Both the Chase Sapphire Preferred® Card and the Alaska Airlines Visa Signature® credit card are excellent travel rewards options, but they cater to different travel preferences. Let's compare them side by side.

General Comparison

The Chase Sapphire Preferred, offered by Chase Bank, is a versatile travel rewards card with a variety of redemption options. On the other hand, the Alaska Airlines Visa Signature Card, issued by Bank of America, is tailored for individuals who frequently travel with Alaska Airlines.

Here's a side by side comparison of the cards main features:

Alaska Airlines Visa Signature | Chase Sapphire Preferred | |

Annual Fee | $95 | $95

|

Rewards | unlimited 3 miles for every $1 spent on eligible Alaska Airlines purchases, 2X on eligible gas, EV charging station, cable, streaming services and local transit (including ride share) purchases and unlimited 1 mile for every $1 spent on all other purchases | 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

Welcome bonus | 70,000 Bonus Miles plus Alaska's Famous Companion Fare™ ($99 fare plus taxes and fees from $23) after you make $3,000 or more in purchases within the first 90 days of your account opening. | 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening |

0% Intro APR | N/A | N/A

|

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 19.74% – 27.74% variable | 21.24%–28.24% variable APR |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Rewards Battle: A Side-by-Side Analysis

We checked how many points you earn when you spend money with each card, and the Sapphire Preferred card clearly gives you a lot more points than the Alaska Airlines Visa Signature Card, especially when you buy groceries or travel.

Spend Per Category | Alaska Airlines Visa Signature | Chase Sapphire Preferred |

$15,000 – U.S Supermarkets | 15,000 miles | 45,000 points |

$5,000 – Restaurants

| 5,000 miles | 15,000 points |

$5,000 – Airline | 15,000 miles | 25,000 points |

$5,000 – Hotels | 5,000 miles | 25,000 points |

$4,000 – Gas | 8,000 miles | 4,000 points |

Total Miles/Points | 48,000 miles | 114,000 points |

Estimated Redemption Value | 1 mile ~ 1.3 cents | 1 point ~ 1 – 1.5 cent |

Estimated Annual Value | $624 | $1,140 – $1,710 |

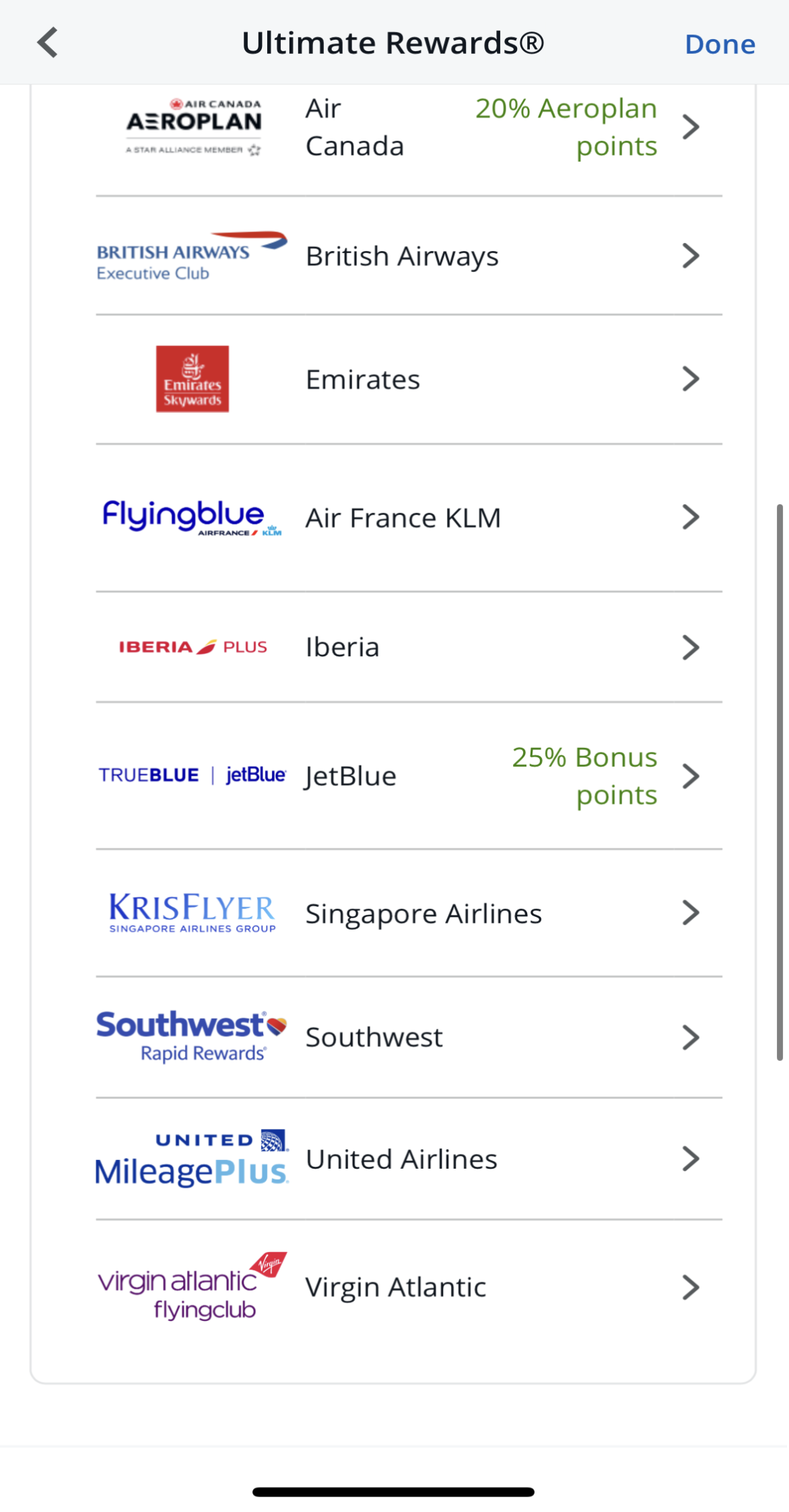

Can I Transfer Chase Sapphire Preferred Points To Alaska?

Unfortunately, direct transfers from Chase Ultimate Rewards to Alaska Mileage Plan are not possible.

However, you have an alternative route for booking Alaska flights. You can transfer Ultimate Rewards to British Airways Executive Club or Iberia Plus, and then utilize Avios, the respective airline's reward currency, to book flights with Alaska.

While direct transfers to Alaska Mileage Plan aren't an option, this workaround allows you to leverage the Avios program, providing a strategic way to access and utilize your Chase Ultimate Rewards points for Alaska flights.

Which Benefits You'll Get With Each Card?

While the Chase Preferred card provides broad travel benefits, the Alaska Airlines Visa Signature card specifically concentrates on offering benefits tailored to its airline platform.

Alaska Airlines Visa Signature

- $99 Alaska's Companion Fare: Receive a $99 Companion Fare (plus taxes and fees) annually after spending $6,000 or more within the prior year, applicable to all Alaska Airlines flights booked on alaskaair.com.

- Free Checked Bag: Cardholders, along with up to 6 additional guests on the same reservation, can check their first bag for free when purchasing airfare with the card.

- Priority Boarding: Enjoy priority boarding for quicker access to your seat when you use your card to pay for your flight.

- 10% Rewards Bonus: Receive a 10% rewards bonus on all miles earned from card purchases with an eligible Bank of America® account.

- 20% Back On Inflight Purchases: Get 20% back on all Alaska Airlines inflight purchases

- $100 Lounge Membership Discount: get a discount on an annual Alaska Lounge+ Membership when paying with the card.

Chase Sapphire Preferred

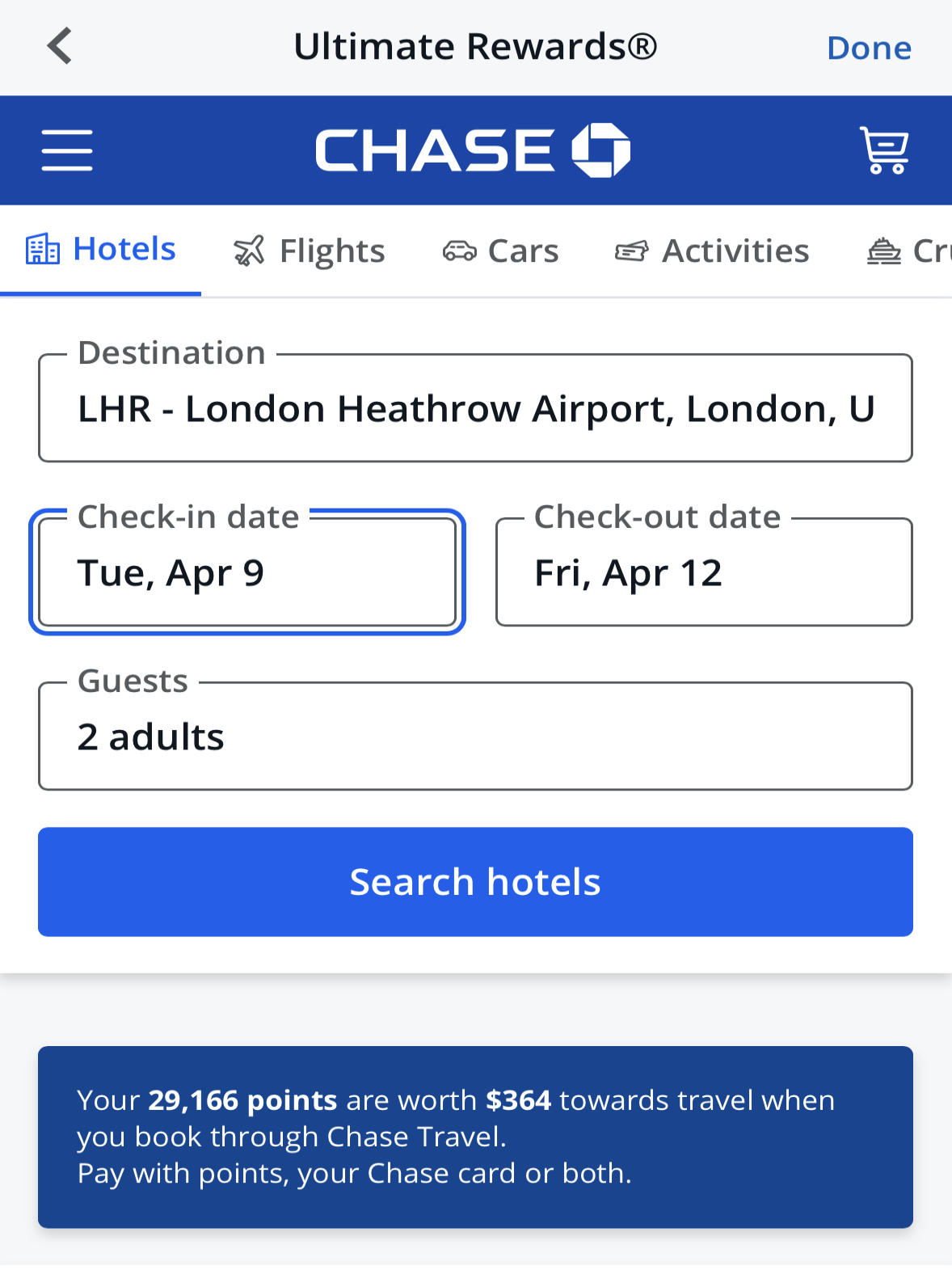

- $50 Anniversary Statement Credit: Every year on your card anniversary, you have the opportunity to earn up to $50 in statement credits for hotel stays made through the Chase Ultimate Rewards portal.

- %25 Travel Bonus: When you redeem your reward points for travel through the Chase Ultimate Rewards portal, you'll receive a 25% bonus, enhancing the value of your points.

- %10 Anniversary Bonus: Chase offers a 10% bonus on your total purchases from the previous year as an anniversary gift. For example, if you earned 20,000 points in the first year, you'll receive a 2,000-point bonus in the second year.

- DoorDash Perks: Upon registration, you'll receive a one-year DoorDash subscription, DashPass, which offers reduced service fees and $0 delivery fees for orders over $12.

- Lyft Rides: During the promotional period, you'll earn extra points on Lyft rides, currently available until March 2025.

- Instacart+ Subscription: Linking your card to Instacart grants you a six-month Instacart+ subscription for free. As a member, you can earn up to $15 in statement credits per quarter until July 2024.

Chase Sapphire Preferred Offers Better Travel Insurance

In addition to the extra perks mentioned above, the Chase Sapphire Preferred card offers the following insurance and protections:

- Purchase Protection: Safeguard your new purchases from damage or theft with comprehensive coverage.

- Auto Rental Collision Damage Waiver: Offers primary coverage for theft and collision damage for most rental cars in the U.S. and abroad when you decline the rental company's insurance, with reimbursement up to the actual cash value of the vehicle.

- Baggage Delay Insurance: Reimburses up to $100 per day for essential purchases like toiletries and clothing when your baggage is delayed by a passenger carrier for more than 6 hours, up to a total of 5 days.

Trip Delay Reimbursement: Covers unreimbursed expenses, such as meals and lodging, up to $500 per ticket when your common carrier travel is delayed for more than 12 hours or necessitates an overnight stay.

- Trip Cancellation Reimbursement: If your trip is canceled or shortened due to covered situations like illness.

- Extended Warranty Protection: Extend the existing U.S. manufacturer's warranty by an additional year for eligible warranties lasting three years or less.

- 24-Hour Travel Assistance Services: In the event of a lost or stolen credit card, access emergency services such as an immediate replacement card and cash advance.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer The Chase Sapphire Preferred?

You might prefer the Chase Sapphire Preferred card if:

Higher Points Rewards Ratio: According to our analysis, the Chase Sapphire Preferred rewards its cardholders with more ponts and higher annual value compared to the Alaska card.

Better Travel Insurance Options: The Chase Sapphire Preferred Card is a preferred choice for those who want broader coverage that includes baggage delay insurance and trip delay reimbursement as well as baggage delay insurance.

Versatile Travel Redemption: If you prefer flexibility in using your rewards for various travel expenses, the Chase Sapphire Preferred is a better choice. It allows you to redeem points for flights, hotels, or cash back, catering to a wide range of travel preferences.

When You Might Prefer The Alaska Visa Signature Card?

You might prefer the Alaska Airlines Visa Signature card if:

Alaska Airlines Loyalty: If you frequently fly with Alaska Airlines or its partner airlines within the Oneworld alliance, the Alaska Airlines Visa Signature is preferable. It offers specialized benefits and rewards tailored to loyal customers of this specific airline network.

You Want Airline Benefits: If you typically travel with multiple companions, the card's free checked bag benefit for the cardholder and up to 6 additional guests, as well as priority boarding and companion fare benefit.

Compare The Alternatives

If you're looking for an airline credit card with travel rewards – there are some good alternatives you may want to consider:

The JetBlue Plus Card | Southwest Rapid Rewards® Premier Credit Card | Citi/AAdvantage Platinum Select World Elite | |

Annual Fee | $99 | $99 | $99 (waived for the first 12 months)

|

Rewards | 1X – 6X

6X points on JetBlue purchases, 2X points at restaurants and grocery stores and 1X points on all other purchases

| 1X – 3X

3X points on Southwest® purchases,2X on Rapid Rewards® hotel and car partners, local transit and commuting, including rideshare, internet, cable, phone services, and select streaming and 1X points on all other purchases.

|

1X – 2X

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

|

Welcome bonus | 50,000 points

50,000 bonus points after spending $1,000 on purchases and paying the annual fee in full, both within the first 90 days

| 50,000 Points

50,000 points after you spend $1,000 on purchases in the first 3 months from account opening

|

50,000 Miles

50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

|

Foreign Transaction Fee | $0 | $0 | $0 |

Purchase APR | 21.24% – 29.99% variable | 21.49%–28.49% variable

| 21.24% – 29.99% (Variable) |

Compare Chase Sapphire Preferred

When it comes to the annual fee, there is a clear winner. But is it worth the exclusive travel rewards you'll get? Here's our analysis.

When it comes to travel benefits, there is a clear winner. But what about if you're looking for rewards on everyday spending?

Amex Blue Cash Preferred vs Chase Sapphire Preferred: Which Card Is Best?

While the Chase Sapphire Preferred Card has more benefits, the Capital One Venture card offers unique features. Which travel card is better?

Capital One Venture vs Chase Sapphire Preferred: Which Card Is Best?

While the Amex gold card is best for everyday spending, the Chase sapphire preferred may be better as a travel card. Here's our comparison:

American Express Gold Card Vs. Chase Sapphire Preferred: Which Is Best?

The Chase Sapphire Preferred offers better travel perks and protections, but unlike the Autograph card – you'll need to pay an annual fee.

Wells Fargo Autograph Vs. Chase Sapphire Preferred: Which Card Is Best?

The Chase Sapphire Preferred offers costs more and offer more benefits than the Freedom Unlimited. Is it worth the annual fee?

Chase Freedom Unlimited Vs. Sapphire Preferred: Compare Side By Side

The Chase Sapphire Preferred is more versatile and offers better travel rewards than the Explorer card. But what if you're loyal to United?

United Explorer Card vs Chase Sapphire Preferred: Side By Side Comparison

The Venture X card offers better travel perks than the Sapphire Preferred, such as annual credit and lounge access. But is it worth the fee?

Capital One Venture X vs. Chase Sapphire Preferred: Comparison

The Marriott Boundless offers great perks for Marriot lovers, while the Preferred card wins when it comes to general travel-related rewards.

Marriott Bonvoy Boundless vs. Chase Sapphire Preferred: Comparison

The Capital One Savor is better for everyday spending, but the Chase Preferred card is the winner when it comes to travel and protections.

Chase Preferred card is the clear winner as it offers better travel rewards than the BofA Premium Rewards and variety of travel protections

Bank of America Premium Rewards vs. Chase Sapphire Preferred: Which Card Wins

While the Chase Sapphire Preferred is our winner due to its various perks, the Aeroplan card offers high cashback value and airline perks.

Chase Sapphire Preferred vs. Air Canada Aeroplan Card: How They Compare?

While we really like both cards, the Chase Sapphire Preferred is our winner due to its diverse redemption options and high rewards rate.

Chase Sapphire Preferred vs. JetBlue Plus Card: Side By Side Comparison

Compare Alaska Visa Signature Card

The Capital One Venture is a clear winner as it offers higher annual cashback value and better travel perks than the Alaska Visa Signature.

Alaska Visa Signature vs Capital One Venture: Side By Side Comparison

While the Hawaiian World Elite Mastercard offers a higher miles rewards ratio, we think the Alaska card offers a bit better airline perks.

Hawaiian World Elite Mastercard vs. Alaska Visa Signature: How They Compare?

While the airline benefits are pretty similar, The JetBlue Plus Card is a clear winner due to much higher cashback rates than the Alaska card.

Alaska Airlines Visa Signature vs JetBlue Plus Card: Side By Side Comparison

Both Alaska and Southwest Premier have similar annual cashback values. While there is no clear winner, each card has its own unique perks.

Alaska Airlines Visa Signature vs Southwest Rapid Rewards Premier: Comparison

While Alaska Visa Signature card offers higher miles rewards ratio on airline, the Delta SkyMiles Gold is our winner. Here's why.

Alaska Visa Signature vs Delta SkyMiles Gold: Side By Side Comparison

The Alaska Visa offers higher annual cashback value than United Explorer, but the latter takes the lead when it comes to airline perks.

Alaska Visa Signature vs United Explorer: Side By Side Comparison