Seeking Alpha PRO

Annual Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Pros & Cons

Seeking Alpha Pro is the highest-tier subscription designed for investors who want exclusive stock insights, expert-driven research, and faster market updates.

It builds on the Premium plan by adding top analyst insights, exclusive stock coverage, rating upgrades/downgrades, and short-selling opportunities.

This makes it particularly useful for self-directed investors, hedge fund managers, and professionals looking for deeper stock research beyond mainstream coverage.

One of the biggest advantages of Seeking Alpha Pro is the Top Analyst Insights feature, which provides stock ideas and market strategies from the platform’s best-performing contributors.

Pro users also get access to in-depth analysis on stocks with little to no Wall Street coverage, while the Short Ideas feature is especially useful for investors looking to hedge their portfolios or explore short-selling strategies.

- Top Analyst Insights

- Exclusive Underfollowed Stocks

- Stock Upgrades & Downgrades

- Short Ideas & Bearish Analysis

- Quant Ratings & Factor Grades

- Advanced Stock Screener

- Top Stock & ETF Rankings

- Portfolio Health Check

- Earnings Call Transcripts

- Stock & ETF Comparison

- Dividend Safety Scores

- Author Performance Tracking

- Exclusive stock insights & research

- Top analyst recommendations

- Access to underfollowed stocks

- Short-selling opportunities

- Real-time upgrades/downgrades

- No real-time stock prices

- Lacks advanced technical charts

- No mutual fund research

- Limited bond market insights

- Lacks automated investment tools

Seeking Alpha PRO Pricing vs Other Plans

Seeking Alpha Pro is the highest-tier subscription, offering exclusive stock insights, expert-driven research, and advanced market analysis beyond what the premium plan provides.

Plan | Annual Subscription | Promotion |

|---|---|---|

Seeking Alpha Premium | $299 ($24.90 / month)

No monthly subscription | $4.95 for 1 month |

Seeking Alpha Pro | $2,400 ($200 / month)

No monthly subscription | $99 for 1 month |

Seeking Alpha – Alpha Picks | $499 ($41.58 / month)

No monthly subscription | N/A |

Alpha Picks, on the other hand, focuses on monthly stock recommendations based on Quant Ratings, making it a simpler, more hands-off option for investors preferring curated stock picks over extensive research tools.

PRO Unique Stock Research Features

Seeking Alpha Pro goes beyond standard stock research by offering unique stock analysis tools and exclusive insights. Let’s explore the additional features that make Seeking Alpha Pro stand out.

-

Top Analyst Insights & Performance Tracking

Unlike a traditional stock advisor, Seeking Alpha Pro doesn’t provide direct financial advice, but it offers a valuable curation of high-quality investment research.

The Seeking Alpha Pro’s Top Analyst Insights provides exclusive investment ideas from the top 15 analysts on the platform, offering insights from contributors with a strong track record of outperforming the market.

For investors, this means access to expert-vetted stock ideas that aren’t available in the free or premium versions. Each analyst’s performance is tracked, so users can evaluate their past success before following their stock recommendations.

We found this particularly useful for those looking for hand-picked stock ideas with strong growth or value potential

During our testing, we noticed that these insights tend to focus on under-the-radar stocks with high potential. However, since these are individual analyst opinions, investors should still conduct their own stock analysis before acting on the recommendations.

-

Exclusive Coverage of Underfollowed Stocks

We explored Seeking Alpha Pro’s exclusive coverage of stocks that lack Wall Street analyst attention.

Unlike major financial platforms that focus on large-cap companies, Seeking Alpha Pro highlights small-cap, mid-cap, and emerging stocks that don’t receive coverage from big banks or investment firms.

From our experience, many of the stocks in this category are high-risk, high-reward plays, meaning they require careful analysis before investing.

However, because these stocks are less known, liquidity and volatility can be a concern, so they may not be ideal for all investors.

-

Upgrades & Downgrades from Multiple Rating Systems

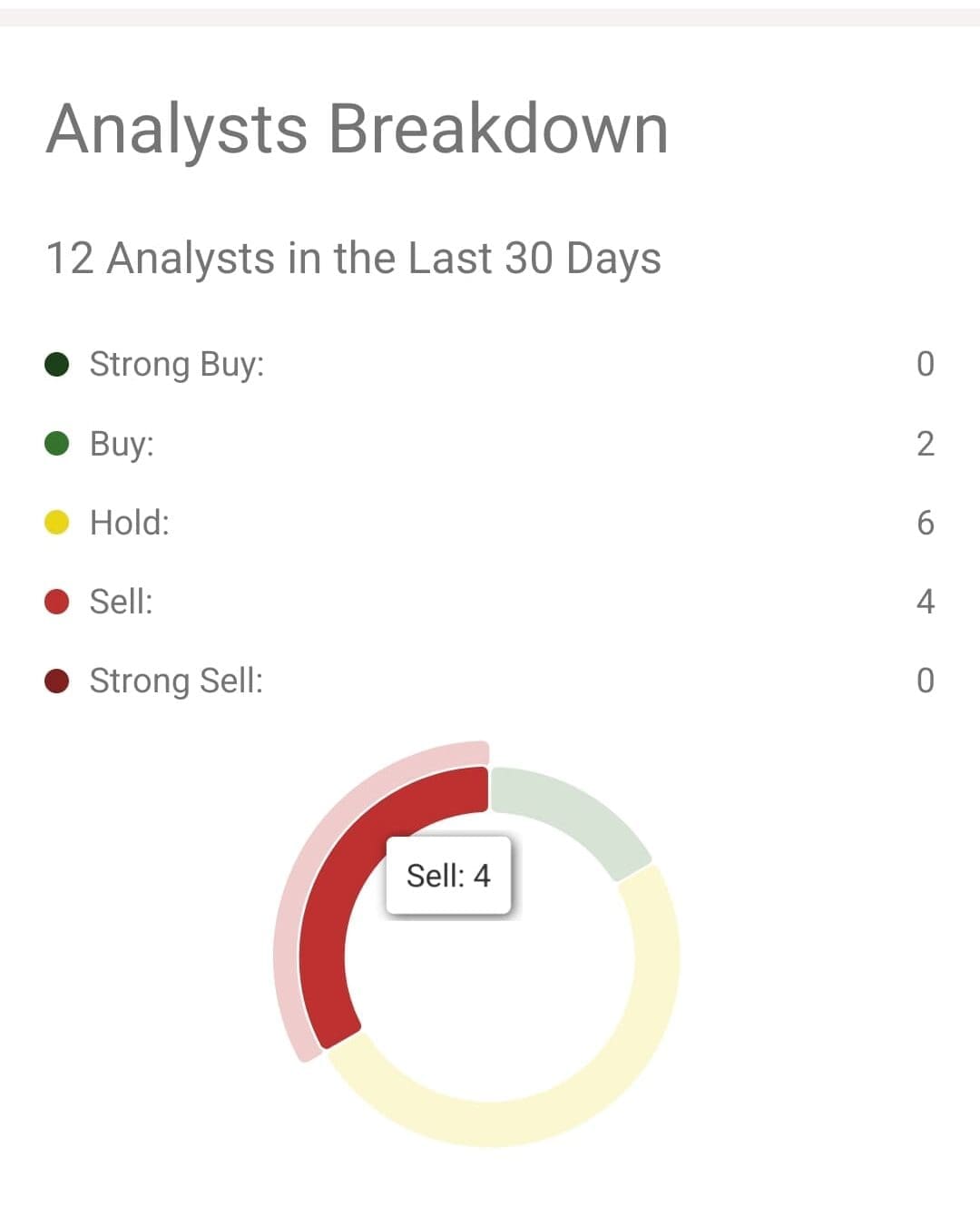

We reviewed Seeking Alpha Pro’s real-time stock upgrades and downgrades, which consolidate rating changes from Quant Ratings, Seeking Alpha Analysts, and Wall Street firms.

This feature provides a quick snapshot of stock movements, helping investors track shifts in market sentiment.

For traders and active investors, this is a great decision-making tool. Instead of manually checking different sources, users can see all major rating changes in one place.

The Quant Ratings provide a data-driven perspective, while Seeking Alpha analysts and Wall Street offer more qualitative insights.

This combination allows investors to weigh both algorithmic ratings and human analysis when making investment decisions.

However, this tool does not provide specific buy/sell signals, meaning users still need to perform their own stock research. It’s most useful as a confirmation tool rather than a sole decision-maker.

-

Access to Short Ideas & Bearish Market Analysis

We analyzed Seeking Alpha Pro’s Short Ideas section, which focuses on bearish stock recommendations from experienced analysts.

Unlike most stock advisor platforms that primarily highlight buy opportunities, this feature provides detailed short-selling strategies, overvalued stock warnings, and market risk analysis.

For traders and hedge fund-style investors, this feature is invaluable for spotting overhyped stocks, potential market bubbles, and companies facing financial difficulties.

The short ideas are backed by fundamental analysis, often identifying stocks with unsustainable growth, declining financials, or industry headwinds.

However, shorting stocks carries significant risk, and these reports should be used alongside other stock analysis methods.

Stocks Screener And Market Analysis: What Else Do You Get?

Beyond PRO's unique research tools, Seeking Alpha offers additional features that enhance stock screening and market analysis, most of them available also in the Premium plan:

-

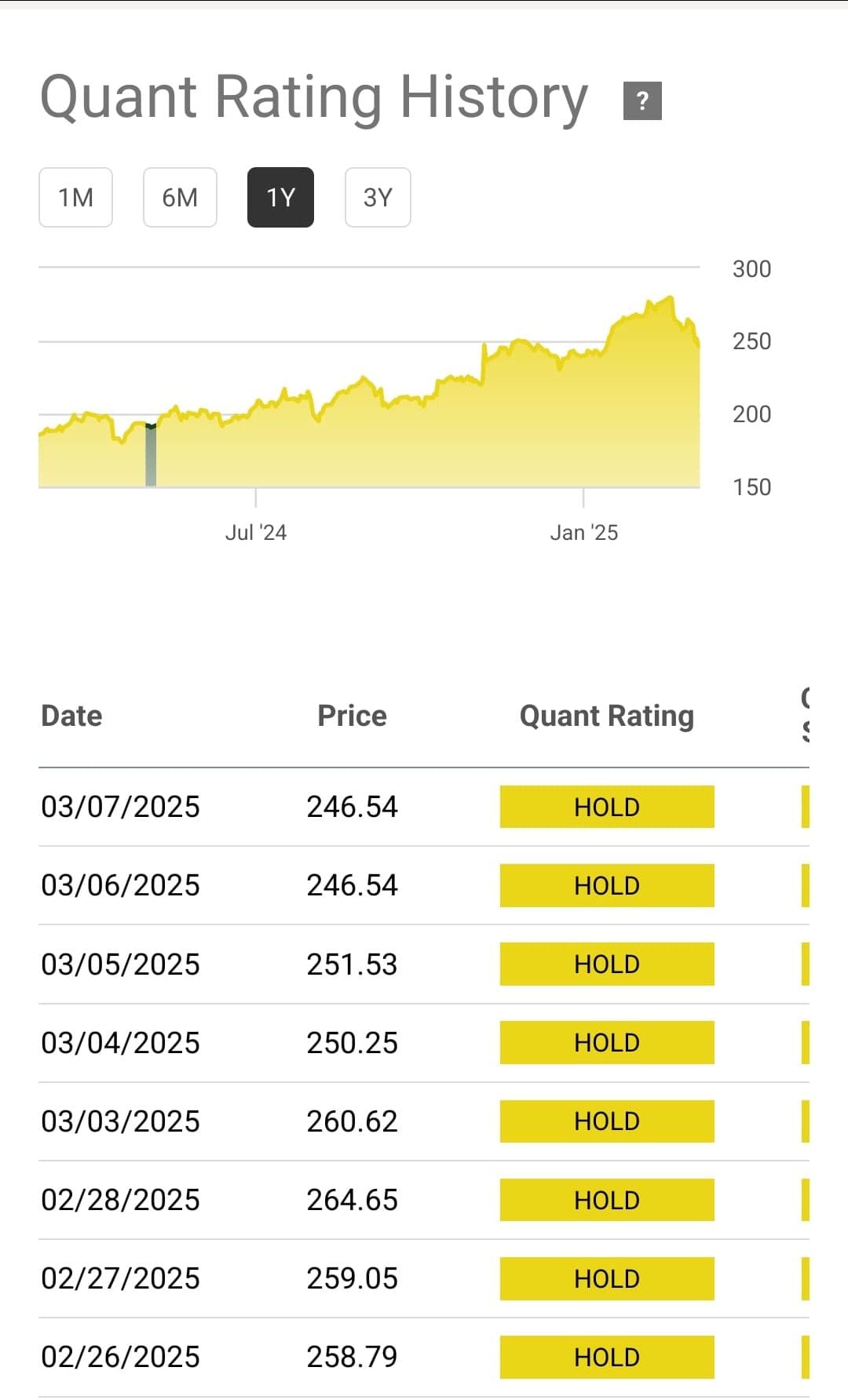

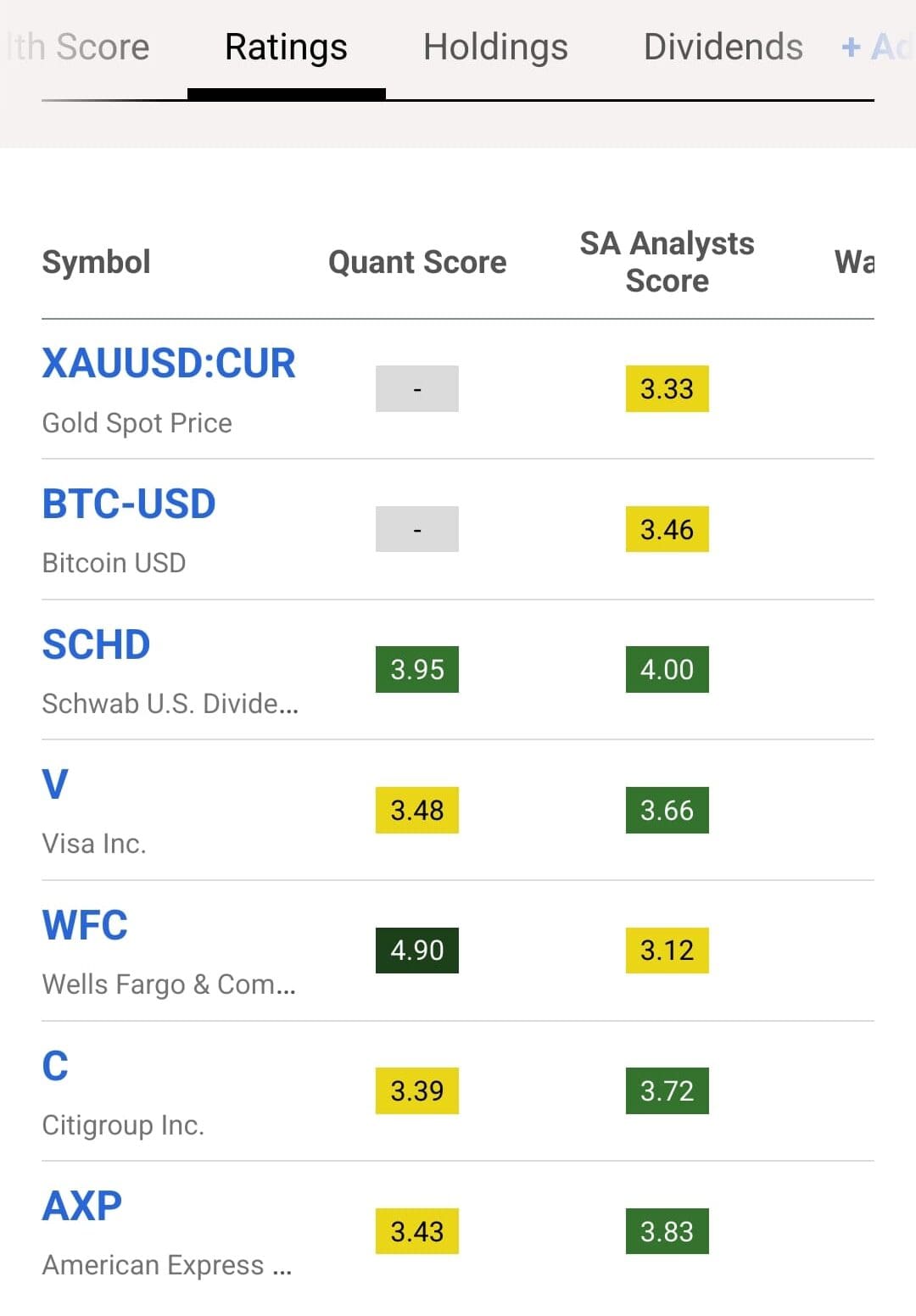

Quant Ratings & Factor Grades

The Seeking Alpha’s Quant Ratings are data-driven stock ratings analyze valuation, growth, profitability, momentum, and earnings revisions to determine a stock’s Strong Buy, Buy, Hold, Sell, or Strong Sell ranking.

For investors, this tool provides an unbiased, numbers-based ranking system that highlights both high-potential stocks and potential risk factors.

The Factor Grades give letter scores (A+ to F) on key financial metrics, making it easier to compare stocks at a glance.

From our experience, Quant Ratings have a strong track record of outperforming the S&P 500, but they shouldn’t be used alone.

We found that pairing them with fundamental research and stock analysis creates a well-rounded investment strategy.

-

Advanced Stock Screener

With the Seeking Alpha Stock and ETF Screener, Premium and Pro users can filter stocks based on Quant Ratings, Factor Grades, dividends, valuation, growth potential, and profitability.

For investors, this means an easier way to find top-ranked stocks across different sectors and investment styles.

Whether looking for undervalued stocks, high-growth opportunities, or dividend leaders, the stock screener helps narrow down choices.

One of the best features we noticed was the ability to screen for stocks using real performance data rather than just analyst opinions.

However, technical indicators are not included, so traders relying on chart-based strategies may use a technical stock screener.

-

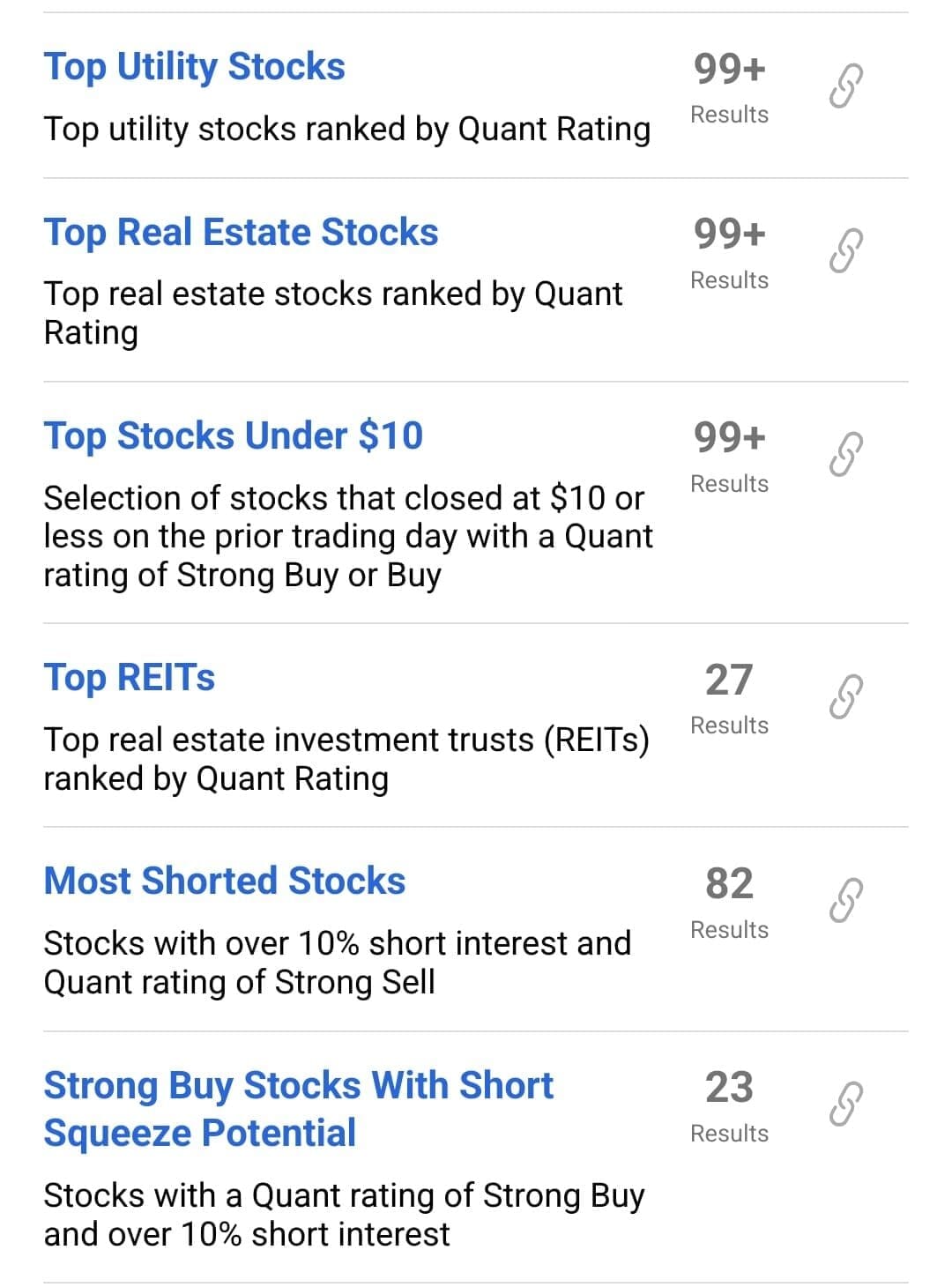

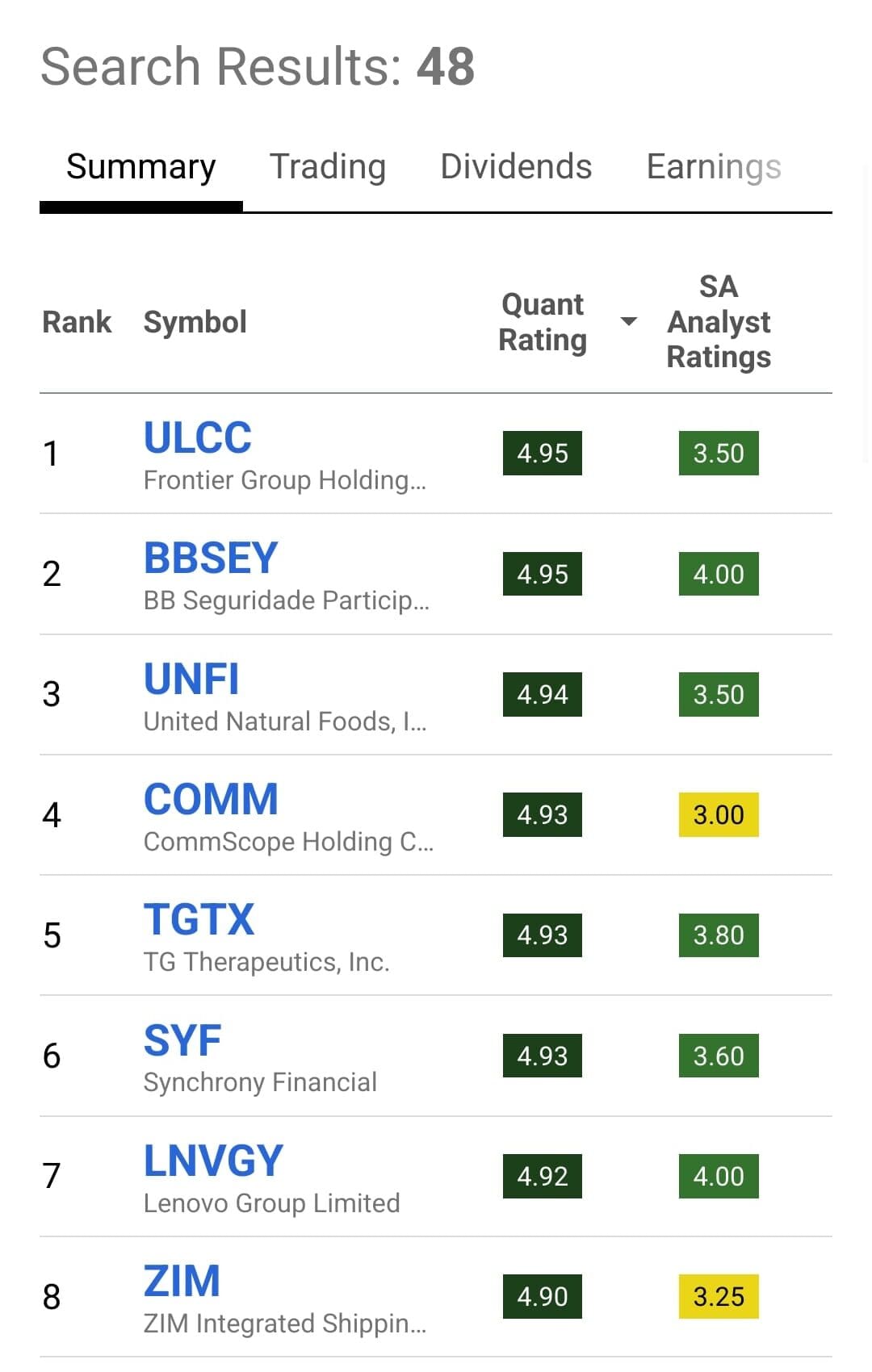

Top Stock & ETF Rankings

This feature ranks stocks and ETFs based on Quant Ratings, Factor Grades, and analyst ratings, making it easier to identify strong-performing assets.

For investors, this is a great tool to quickly filter stocks by performance, growth potential, and dividend yield.

The rankings are categorized into lists such as Top Growth Stocks, Top Value Stocks, Top Dividend Stocks, and Top Small-Cap Stocks, allowing users to focus on their preferred investment strategy.

ETF investors can use the Top ETF Rankings to compare sector-based, growth, and income-focused ETFs.

We found this particularly helpful for those building diversified portfolios or looking for low-cost investment options.

-

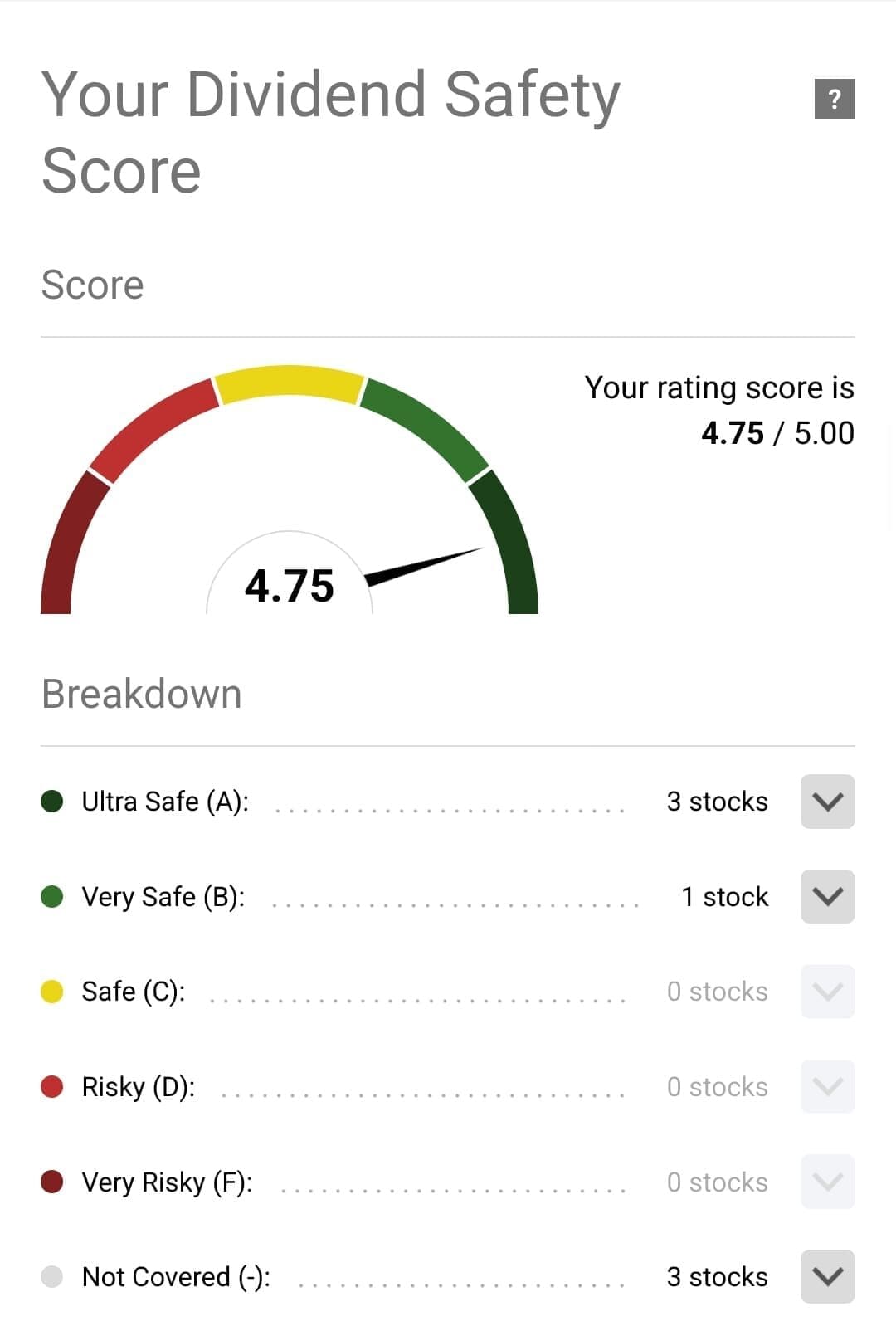

Portfolio Health Check & Warnings

The Seeking Alpha’s Portfolio Health Check & Warning tool analyzes your holdings and flags potential risks, overvalued stocks, and underperforming assets, providing an overview of portfolio strength and diversification.

For long-term investors, this feature is useful for identifying imbalances, dividend sustainability issues, and high-risk stocks.

The system assigns grades to each stock based on valuation, profitability, and growth, helping investors make informed decisions about holding, selling, or rebalancing positions.

However, while this tool provides data-backed risk assessments, it does not offer personalized investment recommendations or automated portfolio rebalancing like a robo-advisor.

Seeking Alpha PRO Plan vs. Competitors: Worth the Price?

Seeking Alpha Pro competes with high-end research platforms like Zacks Ultimate, Morningstar Investor, TradingView Premium, Motley Fool Epic, and Benzinga Pro Essential.

In terms of pricing, it's more expensive than most of the advanced tools in other platforms.

Plan | Subscription | Promotion |

|---|---|---|

Motley Fool Epic | $499 (41.60 / month)

No monthly plan

| 30-day money-back guarantee |

TradingView Premium | $59.95

$432 ($23.98 / month) if paid annually | 30-day free trial |

Zacks Ultimate | $299

$2,995 ($249.5 / month) if paid annually | 30-day free trial |

InvestingPro+ | $39.99

$300 ($24.99 / month) if paid annually | N/A |

Seeking Alpha PRO | $2,400 ($200 / month)

No monthly subscription | $99 for 1 month |

TipRanks Ultimate | $599 ($50 / month)

No monthly plan | 30 day money-back guarantee |

Yahoo Finance Gold | $49.95

$479.40 ($39.95 / month) if paid annually | N/A |

- Unlike Zacks Ultimate, which focuses on earnings-based stock rankings, Seeking Alpha Pro offers exclusive analyst insights and underfollowed stock research.

- Morningstar Investor is stronger in mutual fund and ETF analysis, while TradingView Premium is ideal for technical traders with advanced charting tools.

- Motley Fool Epic provides curated stock picks, whereas Seeking Alpha Pro offers in-depth stock analysis and short-selling opportunities.

- Benzinga Pro Essential delivers real-time news but lacks Seeking Alpha’s fundamental research depth.

Additional Features & Tools

Here’s a breakdown of some key features you'll get with the PRO plan:

- Unlimited Access to Earnings Call Transcripts: Pro users can access historical and real-time earnings call transcripts, helping them analyze management insights, company performance, and forward guidance without relying on second-hand summaries.

- Compare Stocks Side-by-Side: Investors can analyze up to six stocks or ETFs at once, comparing key financial metrics, valuation, growth potential, and analyst ratings in a single view.

- Unlimited Access to Premium Articles: Pro users get full access to expert investment research and stock analysis, helping them stay ahead of market trends and discover new opportunities.

- Advanced Portfolio Monitoring & Alerts: Offers real-time portfolio tracking, risk assessments, and automatic alerts for earnings revisions, stock downgrades, and fundamental shifts in holdings.

- Unlimited News Dashboard & Market Insights: Provides faster access to breaking news and analyst commentary, giving investors an edge during market-moving events.

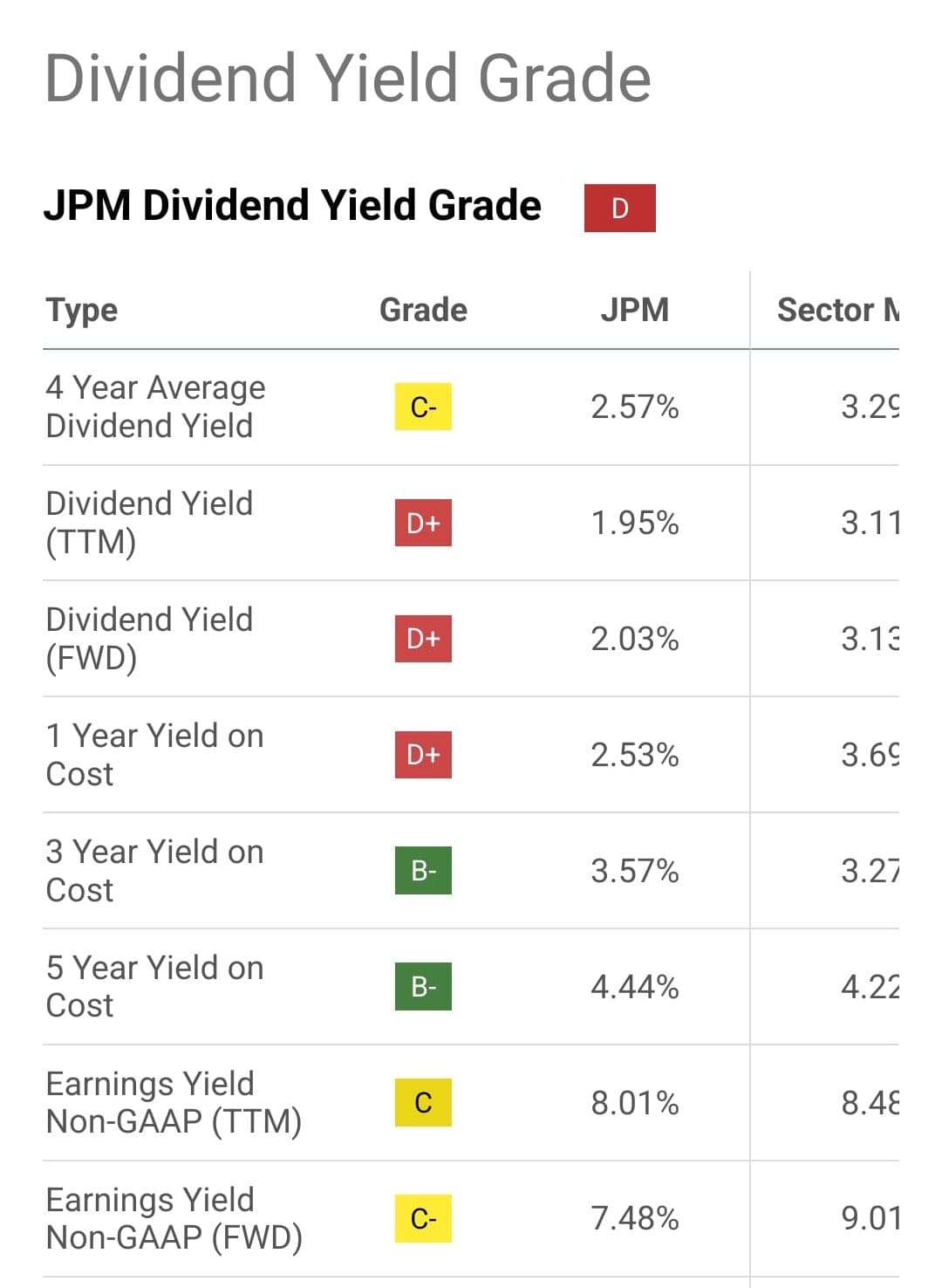

- Dividend Stock Analysis & Safety Scores: Evaluates dividend stocks based on yield, growth, consistency, and payout safety, helping income investors make better long-term choices.

- Author Performance Tracking: Allows users to track the accuracy and performance of Seeking Alpha analysts, making it easier to follow top-rated contributors with strong market insights.

- Stock Valuation Models: Provides fair value estimates and factor-based grading, helping investors determine if a stock is undervalued, overvalued, or fairly priced.

- Stock & ETF Comparison Tool: Enables detailed side-by-side comparisons of multiple stocks and ETFs, making it easier to identify strong investment opportunities.

Limitations

While Seeking Alpha Pro enhances stock research with exclusive analyst insights and other great features,it still has some limitations that investors should be aware of:

-

No Advanced Technical Analysis Tools

Seeking Alpha’s stock analysis tools focus heavily on fundamental research, but technical traders are left out.

There are no interactive charts with technical indicators like Ichimoku Cloud, Stochastics, or Fibonacci retracements, which are essential for traders using chart patterns and price action strategies.

TradingView, ThinkorSwim (Schwab), and StockCharts offer customizable charting tools, AI-driven technical analysis, and other advanced tools.

-

No Mutual Fund or Bond Research

Seeking Alpha Pro is primarily focused on stocks and ETFs, meaning mutual fund and bond investors are left without dedicated tools.

If you’re looking for detailed mutual fund rankings, fixed-income research, or bond yield comparisons, Seeking Alpha does not provide in-depth insights in these areas.

Other tools, such as Morningstar Investor and Zacks premium, offer detailed mutual fund research, bond ratings, and risk metrics for diversified portfolios.

-

No Real-Time Stock Prices or Live Market Data

Despite offering faster access to market news and stock ratings, Seeking Alpha Pro does not provide real-time stock prices or live market data.

Price updates are still delayed, which can be a drawback for active traders who need second-by-second price movements to make trading decisions.

Interactive Brokers, and Bloomberg Terminal provide live stock data, Level 2 market depth, and real-time news updates.

Which Investors/Traders May Be a Good Fit?

Seeking Alpha Pro is designed for investors who want expert insights, exclusive stock analysis, and advanced research tools. Here’s who may benefit the most:

- Long-Term & Fundamental Investors: Those who focus on deep stock research, company financials, and valuation models will find the Quant Ratings, stock rankings, and premium articles valuable.

- Growth & Value Investors: Seeking Alpha Pro helps investors identify strong growth stocks and undervalued companies through Factor Grades and expert recommendations.

- Dividend Investors: The dividend safety scores and payout analysis help income investors assess dividend reliability and long-term stability.

- Institutional & Professional Investors: The real-time market insights and performance tracking of top analysts make this platform useful for hedge fund managers, financial professionals, and serious traders.

Which Investors/Traders May Not Be a Good Fit?

While Seeking Alpha Pro offers advanced stock research and exclusive insights, it may not meet the needs of certain investors and traders:

- Day Traders & Scalpers: Lacks real-time stock prices, live order book (Level 2 data), and high-frequency trading tools, making it unsuitable for short-term, rapid trades.

- Technical & Chart-Based Traders: Does not offer interactive stock charts with advanced indicators like RSI, MACD, or Fibonacci retracements, which are essential for chart pattern and momentum traders.

- Options Traders: Missing options chain data, implied volatility tracking, and advanced options strategies, making it a poor fit for derivatives and options-focused investors.

- Mutual Fund & Bond Investors: Provides little to no research on mutual funds or fixed-income investments, unlike competitors like Morningstar and Zacks.

FAQ

No, Seeking Alpha does not allow stock screener data, stock ratings, or portfolio insights to be exported to Excel or other platforms.

Seeking Alpha mainly focuses on U.S. stocks and ETFs, with limited international stock coverage. Investors needing global market analysis may prefer platforms like Morningstar Direct.

Not really, Pro is best for experienced, self-directed investors. Beginners may find the amount of data overwhelming and may prefer simpler platforms.

Not in detail—Seeking Alpha Pro provides some insights, but it does not offer hedge fund holdings tracking like WhaleWisdom or Bloomberg Terminal.

Yes, Seeking Alpha Pro includes real-time alerts, but notifications may be delayed compared to brokerage platforms.

No, Seeking Alpha does not focus on cryptocurrency markets.

Review Premium Stock Analysis Tools

How We Rated Premium Investing Analysis & Research Tools

At The Smart Investor, we evaluated premium investment research platforms based on their advanced features, data depth, and overall value compared to other paid alternatives. Each platform was rated based on the following key aspects:

- Advanced Fundamental Analysis Tools (20%): We assessed the depth of financial data, historical reports, earnings forecasts, and valuation models. Platforms that provided institutional-grade insights, DCF analysis, customizable financial models, and access to premium analyst reports scored higher.

- Advanced Technical Analysis Features (20%): We reviewed the availability of real-time charting, advanced indicators, custom scripting, and AI-driven pattern recognition. Platforms that offered backtesting tools, automated trading strategies, and integration with third-party software received better ratings.

- Stock Screener & Premium Filters (15%): A high-quality screener is essential for pro investors, so we evaluated customization depth, real-time filtering, and AI-driven stock discovery. Platforms offering pre-built expert screeners, backtesting capabilities, and sector-specific analytics scored the highest.

- Portfolio Tracking & Advanced Alerts (10%): We rated platforms on their ability to provide real-time performance tracking, portfolio rebalancing tools, and tax optimization insights. Platforms with smart alerts, AI-driven risk assessments, and brokerage integration ranked higher.

- Ease of Use & Customization (15%): We assessed how well premium platforms balance advanced capabilities with user-friendly interfaces. Those offering custom dashboards, API access, and seamless multi-device usability received better ratings.

- Pricing (20%): We considered how the plan's pricing compared to other premium plans and what benefits traders/investors get. Is it worth it overall?