Benzinga Pro (Basic Plan)

Subscription/month

Promotion

Our Rating

Best For

- Overview

- Features

- Pros & Cons

The Benzinga Pro Basic Plan is an upgraded version of the free plan, offering real-time stock quotes, full newsfeed access, stock movers, customizable alerts, and technical analysis tools.

The full newsfeed provides live earnings reports, analyst ratings, SEC filings, and breaking financial news, helping investors react quickly to market shifts.

Technical analysis is available through interactive stock charts, which include indicators such as momentum, stochastic, and volatility (limited to two per chart).

Investors can also access key stock fundamentals, including earnings forecasts, analyst ratings, dividend data, and insider trading activity.

However, the plan lacks an advanced stock screener, stock recommendations, and real-time options flow.

- Real-time stock quotes

- Full newsfeed access

- Watchlist alerts

- Technical stock charts

- Earnings reports updates

- Insider trading activity

- ETF data & trends

- Economic calendar

- Dividends & earnings data

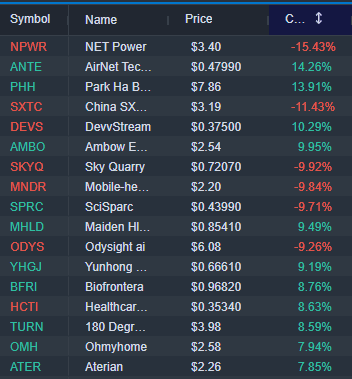

- Stock movers tracking

- Premium research articles

- IPO calendar insights

- Real-time stock quotes

- Full newsfeed access

- Customizable stock alerts

- Technical analysis tools

- Analyst ratings & insights

- No advanced stock screener

- No stock recommendations

- Limited technical indicators

- No portfolio tracking

- No third-party research

Benzinga Pro (Basic Plan): Pricing And Comparison

The Benzinga Pro Basic Plan is the entry-level paid plan, offering real-time stock quotes, a full newsfeed, stock movers, watchlist alerts, and earnings calendars. It is a step up from the free plan, which lacks real-time data and alert customization.

Plan | Monthly Subscription | Promotion |

|---|---|---|

Benzinga Pro – Basic | $37

$367 ($30.58 / month) if paid annually | 14-day free trial |

Benzinga Pro – Streamlined | $147

$1,497 ($124.75 / month) if paid annually | 14-day free trial |

Benzinga Pro – Essential | $197

$1,997 ($166.42 / month) if paid annually | 14-day free trial |

Benzinga Edge | $19

$228 if paid annually

| $129

$129 for new member’s annual price ($11/month), including 7-day money-back guarantee

|

However, it lacks advanced tools available in Benzinga Pro Essential, such as the real-time scanner, audio squawk, unusual options activity, and block trade tracking.

How To Analyze Stocks With Benzinga Pro?

We tested Benzinga Pro Basic’s research tools, from real-time quotes to premium articles, to see how well they help investors analyze stocks:

-

Nasdaq Basic (Real-Time Quotes)

One of the biggest advantages of Benzinga Pro Basic over the free plan is access to Nasdaq Basic real-time stock quotes.

Unlike the free plan, which has slight delays in stock price updates, the real-time data ensures you’re seeing the most current stock prices without waiting for refreshes.

What Investors Can Do With It?

- Get live stock price updates without the delay found in free market data sources.

- Make faster trading decisions based on real-time bid/ask prices.

- Improve stock analysis by ensuring you have up-to-the-second price movements.

- Avoid potential pricing mismatches caused by delayed stock charts or old quotes.

This is a huge benefit for active traders, especially those who rely on day trading, scalping, or momentum trading strategies.

-

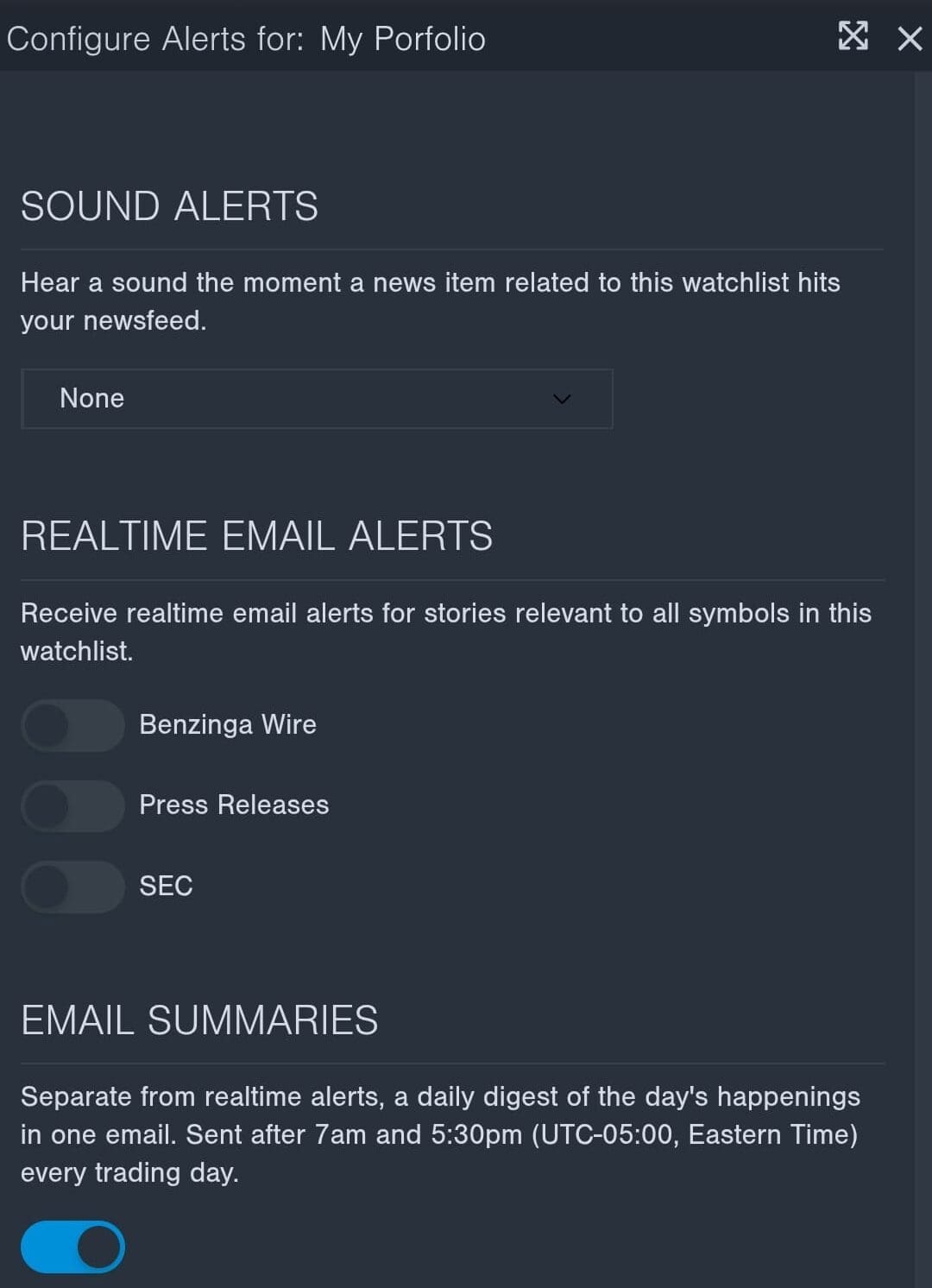

Watchlist Alerts

We tested the watchlist alerts feature in Benzinga Pro Basic, notifying users of key price movements and news updates for their tracked stocks.

As you can see here, users can also get a sound alert – all in real time:

What Investors Can Do With It?

- Set custom alerts for price changes, news updates, and analyst ratings.

- Stay informed without constantly monitoring your screen.

- Use alerts for momentum trading, earnings reactions, and technical breakouts.

- Improve trading efficiency by acting immediately on important stock movements.

This feature makes it far easier to manage multiple stocks and react quickly to market conditions.

-

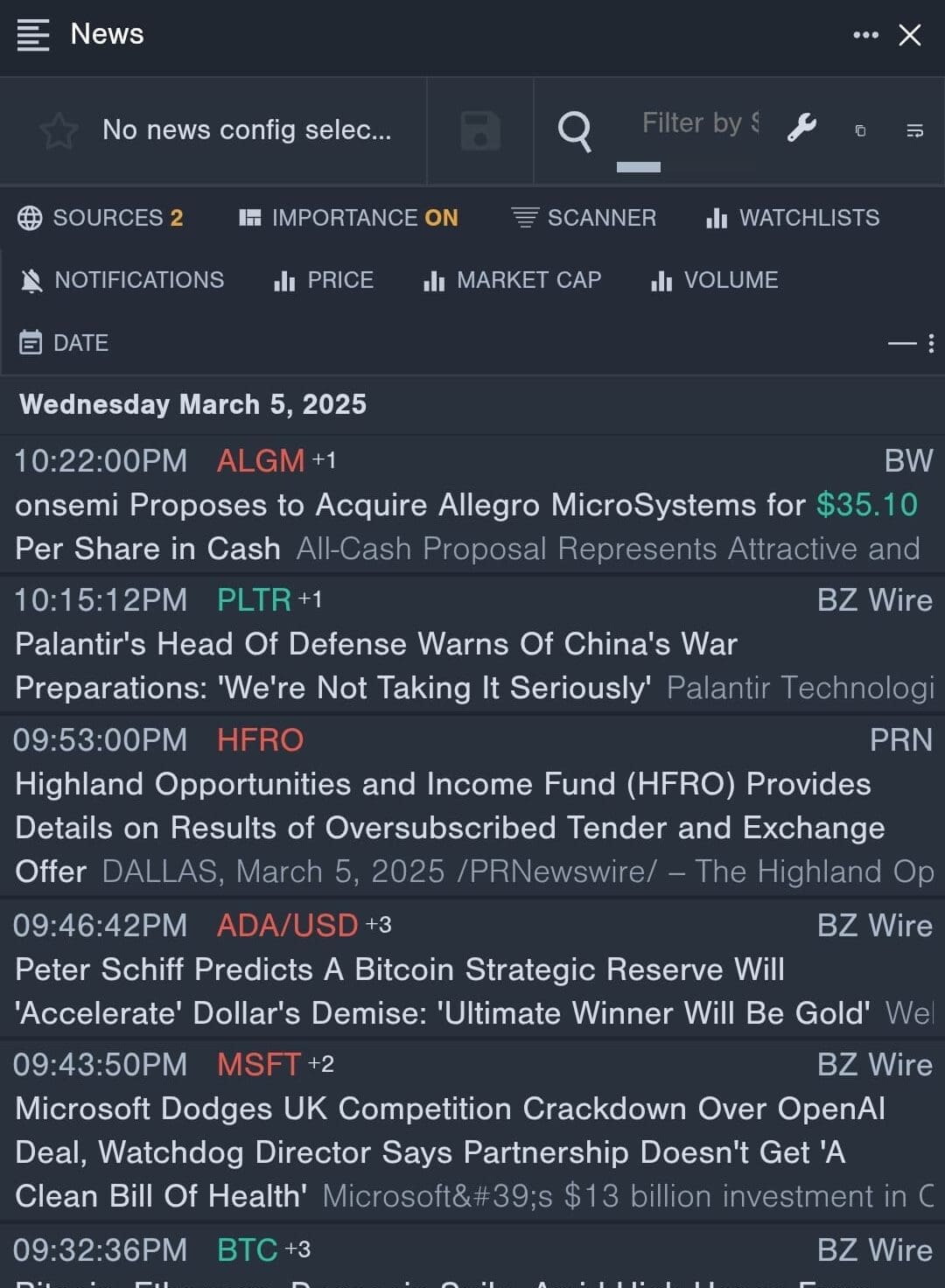

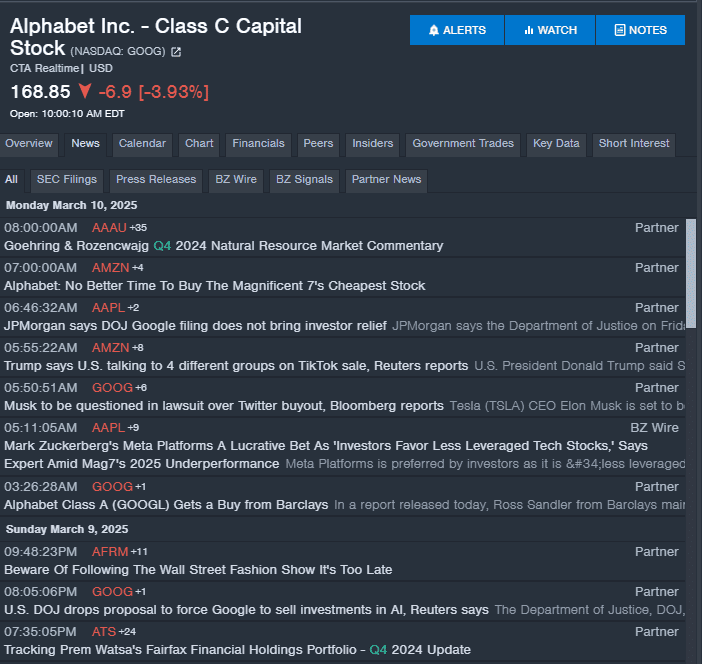

Full Newsfeed (No Advanced Filtering)

Benzinga’s market news coverage is already strong, but in the free plan, some premium content and real-time updates are restricted.

We tested the full newsfeed in Benzinga Pro Basic, and it delivers faster, more comprehensive market-moving headlines, covering everything from earnings reports to analyst ratings and economic data.

What Investors Can Do With It?

- Access all breaking financial news without restrictions.

- Stay ahead of the market with real-time stock news and analyst updates.

- Use news-driven stock analysis to find potential trading opportunities.

- Track earnings, SEC filings, and macroeconomic reports in one place.

However, this plan doesn’t include advanced filtering

-

Benzinga Premium Articles on Benzinga.com

One standout benefit of the Benzinga Pro Basic Plan is access to Benzinga Premium Articles, which provide expert insights, stock advisor recommendations, and in-depth market analysis.

Benzinga Pro’s Additional Features: What You Get?

We explored the extra tools in Benzinga Pro, including ETF data, IPO tracking, and charting, to see if they add value.

-

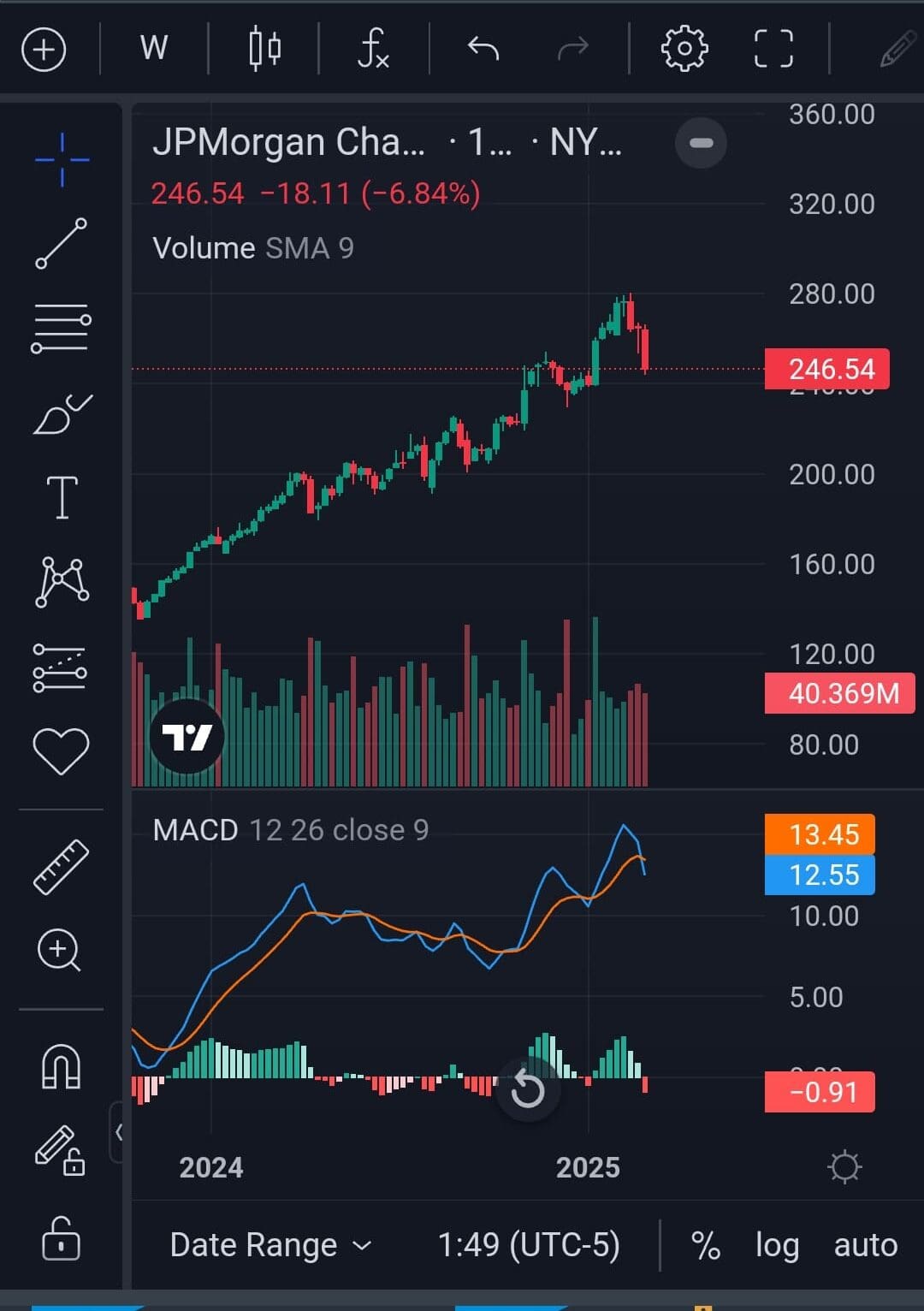

Stock Charts: Solid Technical Analysis Tools

Benzinga’s Stock Charts & Quotes provide investors with an intuitive way to track real-time stock prices and technical indicators.

These charts allow users to monitor price movements, trading volume, and historical trends, making it easier to analyze stocks before making investment decisions.

The free version includes several technical indicators, such as momentum, stochastic, gaps, and volatility, but each chart is limited to a maximum of two indicators at a time.

For traders who rely on multiple advanced indicators, upgrading to the Pro plan is necessary.

The interactive charts help users visualize stock performance across different time frames, making it easier to spot trend reversals, breakouts, and key support/resistance levels.

What Investors Can Do With It?

- Track real-time stock prices and market movements.

- Analyze short-term and long-term price trends with historical data.

- Use up to two technical indicators for stock analysis.

- Get a quick snapshot of stock performance before making trades.

-

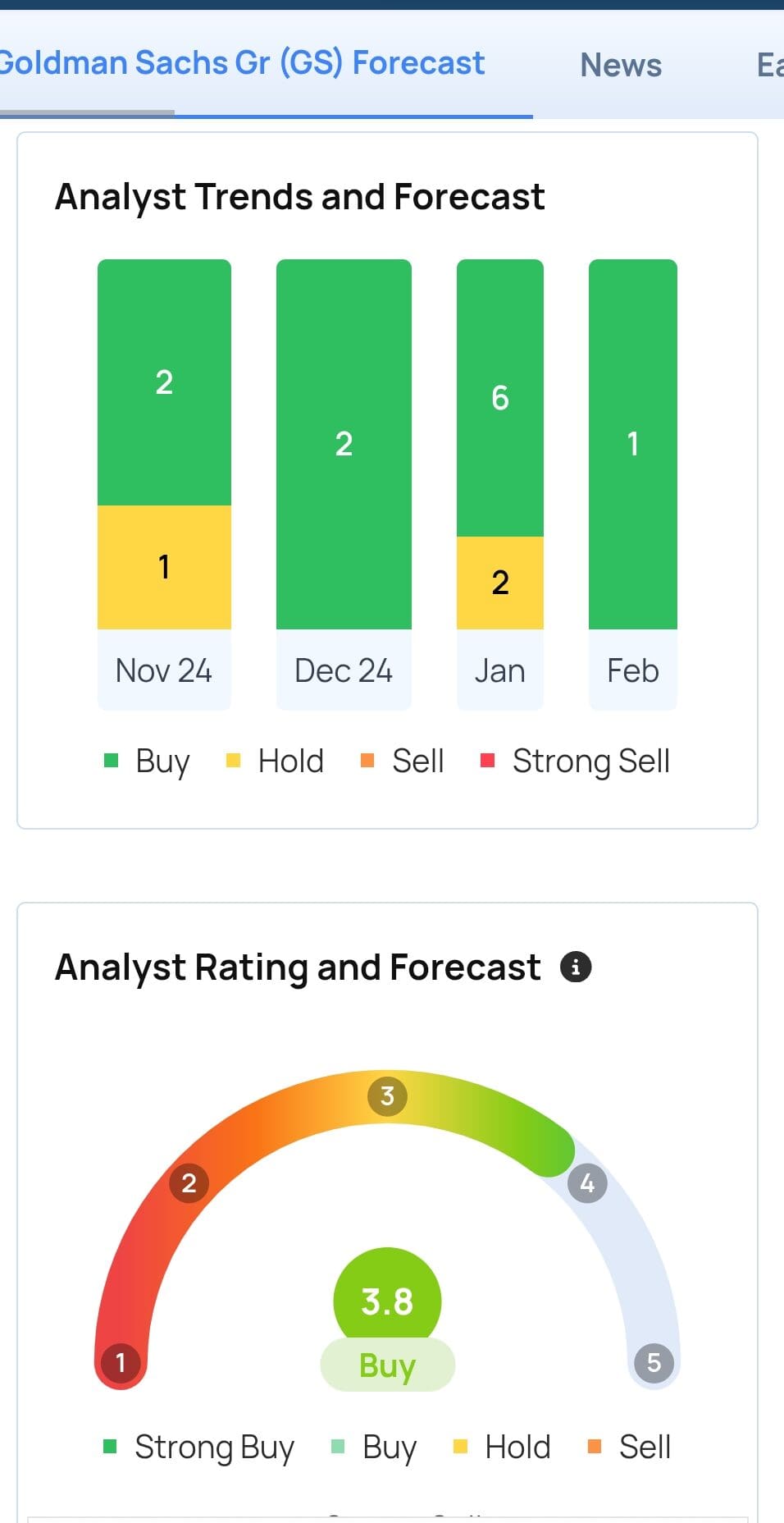

Key Financial For Multiple Stocks

Benzinga’s Stock Charts also integrate fundamental analysis tools, helping investors assess a company’s financial health and market outlook beyond just price action.

- Forecast & Guidance: Investors can review future earnings projections and company guidance to understand growth expectations.

- News & Earnings: The platform provides real-time earnings reports and stock news, allowing users to gauge how financial results impact market sentiment.

- Options & Short Interest: Traders can monitor options activity and short interest to determine market sentiment and potential volatility.

- Dividends: Dividend-focused investors can check dividend yields and payment history to assess income-generating stocks.

- Analyst Ratings: Investors can review Wall Street analyst ratings, including buy, sell, and hold recommendations. However, we couldn't find it on the dedicated pro app – only in the website:

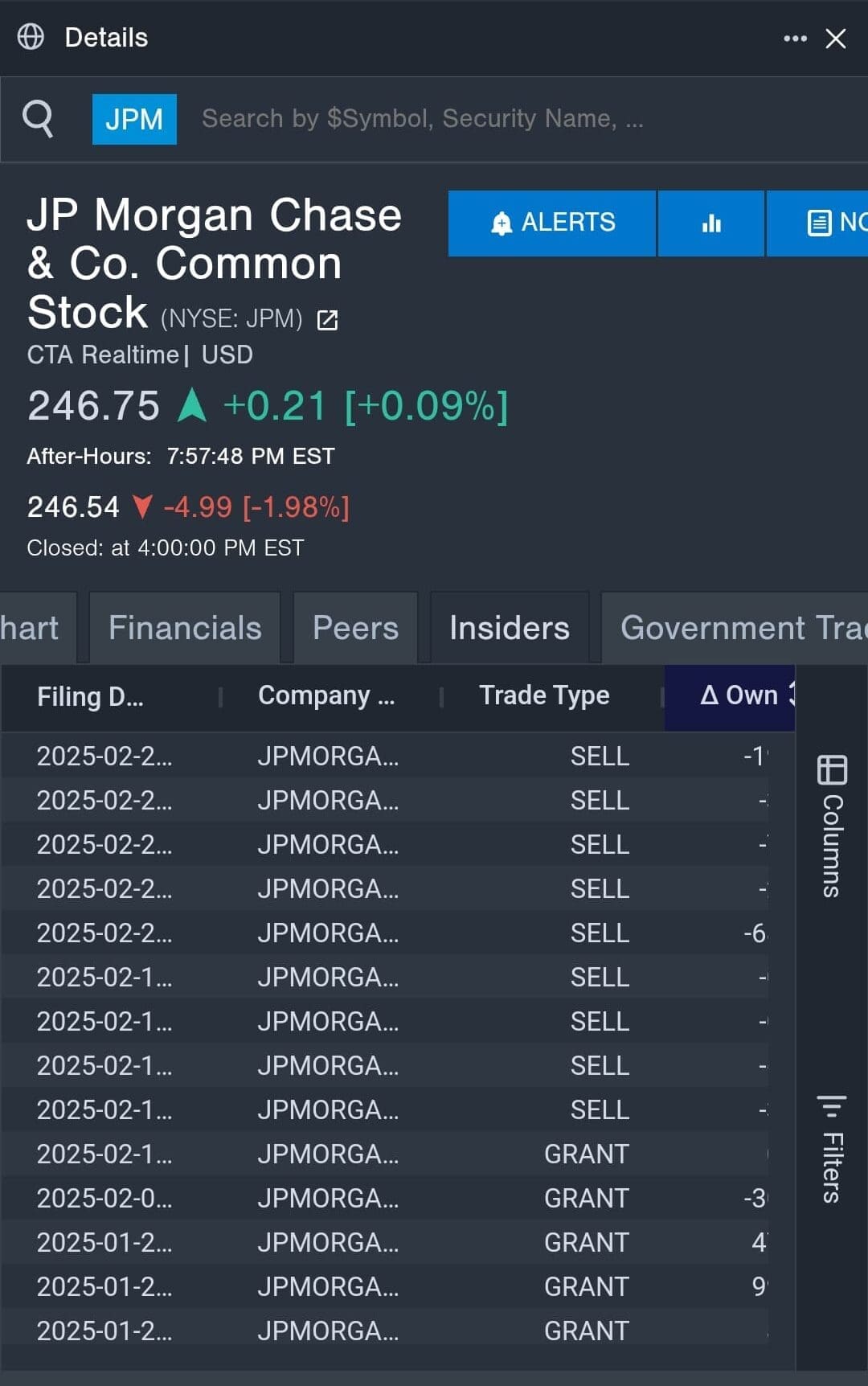

- Insider & Government Trades: Users can track executive and government transactions, which may indicate confidence or caution from key stakeholders.

-

Economic Calendar & Key Events

The economic calendar helps investors follow major financial events like interest rate decisions, inflation reports, and GDP data. While free users get basic access, Pro Basic users receive faster updates and deeper analysis.

What Investors Can Do With It?

- Track macro events that impact the stock market.

- Prepare for market reactions to inflation, GDP, and interest rate news.

- Use economic data for fundamental analysis.

-

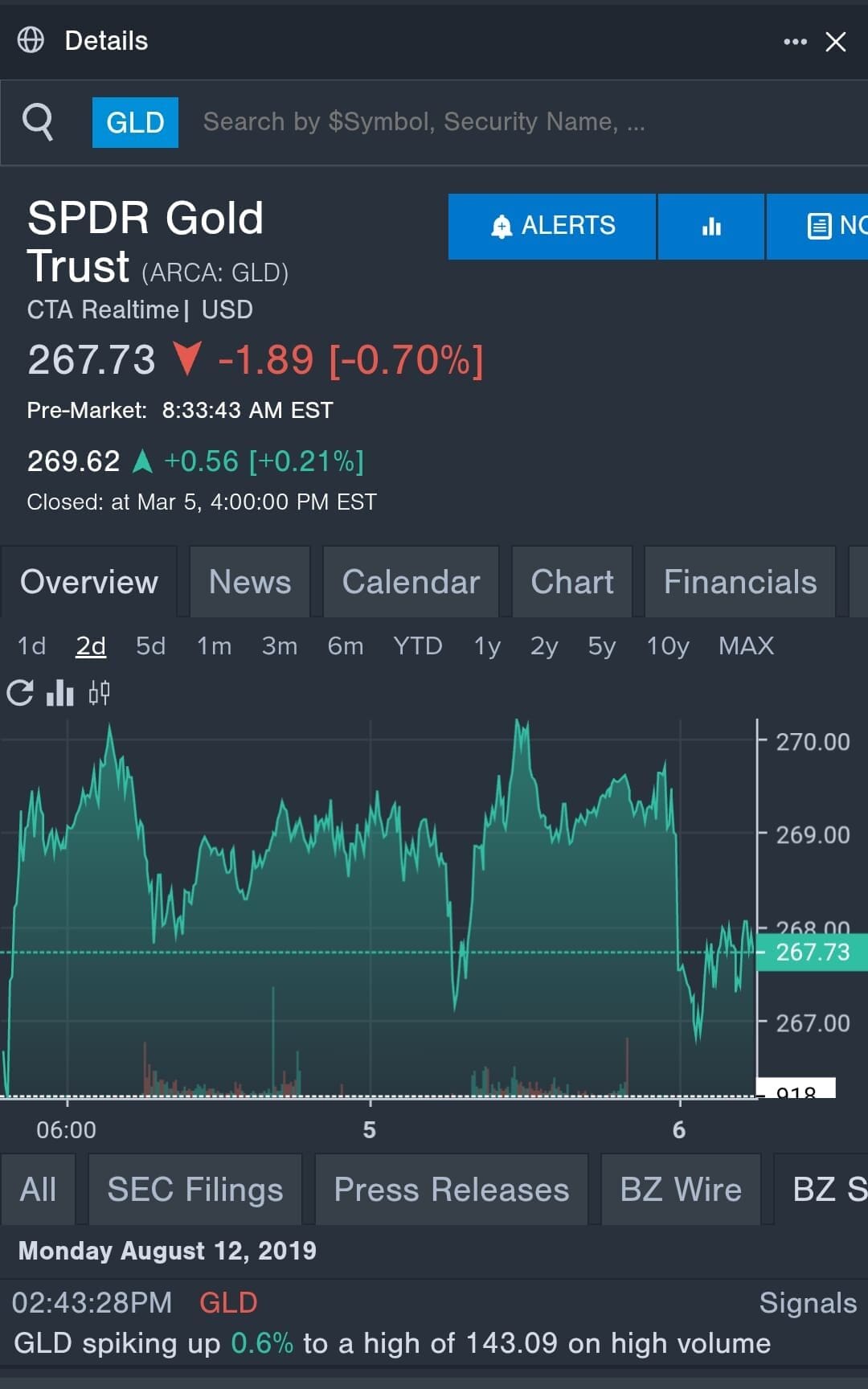

ETF Data & Performance Tracking

Benzinga offers ETF tracking tools, helping investors monitor fund performance, sector trends, and holdings.

While free users get access to basic ETF data, Pro Basic users benefit from more timely updates and additional research insights.

What Investors Can Do With It?

- Track ETF performance across different sectors.

- Research ETF holdings, expense ratios, and trends.

- Compare ETFs to find long-term investment opportunities.

Additional Features & Tools

Benzinga’s Pro Basic plan offers more than just market new. Here are some additional tools available in the free plan:

Crypto Market Data: Benzinga provides real-time cryptocurrency price tracking for Bitcoin, Ethereum, and other altcoins. Users can monitor price movements, market trends, and news related to digital assets.

Stock Movers & Most Active Stocks: This tool highlights stocks with the largest gains, losses, and unusual volume activity. It helps traders identify momentum plays and potential breakout opportunities.

Dividends & Earnings Calendar: The free plan provides upcoming earnings reports and dividend payouts for publicly traded companies. This helps investors plan around key financial events that may impact stock prices.

Insider Trading Activity: Users can view limited recent insider buying and selling activity, which may indicate confidence or caution from company executives.

- ETF Data & Trends: Benzinga provides information on exchange-traded funds (ETFs), including performance trends and holdings. This is helpful for investors looking to diversify their portfolios.

IPO Calendar: This tool tracks upcoming IPOs, recent debuts, and performance data for newly listed companies. It helps investors stay informed about new opportunities in the stock market.

Limitations: Why Benzinga Pro Isn’t For Everyone

While the Benzinga Pro Basic Plan is a step up from the free version, it still has several limitations:

-

No Advanced Stock Screener

Benzinga Pro Basic does not include an advanced stock screener, which is essential for filtering stocks based on fundamental metrics, technical indicators, or valuation models.

Unlike Finviz, Trade Ideas, or Zacks, which offer powerful screening capabilities, Benzinga’s lack of a customizable screener makes it harder for investors to find stocks that match their specific strategies.

Without this tool, traders must rely on manual searches or external platforms to identify trading opportunities.

-

No Stock Recommendations or Proprietary Rankings

Unlike stock picks platforms such as Morningstar, Zacks, or Seeking Alpha, Benzinga Pro Basic doesn’t provide stock recommendations or proprietary ranking systems.

Investors looking for expert-curated lists of top growth, value, or dividend stocks will have to rely on external sources.

Without this feature, traders must manually research stocks, making the platform less useful for long-term investors or those seeking guided recommendations.

-

No Integration with Premium Research Providers

Benzinga Pro does not integrate premium third-party data sources like Morningstar, Argus, or S&P Capital IQ, which provide detailed fundamental research, financial reports, and institutional-grade analysis.

Without these integrations, investors must switch between multiple platforms to access in-depth financial data, making stock analysis more time-consuming.

What Type Of Investor Benefits From It?

Here’s who may find Benzinga Pro Basic most useful:

News-Driven Investors: Investors who base their decisions on earnings reports, analyst upgrades, and breaking financial news will benefit from the full newsfeed and real-time updates.

Active Traders & Momentum Traders: Those who need fast market news, real-time stock quotes, and stock movers data to capitalize on price fluctuations.

Long-Term Investors: While it lacks deep fundamental tools, it still offers analyst ratings, insider trades, and earnings data that can help with long-term investment decisions.

Investors Who Follow Analyst Ratings: Those who use expert recommendations, stock ratings, and price target changes as part of their investment strategy.

Some Traders May Skip Benzinga Pro

Benzinga Pro Basic is a great tool for real-time news and stock updates, but it’s not the best choice for everyone. Some investors and traders may find it lacking in advanced research tools, stock recommendations, and deep analysis features. Here’s who might want to consider other platforms:

Traders Who Need Advanced Technical Charting: While it offers stock charts, the platform lacks advanced indicators, multi-timeframe analysis, and backtesting tools, making it less useful for technical traders.

Investors Looking for Stock Recommendations: There are no buy/sell stock recommendations or proprietary ratings, unlike platforms like Morningstar or The Motley Fool.

Options Traders & Derivatives Investors: It lacks real-time options flow, unusual activity tracking, and options strategy screeners, which are essential for options traders.

Investors Who Want Portfolio Tracking: There’s no detailed portfolio management or performance tracking, meaning users must rely on other platforms for portfolio analysis.

Benzinga Pro Basic Compared to Competitors

Benzinga Pro Basic competes with MarketBeat All Access, StockTwits Edge, InvestingPro, and Seeking Alpha Premium; there is no significant difference in pricing. However, while they look pretty similar, each has its proficiency.

Plan | Subscription | Promotion |

|---|---|---|

Yahoo Finance Silver | $24.95

$239.40 ($19.95 / month) if paid annually | N/A |

TradingView Plus | $29.95

$180 ($14.95 / month) if paid annually

| 30-day free trial |

Zacks Premium | $249 ($20.75/month)

No monthly plan | 30-day free trial |

MarketBeat All Access | $39.99

$399 ($33.25 / month) if paid annually | $199/year or $19.99/month

30-day free trial + $19.99/month for the first year (billed monthly) OR $199/year ($16.58/month). New members only. |

InvestingPro | $15.99

$120 ($9.99 / month)

if paid annually | N/A |

TipRanks Premium | $359 ($30 / month)

No monthly plan | 30 day money-back guarantee |

Finviz Elite | $39.50

$299.5 ($24.96 / month) if paid annually | 30-day money-back guarantee |

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | $4.95 for 1 month |

For example, Seeking Alpha Premium and InvestingPro offer deep fundamental analysis, stock ratings, and valuation tools, while Benzinga focuses more on news-driven trading and real-time market alerts.

FAQ

Yes, Benzinga Pro recently added direct brokerage integration, meaning you can connect it and important your portfolio, but you can't trade.

No, the platform does not include AI-driven trade signals or automated analysis, unlike competitors such as TrendSpider or Trade Ideas.

No, Benzinga Pro Basic only includes Nasdaq Basic real-time quotes. If you need Level 2 market depth, you’ll have to upgrade to use another trading platform.

No, there is no advanced stock screener. You’ll need to use third-party tools for fundamental and technical stock screening or upgrade to the Benzinga Pro Essential plan.

No, the Basic plan does not allow users to export stock data, news reports, or analytics, which limits its use for deeper research.

It provides some insider trading data, but there are no real-time alerts for insider transactions like other platforms offer.

Review Premium Stock Analysis Tools

How We Rated Premium Investing Analysis & Research Tools

At The Smart Investor, we evaluated premium investment research platforms based on their advanced features, data depth, and overall value compared to other paid alternatives. Each platform was rated based on the following key aspects:

- Advanced Fundamental Analysis Tools (20%): We assessed the depth of financial data, historical reports, earnings forecasts, and valuation models. Platforms that provided institutional-grade insights, DCF analysis, customizable financial models, and access to premium analyst reports scored higher.

- Advanced Technical Analysis Features (20%): We reviewed the availability of real-time charting, advanced indicators, custom scripting, and AI-driven pattern recognition. Platforms that offered backtesting tools, automated trading strategies, and integration with third-party software received better ratings.

- Stock Screener & Premium Filters (15%): A high-quality screener is essential for pro investors, so we evaluated customization depth, real-time filtering, and AI-driven stock discovery. Platforms offering pre-built expert screeners, backtesting capabilities, and sector-specific analytics scored the highest.

- Portfolio Tracking & Advanced Alerts (10%): We rated platforms on their ability to provide real-time performance tracking, portfolio rebalancing tools, and tax optimization insights. Platforms with smart alerts, AI-driven risk assessments, and brokerage integration ranked higher.

- Ease of Use & Customization (15%): We assessed how well premium platforms balance advanced capabilities with user-friendly interfaces. Those offering custom dashboards, API access, and seamless multi-device usability received better ratings.

- Pricing (20%): We considered how the plan's pricing compared to other premium plans and what benefits traders/investors get. Is it worth it overall?