Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- Extended Returns

- No Annual Fee

- Rewards Only Usable at Target

- Discount Limitations

Rewards Plan

Sign up Bonus

Our Rating

PROS

- No Annual Fee

- Extended Returns

CONS

- Rewards Only Usable at Target

- Discount Limitations

APR

28.95% Variable

Annual Fee

$0

0% Intro

None

Credit Requirements

Avergae – Good

- Our Verdict

- FAQ

Target Red Card is a store credit card issued by the large retailer Target, one of the largest discount retailers in the US, with many different brick and mortar stores as well as a strong online presence.

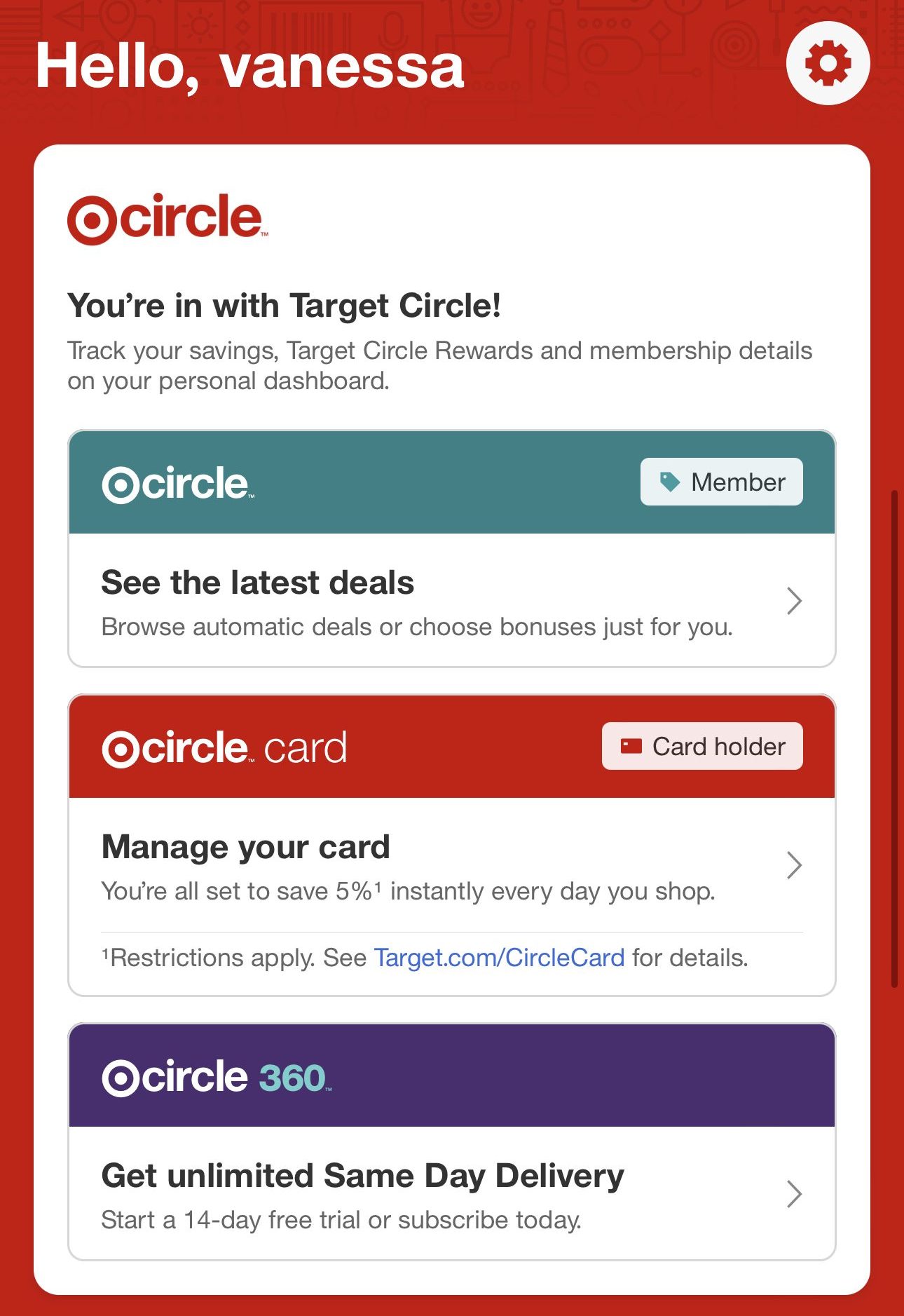

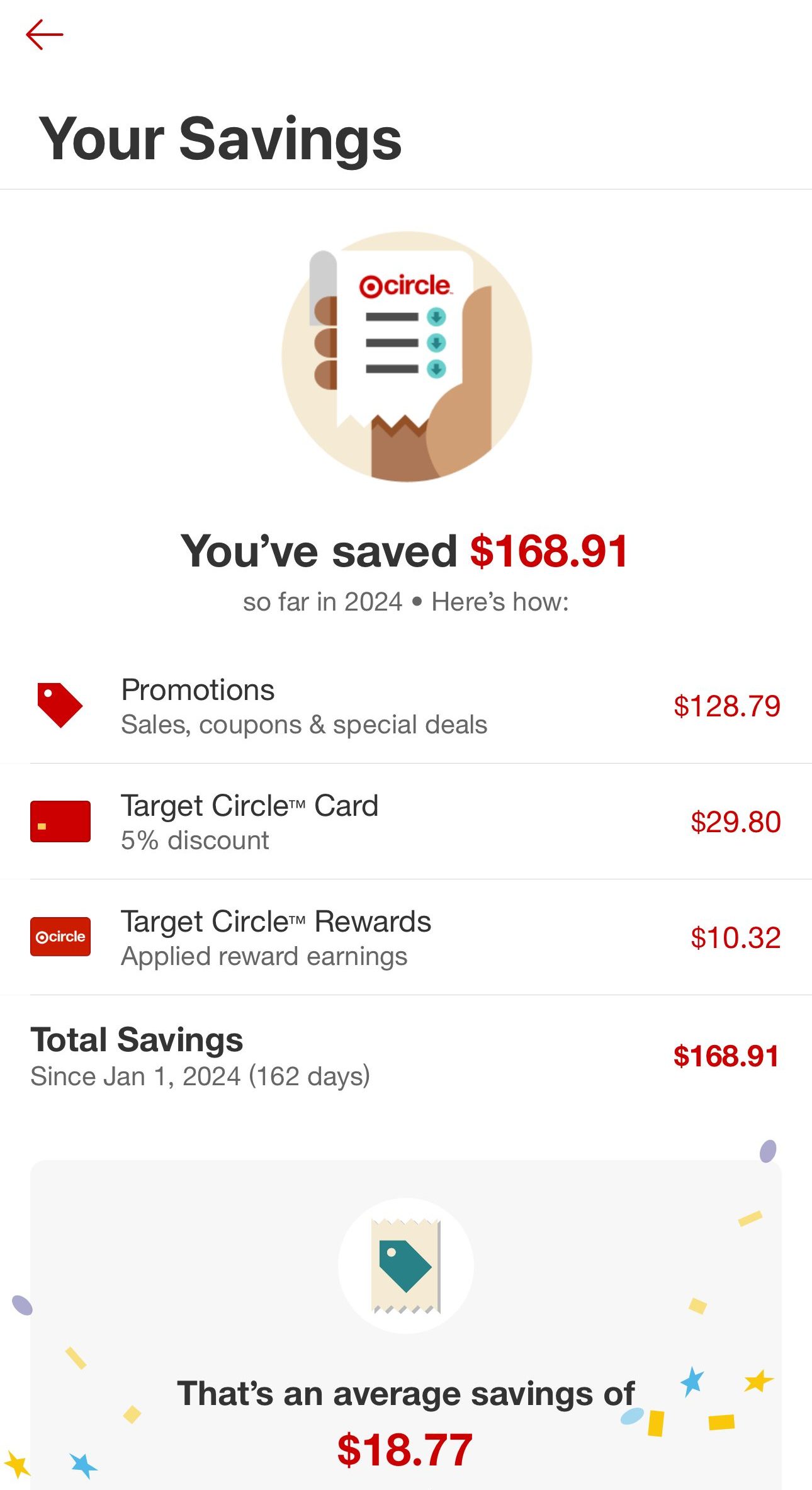

The Target RedCard comes with a variety of perks and rewards for cardholders. The biggest benefit is the 5% off at Target and target.com, 2% on dining and gas purchases and 1% everywhere else outside of Target, with no limits. Plus, when you use your card for online orders, you’ll enjoy free 2-day shipping.

The card doesn't have an annual fee, and can be great for average credit (around a 615 credit score) who want to use it to build or rebuild their credit. In addition, exclusive benefits include extended returns, special discounts, and occasional free items.

While the Target RedCard offers great perks, there are some downsides to consider. It has a high APR 28.95% Variable, and doesn’t come with introductory offers. The welcome bonus is a one-time $40 discount, which is modest compared to other cards. Additionally, the 5% discount isn’t applicable to all items, such as prescriptions and gift cards. Keep in mind, the RedCard is more limited in its use compared to regular cash-back cards.

How do I redeem Target RedCard rewards?

Once you accumulate at least $10 in savings, you can request an electronic or physical Target GiftCard online or by calling.

Are there fees for upgraded shipping with the Target RedCard?

Yes, fees apply for upgraded shipping, and free shipping doesn't cover same-day or grocery delivery orders through Shipt.

Does the 5% discount apply to all Target items?

The 5% discount has limitations; it doesn't apply to certain items like prescriptions, gift cards, and specific services.

Can the Target RedCard benefits be used outside of Target?

No, the benefits, including discounts and rewards, can only be used for purchases at Target and Target.com.

What are the exclusive extras offered with the Target RedCard?

Exclusive extras include an extended return window, special discounts, and occasional free items for cardholders.

Pros & Cons

Let’s look at the benefits and drawbacks of the Target Red card and see if it’s the right one for your wallet.

Pros | Cons |

|---|---|

No Annual Fee

| Rewards Only Usable at Target |

High Cashback on Target | Discount Limitations |

Exclusive Offers, Combined Discounts | No 0% Intro APR |

Extended Returns | High APR |

Free Delivery

|

- No Annual Fee

You do not have to meet a spending threshold in order to offset an annual fee.

- High Cashback on Target

Cardholders of the Target Red card enjoy a 5% off at Target and target.com, 2% on dining and gas purchases and 1% everywhere else outside of Target.

- Exclusive Offers, Combined Discounts

Target Red cardholders get access to special offers ranging from increased discounts and early access to Black Friday deals to exclusive products and discounts on outside vendors like Hotels.com.

Also, the high cashback rate perk can be used with sales, coupons, and clearance items, give you the option to save even more on the discounted purchases.

- Extended Returns

Cardholders get an extra 30 days for returns with the Target Red card. That means customers have up to 120 days to return items they do not like, need, or that were defective.

- Free Delivery

Target Red card can be used online for purchases and when it is used, cardholders get 2 day free shipping.

Usually to get free shipping from Target customers need to purchase over $35 in merchandise. There are some restrictions so make sure to read item details before making an online purchase.

- No Membership Requirement

Unlike some store cards, there is no need to join a membership program to unlock the best discounts and perks, making it more accessible.

- Rewards Only Usable at Target

The benefits, including the 5% discount and gift card rewards, can only be utilized for purchases at Target and Target.com, limiting flexibility.

- Discount Limitations

The 5% discount does not apply universally, excluding certain items like prescriptions, gift cards, and services such as eye exams or protection plans.

- No 0% Intro APR

The Target Red card does not offer an introductory rate unlike many cards on the market. It you need or are looking for an introductory rate, you will have to look at other offerings.

- High APR

The APR for the Target Red card is a 28.95% Variable.

These rates are high but many can qualify with ok credit. Most store cards have very high APRs.

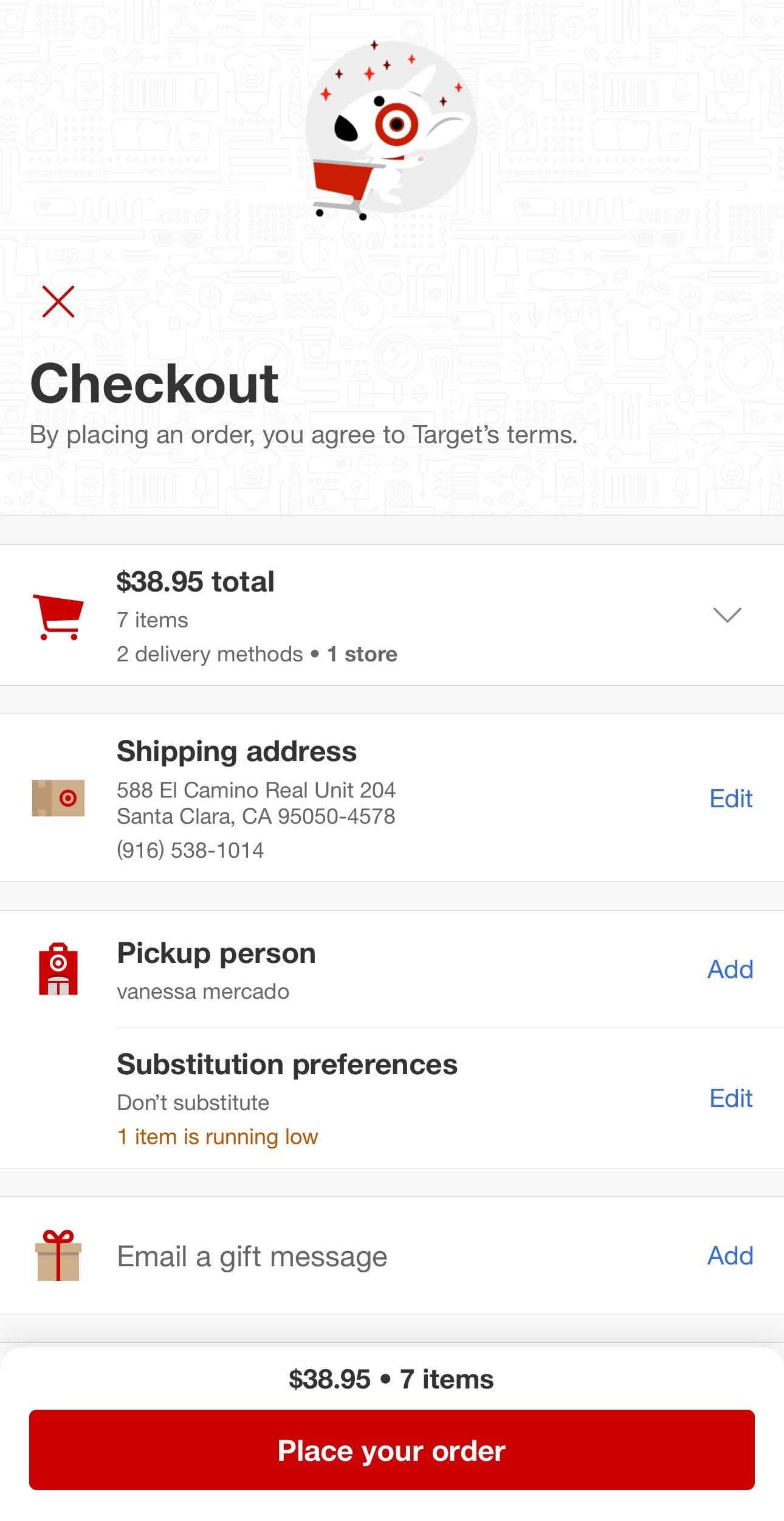

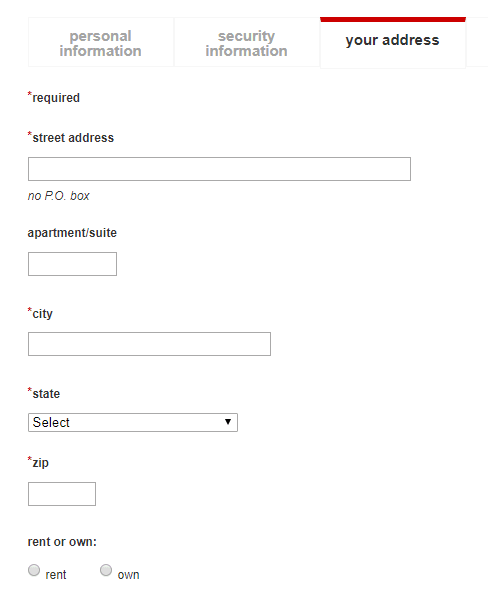

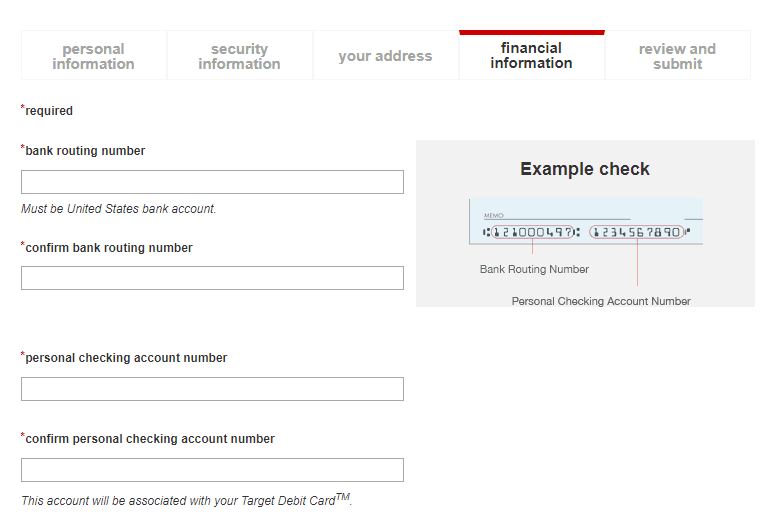

How To Apply For Target Red Credit Card?

- 1.

Visit the Target red card homepage.

- 2.

Next, fill the “Identity Protection Guide,” which includes your names, primary phone, and email address.

- 3.

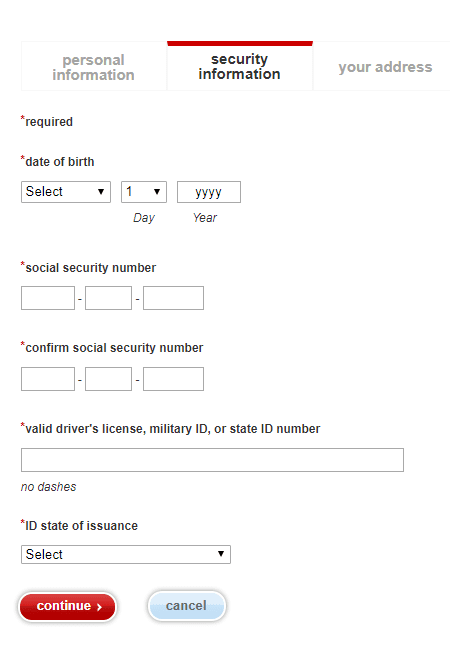

On the next page, fill in your security information such as your date of birth, SSN, and your ID, then click “Continue.”

- 4.

Next, fill in your address as well as your financial information.

- 5.

Finally, review your application and submit it.

How It Compared To Other Store Cards?

The Target RedCard, in comparison to other store credit cards, offers a competitive suite of rewards and benefits but has its distinct advantages and limitations. Similar to Amazon, Walmart, it provides a straightforward 5% discount on eligible purchases, simplifying the rewards structure.

However, the exclusivity of benefits limited to Target and Target.com is a notable drawback. This contrasts with the broader applicability of some other store credit cards, like the Amazon Prime Visa, Walmart Credit Card, Costco Anywhere Visa, Macy's American Express, and Sam's Club Mastercard.

While the Target RedCard offers free two-day shipping and exclusive extras like extended returns, it lacks a compelling welcome bonus. For example, Prime Visa offers Get a $150 Amazon Gift Card instantly upon approval exclusively for Prime members , Walmart card offers 5% cash back for the first 12 months when you use your card with Walmart Pay for in-store purchases, upon approval and Costco card offers None.

However, unlike other store cards, the Target card doesn't require a memebership. The Amazon card require a $139 membership fee, Sam's Club $45 and to get the Costco card you'll need to pay $60 to be a member.

Is the Target Red Card Right for You?

The Target Red card is great for anybody who shops at Target or at Target.com, both loyal customers and occasional shoppers.

The 5% off at Target and target.com, 2% on dining and gas purchases and 1% everywhere else outside of Target cannot be matched by even some of the best cashback credit cards available. Shoppers do not have to wait months or build up points or amounts to use the high cashback.

Those who are loyal Target customers will find even more perks with free shipping and exclusive offers. Customers who may not have stellar credit may still be able to get a Target Red card and benefit from the perks. They can even use the card to help rebuild their credit history.

Customers will get the same perks as with the Red card but it will be connected to your checking account. However, with the debit card you will not be building your credit. If you do not shop at Target or shop very infrequently there, this may not be the card for you.

Compare The Alternatives

If you're looking for a store credit card – the Target Red card is definitely a good option, but there are some good alternatives:

|  |

| |

|---|---|---|---|

Costco Anywhere Visa® Card by Citi | Best Buy Visa Card | Sam's Club® Mastercard® | |

Annual Fee | $0 ($60 Costco membership fee required)

| $0

| $0 ($50/$110 for Club/Plus membership – MUST)

|

Rewards |

1-4%

4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases

|

1-5%

5% back in rewards on shopping at BestBuy, 3% back in rewards on gas purchases, 2% back in rewards on dining, takeout and grocery purchases, 1% back in rewards on everyday purchases

|

1-5%

5% cash back on gas anywhere Mastercard is accepted (on the first $6,000 per year, then 1% after), 3% cash back on Sam’s Club purchases for Plus members, 3% on dining and takeout and 1% on all other purchases

|

Welcome bonus |

None

None

|

20% first day

20% back in rewards on your first day of purchases.

|

None

$30 statement credit after making $30 in Sam’s Club purchases within the first 30 days

|

Foreign Transaction Fee | $0

| N/A

| N/A

|

Purchase APR | 19.24% – 27.24% (Variable)

| 15.24% – 31.74% variable

| 20.40% or 28.40% Variable

|

Compare Target Red Card

While Target RedCard offers a less attractive cashback rewards ratio than Amazon, it still may be a better option for some. Let's compare.

If you focus on groceries – the Target RedCard wins, but if you focus on travel or gas – you may want the Costco credit card.

Target Red Card vs. Costco Anywhere Visa Card: How They Compare?

If you do all your grocery and fuel shopping at either Target or Sam's Club, the cashback you get from both credit cards is pretty similar.

The target RedCard is our clear winner, with a higher cash-back rate and estimated annual value. Here's what you can get with each card.

The Target RedCard is our winner especially if you focus on groceries and dining, with much better cashback rates than Macy's Credit Card.

Target Red Card vs. Macy's Credit Card: What Store Card Offers The Highest Rewards?

Top Offers