Table Of Content

What Is My Chase Plan?

My Chase Plan is a benefits program that allows cardholders of specific Chase cards to select purchases to be split up into monthly payments. The payments are of equal amounts, and while there is a monthly fee plan, you won’t be charged interest for spreading the cost of your purchases.

If eligible, you can pay for select charges over time, which will separate them from your other account charges. The costs for this are shown in advance, but it allows you to carry a balance on some of your charges and continue to avoid paying interest by fully paying off additional charges.

This is a decent program for those who want to extend paying for some of their purchases without compromising on the goal of minimizing financing costs.

You can pay off larger purchases in monthly installments and, provided you continue to pay the remainder of your credit card balance in full with each bill, you can take full advantage of the grace period to not pay interest on all of your credit card purchases.

What is the My Chase Plan Monthly Fee?

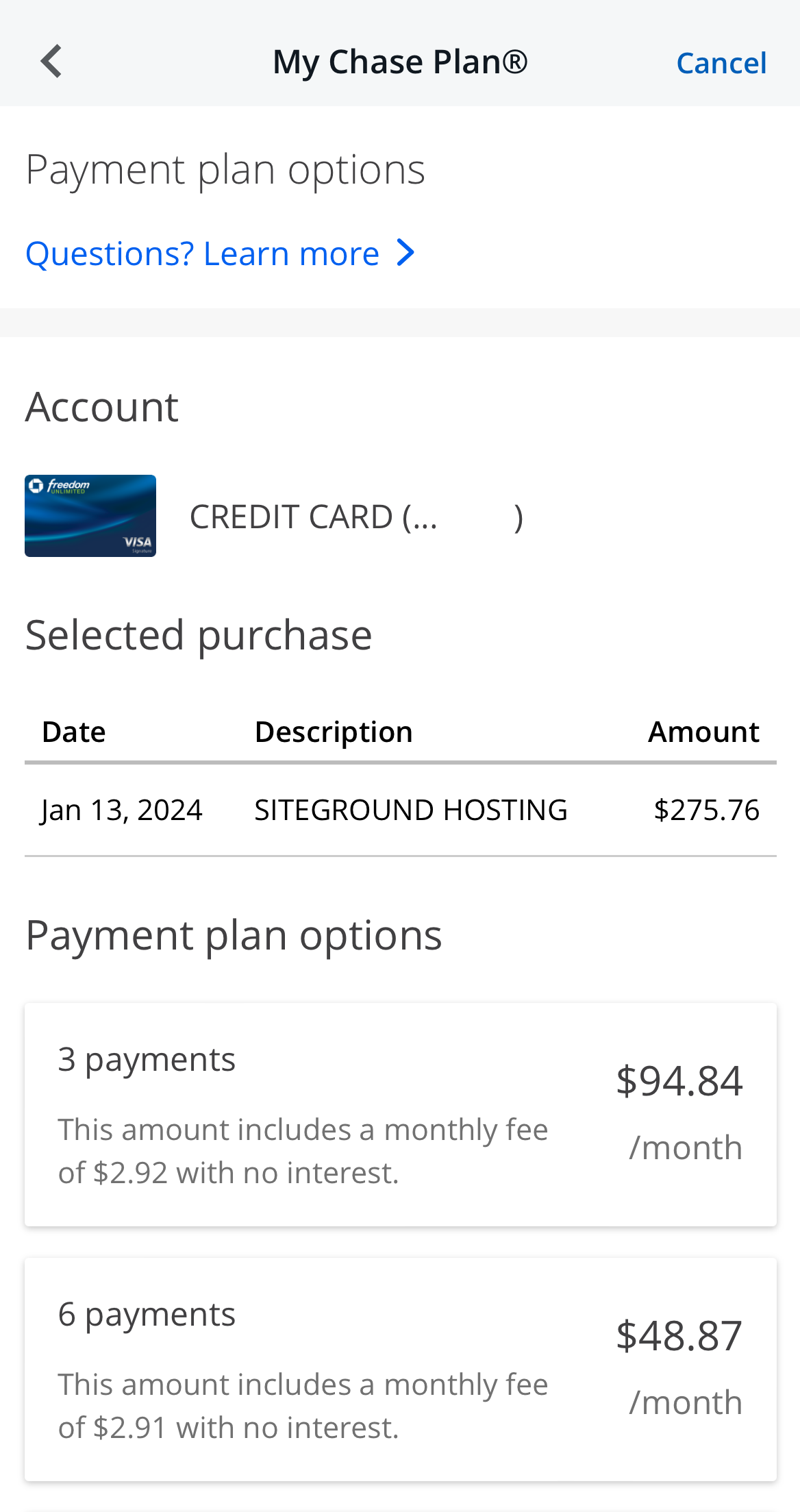

There isn’t a fixed monthly fee for using the My Chase Plan service. The fee is determined when you set up each plan and stays the same until you’ve paid off the balance for that transaction.

The fee depends on the transaction amount, the number of billing periods you choose to spread the cost over, and a few other factors.

Before finalizing the plan, you’ll be shown the specific fee for your transaction so you can make sure you’re comfortable with it.

How To Use My Chase Plan?

Using My Chase Plan involves a few basic steps. You don’t need to complete any additional application, eligible purchases will appear on your account with an option to sign up. The steps to sign up for a plan include the following:

- Make a purchase for over $100: Only purchases over $100 are eligible for My Chase Plan. After you’ve made a purchase, you can log into your online account or use the Chase app and select “Pay with My Chase Plan.”

- Select the term: Depending on the specific purchase and your profile, you may be offered one to three plans with different terms. The plan length varies from three to 18 months. You’ll see the monthly payment amount and monthly fee applicable for each term option.

- Accept the My Chase Plan: Once you agree on a plan, it simply begins. You’ll need to pay the specified amount for the number of months. This amount is added to the minimum payment due on your card’s monthly bill. There is no additional interest to pay.

Does My Chase Plan Affect Available Credit?

The only real downside to using My Chase Plan is that it is highly likely to impact your credit. While you’re spreading the cost of your purchases, these transactions will not be classified as available credit.

So, your credit utilization ratio will go up. This means that the percentage of your available credit will be higher, even though you’re not paying interest charges on that amount.

Since credit utilization is a major factor in calculating your credit score, this has the potential to impact your credit. After all, the higher your credit utilization percentage, the greater the impact on your credit score.

If you wanted to use My Chase Plan, you would need to be careful to ensure that your credit utilization does not stray above the recommended maximum of 30%.

This chart created with Experian data shows that those with an average to good credit score have an average credit utilization ratio of the optimum 33%. This ratio drops significantly for those with very good and excellent scores.

At the other end of the scale, the chart shows that those with poor credit scores typically have a very high credit utilization ratio, with an average of 73%. This will be a massive factor in lending decisions for those in this group.

My Chase Plan Pros and Cons

Of course, no financial product or service is perfect and there are both pros and cons associated with My Chase Plan. These includes

Pros | Cons |

|---|---|

Convenience |

It May Impact Credit |

Versatility | Increase in Monthly Financial Obligations |

Rewards

| It’s Not Completely Free |

Structure |

- Convenience

You don’t need to complete any additional application, eligible purchases will automatically indicate an available My Chase Plan option.

- Versatility

Many Buy Now Pay Later plans are split into four payments, regardless of how large or small the transaction you want to split.

My Chase Plan offers more versatility and flexibility, since you may be eligible for longer time frames. This allows you to choose the most appropriate term for your financial circumstances.

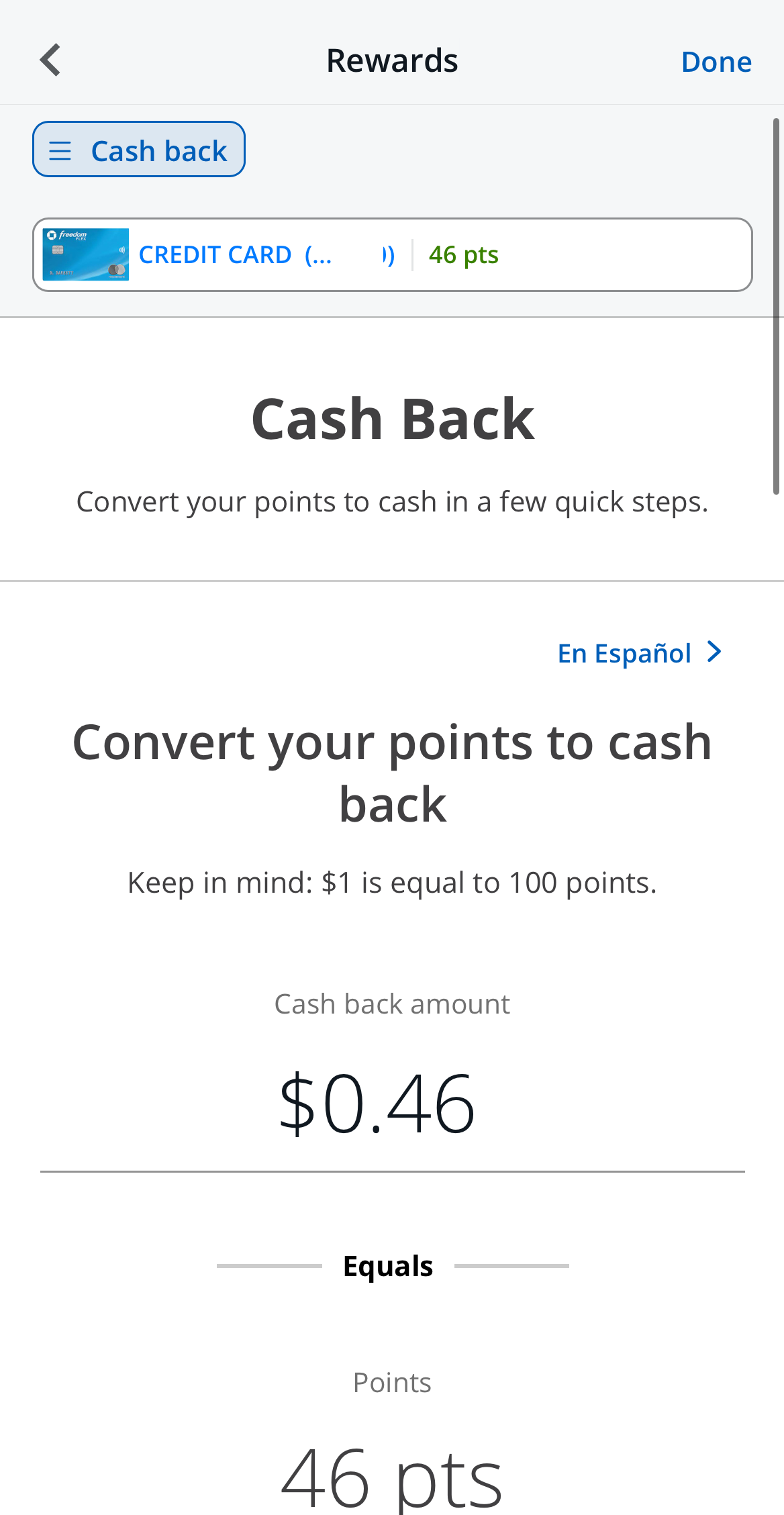

- Rewards

Despite the fact that you won’t be paying interest to spread the cost of your purchases, since you used your Chase card to make the initial purchase, you will still earn cash back, points or other rewards as per your regular transactions.

- Structure

If you tend to carry a balance for a long time or simply have a revolving balance, the fixed payment structure of My Chase Plan may be beneficial to you.

The plan requires fixed monthly payment amounts over the agreed term, so you’ll have an end in sight to pay off larger purchases.

Even with paying the fee, it will be far cheaper than carrying a balance on your card for months.

- It May Impact Credit

As we discussed earlier, when you use My Chase Plan, your available credit and therefore your credit utilization ratio will be impacted. This could cause a drop in your credit score, depending on your credit report.

- Increase in Monthly Financial Obligations

You will need to think carefully about whether you want to increase the amount you must pay each month.

Once you agree to a plan, you can’t simply defer that monthly payment if you’re having a tight month.

- It’s Not Completely Free

While you are not charged interest, it is important to remember that this service is not completely free.

You’ll need to assess the monthly fee to determine affordability and overall cost of the service.

When It May Be a Good Idea to Use My Chase Plan

There are a number of scenarios when using My Chase Plan may be a good idea. These include:

- You Won’t Be Able to Clear the Bill When it Arrives

If you usually pay off your credit card balance in full each month but face an unexpected expense, My Chase Plan can be a helpful way to avoid carrying a balance and paying interest.

With My Chase Plan, you can break down the cost into manageable payments, and as long as you pay off the rest of your bill, you won’t accrue any interest charges.

- You Need Structure and Predictability

If you prefer to have a more established payment structure each month, you’re likely to appreciate My Chase Plan.

You won’t have the wiggle room to only pay the minimum amount, as you’ll need to pay the set amount for the designated number of months. These are agreed when you take out the plan, so you will have a predictable repayment schedule.

What Is My Chase Loan?

My Chase Loan is a different arrangement, allowing you to borrow from your available credit in a far more attractive way than simply requesting a cash advance. While cash advances tend to carry a higher APR, My Chase Loan has no fees, and you can access a lower APR on the amount you borrow.

My Chase Loan will only require part of your card’s credit limit, so you can continue to use the card to make purchases if you need to. This service is available for amounts above $500, with the maximum determined by your account history and creditworthiness. The loan term is available for 12,18 or 24 months.

How To Use My Chase Loan

As with My Chase Plan, My Chase Loan is remarkably easy to use. Again, there is no need for a credit check or additional application. You’ll just need to complete a few basic steps.

- Log in: You’ll need to log in to your online account or the Chase App. You should see the option to choose My Chase Loan on your menu.

- Select an Amount: You can then specify the amount you would like to borrow from your existing credit card account. This needs to be at least $500, but the maximum amount is determined by Chase according to your profile. This will be indicated at the time you click the option.

- Select the Term: There are three term options for My Chase Loan; 12, 18 or 24 months. Bear in mind that the longer the loan duration, the higher the fixed rate. So, you’ll need to carefully consider which term is most appropriate to your needs and financial circumstances.

- Receive the Funds: My Chase Loans are instantly approved, once you’ve completed the above steps. You can expect to receive the funds in your Chase account via direct deposit in one to two business days. Your repayment schedule will begin with your next billing cycle.

My Chase Loan Pros and Cons

There are both benefits and drawbacks to using My Chase Loan that you should be aware of before you make a decision. These include:

Pros | Cons |

|---|---|

Quick Access to Emergency Funds | Temptation to Spend More |

No Credit Check | Possible to Get Better Rates Elsewhere |

Lower APR | No Rewards |

- Quick Access to Emergency Funds

If you have a financial emergency, it is reassuring that you could potentially have the cash in your Chase account in a matter of a day or two.

This is a great alternative to simply charging a purchase to your card or taking out a cash advance.

- No Credit Check

Many people shy away from loans, as they have concerns about the impact of a credit check on their credit report.

Since you’re already an approved Chase borrower, you can access decent terms without needing to subject your credit report to a hard credit pull.

- Lower APR

Using a cash advance is typically considered a bad idea due to the fees and higher APR, but My Chase Loan actually offers a lower APR than your purchase APR.

- Temptation to Spend More

Having easy access to a loan could be an encouragement to spend beyond your typical habits and means.

You’ll need to consider what you want to borrow and not simply use the service because it’s available.

- Possible to Get Better Rates Elsewhere

Although you will be paying a lower APR than your card’s regular rate, it doesn’t mean that My Chase Loan is offering the best rate and terms.

If you do need access to a loan, it is still a good idea to compare other deals to make sure you choose the option that is right for you.

- No Rewards

As with a standard cash advance, you will not earn points, cash back or other card rewards when you take out a My Chase Loan.

When it May Be a Good Idea to Use My Chase Loan

There are still a number of circumstances when using My Chase Loan may be a good idea. These include:

- You need funds but don’t want application hassle

If you need access to funds to make a purchase or pay an unexpected bill, but don’t want the hassle of going through a loan application, you will likely appreciate My Chase Loan's convenience.

If simply charging the purchase to your card is not possible, this makes a great option.

- You need funds quickly

Although there are fast loan companies, the speed at which your loan is funded usually comes at a cost.

However, with My Chase Loan, you could have the funds in your account within one or two business days.

FAQs

Can You Use Them With Every Chase card?

My Chase Plan is available with most Chase cards, but you’ll need to check if your specific card is eligible.

Can you pay off My Chase Plan early?

Once the plan appears on your statement, you can choose to pay it off earlier by paying your full statement balance. You’ll not incur any penalties and you won’t incur any future fees for that specific pla.

How do you pay off My Chase Plan?

Your monthly repayment for the plan will be added to your minimum amount due on your regular monthly credit card bill.

How many My Chase Plans can I have?

Chase allows you to have up to 10 active or pending My Chase Plans on your account at any one time.

Does My Chase Plan reduce balance?

Yes, My Chase Plan will reduce your available balance.

Does My Chase Plan affect credit scores?

It will lower your available credit and thereby increase your credit utilization ratio, which may impact your credit score.