Table Of Content

When Ally Bank Wins?

Ally has a decent banking product lineup that would make it freasonablyeasy to switch from a conventional high street bank. The products include checking, savings, CDs, auto loans, personal loans, mortgages, investment options via Ally Invest, and retirement products. The only noticeable gap in the Ally line is a lack of a credit card.

Ally Bank can be a better choice than Capital One if:

You don’t need a credit card

You are looking for short or long term CDs with great rates

You want to earn more interest on your checking account

When Capital One Bank Wins?

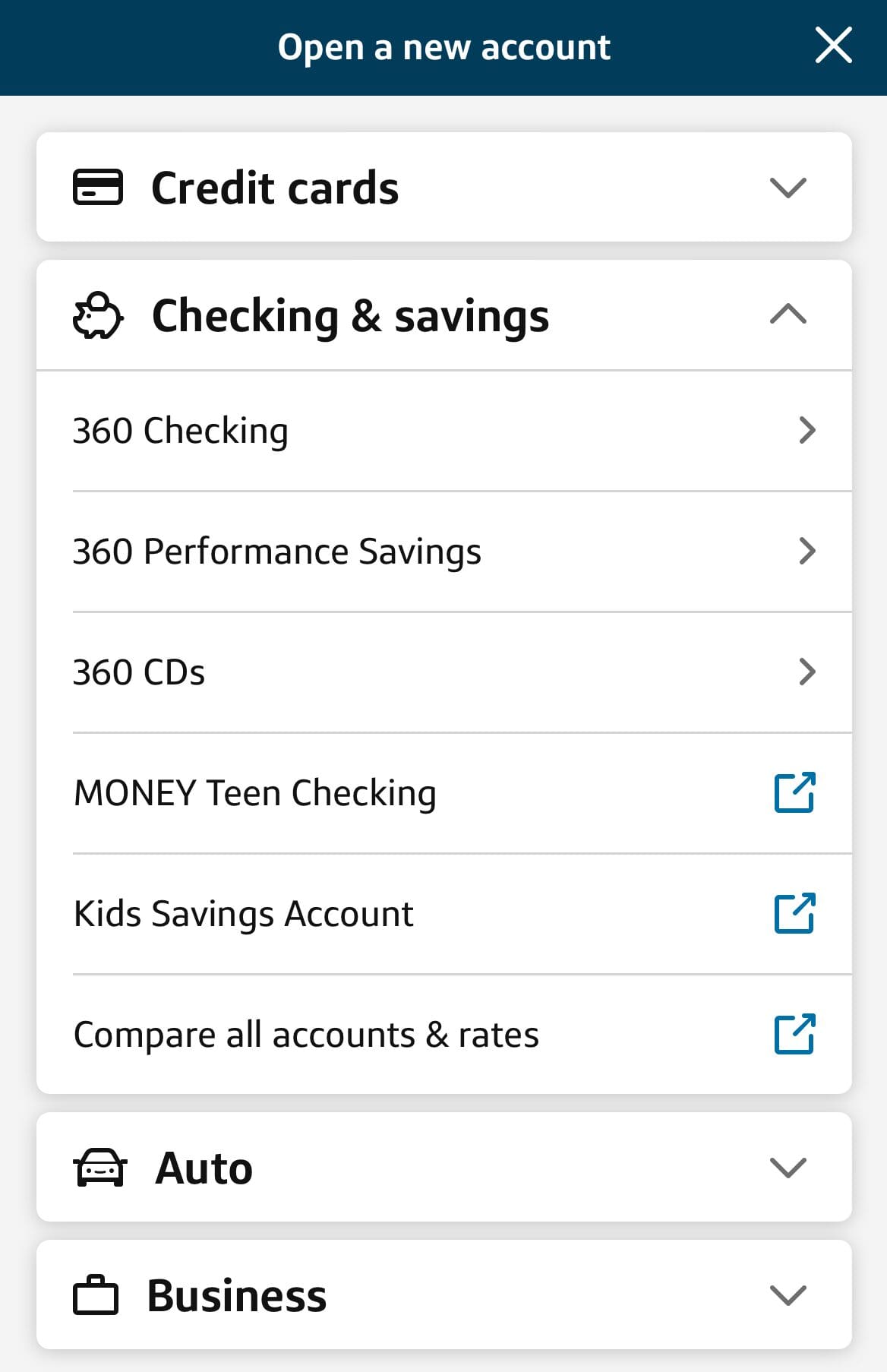

Capital One began as a credit card company, but it has developed a line of other banking products. In addition to saving and checking accounts, you can access auto finance, loan refinancing, and kids’ accounts.

Open a bank account on Capital One can be a better choice than Ally Bank if:

You want access to a variety of credit card options

You are looking for longer term CDs

You want to choose the overdraft options for your checking account.

Ally Bank | Capital One | |

|---|---|---|

Savings Accounts | ||

Checking Accounts | ||

CDs | ||

Money Market Account | ||

Debit Card | ||

Credit Cards | ||

Personal Loans | ||

Mortgage | ||

Government Mortgage | ||

Business Loans | ||

Investing Capabilities |

Savings Account

As of June 2025, the Ally and Capital One savings accounts are very similar, as both accounts are fee-free and require no minimum deposits.

Additionally, the Capital One account has a more comprehensive feature set, including mobile check deposits and auto savings plans.

Ally | Capital One | |

|---|---|---|

APY | 3.60% | 3.70% |

Fees | $0 | $0 |

Minimum Deposit | $0 | $0 |

Checking Needed? | No | No |

Main Benefits |

|

|

Checking Account

Both checking account options are fee-free, with no minimum deposit. Additionally, both accounts are interest-bearing, but the Ally checking account pays a higher rate. In terms of features, the accounts start to show their distinctiveness.

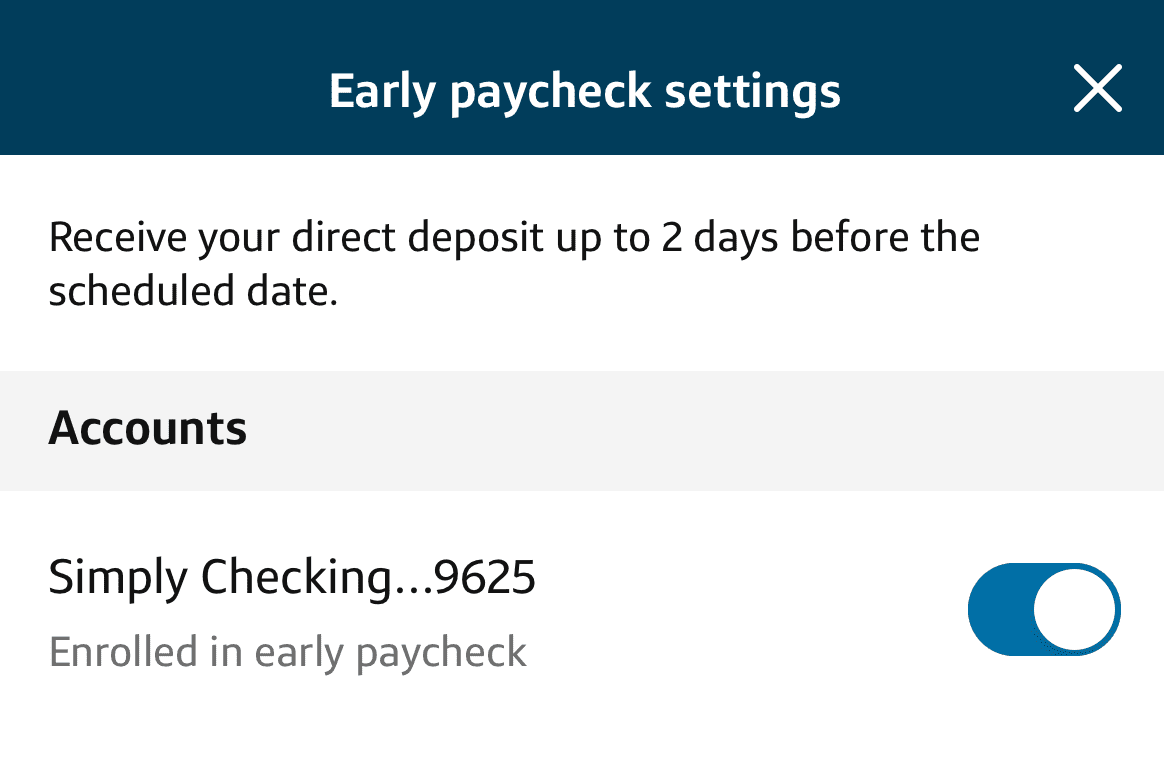

The Capital One checking account has Early Paycheck to gain access to your direct deposit salary up to two days early. You can also choose your preferred overdraft options to avoid fees if you have insufficient funds.

Ally has a round-up that allows you to start to boost your savings in small increments. When you make a debit card purchase, Ally rounds up the amount debited to your account. The difference between the debit and your purchase amount is directed into one of your savings buckets.

Ally | Capital One | |

|---|---|---|

APY | 0.25% | 0.10% |

Fees | $0 | $0 |

Minimum Deposit | $0 | $50 |

Main Benefits |

|

|

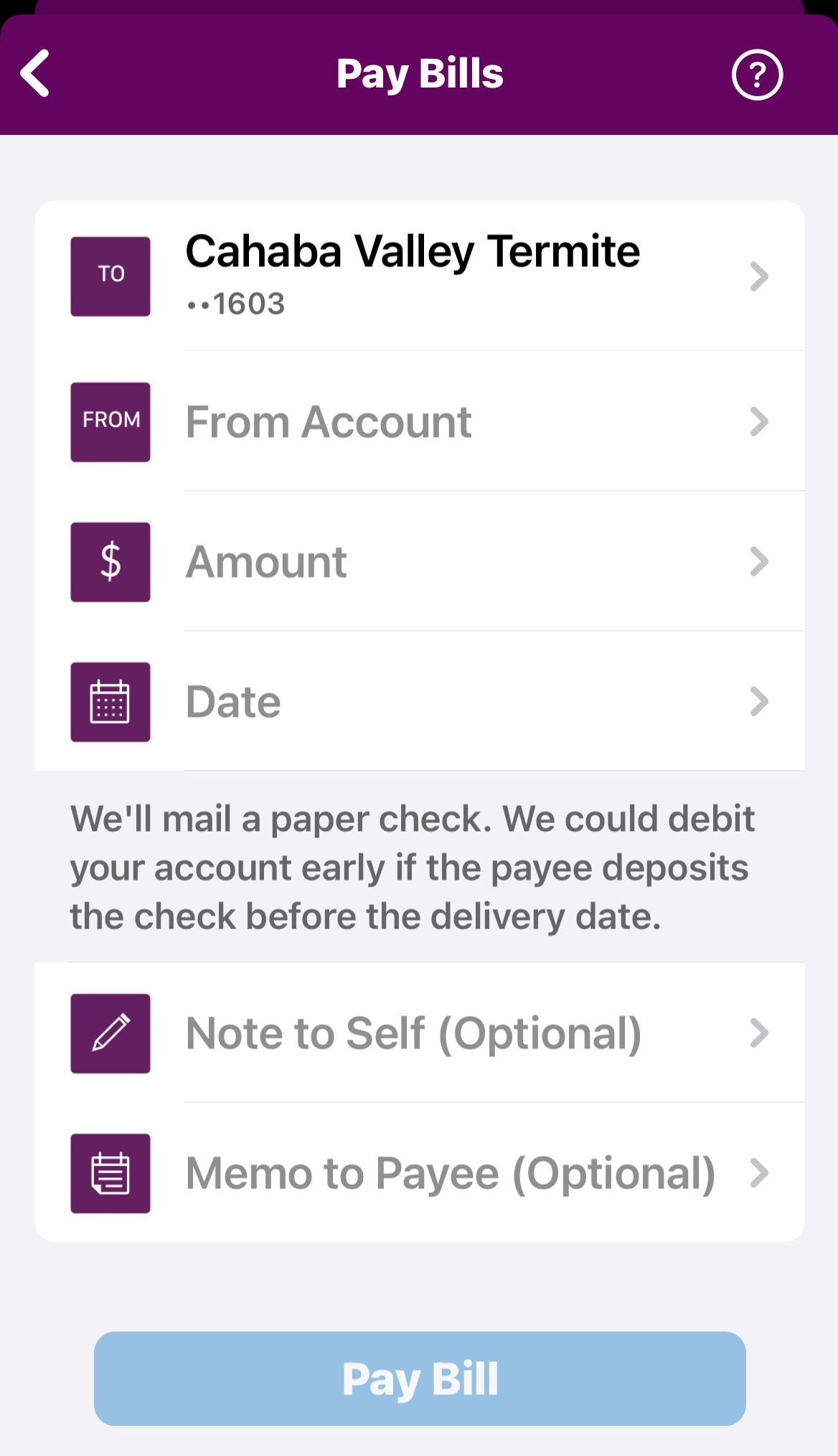

For example, in the following screenshot, we can see one of the helpful features in Ally checking – paying bills. Ally simplifies bill payments with its user-friendly pay bills feature.

Whether it's a one-time or recurring payment, the app guides you through the process. Input the necessary details, and Ally takes care of the rest.

CDs

Both Ally and Capital One CDs have no minimum deposit requirements and the rates are set to encourage committing to a longer term.

Capital One | Ally | |

|---|---|---|

Minimum Deposit | $0 | $0 |

APY Range | 3.50% – 4.00% | Up to 4.00% |

APY 6 months | 2.90% – 4.00% | / |

APY 12 months | 4.00% | 3.90% |

APY 24 months | 3.50% | / |

APY 36 months | 3.50% | 3.50% |

No Penalty CD | / | 11 months, 3.55%

APY |

Top Offers From Our Partners

Credit Cards

Ally Bank offers three credit cards: the Ally Platinum Mastercard®, Ally Everyday Cash Back Mastercard®, and Ally Unlimited Cash Back Mastercard®.

These cards feature benefits like cash back rewards, no annual fees, and free online FICO® scores.

With its credit card heritage, it is no surprise that Capital One has a lot of card options. The Capital One site allows you to browse the cards by category, rate, and credit rating. There are options for all credit statuses.

Mortgage

Ally has mortgage products for both purchasing and refinancing a home. You can choose a fixed or adjustable rate package, but Ally also has Jumbo loans. Ally claims customers can obtain pre-approval in a matter of minutes.

Additionally, the bank has numerous home loan tools, including guides and calculators, to help you discover the best product for your circumstances and requirements.

Loans

Ally Lending is a division of the main bank and offers lending solutions for home renovations and medical bills, with no down payments or application fees.

Capital One has limited loan products, including auto loans, refinance loans and business lending. However, there are no conventional personal loan options.

Customer Service

Ally offers 24/7 customer service with short wait times, typically around one minute. Capital One’s support is more segmented, with dedicated phone lines for specific issues like savings accounts or credit cards, reducing hold times for transfers.

Capital One also provides a detailed online support page, a mailing address, and @AskCapitalOne on Twitter for assistance. On Trustpilot, Ally scores 2/5, while Capital One fares better with a 3.6/5 rating.

Online/Digital Experience

Ally and Capital One both have an app for iOS and Android devices. Ally’s app is rated 4.7/5 for Apple and 4.2 out of 5 for Google. The Capital One mobile app is rated 4.8/5 and 4.9/5 on Apple and Google.

As we touched on above, you can also use the bank’s websites, which allow you to explore the different products to find the right ones for your needs.

Which Bank is The Winner?

To summarize which bank is better, we will need to recap the positives and potential negatives.

Ally has a more comprehensive banking product line, but it lacks a credit card option. On the other hand, while Capital One may lack some products, such as mortgages, it offers an impressive selection of credit card options.

Some of the products are similar, such as the five year CDs and saving accounts, so which bank is best will depend on your particular needs and preferences.

FAQs

Does Ally offer a bonus for new accounts?

Ally’s primary promotion is that the accounts have no hidden fees or account minimums. Currently, there is no cash or cashback bank promotion for new accounts.

Does Capital One offer a bonus for new accounts?

Capital One promotional offers are mainly relevant to credit cards than new bank accounts.

Is Ally worth it if I have bad credit?

While Ally does not have specific products for those with bad credit, the bank does have quite flexible requirements. In fact, the bank has stated that you are more likely to be approved for a car loan if you have a score of 640 or more, which is a below-average score, particularly for seeking finance.

So, even if you have less than ideal credit, it is worth giving Ally a try.

can you close an ally bank account over the phone/online?

If you decide to close your bank account, you can call the Ally helpline and the agent will guide you through the closure procedure. Alternatively, you can send in a written request.

What Capital One products are inflation proof?

Capital One does not tend to have a lot of products that are inflation-proof. While the savings accounts have a fixed rate, this would not benefit you if the inflation rate increases, as your savings balance would be worth less in real terms.

However, Capital One has fixed-rate auto loans, which could benefit you if the inflation rates increase throughout your loan term. You can purchase a vehicle or refinance your existing vehicle loan with a fixed rate for up to six years. This means that you can set your monthly payment, which will remain the same for the entire loan period.

What Does Capital One Worth if I'm a Student?

While Capital One does not have an exclusive student checking account, the main 360 account is a great option for students as there are no account maintenance fees. However, where Capital One stands out is that it has several student credit card options.

The Quicksilver Rewards for Students offers an 1.5% – 5% cashback on all categories. There is also the Journey Rewards for Students, which provides earn 1% cash back and another 0.25% if you pay on time, so you can boost your cash back to a total of 1.25%.

The Smart Investor Comparison Methodology

In our detailed comparison, The Smart Investor team thoroughly looked in five main areas:

Checking Accounts (30%): We checked things like direct deposit, debit card availability, monthly fees, ATM and branch access, check deposit, bill pay options, and account alerts. We also considered any special offers for customers.

Savings Accounts including CDs (20%): We focused on important stuff like how much interest you can earn (APY), the smallest amount you need to open an account, how flexible the accounts are, and if they're insured by FDIC. We also looked at special savings offers, different types of CDs, and any fees for taking money out early.

Credit Cards (15%): We looked at what rewards you get, how much the card costs each year, any bonuses you get for signing up, perks for traveling, how much interest you pay on balances, and if you can transfer balances from other cards.

Lending Options (15%): We checked out the different kinds of loans they offer, like personal loans, student loans, mortgages, and loans where you use your home as collateral.

Customer Experience And Bank Reputation (20%): We looked into how easy it is to use their online and mobile banking, how helpful their customer support is, what people say about them online, any awards they've won, and how stable they are financially. This gave us a good idea of what it's like to be a customer and how much people trust them.

Compare Ally With Other Banks

Ally has a robust banking product offering that rivals that of a traditional bank. Savings accounts, checking accounts, CDs, investments, retirement products, personal loans, auto loans, and mortgages are all available.

Chime's product line has been simplified. All Chime products are designed to assist customers in rebuilding or establishing credit. There are only two savings accounts, one checking account, and one credit card available.

Since the bank's inception, the SoFi product line has come a long way. You can now get access to investment products, mortgages, and loans, in addition to its hybrid checking and savings account. SoFi even offers insurance. The only thing missing from this bank are CDs and traditional savings accounts.

Ally offers a much broader range of traditional banking products. In addition to checking, savings, and CD accounts, there are investment and retirement products, mortgages, auto loans, and personal loans available.

Read Full Comparison: SoFi Money vs Ally Bank: Compare Banking Options

Marcus' banking product offering is more specialized. Marcus' product line reflects its investment pedigree as part of the Goldman Sachs Group. CDs, high-yield savings, investment options, and a variety of loans are available.

Ally has a banking product line that competes with traditional, high-street banks. A checking account, savings account, CDs, mortgages, auto loans, personal loans, retirement products, and investments are among the numerous products available.

Read Full Comparison: Ally vs Marcus: Which Online Bank Is Better?

Discover is a completely online bank, so there are no local branches where customers can go for banking services. Customers can get in touch with Discovery via customer service, which is available 24 hours a day, seven days a week. You can log in to your account in a number of ways. All accounts are accessible online.

Ally offers a much broader range of traditional banking products. In addition to checking, savings, and CD accounts, there are investment and retirement products, mortgages, auto loans, and personal loans available.

Read Full Comparison: Discover vs Ally: Which Bank Wins?

Ally Bank is an online bank that arose from the banking division of General Motors Acceptance Corporation. GMAC used to be an auto financing company before being purchased by Ally Bank. This bank now offers a wide range of products. Among the products available are credit cards, home loans, investing products, savings accounts including certificates of deposit, and checking account options. Ally Bank serves millions of customers and provides high-quality banking services.

Axos is a well-established online-only banking service. It has been in business since 2000 and is constantly expanding its services for both individuals and businesses. The bank is a subsidiary of Axos Financial and is headquartered in San Diego, California. Despite the fact that the bank has three locations, the vast majority of its customers are served online.

Read Full Comparison: Axos Vs Ally Bank Comparison – Which Is Better?

Aspiration has a streamlined banking product line that includes a hybrid account with a $7.99 per month upgrade option and only one credit card option. Aspiration's premise is to help you live a greener life, so the products are heavily weighted in this category. This means that you can earn cash back and other rewards for making environmentally conscious purchases and taking action.

Ally offers a much broader range of banking products. In addition to checking, savings, and CD accounts, you can also get investment and retirement products, mortgages, auto loans, and personal loans. This brings it more in line with a traditional bank, which may make switching from your high street bank easier.

While Wells Fargo has a far more comprehensive product line, Ally does offer better rates on savings, CDs and even its checking account. The only areas where Wells Fargo has the edge is its credit cards and its impressive selection of mortgage products and loans.

Chase is the largest brick-and-mortar bank, while Ally Bank is among the best online banks. Here's our comparison and our winner: Chase vs. Ally Bank

If you feel comfortable with online-only banking and depending on your needs – Ally may be a better option than Bank Of America. Here's why.

Ally Bank vs. Bank of America: Which Bank Account Is Better?

U.S. Bank is one of the largest brick-and-mortar banks, while Ally is among the best online banks. Let's compare them and find our winner: Ally Bank vs. U.S. Bank

Citi is our winner for most consumers, but Ally is also a great option if you are willing to manage your account online. Here's why:

While TD offers a better selection of checking accounts and credit cards, Ally is also a great option for those who want an online-only bank.

While Amex has a decent checking account and better credit card options, Ally's CD and lending options are superior. Here's our comparison: American Express Bank vs. Ally Bank

Ally Bank is one of the top online banks, while HSBC Bank focuses on serving wealthier customers. Let's compare them side by side: Ally Bank vs. HSBC Bank

Barclays provides a comprehensive range of services to US customers, while Ally bank is among the best online banks. How do they compare? Barclays Bank vs. Ally Bank

Ally Bank is our winner with a complete banking package, including a checking account ( not available with Synchrony) and high savings rates.

Both Ally and Upgrade offer a complete banking package, including savings, checking, and credit cards. Here's our side by side comparison.

Compare Capital One With Other Banks

Discover Bank is a full-service online bank as well as a provider of payment services. Discover can be used for banking and retirement planning by individuals. Discover is best known for its credit cards with rewards, but it also provides personal, student, and home equity loans.

Capital One began as a credit card company, but it has grown to offer a diverse range of traditional banking services over the years. In addition to credit cards, it offers checking and savings accounts, loan refinancing, auto finance, and children's accounts. As a result, Capital One is more appealing to those seeking a traditional banking experience.

Read Full Comparison: Discover vs Capital One: Which Bank Account Wins?

Capital One is a premium online banking service that offers convenient, dependable service and physical locations to anyone looking for them. Capitol One 360, in addition to providing a trustworthy and dependable service, has no hidden fees or minimums, allowing you to continue earning interest on your daily money. There are over 38,000 fee-free ATMs and over 2,000 Capital One ATMs to meet your money access needs.

American Express is one of the world's most well-known credit card brand names. Customers can get a personal banking solution from American Express National Bank, which offers online savings and CD options. Personal savings accounts have a high potential yield. American Express National Bank is a respectable, secure banking option that does not offer any extra features but does offer the most important one.

Read Full Comparison: American Express vs Capital One: Which Bank Is Better For You?

CIT Bank offers a variety of savings accounts. Savings Connect has two tiers, with the first offering a higher rate if you make qualifying deposits and link your checking account. Savings Builder, on the other hand, offers 3.99 percent if you keep a balance of $25,000 or make monthly deposits of at least $100. There are no account maintenance fees, but you can only make six transactions per statement cycle.

Capital One offers a high yield savings account with a slightly lower rate than CIT Bank's top rate. However, you are not required to jump through any hoops. The account allows six withdrawals per calendar month, but there is no minimum deposit or balance requirement to keep your account open.

Read Full Comparison: CIT Bank vs Capital One: Which Bank Account Is Better?

Chase and Capital One both have banking product lines that compete with traditional high street banks.

Capital One also has a competitive advantage in terms of checking accounts. The Capital One checking account is not only fee-free, but you can also earn interest on your account balance. Chase's checking account does not pay interest, and you must meet certain requirements to have the $12 monthly fee waived.

However, when you open a qualifying account, Chase will give you a welcome bonus, and its checking account has some nice features such as paperless statements for up to seven years and checking account upgrade options.

Read Full Comparison: Chase vs Capital One: Compare Banking Options

Capital One began as a credit card company, but has expanded its line of banking products to rival a traditional bank. Aside from checking and savings accounts, you can also get loan refinancing, auto finance, and children's accounts.

Wells Fargo offers an even broader range of products. There are several checking accounts available, as well as two savings accounts and investment options such as IRAs and 401ks. You can also get loans and mortgages, as well as wealth management services. Wells Fargo is thus a highly comparable alternative to the traditional high street bank.

Read Full Comparison: Capital One vs Wells Fargo: Which Bank Wins?

Capital One made its name as a credit card company, but in recent years, it has developed a decent banking product line that rivals that of a traditional bank. Capital One offers loan refinancing, kids' accounts, and auto finance in addition to checking and savings accounts.

Credit One remains primarily a credit card company, but it does offer a limited range of banking products, including CDs.

Read Full Comparison: Capital One vs Credit One: Which Bank Account Is Better?

Capital One began as a credit card company, but it has recently expanded its banking product line. Capital One offers checking and savings accounts, children's accounts, auto finance and refinancing, in addition to an impressive selection of credit cards.

Citi offers a diverse range of banking products, including checking and savings accounts, CDs, credit card options, mortgages, personal loans, wealth management plans, IRAs, and investment options.

Read Full Comparison: Citi vs Capital One: Which Bank is Best For You?

Bank of America has an impressive product lineup, as one would expect from a large banking institution. There are various checking and savings accounts, as well as numerous credit card options, auto loans, home loans, and investments. This makes switching from your current bank a breeze.

Capital One began as a credit company, but it has recently expanded its product line. You can now access checking and savings accounts, auto finance, refinancing, and children's accounts in addition to an impressive selection of credit cards.

Read Full Comparison: Bank of America vs Capital One: Which Bank Wins?

Picking the right bank account can be confusing, especially when looking at big banks like U.S. Bank and Capital One. Here's our winner: U.S. Bank vs. Capital One

Capital One is our winner as it offers a full banking package. But if you have specific checking requirements, M&T Bank may win. Here's why.

Capital One is our winner as it offers a full banking package, which is better than TD Bank, especially if you have deposit needs. Here's why.

Regions Bank has physical branches you can visit, while Capital One operates mainly online. Let's compare their banking products: Regions Bank vs. Capital One

While PNC Bank is a brick-and-mortar bank, Capital One's presence is mainly online. Let's compare them and see which is our winner: Capital One vs. PNC Bank

Capital One is our winner as it is a better fit for most consumers, while HSBC banking products are designed for high-net-worth individuals.

Capital One is our winner for most consumers than Barclays bank. But, there are important things to consider when comparing them: Barclays Bank vs. Capital One

Capital One is our winner with a full banking package, including a decent checking option, high savings rates, and great credit cards.

Banking Reviews

Aspiration Review

Alliant Credit Union Review