Yahoo Finance Silver plan

Monthly Subscription

Promotion

Our Rating

Best For

- Overview

- Features

- Pros & Cons

The Yahoo Finance Silver plan is designed for investors looking for premium stock research, expert ratings, and deeper fundamental analysis beyond what the Free and Bronze plans offer.

It provides access to Morningstar stock ratings, Argus Research stock picks, and thousands of professional research reports, making it a powerful tool for long-term investors and fundamental analysts.

One of the most valuable features is the premium newsfeed, which includes Financial Times and The Information, and model portfolio strategies feature that helps guide investors with pre-built stock and ETF portfolios.

Alongside the stock screener, market-moving news, earnings reports and calendar, and market sector performance tracker, investors can quickly filter stocks, track financials, and stay informed on key events.

However, the Silver plan lacks advanced technical analysis tools, AI-powered stock picks, and Level 2 market data, making it less suitable for active traders and day traders.

- Morningstar stock ratings

- Argus Research picks

- Model portfolio strategies

- Premium financial news

- Stock & ETF screener

- Real-time stock quotes

- Portfolio risk analysis

- Company financials overview

- Stock charts & indicators

- Unlimited price alerts

- Insider trades tracking

- Earnings calendar access

- Expert-backed stock research

- Premium news access

- Morningstar & Argus ratings

- Model portfolio strategies

- Real-time stock quotes

- No advanced charting tools

- Limited global market data

- Lacks Level 2 market data

- No portfolio optimization tools

- Not ideal for day traders

Yahoo Finance Silver: Pricing And Comparison

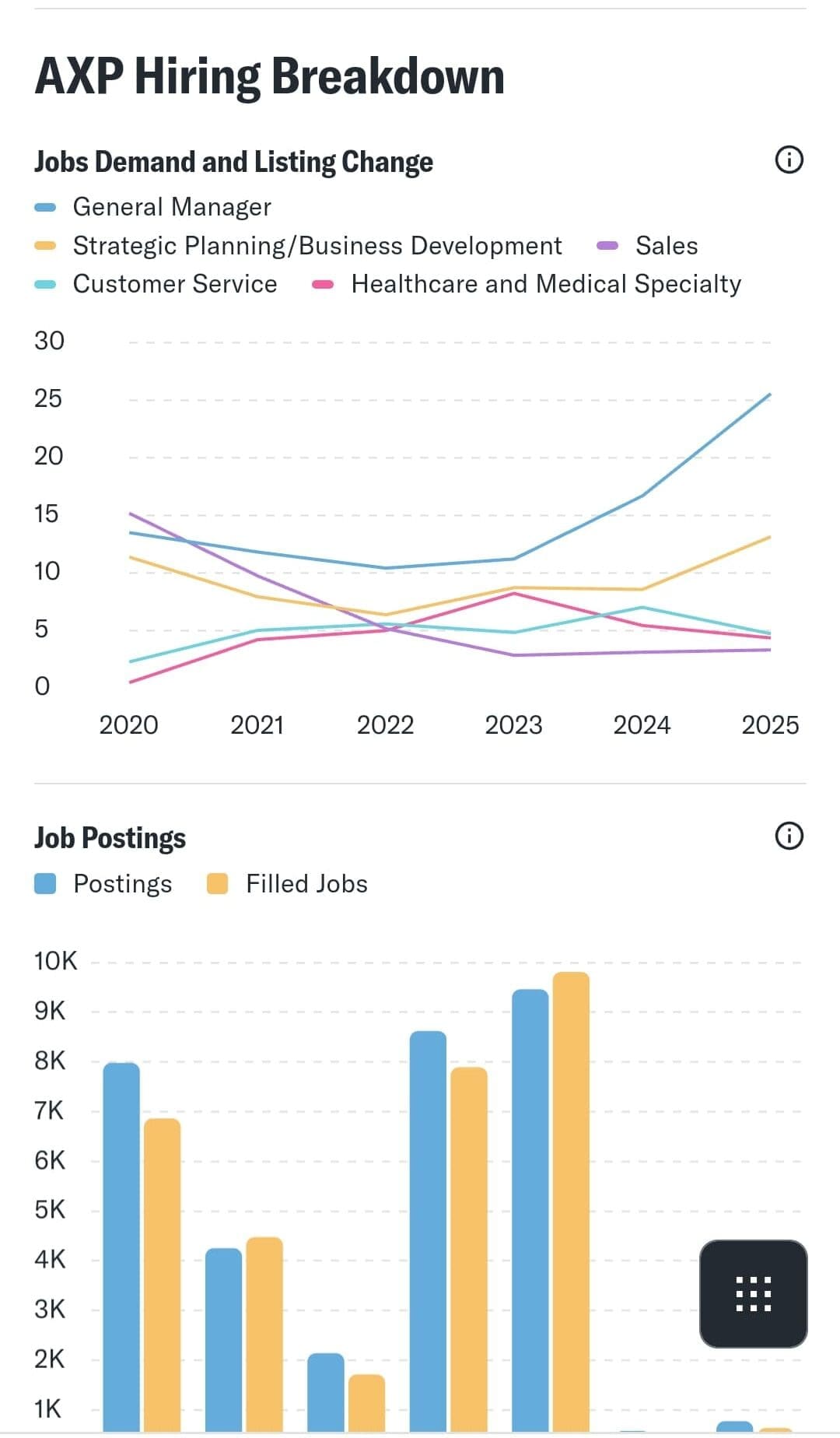

The Yahoo Finance Silver plan is a mid-tier option that builds on Bronze plan. It offers deeper stock research and expert-backed insights, making it ideal for fundamental investors and long-term stockholders.

Plan | Monthly Subscription |

|---|---|

Yahoo Finance – Bronze | $9.95

$95.40 ($7.95 / month) if paid annually |

Yahoo Finance – Silver | $24.95

$239.40 ($19.95 / month) if paid annually |

Yahoo Finance – Gold | $49.95

$479.40 ($39.95 / month) if paid annually |

However, it lacks advanced technical analysis tools, personalized trade ideas, and historical financial data, which are included in Yahoo Finance Gold.

Silver Plan Stock Recommendations & Research

The Yahoo Finance Silver plan offers many additional highly regarded resources to provide more advanced stock research and picks for investors.

-

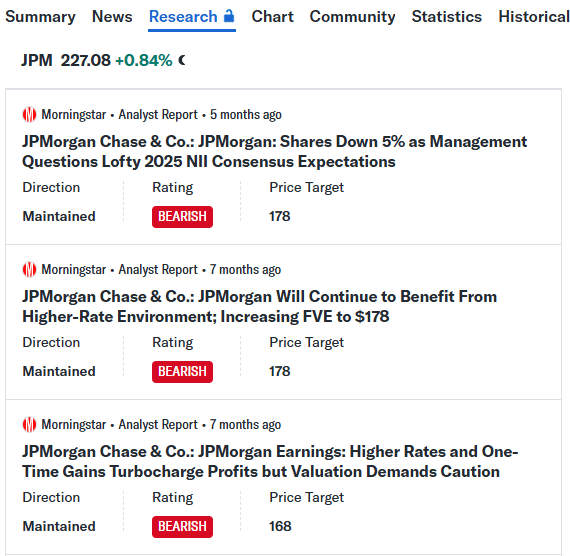

Morningstar Stock Ratings - Expert-Backed Investment Research

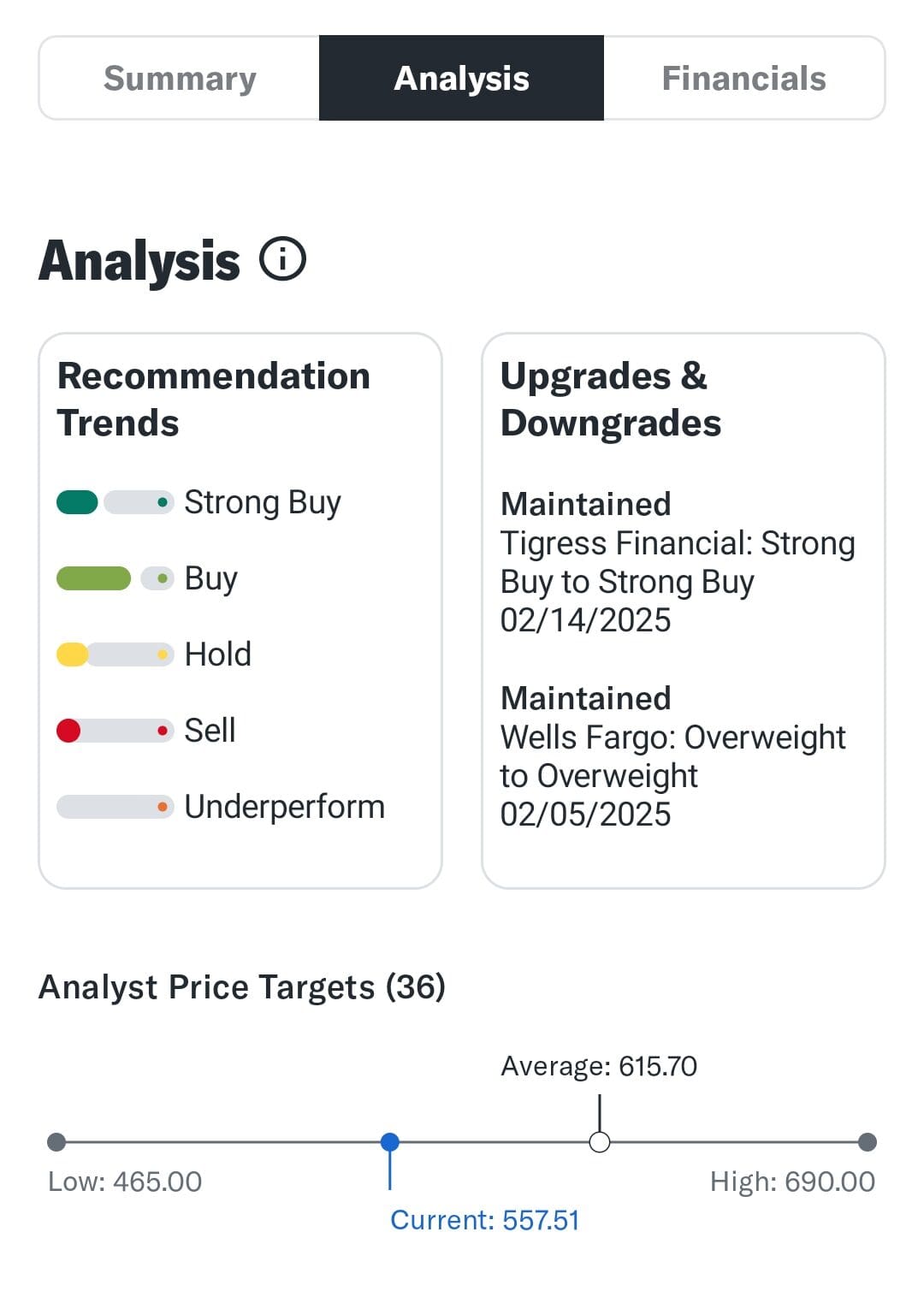

We tested the Morningstar stock ratings feature in Yahoo Finance Silver and found it incredibly valuable for fundamental investors looking for professional-grade research.

Unlike free stock rating apps, Morningstar’s analysis considers deep financial data, fair value estimates, and competitive positioning.

Each stock comes with a star rating system (1 to 5 stars), helping investors quickly assess whether a stock is overvalued, fairly valued, or undervalued.

For dividend investors, Morningstar also provides insights into dividend safety, payout ratios, and long-term sustainability, helping users identify stable income-generating stocks.

-

Argus Research Stock Picks - Analyst Recommendations

The Argus Research stock picks feature in Yahoo Finance Silver provides expert stock recommendations backed by independent analysis.

Argus provides detailed buy, hold, and sell ratings with deep insights into company financials and market positioning.

We found that these reports are particularly useful for investors who want a second opinion from a trusted research firm.

Unlike stock tips from general news sources, Argus focuses on earnings potential, sector outlooks, and macroeconomic conditions, helping investors make more data-driven decisions.

This feature is ideal for stock investors who want high-quality, research-backed stock ideas but don’t want to pay for expensive institutional services like Bloomberg Terminal or FactSet.

-

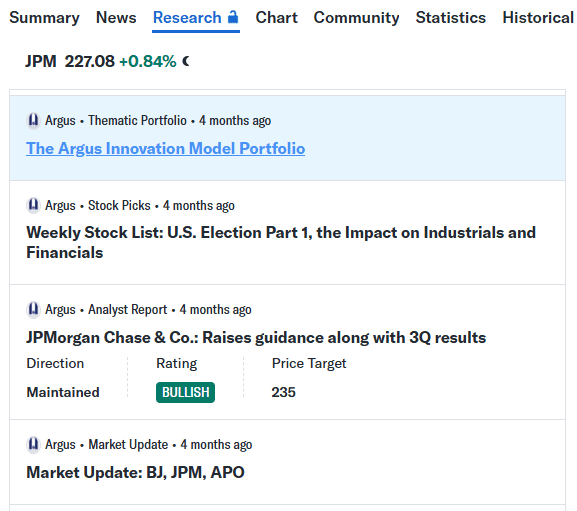

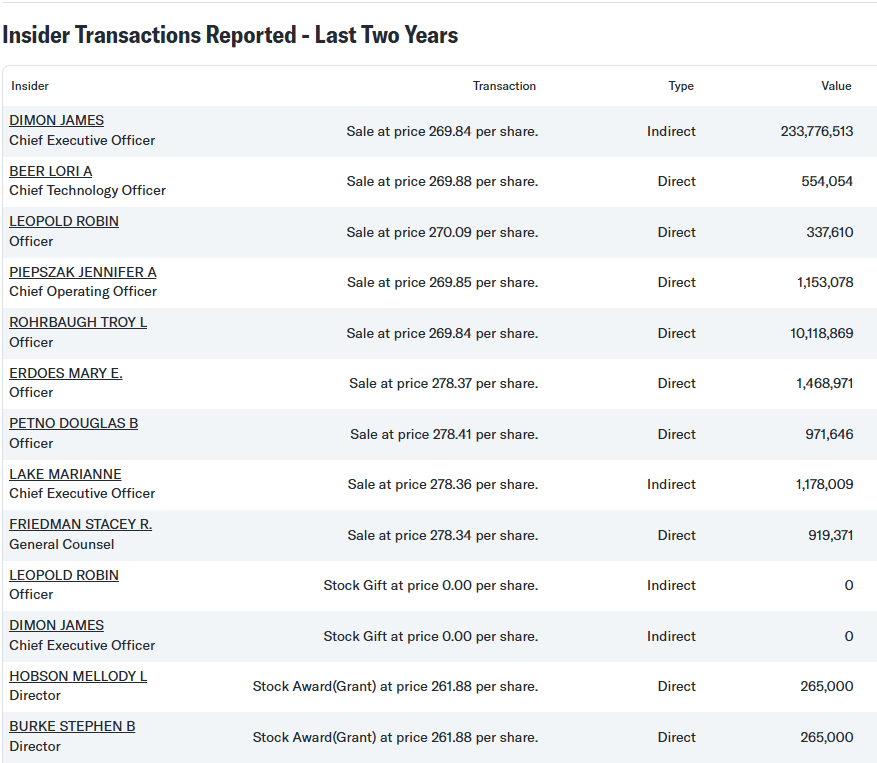

Insider Trades & Hiring Scores

The Yahoo Finance Silver’s Insider Trades & Hiring Scores is an insightful tool for tracking smart money movements.

Unlike the free version, which offers limited insider trade data, this feature provides detailed insights into executive and institutional buying and selling activity.

For stock investors, insider trading trends can signal management confidence or concern about a company’s future.

If CEOs or CFOs are heavily buying shares, it could indicate strong future growth expectations.

The Hiring Scores tool helps investors understand company growth trends by analyzing employee expansion or layoffs.

This is particularly useful in sectors like tech and finance, where workforce shifts can impact stock prices.

-

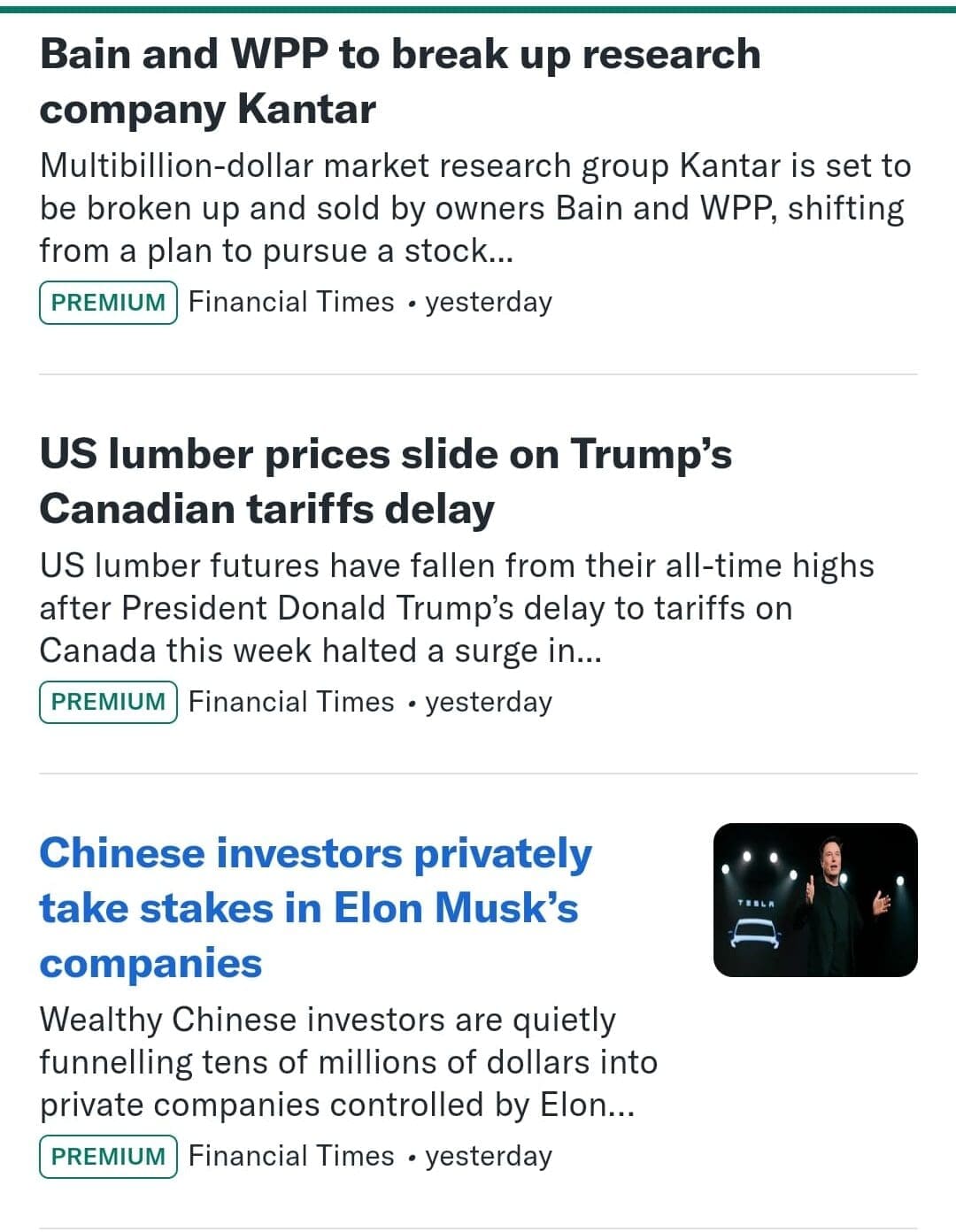

Financial Times & The Information – Exclusive Market News

One of the standout features of Yahoo Finance Silver is the inclusion of premium news sources like Financial Times and The Information.

These are high-quality financial news services that are often paywalled, but Silver users get full access as part of their subscription.

- Financial Times provides in-depth global market analysis, geopolitical insights, and economic trend forecasts.

- The Information focuses on tech industry analysis, startup trends, and venture capital news, making it a must-read for tech investors.

Additional Unique Silver Plan Features & Tools

Beyond the Bronze and Free plan features, Yahoo Finance Silver introduces premium research, stock ratings, and guided investment insights.

Here’s a breakdown of some of its standout features:

Model Portfolio Strategies & Guided Investment Plans: Get access to expert-designed portfolios tailored to different risk levels and investment goals. These model portfolios help investors build a diversified portfolio without needing to pick individual stocks from scratch.

Premium Newsfeed: Stay ahead of the market with exclusive financial news from sources like Financial Times and The Information, typically available only to institutional investors.

- Fair Value & Dividend Analysis: Evaluate stocks with detailed fair value estimates, dividend growth analysis, and payout sustainability insights. This feature helps long-term investors identify undervalued opportunities.

Research & Ratings Alerts: Receive real-time notifications when stocks get upgraded, downgraded, or receive new research reports.

How To Analyze Stocks With Yahoo Finance Silver?

Besides researching and finding new opportunities, the Yahoo Finance Silver plan also offers various analysis tools:

-

Stock & ETF Screener

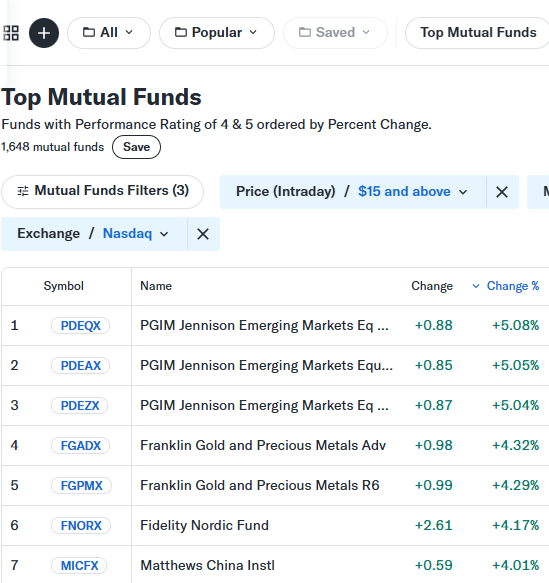

Yahoo Finance Silver users still get access to the stock screener, which we found extremely useful for narrowing down investment choices.

This tool allows investors to filter stocks and ETFs based on market cap, dividend yield, sector, region, market cap, price, and analyst ratings.

For value investors, screening for undervalued stocks using fair value estimates is a major plus.

Growth investors can filter stocks by earnings per share (EPS) growth and revenue trends, while dividend investors can focus on yield and payout ratios.

-

Real-Time Stock Quotes & Market Data

Yahoo Finance Silver users still get access to real-time stock quotes, ensuring they see the latest price updates without delays.

When testing this feature, we found it especially useful for traders and active investors who rely on up-to-the-minute price changes to make informed trades.

Yahoo Finance Silver provides real-time updates for U.S. stocks, ETFs, and crypto, making it easier to track price movements as they happen.

-

Portfolio Performance & Risk Analysis

We tested the Portfolio Performance and Risk Analysis feature, and it provides a deeper understanding of investment returns, sector exposure, and risk levels.

This tool goes beyond simple stock tracking, offering visualized breakdowns of portfolio diversification, volatility, and performance over time.

For investors who hold multiple stocks, ETFs, or crypto, this feature helps measure whether a portfolio is properly balanced or overexposed to risky assets.

Compared to free users, Silver subscribers get more advanced risk metrics and insights into portfolio volatility.

-

Company Financials Overview & Fundamental Analysis

One of the most valuable tools in Yahoo Finance Silver (and all other tiers) is the company financials overview, which allows investors to analyze a company's financial health and performance.

This feature provides access to income statements, balance sheets, and cash flow reports, helping investors evaluate a company's profitability, debt levels, and cash flow strength.

For fundamental investors, these tools help make data-driven investment decisions, ensuring that they invest in financially stable, growing companies.

-

Stock Charts & Technical Indicators

Yahoo Finance’s stock charting tool is great for basic stock analysis. You can view historical price trends, compare multiple stocks, and add technical indicators like Moving Averages and RSI.

For casual traders and long-term investors, this tool helps spot trends and confirm stock entry points.

However, active traders may find it lacking since advanced charting tools, 50+ technical patterns, and historical data exports are only available in Yahoo Finance Gold.

While it’s not a replacement for TradingView or ThinkorSwim, it’s a great option for those who want a simple way to visualize stock trends without additional cost.

-

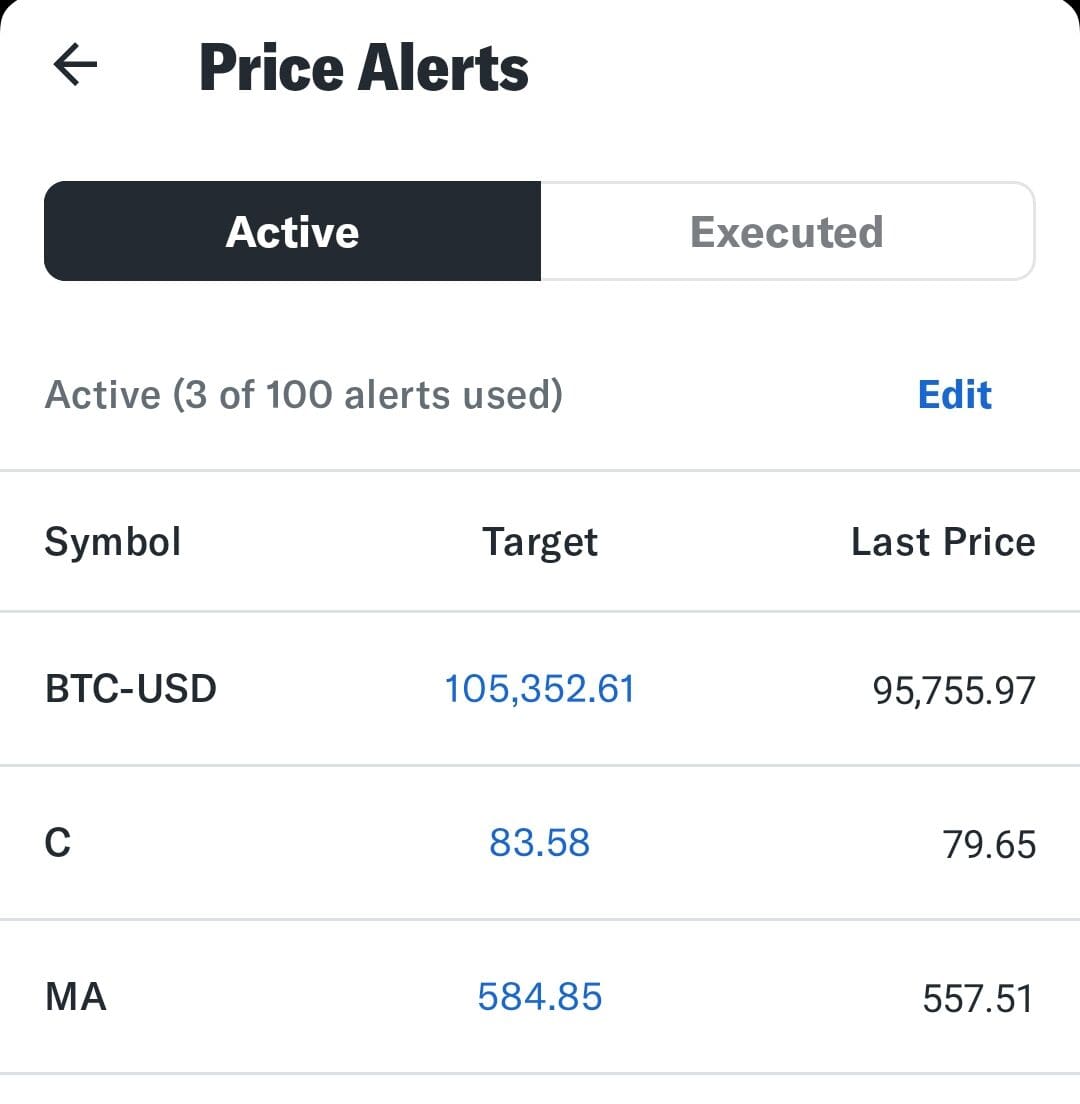

Watchlists & Unlimited Price Alerts

Silver users can set up unlimited stock alerts for price changes, earnings updates, and rating revisions.

For swing traders, this is a game-changer—it allows them to track breakout stocks and react to price movements immediately.

Long-term investors can set buy alerts when a stock drops to a target price, making it easier to wait for the right entry point.

Unlike free users who only get basic price alerts, Silver members receive rating alerts and analyst upgrade notifications, which provide even more valuable stock insights.

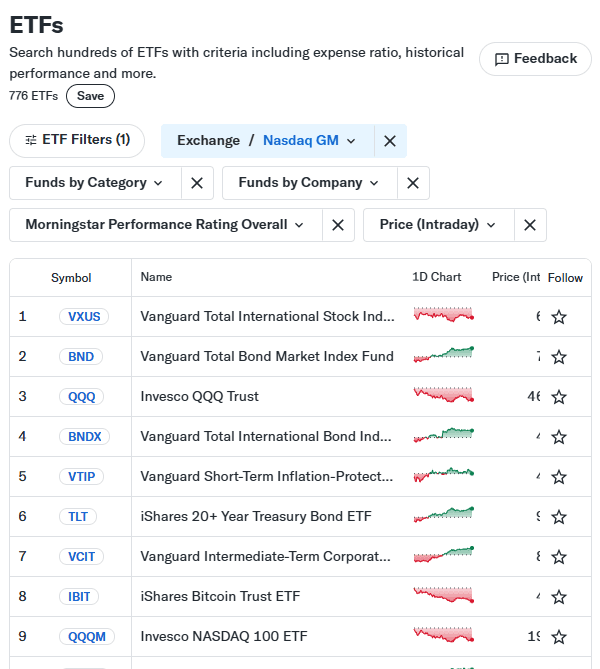

More Investment Tools in Yahoo Finance Silver

Beyond premium news and research, Yahoo Finance Silver provides more tools. Here are more features that Silver users can take advantage of:

- Cryptocurrency Market Tracker: Monitor real-time Bitcoin (BTC), Ethereum (ETH), and other altcoin prices alongside traditional investments. Silver users also gain access to premium crypto analysis and market trends.

- Market Summary & Sector Performance: Get a real-time snapshot of leading and lagging market sectors, helping investors make sector-based investment decisions based on performance trends.

- Earnings Calendar: Track upcoming earnings reports, forecast estimates, and historical trends, ensuring traders and investors prepare for potential price swings before earnings announcements.

- Live Market Hours Chat Support: Get real-time customer support during trading hours, ensuring users receive fast answers to platform-related questions while the market is open.

- ETF & Mutual Fund Screener: Filter ETFs and mutual funds based on expense ratios, sector exposure, performance history, and asset allocation, ensuring users find the best funds to match their investment goals.

- IPO & SPAC Tracker: Stay updated on upcoming IPOs and SPAC mergers, allowing investors to monitor new stock listings and potential high-growth opportunities.

- Stock Comparison Tool: Compare multiple stocks side-by-side based on valuation, financials, and analyst ratings, making it easier to identify strong investment opportunities.

- Commodities & Forex Data: Track real-time prices for gold, silver, oil, and forex pairs, allowing investors to monitor global economic trends and currency movements.

Yahoo Finance Silver: Where It Falls Short

The Yahoo Finance Silver plan is a significant upgrade over the free and Bronze versions, offering premium news sources, stock ratings, and model portfolio strategies. However, it still has some limitatio

-

No Advanced Technical Analysis or Charting Tools

While Yahoo Finance Silver provides basic stock charts and technical indicators, it still lacks advanced charting tools, multi-timeframe analysis, and in-depth technical patterns that traders rely on.

Serious traders looking for customizable chart overlays, pattern recognition, or real-time order book data may need to consider alternative platforms with more sophisticated technical analysis tools.

-

Limited Portfolio Optimization & Asset Allocation Insights

Yahoo Finance Silver includes portfolio performance tracking and diversification insights, but it does not offer deep portfolio optimization tools, tax-efficiency analysis, or automatic rebalancing recommendations.

Competitors like Morningstar Premium, Fidelity’s Wealth Management, and Personal Capital provide asset allocation insights, risk-adjusted return analysis, and tax-efficient investing strategies.

-

Limited Global Market Coverage & International Stock Data

Yahoo Finance Silver focuses primarily on U.S. markets, with limited real-time international stock data and research.

Investors looking for detailed coverage of European, Asian, or emerging markets stocks might find that some international data is delayed or lacks analyst insights.

Competitors like Bloomberg Terminal, FactSet, and Interactive Brokers provide deeper international market access.

Who Should Consider Yahoo Finance Silver?

The Yahoo Finance Silver plan is ideal for investors and traders who want premium research, expert stock ratings, and market insights.

Here’s who will benefit the most:

- Long-Term Investors: Great for those who buy and hold stocks and want access to Morningstar ratings, Argus Research reports, and fair value analysis to validate their investments.

- Fundamental Analysts: Useful for investors who rely on financial statements, stock screeners, and fair value estimates to find undervalued or high-growth stocks.

- Dividend & Income Investors: The dividend analysis tool helps track payout ratios, yield stability, and growth trends, making it easier to build a solid dividend portfolio.

- Investors Who Want Premium Market News: The Financial Times and The Information access provide high-quality institutional-level news, which is essential for making well-informed decisions.

Who Might Not Benefit From Silver?

While Yahoo Finance Silver is great for research-focused investors, it lacks some features that active traders and advanced investors might need. Here’s who might find it limiting:

- Day Traders & High-Frequency Traders: Silver does not offer Level 2 market data, real-time bid/ask spreads, or advanced trading indicators, making it unsuitable for fast-paced trading strategies.

- Options & Futures Traders: The plan lacks options flow tracking, volatility charts, and derivatives analytics, which are essential for traders using complex options strategies.

- Global Market Investors: Yahoo Finance Silver focuses primarily on U.S. stocks, with limited real-time coverage of international markets, making it less useful for those trading foreign equities.

- Investors Seeking Portfolio Optimization Tools: The plan does not include asset allocation optimization, tax-efficiency insights, or robo-advisor-style guidance, which competitors like Morningstar Premium or Personal Capital offer.

Yahoo Finance Silver Plan Compared to Competitors

Yahoo Finance Silver competes with TipRanks Premium, MarketBeat All Access, Zacks Premium, and Morningstar Investor and more.

While it provides analyst ratings, expert stock picks, and premium financial news, it lacks AI-driven trade ideas and predictive analytics that Zacks Premium and TipRanks Premium offer.

Plan | Subscription | Promotion |

|---|---|---|

Morningstar Investor | $34.95

$249 ($20.75 / month) if paid annually | 7-Day free trial |

Zacks Premium | $249 ($20.75/month)

No monthly plan | 30-day free trial |

Motley Fool Stock Advisor | $199 (16.60 / month)

No monthly plan

| 30-day money-back guarantee |

Benzinga Pro | $37

$367 ($30.58 / month) if paid annually | $129

$129 for new member’s annual price ($11/month), including 7-day money-back guarantee

|

GuruFocus Premium | $499 ($41.58/ month)

No monthly plan, price for US citizens, price change by region | 7-day free trial + 30-day money-back guarantee |

StockTwits Edge | $22.95

$229.50 ($19.10 / month) if paid annually

| N/A |

Stock Analysis | $9.99

$79 ($6.58 / month) if paid annually | 60-day money back guarantee |

Morningstar Investor focuses more on mutual funds and ETF analysis, while MarketBeat All Access provides stock alerts and hedge fund activity tracking.

FAQ

No, Silver users only get access to standard historical financials, while Yahoo Finance Gold includes up to 40 years of financial statements.

No, hedge fund activity tracking is not included in the Silver plan. Platforms like Seeking Alpha Pro and WhaleWisdom specialize in hedge fund portfolio tracking.

No, premium reports like Morningstar and Argus Research stock picks are updated periodically, not necessarily every day.

No, data exports are only available in Yahoo Finance Gold, where users can download historical data into CSV files.

No, while Yahoo Finance Silver includes insider trading data, it does not provide real-time alerts for insider stock purchases or sales.

No, Silver only allows linking brokerage accounts for portfolio tracking, but you cannot place trades directly through Yahoo Finance.

Silver focuses on research reports, analyst ratings, and news access, while Gold adds advanced technical analysis, data exports, and personalized trade ideas.

Review Premium Stock Analysis Tools

How We Rated Premium Investing Analysis & Research Tools

At The Smart Investor, we evaluated premium investment research platforms based on their advanced features, data depth, and overall value compared to other paid alternatives. Each platform was rated based on the following key aspects:

- Advanced Fundamental Analysis Tools (20%): We assessed the depth of financial data, historical reports, earnings forecasts, and valuation models. Platforms that provided institutional-grade insights, DCF analysis, customizable financial models, and access to premium analyst reports scored higher.

- Advanced Technical Analysis Features (20%): We reviewed the availability of real-time charting, advanced indicators, custom scripting, and AI-driven pattern recognition. Platforms that offered backtesting tools, automated trading strategies, and integration with third-party software received better ratings.

- Stock Screener & Premium Filters (15%): A high-quality screener is essential for pro investors, so we evaluated customization depth, real-time filtering, and AI-driven stock discovery. Platforms offering pre-built expert screeners, backtesting capabilities, and sector-specific analytics scored the highest.

- Portfolio Tracking & Advanced Alerts (10%): We rated platforms on their ability to provide real-time performance tracking, portfolio rebalancing tools, and tax optimization insights. Platforms with smart alerts, AI-driven risk assessments, and brokerage integration ranked higher.

- Ease of Use & Customization (15%): We assessed how well premium platforms balance advanced capabilities with user-friendly interfaces. Those offering custom dashboards, API access, and seamless multi-device usability received better ratings.

- Pricing (20%): We considered how the plan's pricing compared to other premium plans and what benefits traders/investors get. Is it worth it overall?