The Chase Sapphire Preferred and JetBlue Plus Card are both credit cards, but they serve different purposes for different kinds of travelers. Let's compare them side by side:

General Comparison

The Chase Sapphire Preferred is like a travel companion that's always up for an adventure. With this card, you earn points for your purchases, and the cool part is, you can use those points with a bunch of different airlines and hotels.

It's like having options when you plan your trips – you're not stuck with just one airline or hotel chain. So, if you like the idea of exploring different places and staying in various types of accommodations, this card gives you the freedom to do that.

Now, the JetBlue Plus Card is more like a best friend for those who love JetBlue. If you find yourself flying with JetBlue a lot, this card is tailored for you.

You get points specifically for your JetBlue flights, and that can add up to free trips. Plus, you get perks like free checked bags, 0% intro APR, and a bonus every year on your card anniversary.

Here's a side-by-side comparison of the card's main features:

Chase Sapphire Preferred | JetBlue Plus Card | |

Annual Fee | $95

| $99 |

Rewards | 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| 6X points on JetBlue purchases, 2X points at restaurants and grocery stores and 1X points on all other purchases |

Welcome bonus | 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening | 50,000 bonus points after spending $1,000 on purchases and paying the annual fee in full, both within the first 90 days |

0% Intro APR | N/A

| 12 billing cycles on balance transfers |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 21.24%–28.24% variable APR | 21.24% – 29.99% variable |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Rewards Battle: A Side-by-Side Analysis

We looked into how many points you get for spending money with each card, and the Chase Sapphire Preferred card outshines the JetBlue Plus Card. It earns more points, and the total value of its points per year is higher, making it the better choice.

Spend Per Category | Chase Sapphire Preferred | JetBlue Plus Card |

$15,000 – U.S Supermarkets | 45,000 points | 30,000 miles |

$5,000 – Restaurants

| 15,000 points | 10,000 miles |

$5,000 – Airline | 25,000 points | 30,000 miles |

$5,000 – Hotels | 25,000 points | 5,000 miles |

$4,000 – Gas | 4,000 points | 4,000 miles |

Total Miles/Points | 114,000 points | 79,000 miles |

Estimated Redemption Value | 1 point ~ 1 – 1.5 cent | 1 mile = ~1.4 cents

[/sc |

Estimated Annual Value | $1,140 – $1,710 | $1,106 |

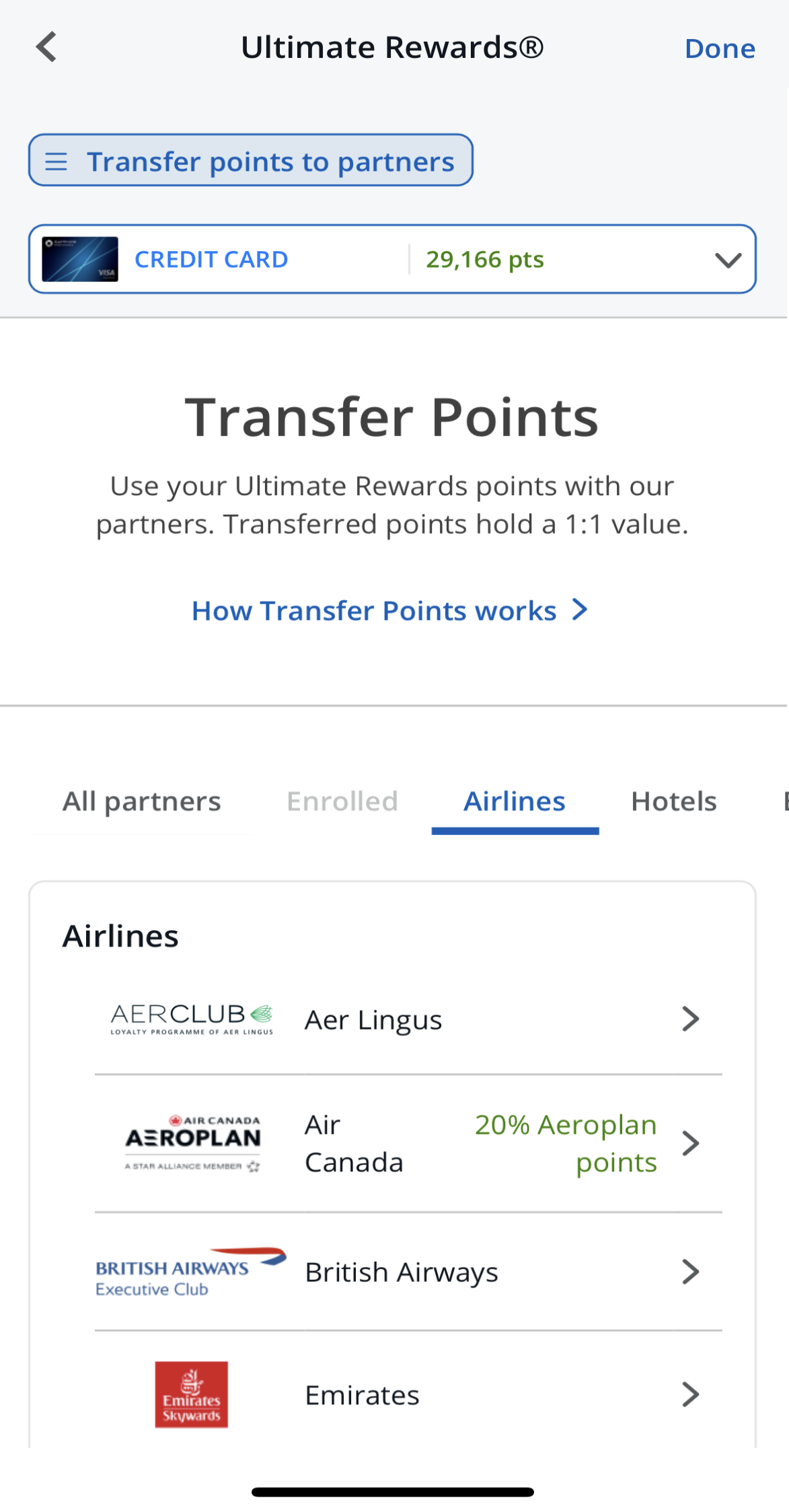

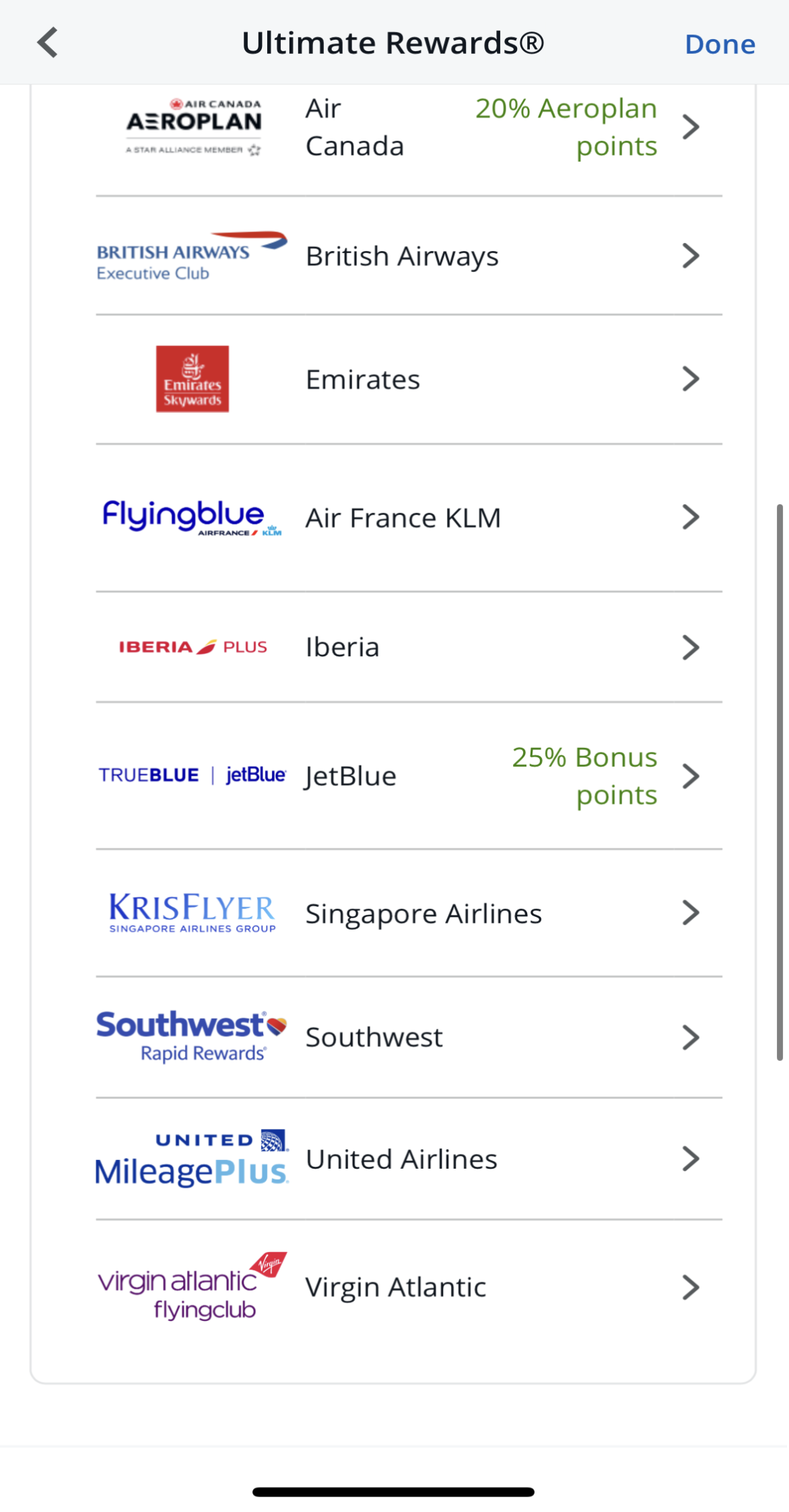

Can I Transfer Chase Sapphire Preferred Points To JetBlue?

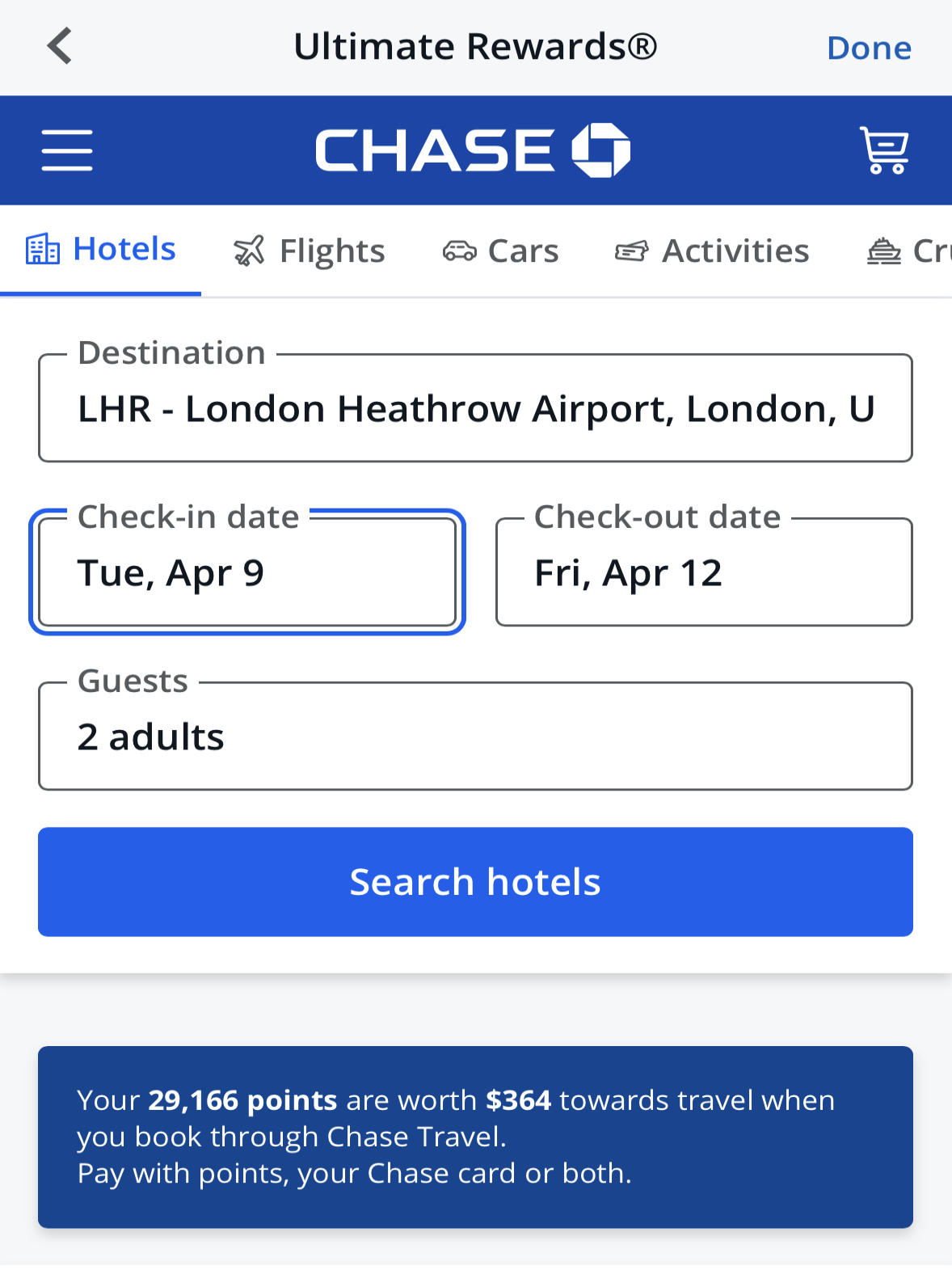

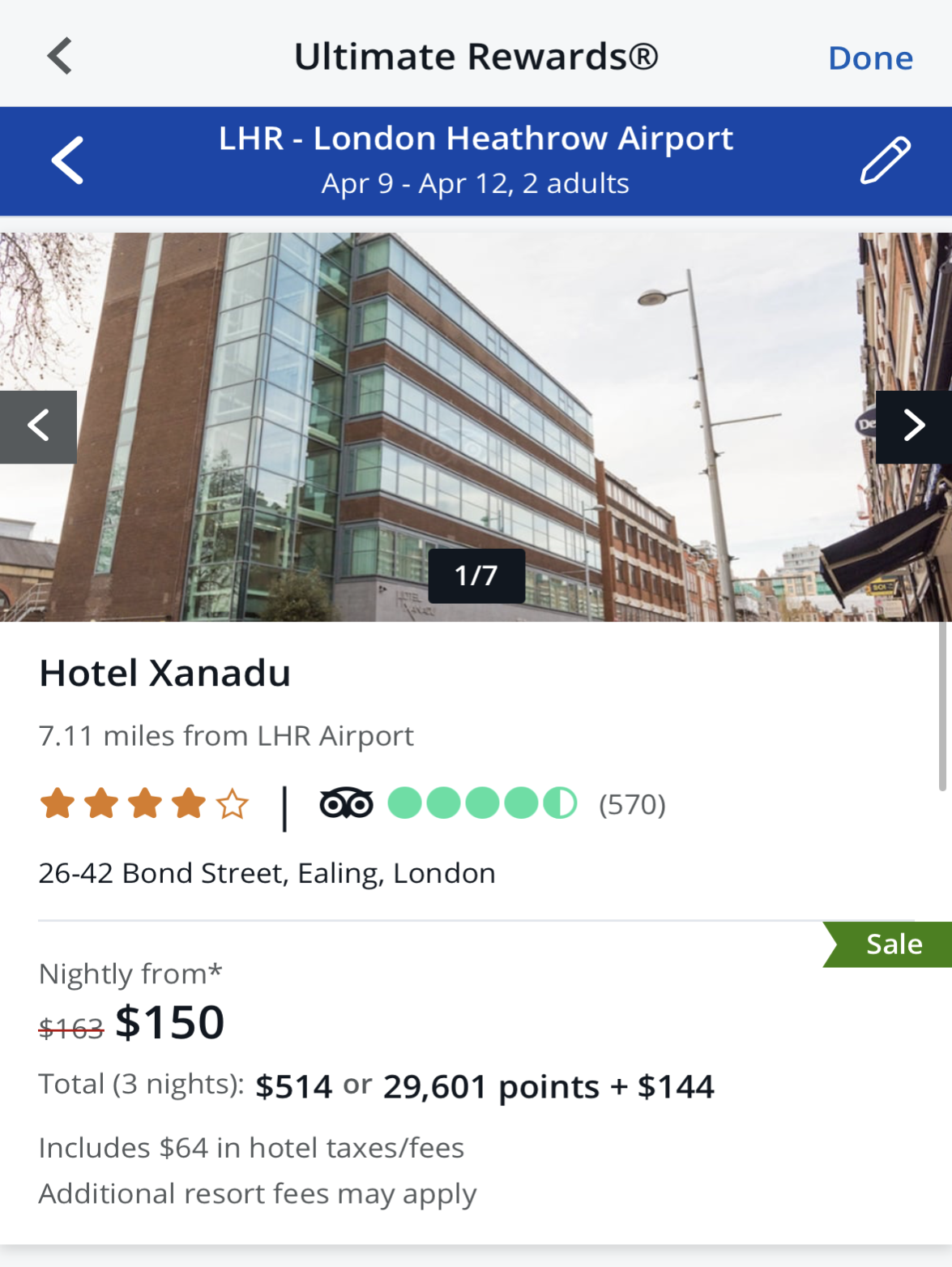

Certainly! You can effortlessly transfer Chase Sapphire Preferred® points to JetBlue TrueBlue points, maximizing their value, especially for domestic travel. The transfer ratio stands at 1:1, ensuring a seamless conversion without loss.

The transfer process within Chase Ultimate Rewards is straightforward, with points appearing in your JetBlue TrueBlue account within 24-48 hours. Keep an eye out for potential transfer bonuses by Chase, as these can enhance point value.

However, exercise caution and research redemption options within JetBlue TrueBlue, as direct flight bookings often offer superior value compared to the Chase travel portal.

Which Card Provides Better Travel And Airline Perks?

When it comes to extra airline and travel perks, we think that there is no clear winner here, but the JetBlue Plus extra airline perks are a bit more enticing than what Chase Preferred offers.

Chase Sapphire Preferred

$50 Anniversary Statement Credit: Enjoy an annual $50 statement credit for hotel stays booked through the Chase Ultimate Rewards portal on your card anniversary, adding extra value to your loyalty.

25% Travel Bonus: Redeem your reward points for travel through the Chase Ultimate Rewards portal and receive a 25% bonus, giving a boost to the overall value of your points and enhancing your travel experience.

10% Anniversary Bonus: As a special anniversary gift, Chase provides a 10% bonus on the total purchases from the previous year. For instance, if you earned 20,000 points in the first year, you'll receive a 2,000-point bonus in the second year.

DoorDash Perks: Upon signing up, enjoy a complimentary one-year DoorDash subscription, DashPass, offering reduced service fees and $0 delivery fees for orders over $12, making your dining experiences more convenient and cost-effective.

Lyft Rides: Benefit from extra points on Lyft rides during the promotional period, currently extending until March 2025, providing added incentives for choosing Lyft as your preferred ride-sharing service.

Instacart+ Subscription: Link your card to Instacart and receive a free six-month Instacart+ subscription. As a member, enjoy up to $15 in statement credits per quarter until July 2024, making grocery shopping both convenient and economically rewarding.

JetBlue Plus Card

- Free First Checked Bag: Enjoy the benefit of a free first checked bag for yourself and up to three eligible travel companions on JetBlue-operated flights.

- 10% Points Back: Receive a 10% points rebate after redeeming points for and traveling on a JetBlue-operated Award Flight, adding value to your rewards.

- $100 Statement Credit: Get a $100 statement credit annually when you use your JetBlue Plus Card to purchase a JetBlue Vacations package totaling $100 or more.

- Cash + Points: Flexibility is at your fingertips with the Cash + Points option, allowing you to pay for your flight using a combination of dollars and TrueBlue points, starting with as few as 500 points.

- Points Payback: With Points Payback, you can redeem your points for a statement credit, providing additional flexibility and the opportunity to recoup up to $1,000 annually.

- In-flight savings: Enjoy a 50% discount on eligible purchases made in-flight on JetBlue-operated flights.

- Fraud protection: Benefit from $0 Fraud Liability, ensuring you are not held accountable for unauthorized charges on your JetBlue Card.

Chase Sapphire Preferred Provides Superior Travel Insurance Coverage.

In addition to the extra perks mentioned above, the Chase Sapphire Preferred card offers the following insurance and protections:

- Purchase Protection: Safeguard your new purchases from damage or theft with comprehensive coverage.

- Auto Rental Collision Damage Waiver: Offers primary coverage for theft and collision damage for most rental cars in the U.S. and abroad when you decline the rental company's insurance, with reimbursement up to the actual cash value of the vehicle.

- Baggage Delay Insurance: Reimburses for essential purchases like toiletries and clothing when your baggage is delayed by a passenger carrier for more than 6 hours, up to a total of 5 days.

Trip Delay Reimbursement: Covers unreimbursed expenses, such as meals and lodging when your common carrier travel is delayed for more than 12 hours or necessitates an overnight stay.

- Trip Cancellation Reimbursement: If your trip is canceled or shortened due to covered situations like illness.

- Extended Warranty Protection: Extend the existing U.S. manufacturer's warranty by an additional year for eligible warranties lasting three years or less.

- 24-Hour Travel Assistance Services: In the event of a lost or stolen credit card, access emergency services such as an immediate replacement card and cash advance.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer The Chase Sapphire Preferred?

Here are the main reasons why you may prefer the JetBlue Plus Card:

Diverse Travel Experiences: If your travel adventures involve different airlines and accommodations, the Chase Sapphire Preferred is more versatile. It allows you to explore a wide range of travel options beyond being tied to a single airline like JetBlue.

Better Travel Insurance Options: The Chase Sapphire Preferred Card is a preferred choice for those who want broader coverage that includes baggage delay insurance and trip delay reimbursement as well as baggage delay insurance.

Dining and Grocery Rewards: If you frequently dine out or shop for groceries, the Chase Sapphire Preferred offers extra points on these purchases. Also, according to our point rewards analysis, it has higher estimated annual points worth.

When You Might Prefer The JetBlue Plus Card?

Here are the main reasons why you may prefer the JetBlue Plus Card:

Frequent JetBlue Traveler: If you find yourself regularly flying with JetBlue, the JetBlue Plus Card is a solid choice. It's designed for loyal JetBlue customers, offering perks like free checked bags and bonus points for your JetBlue flights.

0% Intro APR for Balance Transfers: If you need a card with no interest on balance transfers, the JetBlue Plus Card is the only one that gives you this benefit. It helps with your finances and still comes with the perks of a JetBlue-focused card.

Compare The Alternatives

If you're looking for an airline credit card with travel rewards – there are some good alternatives you may want to consider:

Delta SkyMiles® Gold American Express Card | Southwest Rapid Rewards® Premier Credit Card | Citi/AAdvantage Platinum Select World Elite | |

Annual Fee | $150, $0 intro first year. (See Rates and Fees.) | $99 | $99 (waived for the first 12 months)

|

Rewards |

1X – 2X

2X miles on delta purchases, at restaurants worldwide (including take-out and delivery in the U.S) and at U.S. supermarkets, and 1x miles on all other eligible purchases

| 1X – 3X

3X points on Southwest® purchases,2X on Rapid Rewards® hotel and car partners, local transit and commuting, including rideshare, internet, cable, phone services, and select streaming and 1X points on all other purchases.

|

1X – 2X

Earn 2 AAdvantage® miles for every $1 spent at gas stations and restaurants, 2 AAdvantage® miles for every $1 spent on eligible American Airlines purchases and 1 AAdvantage® mile for every $1 spent on other purchases. Earn 1 Loyalty Point for every 1 eligible AAdvantage® mile earned from purchases.

|

Welcome bonus |

40,000 Miles

40,000 Bonus Miles after you spend $2,000 in purchases on your new Card in your first 6 months

| 50,000 Points

50,000 points after you spend $1,000 on purchases in the first 3 months from account opening

|

50,000 Miles

50,000 American Airlines AAdvantage® bonus miles after $2,500 in purchases within the first 3 months of account opening

|

Foreign Transaction Fee | $0. See Rates and Fees. | $0 | $0 |

Purchase APR | 20.99%-29.99% Variable | 21.49%–28.49% variable

| 21.24% – 29.99% (Variable) |

Compare Chase Sapphire Preferred

When it comes to the annual fee, there is a clear winner. But is it worth the exclusive travel rewards you'll get? Here's our analysis.

When it comes to travel benefits, there is a clear winner. But what about if you're looking for rewards on everyday spending?

Amex Blue Cash Preferred vs Chase Sapphire Preferred: Which Card Is Best?

While the Chase Sapphire Preferred Card has more benefits, the Capital One Venture card offers unique features. Which travel card is better?

Capital One Venture vs Chase Sapphire Preferred: Which Card Is Best?

While the Amex gold card is best for everyday spending, the Chase sapphire preferred may be better as a travel card. Here's our comparison:

American Express Gold Card Vs. Chase Sapphire Preferred: Which Is Best?

The Chase Sapphire Preferred offers better travel perks and protections, but unlike the Autograph card – you'll need to pay an annual fee.

Wells Fargo Autograph Vs. Chase Sapphire Preferred: Which Card Is Best?

The Chase Sapphire Preferred offers costs more and offer more benefits than the Freedom Unlimited. Is it worth the annual fee?

Chase Freedom Unlimited Vs. Sapphire Preferred: Compare Side By Side

The Chase Sapphire Preferred is more versatile and offers better travel rewards than the Explorer card. But what if you're loyal to United?

United Explorer Card vs Chase Sapphire Preferred: Side By Side Comparison

The Venture X card offers better travel perks than the Sapphire Preferred, such as annual credit and lounge access. But is it worth the fee?

Capital One Venture X vs. Chase Sapphire Preferred: Comparison

The Marriott Boundless offers great perks for Marriot lovers, while the Preferred card wins when it comes to general travel-related rewards.

Marriott Bonvoy Boundless vs. Chase Sapphire Preferred: Comparison

The Capital One Savor is better for everyday spending, but the Chase Preferred card is the winner when it comes to travel and protections.

Chase Preferred card is the clear winner as it offers better travel rewards than the BofA Premium Rewards and variety of travel protections

Bank of America Premium Rewards vs. Chase Sapphire Preferred: Which Card Wins

While the Chase Sapphire Preferred is our winner due to its various perks, the Aeroplan card offers high cashback value and airline perks.

Chase Sapphire Preferred vs. Air Canada Aeroplan Card: How They Compare?

The Chase Sapphire Preferred is our winner due to its higher annual cashback value and various redemption options compared to Alaska card

Chase Sapphire Preferred vs. Alaska Airlines Visa Signature Card: How They Compare?

Compare JetBlue Plus Card

If you tend to fly at least twice a year with JetBlue – the plus card is our winner, with a higher cashback rate and enticing airline perks.

The JetBlue Card vs The JetBlue Plus Card: How They Compare?

While the Delta SkyMiles Gold extra perks are better, the JetBlue Plus Card is our winner in this comparison due to its higher cashback value.

The JetBlue Plus Card vs Delta SkyMiles Gold: Side By Side Comparison

While the Southwest Premier card extra travel perks are better, the JetBlue Plus Card is our winner in this comparison. Here's why.

JetBlue Plus Card vs Southwest Rapid Rewards Premier: Which Airline Card Wins

While the airline benefits are pretty similar, The JetBlue Plus Card is a clear winner due to much higher cashback rates than the Alaska card.

Alaska Airlines Visa Signature vs JetBlue Plus Card: Which Airline Card Wins

While the airline perks are quite comparable, the JetBlue Plus Card emerges as the preferred choice thanks to higher cashback rates.

Citi/ AAdvantage Platinum Select vs JetBlue Plus Card: Side By Side Comparison