Capital One Bank

Fees

Our Rating

Current Promotion

APY Savings

- Overview

- Pros & Cons

- FAQ

Capital One 360 is an excellent choice if you are looking for a high-quality banking service. It offers checking account with no monthly fees, high deposit rates on savings and CDs and good customer service.

With a trusted and reliable service, Capital One 360 offers no hidden fees or minimums as you continue earning interest with your daily money. There are over 38,000 fee-free ATMs and over 2,000 Capital One ATMs, which will successfully meet your needs when accessing your money.

Another great incentive Capital One 360 offers is a free MasterCard Debit Card for all purchases. These are beautiful service additions that prioritize your convenience and ease of use.

Capital One Bank can be a perfect fit if:

You want multiple credit card options

You want to earn better rates on your savings & CDs

You want an online bank

- Competitive savings rates

- No minimum balance to open account

- No overdraft fees

- Limited local branches

- Other banks may have higher APYs

- Is Capital One Worth it for Millenials?

As a major bank, Capital One covers your banking basics with the minimum of fuss. Millennials are also likely to appreciate the convenience and functionality of the accounts. Many of the accounts are fee free and you can access decent rates with savings and CD products. There is also a great app for both Android and iOS devices to help you manage your money on the go.

- Is Capital One Worth it if I have Bad Credit?

Capital One may decline your application for a checking account if you have bad credit. However, the bank does offer several products that can help you to build your credit. The savings accounts offer decent rates, so you can start to build up an emergency fund with no account fees or minimum balance requirements.

- Is my Money Safe on Capital One?

While the share price may have fluctuated a great deal during turbulent financial times, Capital One has remained a safe bank for your funds. The bank is FDIC insured, so customers are protected for up to $250,000 in deposits.

Capital One did receive a $3.5 trillion federal bailout in 2008, but the bank has repaid these funds in full.

- Can you Be Denied on a Capital One Checking Account?

Capital One will go through your application form to determine if you will be approved to open an account. Unfortunately, the accounts are subject to approval, so there is a possibility your application may be denied. Capital One does not have a very basic checking account, so if you are denied, you may need to reapply after you have worked on building your credit.

- Can you buy/invest in gold products via Capital One?

Capital One does not have an investment platform, so it is not possible to buy stocks or shares. This means that if you want to buy or invest in gold products, you will need to find a broker, as it will not be possible to make these trades via Capital One.

Capital One 360 Bank Review

Banking Services | Credit Options | ||

|---|---|---|---|

Savings Accounts | Mortgage | ||

Checking Accounts | Government Mortgage | ||

CDs | Credit Cards | ||

Money Market Account | Debit Card | ||

Investing Capabilities | Personal Loans |

Customer Experience

Capital One has phone lines dedicated to specific issues. This makes it a little more complicated because you must locate the appropriate phone number, but it eliminates the need to wait while the agent transfers you to the appropriate department.

According to the J.D. Power 2023 U.S. direct banking satisfaction study Capital One ranked a bit above the average with 716 points (5 out of 10 banks).

Capital One's help sections can assist you in navigating a potentially perplexing minefield of financial products. Customers can communicate with Eno, the digital assistant, through the app or text. Eno assists with various tasks and inquiries.

On Apple and Google, the Capital One app is rated 4.9/5 and 4.6/5, respectively.

Capital One Bank | |

|---|---|

App Rating (iOS)

| 4.9 |

App Rating (Android) | 4.6 |

BBB Rating (A-F) | A+ |

Contect Options | phone/chat |

Availability | 24/7 |

Capital One 360 Performance Savings

APY Savings

Minimum Deposit

Promotion

Fees

The Capital One 360 savings account offers a comprehensive package that provides no monthly fees, so you can keep what you earn without any added costs. There are also no minimum requirements for opening and maintaining your savings account.

The purpose of opening a savings account with Capital One 360 is because they are the leader in digital savings tools. This is an innovative tool that automatically transfers your funds to help increase the functionality of your online account.

Also, there is a top-rated mobile application that allows you to have access to your savings account 24/7.

Capital One 360 Incorporates easy account transfers, which helps you access and move your money between any linked Capital One accounts. This promotes accurate bank statements and keeps your account growing.

Capital One Checking Account

Fees

Minimum Deposit

Promotion

APY Checking

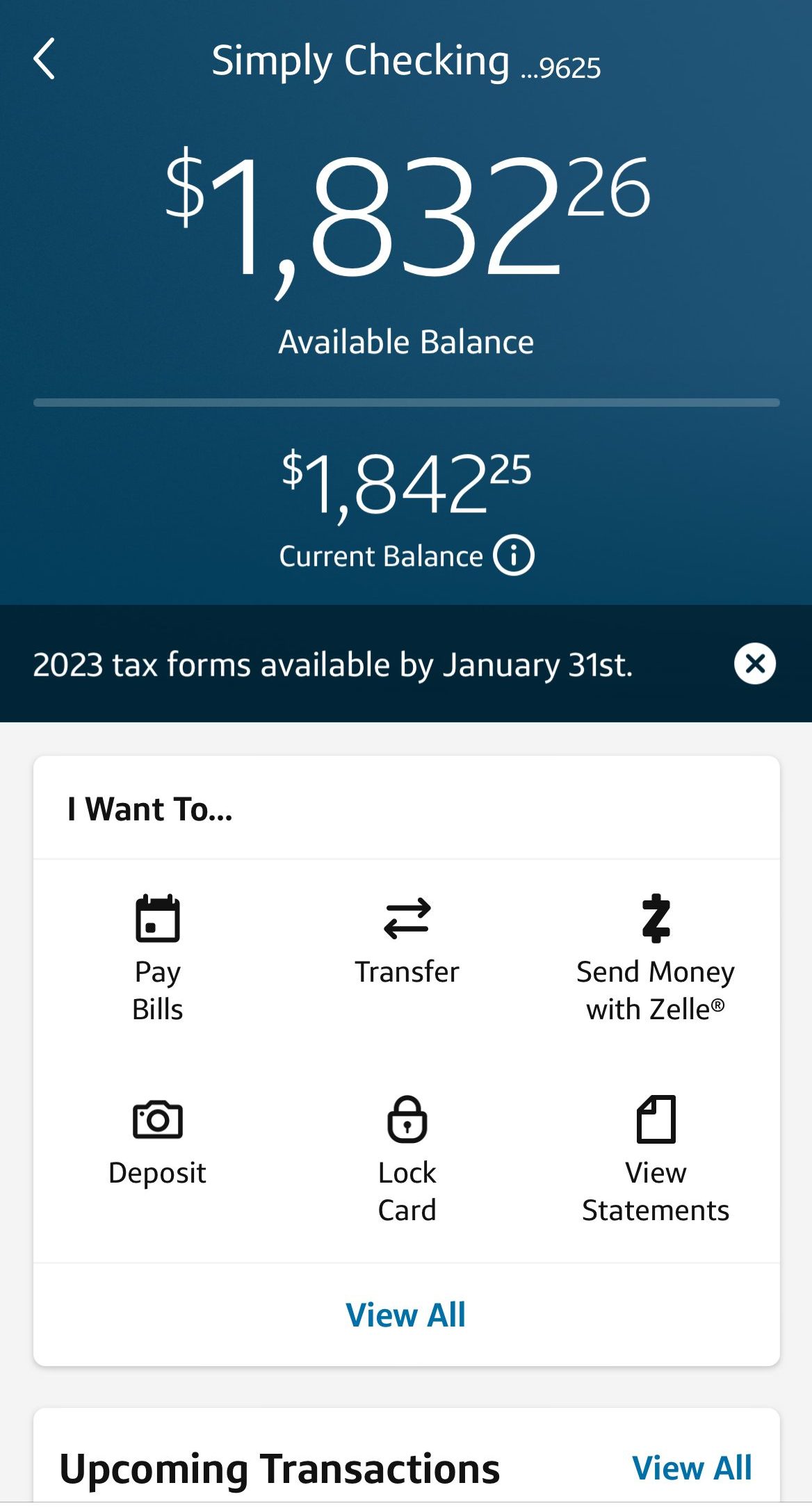

The Capital One checking account is interest-bearing and mainly used and operated online.

Account holders have access to over 70,000 fee-free ATMs nationwide and can manage their finances through a user-friendly mobile app that supports mobile check deposits, bill payments, and real-time alerts.

The account includes multiple overdraft options, such as auto-decline, free savings transfer, and no-fee overdraft, catering to various customer preferences.

You can easily open your Capital One checking account online and manage your account securely by signing onto your phone or computer.

Capital One CDs

APY Range

Minimum Deposit

Terms

Fees

You can earn 3.50% – 4.00% APY, which is quite high. CD rates and terms start at six months, and you can choose from there. The level of commitment is your choice based on the level of savings you wish to incorporate.

The Capital One 360 CDs are savings vehicles that allow you to deposit money and earn interest.

You can deposit your money for a specific amount a time, which is called a term; they cannot access this money until your assigned term is finished. This is the main difference between a CD vs. a savings account.

CD Term | APY | Early Withdrawal Penalty |

|---|---|---|

6 Months | 3.80% | 3 months interest |

9 Months | 3.80% | 3 months interest |

12 Months | 4.00% | 3 months interest |

18 Months | 3.70%

| 6 months interest |

24 Months | 3.50% | 6 months interest |

30 Months | 3.50% | 6 months interest |

36 Months | 3.50% | 6 months interest |

48 Months | 3.50% | 6 months interest |

60 Months | 3.50% | 6 months interest |

You are guaranteed returns for your CD account. You will always know what to expect from your account and the pre-determined rates.

The interest rates are determined by how you decide your account interest is paid out. This is based on what works best for you, which can be at the end of your term, monthly, or annually. It is entirely your choice and what works best with your finances.

* Make sure to adjust APY, terms and deposit

Our Real Experiences with the Capital One

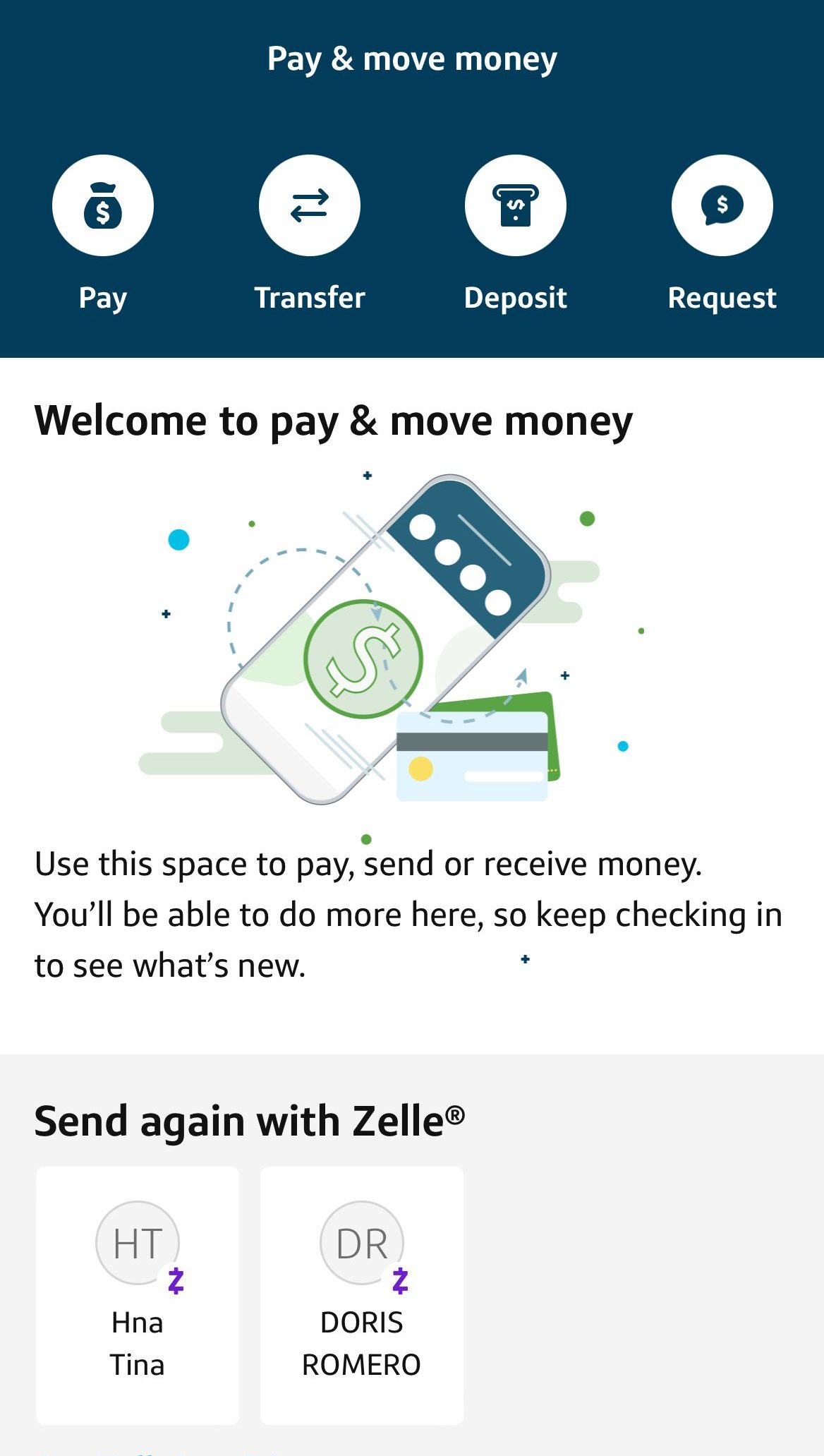

We took a detailed look at the Capital One App's features to determine how well they cater to the needs of regular users. Let's explore our insights on each feature.

The Account Overview in the Capital One app serves as a dashboard for your financial life. It displays account balances, recent transactions, and other popular banking options such as paying bills, transferring money, or depositing a check.

Depositing a check through the Capital One app is as simple as snapping a photo. You'll be guided to position the check correctly within the frame, and the app will do the rest.

The “Pay and Move Money” feature in the Capital One app empowers users to transfer funds effortlessly. Whether you're paying a friend or moving money between your accounts, the process involves specifying the amount and recipient.

Lastly, customers can check their credit scores with Capital One CreditWise. Once authenticated, the app displays your current credit score along with key factors influencing it.

Capital One Credit Cards

With its credit card history, it's no surprise that Capital One credit cards offer a diverse range of credit cards. Even if your credit is poor, you can still earn a lot of money. The QuickSilver One Rewards card gives you an Unlimited 1.5% cash back on all purchases and unlimited 5% cash back on hotels and rental cars booked through Capital One Travel (terms apply).

There's also the Platinum Secured Card, which can assist you in rebuilding your credit. You could have a credit limit of up to $200 with a security deposit of $49 or more. After six months of responsible behavior, Capital One will consider increasing your credit limit. Another great card is the Capital One Venture card that earns 2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel .

Capital One is the issuer of the Walmart Credit Card as well, that provides 5% cash back at Walmart.com (including pickup and delivery), 2% cash back in Walmart stores and gas stations, at restaurants and on travel plus 1% cash back everywhere else Mastercard is accepted. This includes both online orders and products purchased in-store. This is only possible at Walmart and Murphy USA gas stations.

The great thing about Capital One is that you can browse all of the card options on their website. To find the card that best meets your needs, you can filter by credit rating or preferred category.

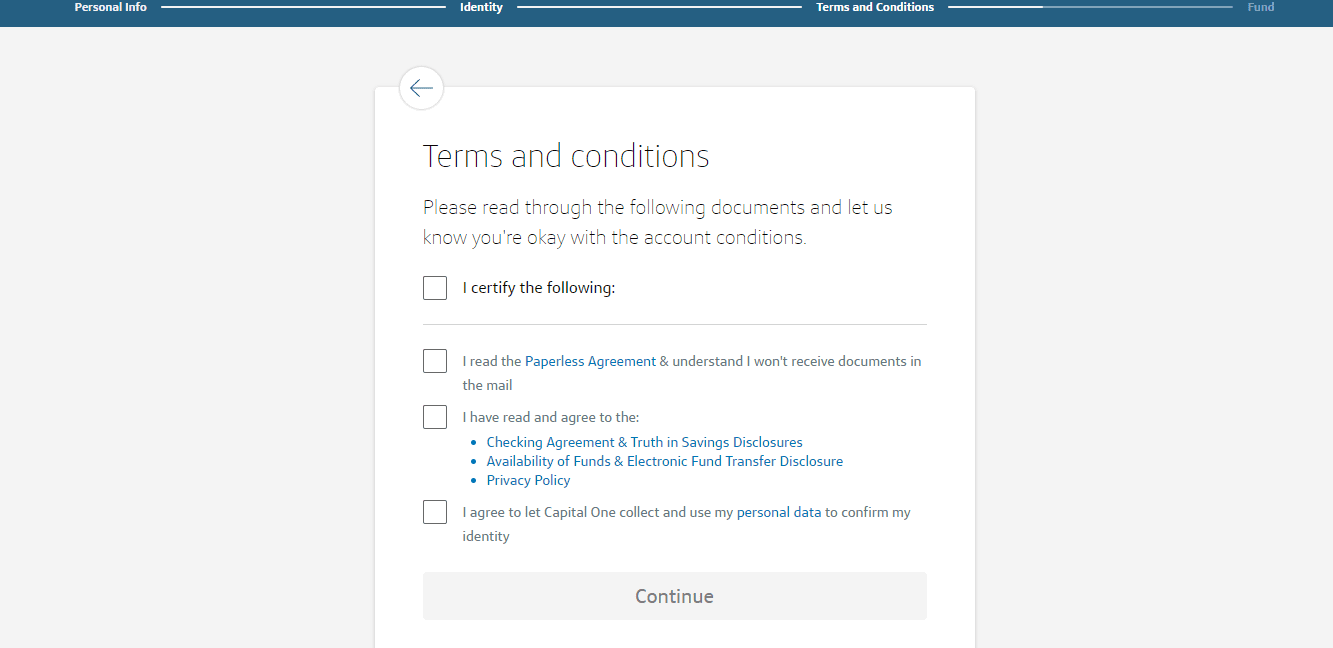

How to Open a Bank Account on Capital One?

It's easy to open a Capital One savings account online. Here are the main steps to take:

Step 1:

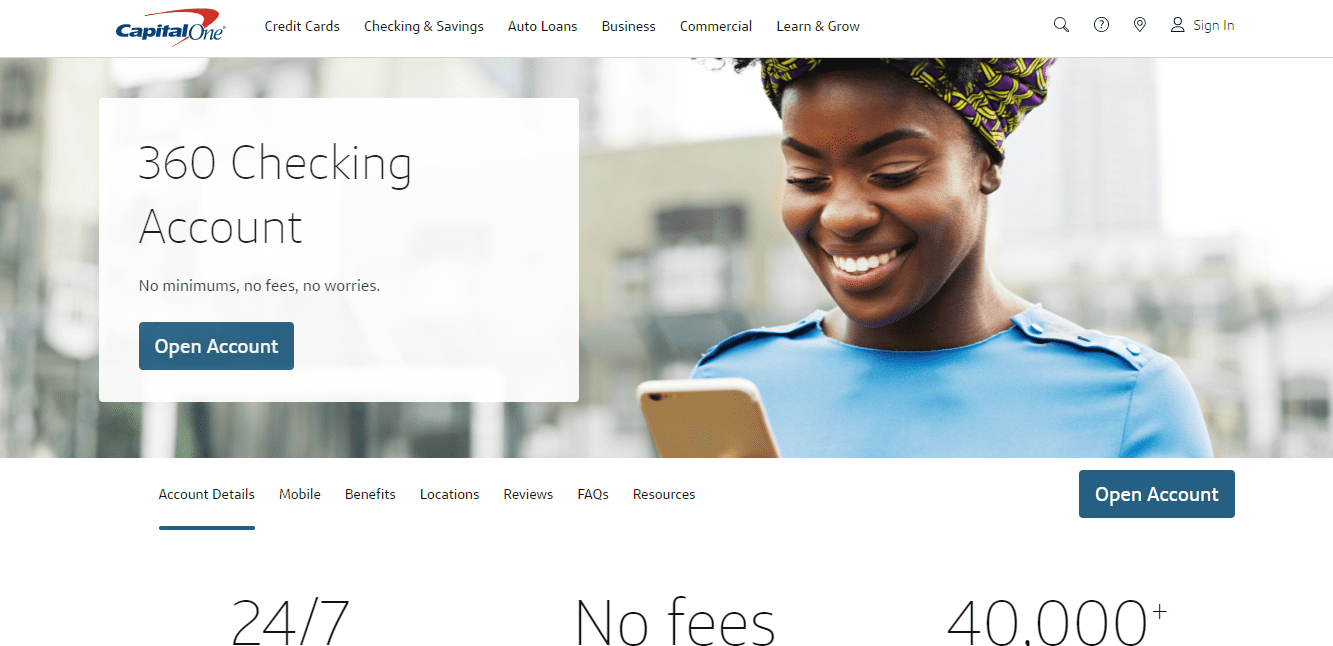

Visit the Capital One 360 homepage and then click on “Open account.”

Step 2:

This brings up the next page, where you are expected to fill in your full name.

Step 3:

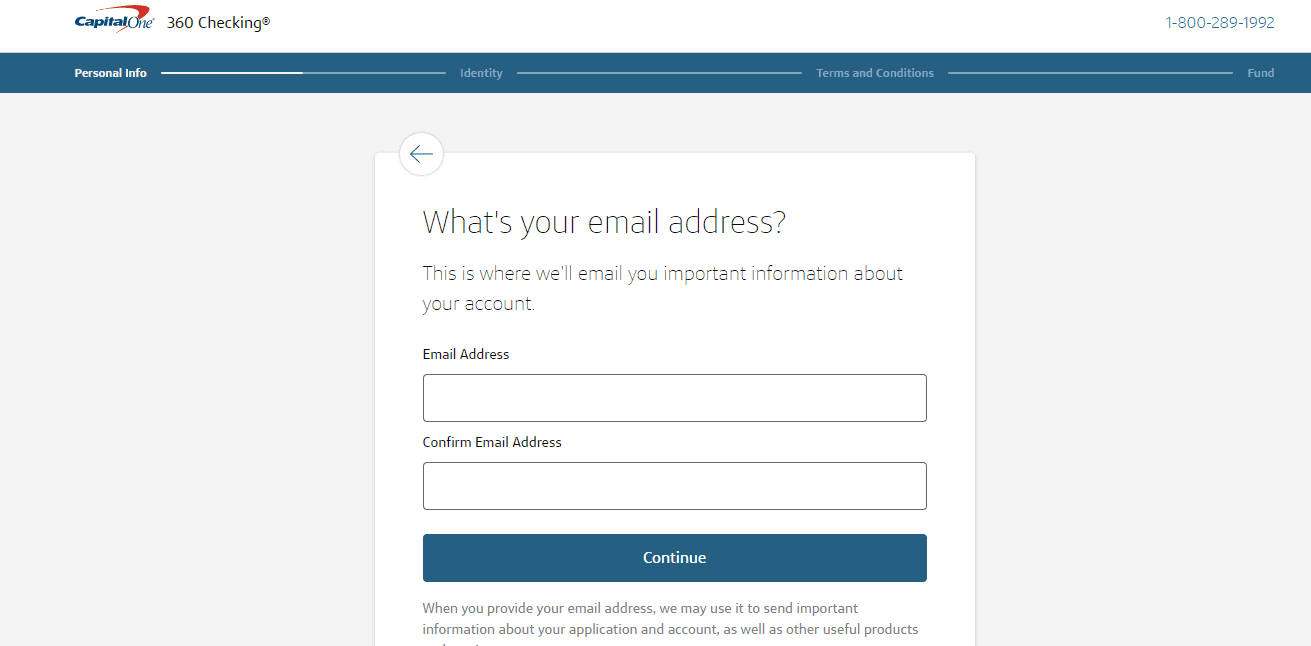

The next page brings up your email address, fill and confirm it and click “Continue.”

Step 4:

Other pages come up requiring you to fill details such as phone number, residential address, city, and zip code; fill them and then click “Continue.”

Step 5:

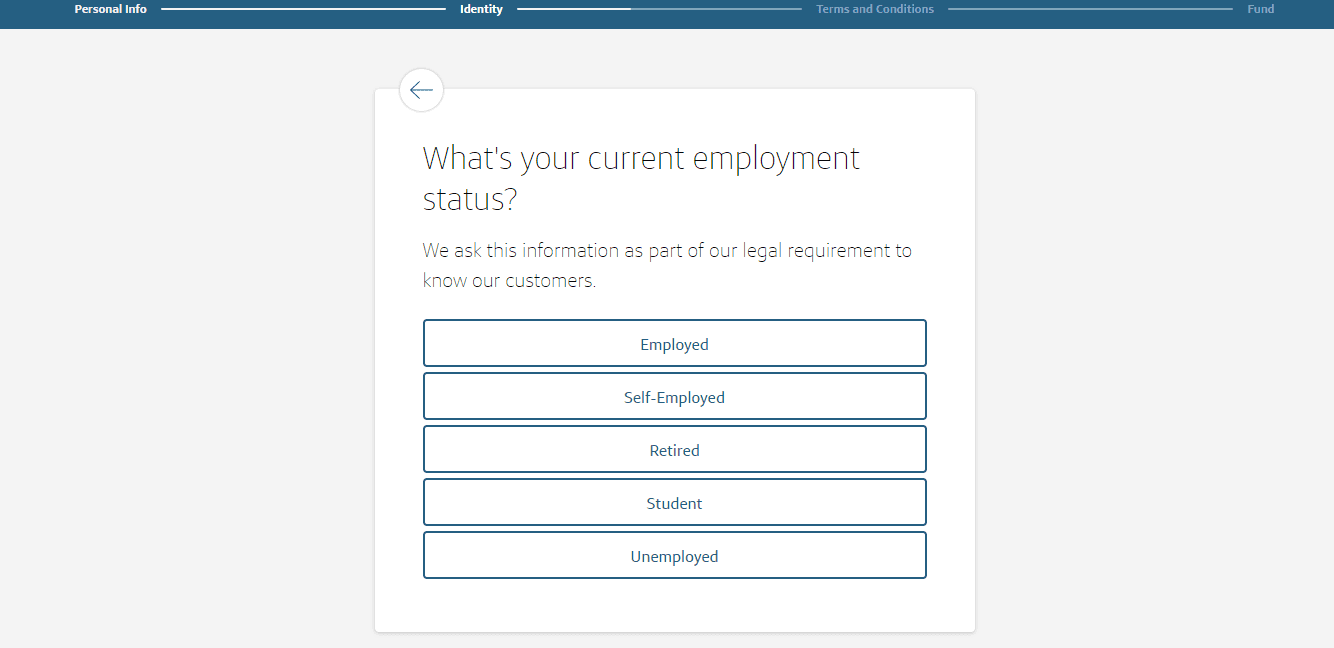

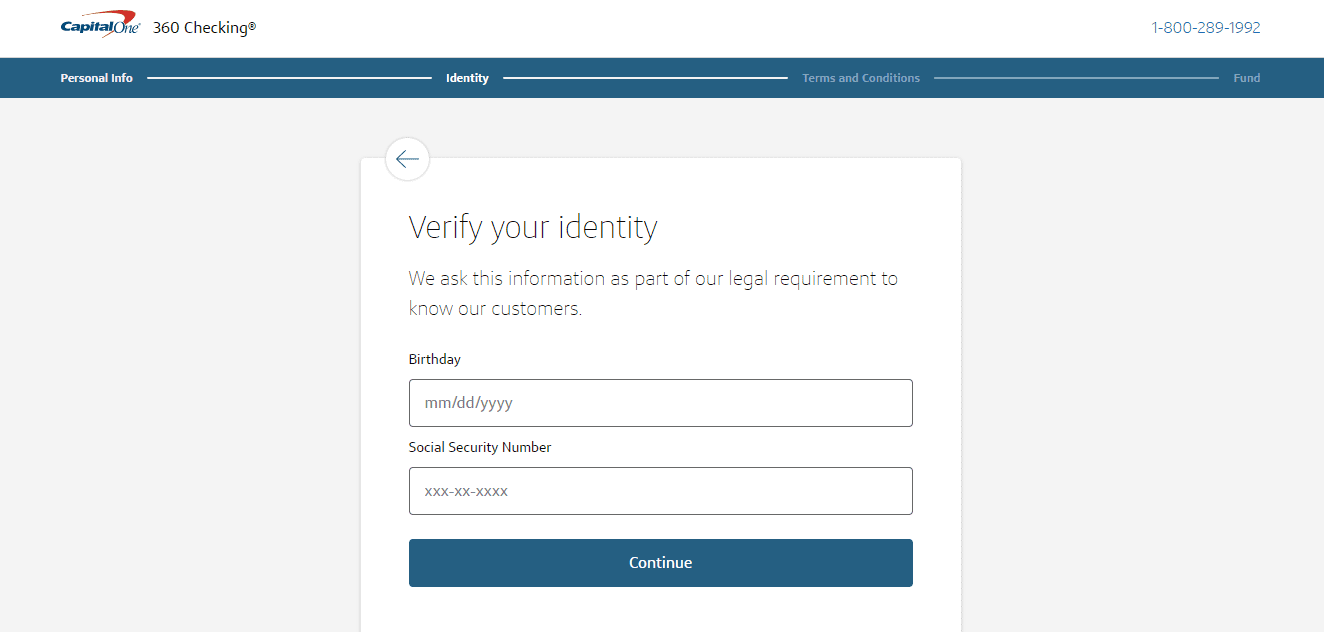

Next indicate your employment status, annual income, your identity.

Finally, agree to the terms and conditions and the make a deposit.

Capital One 360 FAQs

While Capital One banking promotions are a bit limited, it offers a bunch of bonuses for new credit card customers. Check out our Capital One promotions guide to maximize your rewards,

Capital One 360 is a reputable brand offering strong customer support and solid rates on both saving and checking accounts. There are no monthly fees and all accounts are FDIC insured.

Additionally, Capital One 360 has an intuitive and secure app that allows you to check your balance, deposit checks and perform other transactions with ease.

Capital One offers several customer service features such as chat, FAQ page, and a variety of phone numbers for different banking purposes.

All phone numbers can be found on the Capital One website. The support page includes clickable links to the appropriate phone number and when the lines are open.

Lastly, Capital one is one of the most socially responsible bank out there.

Capital One 360 is actually the online banking arm of Capital One. This means that both brands are part of the same company, but they are actually different banks.

Since Capital One 360 is online only, they don’t have the overhead of the standard Capital One bank with its physical branches. This means that if you don’t particularly need to access branches, you may find the Capital One 360 products more attractive.

Capital One 360 provides a top-of-the-line banking experience with access to solid customer support. Its savings and checking accounts offer solid rates with no monthly fees, there are also flexible overdraft options, but the charges are quite high.

However, you will need to be prepared for a fully online banking experience. You won’t have access to branch services and you’ll need to manage your account online or via the mobile app.

If you're not sure how to open a checking account, consult with one of Capital One customer team representatives online or by phone.

Both Capital One 360 and Ally Checking are primarily online banking accounts. They both offer higher rates than many traditional banks, with various accounts. However, there are some differences that will impact which is the better option for you.

Ally is a good bank, especially if you want access to 24/7 live support and would enjoy fee reimbursement for any out-of-network machine usage. However, Capital One does have a massive ATM network and highly competitive products.

Both Capital One 360 offers competitive rates for its savings accounts, Discover's savings account has some of the highest rates on the market. Although there are some minimum deposit requirements, you won’t need to pay service fees.

Discover also offers 24/7 customer support, and cashback checking, but no interest checking accounts. On the other hand, Capital One 360 has no account minimums and some overdraft protection options.

Overall, our Discover bank rating is the same as Capital One: 4.5 stars out of 5.

Capital One offers competitive rates and a variety of banking products. While TD Bank has pros and cons, a few differences will affect whether you consider TD better than Capital One.

One of the most obvious is the number of ATM locations, as Capital One has over 40,000. However, Capital One is only online, so you won’t have as much access to a branch as you could with TD Bank.

Another key difference is that TD Bank provides access to phone customer service 24/7.

So, if you’re happy with online transactions and don’t need access to a branch, Capital One is a good choice. However, if you like the idea of easy access to customer support, you may prefer TD Bank.

While Barclay's savings account does offer competitive rates on savings and investment accounts, the lack of checking account options means that Capital One 360 does have an advantage.

In addition to having fee-free accounts, you can open savings and checking accounts. There is also the option for teen checking accounts and kids' interest-earning accounts. So, the whole family can enjoy banking with Capital One 360.

So, unless a specific Barclays Bank product appeals to you, you will likely find Capital One 360 more appealing.

How We Rated Capital One Bank : Review Methodology

The Smart Investor team extensively reviewed hundreds of banks and credit unions. We assessed them based on four main categories, each with specific features:

-

Diversity of Products and Their Attractiveness (40%): We extensively analyzed the breadth and appeal of each bank's product offerings, including savings accounts, checking accounts, loans, investment options, and more. Higher ratings were assigned to banks with a diverse range of products that are attractive in terms of interest rates, fees, terms, and additional features. This category provides insights into the variety and value of the bank's offerings, crucial for meeting customers' diverse financial needs.

-

Account Features (30%): This category delves into the features and benefits accompanying each bank's accounts. We scrutinized factors such as promotions, deposit and withdrawal options, ATM accessibility, online and mobile banking functionalities, as well as additional perks like overdraft protection and rewards programs. Banks offering comprehensive and convenient features received higher ratings, reflecting the overall value of their accounts to customers.

-

Customer Experience (20%): A positive customer experience is paramount in banking, so we evaluated each bank's performance in this area. This included assessing the ease of account opening, quality of customer service, availability of support channels, and overall user satisfaction. Ratings were based on factors such as responsiveness, efficiency, and the bank's commitment to meeting customer needs, ensuring a seamless and satisfactory banking experience.

-

Bank Reputation (10%): The reputation of a bank is a critical consideration for customers. We examined factors such as financial stability, regulatory compliance, and public perception to determine each institution's overall trustworthiness and reliability. Higher ratings were awarded to banks with strong reputations, reflecting their credibility and ability to inspire confidence among customers.

By considering these categories, individuals can make informed decisions that align with their financial needs and preferences, ensuring they choose a bank that offers competitive products, excellent features, a positive customer experience, and a solid reputation.

Compare Capital One With Other Banks

Discover Bank is a full-service online bank as well as a provider of payment services. Discover can be used for banking and retirement planning by individuals. Discover is best known for its credit cards with rewards, but it also provides personal, student, and home equity loans.

Capital One began as a credit card company, but it has grown to offer a diverse range of traditional banking services over the years. In addition to credit cards, it offers checking and savings accounts, loan refinancing, auto finance, and children's accounts. As a result, Capital One is more appealing to those seeking a traditional banking experience.

Read Full Comparison: Discover vs Capital One: Which Bank Account Wins?

Capital One is a premium online banking service that offers convenient, dependable service and physical locations to anyone looking for them. Capitol One 360, in addition to providing a trustworthy and dependable service, has no hidden fees or minimums, allowing you to continue earning interest on your daily money. There are over 38,000 fee-free ATMs and over 2,000 Capital One ATMs to meet your money access needs.

American Express is one of the world's most well-known credit card brand names. Customers can get a personal banking solution from American Express National Bank, which offers online savings and CD options. Personal savings accounts have a high potential yield. American Express National Bank is a respectable, secure banking option that does not offer any extra features but does offer the most important one.

Read Full Comparison: American Express vs Capital One: Which Bank Is Better For You?

CIT Bank offers a variety of savings accounts. Savings Connect has two tiers, with the first offering a higher rate if you make qualifying deposits and link your checking account. Savings Builder, on the other hand, offers 3.99 percent if you keep a balance of $25,000 or make monthly deposits of at least $100. There are no account maintenance fees, but you can only make six transactions per statement cycle.

Capital One offers a high yield savings account with a slightly lower rate than CIT Bank's top rate. However, you are not required to jump through any hoops. The account allows six withdrawals per calendar month, but there is no minimum deposit or balance requirement to keep your account open.

Read Full Comparison: CIT Bank vs Capital One: Which Bank Account Is Better?

Chase and Capital One both have banking product lines that compete with traditional high street banks.

Capital One also has a competitive advantage in terms of checking accounts. The Capital One checking account is not only fee-free, but you can also earn interest on your account balance. Chase's checking account does not pay interest, and you must meet certain requirements to have the $12 monthly fee waived.

However, when you open a qualifying account, Chase will give you a welcome bonus, and its checking account has some nice features such as paperless statements for up to seven years and checking account upgrade options.

Read Full Comparison: Chase vs Capital One: Compare Banking Options

Capital One began as a credit card company, but has expanded its line of banking products to rival a traditional bank. Aside from checking and savings accounts, you can also get loan refinancing, auto finance, and children's accounts.

Wells Fargo offers an even broader range of products. There are several checking accounts available, as well as two savings accounts and investment options such as IRAs and 401ks. You can also get loans and mortgages, as well as wealth management services. Wells Fargo is thus a highly comparable alternative to the traditional high street bank.

Read Full Comparison: Capital One vs Wells Fargo: Which Bank Wins?

Capital One made its name as a credit card company, but in recent years, it has developed a decent banking product line that rivals that of a traditional bank. Capital One offers loan refinancing, kids' accounts, and auto finance in addition to checking and savings accounts.

Credit One remains primarily a credit card company, but it does offer a limited range of banking products, including CDs.

Read Full Comparison: Capital One vs Credit One: Which Bank Account Is Better?

Ally has a decent banking product lineup that would make switching from a traditional high street bank relatively simple. Checking, savings, CDs, auto loans, personal loans, mortgages, investments, and retirement products are among the products available. The only obvious omission from the Ally line is the absence of a credit card.

Capital One began as a credit card company, but it has since expanded into a variety of other banking services. You can access auto finance, loan refinancing, and children's accounts in addition to savings and checking accounts.

Read Full Comparison: Ally vs Capital One: Compare Banking Options

Capital One began as a credit card company, but it has recently expanded its banking product line. Capital One offers checking and savings accounts, children's accounts, auto finance and refinancing, in addition to an impressive selection of credit cards.

Citi offers a diverse range of banking products, including checking and savings accounts, CDs, credit card options, mortgages, personal loans, wealth management plans, IRAs, and investment options.

Read Full Comparison: Citi vs Capital One: Which Bank is Best For You?

Bank of America has an impressive product lineup, as one would expect from a large banking institution. There are various checking and savings accounts, as well as numerous credit card options, auto loans, home loans, and investments. This makes switching from your current bank a breeze.

Capital One began as a credit company, but it has recently expanded its product line. You can now access checking and savings accounts, auto finance, refinancing, and children's accounts in addition to an impressive selection of credit cards.

Read Full Comparison: Bank of America vs Capital One: Which Bank Wins?

Picking the right bank account can be confusing, especially when looking at big banks like U.S. Bank and Capital One. Here's our winner: U.S. Bank vs. Capital One

Capital One is our winner as it offers a full banking package. But if you have specific checking requirements, M&T Bank may win. Here's why.

Capital One is our winner as it offers a full banking package, which is better than TD Bank, especially if you have deposit needs. Here's why.

Regions Bank has physical branches you can visit, while Capital One operates mainly online. Let's compare their banking products: Regions Bank vs. Capital One

While PNC Bank is a brick-and-mortar bank, Capital One's presence is mainly online. Let's compare them and see which is our winner: Capital One vs. PNC Bank

Capital One is our winner as it is a better fit for most consumers, while HSBC banking products are designed for high-net-worth individuals.

Capital One is our winner for most consumers than Barclays bank. But, there are important things to consider when comparing them: Barclays Bank vs. Capital One

Capital One is our winner with a full banking package, including a decent checking option, high savings rates, and great credit cards.

Compare Capital One Savings

While Citi Accelerate Savings account offers a slightly higher APY than Capital One 360 Performance Savings, it has drawbacks to consider.

Citi Accelerate Savings vs Capital One 360 Performance Savings: Which Is Better

The Discover Online Savings and the Capital One 360 Performance Savings rates are similar. Compare account features, benefits and drawbacks.

Discover Online Savings Account vs Capital One 360 Performance Savings: Compare Side By Side

Compare Ally and Capital One Savings account rates, features, benefits, and limitations to determine which one is the best option for you

Ally Bank Savings Account vs. Capital One 360 Performance Savings: Which Is Best?

Capital One and Amex savings rates are quite similar. However, each of them has its own benefits, features and tools. Here's our comparison: Capital One 360 Performance Savings vs. American Express High Yield Savings Account

Capital One Savings provides a significantly higher savings rate when compared to Chase. Let's explore the features and additional benefits.

Chase Savings vs Capital One 360 Performance Savings: Compare Side By Side

Compare Capital One Certificate Of Deposit (CDs)

Citi has better CD rates than Capital One for specific terms, but Capital One rates are higher on other terms. Here's a full comparison: Capital One CDs and Citibank CDs

Overall, Capital One CD rates are higher than Chase. Compare CD rates, minimum deposit, early withdrawal fees, and alternatives.

Discover and Capital One offer high CD rates on all terms. However, for each term there is a different winner – here's a full comparison: Capital One CDs vs. Discover CDs

Marcus offers higher CD rates than Capital One on most terms but not all of them. Compare CD rates, min deposit, and early withdrawal fees.

Banking Reviews

Aspiration Review

Alliant Credit Union Review