Rewards Plan

Sign up Bonus

Credit Rating

0% Intro

Annual Fee

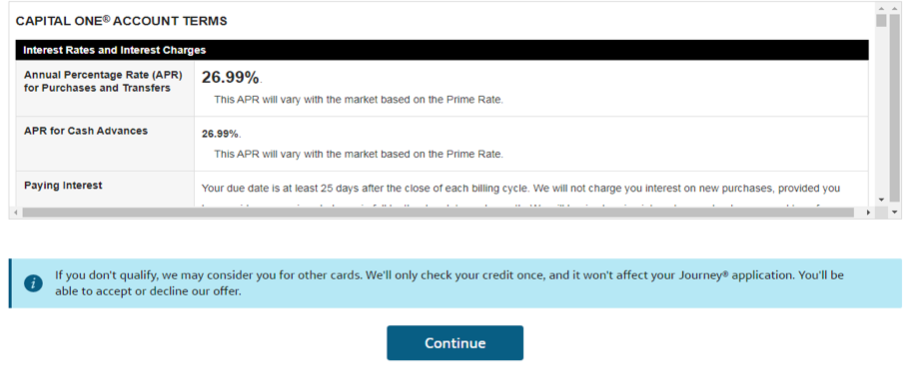

APR

- Cashback

- Insurance Benefits

- No Intro Rate

- No Sign-up Bonus

Rewards Plan

Sign up Bonus

0% Intro

PROS

- Cashback

- Insurance Benefits

CONS

- No Intro Rate

- No Sign-up Bonus

APR

29.99% (Variable)

Annual Fee

$0

Balance Transfer Fee

N/A

Credit Requirements

Fair – Good

- Our Verdict

- Pros & Cons

- FAQ

Contrary to its name, Journey Student Rewards from Capital One is a credit card for students and non-students. You can earn 1% cash back and another 0.25% if you pay on time, so you can boost your cash back to a total of 1.25% There is no annual fee charge, and you may earn up to $60 per year if you subscribe to the streaming platform(s) available. Also, there is no fee for international purchases. The APR for the Capital One Journey Student card is 29.99% (Variable).

The website features an automated customer service available for twenty-four hours, seven days a week, to help customers check their account balances and make quick transactions. Responsible clients can use the Capital One Student card to build credit and access credit scores as often as they like, with up-to-standard tracking tools. This platform permits you to increase your credit line after six months.

- Cashback

- Free $5 per month for streaming

- Credit Line Increase

- Card Lock & Emergency Replacement

- Mobile Application

- Exempted Charges

- Track Your Score

- No Fraud Liability

- Insurance Benefits

- Low Cashback Rate

- No Sign-up Bonus

- High APR

- No Intro Rate

What is the initial credit limit?

Capital One does not promote a specific initial credit limit, but you can expect a limit of $300 to $2,000 depending on your credit circumstances.

Can I Add An Authorized User?

Capital One allows you to add an authorized user to your Journey account. There are no additional costs for this feature, but you will need to provide the person’s details including their full name, address and date of birth. Capital One also makes it easy to remove authorized users from your account if you no longer want to take responsibility for their financial charges.

Does It Report Payments To All Credit Bureaus?

Capital One does report all payment activity for Journey accounts regularly to all three credit bureaus. This means that if you are using your card responsibly, you should have an increase in your score across all credit scoring platforms.

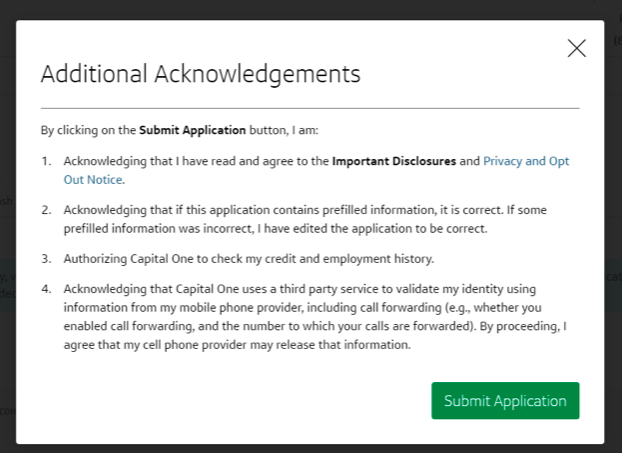

Can I Get Pre Approved?

Unfortunately, it is not possible to get pre approval for the Capital One Journey. This means that if you click apply online, it will be a full application, which will trigger a hard credit pull.

Table of Contents

Advantages

Let’s take a look at the advantages of this card and see if it’s the right one for your wallet or not.

- Cashback

Students earn 1% cash back and another 0.25% if you pay on time, so you can boost your cash back to a total of 1.25%These earnings may be redeemed as statement credits or gift cards. Statement credits are helpful to lower your card balance, while gift cards are for discounted shopping at top brands.

- Free $5 per month for streaming

- Credit Line Increase

Compared to most student credit-cards, Capital One Journey gives customers a chance to increase their credit line as early as six months after usage. Provided that they spend responsibly and maintain good scores.

- Card Lock & Emergency Replacement

- Mobile Application

There is a mobile application for the Capital One Journey Student card. The app lets you make purchases and check your balance as many times as you like. It is downloadable on the apple store for ios devices and on the google play store for android users.

- Exempted Charges

- Track Your Score

Capital One Journey provides customers and non-customers with credit score tracking tools. This feature allows you to manage and build your score effectively.

- No Fraud Liability

There is always the possibility of losing your card or it being stolen. When this happens, Capital One Journey does not charge you for fraud liability. There is a zero percent fraud liability on all unauthorized transactions.

- Insurance Benefits

Disadvantages

Let’s take a look at the disadvantages of this credit card and see if it’s the right one for your wallet or not.

- Low Cashback Rate

Many review sites believe that the Capital One Journey Student card's cashback rate is lower than most.

- No Sign-up Bonus

Many credit card companies offer sign-up bonuses as an incentive to attract customers. Here, clients are not entitled to any welcome bonus after opening the account.

- High APR

- No Intro Rate

Many credit-card companies have an introductory rate for first-time clients – this rate could last up to 6 months or a year. However, Capital One Journey Student does not offer any introductory APR.

Top Offers

Top Offers From Our Partners

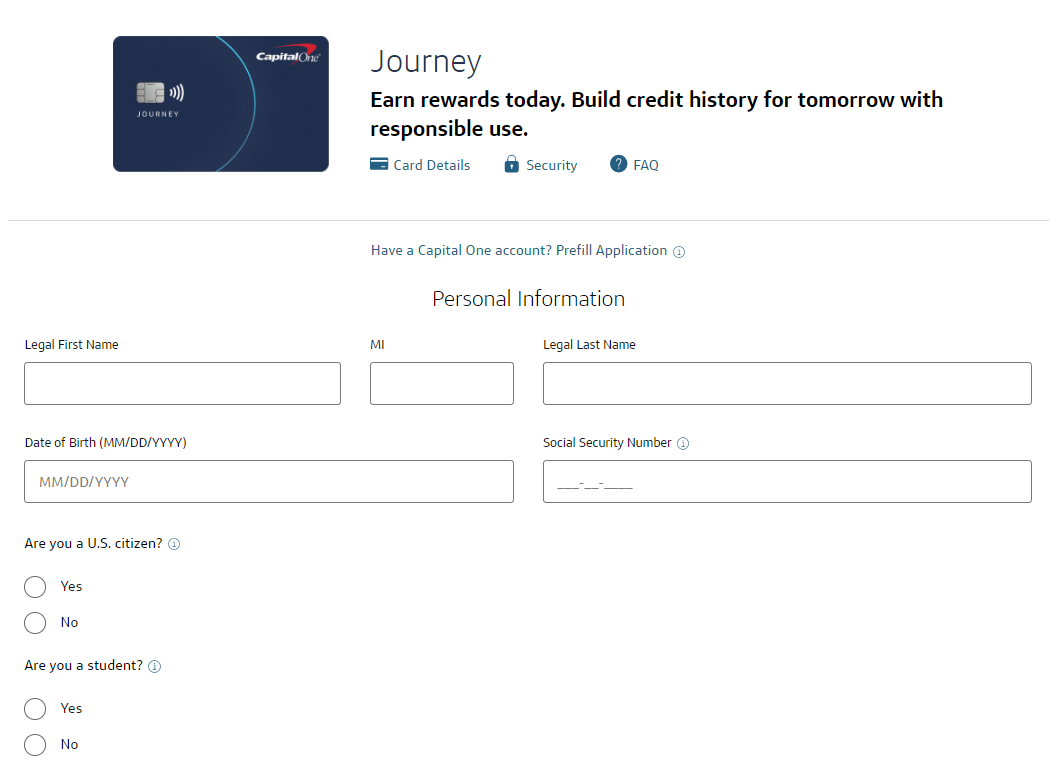

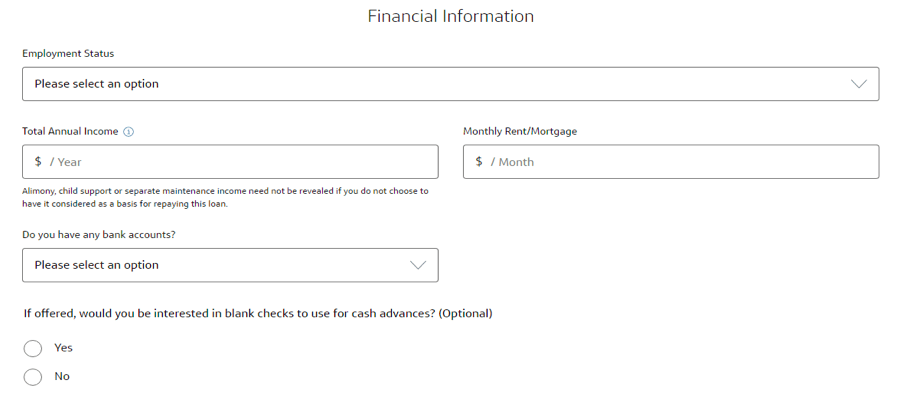

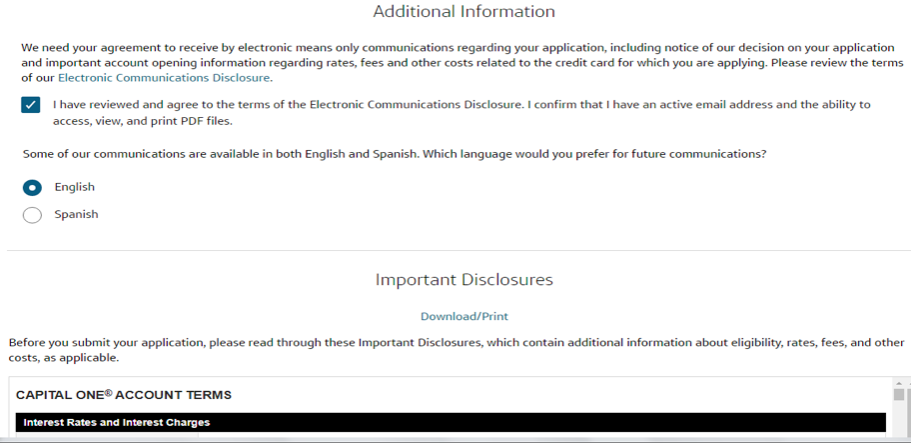

How To Apply For Capital One Journey Student Card?

- 1.

- 2.

You will be asked to fill in the boxes with your personal information, including name, date of birth, social security number, and citizenship. Scroll down to fill in your contact information as well, which includes your residential address, email, and phone number.

- 3.

- 4.

- 5.

- 6.

Is the Capital One Gold Journey Student Card Right for You?

The Capital One Journey Student card is a great option for those with average credit scores, though the name might be a bit misleading since it's not just for students.

This card is a good choice if you’re focused on managing your credit effectively while earning cashback rewards. Paying early can earn you an additional 0.25% cashback.

If you consistently maintain good credit, you could be eligible for a credit line increase within six months. It's also a solid option for international purchases, as there are no foreign transaction fees.

FAQ

If your application is denied, Capital One typically doesn’t provide a specific reason. It’s a good idea to review your credit report for potential issues, like a high credit utilization ratio, that could have contributed to the decision.

By addressing any concerns, you can work toward improving your credit and consider reapplying in the future. In some cases, Capital One might suggest a secured card or other card options as alternatives.

Capital One has a decent online platform for its customers, which allows you to manage all your Capital One accounts.

When you log into your Capital One bank account, there is the option to link a credit card. This will allow you to manage your card from the same platform as your bank accounts.

Capital One cannot provide a specific answer to this question, as how long it takes to affect your credit score will depend on your spending habits, payment activity and general credit situation.

However, a good rule of thumb is that if you use your card responsibly, you should be able to see an improvement in your score in approximately six months.

Compare The Alternatives

|

|

| |

|---|---|---|---|

OpenSky® Secured Visa® Credit Card | First Progress Platinum | Milestone® Mastercard® | |

Annual Fee | $35 | $29

| $175 the first year; $49 thereafter |

Foreign Transaction Fee | 3%

| 3%

| 1% of each transaction in U.S. dollars

|

Purchase APR | 24.64% Variable | 25.24% Variable

| 35.90%

|