Morningstar Investor

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Pros & Cons

Morningstar Investor is an investment research platform designed for investors who want data-driven insights, portfolio management tools, and expert analysis to make informed financial decisions.

It offers in-depth research on stocks, ETFs, and mutual funds, making it a great resource for long-term investors, retirement planners, and value-focused stock pickers.

For ETF and mutual fund investors, Morningstar provides detailed fund analysis, fee comparisons, and fund manager track records, helping users select strong, cost-efficient investments.

The market commentary and analyst reports offer valuable insights into macroeconomic trends and market movements.

However, it lacks real-time stock data, advanced charting tools, and short-term trading signals, making it less appealing for active traders and day traders.

- Stock screener & filters

- Mutual fund analysis

- ETF comparison tools

- Portfolio X-Ray tool

- Fair value estimates

- Economic moat ratings

- Dividend yield analysis

- Independent analyst reports

- Sector & industry trends

- ESG investment ratings

- Watchlists & stock alerts

- Retirement fund insights

- Comprehensive investment research

- Strong ETF & fund analysis

- Independent analyst reports

- Useful portfolio management tools

- Fair value stock estimates

- Dividend & income insights

- No real-time stock data

- Limited technical analysis

- Stock ratings update slowly

- Weak international stock coverage

- Lacks options & futures data

- No crypto or forex research

Morningstar Stock Screener, Research & Ratings

Morningstar’s stock, ETF, and funds screeners, as well as stock research and ratings, help investors filter stocks based on valuation, profitability, and long-term growth potential:

-

Investment Screeners

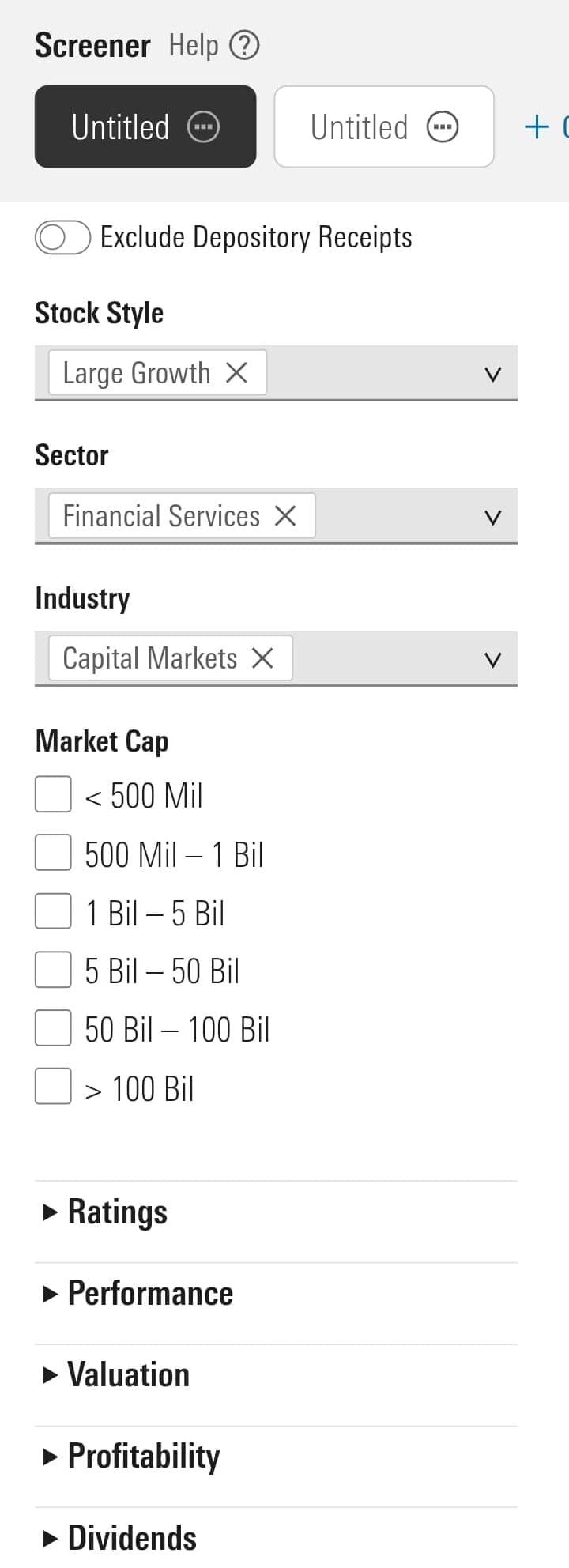

Morningstar Investor offers powerful screening tools to help investors filter and discover stocks, ETFs, and mutual funds based on various financial metrics and ratings.

Whether you’re looking for undervalued stocks, high-performing funds, or low-fee ETFs, the platform provides a structured way to narrow down your options.

There are three main screeners available:

- Stock Screener – Allows investors to filter U.S. stocks based on valuation, growth, stock style, sector, and Morningstar Ratings. You can also filter by economic moat (competitive advantage), fair value, and sector exposure.

- Mutual Fund Screener – Helps users find top-performing mutual funds based on category, historical returns, expense ratios, and fund manager performance.

- ETF Screener – Lets investors filter ETFs by asset class, cost, risk level, Morningstar ratings for funds, and Medalist rating.

We tested the stock screener by setting filters for undervalued stocks with strong profitability.

However, the screeners are designed for fundamental analysis, meaning traders looking for technical indicators like moving averages or RSI won’t find them.

-

Company Research & Stock Analysis

For investors conducting deep stock research, Morningstar Investor provides a comprehensive breakdown of a company’s financial health, performance, and long-term potential.

Key metrics and insights available include:

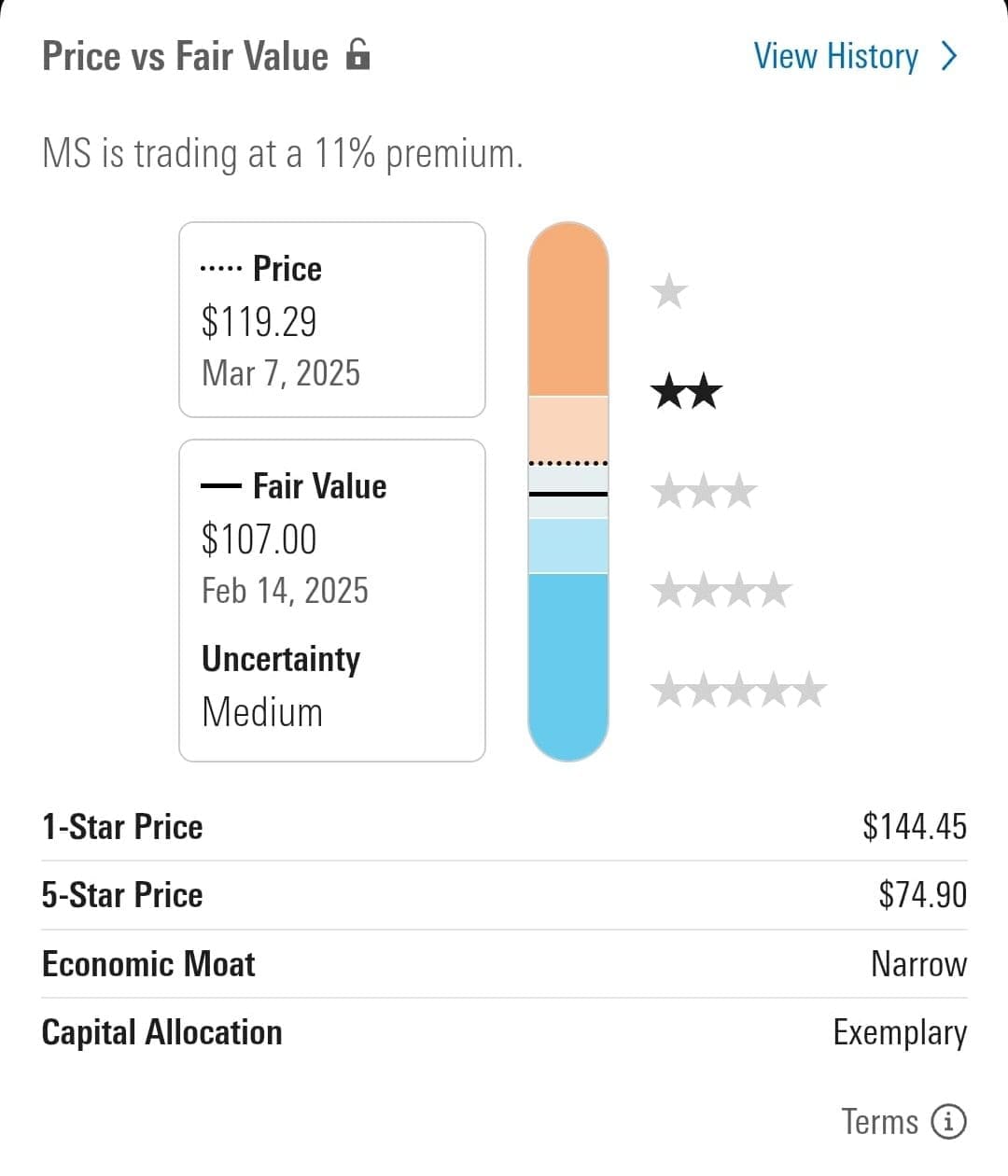

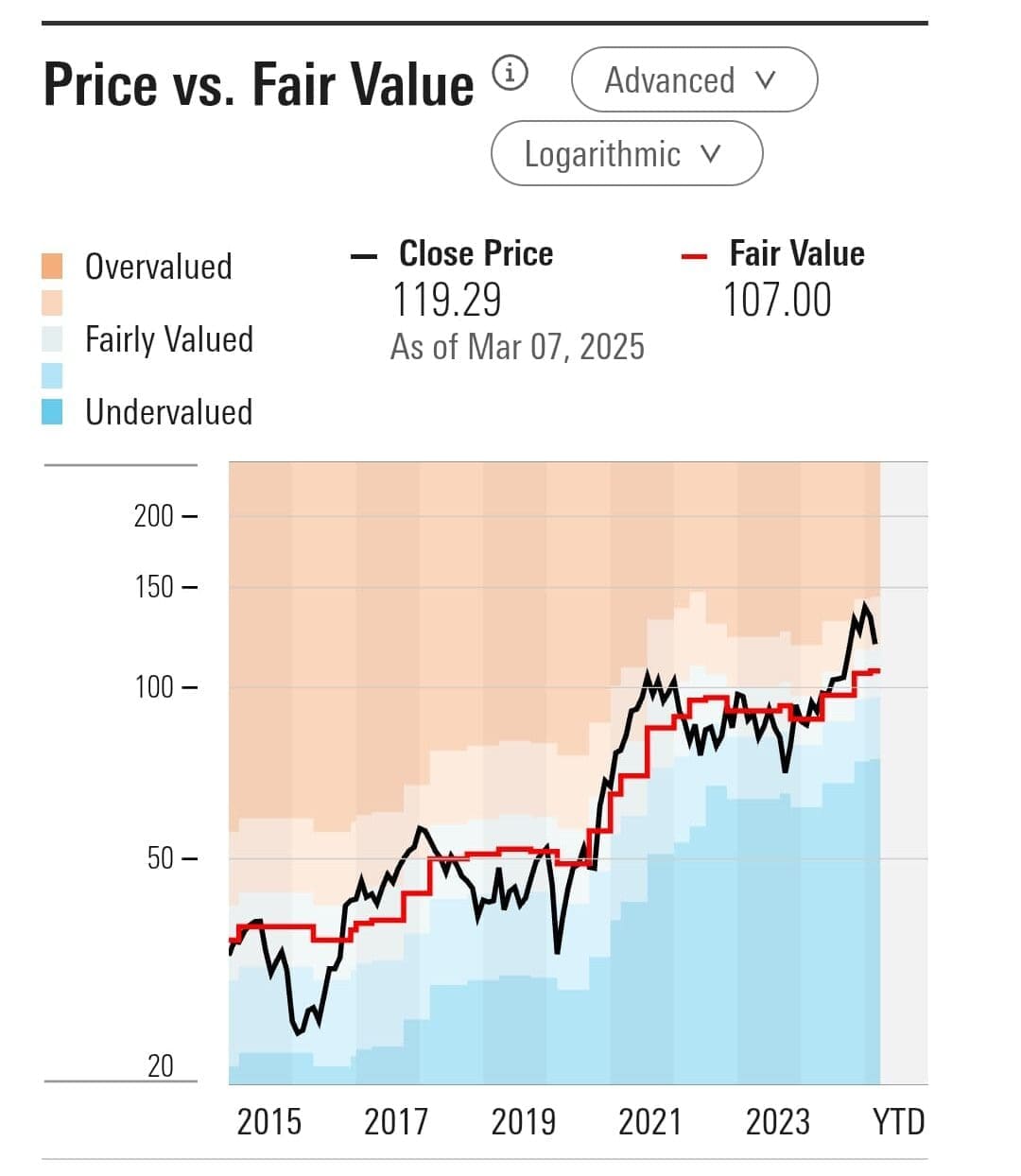

- Fair Value Estimate – Morningstar’s assessment of whether a stock is overvalued, undervalued, or fairly priced.

- Economic Moat Rating – Measures a company’s competitive advantage and ability to maintain profitability over time.

- Financial Metrics – Includes P/E ratio, revenue growth, profit margins, return on equity (ROE), and debt levels.

- Morningstar Ratings – Analyst-driven star ratings that assess a stock’s long-term investment potential.

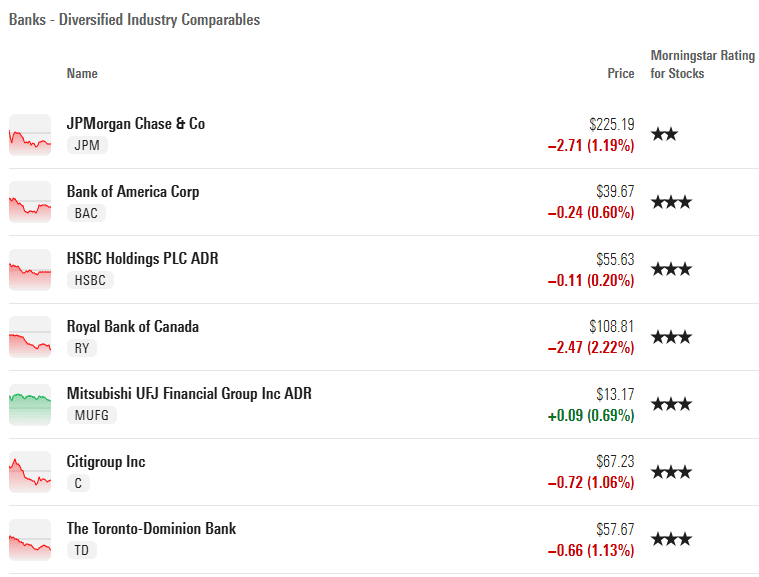

- Industry & Sector Trends – Analysis of how a company compares to its industry peers.

We reviewed a few stocks and found the Fair Value and Moat Ratings especially useful for assessing long-term investment potential.

The research reports provide a clear, structured view of company fundamentals, making it easier to analyze whether a stock is worth buying.

-

Morningstar Ratings

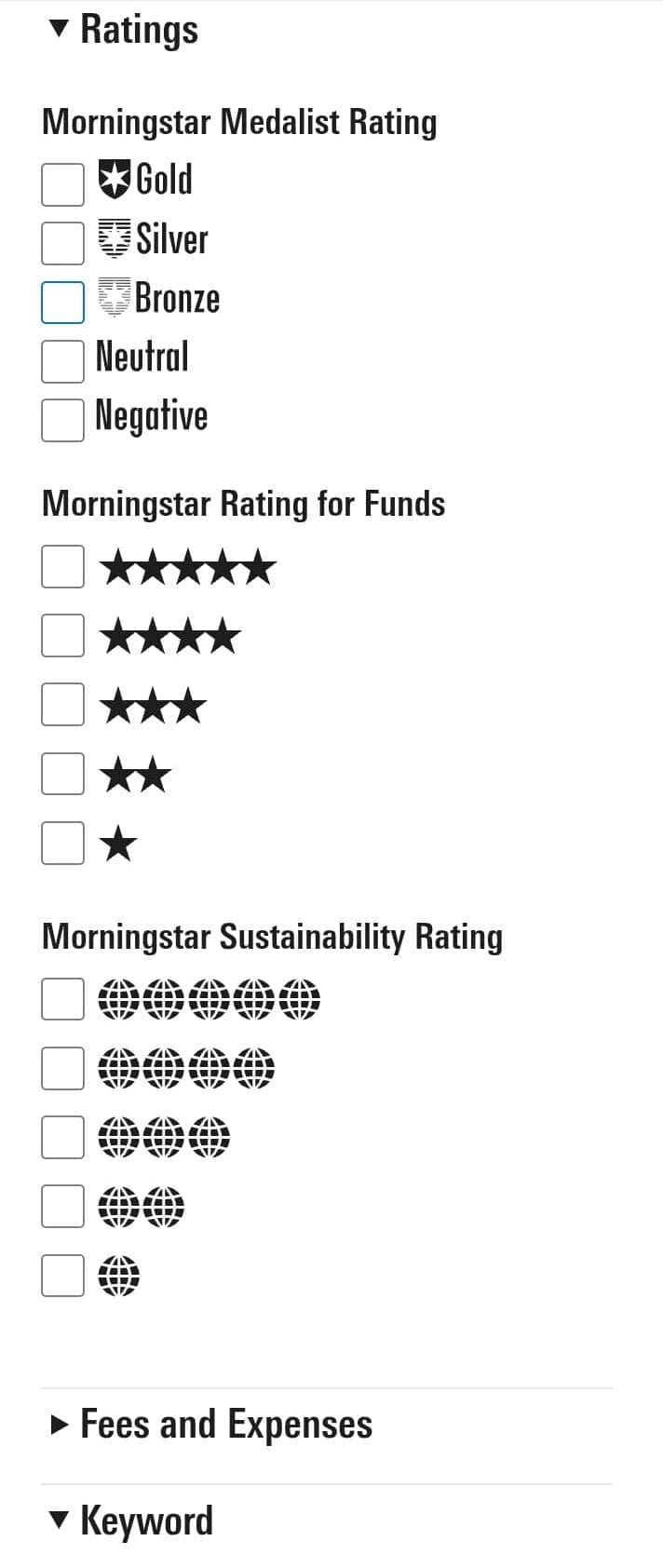

Morningstar offers multiple rating systems to help investors assess investments from different perspectives. Here’s a quick breakdown of each rating system:

Rating System | Focus Area | Purpose |

|---|---|---|

Five-Star Rating | Risk-Adjusted Returns | Compares past fund performance to peers

|

Medalist Rating | Management, Fees, Strategy | Identifies strong funds for long-term investing

|

Quantitative Rating (MQR) | Data-Driven Fund Analysis | Assigns Medalist-like ratings to funds without human coverage

|

Economic Moat Rating | Competitive Advantage | Evaluates a company's ability to sustain profitability

|

Fair Value Estimate | Stock Valuation | Helps investors determine if a stock is over/undervalued

|

ESG Rating | Environmental, Social, Governance | Rates funds and companies on ESG criteria

|

-

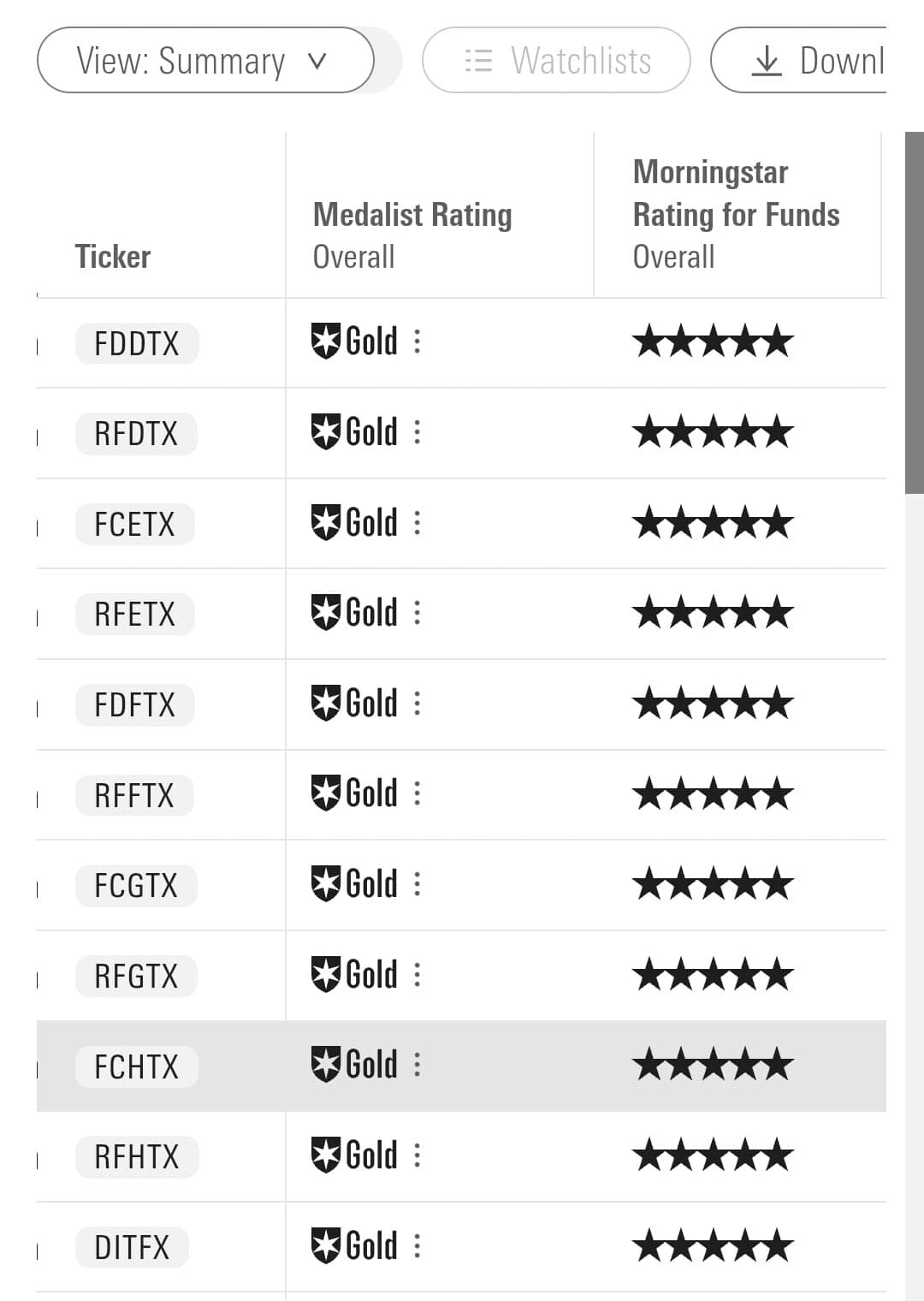

Morningstar Star Rating (Five-Star Rating System)

This is a backward-looking rating that evaluates risk-adjusted returns over a 3-, 5-, and 10-year period, comparing a fund's past performance to its peers.

For example,if two funds/stocks have similar strategies, but one has five stars and the other has three, the five-star fund has historically delivered better risk-adjusted returns.

-

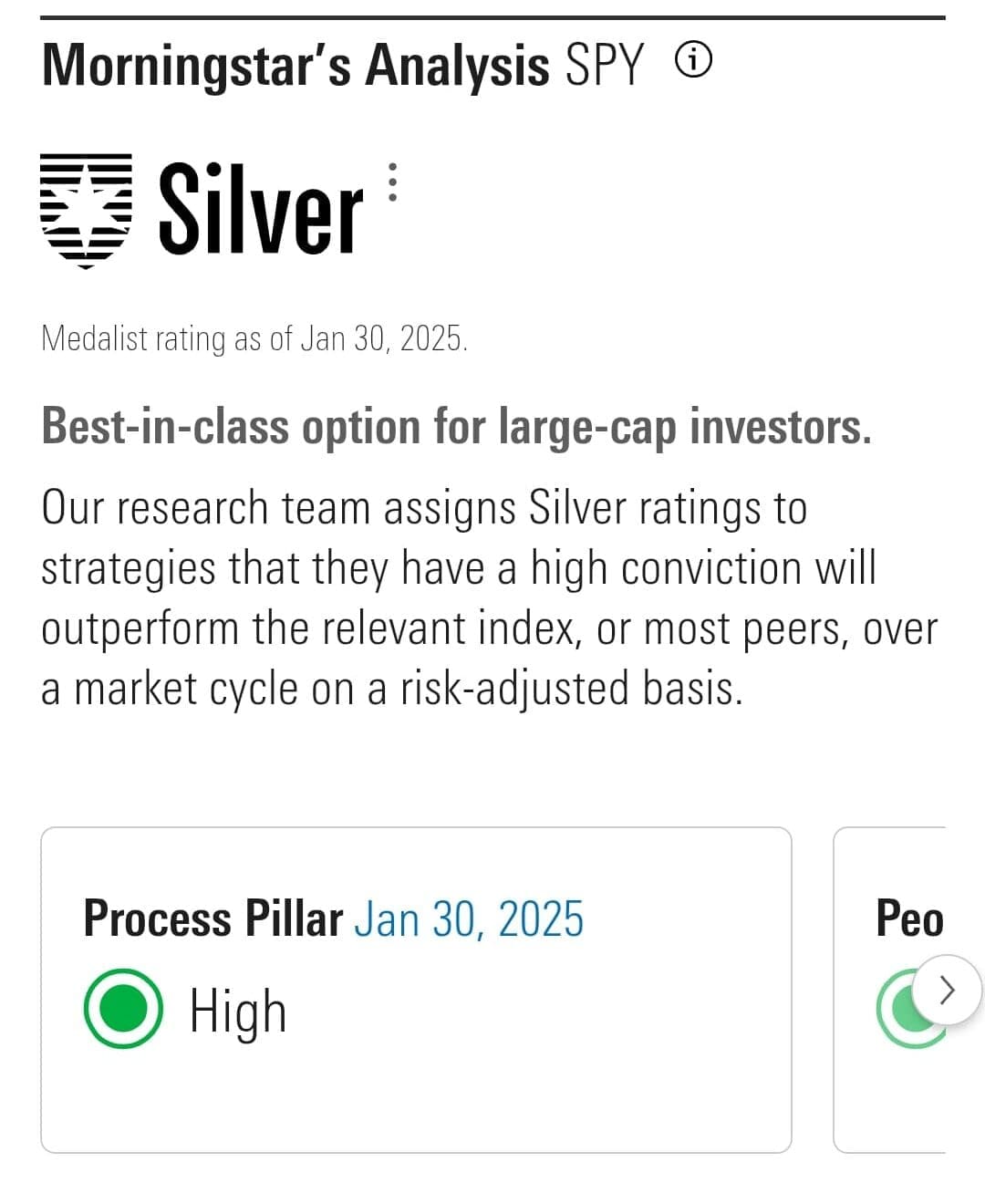

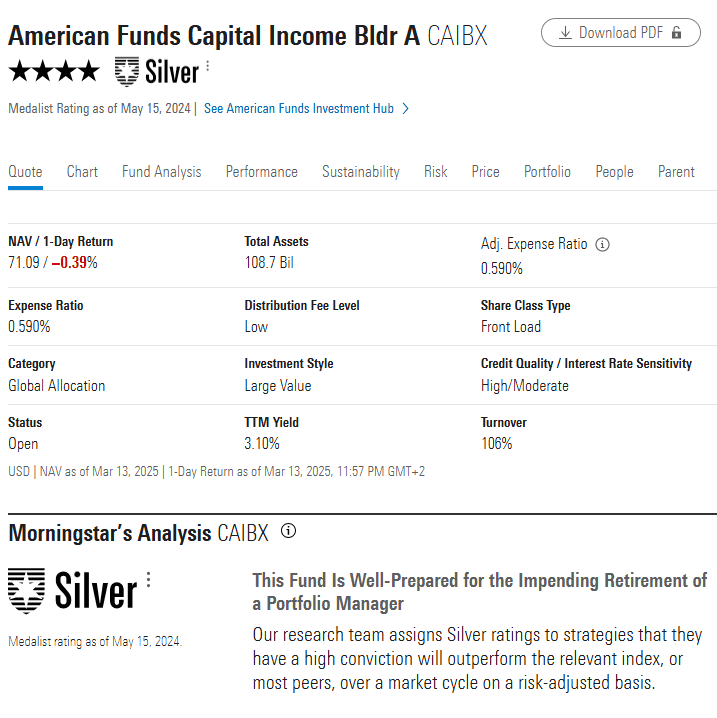

Morningstar Medalist Rating

This forward-looking rating (Gold, Silver, Bronze, Neutral, Negative) assesses a fund’s long-term potential based on factors like management quality, investment strategy, and fees.

For example, a gold-rated fund may be a good choice for a long-term investor because it has a strong, experienced manager and a solid investment process.

-

Morningstar Quantitative Rating (MQR)

A machine-learning-driven rating that assigns Gold, Silver, Bronze, Neutral, or Negative ratings to funds without human analyst coverage, using statistical models.

For example, if a fund lacks an analyst rating but has a Quantitative Gold rating, it suggests that Morningstar’s AI model predicts strong future performance based on past data trends.

-

Morningstar Fair Value Estimate

Estimates a stock’s intrinsic value based on financial modeling and fundamental analysis, helping investors decide whether it's overvalued or undervalued.

For example, if a stock is trading at $50 but its Fair Value Estimate is $70, it may be undervalued and a potential buy opportunity for long-term investors.

-

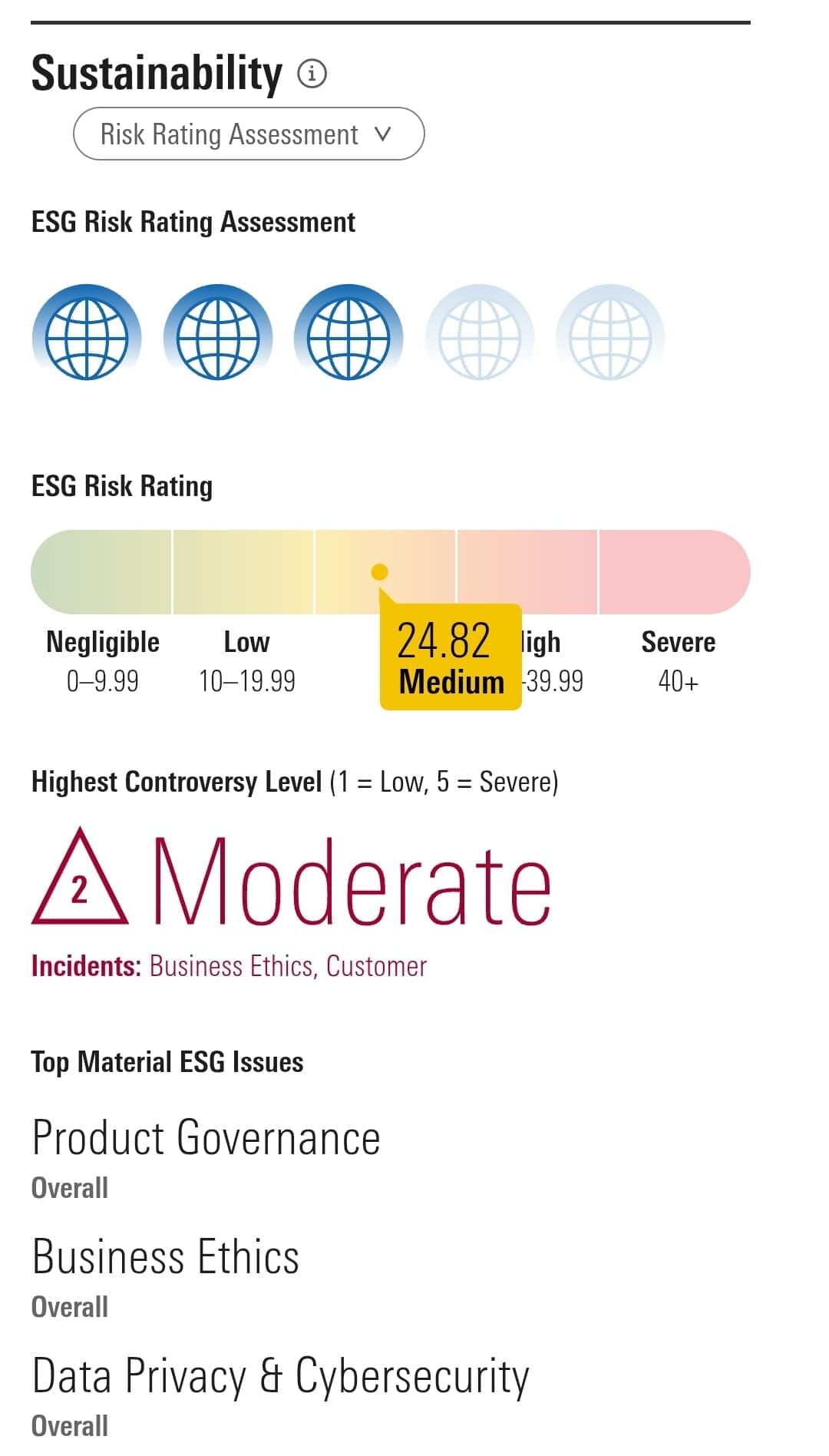

Morningstar ESG Rating

Evaluates funds and companies based on Environmental, Social, and Governance (ESG) factors, assessing sustainability risks.

For example, if an investor prioritizes sustainability, they can use ESG Ratings to choose funds with a strong ESG score, avoiding investments that carry high environmental or governance risks.

-

Morningstar Economic Moat Rating

Measures a company's competitive advantage over time, categorizing it as Wide Moat, Narrow Moat, or No Moat based on business durability.

For example, if two companies have similar financials, but one has a Wide Moat and the other has No Moat, the Wide Moat company is expected to fend off competitors better and maintain profitability.

-

Portfolio Management & Analysis

Morningstar Investor doesn’t just help you pick investments—it helps you manage and analyze your portfolio with in-depth insights.

Here are five key tools that enhance portfolio management:

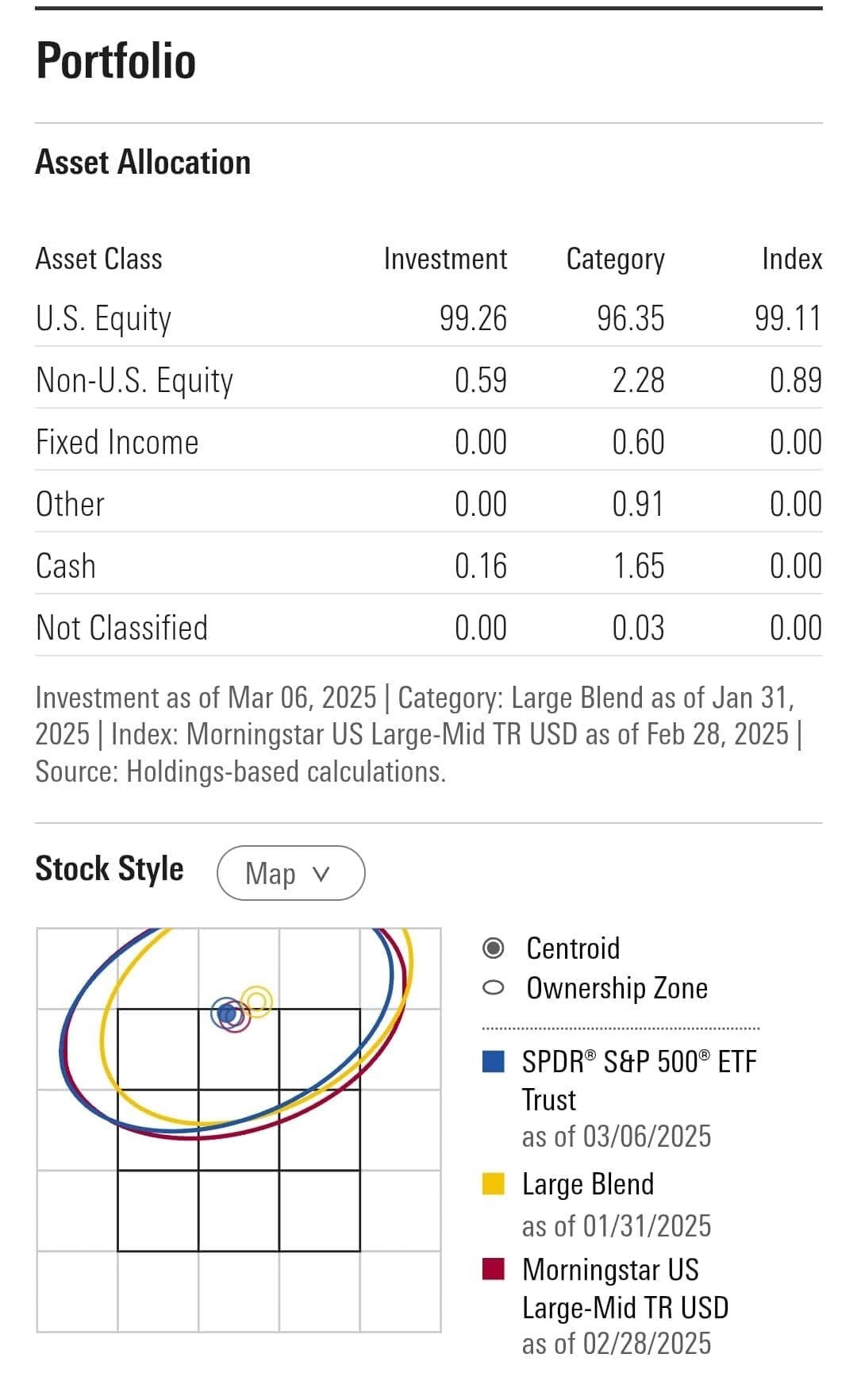

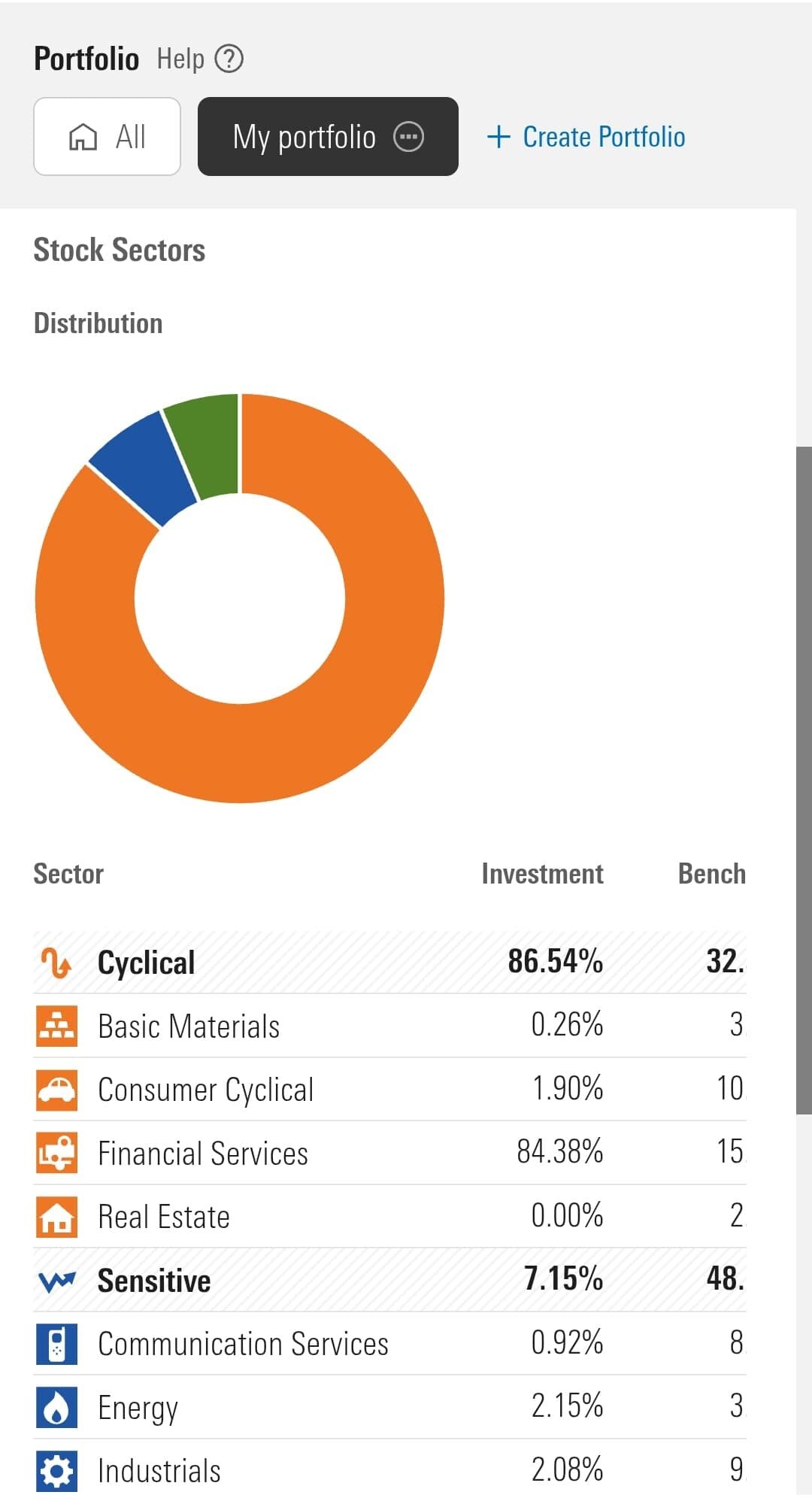

- Portfolio X-Ray Tool – Breaks down your portfolio's asset allocation, sector exposure, stock overlaps, and geographic distribution to ensure proper diversification and reduce risk.

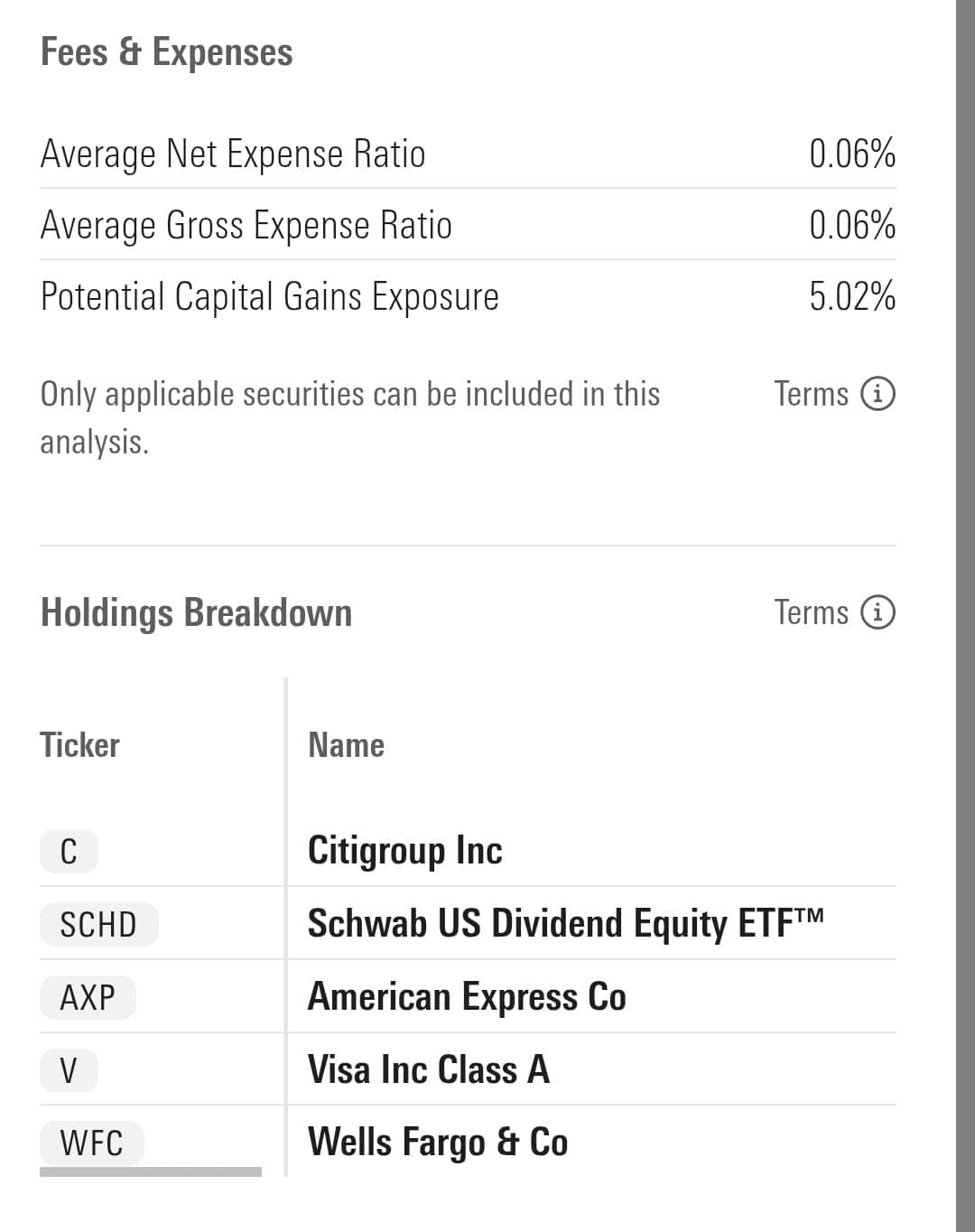

- Fee Analyzer – Identifies hidden expense ratios and fund fees within your portfolio, helping you minimize costs and maximize long-term returns.

- Stock & Fund Overlap Tool – Detects whether you own multiple funds or ETFs that invest in the same stocks, preventing overexposure to individual companies.

- Performance Tracking Dashboard – Provides a historical view of your portfolio’s returns compared to market benchmarks, helping investors evaluate their long-term investment strategy.

- Risk & Style Analysis – Assesses the risk profile and investment style of your holdings, allowing you to see if you’re tilted toward growth, value, or income-generating investments.

We tested this tool by adding different stocks, ETFs, and mutual funds into a sample portfolio.

The system quickly identified sector overweights, stock overlaps, and expense ratios that might impact long-term performance.

Expert Research & More: How Morningstar Stands Out

Morningstar Invesor offers a couple of additional features for analyzing and tracking your investments:

-

Independent Analyst Reports

One of Morningstar’s biggest strengths is its independent, expert-driven research. Their analysts provide deep-dive reports on thousands of stocks, ETFs, and mutual funds.

Morningstar’s team writes these reports of analysts and focus on a fund’s strategy, management quality, asset allocation, risk profile, and fees.

Each report breaks down a fund’s investment philosophy – whether it focuses on growth, value, passive indexing, or active management.

Morningstar also evaluates the fund manager’s track record, underlying holdings, and long-term sustainability.

Stock reports include company financials, sector trends, and potential risks. Each report breaks down a stock’s business model, competitive positioning, and valuation metrics.

We tested this feature by reviewing a Gold-rated actively managed mutual fund and a popular S&P 500 ETF. The mutual fund report detailed how the manager selects stocks, adjusts the portfolio, and compares to category peers.

Meanwhile, the ETF report focused more on expense ratio efficiency, tracking error, and sector allocation.

-

Charts & Technical Analysis

Morningstar Investor provides interactive charts and technical analysis tools to help investors analyze historical price trends, track performance, and assess market movements.

Morningstar’s charts cater more to long-term investors and fund managers by offering insights into multi-year trends, asset allocation shifts, and sector performance.

The platform allows users to overlay different indicators like moving averages, Bollinger Bands, and Relative Strength Index (RSI) to assess price momentum.

Additionally, the comparison tool lets investors chart multiple ETFs, mutual funds, or stocks side by side or against an index:

However, while the system offers some technical indicators, it’s not designed for high-frequency traders who rely on advanced signals or patterns.

-

Retirement & Target-Date Fund Analysis

Morningstar's Retirement & Target-Date Fund Analysis offers in-depth evaluations of funds designed to simplify retirement investing.

Target-date funds automatically adjust their asset allocation over time, becoming more conservative as the target retirement date approaches.

Morningstar analyzes these funds based on factors like glide path design, underlying holdings, and performance metrics.

Investors can use this analysis to select target-date funds that align with their retirement goals and risk tolerance.

For instance, by comparing the glide paths of different funds, investors can choose one that matches their comfort level with equity exposure as they near retirement.

-

Morningstar Style Box

The Morningstar Style Box is a visual tool that categorizes investments based on market capitalization (size) and investment style (value, blend, growth).

The grid consists of nine squares, allowing investors to quickly assess where a particular stock or fund falls in terms of size and style.

By utilizing the Style Box, investors can:

Assess Diversification: Ensure their portfolio isn't overly concentrated in a specific market segment.

Identify Gaps: Spot missing investment styles or sizes in their holdings.

Align with Objectives: Match investments to their risk tolerance and growth expectations.

For instance, a conservative investor might prefer large-cap value stocks, while an aggressive investor might lean towards small-cap growth stocks.

-

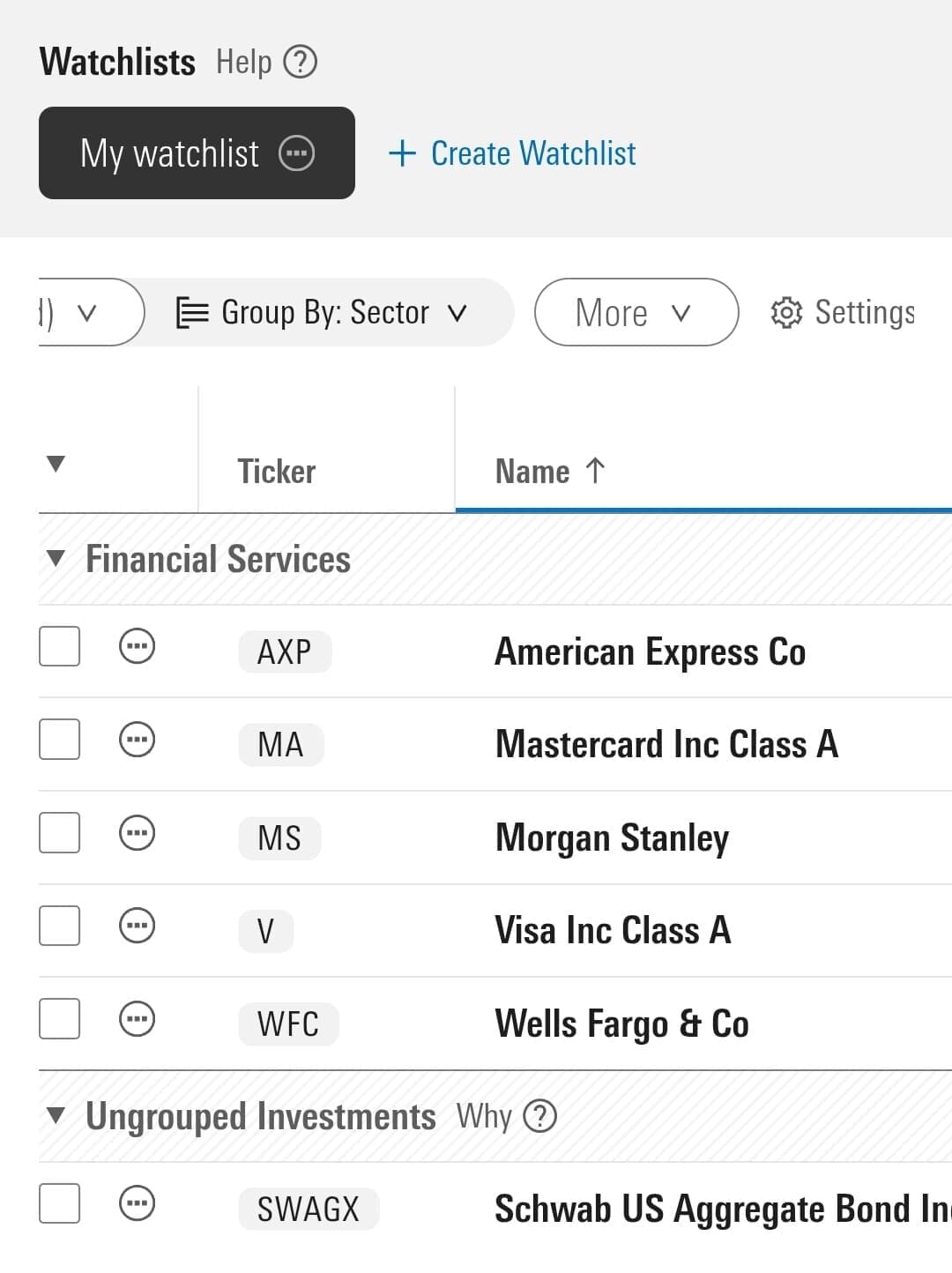

Watchlists

Morningstar Investor makes it easy to track stocks, ETFs, and funds with custom watchlists.

You can create multiple lists, add securities, and view key metrics like Morningstar Ratings, performance trends, and fair value estimates. You can also group by sector ot industry:

We built a few watchlists and found them helpful for tracking potential investments over time.

For example, you can create a dividend stock watchlist and set up alerts for changes in valuation or ratings. The ability to group investments by themes (e.g., growth stocks, value stocks, sectors) is a plus.

However, watchlists don’t offer real-time price alerts

-

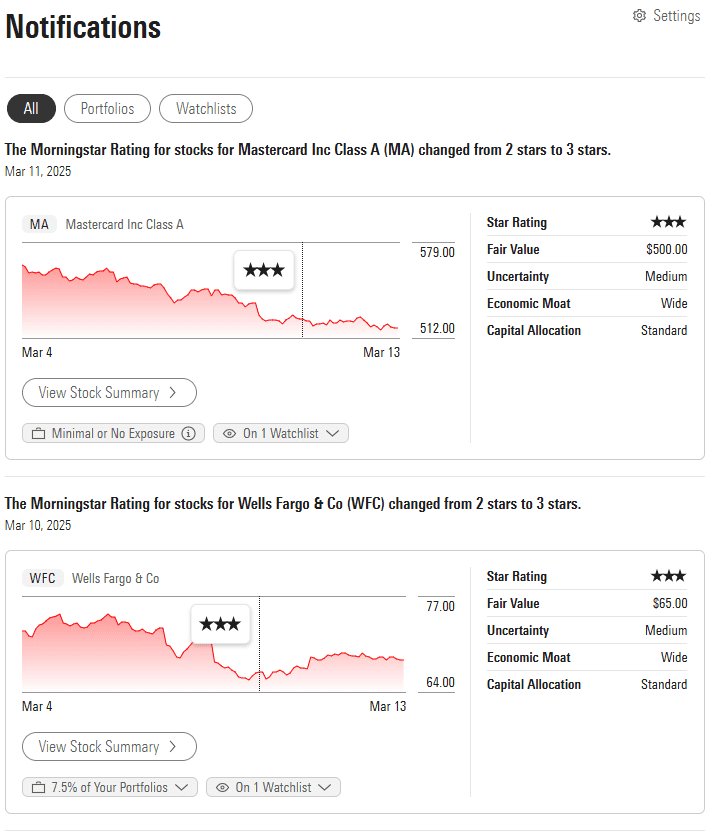

Alerts

Morningstar Investor’s alerts system helps investors stay updated on critical changes to their tracked stocks, ETFs, mutual funds, and market trends.

We tested the alerts feature by setting notifications on a high-dividend ETF and a growth stock to monitor significant movements or analyst rating changes.

The alerts notified us via email when the ETF’s yield changed and when the stock hit a key price level.

For mutual fund investors, the system can alert you to management changes, new expense ratio adjustments, or performance shifts compared to peers.

However, Morningstar’s alerts don’t offer real-time push notifications—they’re mostly email-based, which may cause delays for fast-moving stocks.

Morningstar’s Lesser-Known Investment Tools & Insights

Morningstar Investor offers a wide range of additional tools designed to help investors analyze investments:

- Global Market Trends & Economic Data: Provides macroeconomic insights and global market indicators to help investors track economic cycles, inflation trends, and interest rate movements.

- Ownership & Institutional Holdings Data: Shows which institutional investors and major shareholders hold specific stocks and funds, offering insights into professional investor confidence.

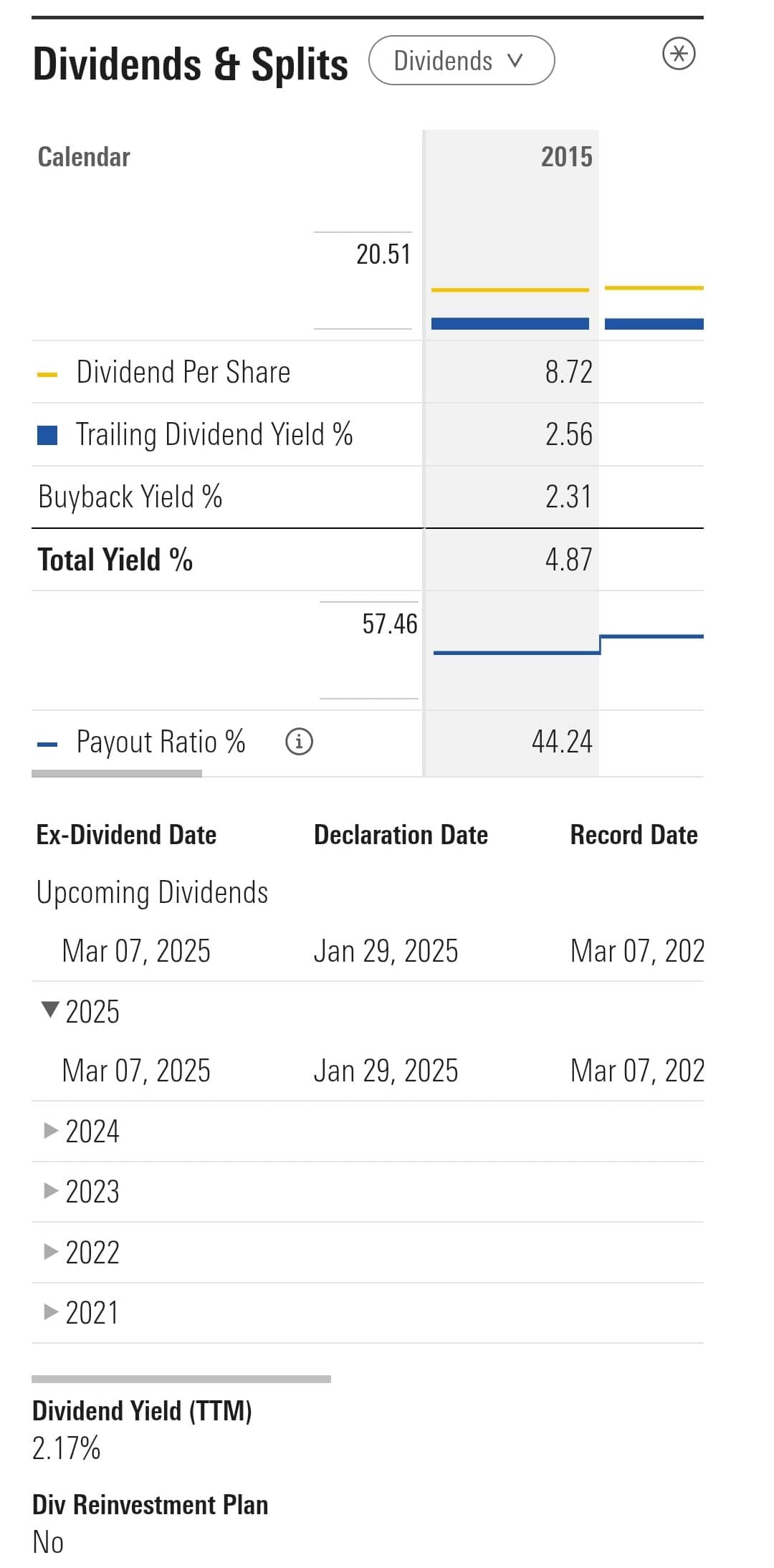

- Yield & Dividend Analysis: Provides insights into dividend-paying stocks and funds, displaying historical yields, payout ratios, and dividend growth trends for income-focused investors.

- Sector & Industry Exposure: Breaks down how a stock, ETF, or fund is allocated across various industries, helping investors avoid over-concentration in a single sector.

- Historical Risk & Return Analysis: Allows users to review long-term performance trends and volatility metrics, comparing an investment’s risk-adjusted returns against its benchmarks.

Morningstar’s Gaps: What It Doesn’t Offer

Morningstar Investor is a powerful research platform, but it’s not perfect. Here are four key areas where Morningstar Investor could be improved:

-

Limited Technical Analysis Tools

While Morningstar Investor provides basic charting features with trendlines, moving averages, and overlays, it lacks the advanced technical indicators that many traders use.

Morningstar does not offer tools such as Fibonacci retracements, MACD, Ichimoku Clouds, or real-time volume analysis. This makes it less useful for short-term traders or those who rely on price action strategies.

-

No Real-Time Data or Live Market Feeds

Morningstar Investor focuses on long-term investing, which means it doesn’t provide real-time stock prices, bid-ask spreads, or live market depth data.

This can be a drawback for active traders or day traders who rely on instant price movements and real-time quotes to make quick decisions.

-

Stock Ratings Can Feel Conservative or Slow to Update

Morningstar’s stock ratings are highly respected, but they often lean conservative and may take longer to update than investor expectations.

The Fair Value Estimate and Economic Moat Ratings are based on long-term fundamentals, meaning they don’t react quickly to short-term price swings or breaking news.

-

International Stock Coverage is Limited

Morningstar Investor heavily focuses on U.S. stocks, ETFs, and mutual funds, but its international stock coverage is weaker compared to platforms like GuruFocus or Interactive Brokers.

Many non-U.S. companies lack full analyst reports, quantitative ratings, or fair value estimates, making it harder for investors to evaluate foreign markets, emerging economies, or international ETFs.

Who Should Use Morningstar Investor?

Morningstar Investor is designed primarily for long-term investors and those who focus on fundamental research rather than short-term trading.

Here are four types of investors who may find Morningstar Investor a good fit:

- Long-Term Stock Investors: Those who prefer to buy and hold stocks for years or decades will benefit from Morningstar’s fair value estimates, economic Moat ratings, and analyst reports to assess a company’s long-term growth potential.

- ETF & Mutual Fund Investors: Investors who focus on diversified funds can take advantage of fund ratings, portfolio analysis tools, and fee comparisons to choose the best options with low costs and strong management.

- Dividend & Income Investors: Morningstar’s dividend analysis tools and yield comparison features help income-focused investors find stable, high-yielding stocks and funds with consistent payouts.

- DIY Portfolio Managers: Those who prefer to manage their own investments can use Morningstar’s Portfolio X-Ray, Asset Comparison, and Market Commentary to track diversification and adjust strategies over time.

Who Should Skip Morningstar Investor?

Morningstar Investor is not ideal for every type of investor or trader, especially those who rely on real-time data, short-term price movements, or advanced technical analysis:

- Day Traders & Scalpers: Morningstar lacks real-time price feeds, live trading tools, and advanced technical indicators, making it unsuitable for traders who need instant execution and price action analysis.

- Options & Futures Traders: Since the platform focuses on stocks, ETFs, and mutual funds, it does not provide in-depth options chains, derivatives analysis, or futures contracts data.

- Penny Stock & Speculative Traders: Morningstar prioritizes well-established companies and does not offer strong coverage for high-risk, speculative, or ultra-low-priced stocks.

- Crypto & Forex Traders: The platform does not provide cryptocurrency or forex market coverage, making it irrelevant for investors trading Bitcoin, Ethereum, or currency pairs.

Morningstar Investor Alternatives: How They Compare?

Morningstar Investor is among the mid-tier investment research platforms.

MarketBeat All Access and InvestingPro provide great fundamental analysis tools and screeners but less research like Morningstar Investor.

Plan | Subscription | Promotion |

|---|---|---|

Morningstar Investor | $34.95

$249 ($20.75 / month) if paid annually | 7-Day free trial |

Zacks Premium | $249 ($20.75/month)

No monthly plan | 30-day free trial |

Motley Fool Stock Advisor | $199 (16.60 / month)

No monthly plan

| 30-day money-back guarantee |

Benzinga Pro | $37

$367 ($30.58 / month) if paid annually | $129

$129 for new member’s annual price ($11/month), including 7-day money-back guarantee

|

GuruFocus Premium | $499 ($41.58/ month)

No monthly plan, price for US citizens, price change by region | 7-day free trial + 30-day money-back guarantee |

StockTwits Edge | $22.95

$229.50 ($19.10 / month) if paid annually

| N/A |

Stock Analysis | $9.99

$79 ($6.58 / month) if paid annually | 60-day money back guarantee |

Motley Fool Epic focuses on stock picks, not broad research. Benzinga Basic Pro emphasizes real-time data, and Zacks Premium prioritizes earnings-based rankings, but also have great research team – but less focused on mutual funds and ETFs.

FAQ

Morningstar Investor is a platform offering investment research, analysis tools, and portfolio management resources to help investors make informed decisions.

Yes, Morningstar allows importing portfolios from other sites or software for seamless tracking.

No, Morningstar focuses on long-term investing and does not offer real-time stock quotes.

Stock ratings are updated daily based on price movements, analyst assessments, and other factors.

While primarily focused on U.S. markets, Morningstar does provide information on select international stocks.

Yes, Morningstar offers a mobile app for both iOS and Android devices, allowing access to tools and research on-the-go.

Review Premium Stock Analysis Tools

How We Rated Premium Investing Analysis & Research Tools

At The Smart Investor, we evaluated premium investment research platforms based on their advanced features, data depth, and overall value compared to other paid alternatives. Each platform was rated based on the following key aspects:

- Advanced Fundamental Analysis Tools (20%): We assessed the depth of financial data, historical reports, earnings forecasts, and valuation models. Platforms that provided institutional-grade insights, DCF analysis, customizable financial models, and access to premium analyst reports scored higher.

- Advanced Technical Analysis Features (20%): We reviewed the availability of real-time charting, advanced indicators, custom scripting, and AI-driven pattern recognition. Platforms that offered backtesting tools, automated trading strategies, and integration with third-party software received better ratings.

- Stock Screener & Premium Filters (15%): A high-quality screener is essential for pro investors, so we evaluated customization depth, real-time filtering, and AI-driven stock discovery. Platforms offering pre-built expert screeners, backtesting capabilities, and sector-specific analytics scored the highest.

- Portfolio Tracking & Advanced Alerts (10%): We rated platforms on their ability to provide real-time performance tracking, portfolio rebalancing tools, and tax optimization insights. Platforms with smart alerts, AI-driven risk assessments, and brokerage integration ranked higher.

- Ease of Use & Customization (15%): We assessed how well premium platforms balance advanced capabilities with user-friendly interfaces. Those offering custom dashboards, API access, and seamless multi-device usability received better ratings.

- Pricing (20%): We considered how the plan's pricing compared to other premium plans and what benefits traders/investors get. Is it worth it overall?