If you live in Florida and are looking for a good bank that suits your needs, you probably know that there are plenty of options out there. You can choose from small community banks, larger regional banks, big national banks, or even online banks. It can be overwhelming to decide which one to go for.

We carefully selected the top banks in Florida banks based on different factors like the number of branches they have, the variety of products they offer, the interest rates they give for deposits, how good their online banking services are, and how well they take care of their customers.

Best Florida Regional Banks

You can find hundreds of regional and community banks in Florida, here are some of the best of them:

Truist Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Truist Bank offers a wide range of financial solutions designed for both individuals and businesses. They have various options such as savings and checking accounts, CDs, and a money market account.

Additionally, they have around 3,000 ATMs available for their customers to use. While their interest rates may not be the highest in the market, they do keep their fees relatively low.

The bank was formed in 2019 through the merger of BB&T and SunTrust, creating a single, unified entity called Truist. Currently, Truist Bank ranks among the top 10 largest banks in the entire United States.

They have a strong presence with more than 440 branches spread across 180 cities and Florida, making their services accessible to customers from various parts of the country.

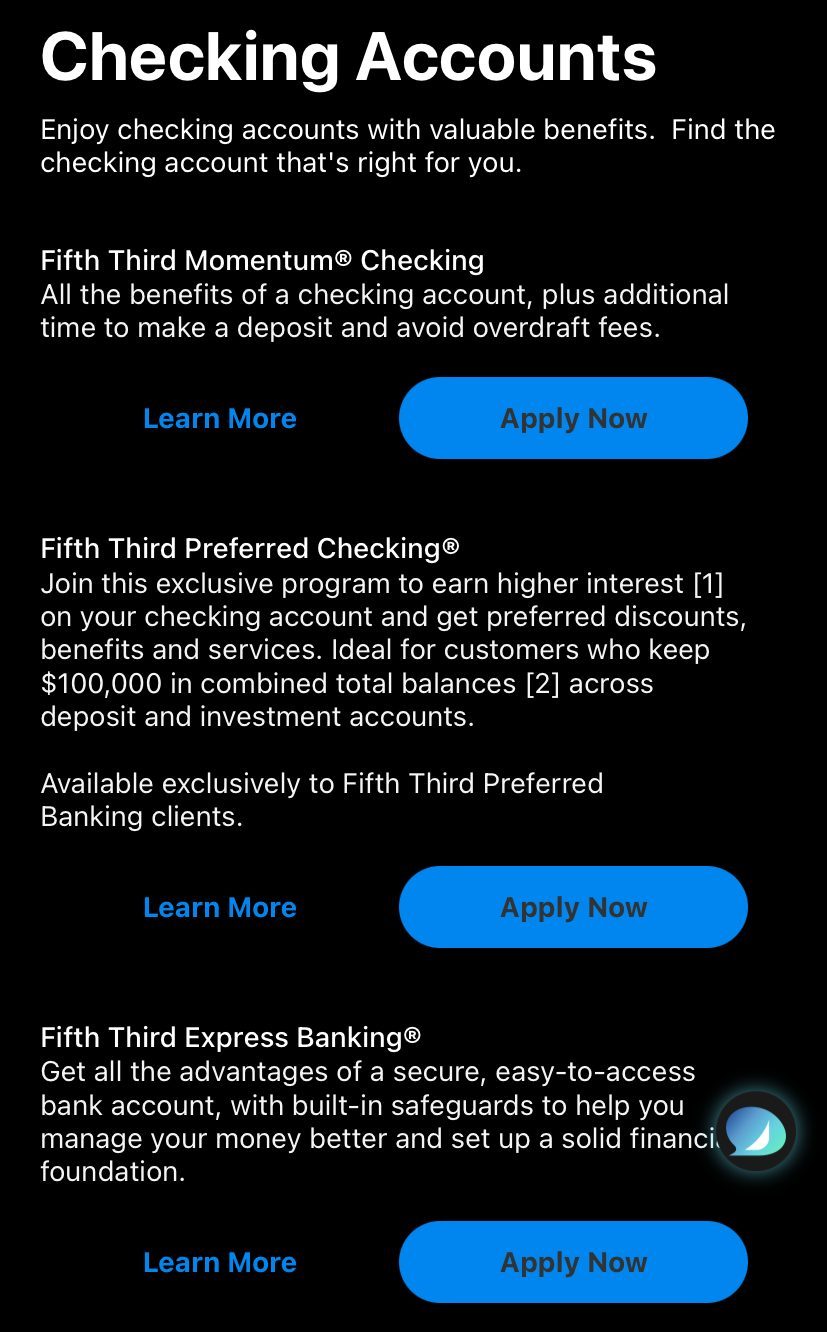

Fifth Third Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Fifth Third Bank is a regional financial institution that serves customers in Florida. They have a strong presence in 60 cities, with nearly 150 branches in the state. The bank offers various checking and savings accounts, and the good thing is that none of them require a minimum deposit to open.

They also provide a money market account and offer a range of CD terms for those who want to save and grow their money. Although their main presence is in Ohio, customers in Florida can still benefit from their services.

One advantage of banking with Fifth Third is that they have low minimum deposit requirements for their accounts, and they offer access to a wide network of fee-free ATMs.

However, if you're looking for banks with the highest interest rates, you might want to check out other options. Also, it's worth noting that their customer service representatives may not be available 24/7, but they're still reachable even on weekends.

First Horizon Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

First Horizon Bank operates as a regional financial institution catering to Florida residents across 40 cities via a network of nearly 70 branches.

They offer extensive personal banking products encompassing checking, savings, money market accounts, and CDs. Though these accounts incur monthly maintenance fees, the bank provides alternatives for waiving them. Additionally, First Horizon extends various other services, such as auto loans, mortgage loans, and credit cards.

Overall, First Horizon Bank is a reliable option for individuals in Florida seeking various banking services, particularly those who prioritize flexible checking choices and have modest initial deposits. Nevertheless, customers interested in higher interest rates on their savings or those who prefer fee-free accounts might want to explore alternative options.

Regions Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Regions Bank is a prominent financial institution with an extensive presence in Florida, boasting over 250 branches across 140 cities. The bank offers a diverse range of checking accounts tailored to various needs, such as interest-bearing accounts, accounts with no overdraft fees, e-checking accounts, and specialized accounts for students and seniors.

For customers looking to maximize their benefits, Regions Bank provides enticing perks for those who open multiple accounts. These advantages encompass discounts on safe deposit boxes at their branches, relationship rates on certificates of deposit (CDs), discounted loans, and cash back rewards on select purchases.

However, there are some drawbacks to consider. Monthly fees are applicable to certain accounts. Additionally, the bank's savings accounts offer low APY. Lastly, both money market and checking accounts impose high minimum balance requirements to avoid monthly fees, which could pose challenges for those with limited funds.

Best Florida National Banks

For our list of favored national banks in Florida, we conducted a comprehensive evaluation, taking into account several crucial factors.

These factors encompassed the availability and abundance of branches, the diversity of products available, and the potential for attaining competitive deposit rates, with a particular focus on CDs over traditional savings accounts.

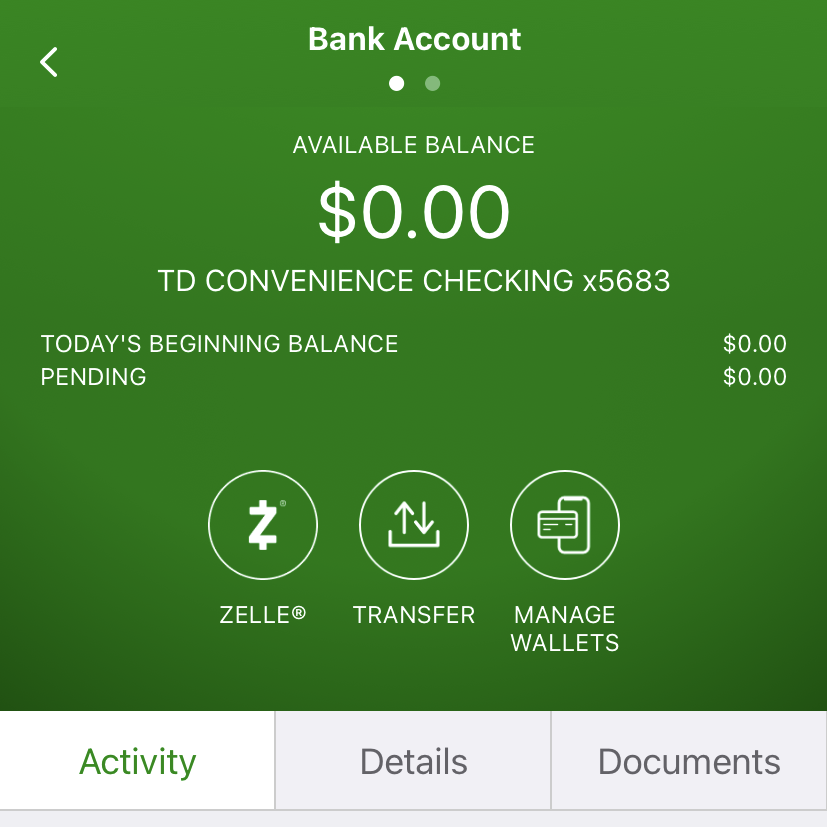

TD Bank

Checking Fees

Money Market APY

TD Bank offers a welcome bonus for new account – you can get $300 bonus if you open a new checking account, and another $200 if you open a savings account. There is a minimum deposit required of $500 or $2,500, depending on account, within 60 days.

. Expired on 11/30/2024Savings APY

CDs APY

TD Bank has a strong presence in Florida with a vast network of 140 branches spread across 90 cities. They offer a variety of services and accounts, including savings, checking, certificates of deposits, and credit cards. The bank also provides convenient access to nearly 2,700 ATMs.

Some advantages of banking with TD Bank include no foreign transaction fees on debit cards, 24/7 customer service via phone, highly rated mobile apps, and extended operating hours as many locations are open seven days a week. Customers can also enjoy a range of digital banking features such as Zelle, remote check deposit, and online bill pay.

However, there are some downsides to consider. TD Bank imposes monthly fees, and their savings accounts yield a low (APY. Additionally, customers will be charged a $3 fee for using a non-TD Bank ATM. The bank's overdraft fee is particularly steep, at $$35 per transaction and can be charged up to three times a day.

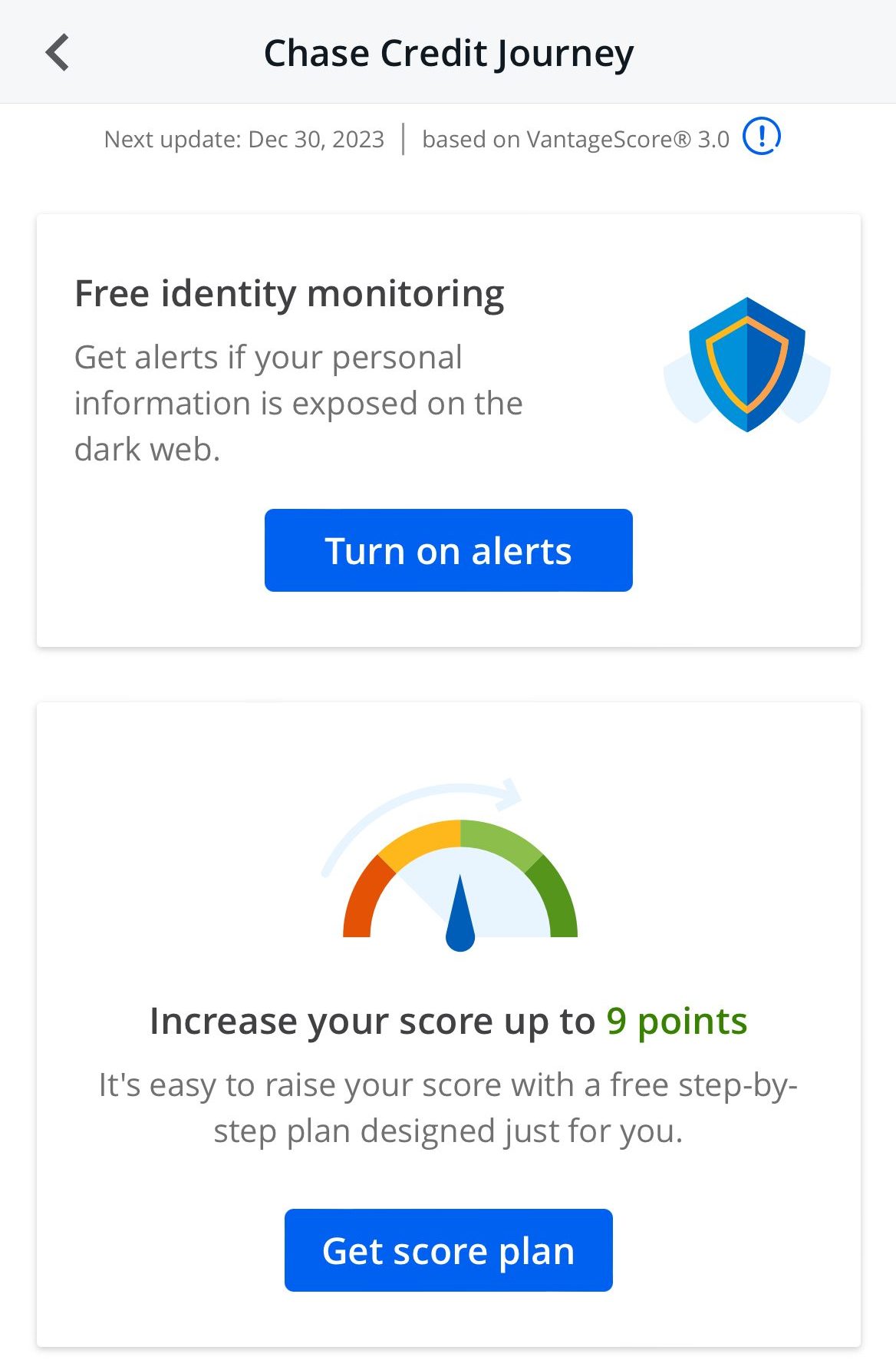

Chase Bank

Checking Fees

Checking Promotion

Savings APY

CDs APY

Chase Bank has a bunch of different services to handle your banking needs, like checking and savings accounts, credit cards, mortgages, personal and auto loans, investment services, and small business banking. They have loads of branches in Florida – over 380 of them – and you can find them in 140 cities, so it's super easy to find one nearby.

The good stuff about Chase Bank is that they have plenty of branches and ATMs all over the place, making it convenient to get your money when you need it. Plus, they've got a big selection of credit cards, giving you lots of choices.

Customers can track their credit score with Chase's credit journey, and Chase also offers promotions on its checking accounts from time to time.

But, there are some not-so-great things you should know too. Some of their accounts have high monthly fees, so it's important to watch out for that. Their savings account and CD rates aren't as high as some other banks.

Best Florida Online Banks

When we were looking into the online banks available in Texas, our main focus was on their savings and CD rates. We also wanted to see if they had a good variety of financial products, like checking accounts, loans, credit cards, and even mortgages.

Discover Bank

Checking Fees

Money Market APY

Savings APY

CDs APY

Discover Bank is a prominent online institution offering a range of financial services, including deposit accounts, credit cards, personal loans, and student loans. Operating without physical branches, it compensates by providing access to over 415,000 ATMs nationwide for its banking customers (with access to over 60,000 surcharge-free ATMs through the Allpoint® or MoneyPass® networks).

The bank boasts several advantages, such as cashback on debit card purchases, and a lack of monthly maintenance, insufficient funds, or overdraft fees. Moreover, Discover CD rates are very competitive as well as its savings account, providing attractive returns on customers' funds. Additionally, the bank offers round-the-clock customer service for any queries or concerns.

However, some limitations come with an online-only model, as Discover Bank lacks physical branch locations. This may not be suitable for customers who prefer in-person banking interactions. Furthermore, the bank does not provide reimbursement for out-of-network ATM fees, potentially leading to additional costs for users who frequently use non-affiliated ATMs.

EverBank

Checking Fees

Money Market APY

Savings APY

CDs APY

EverBank (formerly TIAA Bank) is an online financial institution that offers deposit accounts with competitive rates and low minimum balances.

Customers benefit from access to thousands of fee-free ATMs, although physical branches are limited mainly to Florida. The bank is an excellent choice for those seeking a full-service online bank with competitive deposit yields, as it does not charge monthly maintenance fees and offers competitive rates on EverBank CD accounts and savings.

A notable advantage is the ability to deposit checks via mobile devices. Additionally, customers enjoy a large fee-free ATM network and ATM fee reimbursements. However, the bank has some limitations, such as a restricted range of account types and branch locations. Also, the high APY on the money market account applies only for one year.

FAQs

What are the banks with the highest number of branches in Florida?

As of 2025, Florida's banking landscape is dominated by Truist Bank, Wells Fargo Bank, and Bank of America, each boasting an extensive network of over 400 branches. These three banks stand out as the ones with the most branch locations in the state.

What's the top bank in Florida?

Choosing the best Florida bank relies on your preferences – in-person service, variety of products, or no-fee checking accounts. Explore our suggested banks above, each excelling in its own way.

Which bank has the best CD rates in Florida?

In Florida, the best CD rates change with different terms. Some banks offer the best rates for 1 year, while others have the best rates for 2 years. Take a look at our recommended Florida banks for high CD rates and compare them with credit unions.

What's the bank with the most competitive savings rates in Florida?

Searching for high savings rates can be tricky, but we've narrowed it down for you. Here are the some of best savings rates in Florida for 2025.