The Chase Sapphire Preferred Card and the Air Canada Aeroplan Credit Card are two popular travel rewards credit cards, each offering unique advantages. Let's compare them side by side.

General Comparison

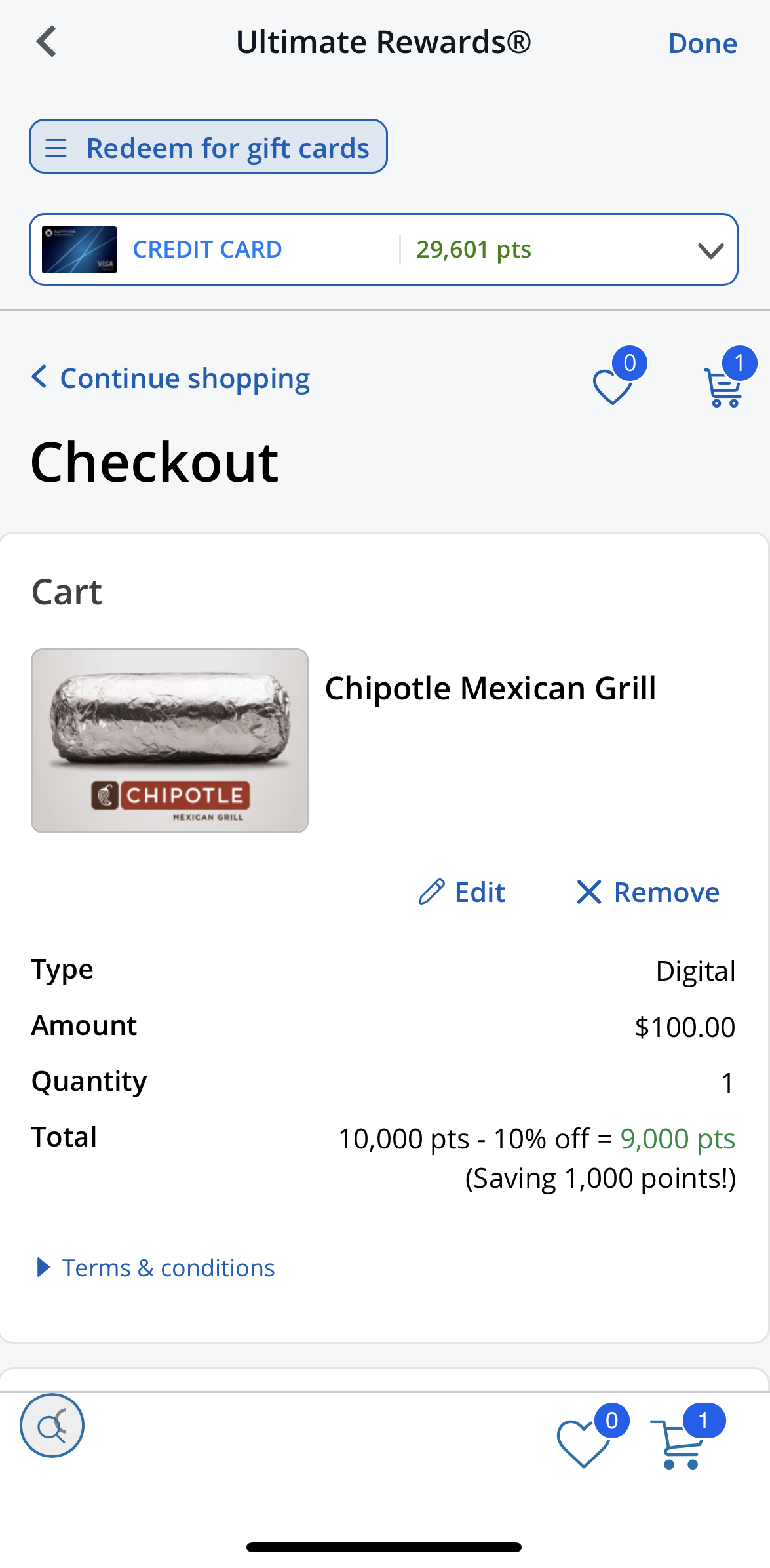

The Chase Sapphire Preferred stands out for its flexibility, allowing cardholders to redeem points for a variety of travel expenses through the Chase Ultimate Rewards program.

On the other hand, the Air Canada Aeroplan Card is tailored for individuals frequently flying with Air Canada and its partner airlines. This card emphasizes airline-specific perks, including priority boarding, free checked bags, and Aeroplan 25K Status.

Air Canada Aeroplan Card | Chase Sapphire Preferred | |

Annual Fee | $95 | $95

|

Rewards | 3x points for each dollar spent at grocery stores, dining at restaurants including takeout and eligible delivery services, Air Canada and 1x on all other purchases | 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

Welcome bonus | 60,000 bonus points after you spend $3,000 on purchases in the first 3 months your account is open | 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening |

0% Intro APR | N/A | N/A

|

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 21.74%–28.74% variable | 21.24%–28.24% variable APR |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Rewards Battle: A Side-by-Side Analysis

We looked at how many points you get for spending money with each card, and one card clearly stands out: the Sapphire Preferred card gives a lot more points, especially when you buy groceries or travel.

Spend Per Category | Air Canada Aeroplan Card | Chase Sapphire Preferred |

$15,000 – U.S Supermarkets | 30,000 points | 45,000 points |

$5,000 – Restaurants

| 15,000 points | 15,000 points |

$5,000 – Airline | 15,000 points | 25,000 points |

$5,000 – Hotels | 5,000 points | 25,000 points |

$4,000 – Gas | 4,000 points | 4,000 points |

Total Points | 69,000 points | 114,000 points |

Estimated Redemption Value | 1 point ~ 1.7 cents | 1 point ~ 1 – 1.5 cent |

Estimated Annual Value | $1,173 | $1,140 – $1,710 |

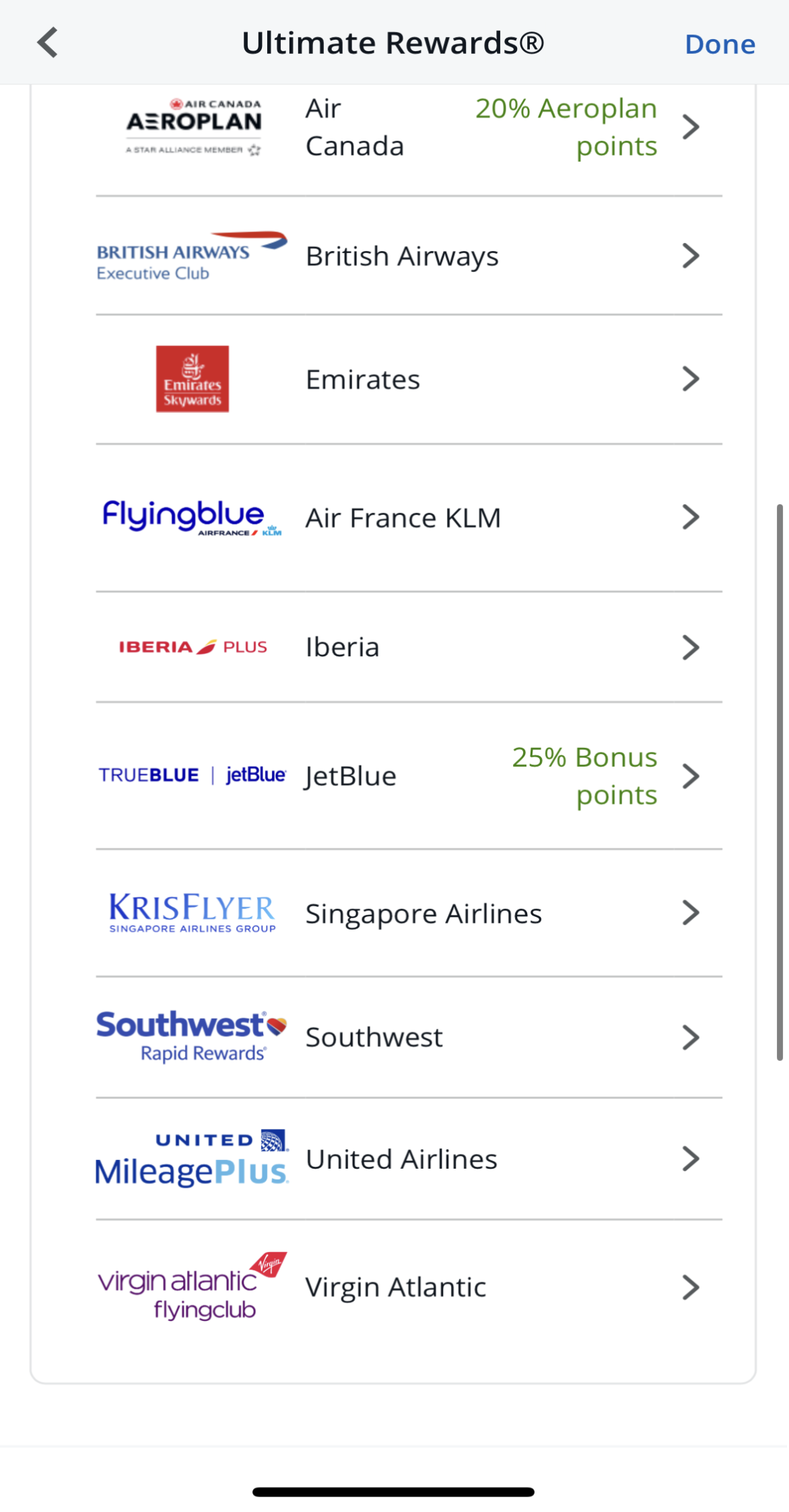

Can I Transfer Chase Sapphire Preferred Points To Air Canada?

Certainly! You can easily transfer Chase Sapphire Preferred points to Air Canada Aeroplan with a 1:1 ratio, ensuring no loss of value.

The seamless transfer typically takes 24-48 hours, making it a fantastic option for those preferring Air Canada or Star Alliance partners, maximizing the utility of your points for travel needs.

Which Benefits You'll Get With Each Card?

While the Chase Preferred card offers general travel benefits, the Aeroplan card offers airline benefits:

Air Canada Aeroplan Card

Aeroplan 25K Status: New cardmembers receive Aeroplan 25K Status for the current and following calendar year automatically, with the opportunity to maintain it by spending $15,000 in a calendar year.

Priority Airport Services: Enjoy exclusive benefits such as Priority Airport Services and upgrades to premium cabins on Air Canada operated flights.

Free First Checked Bags: Cardmembers and travel companions on the same reservation receive complimentary first checked bags (up to 50lb) on Air Canada flights.

Global Entry, TSA PreCheck, or NEXUS Fee Credit: Receive up to $100 in statement credit every 4 years for the application fee of Global Entry, TSA PreCheck, or NEXUS.

Preferred Pricing: Access preferred pricing on flight rewards, allowing the Primary Cardmember to book flight rewards for fewer points.

10% Bonus on Ultimate Rewards Points Transfers: Chase Aeroplan credit cardmembers receive a 10% transfer bonus when transferring 50,000 or more Ultimate Rewards points in a single transaction to their Aeroplan account.

DoorDash Benefits: Cardholders enjoy a one-year complimentary DashPass membership for DoorDash and Caviar, providing unlimited deliveries with $0 delivery fees and lower service fees on eligible orders.

Chase Sapphire Preferred

- $50 Anniversary Statement Credit: Every year on your card anniversary, you have the opportunity to earn up to $50 in statement credits for hotel stays made through the Chase Ultimate Rewards portal.

- %25 Travel Bonus: When you redeem your reward points for travel through the Chase Ultimate Rewards portal, you'll receive a 25% bonus, enhancing the value of your points.

- %10 Anniversary Bonus: Chase offers a 10% bonus on your total purchases from the previous year as an anniversary gift. For example, if you earned 20,000 points in the first year, you'll receive a 2,000-point bonus in the second year.

- DoorDash Perks: Upon registration, you'll receive a one-year DoorDash subscription, DashPass, which offers reduced service fees and $0 delivery fees for orders over $12.

- Lyft Rides: During the promotional period, you'll earn extra points on Lyft rides, currently available until March 2025.

- Instacart+ Subscription: Linking your card to Instacart grants you a six-month Instacart+ subscription for free. As a member, you can earn up to $15 in statement credits per quarter until July 2024.

Which Card Offers Better Travel Insurance?

Both cards offer the following insurance and protections:

- Purchase Protection: Safeguard your new purchases from damage or theft with comprehensive coverage.

- Auto Rental Collision Damage Waiver: Offers primary coverage for theft and collision damage for most rental cars in the U.S. and abroad when you decline the rental company's insurance, with reimbursement up to the actual cash value of the vehicle.

- Baggage Delay Insurance: Reimburses up to $100 per day for essential purchases like toiletries and clothing when your baggage is delayed by a passenger carrier for more than 6 hours, up to a total of 5 days.

Trip Delay Reimbursement: Covers unreimbursed expenses, such as meals and lodging, up to $500 per ticket when your common carrier travel is delayed for more than 12 hours or necessitates an overnight stay.

- Trip Cancellation Reimbursement: If your trip is canceled or shortened due to covered situations like illness.

- Roadside Assistance (Aeroplan card only): In case of a roadside emergency, cardmembers can call the Benefit Administrator to dispatch necessary assistance, with associated service fees billed directly to the Aeroplan card.

- Extended Warranty Protection (Chase Sapphire Preferred only): Extend the existing U.S. manufacturer's warranty by an additional year for eligible warranties lasting three years or less.

- 24-Hour Travel Assistance Services (Chase Sapphire Preferred only): In the event of a lost or stolen credit card, access emergency services such as an immediate replacement card and cash advance.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer The Air Canada Aeroplan Card?

You might prefer the Air Canada Aeroplan Card card if:

Loyalty to Air Canada: If you frequently fly with Air Canada or its partner airlines, the Air Canada Aeroplan card is advantageous, offering specific perks tailored to the Aeroplan loyalty program, including priority boarding and access free first checked bags.

Maintaining Aeroplan 25K Status: For individuals seeking to maintain or achieve Aeroplan 25K Status, the Air Canada Aeroplan card provides an avenue to do so through specific spending requirements, offering additional privileges within the Aeroplan program.

When You Might Prefer The Chase Sapphire Preferred?

You might prefer the Chase Sapphire Preferred card if:

Higher Points Rewards Ratio: According to our analysis, the Chase Sapphire Preferred rewards its cardholders with more ponts and higher annual value compared to the Aeroplan card

Points That Can Be Redeemed For Travel On A Variety Of Airlines And Hotels: Chase Ultimate Rewards® points can be redeemed for travel through the Chase Ultimate Rewards® portal at a rate of 1.25 cents per point. You can also transfer your points to a number of airline and hotel partners, including Air Canada, United Airlines, Hyatt, and Marriott.

Compare The Alternatives

Whether you're seeking travel rewards, a straightforward cashback system, or specific perks tailored to your lifestyle, these alternatives have something for everyone.

Bank of America® Travel Rewards credit card | Capital One Venture Rewards Credit Card | Wells Fargo Autograph℠ Card | |

Annual Fee | $0 | $95 | $0

|

Rewards |

1.5X

1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points

|

2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

| 1X – 3X

3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases

|

Welcome bonus |

25,000 points

25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases

|

75,000 miles

| 20,000 Points

20,000 bonus points when you spend $1,000 in purchases in the first 3 months

|

Foreign Transaction Fee | $0 | $0 | $0

|

Purchase APR | 18.24% – 28.24% Variable APR will apply. | 19.99% – 29.99% (Variable)

| 20.24% – 29.99% variable

|

Compare Chase Sapphire Preferred

When it comes to the annual fee, there is a clear winner. But is it worth the exclusive travel rewards you'll get? Here's our analysis.

When it comes to travel benefits, there is a clear winner. But what about if you're looking for rewards on everyday spending?

Amex Blue Cash Preferred vs Chase Sapphire Preferred: Which Card Is Best?

While the Chase Sapphire Preferred Card has more benefits, the Capital One Venture card offers unique features. Which travel card is better?

Capital One Venture vs Chase Sapphire Preferred: Which Card Is Best?

While the Amex gold card is best for everyday spending, the Chase sapphire preferred may be better as a travel card. Here's our comparison:

American Express Gold Card Vs. Chase Sapphire Preferred: Which Is Best?

The Chase Sapphire Preferred offers better travel perks and protections, but unlike the Autograph card – you'll need to pay an annual fee.

Wells Fargo Autograph Vs. Chase Sapphire Preferred: Which Card Is Best?

The Chase Sapphire Preferred offers costs more and offer more benefits than the Freedom Unlimited. Is it worth the annual fee?

Chase Freedom Unlimited Vs. Sapphire Preferred: Compare Side By Side

The Chase Sapphire Preferred is more versatile and offers better travel rewards than the Explorer card. But what if you're loyal to United?

United Explorer Card vs Chase Sapphire Preferred: Side By Side Comparison

The Venture X card offers better travel perks than the Sapphire Preferred, such as annual credit and lounge access. But is it worth the fee?

Capital One Venture X vs. Chase Sapphire Preferred: Comparison

The Marriott Boundless offers great perks for Marriot lovers, while the Preferred card wins when it comes to general travel-related rewards.

Marriott Bonvoy Boundless vs. Chase Sapphire Preferred: Comparison

The Capital One Savor is better for everyday spending, but the Chase Preferred card is the winner when it comes to travel and protections.

Chase Preferred card is the clear winner as it offers better travel rewards than the BofA Premium Rewards and variety of travel protections

Bank of America Premium Rewards vs. Chase Sapphire Preferred: Which Card Wins

The Chase Sapphire Preferred is our winner due to its higher annual cashback value and various redemption options compared to Alaska card

Chase Sapphire Preferred vs. Alaska Airlines Visa Signature Card: How They Compare?

While we really like both cards, the Chase Sapphire Preferred is our winner due to its diverse redemption options and high rewards rate.

Chase Sapphire Preferred vs. JetBlue Plus Card: Side By Side Comparison