If you enjoy flying United and enjoy the United loyalty program, you may have considered a co-branded United card. These cards can offer some great benefits. So, here we’ll explore the best United cards.

United Explorer Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The United Explorer Card has a modest annual fee, which is waived for the first year and considered one of the top airline cards out there.

In addition to the DashPass and insurance you get with the United Gateway card, you’ll also get first checked bags free for you and a travel companion, reimbursement for your Nexus, Global Entry or TSA PreCheck application fee, priority boarding, and two United Club one time passes per calendar year.

The United Explorer card has a two tiered reward structure weighted towards United purchases, hotel stays and dining including eligible delivery services.

- Rewards Plan: 2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

- APR: 21.49% – 28.49% variable APR

- Annual fee: $95 ($0 first year)

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: $0

- Sign Up bonus: Earn 60,000 bonus miles after qualifying purchases

- 0% APR Introductory Rate: N/A

- Free Checked Bag & Priority Boarding

- Annual United Club Passes

- No Foreign Transaction Fee

- Mileage Rewards & Sign-Up Bonus

- Annual Fee

- Balance Transfer Fee

- High APR for purchases

What are the card income requirements?

Chase does not disclose any minimum income requirements. However, Chase will use your income to determine your credit limit, which may require proof of income.

Should you move to the Explorer card?

If you’re a frequent flyer with United, the Explorer card will offer some great rewards. If you’re currently not getting good travel rewards and you want to make the most of your travels, these cards do represent a good option.

What's the rewards limit?

There is no cap on how many miles you can earn in any statement year.

What are the top reasons not to get it?

The Explorer card are specifically designed to offer great rewards for United travel. This does mean that there are not great rewards for other purchases. So, if you’re looking for an all round card for every day purchases, this card are not the right choice for you.

What is the initial credit limit?

The starting credit limit for the United Explorer is $3,000. However, depending on your credit limit and income, your initial credit limit may be higher

United Quest Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

This card is more suited to regular travelers who can easily offset the $250 annual fee.

However, this higher fee does provide some nice perks. This includes up to $125 in statement credit per year as reimbursement for United purchases. While the fee is higher compared to the Explorer card, the benefits you can get with the Quest card are much more extensive.

You’ll also get first and second checked bags free for you and a travel companion, reimbursement for Nexus, TSA PreCheck or Global Entry application fees, priority boarding, and two 5,000 mile anniversary bonuses.

If you book a United or United Express award flight with your miles, you’ll get miles back in your account up to two times per anniversary year.

The United Quest card has a multi tiered reward structure. You’ll earn 3 miles per $1 spent on United purchases immediately after earning your $125 annual United purchase credit, 2 miles on all other travel and select streaming services, 1 mile on all other purchases.

- Rewards Plan: 3 miles per $1 spent on United purchases immediately after earning your $125 annual United purchase credit, 2 miles on all other travel and select streaming services, 1 mile on all other purchases

- APR: 21.49% – 28.49% variable APR

- Annual fee: $250

- Balance Transfer Fee: 5$ or 5% (whichever is greater)

- Foreign Transaction Fee: $0

- Sign Up bonus: 100,000 bonus miles + 3,000 Premier qualifying points (PQP) after qualifying purchases

- 0% APR Introductory Rate: N/A

- Free Checked Bag & Priority Boarding

- United Club Passes

- No Foreign Transaction Fee

- Premium Upgrades

- Mileage Rewards & Sign-Up Bonus

- Global Entry/TSA PreCheck Credit

- Access to the Luxury Hotel & Resort Collection

- Annual Fee

- No Lounge Access

The United Quest card offers auto rental collision damage waiver protection. If you charge the entire rental and decline the collision insurance from the rental company, you’ll enjoy primary coverage against collision damage or theft.

The Quest card requires good to excellent credit, but Chase does not disclose any minimum income requirements. However, Chase will use your income to determine your credit limit, which may require proof of income.

Yes, Chase uses the Star Alliance network of airlines for its rewards program. So, while you may get additional perks for using your miles for United flights, you can use your miles for flights with a number of other airlines including SkyWest, Trans States, Air Canada, Aer Lingus, Lufthansa, and GoJet.

While Chase does send out pre-approval letters for some of its cards on occasion, pre-approval is not available, and you must submit an application and have Chase pull your credit.

United Gateway℠ Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

The United Gateway card is the entry-level option that offers solid rewards without an annual fee. It comes with a 0% introductory APR on purchases for the first 12 months after account opening.

The card has a two-tier rewards system, with higher earning rates for United purchases, gas, commuting, and local transit, and a base rate for all other spending.

While there’s no annual fee, the card does come with some nice perks, including no foreign transaction fees, credit for United inflight premium drinks, trip cancellation insurance, purchase protection, and a complimentary one-year DoorDash DashPass.

- Rewards Plan: 2X per $1 spent on United® purchases, at gas stations and on local transit and commuting and 1X on all other purchases

- APR: 21.49% – 28.49%

- Annual fee: $0

- Balance Transfer Fee: N/A

- Foreign Transaction Fee: $0

- Sign Up bonus: 20,000 bonus miles after qualifying purchases

- 0% APR Introductory Rate: None

United℠ Business Card

United Business Review

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

If you’re a business owner, you don’t need to miss out on United benefits. The United Business Card has a $99 annual fee, which is waived for the first year and a tiered reward structure, weighted towards United purchases, dining, gas stations, local transit and office supply stores.

With this card, you’ll not only get free first checked bags for you and one travel companion, but there is United travel credit, anniversary bonuses and two one time United Club passes per year. You can also enjoy priority boarding, cash back statement credit for inflight drinks and a generous welcome bonus.

However, what makes this card particularly attractive is that employee cards are available at no additional cost. So, you can manage all of your business expenses through your United Business Card account and accumulate even greater rewards.

- Rewards Plan: 2X per $1 spent on United® purchases, dining (including eligible delivery services), at gas stations, office supply stores, and on local transit and commuting and 1X on all other purchases

- APR: 21.49% – 28.49% variable APR

- Annual fee: $99

- Balance Transfer Fee: N/A

- Foreign Transaction Fee: $0

- Sign Up bonus: 100,000 bonus miles + 2,000 Premier qualifying points (PQP) after you spend $5,000 on purchases in the first 3 months your account is open

- 0% APR Introductory Rate: None

United Club℠ Infinite Card

Reward details

Current Offer

| 80,000 bonus miles after qualifying purchases |

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The United Club Infinite is the premium United co-branded credit card. While it does have a substantial annual fee, you’ll have United Club membership, which should immediately offset the annual fee.

Other benefits include free first and second checked bags, priority check in, baggage handling, security screening and boarding. The leading competitors are the Citi® / AAdvantage® Executive World Elite Mastercard and the Delta SkyMiles® Platinum American Express Card.

You can also save 10% on United Economy Saver Awards, and you’ll be eligible for IHG Rewards Platinum Elite status along with up to $75 in statement credit for IHG Hotels and Resorts purchases.

This card also has a more generous reward structure weighted towards United Purchases.

- Rewards Plan: 4x miles on United Airlines purchases, 2x miles on all other travel purchases, dining and eligible delivery services and 1x miles on all other purchases

- APR: 21.49% – 28.49% variable APR

- Annual fee: $525

- Balance Transfer Fee: $5 or 5% (whichever is greater)

- Foreign Transaction Fee: $0

- Sign Up bonus:

80,000 bonus miles after qualifying purchases - 0% APR Introductory Rate:N/A

- IHG Rewards Platinum Elite

- Luxury Hotels & Resorts Collection

- Baggage Insurance

- Trip Delay Coverage/Trip Cancellation/Interruption Coverage

- High Annual Fee

- Balance Transfer Fee

- Limited Non United Flight Redemptions

Can I redeem for flights with airline partners?

United has over 30 airline partners, with which you can spend your miles. Of course, you will get preferential redemption rates if you choose a United operated flight, but it is still possible to use your miles with airlines including Lufthansa, SkyWest, Air Canada, Trans States, Aer Lingus, and GoJet.

Can I get pre approved?

Chase does not typically have pre approval for the United Club Infinite card. When you apply online, Chase will pull a hard credit search.

Can I get car rental insurance?

The United Club Infinite card does have auto rental collision insurance if you pay for the rental with your card and decline the car rental company’s optional coverage.

Does the card insurance cover flight cancellation?

The United Club Infinite does have trip interruption/cancellation insurance that allows you to have pre paid, non refundable charges reimbursed. So, if your flight is canceled and you incur non reimbursed charges, you could recover them on your insurance.

What are the card income requirements?

The United Club Infinite card requires excellent credit. Your income will be used to determine your credit limit once approved.

Do the miles expire?

The United Club Infinite miles have no expiry date.

How much is 10,000 miles worth?

The average redemption value for United Club miles is about two cents per mile, depending on your redemption method. This means that 10,000 miles could be worth $200 with the United Club Infinite.

Sign Up for

Our Newsletter

and special member-only perks.

Sign Up for

Our Newsletter

and special member-only perks.

Table Of Content

Requirements for United Credit Cards

Since United credit cards offer some great perks, they do have some firm requirements to qualify. You will need:

- Fair to Excellent Credit: This is a fairly broad range, but the higher the card perks, the higher the necessary credit score. So, while you may qualify for a United Gateway credit card with a 660 credit score, you’ll need a good score for the Quest or Club Infinite cards.

- Sufficient Income: You will also need to demonstrate that you have sufficient income to support your new United card. Your debt to income ratio will be examined, so it may be worthwhile paying down another account or boosting your income with a side hustle, if you want to be sure that you can qualify.

- 5/24 Rule: United credit cards are issued by Chase Bank and Chase has its 5/24 rule. Essentially, this means that regardless of your financial circumstances, if you’ve already opened five credit card accounts in the last 24 months, your application will be rejected. This is regardless of whether the new credit cards are from Chase or other financial institutions.

Pros and Cons of United Cards

As with all financial products, there are both pros and cons of United credit cards, so it is important to be aware of these before you make a decision about which card is best for you.

Pros | Cons |

|---|---|

No Branches | APY |

No Monthly Fees | ATM Access |

No Deposit or Balance Requirements | `ATM Fee Reimbursement |

- Miles Bonus

United credit cards can be a great option if you’re looking to boost your United MileagePlus balance. In addition to welcome bonuses, the cards offer a great way to get more miles without having to take additional flights.

This makes them a viable option for the less frequent traveler who still wants to accumulate sufficient miles for award flights.

- Excellent United Benefits

Even the base card offers some nice benefits when you fly United including statement credit for inflight beverage purchases.

However, as you progress to the more premium cards, you can enjoy some excellent perks including free checked bags, priority services and even lounge access.

- Additional Perks

Unlike many co-branded credit cards, United cards offer some excellent additional perks that are not necessarily geared towards United flights, including reimbursement for TSAPrecheck or Global Entry application fees and a free DashPass.

- Reasonable Annual Fees

The annual fees for United credit cards are quite reasonable considering the perks offered. This should make it quite easy for cardholders to offset the cost of the annual fee with the card benefits.

- 5/24 Rule

Since United cards are issued by Chase, they are subject to Chase’s 5/24 rule.

This means that even if you have excellent credit, a low debt to income ratio and a high income, your application can still be rejected if you’ve opened up multiple new credit card accounts over the last two years.

- United Centric

Obviously, since these are United co-branded cards, the benefits and rewards are United centric.

This means that if you’re not especially brand loyal to United, you will struggle to leverage the full potential of these cards.

- No Lower Credit Option

You’ll need at least a score of 660 to stand a chance of qualifying for a United credit card. So, if you have a lower score, you’ll have no avenue of entry.

Top Offers

Top Offers

Top Offers From Our Partners

How to Choose a United Credit Card

While there are only a handful of options, it is still important to choose the right United credit card for your circumstances. Fortunately, there are a few tips that can help you to choose the best United cards for you.

- Check Your Credit Score: The first thing that you should do is check your latest credit score. Generally speaking, the higher the benefits package, the more stringent the credit score requirements. So, if your score is fair or at the low end of good, you may need to consider the lower tier United cards rather than aiming straight for the United Club Infinite.

- Assess the Benefits Package: While a long list of card perks is great, they are only worth the annual fee if you will use them. So, you need to assess the benefits package of each card and work out if it offers good value for you. There is no point in paying a hefty annual fee if you only tend to travel once a year. In this case, you are better off with a lower tier card and paying for a day lounge pass or your checked bag fees.

- Evaluate the Welcome Bonus Requirements: United credit cards offer a welcome bonus, letting you earn extra miles. Keep in mind that bigger bonuses often come with higher spending requirements. Be sure to read the details to understand how much you need to spend within the promotional period and make sure it’s manageable for you. It’s better to choose a card with a smaller welcome bonus than to miss out on a big one because you can’t meet the spending threshold.

How Does the United Loyalty Program Work?

United MileagePlus is the United Loyalty program and it is designed for frequent flyers to earn further rewards. You can accumulate miles in various ways including using your new United credit card and then redeem them for free flights and other rewards.

One of the easiest ways to earn more miles is to book and take United flights. You’ll earn at least five miles per dollar spent on your fare, depending on your elite status. There are four tiers of elite status, which not only offer a higher rewards rate for your flights, but additional United perks.

As a member of the program, you can enjoy free checked bags, priority award waitlist, priority check in and screening, and free confirmed flight changes within 24 hours of departure. However, each tier of elite status from Premier

Silver to Premier 1K adds further benefits including: additional free checked bags, priority check-in, screening and boarding, Hertz Gold Plus Status, complimentary Avis Preferred Plus Status, discounted CLEAR membership, complimentary Marriott Bonvoy Gold Status, discount on United Club annual membership, complimentary Avis President’s Club Status, free Timeshifter annual subscription and free inflight drinks.

Redeeming Options

Once you accumulate sufficient miles, you have several redemption options. These include:

-

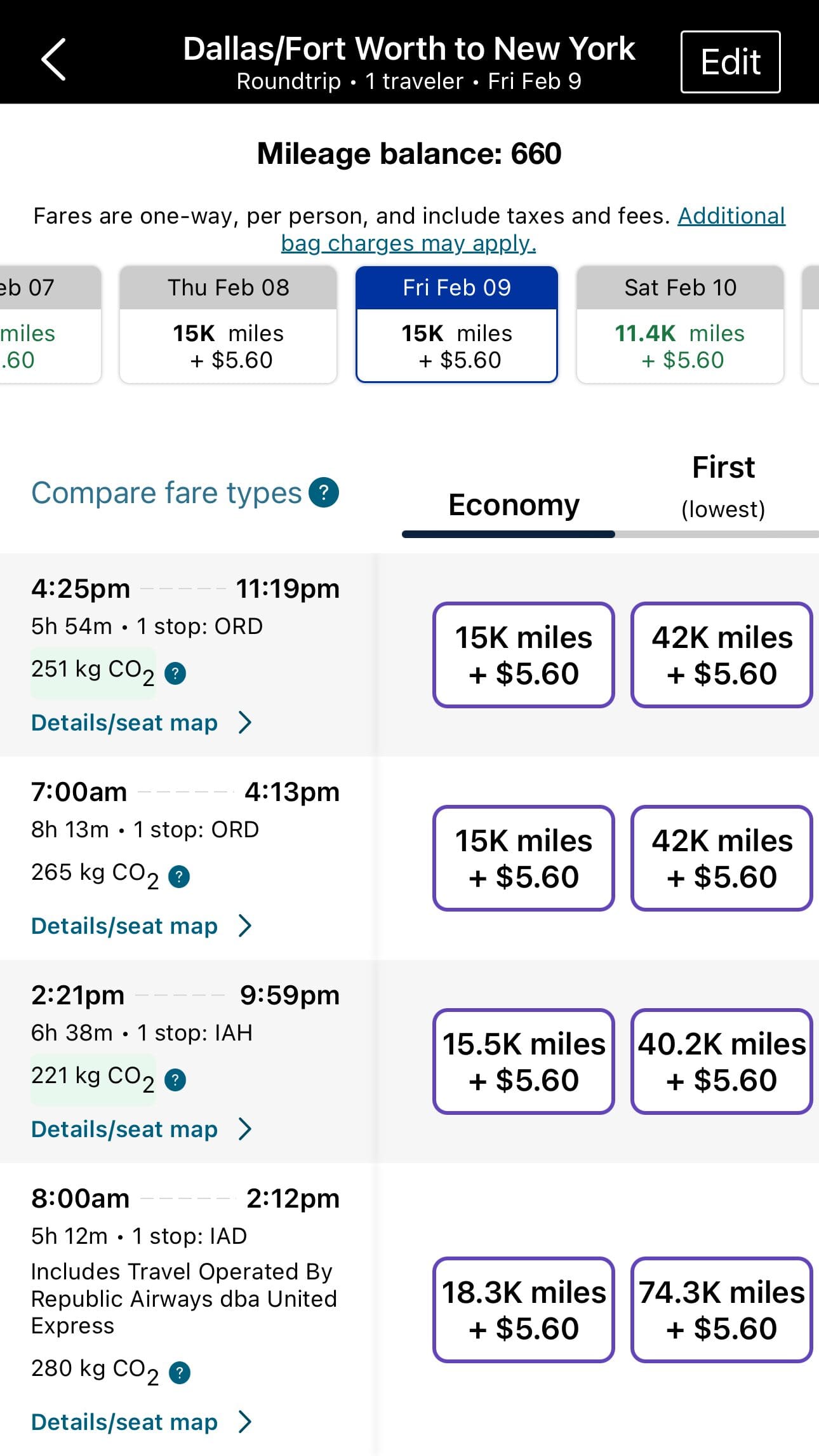

United Flights

The most obvious way to redeem your United miles is by booking United flights. You can search for award tickets using the United platform by selecting “Book with Miles.”

United has dynamic pricing for its awards, so you can find some great deals, particularly if you fly off peak or on less popular routes. United also has a 30 day calendar, so you can compare if it costs fewer miles to travel a day or two earlier or later.

Depending on the specific flight itinerary, your miles can be worth anything from 1.2 to 5 cents plus each. The United site provides a cash value and a miles cost for each flight, so you can easily calculate the miles value by dividing the cash price of the ticket by the miles required.

-

Partner Deals

United is a member of Star Alliance, so you can book award flights with 26 airline partners. There are also a further 14 airlines that have a partnership agreement with United. There are also hotel, vacation and car rental partners.

You don’t need to try to transfer your miles to any of these partnership programs as you can use the United booking tool to check for partner deals. This is similar to the process to book an United flight, but you can select vacations, car rentals or hotels in the search bar.

As with United flights, you can divide the cash price by the number of miles to work out your mileage value. The average redemption values for this method vary from less than one cent per mile to five or more.

-

Other Redemption Options

If you don’t have any immediate travel plans, you can spend your United miles in other ways. These include:

- United Club Membership: If you don’t get this as a perk with your United credit card, you can purchase an annual subscription using your miles. The current cost is 85,000 miles, which provides a redemption value of 0.8 cents per mile.

- Airport Dining: In some locations, you can use your miles to pay for your meal in the airport cafes and restaurants. You will need to scan your boarding pass and choose “miles” when you pay your bill at the checkout.

- Newspapers and Magazines: The United MileagePlus website has a choice of newspaper and magazine subscriptions. Depending on the specific deal, you can get a redemption value of 2.5 cents for each mile.

- Gift Cards: If you are still struggling to use your miles, you could choose a gift card from the selection on the Mileageplus redemption site. While the cost can vary, the average redemption rate is only 0.3 cents per mile.

United vs Delta Cards

If you’re unsure whether a United or Delta card is the best choice for you, you need to be aware of the main differences.

These cards tend to have similar annual fees and welcome bonuses. However, there are some important differences.

- Lower tier Delta cards tend to offer discounted lounge access: While you can get lounge access with higher tier United cards, this is not an option with the lower tier cards. However, Delta cards often offer discounted lounge access passes.

- Purchase credit: United cards tend to offer purchase credit, which is not typically offered with Delta cards.

- Additional checked bags: This is potentially one of the most lucrative benefits, since Delta offers free checked bags for you and up to eight travel companions. So, if you typically travel in a large party, there is the potential to save hundreds of dollars per trip.

United vs American Airlines Cards

Both United and American Airlines credit cards offer some great perks, but the American Airlines annual fees tend to be a little lower.

While the benefits offered with the base American Airlines card are very limited, once you look at the higher tier cards, you may be surprised at some of the perks. For example, with the mid tier card, you can earn companion passes with your annual spending.

However, on the whole, the benefits package for each United card outweighs the American Airlines offerings, making them worth paying slightly more on the annual fee.

Sign Up for

Our Newsletter

and special member-only perks.

Sign Up for

Our Newsletter

and special member-only perks.

Related Posts

How We Picked The Best United Credit Cards: Methodology

To identify the best United credit cards, our team researched various cards, focusing on United. We rated these cards based on two key categories tailored for consumers seeking United rewards:

United Rewards & Benefits (50%): We evaluate the rewards program specific to United, including miles earned per dollar spent on United purchases, bonus categories for accelerated rewards, and redemption options such as free flights, upgrades, or lounge access. Cards offering generous rewards rates, versatile redemption choices, and valuable benefits like companion passes or priority boarding score higher in this category.

Card Features & Offers (50%): This category assesses additional features that enhance the overall value of the card for United travelers, such as annual or foreign transaction fees , free checked bags, priority check-in, and discounts on in-flight purchases. Cards offering a comprehensive range of benefits without excessive fees earn higher scores.

This comprehensive evaluation ensures that the best United credit cards offer valuable rewards, benefits, and a seamless user experience for consumers seeking to maximize their travel with United.

Review Airline Credit Cards

Delta SkyMiles Blue American Express