Table Of Content

Key Takeaways

- Generally speaking, checking accounts pay little or no interest. On the other hand, money market accounts pay interest rates that are higher than checking and savings accounts.

- To open the money market account, you have to come up with at least the minimum deposit amount, ranging from $1,000 to $2,500. On the other hand, checking accounts do not usually have such a large minimum deposit requirement.

- most money market accounts only allow up to 6 withdrawals in a month, while the number of transactions per month is not usually limited to checking accounts.

Most Americans have a savings account, but at least 77.02% of the savings accounts have less than $15,000. This is according to a report by Motley Fool, which shows 21.99% of savings accounts in the US have a balance of $1,000 to $5,000.

What is a Money Market Account?

Kind of like a hybrid between a savings account and a checking account is a money market account. They actually earn interest in the same way as your savings. And sometimes you get better rates, though that’s going to be dependent on the specific institution.

On the other side of things, you’ll usually be able to write checks and you could have an ATM card. That means you can access your money easily. All you need to do is ask for these things to get them.

What is a Checking Account?

A checking account, on the other hand, is what you use for normal transactions. This account gives you continuous access to your account. You get to use checks, debit cards, and more. In fact, you can even manage your account online. Plus, you’re going to have the freedom to transfer money, make payments or deposits and even pay your bills.

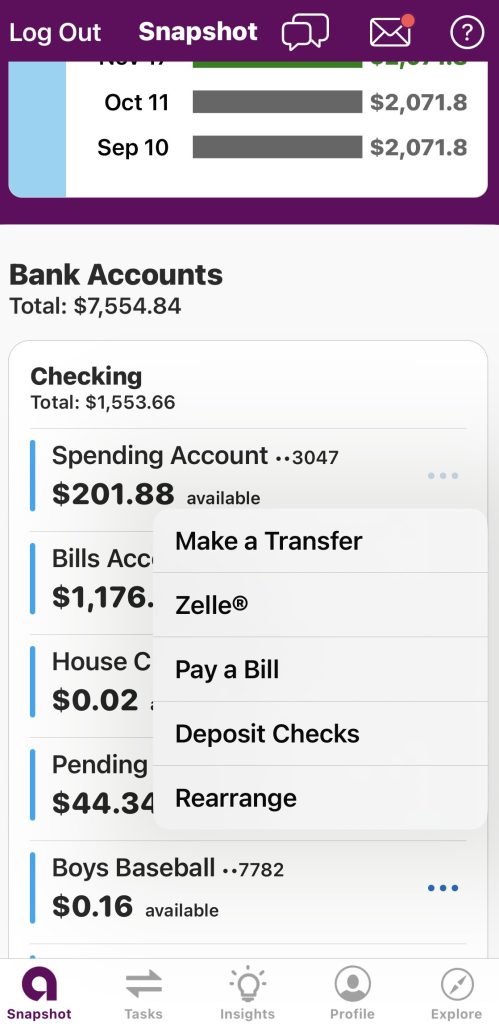

Most people get a checking account before they get any other. They give you access to other types of accounts like savings and investment as well. Here's an example of the how it looks like to manage an account with Ally:

Money Market Vs. Checking Account: Comparison

A money market account and a checking account are both deposit accounts offered by banks, but there are some key differences between the two:

| Checking Account | Money Market Account | |

|---|---|---|

| Purpose | General spending and financial needs | Earning interest faster than a savings account |

| Access your fund | ATMs, debit cards, checks, bill pay, transactions, and transfers | ATMs, debit cards, checks |

| Minimum Balance | Usually $25 or more | Usually $1000 or more |

| Interest | Little – None | About 3% (as of October 2025) |

| Withdrawal Restrictions | Daily limit – None | 3-6 per month |

| Fees | monthly maintenance fee + ATM withdrawal | Little to none |

| protection | up to $250,000 per account holder by FDIC | up to $250,000 per account holder by FDIC |

-

Money Market Accounts Offer Higher Interest

A money market account is going to offer higher interest than a checking account.

In general, you’re not even going to get any interest on most checking account types, even if you have a lot of money in there. If you really want something though you may be able to shop around a bit.

-

Money Market Accounts Minimum Balance is Higher

With a money market account, you’ll usually have a higher minimum. That means you’ll need to have a set amount in your account at all times and it could be $1,000 or more.

With a checking account, you usually have a minimum daily or average balance. These are as low as $25 per day.

-

Access Your Funds Easily With Checking Account

If you need a way to access your funds you’ll want to look at the options here. With a money market account, you can generally write checks and you can use an ATM card or a debit card. What you’ll find are federal limits on the number of transactions.

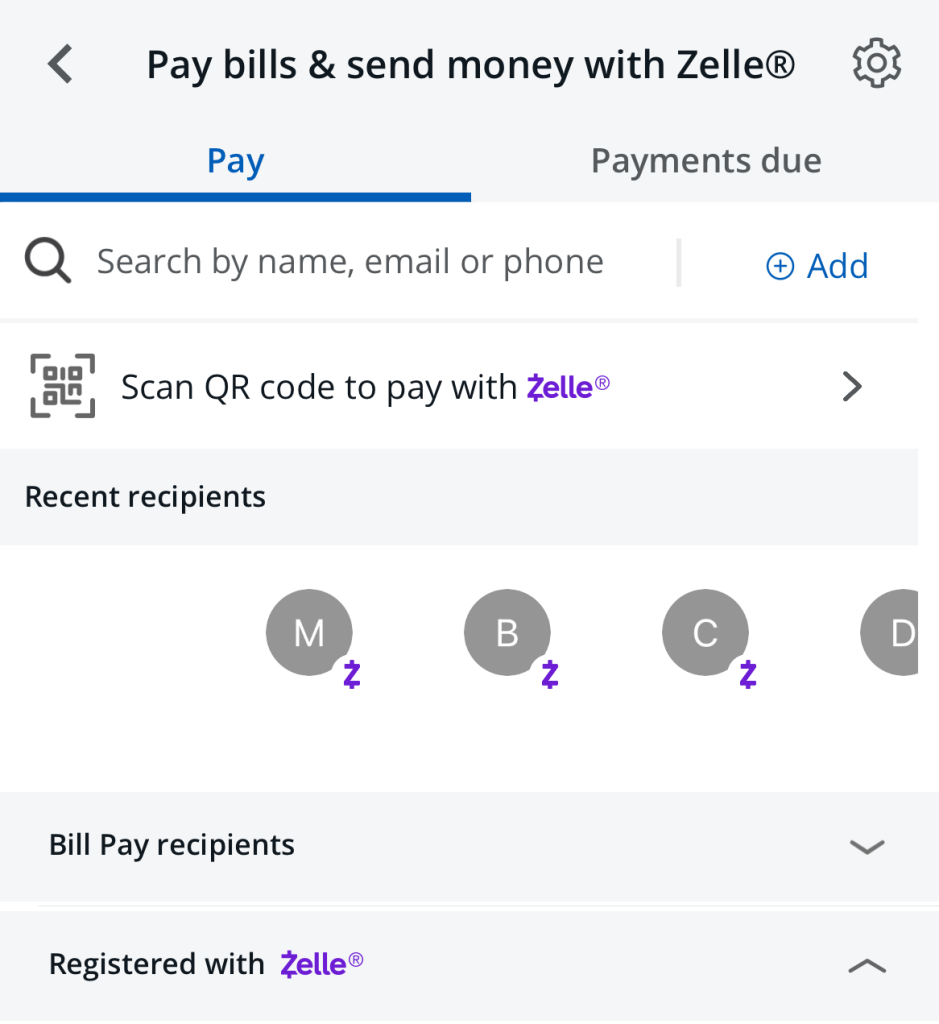

On the other hand, a checking account gives you options for checks, ATMs, branch withdrawals, debit cards, and online banking. Chase bank, for example, offers to pay bills and send money with Zelle on app:

-

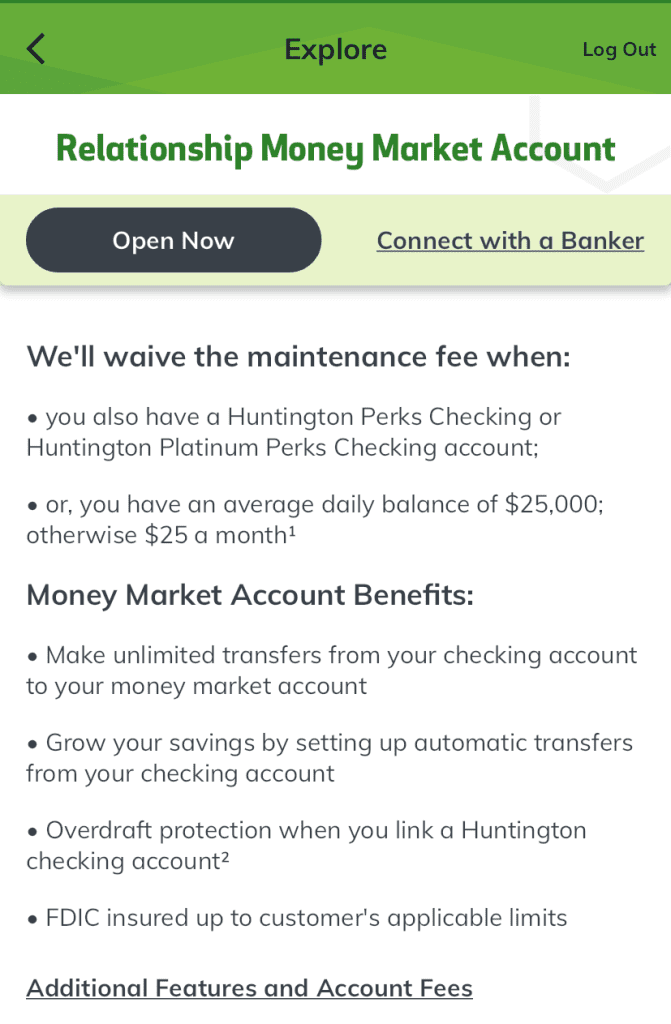

Money Market Account Monthly Fees Are Generally Lower

In a money market account, a bank will make money off how much interest they make on the loans they’re using your money for versus how much they give you. They will have very few fees because they’re making money elsewhere.

For some checking accounts, you’ll be able to get a fee-free option, but there are fewer and fewer of those around. That means you could have a maintenance fee.

The only good thing is that there are usually a few rules or ways to avoid that maintenance fee. A daily minimum, a monthly average, or a set direct deposit could negate the fee. On the other hand, you could have fees for ATMs that are outside your network.

-

Money Market Account Have More Limits on Withdrawals

With a money market account, you’ll generally have only 6 transactions and withdrawals in a month. Anything over that is going to mean you have to pay money and it could be more money than you’re even making.

For a checking account, you’re not going to have a limit to the number of withdrawals you want to make.

The only limit is the amount of money that’s taken out by debit card, $1,000. ATM withdrawals per day are generally about $500. With checks, you generally don’t have a limit, but you should check with your financial institution.

-

Both Options Are Secured And Safe

No matter which accounts you choose you are going to have methods to keep you safe. A financial institution provides you with some protection, after all.

First, they have to keep your personal and financial information protected from outside forces. Second, they have to ensure your account up to $250,000 under the Federal Deposit Insurance Corporation. And that protection is completely free and automatic.

Checking Account Benefits

When you do anything with your checking account it’s usually going to be super easy. You can use any of a number of different methods, like:

- ATM – With these, you can withdraw money anytime you want. And ATMs are located just about anywhere you go. Keep in mind you may have to pay fees for out-of-network ATMs.

- Debit Card – With this card you can pay for anything you want directly out of your account. You can only spend up to the amount that’s actually in the account as well. Plus they’re free when you get an account.

- Checks – Not a whole lot of people still use checks but they’re definitely effective. They work the same way as a debit card, taking money directly and immediately out of your account. These are generally going to cost money, though the first pack may be free.

- Bill Pay – For some banks, this is another free service. You’d be able to set up automatic withdrawals to pay any bills out of your checking.

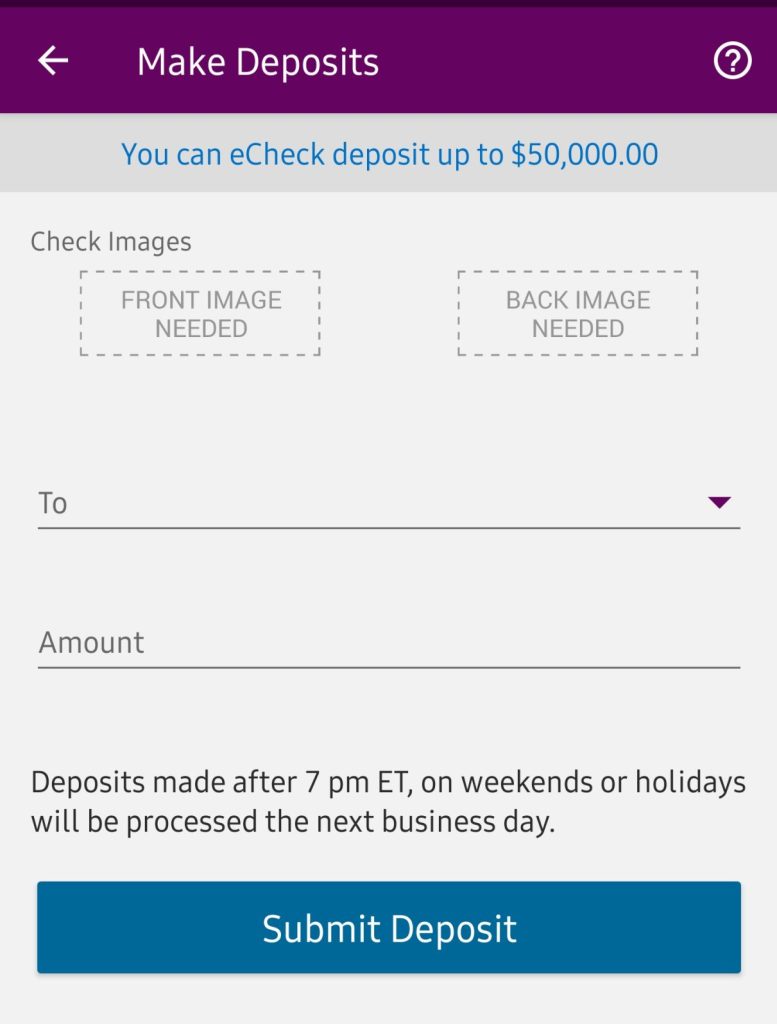

- Online Banking – If you’re more at home on the computer or a mobile device you can use them to manage your banking. Online banking lets you be in control of anything and everything. You can pay bills, deposit checks, transfer money and more.

Money Market Account Benefits

With a money market account, you’re generally earning better interest than a savings account.

What’s really great about these is they work well for medium length plans. If it’s going to take at least a few years but not quite a decade you can use a money market account. Saving for that down payment is one reason you might want one. It will help you earn a bit more interest but you don’t need it right away.

When it comes to these accounts though, you’re going to have a few rules in order to get the benefits. Most banks are going to require you to have some kind of minimum, for example. That means you’re going to need to maintain a specific balance or you could incur fees. For some accounts it’s only a few hundred dollars (or less) for others it might be thousands.

How to Open a Checking Account?

There are various types of accounts to consider when deciding which is best for you, so it's critical to understand the advantages of each.

When you're ready, opening a checking account can be relatively simple if you have the necessary information and documentation.

1. Prepare Your Documents

When opening a checking account, whether online or in person, there are a few things you should prepare or bring with you.

Different banks and financial institutions have different requirements, but here is a list of what is typically required to open a traditional checking account. Some examples are a driver's license, a social security card, a state ID, a passport, and a birth certificate.

You may be required to provide more than one form of official identification in some cases, so be sure to read the requirements for the type of account you're opening.

Whether you open your account online or in person at a physical location, you should prepare the necessary documents ahead of time. Your identification, proof of address, opening deposit (if applicable), and application are all included.

2. Compare And Apply

To begin, consider which services, perks, and benefits are important to you—and which are not. Consider the potential drawbacks such as monthly service fees, withdrawal fees, and minimum deposit requirements. Compare checking accounts and banks, and understand what each of the, offers

Another thing to consider is opening an account with a bank, another financial institution, or an online bank. Consider whether having an in-person location is necessary for you, or if you are comfortable managing your account entirely online.

Is it Possible to Open a Checking Account Without Deposit?

Most banks will require you to make a deposit in order to open a checking account, but some will not. Credit unions may be more willing to accept a deposit in order to open a bank account.

Even though most banks require a deposit, some are not very high and are within most people's means. Some checking accounts also do not have a minimum monthly balance, so you can withdraw the deposit a few days after you make it if necessary.

How to Open a Money Market Account?

If you're looking to learn how to open a money market account, keep in mind that the exact steps will vary depending on where you open your account. The following is an overview of the general procedure for opening a money market account:

Compare Money Market Accounts

When applying for a money market account, you may be required to share or decide on the following:

- Your name, date of birth, taxpayer identification number/Social Security number, mother's maiden name, address, employment status, and income.

- Whether or not you want to include a co-owner. If this is the case, you may require their personal information.

- Whether you want to name a beneficiary who will receive the money if you die. You will also need the personal information of your beneficiary.

- If you wish to receive checks for your account.

- How much money do you want to deposit or transfer into your account?

2. Submit Application And Make A Deposit

To confirm the information in your application, you may be required to submit or upload copies of identification or income-related documents. A utility bill or lease with your name and address, for example, may be required to verify your address.

When opening a money market account, you may be required to make an initial deposit in order to meet the minimum funding requirement. If you did not deposit your funds during the application process, you must do so as soon as your account is opened.

When you open a money market account, you can set up automatic transfers from other accounts to take advantage of the higher APY. You may also be able to request that your employer direct deposit your pay, or a portion of your pay, into the account.

Is it Possible to Lose Money in a Money Market Account?

Money market accounts are not savings accounts, but rather forms of investment. This means that there is a chance of losing money and no guarantee of profit. If interest rates are low, money market rates will be low as well, making it difficult for investors to earn a lot of money.

Money market rates almost never exceed inflation, making them unsuitable for long-term investments. If you're looking for long-term savings or an investment, you might want to look into something other than a money market account. A savings account will ensure that you do not lose any money, but it will also ensure that you do not gain any money other than the interest.

FAQs

How Money market differs from a savings account?

A money market account is an investment where you have the potential to lose or make more money. A savings account will not earn you any more money except for the interest it accumulates while not being used.

Money market funds carry much less risk than a stock or other forms of investment. They also do have fees as savings accounts do. Savings accounts are insured by the FDIC and money market mutual funds are not.

Both accounts give you limited access to the money and only allow you to withdraw a certain amount of times per month.

Which is better CD or money market account?

This depends on what your goals are. If you want to earn the most amount of interest possible and don’t think you need to touch the money for a long time, you can open a CD. It will give you the most return, especially if you open a long-term CD.

A money market account might be a better option If you want to earn a little interest, but think you might need to use some of the money for bills or emergencies.

Are money market accounts FDIC insured?

Money market deposit accounts are FDIC insured, but money market mutual funds are not. If the money market deposit account is from a credit union, it will be insured by the National Credit Union Administration (NCUA).

Savings accounts are also insured by the FDIC. Even though money market mutual funds are not insured by the FDIC, they are regulated by the Securities and Exchange Commission (SEC). Money market accounts and mutual funds are different, so make sure to pay careful attention to which one you are opening and using.

Is there a fee to close a money market account?

In contrast to other types of bank accounts or CDs, most money market accounts do not charge a fee to close the account. They also do not impose a time limit on how long you must keep your funds in the account before removing them. They will, however, charge fees if your balance falls below the minimum.

If you aren't using the account, you should close it to avoid monthly fees and fees for having an insufficient balance. You must contact the bank to close the account, rather than simply withdrawing all of the funds. Always ensure that the account is completely closed.

Why Was I Denied a Checking Account?

A checking account denial is much more common than a credit card or loan denial. However, if you have a history of bad banking decisions, you may be denied a checking account. If you are suspected of bank fraud, a bank may refuse to open a checking account for you.

You may also be denied a checking account if you have a history of overdraft fees or if you have violated the terms and regulations of another bank in some way. A bank will check all of these things through ChexSystems before agreeing to let you open a bank account.

Are money market accounts FDIC insured?

Money market deposit accounts are FDIC insured, but money market mutual funds are not. If the money market deposit account is from a credit union, it will be insured by the National Credit Union Administration (NCUA).

Savings accounts are also insured by the FDIC. Even though money market mutual funds are not insured by the FDIC, they are regulated by the Securities and Exchange Commission (SEC). Money market accounts and mutual funds are different, so make sure to pay careful attention to which one you are opening and using.