InvestingPro

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Pros & Cons

InvestingPro’s Pro plan is built for investors and traders who want solid stock research tools without unnecessary complexity.

With a focus on fundamental analysis, InvestingPro provides access to 1,000+ financial metrics in the Pro plan, along with AI-powered stock picks, company health scores, and peer comparison tools.

For traders, the real-time market data and stock screener allow you to filter stocks based on valuation, profitability, and growth potential. Additionally, ProTips deliver quick, actionable insights on stocks, making it easy to assess a company without digging through complex reports.

However, the plan has some limitations. It lacks analyst ratings seen on platforms like TipRanks, and the technical analysis tools are limited, making it less suitable for active traders. Additionally, there is no free trial, so users must commit without testing it first.

- Advanced Stock Screener

- AI-Powered Stock Picks

- Customizable Metric Views

- Real-Time Market Data

- Customizable Stock Charts

- Stock Comparison Tool

- Company Health Scores

- Sector Ranking System

- ProTips Instant Insights

- Stock Alerts & Watchlists

- Premium Market News

- Fair Value Gap Analysis

- Comprehensive fundamental analysis

- AI-powered stock picks

- Real-time market data

- Advanced stock screener

- Company health scores

- No free trial available

- Lacks analyst ratings

- Limited technical analysis tools

- Higher cost for full access

- Not ideal for day traders

InvestingPro Pricing: Between The Free and Pro+ plans

InvestingPro sits between the Free and Pro+ plans, offering more advanced stock research at a reasonable price.

While the Free plan provides basic market data and limited stock insights, InvestingPro unlocks essential features like fair value estimates, AI ProPicks, and 100+ fundamental metrics.

Plan | Monthly Subscription |

|---|---|

InvestingPro | $15.99

$120 ($9.99 / month)

if paid annually |

InvestingPro+ | $39.99

$300 ($24.99 / month) if paid annually |

How To Research Stocks With InvestingPro?

InvestingPro provides a powerful suite of stock research tools that can help investors and traders make smarter, data-driven decisions:

-

InvestingPro Advanced Stock Screener

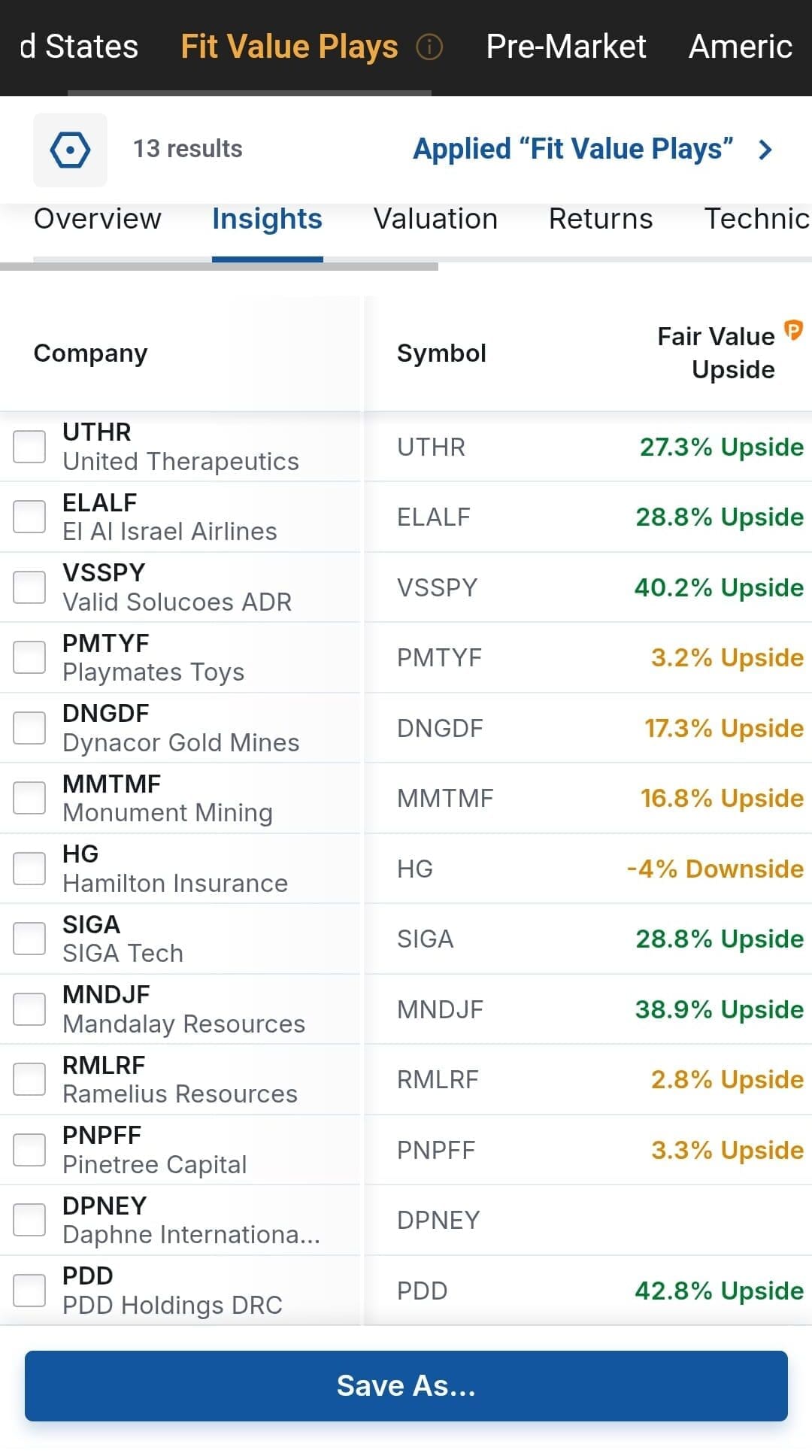

A good stock screener can save hours of research, and InvestingPro delivers one of the best we’ve used.

It lets you filter stocks based on 1,000+ metrics, including revenue growth, financial ratios, profitability indicators, and valuation measures.

We used it to find stocks with strong fundamentals and high upside potential, and it worked like a charm. You can filter stocks by sector, country, valuation metrics, and more, making it easy to find exactly what you’re looking for.

-

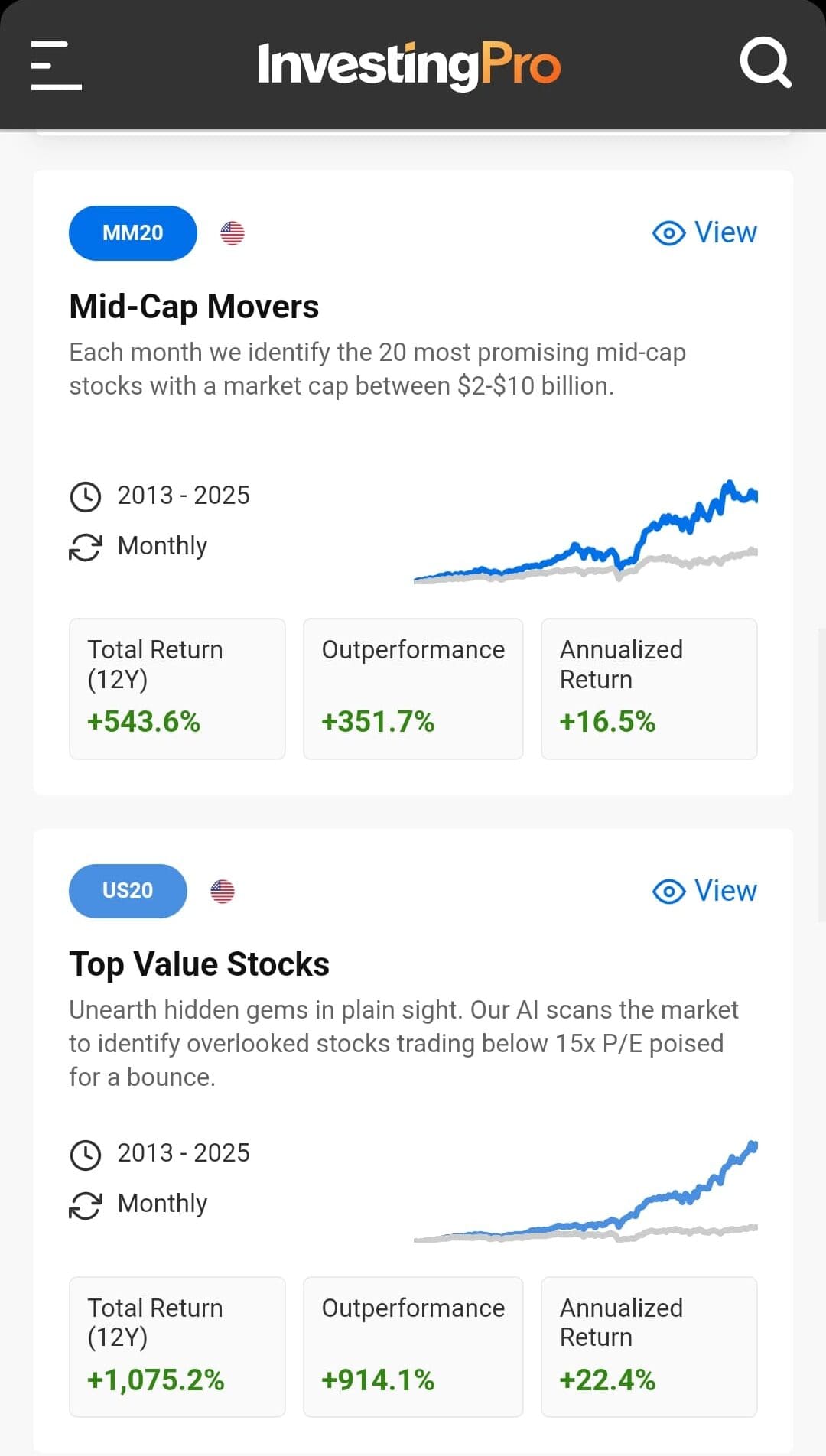

AI ProPicks – Smarter Stock Picks with AI

One of the standout features we tested was AI ProPicks, InvestingPro’s AI-powered stock advisor. The AI scans the market, analyzes patterns, and selects stocks with the potential to outperform the S&P 500.

We used it to find stocks across different sectors, and the picks often aligned with well-researched investment strategies.

For investors, this means you can get stock ideas without manually sifting through endless charts and financial reports.

It’s like having a smart stock advisor in your pocket, giving you ideas based on proven strategies.

For traders, AI ProPicks helps you quickly spot trending opportunities and potential breakouts. Whether you're swing trading or holding long-term, this feature speeds up stock selection so you can focus on execution.

If you’re short on time but want high-quality stock ideas, AI ProPicks is a nice options

-

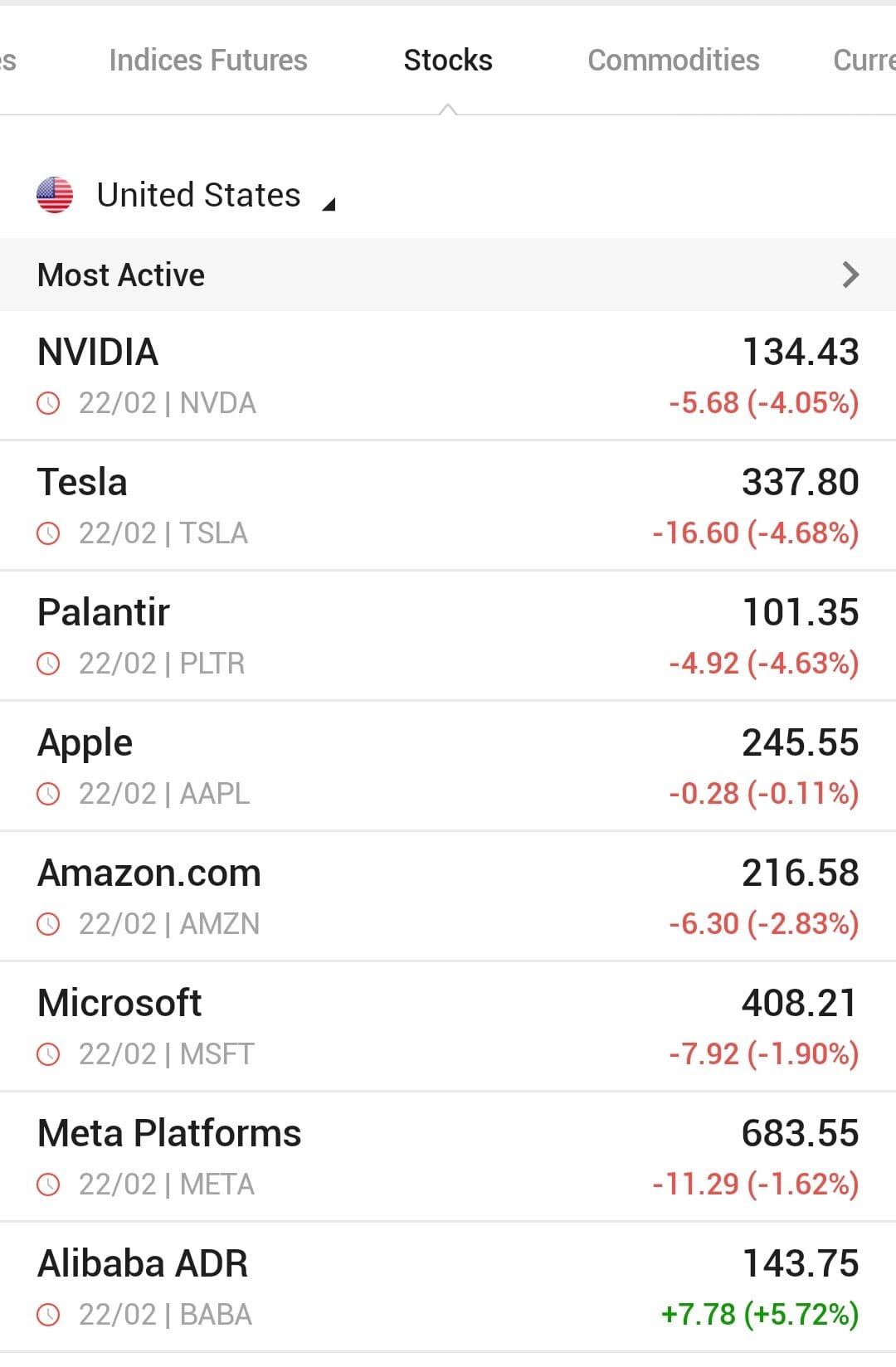

Real-Time Market Data

One of the biggest advantages of InvestingPro is the real-time market data.

Unlike the free plan, which provides real-time market data for specific indices, the Pro plan lets you get instant updates on stock prices, trading volume, and market movements.

The stock analyst data (available also with the free plan) adds another layer of insight for those who see stock ratings.

You can search for a stock and find analyst price targets, earnings estimates, and recent stock ratings, helping you gauge market sentiment and expert expectations.

InvestingPro+ vs. Competitors: Is It Worth the Price?

InvestingPro is competitively priced compared to similar stock research platforms.

It is more affordable than most other Premium while still providing detailed fair value estimates, sector rankings, and AI-powered stock picks.

Plan | Subscription | Promotion |

|---|---|---|

Yahoo Finance Silver | $24.95

$239.40 ($19.95 / month) if paid annually | N/A |

TradingView Plus | $29.95

$180 ($14.95 / month) if paid annually

| 30-day free trial |

Zacks Premium | $249 ($20.75/month)

No monthly plan | 30-day free trial |

MarketBeat All Access | $39.99

$399 ($33.25 / month) if paid annually | $199/year or $19.99/month

30-day free trial + $19.99/month for the first year (billed monthly) OR $199/year ($16.58/month). New members only. |

InvestingPro | $15.99

$120 ($9.99 / month)

if paid annually | N/A |

TipRanks Premium | $359 ($30 / month)

No monthly plan | 30 day money-back guarantee |

Finviz Elite | $39.50

$299.5 ($24.96 / month) if paid annually | 30-day money-back guarantee |

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | $4.95 for 1 month |

However, some competitors, like Zacks Premium , offer Wall Street analyst ratings, which InvestingPro lacks.

For investors who prioritize affordability and fundamental analysis, InvestingPro is one of the best-value options on the market

How To Analyze Stocks With InvestingPro?

Stock analysis is crucial, and with the InvestignPro plan it's much easier to analyze many assets. Here are the main features:

-

Customizable Stock Charts For Technical Analysis

A great stock chart tells a story, and InvestingPro’s charts are fully customizable. We tested them for tracking trends, price action, and technical indicators.

You can adjust everything—timeframes, indicators, and overlays—to match your strategy.

For investors, these charts help spot long-term trends and cycles, making it easier to plan entry and exit points. If you're into technical analysis, you’ll love how detailed and easy to customize these charts are.

Traders can use them to identify breakout patterns, support and resistance levels, and trend reversals. The ability to set alerts on price movements is also a huge plus.

-

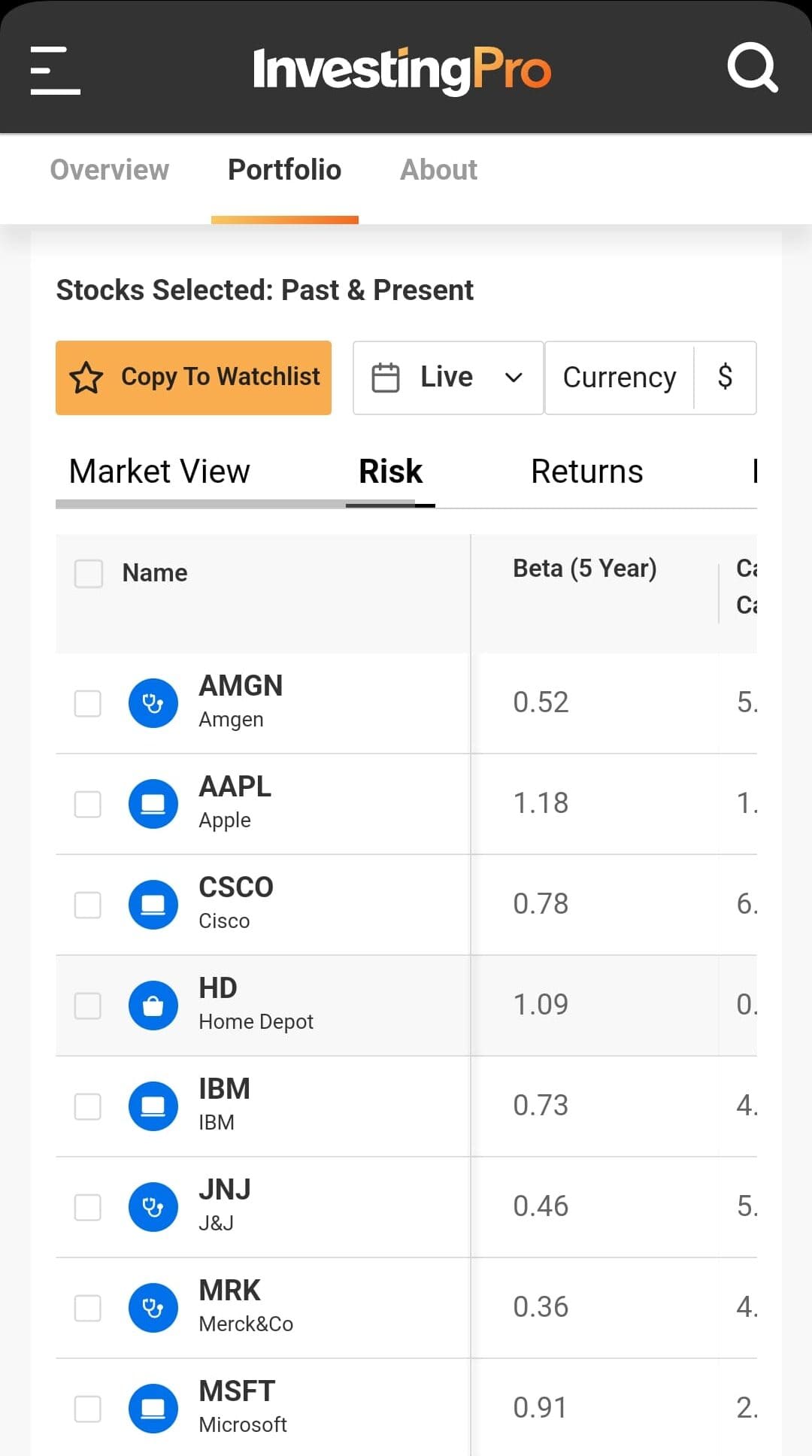

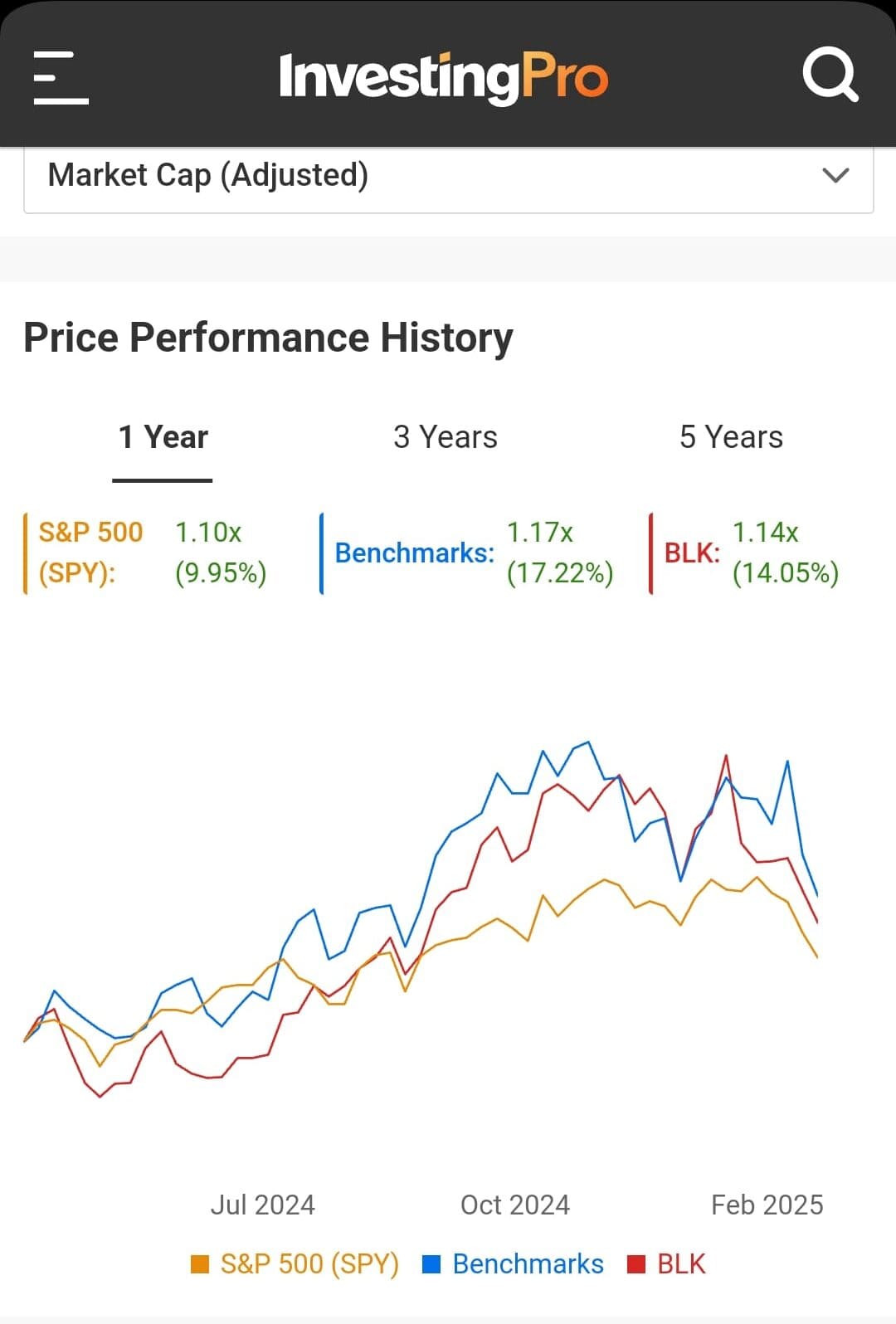

InvestingPro Stock Comparison Tool

One of the most useful features we tested was the Company Peer Comparison tool, which lets you compare a stock to its closest competitors.

You can also compare against benchmarks and s&p 500:

-

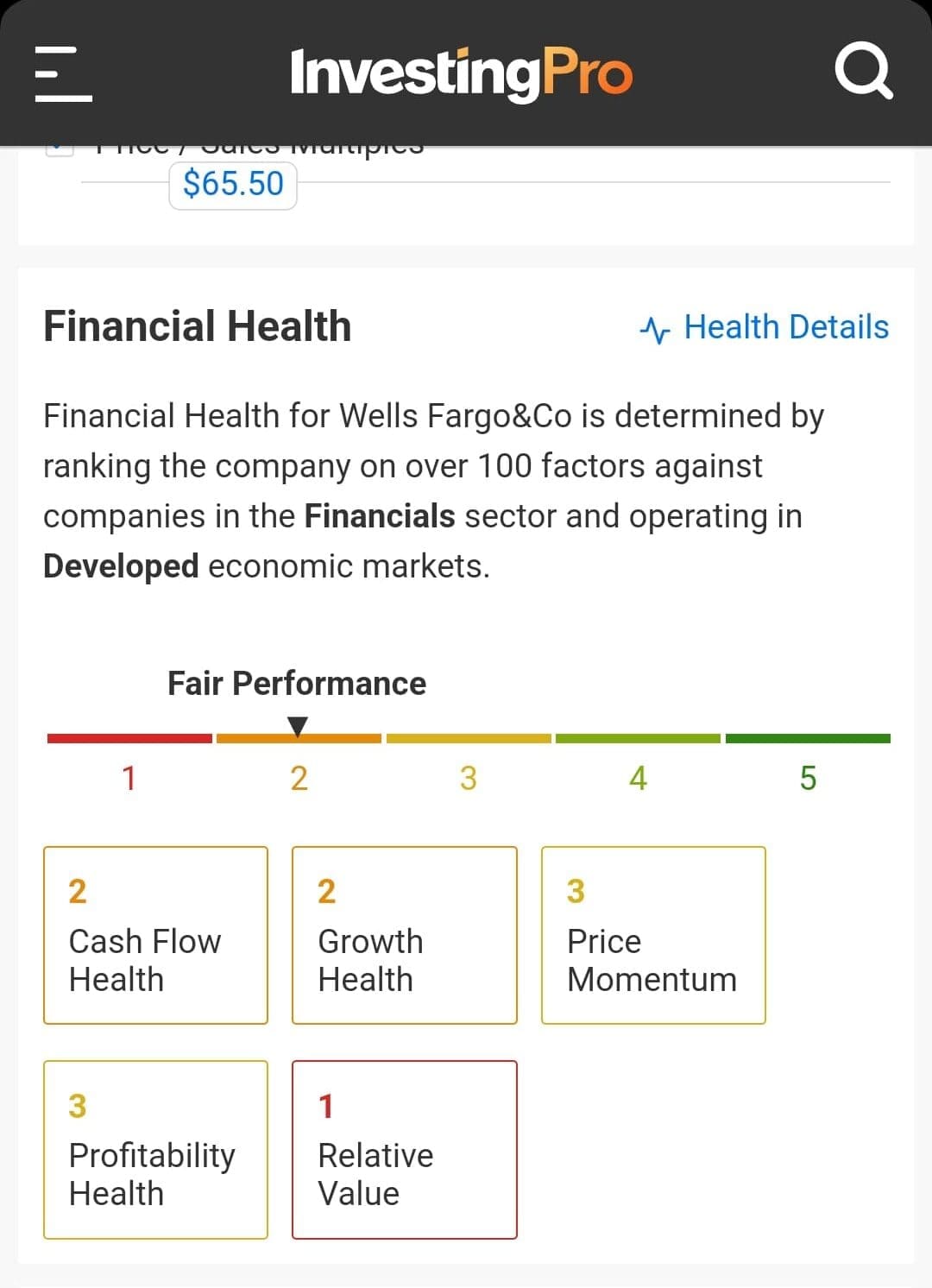

Company Health Scores & Sector Ranking

InvestingPro’s Company Health Scores and Sector Ranking provide a quick and reliable way to assess a company’s overall financial strength.

This feature evaluates a stock based on key financial metrics such as profitability, growth, valuation, and financial stability, assigning it a score from 1 to 5.

A higher score indicates a healthier company with strong fundamentals, while a lower score may signal financial weaknesses or risks.

The Sector Ranking feature allows investors to compare a stock against its industry peers.

-

ProTips Stock Insights – Instant Analysis on Any Stock

ProTips is a powerful time-saving tool within InvestingPro that delivers quick, digestible insights on stocks.

Instead of spending hours analyzing financial data, ProTips simplifies complex company information into clear, actionable observations.

Each ProTip is classified as either bullish or bearish, making it easy to identify growth opportunities or potential risks at a glance.

ProTips go beyond basic financials by incorporating peer comparisons, industry benchmarks, and market trends, ensuring insights remain relevant and dynamic.

Additional Features & Tools

InvestingPro goes beyond standard stock research by offering powerful tools that help investors and traders make smarter, faster, and more informed decisions:

- Stock Alerts & Watchlists: With custom stock alerts and watchlists, InvestingPro lets you track price movements, fair value changes, and breaking news for stocks you follow. Alerts help you stay on top of market shifts without constant monitoring.

- Premium Market News: InvestingPro provides exclusive market news, earnings reports, and economic updates without distractions. It filters out irrelevant news, focusing only on high-impact events that move the markets.

- Fair Value Gap Analysis: This feature helps investors identify gaps between a stock’s market price and its intrinsic value. Investors can find long-term undervalued stocks before the market catches on.

Limitations

While InvestingPro is packed with great features, it’s not perfect. There are a few areas where it could improve, especially when compared to top competitors in stock research and analysis.

Here are some key limitations that investors and traders should be aware of before subscribing:

-

No Stock Ratings from Analysts

One major drawback is the lack of stock ratings from Wall Street analysts.

Platforms like Zacks Premium, TipRanks (premium), and MarketBeat All Access provide buy, hold, or sell ratings from professional analysts, making it easier for investors to gauge sentiment.

With InvestingPro, you can search for recent analyst ratings of a specific stock, but it's more like news on ratings changes than full analyst ratings.

-

Technical Analysis Tools Can Be Better

InvestingPro is heavily focused on fundamentals, which is great for long-term investors but less ideal for active traders.

Unlike TradingView or ThinkorSwim, it lacks advanced technical indicators, real-time charting tools, and customizable signals.

If you like a deep technical analysis with various indicators and tools, you may find InvestingPro’s charting tools too basic for in-depth technical analysis.

-

No Free Trial & Higher Cost for Full Access

Unlike some competitors, InvestingPro doesn’t offer a free trial, making it harder for potential users to test its features before committing.

Additionally, for the most advanced options, you'll need the Pro+ plan.

Which Investors/Traders May Be a Good Fit?

InvestingPro is best suited for investors and traders who rely on fundamental data and stock valuation insights. Here’s who will benefit the most from its features:

- Long-Term Investors: If you prefer buy-and-hold strategies, InvestingPro helps you find undervalued stocks using fair value estimates and deep financial data.

- Value Investors: Those who focus on finding strong companies trading below their fair value will appreciate the financial modeling tools and historical fundamentals.

- Dividend Investors: With dividend growth tracking and payout analysis, income investors can easily find reliable, high-yield stocks.

- Fundamental Analysts: If you prefer digging into financials, balance sheets, and valuation metrics, InvestingPro provides over 1,000+ data points.

Which Investors/Traders May Not Be a Good Fit?

While InvestingPro is great for fundamental analysis, it lacks some key features that certain investors and traders rely on. Here’s who may not find it the best fit:

- Day Traders & Scalpers: If you rely on real-time charts, order flow data, and fast execution signals, InvestingPro lacks the advanced technical analysis tools found in platforms like TradingView or ThinkorSwim.

- Technical Analysts: Those who depend on candlestick patterns, moving averages, RSI, MACD, or advanced charting tools may find InvestingPro’s technical indicators too basic.

- Options & Forex Traders: InvestingPro is focused on stocks and doesn’t provide the in-depth options flow or forex market tools that traders on Tastyworks or Forex.com might need.

- Investors Who Want Analyst Ratings: Unlike TipRanks or Zacks, InvestingPro doesn’t provide Wall Street buy/sell ratings, making it harder to gauge analyst sentiment.

FAQ

Forecasts are sourced from reputable financial data vendors and trading exchanges.

InvestingPro supports a wide range of global exchanges, covering over 120,000 companies across more than 50 markets.

Data on InvestingPro is updated in real-time or near real-time, depending on the specific data type and source.

Yes, users can access dividend data, including yield, history, and upcoming payment dates.

Review Premium Stock Analysis Tools

How We Rated Premium Investing Analysis & Research Tools

At The Smart Investor, we evaluated premium investment research platforms based on their advanced features, data depth, and overall value compared to other paid alternatives. Each platform was rated based on the following key aspects:

- Advanced Fundamental Analysis Tools (20%): We assessed the depth of financial data, historical reports, earnings forecasts, and valuation models. Platforms that provided institutional-grade insights, DCF analysis, customizable financial models, and access to premium analyst reports scored higher.

- Advanced Technical Analysis Features (20%): We reviewed the availability of real-time charting, advanced indicators, custom scripting, and AI-driven pattern recognition. Platforms that offered backtesting tools, automated trading strategies, and integration with third-party software received better ratings.

- Stock Screener & Premium Filters (15%): A high-quality screener is essential for pro investors, so we evaluated customization depth, real-time filtering, and AI-driven stock discovery. Platforms offering pre-built expert screeners, backtesting capabilities, and sector-specific analytics scored the highest.

- Portfolio Tracking & Advanced Alerts (10%): We rated platforms on their ability to provide real-time performance tracking, portfolio rebalancing tools, and tax optimization insights. Platforms with smart alerts, AI-driven risk assessments, and brokerage integration ranked higher.

- Ease of Use & Customization (15%): We assessed how well premium platforms balance advanced capabilities with user-friendly interfaces. Those offering custom dashboards, API access, and seamless multi-device usability received better ratings.

- Pricing (20%): We considered how the plan's pricing compared to other premium plans and what benefits traders/investors get. Is it worth it overall?