The World of Hyatt Card and the IHG One Rewards Premier card are both popular hotel rewards credit cards, each catering to different hotel chains with distinct perks and benefits.

Here's our full comparison to help you decide between the two:

General Comparison

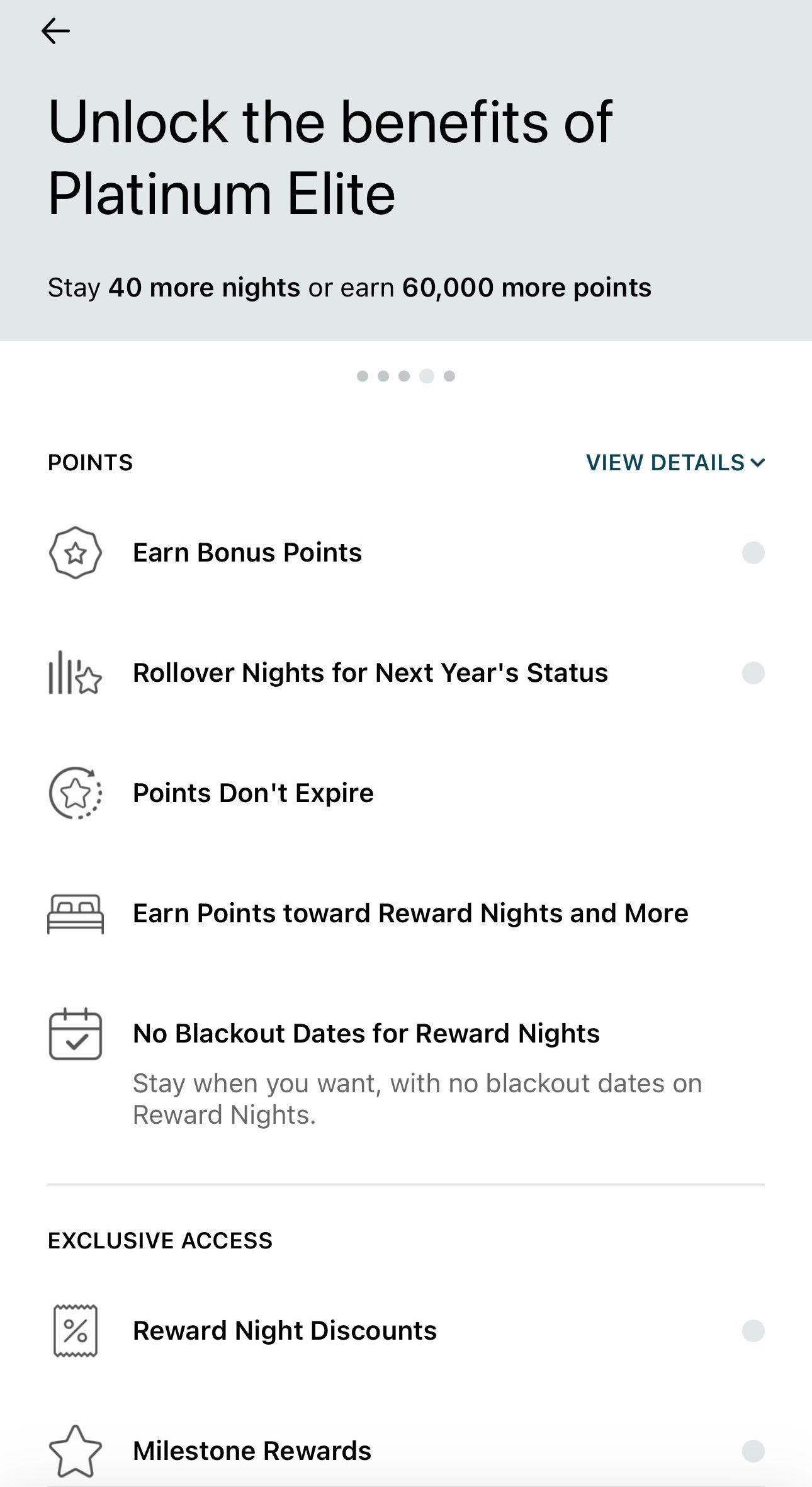

The IHG One Rewards Premier card gives you Platinum Elite status, which includes perks like room upgrades and priority check-in. It also offers a credit for Global Entry or TSA PreCheck fees to enhance your travel experience.

On the other hand, the World of Hyatt Card is designed for Hyatt hotel lovers, offering great benefits like higher rewards on Hyatt purchases. Cardholders also earn an annual free night certificate after meeting the required spending, automatic Discoverist status, and travel perks like trip cancellation/interruption insurance.

Here’s a side-by-side comparison of the main features of each card:

|

| |

|---|---|---|

IHG One Rewards Premier | World of Hyatt Card | |

Annual Fee | $99 | $95 |

Rewards | Up to 10X points from IHG® on stays for being an IHG One Rewards member. Up to 6X points from IHG® on stays with Platinum Elite Status. 5X total points on travel, dining, and at gas stations and 3X points per $1 spent on all other purchases. | 4 Bonus Points per $1 spent on purchases at all Hyatt hotels. Plus, 5 Base Points from Hyatt per eligible $1 spent for being a World of Hyatt member. 2x Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airline, local transit and commuting as well as fitness club and gym memberships. Plus, earn 1 Bonus Point per $1 spent on all other purchases. |

Welcome bonus | Earn 165,000 Bonus Points after you spend $3,000 on purchases in the first 3 months from account opening.*

| “Earn up to 60,000 Bonus Points

30,000 Bonus Points after you spend $3,000 on purchases in your first 3 months from account opening.* Plus, up to 30,000 more Bonus Points by earning 2 Bonus Points total per $1 spent in the first 6 months from account opening on purchases that normally earn 1 Bonus Points, on up to $15,000 spent”

|

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | $0 |

Purchase APR | 19.74%–28.24% variable

| 19.74%–28.24% variable

|

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

World of Hyatt vs IHG Premier: Compare Point Rewards

When we compare the points earned from specific purchases, the IHG One Rewards Premier card shows a higher point accumulation. However, it's worth noting that the value of IHG points is generally lower than that of World of Hyatt points.

As a result, even though the IHG card earns more points, our analysis suggests that the estimated annual value of the World of Hyatt card is higher. So, when it comes to point rewards, the World of Hyatt card comes out on top.

|

| |

|---|---|---|

Spend Per Category | IHG One Rewards Premier | World of Hyatt Card |

$10,000 – U.S Supermarkets | 20,000 points | 10,000 points |

$4,000 – Restaurants

| 8,000 points | 8,000 points |

$4,000 – Airline | 4,000 points | 8,000 points |

$5,000 – Hotels | 50,000 points | 20,000 points |

$4,000 – Gas | 4,000 points | 4,000 points |

Total Points | 90,000 points | 50,000 points |

Redemption Value (Estimated) | 1 point = ~0.7 cent | 1 point = ~2.1 |

Estimated Annual Value | $630 | $1,050 |

Which Hotel Benefits You'll Get With Each Card?

Chase issues both cards, but the IHG Premier card is the winner when it comes to extra perks:

IHG One Rewards Premier

- IHG One Rewards Platinum Elite Status: Enjoy Platinum Elite status in the IHG Rewards program as an IHG One Rewards Premier cardmember.

- Global Entry, TSA PreCheck, or NEXUS Statement Credit: Get up to $100 in statement credits every 4 years to cover the application fees for Global Entry, TSA PreCheck, or NEXUS.

- Redeem 3 Nights, Get 4th Night Free: Enjoy a complimentary fourth night when redeeming points for a consecutive four-night stay at an IHG hotel.

- 20% Discount on Reward Points Purchases: Save 20% on purchases of IHG reward points when using your IHG One credit card, allowing you to maximize your point accumulation and potentially unlock additional benefits within the IHG loyalty program.

- Anniversary Free Night: Receive a complimentary night each account anniversary year, redeemable for stays at IHG hotels, with a redemption cap of 40,000 points.

World of Hyatt Card

- World of Hyatt Discoverist Status: Enjoy Discoverist status as long as your account is open, offering perks like room upgrades and late check-out.

- Free Night Benefit: Cardholders receive a complimentary night at any Category 1–4 Hyatt hotel or resort annually after their cardmember anniversary, with an additional free night for spending $15,000 in a calendar year.

- Qualifying Night Credits: Earn 5 qualifying night credits each year towards your next tier status, and an additional 2 credits for every $5,000 spent on the card.

You'll also get the following benefits with both cards:

DoorDash: Receive one year of complimentary DashPass, granting unlimited deliveries with $0 delivery fees and reduced service fees on eligible order

- Visa Concierge: Enjoy complimentary 24/7 Visa Signature® Concierge Service, providing assistance with various tasks, including finding event tickets, making restaurant reservations, and helping you select the perfect gift.

Which Protections You'll Get With Each Card?

The protections are quite similar with an advantage to the World Of Hyatt card, due to the auto rental collision damage waiver which is not available via the IHG card:

Baggage Delay Insurance: Reimburses up to $100 per day for essential purchases like toiletries and clothing when your baggage is delayed by a passenger carrier for more than 6 hours, up to a total of 5 days.

Lost Luggage Reimbursement: Provides coverage of up to $3,000 per passenger for damaged or lost luggage checked or carried on by you or an immediate family member when traveling.

Purchase Protection: Safeguards your new purchases against damage or theft for 120 days, with coverage up to $500 per claim and a maximum of $50,000 per account.

- Trip Cancellation/Trip Interruption Insurance: Receive reimbursement, up to $5,000 per person and $10,000 per trip, for pre-paid, non-refundable travel expenses in case of trip cancellation or interruption due to covered situations like sickness or severe weather.

- Auto Rental Collision Damage Waiver (World of Hyatt Card Only): Decline the rental company's collision insurance and charge the entire rental cost to the card for coverage against theft and collision damage for most cars in the U.S. and abroad.

When You Might Prefer The World of Hyatt Card?

You might prefer the World of Hyatt Card card over the IHG One Rewards Premier in the following situations:

Frequent Stays at Hyatt Properties: If you regularly stay at Hyatt hotels, the World of Hyatt Card is a better choice as it offers bonus points for spending at Hyatt, automatic Discoverist status, and an annual free night award, enhancing your overall experience and value.

Better Rewards Value And Higher Point Values: While the IHG One Rewards Premier card may accumulate more points, the World of Hyatt points tend to have higher redemption value. If you prioritize the quality and value of your points over sheer quantity, the World of Hyatt Card is preferable.

- You appreciate Hyatt's hotel portfolio: Hyatt's hotel portfolio includes a variety of upscale and luxury brands, such as Park Hyatt, Andaz, and The Ritz-Carlton. If you prefer these more premium hotel experiences, the World of Hyatt Credit Card aligns better with your travel preferences.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer The IHG One Rewards Premier?

You might prefer the IHG One Rewards Premier card over the World of Hyatt Card in the following situations:

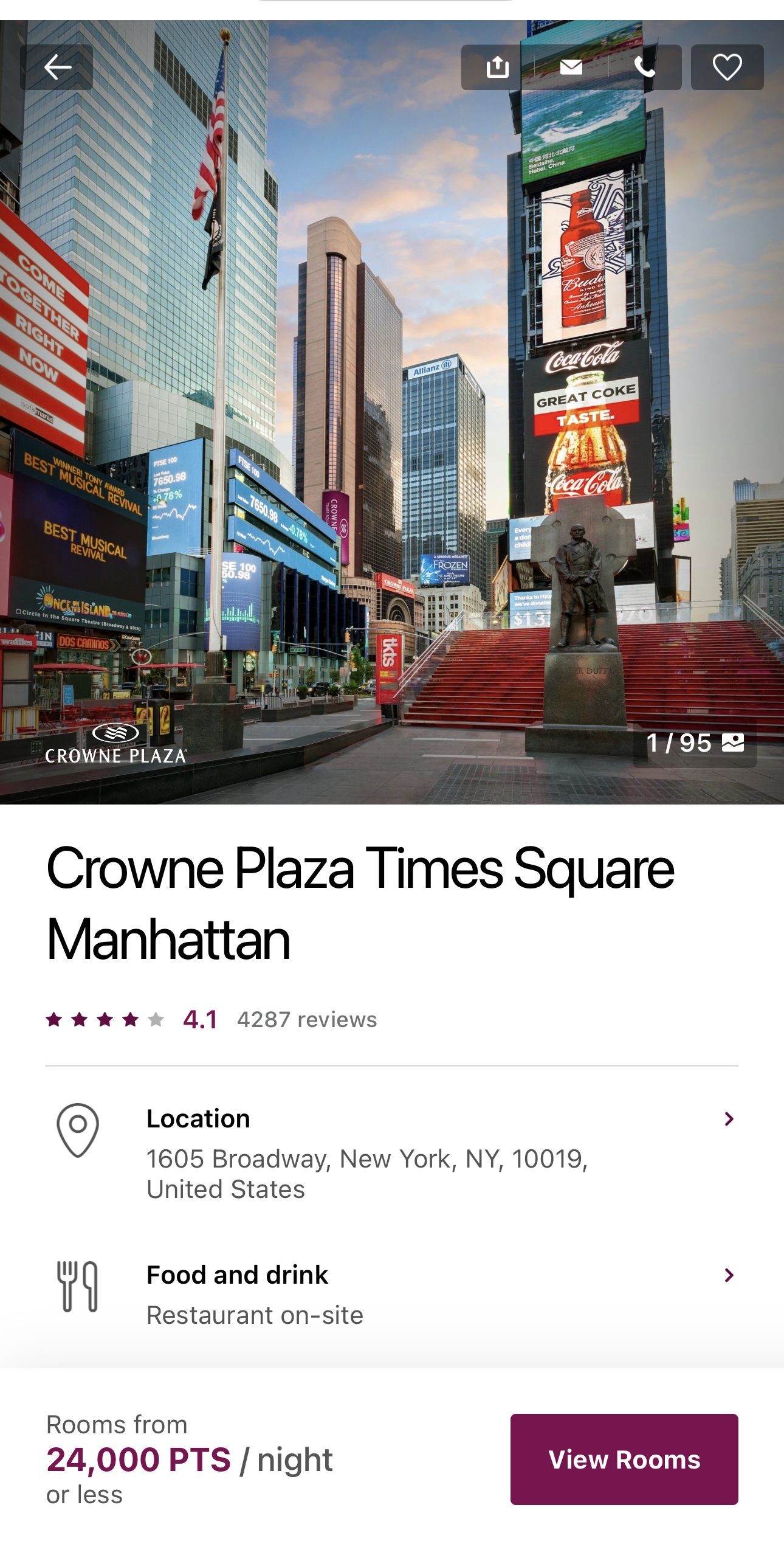

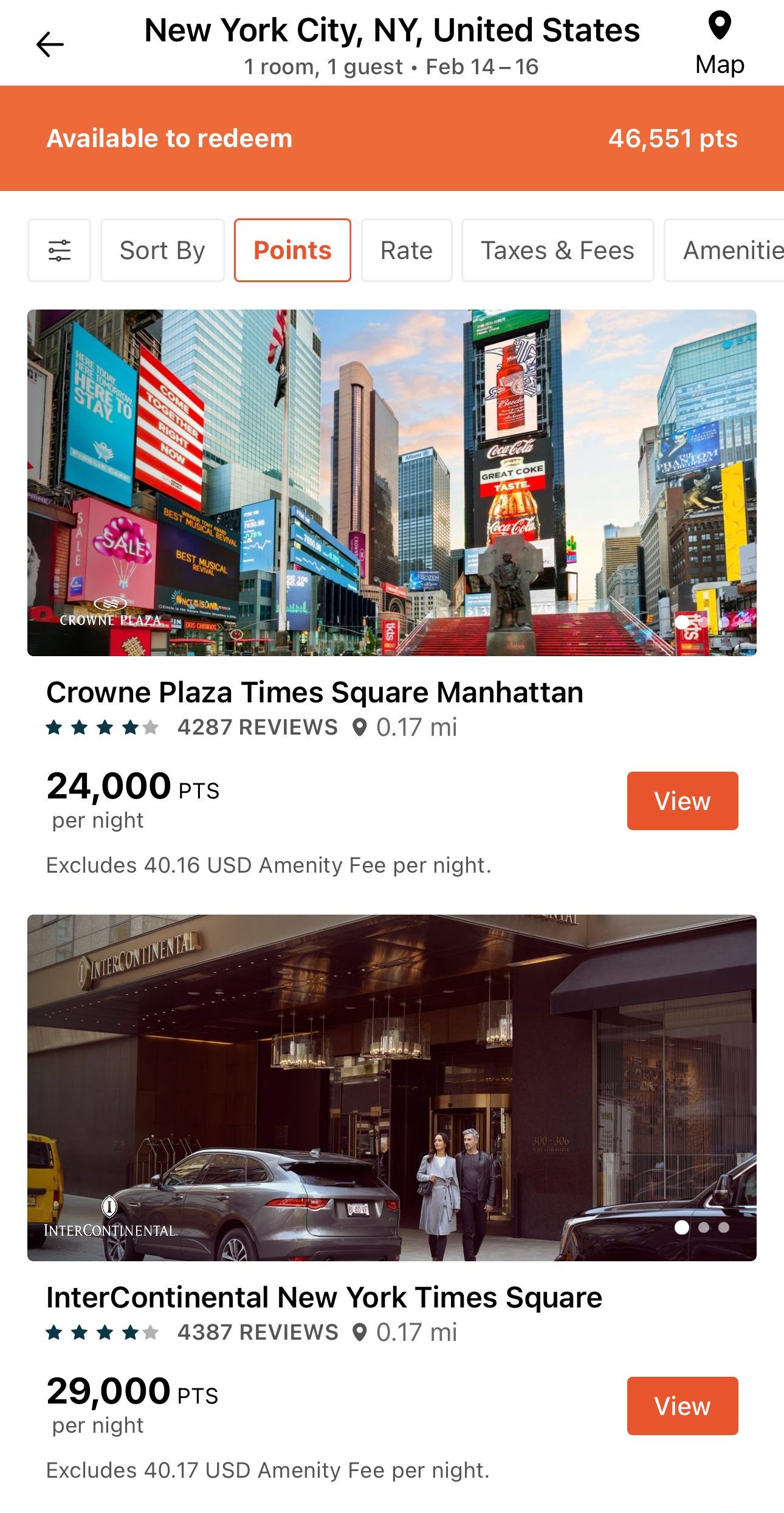

Diverse Hotel Options Worldwide: If you prefer a broader range of hotel options, including InterContinental, Holiday Inn, and other IHG brands, the IHG One Rewards Premier card is more suitable. Its extensive hotel network provides flexibility in choosing accommodations as it has over 6,000 options while World Of Hyatt offers less than 1,500 in its portfolio.

Global Entry or TSA PreCheck Benefit: The IHG One Rewards Premier card offers a Global Entry or TSA PreCheck fee credit, streamlining your travel experience. If expedited security screening is a priority for you, this card provides an additional travel-related benefit.

Compare The Alternatives

If you're looking for a travel rewards credit card with hotel benefits – there are some excellent alternatives you may want to consider:

|

|

| |

|---|---|---|---|

Marriott Bonvoy Brilliant® American Express® Card

| The Platinum Card® from American Express | Hilton Honors American Express Card | |

Annual Fee | $650. See Rates & Fees | $695. See Rates & Fees | $0 |

Rewards | 2X – 6X

6 Marriott Bonvoy points for each dollar of eligible purchases at hotels participating in the Marriott Bonvoy™ program, 3 points at Worldwide restaurants and on flights booked directly with airlines and 2 points on all other eligible purchases

|

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

3X – 7X

7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio, 5x points at U.S. restaurants (including takeout and delivery) U.S.supermarkets, U.S. gas stations and 3x points for each dollar on other eligible purchases

|

Welcome bonus | 100,000 points

100,000 Marriott Bonvoy® bonus points after you use your new card to spend $6,000 on purchases within your first six months of card membership.

|

175,000 points

175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership

|

100,000 points

100,000 Hilton Honors Bonus Points with the Hilton Honors American Express Card after you spend $2,000 in purchases on the Card within your first 6 months of Card Membership.

|

Foreign Transaction Fee | $0 | $0. See Rates & Fees | $0. See Rates and Fees. |

Purchase APR | 19.99%-28.99% Variable

| See Pay Over Time APR | 19.99% – 28.99% variable

|

Compare World of Hyatt Card

If you're looking for an hotel card, a good one can provide exclusive benefits. Which card offers more perks and what are the differences?

Amex Hilton Honors vs World of Hyatt: Which Hotel Card Wins?

The World of Hyatt Card is our winner – it offers a significantly higher annual cash back for the average consumer than Marriott Boundless.

World of Hyatt Card vs. Marriott Bonvoy Boundless: Side By Side Comparison

The Hilton Surpass and World of Hyatt card are two of the best medium tier hotel cards with great cash back rates and extra hotel perks.

World of Hyatt Card vs. Hilton Amex Surpass: Side By Side Comparison

Compare IHG One Rewards Premier Card

In our opinion, the IHG One Rewards Premier wins only if you plan to spend a significant amount on hotels. If not, the differences are minor.

IHG One Rewards Traveler vs. Premier: Side By Side Comparison

Both cards offer similar rewards ratio and hotel perks, so overall it comes down to which hotel chain you like better – IHG or Marriot?

IHG One Rewards Premier vs. Marriott Bonvoy Boundless: Side By Side Comparison