When it comes to Capital One's credit card offerings, the Venture and VentureOne cards stand out as popular choices for mid level cards, each with its unique perks and features.

Whether you're a frequent traveler looking for robust rewards or a savvy spender focused on saving, this comparison will shed light on the nuances of these two cards, helping you make an informed decision tailored to your financial preferences and lifestyle.

General Comparison: Capital One Venture vs. VentureOne

The Venture card is perfect for frequent travelers who want to earn great rewards. With a higher annual fee, it offers a generous rewards program, giving at least 2X miles on every purchase.

In contrast, the VentureOne card is ideal for those looking to save. With no annual fee, it's a more budget-friendly option that still offers a rewards program, though the miles per dollar spent are lower compared to the Venture card. Plus, it comes with a 0% intro APR.

|

| |

|---|---|---|

Capital One VentureOne | Capital One Venture | |

Annual Fee | $0 | $95 |

Rewards | unlimited 5X miles on hotels and rental cars booked through Capital One Travel and 1.25X miles on all other purchases | 2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel |

Welcome bonus | Enjoy a $100 credit to use towards flights, stays and rental cars booked through Capital One Travel during your first cardholder year. 20,000 bonus miles when you spend $500 within the first three months

| 75,000 miles once they spend $4,000 on purchases within 3 months from account opening |

0% Intro APR | 18 months on purchases and balance transfers | N/A |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 18.99% – 28.99% (Variable)

| 19.99% – 28.99% (Variable)

|

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Credit Card Points Battle: Venture vs. VentureOne

The Venture card provides a higher rewards rate across all categories, making it an excellent choice for frequent travelers. These miles can be redeemed for travel expenses, adding great value for those always on the go.

Capital One Travel also offers flexible points redemption options, allowing users to easily combine travel and lifestyle rewards. Points can be redeemed for flights, hotels, and car rentals, or transferred to partner airlines and hotels, expanding the range of options and increasing the value of your rewards.

|

| |

|---|---|---|

Spend Per Category | Capital One VentureOne | Capital One Venture |

$15,000 – U.S Supermarkets | 18,750 miles | 30,000 miles |

$5,000 – Restaurants

| 6,250 miles | 10,000 miles |

$5,000 – Airline | 6,250 miles | 10,000 miles |

$5,000 – Hotels | 25,000 miles | 25,000 miles |

$4,000 – Gas | 5,000 miles | 8,000 miles |

Estimated Annual Value | 61,250 miles (About $612) | 83,000 miles ( $830) |

Which Benefits Of You'll Get On Both Cards?

There are some additional types of perks that you will see with both of these cards:

- Capital One Dining and Entertainment: Enjoy exclusive reservations at award-winning restaurants and access to culinary experiences, as well as exclusive pre-sales, tickets, and more for music, sports, and dining events.

- No Foreign Transaction Fees: You won’t pay a transaction fee when making a purchase outside of the United States

- Auto Rental Collision Damage Waiver: Enjoy primary coverage against theft and collision damage for most rental cars globally, provided you opt out of the rental company's insurance. Reimbursement extends up to the actual cash value of the vehicle.

- Purchase Protection: Safeguard your new purchases from damage or theft with comprehensive coverage.

- Extended Warranty Protection: Extend the existing U.S. manufacturer's warranty by an additional year for eligible warranties lasting three years or less.

- Travel Accident Insurance: Automatically receive insurance coverage for eligible losses when you use your credit card to purchase your travel fare.

- 24-Hour Travel Assistance Services: In the event of a lost or stolen credit card, access emergency services such as an immediate replacement card and cash advance.

Which Benefits You'll Get Only With The Venture?

The Venture offers some unique, premium benefits for cardholders that you won't be able to get with the VentureOne card:

- Capital One Lounges: Cardholders can escape airport crowds by accessing all-inclusive Lounges with unlimited complimentary access for themselves and two guests per visit.

- Hertz Gold Plus Rewards President's Circle® status: Venture X cardholders are eligible for complimentary Hertz President’s Circle status, allowing them to skip the rental counter, choose from a wide selection of cars, and receive guaranteed upgrades.

- Global Entry or TSA PreCheck® Credit: Receive up to a $100 credit for Global Entry or TSA PreCheck®.

- Partner Lounge Network: Enjoy unlimited access for yourself and two guests to over 1,300 lounges worldwide from Priority Pass™ and Plaza Premium Group.

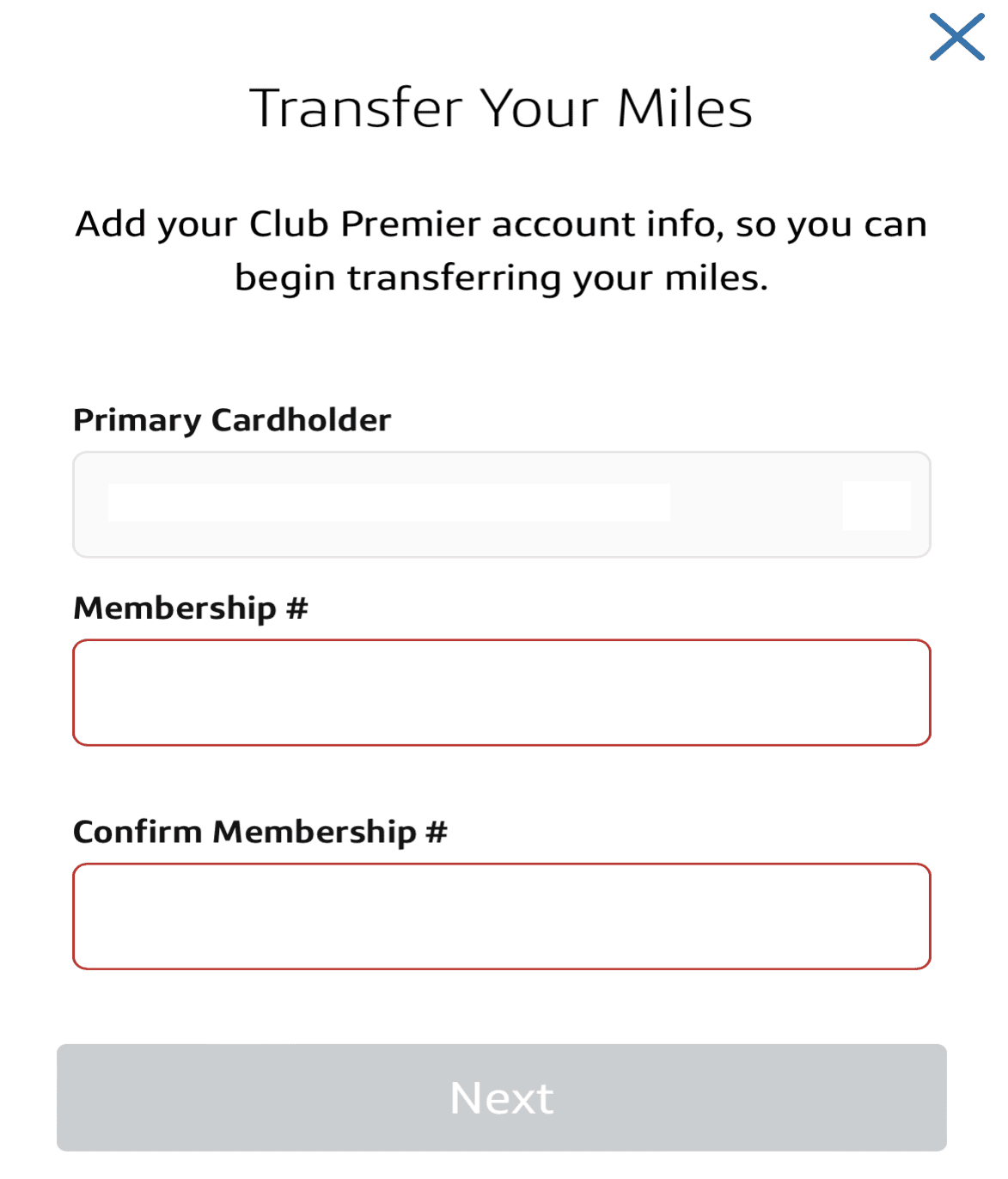

- Miles Redemption: Use your Capital One miles to cover various travel expenses, such as flights, hotels, rental cars, and transfer miles to a choice of 17+ travel loyalty programs. It's quick and easy to do it via Capital One app:

Which Benefits You'll Get Only With The VentureOne ?

With the VentureOne card, cardholders can get 0% intro APR for 18 months on purchases and balance transfers. This is something unique to VentureOne and you won't be able to get it with the Venture card.

When You Might Want the Capital One Venture?

Here are scenarios where the Venture card might be the superior choice:

- Frequent Traveler: If you find yourself jet-setting often for business or leisure, the Capital One Venture card is a stronger choice. Its higher annual fee is justified by more robust travel rewards, making it a valuable companion for those who accumulate miles quickly and want to maximize their travel benefits.

- Lounge Access: For those who enjoy premium travel experiences, the Venture card's enhanced rewards can be particularly appealing as the additional benefits include access to airport lounges.

- Big Spender: If you tend to make significant purchases regularly, the Venture card's higher miles-per-dollar spent ratio becomes advantageous. The more you spend, the more you earn in rewards, making it a lucrative option for individuals with higher monthly expenses.

When You Might Want the Capital One VentureOne?

Here are scenarios where opting for the VentureOne might be the smarter choice:

- Introductory 0% APR: If you're planning a larger purchase or need to carry a balance for a short period, the VentureOne card's 0% introductory APR can be a significant advantage. This feature allows you to make purchases without incurring interest charges for an initial period, providing financial flexibility.

- Cost Conscious: If you're looking to minimize expenses and avoid annual fees, the VentureOne card is a practical choice, offering a rewards program without the added cost.

- Building Credit: If you're establishing or rebuilding credit and want a rewards card without committing to an annual fee, the VentureOne offers a good entry point.

Top Offers

Top Offers From Our Partners

Top Offers

Compare The Alternatives

If you're looking for a travel rewards credit card– there are some excellent alternatives you may want to consider:

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

175,000 points

175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership

|

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | See Pay Over Time APR | 19.99%–28.49% variable

| 19.99% – 28.99% (Variable)

|

Compare Capital One Venture Card

The Venture X card outshines the Venture card with superior rewards and premium travel perks. Is It worth the annual fee difference?

If you're looking for travel rewards, it's an easy decision. But what about if you're looking to get rewards on everyday spending?

Capital One Venture vs Capital One Quicksilver: Which Card Wins?

While the Chase Sapphire Preferred Card has more benefits, the Capital One Venture card offers unique features. Which travel card is better?

Capital One Venture vs Chase Sapphire Preferred: Which Card Is Best?

While Amex Gold Card offers statements credits and everyday spending benefits, the Venture card is cheaper and include decent travel perks.

The Capital One Venture is designed for avid travelers, while the Savor card caters to foodies and entertainment lovers. How do they compare?

The Capital One Venture offers a better points rewards ratio and travel benefits than the BofA Travel rewards. Is it worth the annual fee?

BofA Travel Rewards vs. Capital One Venture Card: How They Compare?

The Capital One Venture is a clear winner as it offers a better miles rewards ratio and extra travel benefits. But it charges an annual fee.

Discover it Miles vs. Capital One Venture Card: How They Compare?

The Capital One Venture is a clear winner as it offers higher annual cashback value and better travel perks than the Alaska Visa Signature

Alaska Visa Signature vs Capital One Venture: Side By Side Comparison