issuers will contact you with a list of acceptable documents.

Can you get pre approval?

Capital One requires that you complete a full application for the Venture X, which will involve a hard credit pull.

What is the initial credit limit?

You can expect an initial credit limit of $5,000 to $30,000 with the Capital One Venture X.

How much is 10,000 miles worth?

The average value of Capital One miles is one cent per mile. This means that 10,000 miles would be worth $100. However, it may be possible to get a higher redemption rate with partner programs.

How’s the card customer service availability?

Capital One has a customer service line that is available 24/7, so you can access help at any time of the day or night

How long does it take for approval?

Capital One aims to give an approval decision within a few minutes, unless additional information is required to support your application. In this case, it can take a further 7 to 10 days. After approval, you should receive your card within 10 days.

Delta SkyMiles® Reserve American Express

Delta SkyMiles® Reserve American Express

Reward details

Current Offer

125,000 Bonus Miles after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Offer Ends 10/29/2025.

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

This is another American Express card, but it is a must for those who frequently fly Delta. This co-branded card offers rewards on all purchases, particularly Delta, but where it really shines is the list of benefits. For example, there is complimentary SkyClub access when you fly Delta Airlines, or you can use the Centurion or Escape Lounges.

The card also provides a status boost if you hit the annual spending requirement, there is a first checked bag free for you and up to eight travel companions, priority boarding, and a companion certificate on your account anniversary.

Some non-Delta benefits include travel insurance, cell phone insurance, and reimbursement for Global Entry/TSA PreCheck application fees.

- Rewards Plan: 3X miles per dollar on eligible Delta flights and Delta Vacations® with 1X miles on all other purchases

- APR: 19.99%-28.99% Variable

- Annual fee: $650

- Balance Transfer Fee: N/A

- Foreign Transaction Fee: $0

- Welcome Bonus: 125,000 Bonus Miles after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Offer Ends 10/29/2025.

- 0% APR Introductory Rate: N/A

- First Class, Comfort+® or Main Cabin

- Free Global Entry or TSA PreCheck

- Upgrades

- No Foreign Transaction Fee

- Trip Delay Insurance

- Medallion Status Boost

- The Centurion® Lounge

- Free First Checked Bag

- Car Rental Damage and Loss Insurance

- $650 Annual Fee

- Rewards Rate Could Be Better

Can I Get Preapproved?

American Express does allow you to see if you can pre qualify for the Delta SkyMiles Reserve in just 30 seconds on the official website.

What is the Initial Credit Limit?

There is no stated initial credit limit for the Delta SkyMiles Reserve, but there are reports that it can be quite high.

How Much is 10,000 Miles worth?

American Express has a typical average redemption for their miles of about 2 cents per mile. However, this depends on your redemption method, as it can be as low as 1 cent per mile.

When you should Move to the Delta Reserve card?

If you’re a frequent traveler with Delta, the Delta SkyMiles Reserve respectively are a good option. You can get decent rewards, but after the initial introductory period, you may find there are more attractive Delta reward cards available.

Does the Card Insurance Cover Flight Cancellation?

Yes, the card offers trip cancellation/interruption insurance, which provides reimbursement if your trip is delayed or canceled due to a covered incident.

What's the top reason to skip the Delta Reserve?

Although these it's a travel travel cards, if you are looking for cards that offer both travel and other purchase rewards, there are better options on the market. These cards are really only the best option for frequent flyers with the respective airlines.

United Club℠ Infinite Card

Reward details

4x miles on United Airlines purchases, 2x miles on all other travel purchases, dining and eligible delivery services and 1x miles on all other purchases

Current Offer

| 80,000 bonus miles after qualifying purchases |

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Special Perks

- Pros & Cons

- FAQ

The United Club℠ Infinite Card is a high-end travel card for frequent United passengers. Cardholders earn

4x miles on United Airlines purchases, 2x miles on all other travel purchases, dining and eligible delivery services and 1x miles on all other purchases. If you're looking for a luxury airline card, you may want to compare it with the Citi AAdvantage Executive card or the Delta SkyMiles Reserve card.

As a cardholder, you gain access to the Luxury Hotels & Resorts collection, offering perks like complimentary breakfast, early check-in, late check-out, and room upgrades at over 1,000 luxury properties worldwide. Primary cardholders can also work toward elite status, unlocking additional benefits such as free upgrades, extended check-out times, and exclusive travel privileges.

You should, however, make sure to cover the high annual fee of $525.

- Access to United Club (and participating Star Alliance™ affiliate) airport lounges worldwide for cardholders and up to two guests

- Up to $100 statement credit every four years when you enroll in NEXUS, TSA PreCheck or Global Entry.

- Primary cardholder and up to one companion on the same reservation can get their first and second checked bags free on United flights

- Trip cancellation/interruption insurance — Up to $10,000 per person and $20,000 per trip reimbursement for prepaid, non-refundable travel expenses.

- Baggage delay insurance — Up to $100 reimbursement per day for 3 days for baggage delays over 6 hours.

- Lost luggage reimbursement — For luggage lost or damaged by the carrier, you are covered for up to $3,000 per passenger.

- IHG Rewards Platinum Elite

- Luxury Hotels & Resorts Collection

- Baggage Insurance

- Trip Delay Coverage/Trip Cancellation/Interruption Coverage

- High Annual Fee

- Balance Transfer Fee

- Limited Non United Flight Redemptions

Can I redeem for flights with airline partners?

United has over 30 airline partners, with which you can spend your miles. Of course, you will get preferential redemption rates if you choose a United operated flight, but it is still possible to use your miles with airlines including Lufthansa, SkyWest, Air Canada, Trans States, Aer Lingus, and GoJet.

Can I get pre approved?

Chase does not typically have pre approval for the United Club Infinite card. When you apply online, Chase will pull a hard credit search.

Can I get car rental insurance?

The United Club Infinite card does have auto rental collision insurance if you pay for the rental with your card and decline the car rental company’s optional coverage.

Does the card insurance cover flight cancellation?

The United Club Infinite does have trip interruption/cancellation insurance that allows you to have pre paid, non refundable charges reimbursed. So, if your flight is canceled and you incur non reimbursed charges, you could recover them on your insurance.

What are the card income requirements?

The United Club Infinite card requires excellent credit. Your income will be used to determine your credit limit once approved.

Do the miles expire?

The United Club Infinite miles have no expiry date.

How much is 10,000 miles worth?

The average redemption value for United Club miles is about two cents per mile, depending on your redemption method. This means that 10,000 miles could be worth $200 with the United Club Infinite.

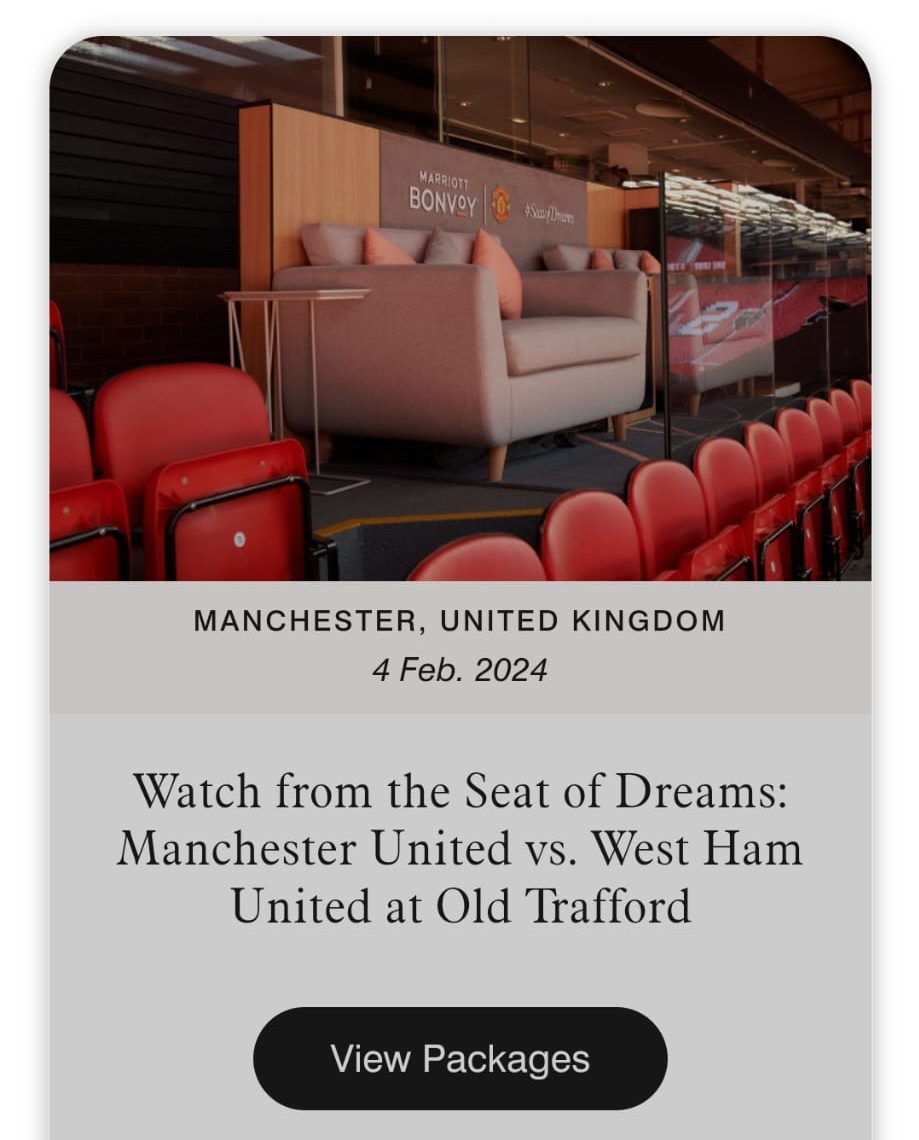

Marriott Bonvoy Brilliant® American Express® Card

Marriott Bonvoy Brilliant® American Express® Card

Reward details

6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Special Perks

- Pros & Cons

- FAQ

The Amex Bonvoy Brilliant card can be a fantastic luxury card option and one of the best hotel cards for you if you're a devoted Marriott customer. The card offers 6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases. You can redeem Marriot points for free nights, upgrades, and more.

While it has a high annual fee of $650, the card provides great travel benefits and Marriott reward-earning opportunities. With a greater redemption cap than other Bonvoy cards, the Bonvoy Brilliant credit card allows you to maximize the value of your yearly free night award.

Since this is an American Express card, you can also take advantage of special Amex benefits. This makes it a premium Marriott Bonvo credit card that's perfect for heavy spenders, frequent travels, and Bonvoy devotees.

- Every year following the month of your card renewal, you will receive 1 free night.

- At participating hotels, a Marriott Bonvoy Platinum Elite member will earn 50% additional points on qualified transactions.

- Get up to $300 in statement credits per calendar year (up to $25 per month) for qualified restaurant purchases each time your card is renewed.

- Regardless of the airline or flight class you are travelling, sign up for Priority Pass Select, which allows unrestricted access to more than 1,200 lounges in over 130 destinations.

- You can earn 25 Elite Night Credits toward the subsequent level of Marriott Bonvoy Elite membership each year. Per Marriott Bonvoy member account, restrictions apply.

- Protection for cell phones: You may be compensated for the costs of replacing or repairing a damaged or stolen cell phone.

- You can be covered for Damage to or Theft of a Rental Vehicle in a Covered Territory when you use your Eligible Card to book and pay for the Entire Rental and decline the collision damage waiver (CDW) at the Rental Company counter.

- When you pay the entire fare for a ticket for a common carrier vehicle (such as a plane, train, ship, or bus), you are covered for lost, damaged, or stolen baggage.

- Terms apply

- Annual Marriott Bonvoy Credit

- Gold Elite Status

- Global Entry/TSA PreCheck Credit

- No Foreign Transaction Fees

- Property Credit

- Free Night Award

- Airport Lounge Access

- Purchase and Travel Protections

- Annual Fee

- Limited Elite Status

- Specialized Rewards

Does the Marriott Bonvoy Brilliant Card offer a Global Entry or TSA PreCheck application fee credit?

Yes, the card provides a credit of up to $100 for either Global Entry or TSA PreCheck every four years.

Can you use Marriott Bonvoy points for experiences through Marriott Bonvoy Moments?

Yes, cardholders can redeem points for unique culinary, arts, and entertainment experiences.

What is the value of Marriott Bonvoy points when redeemed for free stays?

Point values vary, but on average, Marriott Bonvoy points are estimated to be worth 0.8 cent each.

What are the alternatives to the Marriott Bonvoy Brilliant Card for hotel rewards?

Alternatives include the Hilton Honors American Express Aspire Card and The Platinum Card from American Express, each offering unique benefits.

What are the perks of Marriott Platinum Elite status offered by the Bonvoy Brilliant Card?

Platinum Elite status includes benefits like room upgrades, complimentary breakfast, and lounge access at Marriott properties.

Can you transfer Marriott Bonvoy points to airline partners with the Bonvoy Brilliant Card?

Yes, you can transfer points to more than 35 airline partners, but it's generally not the most value-efficient option.

Citi AAdvantage® Executive World Elite Mastercard®

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Citi® / AAdvantage® Executive World Elite Mastercard® offers similar perks to other luxury airline cards.

With a $525 annual cost, it's targeted directly at American Airlines frequent flyers who value the superior travel advantages in exchange for the high annual price.

The card offers 10X AAdvantage® miles on eligible rental cars/hotels through aa.com, 4X miles on eligible American Airlines purchases and 1X on all other purchases. These miles can be redeemed for American Airlines flights, hotels, and even on American Airlines airline partners.

In addition to the Admirals Club membership, the Citi AAdvantage Executive World Elite Mastercard offers some other American Airlines extras such as AAdvantage Elite Qualifying Miles, TSA PreCheck credit of $100 every five years, American’s Reduced Mileage Awards discounts and first checked bag free.

- Rewards Plan: 10X AAdvantage® miles on eligible rental cars/hotels through aa.com, 4X miles on eligible American Airlines purchases and 1X on all other purchases

- APR: 19.99% – 28.99% (Variable)

- Annual fee: $525

- Balance Transfer Fee: $5 or 5% (whichever is greater)

- Foreign Transaction Fee: $0

- Sign Up bonus: 70,000 American Airlines AAdvantage® bonus miles after spending $7,000 within the first 3 months of account opening.

- 0% APR Introductory Rate: N/A

- Admirals Club Membership

- Reimbursement for TSA PreCheck or Global Entry

- Free First Checked Bag

- Enhanced Airport Experience

- Dedicated Concierge

- Non-Flight Benefits are Limited

- Few Non-Travel Perks

- Annual Fee

- There is no insurance coverage

Can I get car rental insurance?

Unfortunately, the AAdvantage Executive doesn't offer a rental car insurance.

What are the card income requirements?

it is possible to obtain the Citi AAdvantage card with good to excellent credit. However, there are no stated income requirements. Your credit score will be used to determine your eligibility, while your income will determine your credit limit upon approval.

Can I redeem for flights with airline partners?

Other airlines have few redemption options with American Airlines. You can use your AAdvantage miles on JetBlue flights, but only on American Airlines flights.

U.S Bank Altitude Reserve Visa Infinite Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The U.S. Bank Altitude Reserve Visa Infinite Card offers competitive rewards for travel spending categories. The cards earns 5 points per dollar on prepaid hotels and car rentals booked directly in the Altitude Rewards Center, 3 points per dollar on eligible travel purchases and mobile wallet spending and 1 point per dollar on all other eligible net purchases.

With a $400 annual travel credit, cardholders can offset travel expenses such as flights, hotels, and car rentals. Additional perks include Priority Pass Select membership, car rental discounts, and a 30% discount on Silvercar rentals.

However, despite its $400 annual fee, the card lacks travel transfer partners, has limited airport lounge access (four visits per year), and imposes a minimum redemption amount for hotels and rental cars.

- APR: 21.74% – 28.74% (variable)

- Annual fee: $400

- Balance Transfer Fee: N/A

- Foreign Transaction Fee: $0

- Rewards Plan: 5 points per dollar on prepaid hotels and car rentals booked directly in the Altitude Rewards Center, 3 points per dollar on eligible travel purchases and mobile wallet spending and 1 point per dollar on all other eligible net purchases

- Sign Up bonus: 50,000 points if you spend $4,500 in the first 90 days.

- 0% APR Introductory Rate period: N/A

- Generous Rewards

- Annual Travel Credit

- Priority Pass Select

- Luxurious Features

- High Annual Fee

- Limited Lounge Access

- Redemption Limitations

Are there any restrictions on using the Real-Time Rewards program?

While you can redeem rewards instantly using Real-Time Rewards, there's a minimum redemption amount of $150 for rental cars or hotels.

How many lounge visits do I get with Priority Pass Select?

The card offers a 12-month Priority Pass Select membership with four free lounge visits per year for the cardholder and a guest.

How can I maximize the value of my points?

Redeem points through the Altitude Rewards Center for travel to get a 50% bonus, enhancing their value.

Does the card provide benefits for Global Entry or TSA PreCheck?

Yes, cardholders can receive up to a $100 statement credit every four years when applying for Global Entry or TSA PreCheck.

Is the U.S. Bank Altitude Reserve card suitable for international premium flights?

The fixed-value redemption system may not be optimal for those seeking premium international flight redemptions typically offered by transferable points programs.

Bank of America® Premium Rewards® Elite

Reward details

Current Offer

75,000 bonus points if you spend $5,000 or more within 90 days of opening your account

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Bank of America® Premium Rewards® Elite credit card targets existing Bank of America customers seeking an upscale travel credit card, offering competitive rewards for those at the highest tiers of the Preferred Rewards program.

The card earns 2 points for every dollar you spend on travel or dining purchases, with 1.5 points per dollar on all your other purchases. Preferred Rewards members can boost rewards by 25% to 75%.

Travel benefits include a $300 annual airline incidental fee credit, Priority Pass lounge access, and a 20% discount on airfare redemption through Bank of America's Travel Center. Additional perks encompass a $100 TSA PreCheck/Global Entry credit, a $150 annual lifestyle credit, and various Visa Infinite benefits.

Despite its competitive perks, the annual fee is highm rewards ratio is average and it lacks travel transfer partners, limiting redemptions to Bank of America's travel portal.

- APR: 19.99% – 27.99% variable

- Annual fee: $550

- Balance Transfer Fee: 3%

- Foreign Transaction Fee: $0

- Rewards Plan: 2 points for every dollar you spend on travel or dining purchases, with 1.5 points per dollar on all your other purchases

- Sign Up bonus: 75,000 bonus points if you spend $5,000 or more within 90 days of opening your account

- 0% APR Introductory Rate period: N/A

- High Rewards for Preferred

- Rewards Members

- Airline Benefits

- Statement Credits

- Visa Infinite Benefits

- High Annual Fee

- Similar Rewards Structure to Lower-Fee Version

- Restricted Travel Portal

- Competitive Alternatives

Can points be redeemed for cash back?

Yes, points can be redeemed for cash via direct deposit to Bank of America accounts, credit redemptions to Merrill accounts, or as statement credits.

Does the card provide airport lounge access?

Yes, enrolled cardholders receive a 12-month Priority Pass Select membership for access to airport VIP lounges worldwide.

What is the redemption value of points for travel?

Points are worth 1 cent each when redeemed for travel, but a 20% discount is applied when booking airfare through the Bank of America Travel Center.

How does the card compare to the Bank of America® Premium Rewards® credit card?

The Elite card shares a similar rewards structure but comes with additional benefits and a higher annual fee compared to the Premium Rewards credit card.

What are the Visa Infinite benefits offered with the card?

Visa Infinite benefits include trip delay insurance, trip cancellation coverage, lost luggage reimbursement, primary auto rental coverage, and access to Visa's concierge service.

Is there a limit to the number of points that can be earned?

No, there is no specified limit on the number of points that can be earned, providing cardholders with unlimited earning potential.

What is a Luxury Credit Card?

A luxury or premium credit card is a card that offers a variety of luxury benefits such as increased point earning potential, greater insurance protections and lounge access. In most cases, these benefits are not airline specific, so you can get maximum value from your card even if you are not, particularly brand loyal to a specific airline.

In fact, some of the luxury benefits may not even be travel related. You could enjoy shopping credits, elite hotel status, and dining experiences.

So, even if you don’t tend to travel regularly, you can leverage the benefits of your luxury card. Of course, these luxury benefits do tend to come at a cost. You can expect to pay a high annual fee, but this is usually offset by the value of the card perks and benefits.

Top Offers

Top Offers From Our Partners

Top Offers

What to Look for When Choosing a Luxury Card?

There are some excellent offerings on the market, but if you’re looking to choose the right luxury card for you, there are several things that you should consider:

- The Annual Fee: First and foremost, you need to look at the annual fee that you’ll need to pay each year. You will need to assess the benefits and rewards offered with the card to see if you will be able to easily offset this charge.

- The Benefits: You will also need to assess whether the benefits and perks of the card will be of value to you. If you enjoy a luxury travel experience, lounge access, free checked bags and priority boarding are likely to have real value for you. However, if you don’t travel regularly, you’ll need to check if there are sufficient non-travel perks that you’ll use.

- The Rewards Structure: Ideally, your card will have a reward structure that allows you to earn the maximum cash back, points or miles without altering your typical spending patterns. Look at the highest reward categories or you can designate top-tier categories to see if these are areas where you tend to spend the most.

- Other Fees and Charges: While you may be focused on the annual fee, it is also important to check what other fees or charges would apply to your account. Even nominal fees such as a 3% foreign transaction fee can quickly add up if you tend to travel abroad regularly.

- The Network: Another important consideration is what credit card network the card uses. There are four credit card networks; Visa, Mastercard, American Express and Discover. Which one your card uses may not be important to you if you live in an area where all are readily accepted.

However, if you tend to travel to Europe or other areas of the world, you may find it more difficult to find merchants that accept American Express or Discover.

- Welcome Bonus Requirements: Finally, many luxury credit cards have welcome bonuses for new cardholders. These bonuses usually have a minimum spending requirement that you’ll need to meet within a designated time period. You need to feel confident that you can meet these bonus requirements comfortably without changing your spending habits.

There is no point in going for a card with a massive welcome bonus if you would be unable to hit the spending requirement in time. It is better to go for a card with a more modest spending requirement that you are certain that you can meet.

What Luxury Benefits Can You Get?

Although the benefits for each luxury credit card can vary from card to card, there are some common benefits that you may be able to access. These include:

- Annual Dining Credit

Many credit card issuers have partnerships with dining companies, so you may be able to get statement credit when you use Grubhub or other food delivery services.

Some cards also offer statement credit when you use your card for eligible restaurant purchases.

- Transportation Credit

You may also receive statement credit when you use Uber or Lyft services, depending on the card issuer’s partnership agreements.

- Travel Credit

Many luxury credit cards are aimed at travelers and in addition to traveler benefits, you may also receive annual travel credit against eligible travel purchases. For example, the Chase Sapphire Reserve offers up to $300 per year.

- Lounge Access

This is a major luxury perk for many people, as lounge memberships can cost hundreds of dollars a year. If you have an airline co-branded card, you may have an airline lounge membership included in your card perks.

Alternatively, you could have a Priority Pass or a membership for a card issuer network of lounges such as Amex’s Admirals Club.

- Travel Insurances

Although basic insurance coverage plans may be included with more basic cards, the top travel credit cards tend to offer a comprehensive package.

This could include baggage insurance plans, trip delay insurance, reimbursement cover, and other insurances that will provide peace of mind when you travel and eliminate the need to purchase coverage from your travel agent.

- Access to Luxury Collections

Another perk of many luxury credit cards is access to luxury collections of hotels and resorts, such as with the Chase Sapphire Reserve.

This is a collection of premium locations where you can book exclusive deals on stays to make a break particularly special.

Are Luxury Cards Worth It?

While a list of great perks is nice, this doesn’t necessarily mean that a luxury card would be worth it for you. There are both pros and cons associated with luxury cards and it is important to be aware of these before you make a final decision.

Pros | Cons |

|---|---|

Increased Rewards | Excellent Credit Needed |

Greater Variety of Perks | High Annual Fee |

Higher Credit Limit | Weighted Towards Travel |

- Increased Rewards

Typically, luxury cards offer a higher rate of rewards, which makes it easier to accumulate sufficient points, miles or cash back for your preferred redemption method.

The cards also tend to be more generous, so you can enjoy a higher rewards rate in multiple categories, rather than just the top tier spending.

- Greater Variety of Perks

The most obvious advantage of luxury cards is that you tend to get a massive list of perks and benefits.

These vary according to the specific card, but they are usually more than sufficient to offset the annual fee.

- Higher Credit Limit

Since these cards are considered premium or luxury, they tend to offer a higher credit limit compared to many other credit cards.

This means that you can take full advantage of the rewards, by using the card for the majority of your spending without needing to make a payment to your account mid month.

- Excellent Credit Needed

Most, if not all, luxury credit cards require that you have excellent credit to qualify.

These cards tend to be the top of the line product for each credit card issuer, so they reserve them for only the best possible customers. This means that if you have less than perfect credit, you may struggle to get your hands on one.

- High Annual Fee

All of those perks do come at a cost and the annual fee for luxury cards can run to hundreds of dollars a year.

While this may be offset with the perks, if you have a spell where you cannot use the card benefits, you could be left out of pocket.

- Weighted Towards Travel

Many of the card benefits and reward redemptions tend to be weighted toward travel.

So, if you’re not a regular traveler, you may struggle to harness the full potential of the credit card.

When to Consider a Luxury Credit Card?

If you tend to travel regularly and will appreciate lounge access, free checked bags and other travel perks, the higher annual fee is likely to be easily offset. In this scenario, you can enjoy a more luxurious experience every time you travel. You may even be able to enjoy priority boarding, and other benefits that will allow you to start your vacation early.

Luxury cards are also a good idea if the statement credit perks easily mesh with your typical spending habits. If you can earn $100 statement credit here and $100 statement credit there, you’ll easily cover the annual fee.

When You Shouldn’t Consider a Luxury Card

While you may want to enjoy a luxury airport experience and the other perks of a luxury card, if you only tend to travel once or twice a year, this type of card simply may not be worth it for you. Although airport lounge membership can run to hundreds of dollars per year, you can usually purchase a day pass, which will allow you to enjoy the lounge regardless of what card you carry.

Luxury cards are also not a good idea if you tend to carry a balance or need to transfer a balance. These cards rarely offer an introductory rate, so you would be better with a more specific balance transfer card.

How Does Inflation Impact Luxury Credit Cards?

With inflation on the rise in the U.S and around the world, you would not be alone in wondering how inflation can impact luxury credit cards. In this regard, they are very similar to most credit cards.

Luxury credit cards tend to have a variable rate, which means that when the base rate goes up, you can expect a notification from your credit card issuer letting you know that your rate is also going to go up. This means that if you’re carrying a balance on your card, you’ll be paying more in interest charges.

Another thing to consider is whether the high rate of inflation will impact your lifestyle. If you’re tightening your financial belt and not traveling as frequently, you’ll be getting less value from your card perks, such as free checked bags, lounge access, and travel insurance coverage. This means that you may have greater difficulty offsetting the annual fee.

You will also need to consider whether the rate of inflation will impact your card redemption deals. If inflation is increasing the cost of flights, surcharges and hotel bookings, you will need more points or miles to book your award.

Top Offers

Top Offers From Our Partners

Top Offers

How to Maximize Your Luxury Card?

If you’ve qualified for a luxury credit card, you’ll want to make the most of it. Fortunately, there are some simple ways to maximize your luxury card. These include:

- Plan Your Purchases

If your new luxury credit card has reward categories, make sure that you plan your purchases accordingly. Remember that many of the categories are quite general.

This means that you need to check any upcoming revolving categories and make your purchases when you can get the most points or miles.

- Meet the Welcome Bonus Spend Requirement

Most luxury credit cards offer a generous welcome bonus, but you’ll need to meet the spending requirement to qualify.

So, be sure that you’re familiar with the amount you need to spend and the deadline for the offer.

You don’t want to miss out because your final purchases didn’t apply to your account until one or two days after the promotion period.

- Take Advantage Of Rotating Bonus Categories

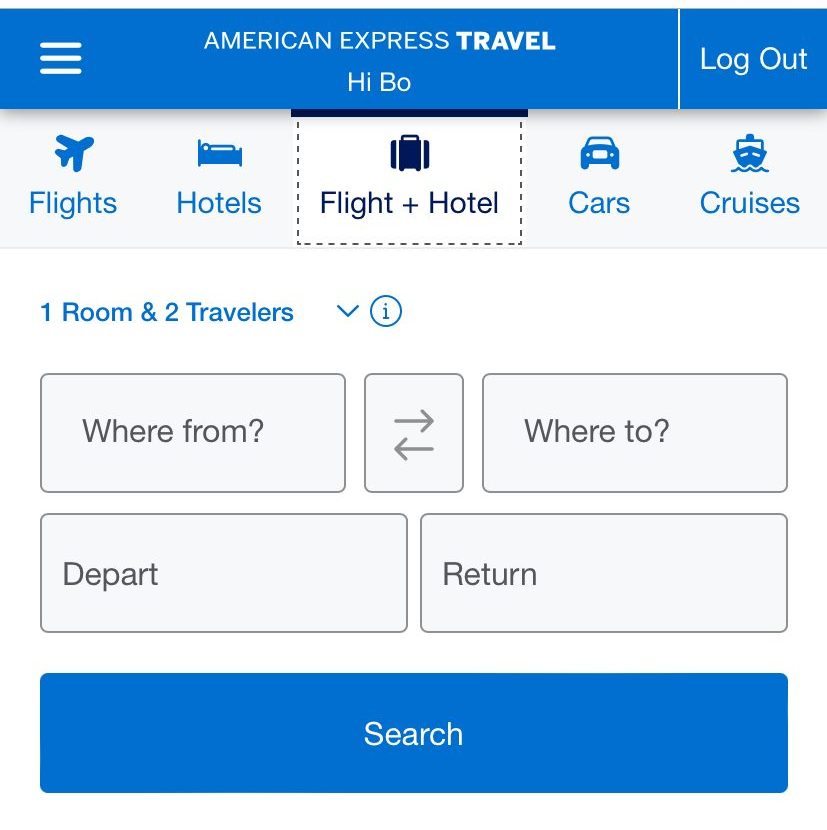

Use the Travel Portal: Most credit card issuers have a travel portal that allows you to book flights, hotels, rental cars, and other travel purchases. The popular portals are:

This portal is not only a good way to redeem your rewards, but you typically earn the highest tier rewards on these purchases. So, avoid using third party travel platforms and use your credit card company’s.

- Check Your Perks

When you first received your card, you may have scanned the paperwork detailing all of the card perks, but don’t just read it once and put it in a drawer.

Be sure to regularly check what perks and benefits you can use. Even small things such as statement credit for rideshare purchases can quickly add up and add value to your card membership

Chase vs Amex Luxury Cards: Which is Best?

As you are likely to notice from our picks for the best luxury credit cards, American Express does tend to dominate the segment. However, Chase is keen to compete and you may find one is a better choice for you over the other. If you’re unsure, consider a number of factors including:

- Luxury Card Benefits: In this area, American Express typically comes out ahead, simply due to having its own lounge network. Although Chase offers lounge access, the American Express lounge network seems to be ever-expanding and the company prides itself in offering the premier lounge experience. Chase does offer some great luxury card benefits, but it tends to prioritize rewards rather than a massive list of card perks.

- Fees: Generally speaking, Chase has lower annual fees compared to the Amex luxury cards, but you really need to check the specific fees for each card. For example, Amex Gold has a lower annual fee compared to Chase Sapphire Reserve.

- Co-Branding: Partnership cards tend to be very popular as they allow those who are brand loyal to enjoy some brand-specific perks and benefits. American Express has a number of co-branding partnerships including Delta, Hilton Honors, and Marriott Bonvoy. On the other hand, Chase has a wider variety of co-branded cards including Marriott Bonvoy, United Airlines, Southwest Airlines, Instacart, IHG, British Airways, Aer Lingus, World of Hyatt, Disney, and Amazon. Of course, not all of these are luxury cards, but it does offer a greater chance of having a card with your favorite brand.

- Concierge services: Chase premium concierge services are available with a Chase Visa Infinite card or the Chase Reserve Card. You might have easier access to making reservations at well-known restaurants or obtaining tickets for particular events. Furthermore, the concierge is accessible round-the-clock.

When it comes to making travel arrangements, the American Express concierge truly shines compared to the Chase concierge. The concierge can assist you if your plans are delayed and even advocate on your behalf to get any refunds you are due. They can essentially serve as a travel assistant.

- Travel Portals: Both Amex and Chase offer travel portals where you book flights, transfer points to airline and hotel programs, and order gift cards. Each of them comes with a lot of options and provides a great option to redeem your points.

Are There Cheaper Alternatives to Luxury Cards?

While having all the perks of a luxury card may seem great, you may not be prepared for the higher annual fee. Fortunately, there are some great alternatives.

American Express® Gold Card

The American Express® Gold Card welcome bonus includes 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership.

While the Platinum American Express is considered a luxury card, its sibling can also offer some great perks for a far more reasonable annual fee. You’ll still have access to tiered rewards weighted towards dining and grocery store purchases, and there is a welcome bonus with a reasonable spend requirement.

Although the Platinum card is aimed at frequent travelers, regular travelers can still access the 24/7 Global Assist Hotline, no foreign transaction fees, and preferred seating. There is also statement credit for Uber purchases and for participating restaurants when you pay with your Gold Card. (terms apply).

The annual fee is $325, see rates & fees.

Capital One Venture Rewards

If you’re considering a luxury card for its travel benefits, the Capital One Venture Rewards could provide a cheaper alternative.

This card has a low fee, but there is still a nice welcome bonus and unlimited miles on your purchases. There is statement credit to cover your application fee for Global Entry or TSA PreCheck when you pay with your card and no foreign transaction fees.

Although there is no lounge access, there is a 24/7 travel assistance helpline and travel accident insurance included with your card.

Citi Premier® Card

The Citi Premier® Card is another card with a low annual fee that is easy to overlook. However, it not only has a welcome bonus and generous reward structure, but you can also receive annual statement credit if you spend $500 or more on a single hotel stay with your card.

There are no foreign transaction fees, and you can also have special access to tickets for events such as dining experiences, concerts and sporting events to give you that luxury experience.

FAQs

A premium credit card works in the same way as a regular credit card, except you’re likely to pay a higher annual fee to access the premium benefits.

This depends on the card, but some luxury cards have no preset limit.

Yes, if your account is not in good standing and you fail to manage your account responsibly, the bank could cancel your card.

Millionaires tend to have access to a different variety of credit cards that typically are invitation only or require a high minimum net worth. For example, the American Express Black Card.

The Amex Platinum card is a great shopping card and you can even earn statement credit on some of your shopping purchases, for example if you use your card in Saks Fifth Avenue

The Capital One Venture X is a good choice, as it focuses more on rewards and less on luxury benefits

If you’re a Delta frequent flyer, the Delta SkyMiles Reserve Amex is a great pick with lots of airline perks. Take a look at the best co-branded airline cards if you're looking for an airline card.

The Amex Black Card is invitation only and has a strict income requirement. It also carries a $5,000 annual fee.

A 600 is classified as a below average score, which means you will struggle to qualify for a luxury card, as these cards are typically reserved for those with excellent credit

How We Picked The Best Luxury Credit Cards: Methodology

To identify the best no foreign transaction fee credit cards, our team meticulously evaluated offerings from various issuers, focusing on major banks and financial institutions. We rated these cards based on three key categories tailored for travelers:

- Luxury Benefits (40%): This category evaluates features that enhance the overall luxury experience, such as annual fees, airport lounge access, travel credits, complimentary elite status with hotels or airlines, fine dining experiences, and luxury travel insurance coverage. Cards offering a comprehensive range of premium benefits without excessive fees and tailored for luxury lifestyles earn higher scores.

Card Features & Offers (40%): We examine card features such as annual fees, welcome bonuses, rewards, APR, insurance benefits, and protections. Cards offering a comprehensive range of benefits without excessive fees and competitive rates earn higher scores.

User Experience & Support (20%): We scrutinize the ease of application, customer service quality, and online account management tools provided by the issuer. Cards with streamlined application processes, responsive customer support, and user-friendly online portals or mobile apps receive higher ratings, ensuring a positive experience for cardholders.

This comprehensive evaluation ensures that the best no foreign transaction fee credit cards offer attractive rewards, valuable benefits, a seamless user experience, and a positive relationship with the issuer, catering to the needs of travelers who frequently make purchases abroad.