Yahoo Finance Bronze plan

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Pros & Cons

The Yahoo Finance Bronze plan enhances the free version by adding portfolio performance tracking, risk analysis, and market sentiment insights.

Investors can see how their portfolio is performing over time, check for volatility risks, and visualize sector diversification—helping them make more informed investment decisions.

Beyond the Bronze-exclusive features, users still benefit from stock screeners, fundamental analysis tools, and customizable watchlists.

The plan also includes live market hours chat support, making it easier to get assistance while markets are open.

While the plan offers strong portfolio analysis tools, it lacks premium stock research, advanced technical charting, and real-time institutional trading data, which are available in higher-tier plans like Silver and Gold.

- Portfolio performance tracking

- Volatility & risk exposure

- Sector diversification insights

- Stock & ETF screener

- Real-time stock quotes

- Company financials overview

- Basic stock charting tools

- Customizable watchlists & alerts

- Community sentiment insights

- Daily investment newsletter

- Live market hours chat

- Ad-free experience & support

- Portfolio performance tracking

- Volatility risk analysis

- Sector diversification insights

- Real-time market support

- Ad-free browsing experience

- No premium stock research

- Limited technical charting

- No AI trade recommendations

- Lacks institutional trading data

- Basic analyst research access

Pricing And Plans: Yahoo Finance Bronze vs Higher Tiers

The Yahoo Finance Bronze plan is the entry-level premium tier, offering portfolio performance tracking, volatility risk analysis, and sentiment insights beyond the free plan.

However, it lacks analyst research reports, Morningstar ratings, and premium news sources found in Yahoo Finance Silver.

Plan | Monthly Subscription |

|---|---|

Yahoo Finance – Bronze | $9.95

$95.40 ($7.95 / month) if paid annually |

Yahoo Finance – Silver | $24.95

$239.40 ($19.95 / month) if paid annually |

Yahoo Finance – Gold | $49.95

$479.40 ($39.95 / month) if paid annually |

Compared to Yahoo Finance Gold, Bronze is much more limited in stock screeners, historical financial data, and technical charting tools.

It’s a good upgrade for casual investors who need basic risk management and portfolio insights but don’t require advanced fundamental tools.

What's New With The Bronze Plan?

The Yahoo Finance Bronze plan offers additional tools for investors that enhance the free plan. However, this is still far from the advanced options in the higher tiers:

-

Portfolio Performance Analysis

We tested the portfolio performance analysis tool and found it incredibly helpful for tracking investment returns, asset allocation, and historical performance.

Unlike the free plan, which only shows basic price movements, this feature provides a more detailed breakdown of how your investments are performing over time.

Investors can view gains and losses across different timeframes, compare portfolio returns against market benchmarks like the S&P 500 or Nasdaq, and identify trends in their portfolio’s performance.

This is particularly useful for long-term investors who want to make data-driven decisions about holding, selling, or rebalancing their portfolios.

For traders, this tool helps in reviewing past trades, tracking overall strategy effectiveness, and adjusting positions based on past performance.

-

Check Volatility & Risk Exposure

The volatility and risk exposure tool is particularly useful for investors looking to understand the risk levels in their portfolio.

The tool allows users to assess how volatile their holdings have been over time, which is crucial for both long-term investors and short-term traders.

By analyzing historical price swings, standard deviation, and beta values, investors can see which stocks or ETFs carry more risk and which are stable long-term assets.

This is a key feature for those who want to avoid overexposure to highly volatile stocks or rebalance their investments for a more stable approach.

-

Visualize Holdings Characteristics

One of the standout features we analyzed was the visualize holdings characteristics tool, which provides a real-time overview of your portfolio’s assets.

Instead of just looking at a list of stocks, investors get easy-to-read visualizations that show how their investments are distributed across industries, market caps, and asset classes:

If you realize that most of your holdings are concentrated in tech stocks, for example, you can consider rebalancing into other sectors like healthcare or energy.

Additional Unique Bronze Plan Features & Tools

Here are some additiona features that available only for the Bronze plan (and higher tiers):

- Community Sentiment Insights: Get access to investor sentiment data, including how other traders feel about a particular stock—helpful for gauging market trends and hype levels.

- Subscriber-Only Daily Newsletter: Receive exclusive market analysis, stock picks, and investment insights delivered to your inbox daily.

- Live Market Hours Chat Support: Get real-time support during trading hours, ensuring you have help when managing investments.

- Ad-Free Experience + 24/7 Account Support: Enjoy distraction-free browsing with no ads and access to customer support anytime.

How To Analyze & Research With The Bronze Plan?

The Yahoo Finance Bronze plan offers basic stock analysis tools and a broad market research including real time quotes:

-

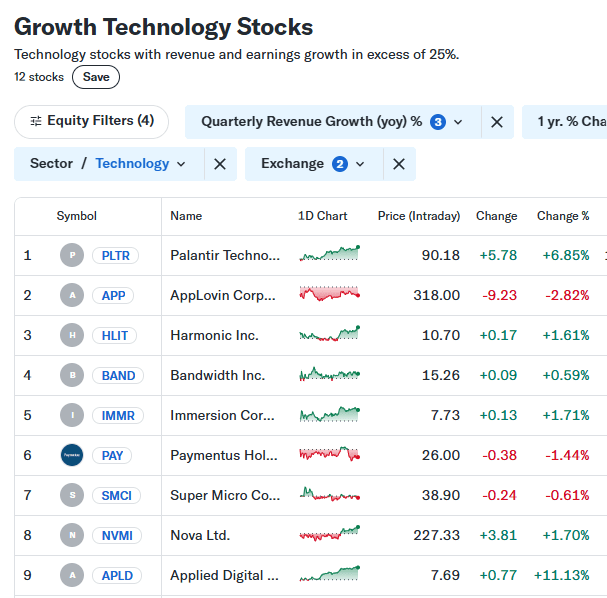

Stock & ETF Screener

We tested the Yahoo Finance Stock & ETF Screener, and it remains one of the best free tools for filtering stocks and ETFs based on key financial metrics.

It’s great for investors looking to find undervalued stocks, growth opportunities, or high-dividend payers.

Bronze users can screen for stocks by sector, region, market cap, price, and more. ETF investors can filter funds by sector exposure, fund net assets, region, annual return, Morningstar performance, and volume.

While the free plan offers solid screening options, higher-tier plans provide even more advanced filters like technical indicators and premium stock picks.

-

Real-Time Stock Quotes & Market Data

We found Yahoo Finance’s real-time stock quotes highly useful for staying on top of live market moves.

Unlike other platforms with 15-minute delays, Yahoo Finance Free and Bronze users get real-time data for U.S. stocks, which is essential for traders and active investors.

Whether you’re monitoring price action before making a trade or tracking your long-term holdings, having access to instant stock price updates makes decision-making easier.

This feature pairs well with watchlists and price alerts, helping investors react faster to news and market trends.

-

Company Financials Overview & Fundamental Analysis

One of the most valuable tools in Yahoo Finance Bronze is the Company Financials Overview, which allows investors to analyze a company's financial health and performance.

This feature provides access to income statements, balance sheets, and cash flow reports, helping investors evaluate a company's profitability, debt levels, and cash flow strength.

For fundamental investors, these tools help make data-driven investment decisions, ensuring that they invest in financially stable, growing companies.

-

Basic Stock Charts & Technical Indicators

Yahoo Finance’s free stock charting tool is great for basic stock analysis. You can view historical price trends, compare multiple stocks, and add technical indicators like Moving Averages and RSI.

For casual traders and long-term investors, this tool helps spot trends and confirm stock entry points.

However, active traders may find it lacking since advanced charting tools, 50+ technical patterns, and historical data exports are only available in Yahoo Finance Gold.

While it’s not a replacement for TradingView or ThinkorSwim, it’s a great option for those who want a simple way to visualize stock trends without additional cost.

-

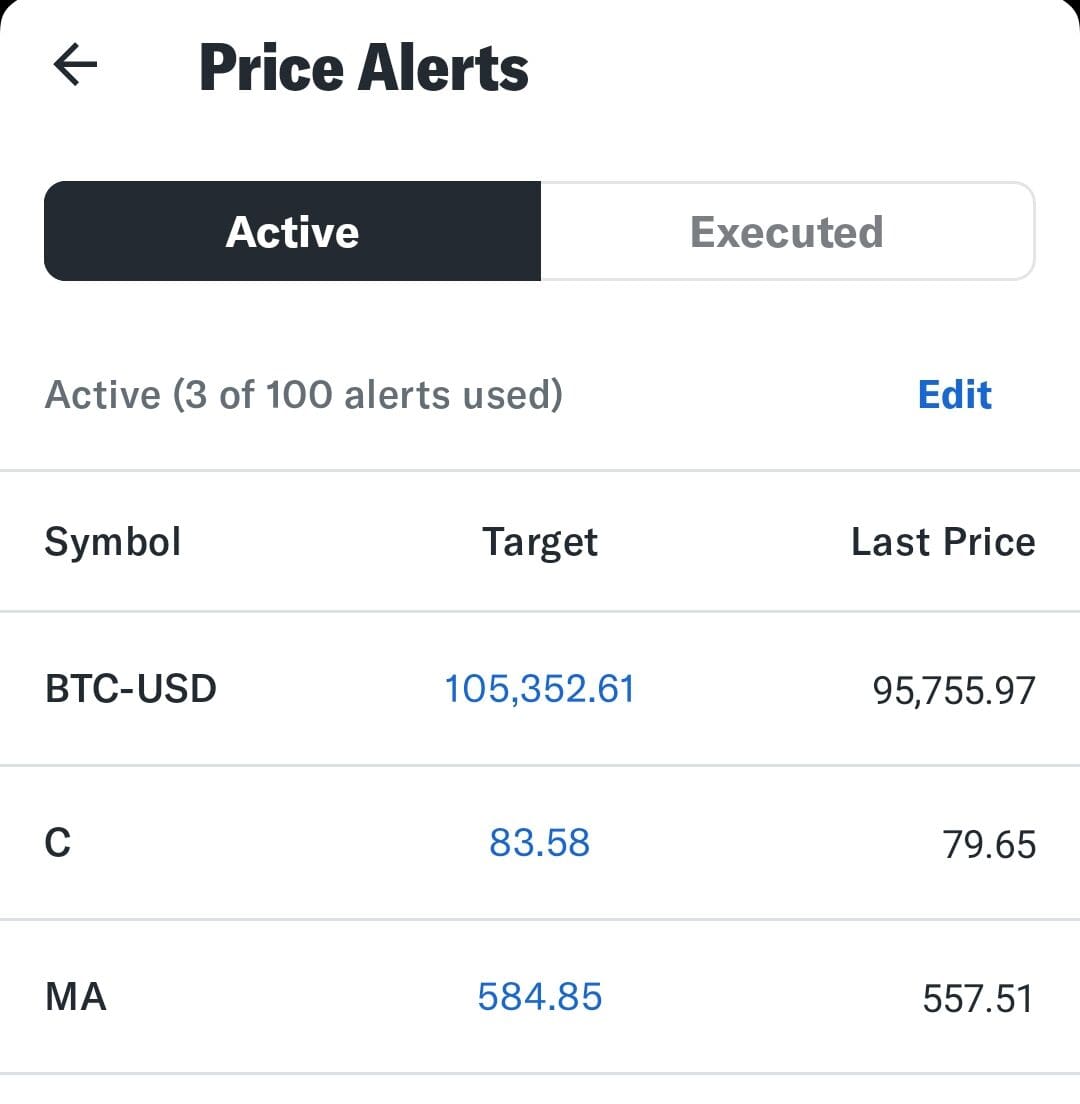

Watchlists & Unlimited Alerts

With the Yahoo Finance’s watchlist and alerts system, you can create customized watchlists, add unlimited stocks, and set up alerts for price changes, volume spikes, and news events.

For long-term investors, it’s useful for monitoring stocks on your radar before buying. For traders, alerts help track breakout levels, earnings surprises, and analyst rating changes.

One limitation is that technical pattern alerts are only available in higher-tier premium plans, so traders who rely on chart signals and momentum trading indicators may need additional tools.

Hidden Features of Yahoo Finance Bronze Plan

Beyond its core features, Yahoo Finance Bronze provides additional tools that help investors analyze stocks, track risk, and make more informed financial decisions.

Here are additional tools available to Bronze users:

- Market Summary & Sector Performance – Spot Market Trends Fast: Get a quick overview of market sectors and see which industries are gaining or losing momentum, helping investors make sector-based investing decisions.

- Cryptocurrency Market Tracker – Monitor Bitcoin & Altcoins: Follow real-time prices, market cap, and historical trends for Bitcoin, Ethereum, and altcoins, keeping track of the crypto market alongside traditional investments.

- Earnings Calendar – Track Key Earnings Reports: Stay on top of upcoming earnings announcements and see past results to anticipate market reactions and price movements.

- Insider Trading & Institutional Holdings: See which company executives and hedge funds are buying or selling stocks, helping investors gauge confidence levels from insiders.

- ETF & Mutual Fund Performance Comparisons: Compare ETF and mutual fund performance, fees, and sector exposure, making it easier to find the best investment funds for your portfolio.

- Market Movers & Trending Stocks: Instantly spot biggest gainers, losers, and most actively traded stocks, helping traders identify momentum plays and breakout stocks.

- Live Market News & Video Streams: Stay updated with real-time financial news, expert analysis, and live market commentary, offering valuable insights during trading hours.

- Commodities & Forex Market Data: Monitor live prices for gold, silver, oil, and forex pairs, keeping track of global economic trends and inflation hedges.

Where Yahoo Finance Bronze Falls Short

While the Yahoo Finance Bronze plan is a step up from the free version, it still has some limitations:

-

No Premium Stock Ratings or Deep Analyst Research

Yahoo Finance Bronze lacks exclusive stock ratings and premium analyst reports from firms like Morningstar, Argus Research, and The Information, which are included in Yahoo Finance Silver and Gold.

This means investors using the Bronze plan must rely on free financial data and public analyst opinions instead of getting expert-backed stock recommendations.

-

Limited Technical Analysis & Charting Features

While Bronze users still have access to basic stock charts with technical indicators, the platform lacks advanced charting tools, custom overlays, and historical price pattern recognition.

Gold plan subscribers get access to 50+ chart patterns, deeper technical event insights, and the ability to export historical stock data to CSV files – features that active traders need.

-

No AI-Powered Trade Ideas or Smart Screener Insights

Many modern stock research platforms, such as Zacks Premium, use AI-driven trade suggestions, hedge fund tracking, and backtested strategies.

Yahoo Finance Bronze does not include personalized trade ideas, hedge fund activity alerts, or AI-powered screening recommendations, which are common in premium stock research tools and stock advisor apps.

Which Investors Gain the Most?

The Yahoo Finance Bronze plan is ideal for investors and traders who want deeper portfolio insights, and risk tracking.

Here’s who can benefit the most:

Long-Term Investors: Great for those who want to track their portfolio performance over time, analyze risk exposure, and ensure diversification without needing real-time trading tools.

Dividend & Income Investors: The dividend analysis and fair value insights help investors identify strong dividend-paying stocks and ETFs for long-term income generation.

ETF & Passive Investors: Useful for evaluating sector exposure, comparing ETFs, and tracking how different industries are performing.

Casual Traders & Market Watchers: Ideal for those who don’t need advanced stock analysis or AI-powered trade ideas but want a cleaner, ad-free experience with better portfolio insights.

Yahoo Finance Bronze: Who It’s Not For

While Yahoo Finance Bronze offers solid portfolio insights and stock tracking tools, it may not be the best fit for all investors. Here’s who might find it lacking:

Day Traders & Active Traders: Without Level 2 market data, real-time order book depth, and advanced technical screeners, it’s not built for high-frequency trading or day trading strategies.

Investors Who Rely on Analyst Research: The Bronze plan doesn’t include premium research reports, stock ratings, or buy/sell recommendations, which are common in Seeking Alpha Premium, Zacks, and Morningstar.

Serious Technical Analysts: The basic stock charts and limited technical indicators make it less useful for traders who rely on in-depth charting and price action strategies.

Institutional & Hedge Fund-Inspired Investors: Unlike platforms that track hedge fund movements and AI-generated trade ideas, Yahoo Finance Bronze doesn’t offer advanced screening tools for smart money insights.

Yahoo Finance Bronze Plan Compared to Competitors

Yahoo Finance Bronze competes with entry-level premium stock research services like Zacks Premium, Morningstar Investor, MarketBeat All Access and InvestingPro.

Plan | Subscription | Promotion |

|---|---|---|

Morningstar Investor | $34.95

$249 ($20.75 / month) if paid annually | 7-Day free trial |

Zacks Premium | $249 ($20.75/month)

No monthly plan | 30-day free trial |

Motley Fool Stock Advisor | $199 (16.60 / month)

No monthly plan

| 30-day money-back guarantee |

Benzinga Pro | $37

$367 ($30.58 / month) if paid annually | $129

$129 for new member’s annual price ($11/month), including 7-day money-back guarantee

|

GuruFocus Premium | $499 ($41.58/ month)

No monthly plan, price for US citizens, price change by region | 7-day free trial + 30-day money-back guarantee |

StockTwits Edge | $22.95

$229.50 ($19.10 / month) if paid annually

| N/A |

Stock Analysis | $9.99

$79 ($6.58 / month) if paid annually | 60-day money back guarantee |

While it provides solid portfolio tracking and lower price, it lacks deep stock ratings, AI-driven trade ideas, and advanced fundamental research reports that competitors offer.

FAQ

Yes, the Yahoo Finance app for iOS and Android supports Bronze features, including portfolio tracking, stock screeners, and sentiment insights.

Yes, it provides breaking financial news and market updates in real time, but premium news sources like Financial Times and The Information require Silver or Gold.

Yes, but availability of real-time quotes and data depends on the country and stock exchange. Some international stock data may be delayed.

No, only the Gold plan allows exporting historical stock prices to CSV files for deeper custom analysis.

No, Bronze includes the basic stock and ETF screener, but advanced technical screeners and Smart Money insights require Gold.

No, analyst stock ratings and recommendations from Morningstar, Argus, and The Information are only available in Silver and Gold.

Yes, it helps users track 401(k), IRA, and other investment accounts, but it doesn’t include tax-optimization insights like Empower or Fidelity.

Silver includes premium news sources, Morningstar stock ratings, research reports, and advanced stock analysis, making it better for in-depth research.

Review Premium Stock Analysis Tools

How We Rated Premium Investing Analysis & Research Tools

At The Smart Investor, we evaluated premium investment research platforms based on their advanced features, data depth, and overall value compared to other paid alternatives. Each platform was rated based on the following key aspects:

- Advanced Fundamental Analysis Tools (20%): We assessed the depth of financial data, historical reports, earnings forecasts, and valuation models. Platforms that provided institutional-grade insights, DCF analysis, customizable financial models, and access to premium analyst reports scored higher.

- Advanced Technical Analysis Features (20%): We reviewed the availability of real-time charting, advanced indicators, custom scripting, and AI-driven pattern recognition. Platforms that offered backtesting tools, automated trading strategies, and integration with third-party software received better ratings.

- Stock Screener & Premium Filters (15%): A high-quality screener is essential for pro investors, so we evaluated customization depth, real-time filtering, and AI-driven stock discovery. Platforms offering pre-built expert screeners, backtesting capabilities, and sector-specific analytics scored the highest.

- Portfolio Tracking & Advanced Alerts (10%): We rated platforms on their ability to provide real-time performance tracking, portfolio rebalancing tools, and tax optimization insights. Platforms with smart alerts, AI-driven risk assessments, and brokerage integration ranked higher.

- Ease of Use & Customization (15%): We assessed how well premium platforms balance advanced capabilities with user-friendly interfaces. Those offering custom dashboards, API access, and seamless multi-device usability received better ratings.

- Pricing (20%): We considered how the plan's pricing compared to other premium plans and what benefits traders/investors get. Is it worth it overall?