Benzinga Essential Pro

Subscription/month

Promotion

Our Rating

Best For

- Overview

- Features

- Pros & Cons

The Benzinga Pro Essential Plan is a powerful trading platform designed for active traders and investors who need real-time stock market data, fast news updates, and advanced trading tools.

It builds on the Basic Plan, adding features like the Real-Time Scanner, Audio Squawk, advanced stock screener, stock trade signals and unusual options activity tracker.

The advanced stock screener allows for real-time filtering based on technical and fundamental metrics, while the stock signals help traders identify potential opportunities based on technical patterns, key market events, and market trends.

However, Benzinga Pro Essential has some limitations. It lacks stock ranking or recommendations, AI-powered trade features, and deep fundamental research reports.

- Real-Time Stock Screener

- Audio Squawk Live Updates

- Unusual Options Activity Tracker

- Stock Trade Signals & Alerts

- Advanced Economic Events Calendar

- Block Trade & Large Volume Scanner

- Level 2 Market Depth Data

- Insider Trading & SEC Filings

- Advanced News Filtering System

- Technical Analysis Charting Tools

- Stocks & ETFs Fundamental Data

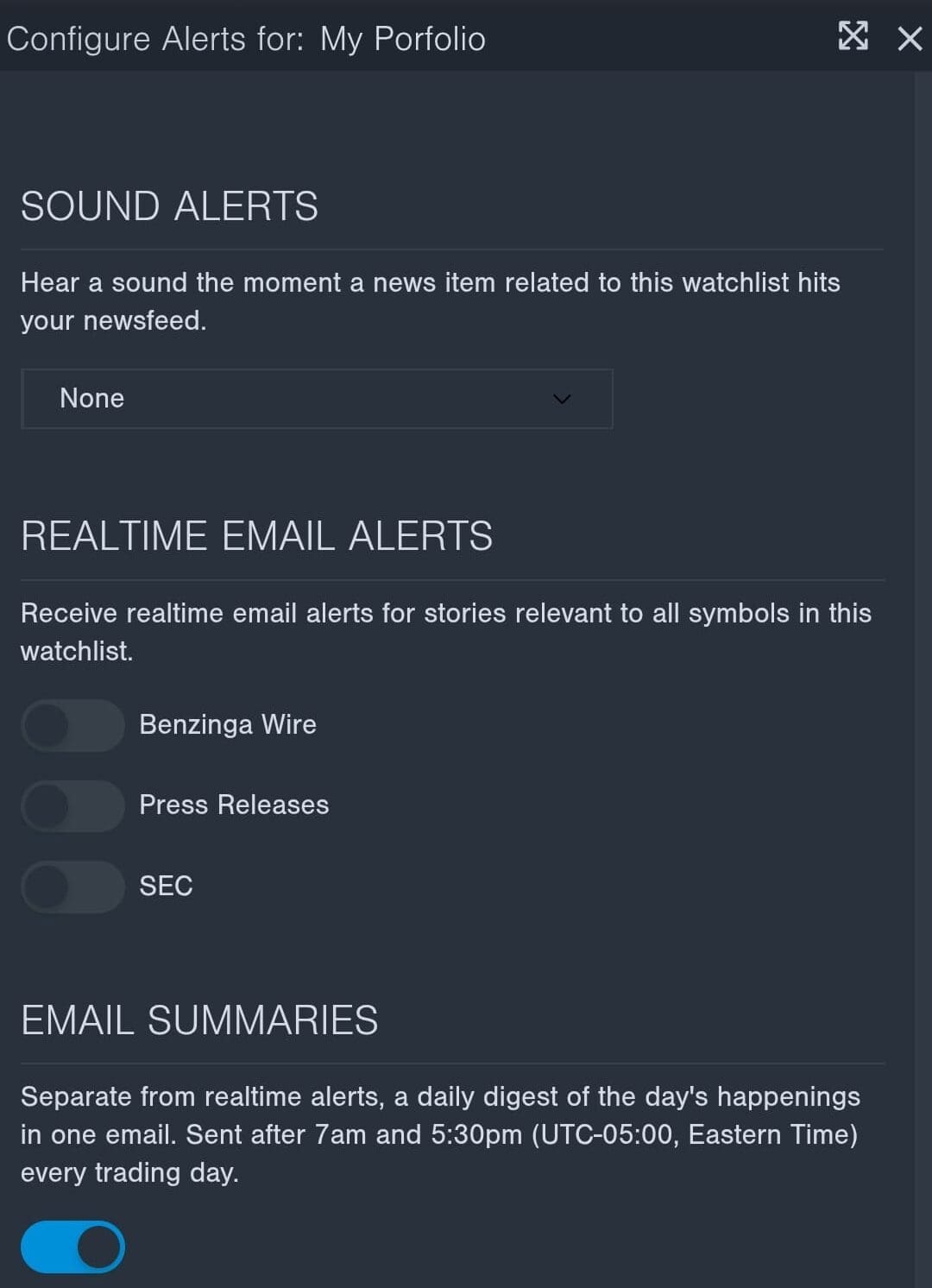

- Custom Alerts & Personalized Watchlists

- Real-time stock data updates

- Advanced stock screener tool

- Live market audio squawk

- Unusual options activity tracker

- Customizable alerts & watchlists

- No stock recommendations/rankings

- Lacks AI-driven trade analysis

- Limited portfolio tracking tools

- No long-term investment research

- Subscription-based, no free version

Benzinga Pro Essential Plan: Pricing And Comparison

The Benzinga Pro Essential Plan is the highest-tier plan beyond the Streamlined and Basic Plans, offering real-time news, an advanced stock screener, Audio Squawk, and the Real-Time Scanner.

Plan | Monthly Subscription | Promotion |

|---|---|---|

Benzinga Pro – Basic | $37

$367 ($30.58 / month) if paid annually | 14-day free trial |

Benzinga Pro – Streamlined | $147

$1,497 ($124.75 / month) if paid annually | 14-day free trial |

Benzinga Pro – Essential | $197

$1,997 ($166.42 / month) if paid annually | 14-day free trial |

Benzinga Edge | $19

$228 if paid annually

| $129

$129 for new member’s annual price ($11/month), including 7-day money-back guarantee

|

For traders who need fast market-moving insights, customizable alerts, and advanced screening tools, Essential is the most comprehensive self-directed trading plan.

How To Research Stocks With Benzinga Essential Pro?

We tested Benzinga Essential Pro’s stock screener, audio squawk, and signals to see what it offers for those ready to pay more than the average service. Here's what we found:

-

Stock Screener

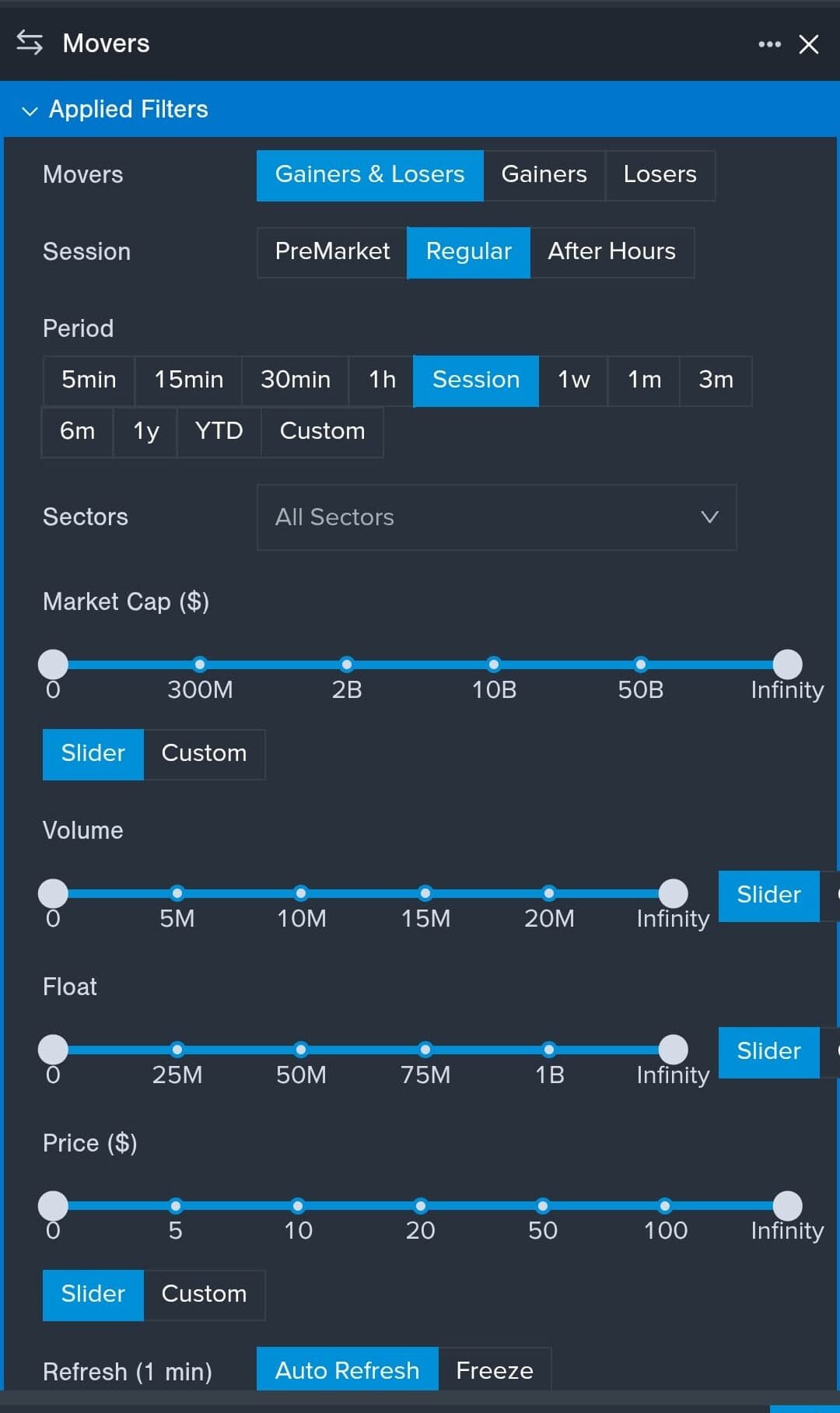

Benzinga Pro Essential comes with an advanced stock screener that offers real-time filtering, making it one of the most responsive screeners available.

Unlike free stock screeners that refresh every few minutes, this one updates stock movements instantly, which is crucial for day traders.

We tested the screener and found it to be a powerful tool for traders looking for stocks that meet specific technical or fundamental criteria.

Here we searched for high gainers in the financial sector:

The filtering options go beyond just price and volume, allowing users to screen stocks based on moving averages, RSI, gap percentages, and volatility metrics.

What Investors Can Do With It?

- Filter stocks based on real-time price, volume, and technical indicators.

- Customize pre-set and personalized screeners for momentum, breakouts, and fundamental strength.

- Track stocks across multiple sectors and timeframes.

- Get real-time updates on high-impact stock movements.

Benzinga’s screener updates continuously, providing instant insights into the fastest-moving stocks.

-

Audio Squawk - Live Market Updates Without Distractions

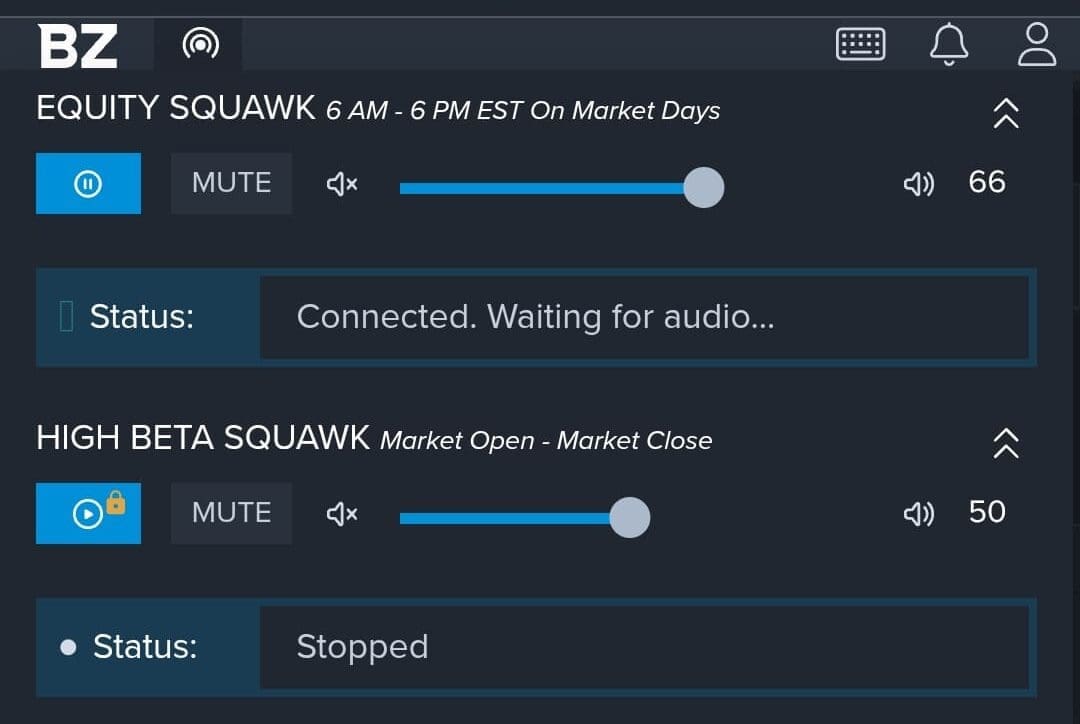

The Audio Squawk feature in Benzinga Pro Essential provides live, real-time audio updates on market-moving news, eliminating the need to constantly read through headlines.

We tested this feature and found it to be an invaluable tool for traders who need instant news without distractions.

What Investors Can Do With It?

- Get live updates on stock news, economic data, and major earnings reports.

- Hear breaking news as it happens, instead of relying on delayed headlines.

- Track options activity, large trades, and unusual market movements in real time.

- Free up screen space by listening instead of reading market updates.

Compared to other news services, Benzinga’s Audio Squawk is fast, reliable, and trader-focused, making it an ideal feature for active traders who don’t want to miss breaking news.

-

Signals - Catching Unusual Market Activity Instantly

Benzinga Pro Essential’s Signals feature provides real-time trading alerts based on price action, volume spikes, and other market-moving conditions.

We tested this tool and found it to be one of the most useful features for traders who rely on price momentum and breakout strategies.

What Investors Can Do With It?

- Receive instant alerts for price spikes, block trades, and volatility changes.

- Identify stocks breaking above resistance levels or hitting new highs/lows.

- Track unusual volume surges that indicate large institutional activity.

- Use signals to spot potential trade setups before the broader market reacts.

Compared to traditional stock alerts, Benzinga’s Signals feature is highly customizable and delivers actionable data in real time.

Traders who use momentum trading, breakout strategies, or volume-based indicators will find this tool particularly valuable for catching high-probability trade setups as they develop.

-

Advanced Calendar (Earnings, IPOs, Economic Events)

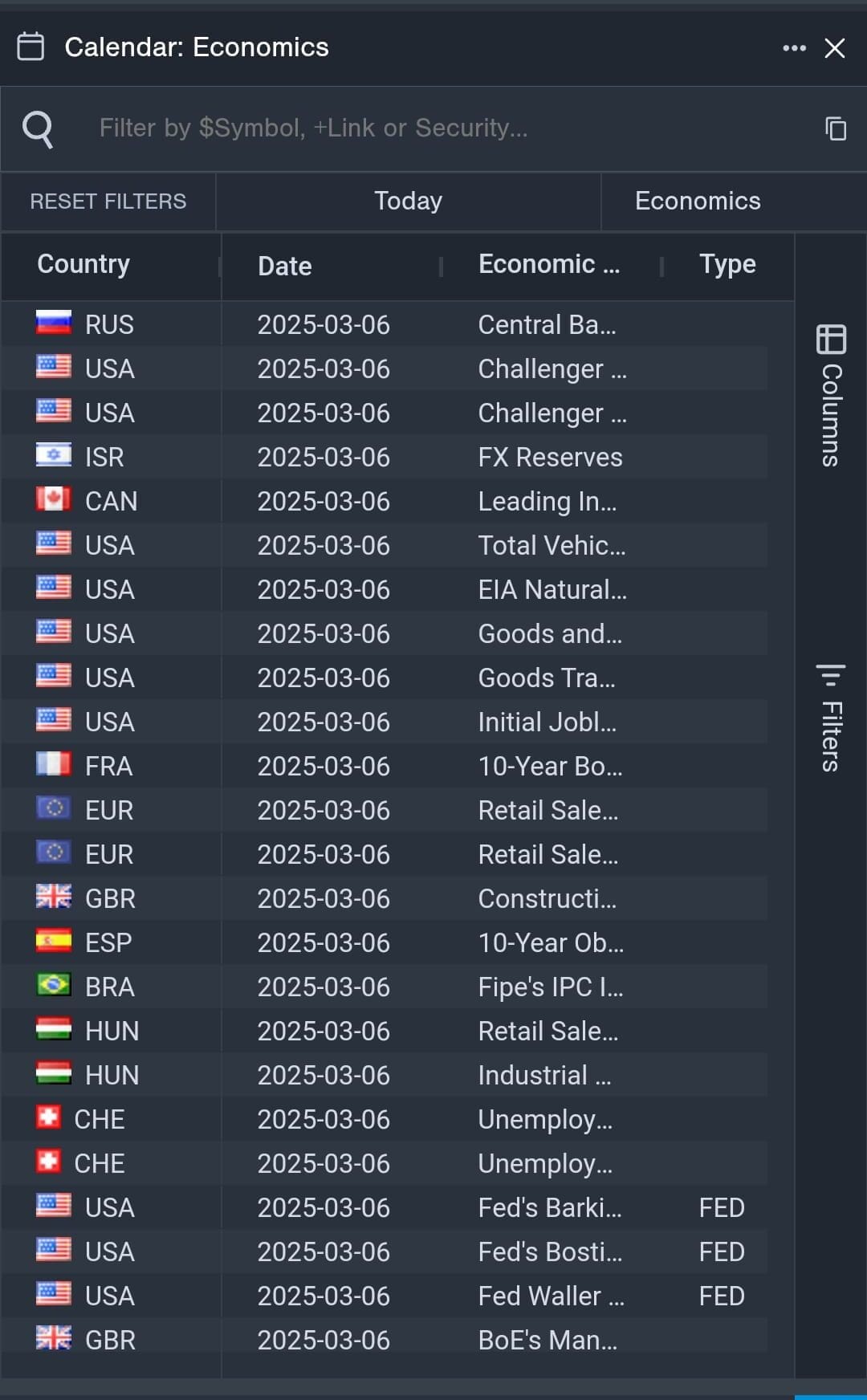

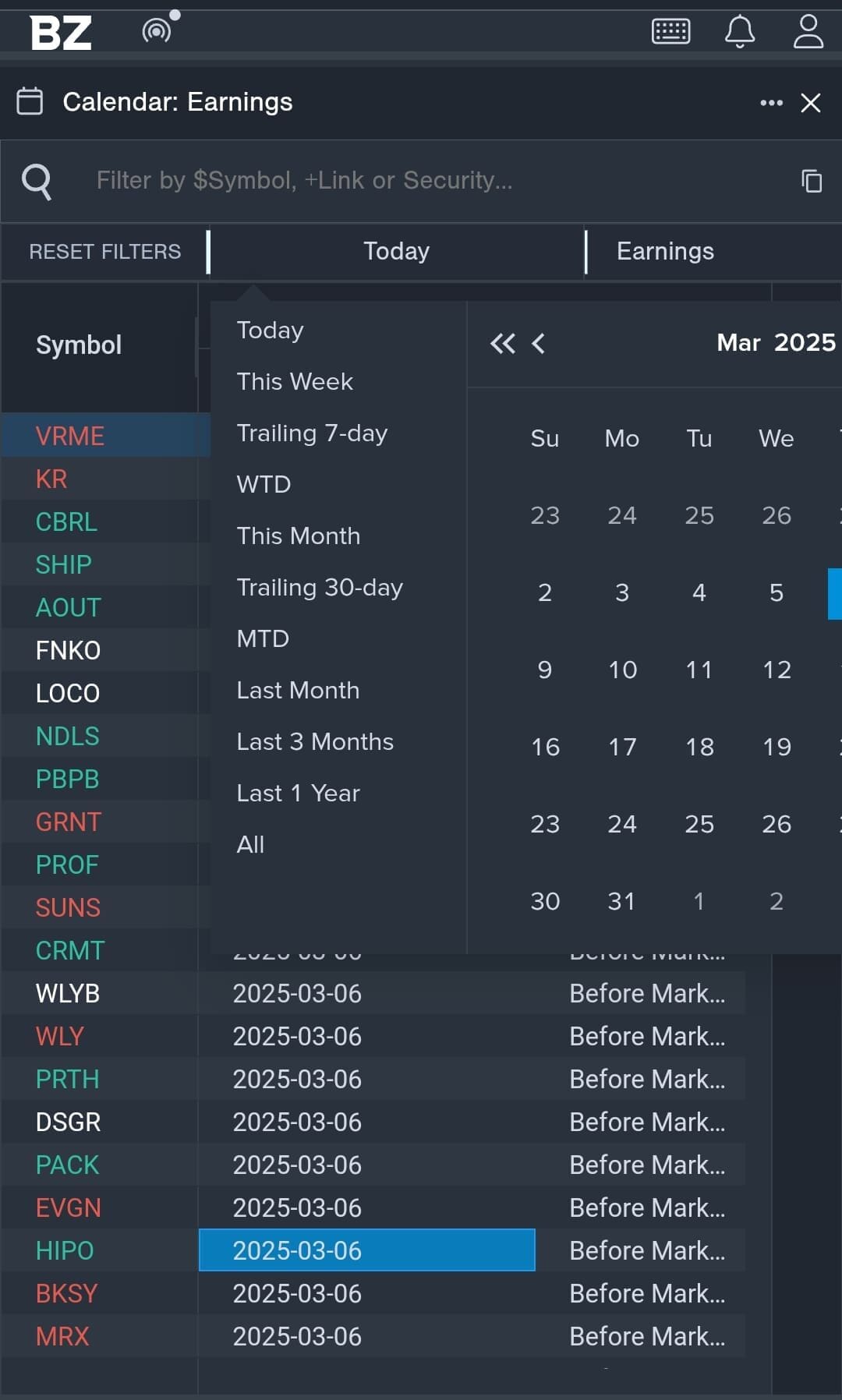

The Benzinga Pro Essential Plan includes an advanced calendar covering earnings reports, IPO listings, dividends, and economic events.

We tested this feature and found it to be an essential tool for traders and investors looking to time their trades around key market events:

What Investors Can Do With It?

- Track upcoming earnings reports, analyst expectations, and historical earnings data.

- Monitor new IPO listings and follow their market debuts.

- Stay updated on Federal Reserve meetings, inflation reports, and job data that affect the market.

- Use the calendar to plan trading strategies based on scheduled events.

Unlike free financial calendars, Benzinga Pro’s version updates in real time and provides extra context and ability to filters as you can see here:

Additional Features & Tools

The Benzinga Pro Essential Plan offers additional, unique tools for investors and traders :

- Unusual Options Activity Tracker: Provides real-time insights into large, unusual options trades to help traders spot where institutional investors are placing their bets. Tracks high-volume options flow, open interest spikes, and unusual contract purchases that may indicate upcoming stock movements.

- Block Trade & Large Volume Scanner: Identifies large institutional trades that happen outside of regular market activity. Helps traders track big money moves, detect accumulation or distribution patterns, and anticipate price action based on whale activity.

- Real-Time Market Depth (Level 2 Quotes): Offers real-time bid/ask order book data, allowing traders to see market depth and liquidity. This feature is crucial for scalpers and high-frequency traders who need to assess potential price movements.

- Customizable Real-Time Alerts & Watchlists: Allows users to set alerts for stock price movements, unusual volume, and breaking news, keeping traders informed without needing to constantly monitor the screen.

How To Analyze Stocks With Benzinga Essential Pro?

Benzinga Essential Pro also offers an insider trading tracker, sentiment analysis, and advanced charting for technical analysis. Here's how it work and what you can do with it:

-

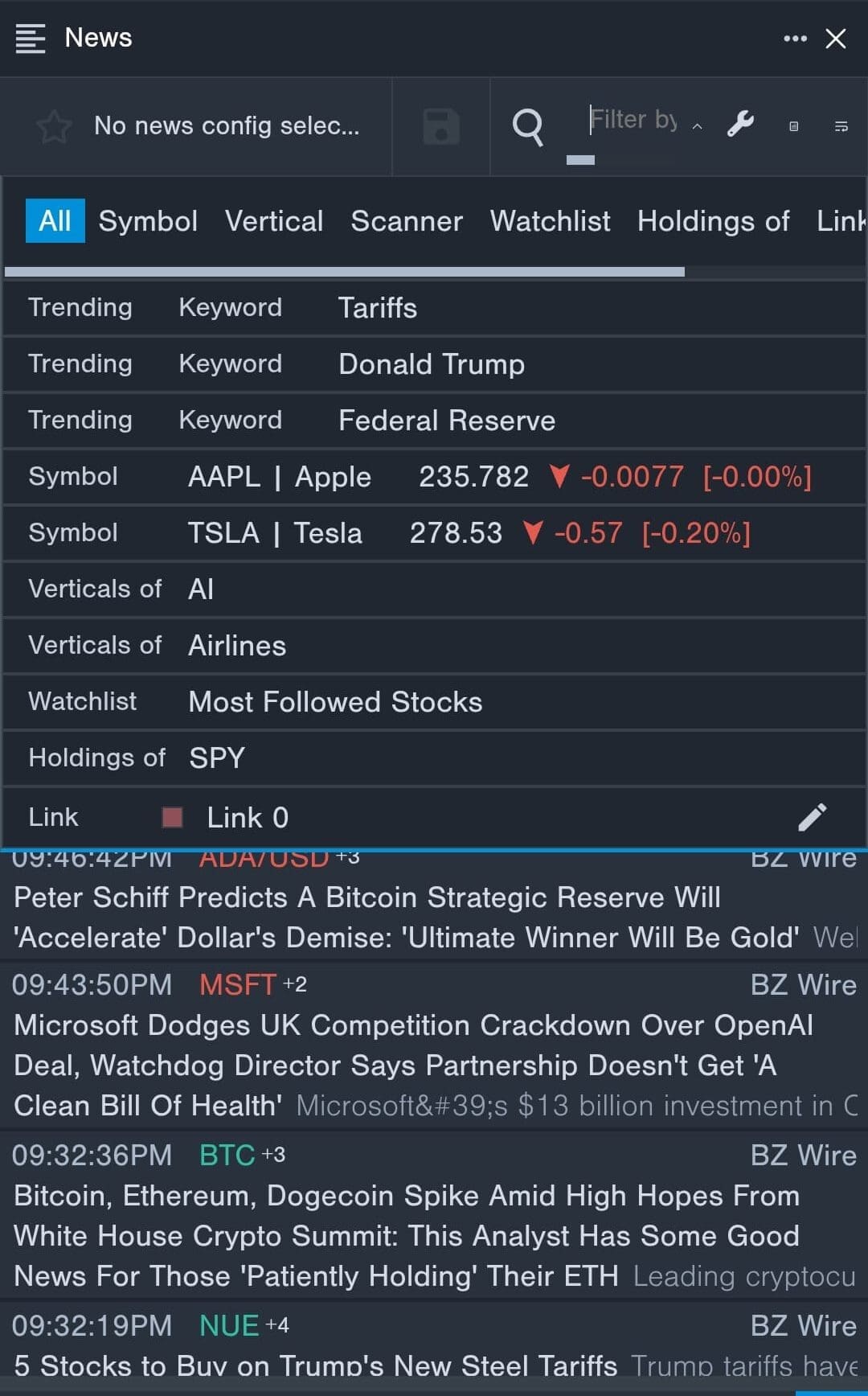

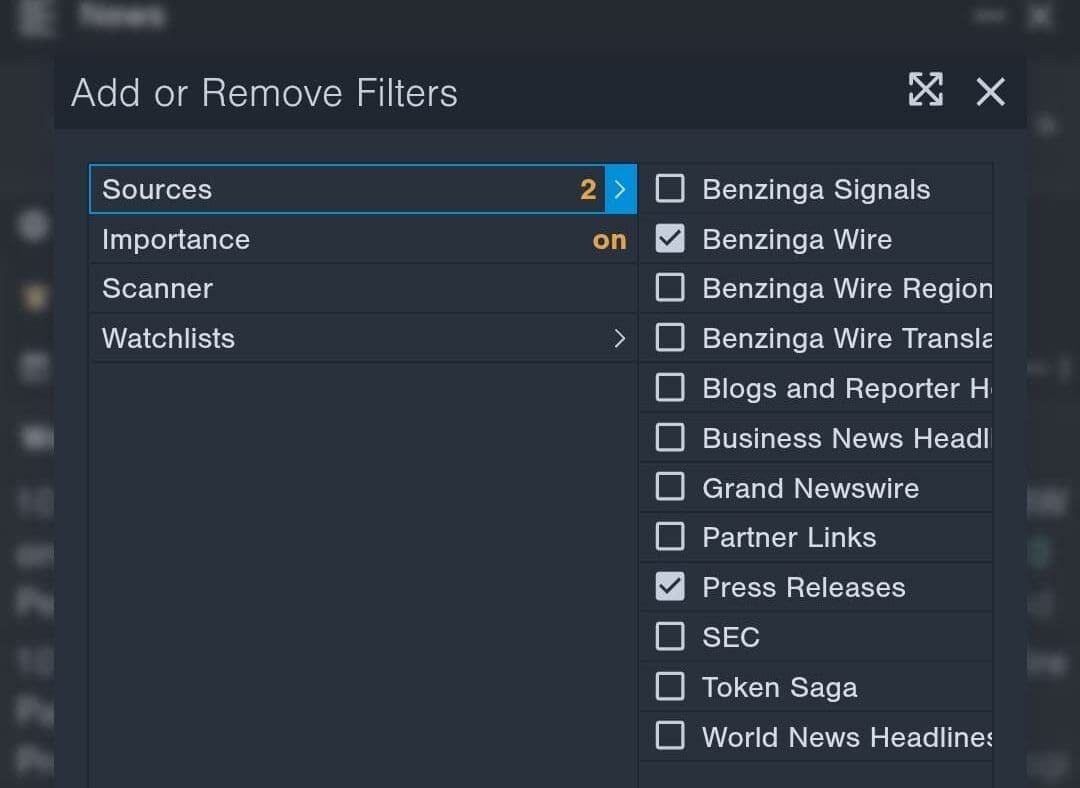

Advanced News Filtering & Sentiment Analysis

Benzinga Pro Essential enhances the standard newsfeed with advanced filtering and sentiment analysis, making it easier to find relevant news quickly.

Let's see the different filtering options:

We tested this feature and found that it cuts through market noise, helping traders focus only on the news that matters to their strategy.

What Investors Can Do With It?

- Filter stock news based on specific tickers, sectors, or keywords.

- Sort news by impact level, allowing traders to focus on the most significant headlines.

- View sentiment indicators that help gauge whether a news event is bullish or bearish.

- Quickly access breaking stock news without scrolling through unrelated updates.

-

Advanced Charting for Technical Analysis

Benzinga Pro Essential enhances technical analysis by offering using of up to 50 advanced charting features in the same chart, from hundreds of available indicators.

We tested the charting tools and found them fast, responsive, and customizable, allowing traders to analyze price action, trends, and momentum indicators in real time.

What Investors Can Do With It?

- Use advanced technical indicators like RSI, MACD, Bollinger Bands, and Fibonacci retracements.

- Customize multiple timeframes for intraday, daily, weekly, or long-term trend analysis.

- Identify chart patterns and key support/resistance levels to time entries and exits.

- Compare multiple stocks on the same chart for relative strength analysis.

Compared to free charting tools, Benzinga’s advanced charts provide greater flexibility with up to 50 inducators on a chart.

-

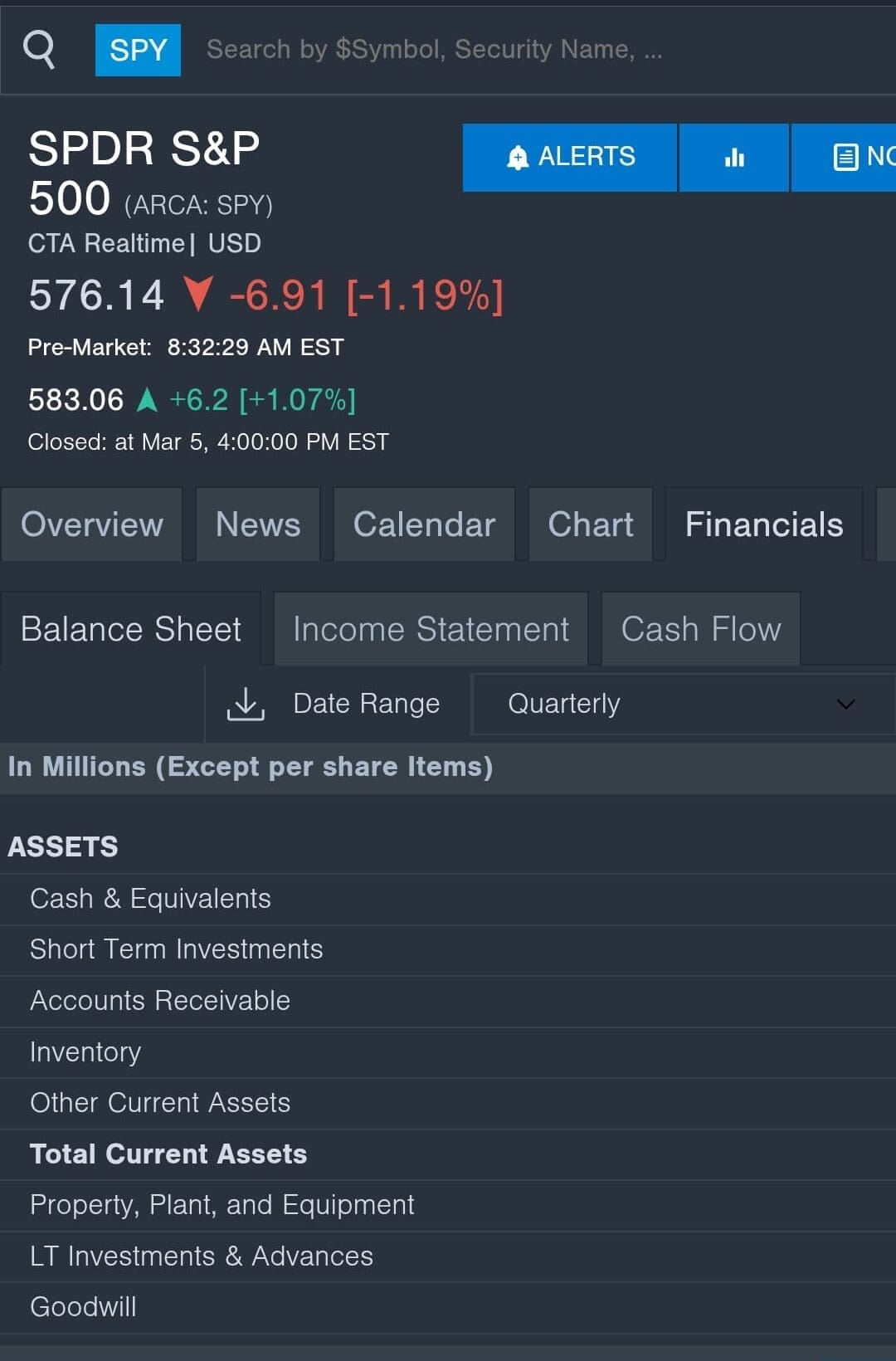

Stocks & ETF Key Financial Data

Benzinga Pro Essential provides detailed fundamental data for both stocks and ETFs, making it a valuable tool for investors who analyze company financials and fund performance.

We tested this feature and found it helpful for long-term investors, ETF traders, and fundamental analysts who need quick access to key financial metrics.

What Investors Can Do With It?

- Access real-time earnings reports, revenue, and profit margins for individual stocks.

- View ETF holdings, expense ratios, and fund performance to evaluate investment options.

- Track dividend history, payout yields, and valuation ratios for income-focused investing.

- Analyze short interest and institutional ownership trends for both stocks and ETFs.

- Compare P/E ratios, return on equity (ROE), and sector performance to assess long-term value.

-

Full Newsfeed (Including Advanced Filtering)

Benzinga’s market news coverage is already strong, but in the free and Basic plans, some filters are restricted.

We tested the full newsfeed in Benzinga Pro Essential, and it delivers even faster with a bunch of premium filters:

The real-time filtering options allow traders to customize news based on tickers, sectors, or impact level, making it a valuable tool for those who need instant updates without unnecessary noise.

Additional Features & Tools

While they are not unique to the essential plan, here are a couple of interesting features that also exist for lower-tier plans:

- Market News & Analysis: Provides real-time stock market news, analyst ratings, and company updates to help investors stay informed on market-moving events.

- Stock Movers & Most Active Stocks: Highlights stocks with significant price changes, high trading volume, and pre-market or after-hours movement, helping traders find momentum plays.

Limitations: Key Downsides to Consider

While Benzinga Pro Essential is a powerful platform, it still has some gaps. Here are some areas where it could improve:

-

No In-Depth Stock Ratings or Proprietary Rankings

Benzinga Pro Essential provides real-time analyst ratings, but it does not offer proprietary stock rankings or in-depth buy/sell recommendations like Zacks or Morningstar.

Investors looking for a clear investment thesis, risk analysis, or long-term stock ratings will need to supplement Benzinga with another research platform.

-

Limited Portfolio Tracking & Performance Analytics

While Benzinga Pro offers custom watchlists and alerts, it does not provide full portfolio tracking, performance analysis or recommendations like Yahoo Finance Premium or Empower.

There’s no way to track historical performance, portfolio diversification, get actions for rebalance your portfolio or understand risk-adjusted returns.

-

No Stock Advisor or Buy/Sell Recommendations

Unlike stock recommendation platforms such as The Motley Fool, Morningstar, or Zacks, Benzinga Pro does not provide stock advisor services, model portfolios, or buy/sell recommendations.

Without a proprietary ranking system or stock scoring model, investors have to rely entirely on their own research and analysis rather than expert-backed investment strategies.

Who Is a Good Fit?

Benzinga Pro Essential is designed for active traders and investors who need real-time market data, stock screening, and fast news updates to make quick decisions.

Here’s who may find Benzinga Pro Basic most useful:

- Stock Day Traders & Momentum Traders: Those who need real-time stock quotes, unusual volume alerts, and breaking news to react quickly to market movements.

- News-Driven Traders: Those who rely on breaking headlines, analyst upgrades/downgrades, and SEC filings to make informed trading decisions.

- Technical Analysts & Chart Traders: Traders who use advanced stock charts, technical indicators, and price action strategies to identify trade setups.

- Event-Driven Traders: Those who capitalize on earnings reports, economic events, IPOs, and mergers will benefit from Benzinga’s earnings calendar and real-time alerts.

Who May Not Be a Good Fit?

While Benzinga Pro Essential is packed with real-time data and trading tools, it may not be the best fit for every type of investor:

- Long-Term & Value Investors: Investors who focus on buy-and-hold strategies, deep fundamental analysis, and dividend investing may find Benzinga lacks stock recommendation and long-term valuation and analysis tools.

- Beginners & Passive Investors: Those who prefer hands-off investing, robo-advisors, or simple brokerage tools might find Benzinga’s features too complex and trader-focused.

- Investors Looking for Stock Recommendations: Unlike Morningstar, Zacks, or The Motley Fool, Benzinga doesn’t provide buy/sell recommendations or model portfolios.

- Investors Who Need Full Portfolio Tracking: There’s no integrated portfolio management or performance tracking, meaning long-term investors must use other tools for risk assessment and allocation analysis.

Benzinga Pro Essential Compared to Competitors

Benzinga Pro Essential competes with Zacks Ultimate, Motley Fool Epic, Yahoo Finance Gold, and Seeking Alpha Pro.

Unlike Zacks Ultimate and Motley Fool Epic, which focus on stock picks, long-term research, and portfolio strategies, Benzinga Pro Essential is built for real-time market reaction and fast trade execution.

Plan | Subscription | Promotion |

|---|---|---|

Motley Fool Epic | $499 (41.60 / month)

No monthly plan

| 30-day money-back guarantee |

TradingView Premium | $59.95

$432 ($23.98 / month) if paid annually | 30-day free trial |

Zacks Ultimate | $299

$2,995 ($249.5 / month) if paid annually | 30-day free trial |

InvestingPro+ | $39.99

$300 ($24.99 / month) if paid annually | N/A |

Seeking Alpha PRO | $2,400 ($200 / month)

No monthly subscription | $99 for 1 month |

TipRanks Ultimate | $599 ($50 / month)

No monthly plan | 30 day money-back guarantee |

Yahoo Finance Gold | $49.95

$479.40 ($39.95 / month) if paid annually | N/A |

Seeking Alpha Pro provides deep fundamental analysis and hedge fund tracking, whereas Benzinga prioritizes speed, breaking news, and trader-friendly tools for short-term market opportunities.

FAQ

No, the platform does offer brokerage integration for portfolios tracking, but users must place trades through a separate trading platform.

No, Benzinga primarily focuses on stocks, ETFs, options, and market news, with limited Forex market coverage.

Yes, there is a dedicated mobile app for Pro users – but this is limited compared to desktop capabilities.

The newsfeed is updated in real time, making it significantly faster than free financial news sources.

Yes, the platform allows users to filter news by stock, sector, or impact level, making it easier to focus on the most relevant updates.

While it provides crypto news and basic price tracking, it does not offer real-time blockchain analytics or deep crypto trading tools.

It provides real-time analyst ratings, but does not include full research reports like Morningstar or Zacks.

No, users cannot export news reports, stock screening results, or financial data from the platform.

Review Premium Stock Analysis Tools

How We Rated Premium Investing Analysis & Research Tools

At The Smart Investor, we evaluated premium investment research platforms based on their advanced features, data depth, and overall value compared to other paid alternatives. Each platform was rated based on the following key aspects:

- Advanced Fundamental Analysis Tools (20%): We assessed the depth of financial data, historical reports, earnings forecasts, and valuation models. Platforms that provided institutional-grade insights, DCF analysis, customizable financial models, and access to premium analyst reports scored higher.

- Advanced Technical Analysis Features (20%): We reviewed the availability of real-time charting, advanced indicators, custom scripting, and AI-driven pattern recognition. Platforms that offered backtesting tools, automated trading strategies, and integration with third-party software received better ratings.

- Stock Screener & Premium Filters (15%): A high-quality screener is essential for pro investors, so we evaluated customization depth, real-time filtering, and AI-driven stock discovery. Platforms offering pre-built expert screeners, backtesting capabilities, and sector-specific analytics scored the highest.

- Portfolio Tracking & Advanced Alerts (10%): We rated platforms on their ability to provide real-time performance tracking, portfolio rebalancing tools, and tax optimization insights. Platforms with smart alerts, AI-driven risk assessments, and brokerage integration ranked higher.

- Ease of Use & Customization (15%): We assessed how well premium platforms balance advanced capabilities with user-friendly interfaces. Those offering custom dashboards, API access, and seamless multi-device usability received better ratings.

- Pricing (20%): We considered how the plan's pricing compared to other premium plans and what benefits traders/investors get. Is it worth it overall?