The Marriott Bonvoy Boundless® Credit Card and the Chase Sapphire Preferred® Card offer a variety of benefits, including bonus points on travel and everyday purchases, as well as valuable travel protections. However, there are some key differences between them.

In this comparison, we'll delve into the unique features, benefits, and rewards associated with each card

Comparison: Marriott Boundless vs. Chase Preferred

The Marriott Bonvoy Boundless card is a top choice for frequent travelers who prefer Marriott hotels and want to maximize their loyalty rewards. With this card, you can earn points for your hotel stays, receive elite status benefits, and enjoy a free night award annually. It's ideal for those who frequently stay at Marriott properties.

On the other hand, the Chase Sapphire Preferred card is a versatile option for travelers seeking flexibility in their rewards. It offers a generous sign-up bonus, the ability to transfer points to various airline and hotel partners, and bonus points on travel and dining expenses. This card appeals to those who want to explore a range of travel options beyond just one hotel chain.

Marriott Bonvoy Boundless | Chase Sapphire Preferred | |

Annual Fee | $95 | $95

|

Rewards | 6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases. | 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

Welcome bonus | 3 Free Nights (each night valued up to 50,000 points) after you spend $3,000 on purchases in your first 3 months from your account opening | 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening |

0% Intro APR | N/A | N/A

|

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 21.49%–28.49% variable | 21.24%–28.24% variable APR |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Compare Rewards: Which Card Gives More?

When assessing points rewards, the Chase Sapphire Preferred card not only provides a higher points earning rate for the same level of expenditure but also boasts a more favorable points valuation compared to Marriott Bonvoy.

Consequently, for the typical consumer, the Preferred card offers a superior rewards-to-spending ratio.

Spend Per Category | Marriott Bonvoy Boundless | Chase Sapphire Preferred |

$10,000 – U.S Supermarkets | 22,000 points | 30,000 points |

$5,000 – Restaurants | 10,000 points | 15,000 points |

$6,000 – Hotels | 36,000 points | 30,000 points |

$8,000 – Airline

| 16,000 points | 40,000 points |

$4,000 – Gas | 8,000 points | 4,000 points |

Total Points | 92,000 points | 119,000 points |

Estimated Redemption Value | 1 point ~ 0.8 cent | 1 point ~ 1 – 1.5 cent |

Total Points | $736 | $1,190 – $1,785 |

* Marriot Boundless Card: 3X on the first $6,000 spent on supermarkets

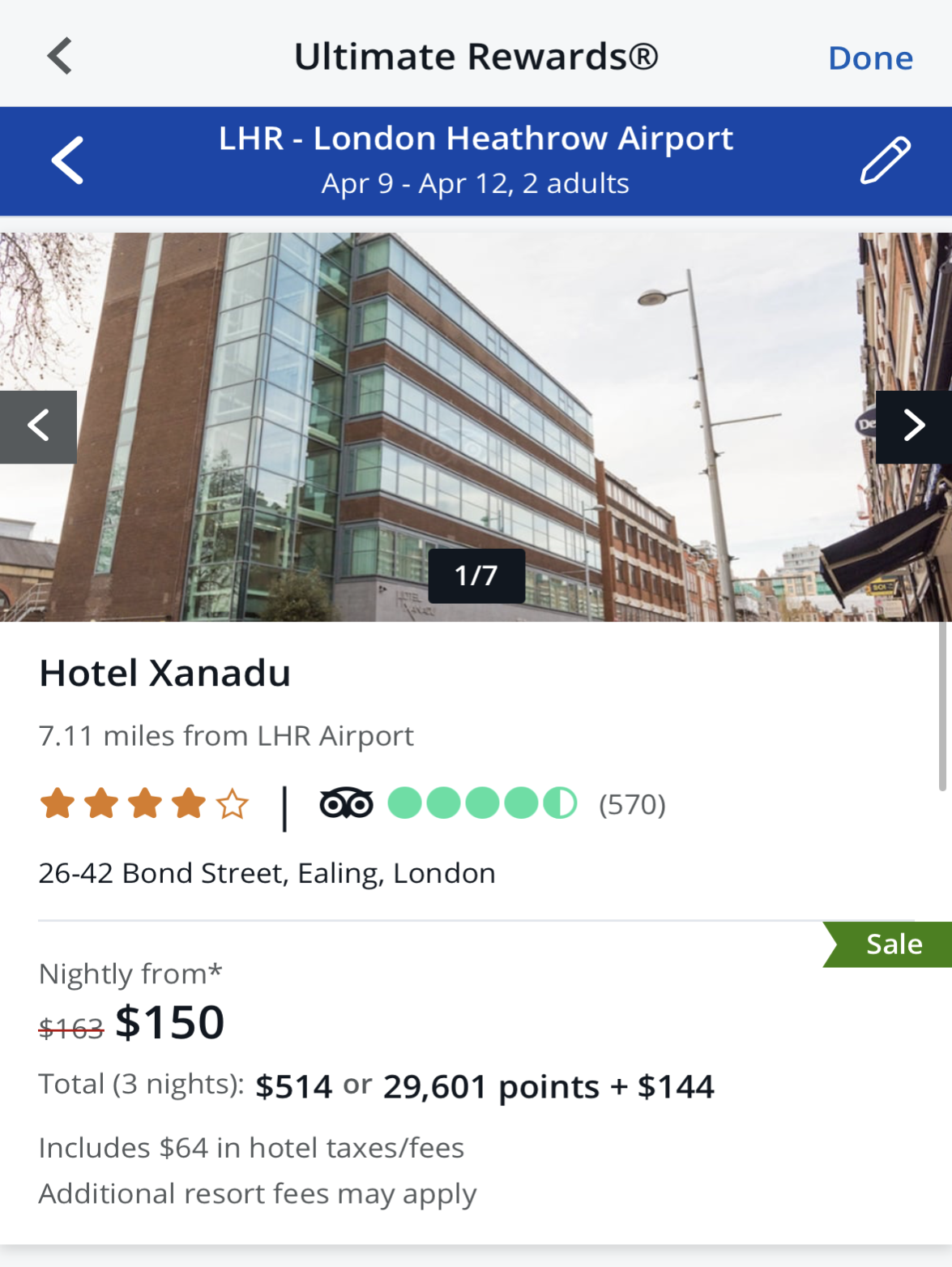

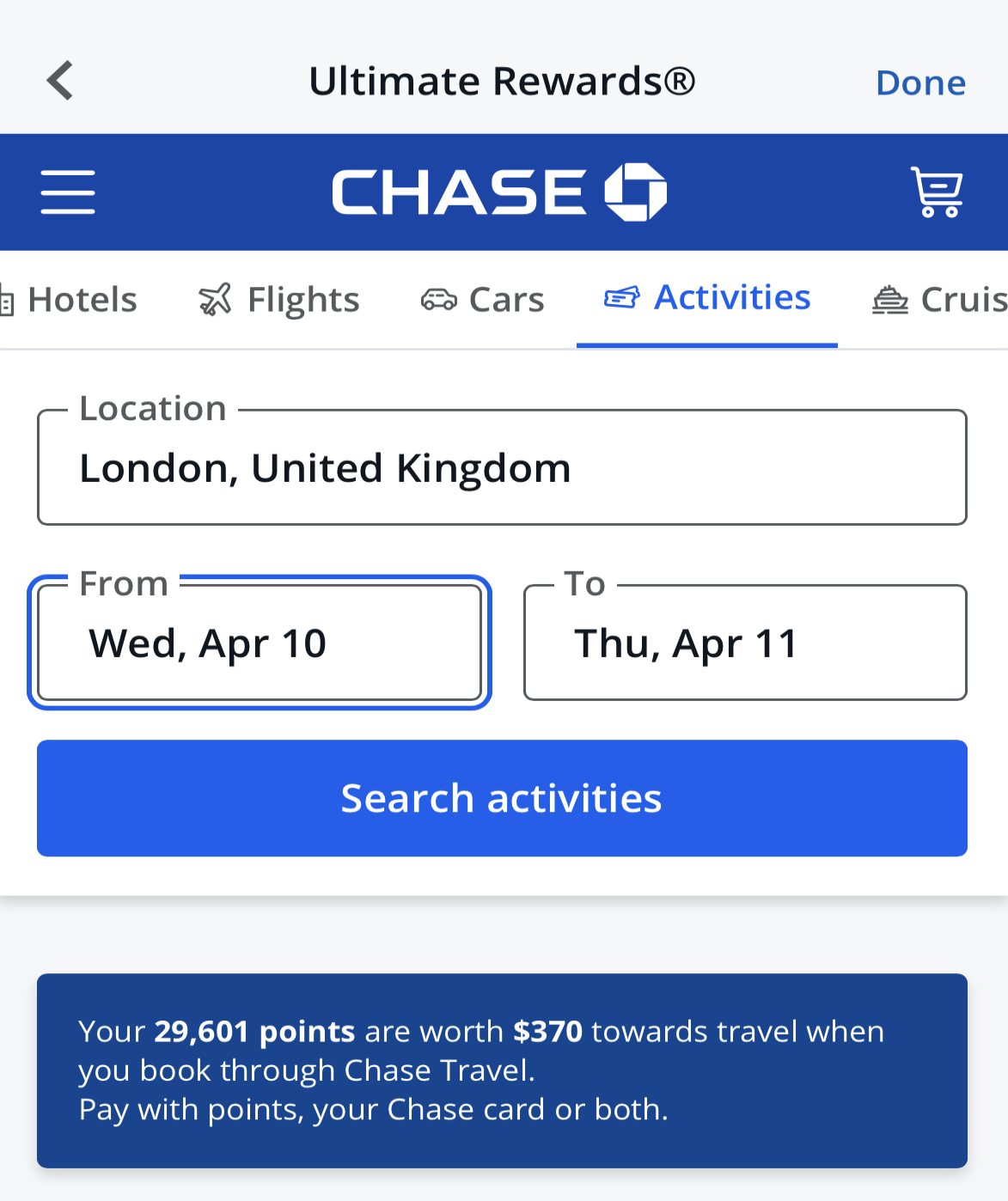

The Chase Sapphire Preferred® Card provides a range of flexible redemption options for travelers and beyond. Utilize the Ultimate Rewards® portal for optimal value, securing 1.25 cents per point when booking flights, hotels, and car rentals.

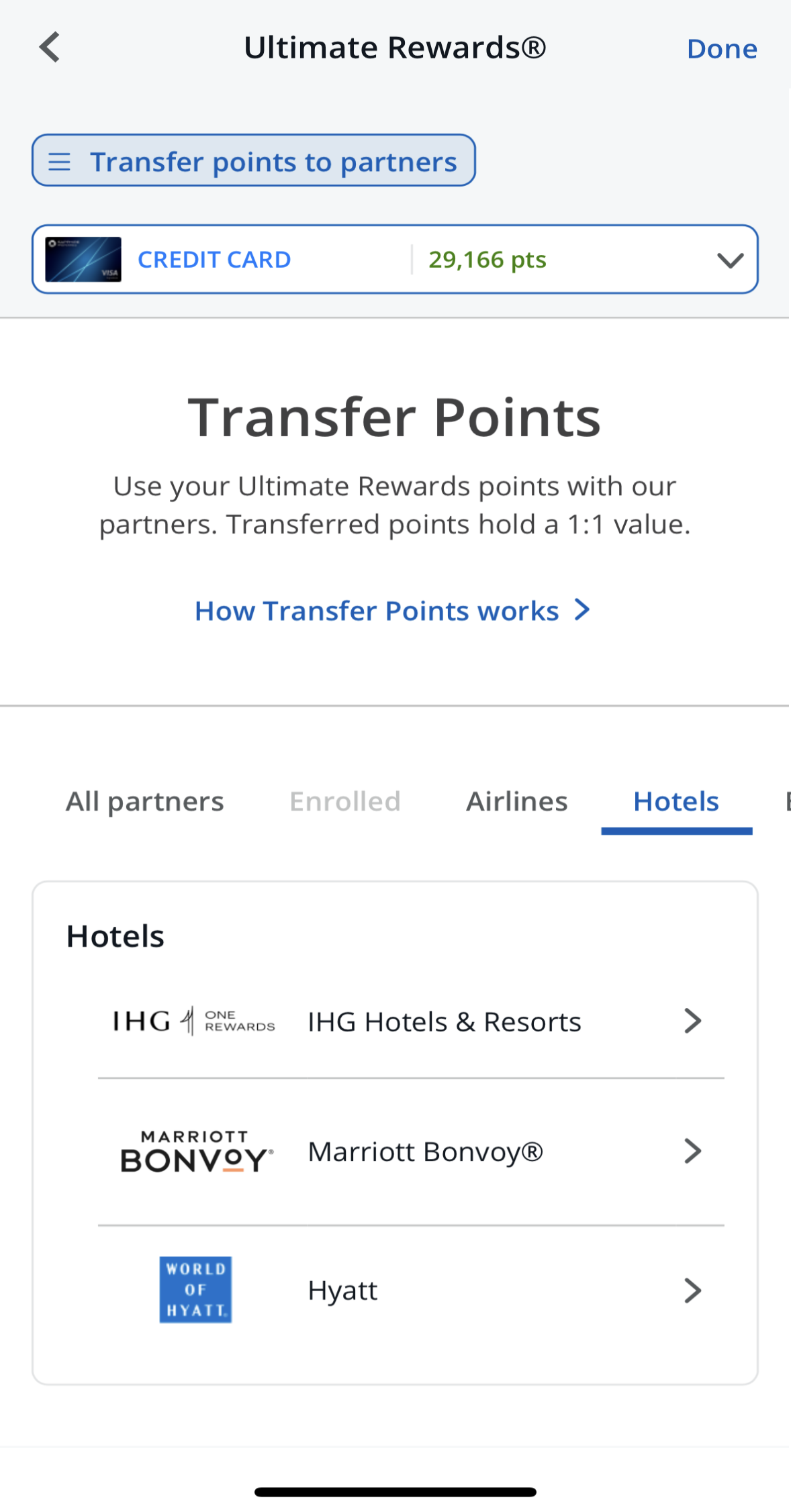

There are travel experiences by transferring points at a 1:1 ratio to 14 partner programs like United, Air France, Hyatt, and Marriott. Pay with points directly on Amazon.com or through PayPal, converting points to cash.

Non-travel options include statement credits at 1 cent per point, gift card redemptions, unique experiences through Chase Ultimate Rewards, and charitable donations.

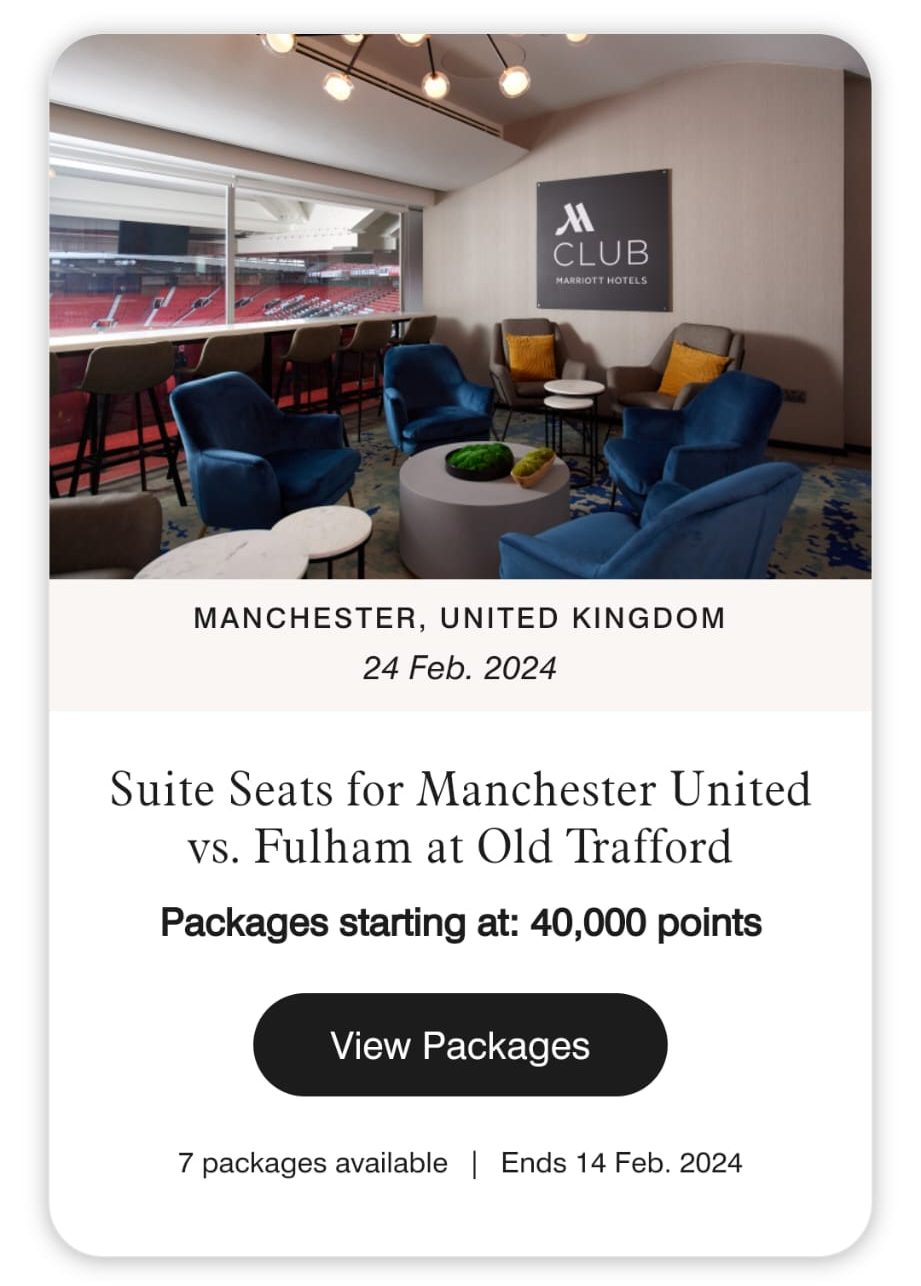

Marriott Bonvoy® points open up a world of options for travel and more. Use your points for hotel stays at Marriott properties worldwide, with extra perks like the Fifth Night Free offer for longer vacations and suite upgrades for added luxury.

You can go beyond hotels by booking flights, cruises, and unique experiences like spa treatments or theme park tickets. Bid on exclusive opportunities through Marriott Bonvoy Moments, from concerts to meet-and-greets with celebrities.

Lastly, there are everyday perks like instant redemptions for dining or shop for electronics and gift cards.

Which Extra Benefits You'll Get With Each Card?

There are some additional types of perks that you will see with both of these cards. Both cards offer statement credits and protections. However, there are no premium benefits with any of these cards.

Marriott Bonvoy Boundless

- Marriott Bonvoy Silver Elite Status:Enjoy Silver Elite Status automatically each account anniversary year as a cardmember.

Elevate Your Status: Earn 1 Elite Night Credit for every $5,000 spent, helping you achieve higher elite status.

15 Elite Night Credits: Receive 15 Elite Night Credits annually, contributing to your elite status. Some restrictions apply.

1 Free Night Award: The Boundless card offers a free night award after spending $35,000 in a calendar year.

Path to Gold Status: Spend $35,000 on purchases in a calendar year to progress towards Gold Status.

DoorDash: Receive one year of complimentary DashPass, granting unlimited deliveries with $0 delivery fees and reduced service fees on eligible order

- Visa Concierge: Enjoy complimentary 24/7 Visa Signature® Concierge Service, providing assistance with various tasks, including finding event tickets, making restaurant reservations, and helping you select the perfect gift.

Chase Sapphire Preferred® Card

- $50 Anniversary Statement Credit: Every year on your card anniversary, you have the opportunity to earn up to $50 in statement credits for hotel stays made through the Chase Ultimate Rewards portal.

- %25 Travel Bonus: When you redeem your reward points for travel through the Chase Ultimate Rewards portal, you'll receive a 25% bonus, enhancing the value of your points.

- %10 Anniversary Bonus: Chase offers a 10% bonus on your total purchases from the previous year as an anniversary gift. For example, if you earned 20,000 points in the first year, you'll receive a 2,000-point bonus in the second year.

- DoorDash Perks: Upon registration, you'll receive a one-year DoorDash subscription, DashPass, which offers reduced service fees and $0 delivery fees for orders over $12.

- Lyft Rides: During the promotional period, you'll earn extra points on Lyft rides, currently available until March 2025.

- Instacart+ Subscription: Linking your card to Instacart grants you a six-month Instacart+ subscription for free. As a member, you can earn up to $15 in statement credits per quarter until July 2024.

Can I Transfer Chase Sapphire Preferred Points To Marriot?

Absolutely, you can transfer Chase Sapphire Preferred® points to Marriott Bonvoy® at a 1:1 ratio, providing flexibility for hotel stays and experiences. Every 1,000 Chase points convert to 1,000 Marriott points.

Before transferring, assess redemption options; sometimes, using points through the Chase travel portal may offer better value.

The Preferred Card Offer More Travel Protections & Insurance

Both cards offer the following insurance and protections:

Baggage Delay Insurance: Reimburses up to $100 per day for essential purchases like toiletries and clothing when your baggage is delayed by a passenger carrier for more than 6 hours, up to a total of 5 days.

Lost Luggage Reimbursement: Provides coverage of up to $3,000 per passenger for damaged or lost luggage checked or carried on by you or an immediate family member when traveling.

Trip Delay Reimbursement: Covers unreimbursed expenses, such as meals and lodging, up to $500 per ticket when your common carrier travel is delayed for more than 12 hours or necessitates an overnight stay.

Purchase Protection: Safeguards your new purchases against damage or theft for 120 days, with coverage up to $500 per claim and a maximum of $50,000 per account.

However. the Chase Preferred card offers better travel insurance with different types of protections:

- Extended Warranty Protection: Extends the U.S. manufacturer's warranty by an additional year for eligible warranties of three years or less.

- Auto Rental Collision Damage Waiver: Offers primary coverage for theft and collision damage for most rental cars in the U.S. and abroad when you decline the rental company's insurance, with reimbursement up to the actual cash value of the vehicle.

- Travel and Emergency Assistance Services: Provides access to legal and medical referrals and other emergency assistance services when encountering problems away from home, though you are responsible for the costs of goods or services obtained.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer The Chase Sapphire Preferred?

You might prefer the Chase Sapphire Preferred over the Marriott Bonvoy Boundless card in several scenarios:

- You Want Flexibility in Redemptions: If you value the flexibility to redeem your rewards for various travel options, such as flights, hotels, and more, the Chase Sapphire Preferred is the better choice. It allows you to transfer points to multiple airline and hotel partners, offering a broader range of redemption possibilities.

- You Want Frequent Traveler: For frequent travelers who don't have a strong allegiance to the Marriott hotel chain and enjoy exploring diverse accommodation choices, the Chase Sapphire Preferred is the ideal choice. This card not only offers bonus points with a higher inherent value compared to Marriott points but also comes with a range of travel insurance and protection benefits.

- You Want More Valuable Travel Protections: The Chase Sapphire Preferred® Card offers primary rental car insurance, which is a more valuable benefit than the auto rental collision damage waiver offered by the Marriott Bonvoy Boundless® Credit Card.

When You Might Prefer The Marriott Bonvoy Boundless?

You might prefer the Marriott Bonvoy Boundless card over the Chase Sapphire Preferred in the following situations:

- You Are Loyal to Marriott: If you are a dedicated traveler who frequently stays at Marriott properties, the Marriott Bonvoy Boundless card is an obvious choice. It allows you to maximize your loyalty rewards with Marriott, earning bonus points for your stays and offering exclusive benefits like elite status and an annual free night award.

- You Want Hotel-Driven Rewards: If your primary focus is on earning and redeeming points for hotel stays and related expenses, the Marriott Bonvoy Boundless card aligns perfectly with your travel goals, as it's specifically designed for hotel enthusiasts.

- You Want Marriott Bonvoy Elite Status: If you value the perks that come with Marriott Bonvoy elite status, such as room upgrades and late checkout, the Marriott Bonvoy Boundless card can help you achieve and maintain these levels more easily.

Compare The Alternatives

If you're looking for a travel rewards credit card– there are some excellent alternatives you may want to consider:

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases. | 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

80,000 points

80,000 Membership Rewards® points after you spend $8,000 on purchases on your new Card in your first 6 months of Card Membership

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | 21.24% – 29.24% APR Variable | 22.49%–29.49% variable | 19.99% – 29.99% (Variable) |

Compare Chase Sapphire Preferred

When it comes to the annual fee, there is a clear winner. But is it worth the exclusive travel rewards you'll get? Here's our analysis.

When it comes to travel benefits, there is a clear winner. But what about if you're looking for rewards on everyday spending?

Amex Blue Cash Preferred vs Chase Sapphire Preferred: Which Card Is Best?

While the Chase Sapphire Preferred Card has more benefits, the Capital One Venture card offers unique features. Which travel card is better?

Capital One Venture vs Chase Sapphire Preferred: Which Card Is Best?

While the Amex gold card is best for everyday spending, the Chase sapphire preferred may be better as a travel card. Here's our comparison:

American Express Gold Card Vs. Chase Sapphire Preferred: Which Is Best?

The Chase Sapphire Preferred offers better travel perks and protections, but unlike the Autograph card – you'll need to pay an annual fee.

Wells Fargo Autograph Vs. Chase Sapphire Preferred: Which Card Is Best?

The Chase Sapphire Preferred offers costs more and offer more benefits than the Freedom Unlimited. Is it worth the annual fee?

Chase Freedom Unlimited Vs. Sapphire Preferred: Compare Side By Side

The Chase Sapphire Preferred is more versatile and offers better travel rewards than the Explorer card. But what if you're loyal to United?

United Explorer Card vs Chase Sapphire Preferred: Side By Side Comparison

The Venture X card offers better travel perks than the Sapphire Preferred, such as annual credit and lounge access. But is it worth the fee?

Capital One Venture X vs. Chase Sapphire Preferred: Comparison

The Capital One Savor is better for everyday spending, but the Chase Preferred card is the winner when it comes to travel and protections.

Chase Preferred card is the clear winner as it offers better travel rewards than the BofA Premium Rewards and variety of travel protections

Bank of America Premium Rewards vs. Chase Sapphire Preferred: Which Card Wins

While the Chase Sapphire Preferred is our winner due to its various perks, the Aeroplan card offers high cashback value and airline perks.

Chase Sapphire Preferred vs. Air Canada Aeroplan Card: How They Compare?

The Chase Sapphire Preferred is our winner due to its higher annual cashback value and various redemption options compared to Alaska card

Chase Sapphire Preferred vs. Alaska Airlines Visa Signature Card: How They Compare?

While we really like both cards, the Chase Sapphire Preferred is our winner due to its diverse redemption options and high rewards rate.

Chase Sapphire Preferred vs. JetBlue Plus Card: Side By Side Comparison

Compare Marriott Bonvoy Boundless Card

While there is no big difference when it comes to points rewards, the Brilliant offers lounge access, credit statements, and Platinum status.

In our opinion, the new Marriott Bountiful isn't worth the higher annual fee compared to the traditional Boundless card. Here's why.

Marriott Bonvoy Bountiful vs Boundless: Side By Side Comparison

The Marriott Bonvoy Bevy is more expensive than the Boundless. Are the extra benefits worth the difference? We don't think so. Here's why.

The Hilton Amex Surpass is our winner as it offers higher estimated total cashback than the Marriot Boundless card and additional hotel perks.

Marriott Bonvoy Boundless vs. Hilton Amex Surpass: Side By Side Comparison

Both cards offer similar rewards ratio and hotel perks, so overall it comes down to which hotel chain you like better – IHG or Marriot?

IHG One Rewards Premier vs. Marriott Bonvoy Boundless: Side By Side Comparison

The World of Hyatt Card is our winner – it offers a significantly higher annual cash back for the average consumer than Marriott Boundless.

World of Hyatt Card vs. Marriott Bonvoy Boundless: Which Hotel Card Is Best?

Surprisingly, despite having no annual fee – the Wyndham Rewards Earner offers higher estimated cash back, which is why it's our winner.

Wyndham Rewards Earner vs. Marriott Bonvoy Boundless: Which Hotel Card Is Best?