Rewards Plan

Welcome Bonus

Credit Rating

0% Intro

Annual Fee

APR

- Member Exclusives

- Star Money Bonus Days

- High APR

- Limited Reward Rates

Rewards Plan

spend $1,200 or more annually to get 5X points per dollar on purchases made at Macy's, 3X points if you spend $500 to $1199 and 2X points if you spend up to $500. Also, get 3X points at restaurants including delivery, 2X at gas stations & supermarkets and 1 point per $1 spent everywhere else

Welcome Bonus

0% Intro

PROS

- Member Exclusives

- Star Money Bonus Days

CONS

- High APR

- Limited Reward Rates

APR

33.24% variable

Annual Fee

$0

Balance Transfer Fee

N/A

Credit Requirements

Fair - Good

- Our Verdict

- Pros & Cons

The Macy's Credit Card is a store-branded credit card issued by Macy's, the well-known department store chain in the U.S. It offers exclusive discounts and rewards for Macy's customers, including special discounts on purchases, free shipping, and access to exclusive events and sales.

Compared to other store cards, the Macy's Credit Card provides solid rewards and benefits for frequent Macy's shoppers. However, it may not be as valuable for those who shop at other retailers or prefer more flexible redemption options.

- Rewards On Many Categories

- Higher Rewards For Loyal Customers

- Star Passes

- Free Shipping For Gold & Platinum

- Cardholders Exclusive Offers

- Co-Branded

- High APR

In this Review

Estimating Your Rewards: A Practical Simulation

Displayed in the table below is a rewards simulation that illustrates the advantages of utilizing the Macy’s Credit Card. The table estimates the potential rewards that could be earned by utilizing the card for expenses in different categories.

| |

|---|---|

Spend Per Category | Macy’s Credit Card |

$10,000 – U.S Supermarkets | 20,000 |

$3,000 – Restaurants

| 9,000 |

$3,000 – Airline | 3,000 |

$3,000 – Hotels | 3,000 |

$4,000 – Gas | 4,000 |

Estimated Annual Points | 39,000 Points |

Pros and Cons

Just like any other credit card, the Macy's card has some advantages and disadvantages:

Pros | Cons |

|---|---|

Rewards On Many Categories | Co-Branded |

Higher Rewards For Loyal Customers | High APR |

Star Passes | |

Free Shipping For Gold & Platinum | |

Cardholders Exclusive Offers |

- Rewards On Many Categories

Macy's credit card customers earn spend $1,200 or more annually to get 5X points per dollar on purchases made at Macy's, 3X points if you spend $500 to $1199 and 2X points if you spend up to $500. Also, get 3X points at restaurants including delivery, 2X at gas stations & supermarkets and 1 point per $1 spent everywhere else.

- Higher Rewards For Loyal Customers

Macy’s Credit Card’s Reward rates vary according to your status level and spending. Here are the status levels for the Macy's Credit Card:

- Silver: This is the default status level, which is based on spending between $1 to $500. It allows you to earn 2X points per dollar on purchases made at Macy's.

- Gold: With a Gold status membership, you can earn 3X points per dollar. However, your spending must fall between $500 and $1199 annually at Macy's.

- Platinum: The Platinum status level allows you to earn 5X points per dollar and requires an annual spend of $1,200 or more at Macy's with a Macy's Card.

- Star Passes

With Star Passes cardholders are provided with an opportunity to select a specific day of their preference to earn a discount of 25% on qualifying items by presenting a Star Pass coupon and making payment using the credit card.

- Co-Branded

If you’re not a frequent Macy shopper you won’t be much benefiting from this card.

Macy's Credit Card is specifically designed to be used only at Macy's stores or online, so individuals who tend to shop more frequently at merchants other than Macy's may find the card to be less versatile compared to shopping credit cards that offer greater acceptance at a wider range of merchants.

- High APR

Macy's Credit Card comes with a hefty APR of 31.24% variable, which could potentially result in substantial interest charges for users who maintain a balance on their card.

- Free Shipping

Members with Gold and Platinum status are eligible for free shipping without any minimum purchase requirement. For those with Silver status membership, free shipping is available on purchases worth $25 or more.

- Cardholders Exclusive Offers

If you are a Macy's Credit Card cardholder you can get access to special product offers and deals that are not accessible to non-cardholders.

These exclusive offers may involve reduced prices, complimentary items, or other exceptional promotions that are exclusively designed for cardholders.

Top Offers

Top Offers From Our Partners

Top Offers

Is It The Right Card For You?

If you are a frequent shopper at Macy's, the Macy's Credit Card can provide significant benefits, such as exclusive offers, free shipping, and special financing options. This credit card is specifically designed for those who shop regularly at Macy's stores or online and wish to take advantage of the card's unique rewards, discounts, and other perks.

Moreover, Macy's Credit Card can be a useful tool for individuals looking to establish or improve their credit. By using the card responsibly and making regular payments, one can build a positive credit history, which may ultimately result in higher credit scores and access to other credit options.

If you are looking for a co-branded shopping card, in the table below you can see some of the alternatives:

Card | Rewards | Bonus | Annual Fee | |

|---|---|---|---|---|

| 1% – 3%

3% cash back at Apple and select Apple pay partners. 3% Daily Cash back at Ace Hardware, Duane Reade, Exxon, Mobil, Nike, Panera Bread, T-Mobile, Uber, Uber Eats, and Walgreens. 2% on other Apple pay purchases, and 1% on all other purchases

| N/A

N/A

| $0 | |

| 1% – 5%

5% off at Target and target.com, 2% on dining and gas purchases and 1% everywhere else outside of Target

| None

None

|

$0 | |

| 1-4%

4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases

| None

| $0 ($60 Costco membership fee required)

$60 Costco membership fee required

| |

| 1-5%

5% back on Amazon.com, Amazon Fresh, Whole Foods Market, and Chase Travel purchases. Plus, you’ll get 2% back at gas stations, restaurants, and on local transit, and 1% on all other purchases

| $150

$150

| $0 ($139 Amazon Prime subscription required) | |

| 1-5%

5% cash back at Walmart.com (including pickup and delivery), 2% cash back in Walmart stores and gas stations, at restaurants and on travel plus 1% cash back everywhere else Mastercard is accepted

| 5%

5% cash back for the first 12 months when you use your card with Walmart Pay for in-store purchases, upon approval

| $95 | |

| 1% – 5%

5% (10 points) back in rewards at Victoria Secret or PINK, 2% (4 points) on dining, travel and streaming services and 1% (2 points) on all other purchases

| $30

$30 Reward when you spend $500+ outside VS & PINK within 90 days of account opening

| $0 |

How To Get the Most Out of Your Card?

Here are some tips that will help you to maximize the benefits of Macy's Card:

-

Take Advantage Of Rewards

You can earn points at a rate of 2X – 5X for every dollar spent at Macy's stores or online, depending on your membership level.

You can increase the value of your purchases by exchanging these points for discounts, unique incentives, or other special benefits.

-

Take Advantage Of Free Shipping

With Gold and Platinum status membership you are eligible for the free shipping and if you are someone who pays a lot for shipping charges this can be a potential reward for you.

-

Special Promotions

Being attentive for special promotions that offer bonus points for specific purchases or at certain times of the year is one way to make the most of your Macy's Credit Card.

These limited-time offers can help you earn more points and get closer to redeeming them for important prizes.

-

Pay On Tiime And Avoid High Interest Charges

You must pay your bills on time to avoid high-interest charges and establishing a positive credit history. This can ultimately lead to better access to credit options in the future.

-

Keep Your Account Updated

One of the additional benefits that comes with Macy's Credit Card is a birthday surprise and exclusive offers, so make sure that the information on your account, such as your date of birth or phone number, is updated.

How To Apply?

It's easy and quick to apply for the Macy's Card:

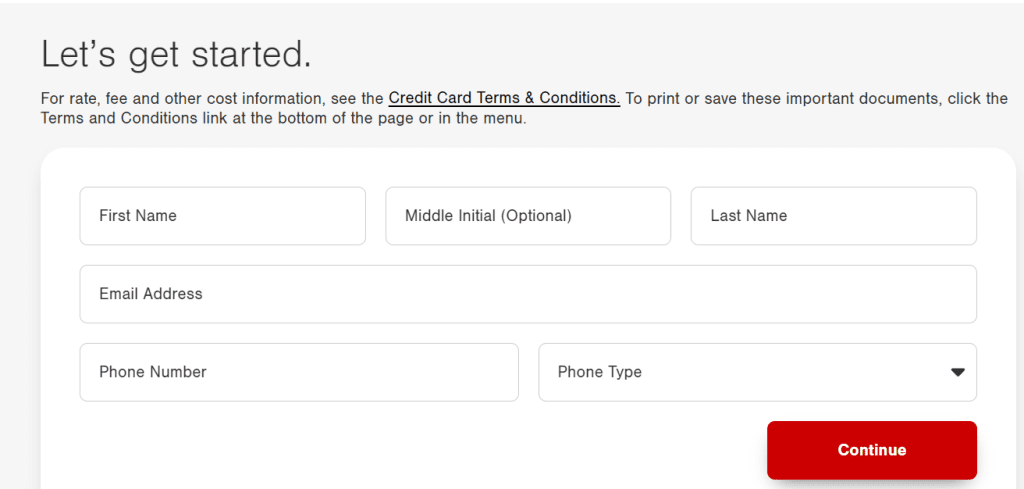

Step 1: Visit the Macy’s Credit Card page and click “Apply Now”.

Step 2: After you click on ‘apply now', it takes you to the next page where you have to fill in your personal information, such as name, email, etc.

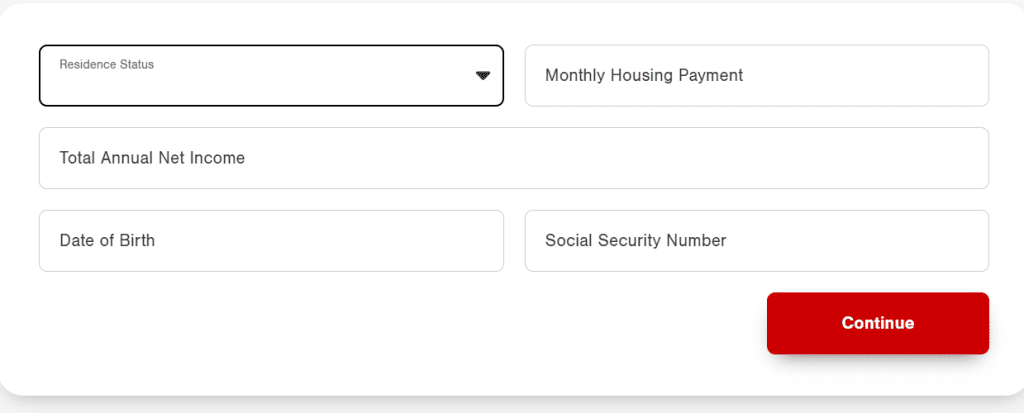

Step 3: After filling out the required information and clicking on “continue,” you will be prompted to provide additional information such as your full address, your current residence status, annual income, Etc.

Step 4: You will get a preview page to check whether the information you filled in is correct or not. Lastly, ensure that you read through the important disclosure page to know about your eligibility, fees, costs, rates, etc. Then, click on “submit” to complete the process.

FAQs

Upon instant approval of your new Macy's Card account, you'll receive a one-time 25% discount to use within the first two days, either in-store or online, for purchases made with your Macy's Card. This discount is valid for up to $100 on Macy's purchases made during those two days.

New Macy's Credit Card accounts start at Silver status, which comes with great benefits (as mentioned above). You can upgrade to Gold status by spending at least $500 in net purchases on your Macy's Card within a calendar year, or to Platinum status by spending at least $1,200 in net purchases within the same time frame. Your loyalty status will be upgraded 7 days after you reach the $500 or $1,200 threshold.

To contact the Credit Customer Service center, call 1-888-257-6757 (TTY: 711) between 10am to 10pm ET, any day of the week. If you're calling from outside the U.S., Canada & Puerto Rico, call collect at 1-727-556-5758.

Citibank, N.A. is the issuer of both the Macy's Credit Card and the Macy's American Express Card.

If you're approved for the Macy's Card, you should receive instant notification. However, if your application requires further processing, the bank will inform you of the decision by mail and provide the reasons for their decision.

Compare Macy's Credit Card

The Target RedCard is our winner especially if you focus on groceries and dining, with much better cashback rates than Macy's Credit Card.

Target Red Card vs. Macy's Credit Card: What Store Card Offers The Highest Rewards?

The Macy's Credit Card is a clear winner with higher points rewards ratio and higher cashback value for the same spend than Nordstrom Card.

Nordstrom vs. Macy’s Credit Card: Which Store Card Gives You The Most Value?

The Macy's Credit Card is a clear winner with higher points rewards ratio and overall cashback value for the same spend than JCPenney Card.

Macy’s vs. JCPenney Credit Card: Which Gives You The Most Value?

Unlike Kohl's card, the Macy's Credit Card offers points rewards on all categories, making it more attractive for the average consumer.

Macy's Credit Card vs Kohl's Charge Card by Capital One: Which One Wins?