The Emirates Skywards Premium World Elite Mastercard and The Platinum Card® from American Express are both prestigious credit cards catering to a high-end clientele, yet they differ in several key aspects. Let's compare them side by side.

General Comparison

The Emirates Skywards Premium World Elite Mastercard primarily appeals to frequent travelers with a penchant for luxury. Geared towards Emirates Airlines loyalists, it offers an array of travel-centric perks such as complimentary lounge access, priority boarding, and bonus Skywards Miles for Emirates flights.

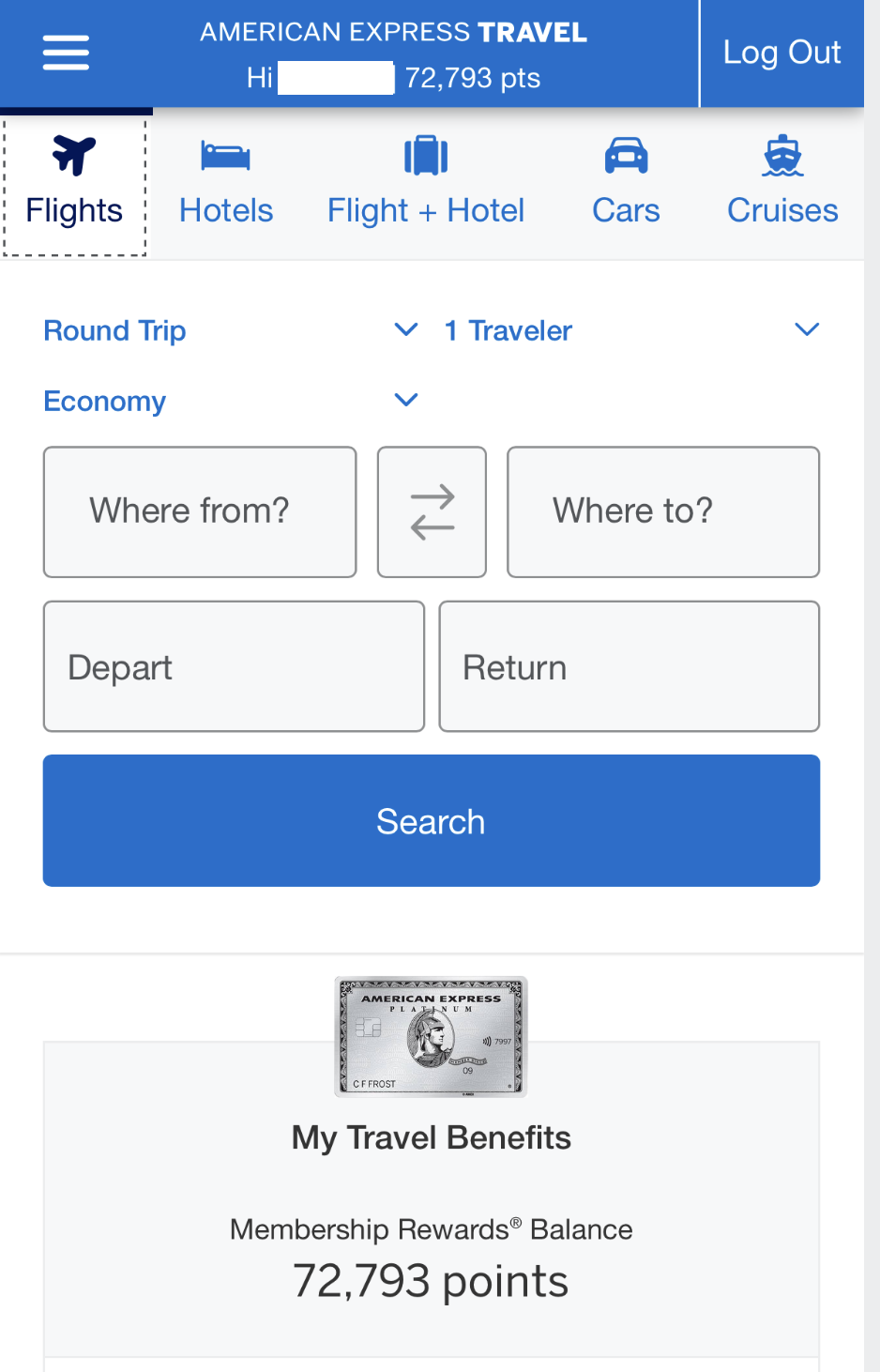

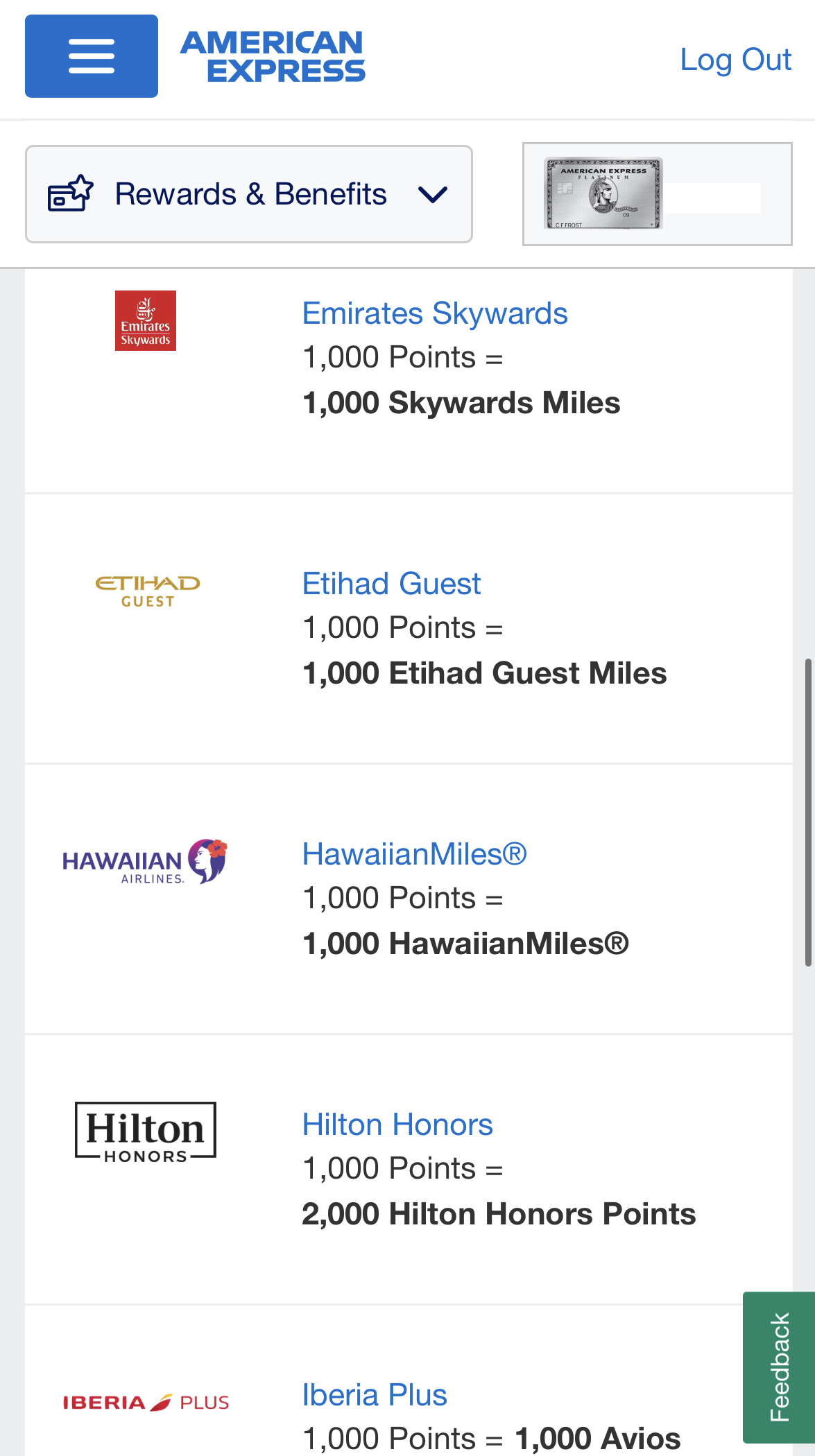

On the other hand, the Amex Platinum Card positions itself as a versatile luxury card with broader appeal. Its benefits extend beyond travel, encompassing exclusive access to the American Express Global Lounge Collection, statement credits for select purchases, elite hotel status, and concierge services.

Here's a comparison of the card's main features:

|

| |

|---|---|---|

The Amex Platinum Card | Emirates Skywards Premium World Elite Mastercard | |

Annual Fee | $695. See Rates and Fees. | $499 |

Rewards | 5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases. | 3X miles per dollar on eligible Emirates purchases, 2X miles for travel purchases and 1X mile for all other purchases |

Welcome bonus | 175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership. | 70,000 bonus Skywards Miles after spending $3,000 on purchases in the first 90 days.

|

0% Intro APR | None | N/A |

Foreign Transaction Fee | $0 | |

Purchase APR | See Pay Over Time APR | 19.99% to 29.99%

|

Read Review | Read Review |

Compare Rewards: Which Card Gives More?

The Amex Platinum card is a clear winner when we compare rewards for the same spend. The Emirates points rewards ratio is less attractive in all categories, not to mention the variety of redemption options cardholders can get with the Platinum card.

|

| |

|---|---|---|

Spend Per Category | The Platinum Card | Emirates Skywards Premium World Elite Mastercard |

$10,000 – U.S Supermarkets | 10,000 points | 10,000 miles |

$5,000 – Restaurants | 5,000 points | 5,000 miles |

$6,000 – Hotels | 30,000 points | 12,000 miles |

$8,000 – Airline

| 40,000 points | 24,000 miles |

$4,000 – Gas | 4,000 points | 4,000 miles |

Total Points | 89,000 points | 55,000 miles |

Estimated Redemption Value | 1 point ~ 0.6 – 1.6 cents | 1 point = ~1.1 cents |

Estimated Annual Value | $534 – $1,424 | $605 |

Travel And Airline Benefits: Comparison

When it comes to travel perks and benefits, the Amex Platinum card clearly takes the lead. It offers a range of high-value statement credits, Marriott Bonvoy Gold Elite status, and several other premium perks.

The Emirates card, on the other hand, offers Gold Tier membership only for the first year, which you can keep by spending $40,000. While the card has its benefits, they don’t quite measure up to the value you get with the Platinum card.

The Amex Platinum Card

- Marriott Bonvoy Gold Elite Status: Cardholders are eligible for complimentary enrollment in Marriott Bonvoy Gold Elite status, providing access to a range of exclusive hotel perks and benefits.

- Priority Pass: Platinum Card members receive a complimentary Priority Pass Select membership, granting access to over 1,400 lounges worldwide (excluding Priority Pass restaurant lounges).

- Dedicated Service Team: Access a 24/7 customer service team for swift issue resolution and assistance.

- Up to $200 Uber Cash: Enjoy up to $200 in Uber Cash, along with Uber VIP status for top-rated drivers, without the need to meet minimum ride requirements.

- Up to $100 Fee Credit for Global Entry or TSA PreCheck®: The Platinum card offers this reimbursement, one credit for every four years.

- Preferred Seating: Experience preferred seating at sporting and cultural events, subject to availability.

- $100 Experience Credit: Receive a $100 experience credit when booking The Hotel Collection through American Express Travel for stays of at least two nights.

- Extra Cards: Add supplementary cards to your account at no additional cost, allowing others to earn rewards on their purchases.

- Signature Perks at Upscale Hotels: Enjoy exclusive signature perks at upscale hotels within the Amex Hotel Collection when booking through American Express Travel.

- Up to $200 Hotel Credits: Receive up to $200 in hotel credits annually (Fine Hotels + Resorts or The Hotel Collection) when staying for a minimum of two nights through American Express Travel.

- Up to $240 Digital Entertainment Credit: Obtain up to $240 per year (or $20 per month) in statement credits for subscriptions to The New York Times, Peacock, or SiriusXM when using your card for payment.

- Up to $155 Walmart+ Credit: Cardholders can receive up to $155 in Walmart+ credits by utilizing their card for monthly Walmart+ membership payments.

- Up to $200 Airline Fee Credit: Benefit from up to $200 in airline fee credits per year when charging incidental travel fees from selected airlines to your card.

- Equinox Membership Credit: Receive up to $300 in statement credit for eligible Equinox memberships when enrolling and paying with your card, subject to auto-renewal.

- CLEAR® Plus Membership Credit: Get up to $199 back per year when using your card to pay for a CLEAR® Plus membership.

Terms apply to American Express benefits and offers.

Emirates Skywards Premium World Elite

- Emirates Gold Tier Membership: Available during your first year, and you can keep your status by spending $40,000 each membership year. Benefits include:

- Increased baggage allowance.

- Priority customer service.

- Guaranteed economy class seats, even on full flights.

- Complimentary access to Emirates Business Class lounges in Dubai and across the Emirates network for you and a guest.

- A 50% bonus on miles earned from flights on Emirates or Flydubai.

- Global Entry or TSA PreCheck Application Fee Credit: Enjoy an automatic statement credit covering one application fee every five years, up to $100.

- 25% Savings on Buying or Gifting Miles: Benefit from a 25% discount when purchasing or gifting Skywards Miles.

- Priority Pass™ Select Lounge Access: Gain unlimited access to over 1,200 lounges globally for both the primary cardmember and their guest(s).

- World Elite Concierge: Access a complimentary 24/7 concierge service.

- Elite Rental Car Status: Receive elite status with Avis, Sixt, and National Car Rental.

- Mastercard Luxury Hotels and Resorts: Enjoy perks such as upgrades, amenity credits, and complimentary breakfast at over 3,000 properties in Mastercard's Luxury Hotels and Resorts portfolio.

- Mastercard Priceless: Gain access to unique experiences and events, including PGA TOUR access in more than 40 cities worldwide.

- Peacock Premium Discounts: Save $3 on Peacock Premium or $5 on Peacock Premium Plus monthly subscription using your World Elite Mastercard.

- Instacart Benefits: Enjoy fast grocery delivery within an hour with Instacart, plus receive 2 free months of Instacart+ for free delivery and a $10 monthly discount on your second order.

- Lyft Rewards: Take 3 Lyft rides in a month and receive a $5 credit each month towards your next ride, adding an adventurous touch to your travels.

- ShopRunner Membership: Unlock the convenience of free 2-day shipping and returns at top stores like Under Armour and Bloomingdale’s with a complimentary ShopRunner membership

Travel Insurance And Protections: Comparison

Overall, the Amex Platinum card coverage is much better than the Emirates Skywards Premium card. Here are the common protections for both cards:

$0 Liability On Unauthorized Charges: ensuring you are not held responsible for charges you did not authorize.

- Cell Phone Protection: This embedded benefit provides reimbursement for repair or replacement costs after cell phone damage or theft.

However, there is a protection that is available only for the Amex Platinum card:

Car Rental Loss and Damage Insurance: When you reserve and pay for a rental vehicle with your Card, declining the rental counter's collision damage waiver, you can be protected against damage or theft in specific regions, subject to certain exclusions and limitations

Trip Delay Insurance: If your trip faces a delay of more than 6 hours due to a covered reason and you paid for the round-trip with your Eligible Card.

Baggage Insurance Plan: When you purchase a common carrier vehicle ticket with your Eligible Card, you can receive coverage for lost, damaged, or stolen baggage.

Trip Cancellation and Interruption Insurance: Buying a round-trip with your s Card can provide assistance in the event of trip cancellation or interruption, following the specified terms and conditions.

- Purchase Protection: Eligible purchases made with your card can be protected for up to 90 days from the purchase date, offering coverage for theft, accidental damage, or loss.

- Extended Warranty: When you use your card for eligible purchases, you can receive an extra year of warranty coverage for warranties lasting 5 years or less in the United States or its territories.

When You Might Prefer The Amex Platinum Card?

You might prefer the Amex Platinum card because it offers:

- Better Points Rewards Ratio: According to our analysis we can see that the Amex Platinum provides a superior value compared to Emirates Skywards Premium World Elite Mastercard.

- Better Travel Insurance And Protections: Amex Platinum provides comprehensive travel insurance and protections, including trip cancellation/interruption coverage and primary rental car insurance, surpassing the coverage offered by Emirates Skywards Premium World Elite Mastercard.

- Better Extra Travel Perks: Amex Platinum presents a broader range of extra travel perks, such as complimentary airport lounge access, Global Entry/TSA PreCheck fee credit and various statement credits, offering a more extensive set of benefits compared to the Emirates card.

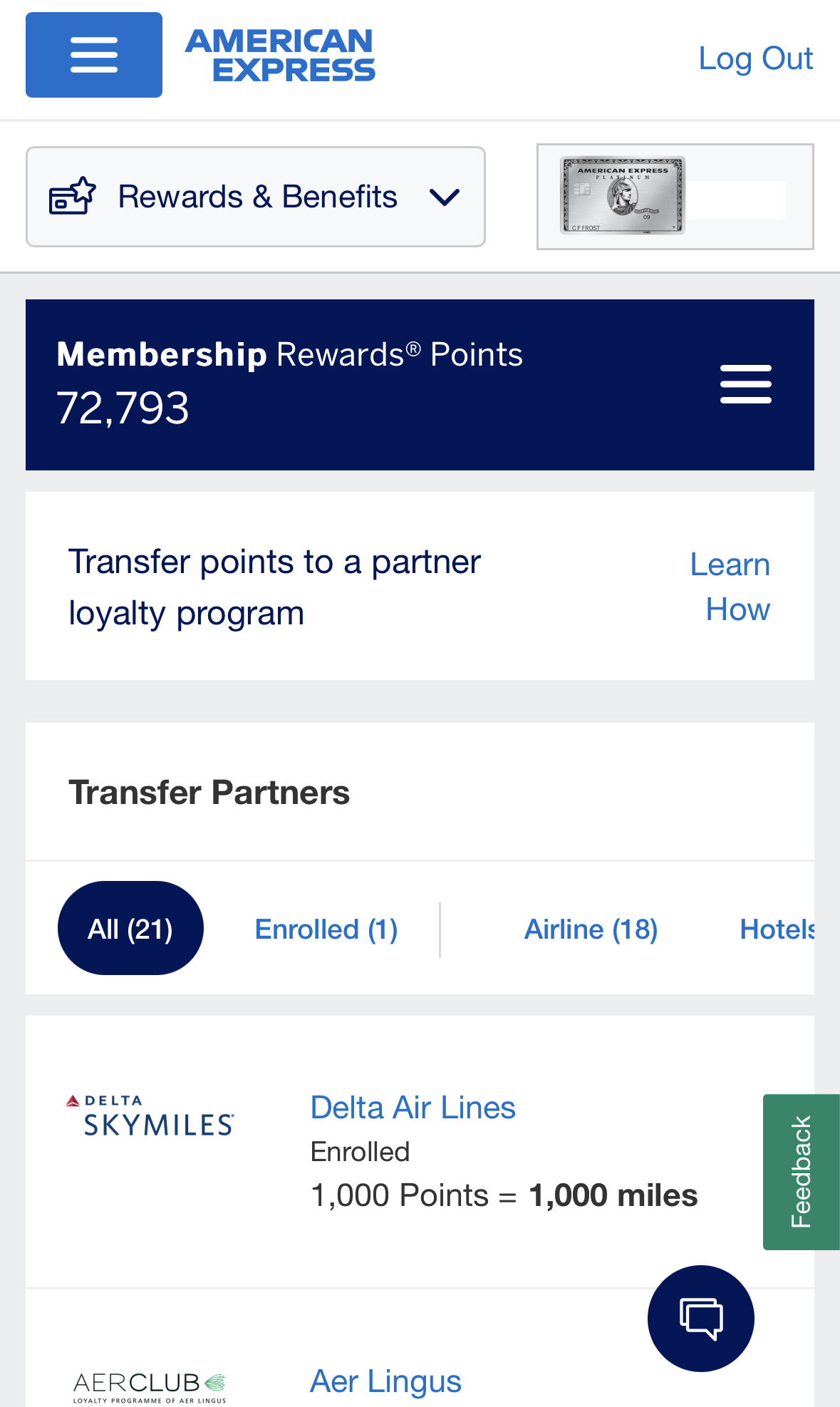

- Better Redemption Options: Amex Platinum provides more versatile redemption options through the Amex membership portal, allowing cardholders to use points for various travel-related expenses, while Emirates Skywards Premium World Elite Mastercard is more limited in its redemption scope, primarily tied to Emirates Airlines.

When You Might Prefer The Emirates Premium Card?

You might prefer Emirates Premium Card if:

Dedicated Emirates Traveler: If you are a loyal Emirates Airlines traveler, the Emirates Skywards Premium World Elite Mastercard is preferable, offering specialized benefits such as bonus Skywards Miles for Emirates flights, priority boarding, and complimentary lounge access specific to the airline.

Lower annual fee: The Emirates Skywards Premium World Elite Mastercard has a lower annual fee ($499) compared to Chase Sapphire Reserve Card ($695). If you're looking for a premium travel rewards card with a more affordable annual fee, the Emirates card could be a better fit.

Compare The Alternatives

If you're looking for a premium travel credit card with airline rewards – there are some good alternatives you may want to consider:

|

|

| |

|---|---|---|---|

Capital One Venture X | Chase Sapphire Reserve® | Delta SkyMiles® Reserve American Express | |

Annual Fee | $395 | $550 | $650. See Rates and Fees. |

Rewards |

1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases |

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| 1X – 3X

3X miles per dollar on eligible Delta flights and Delta Vacations® with 1X miles on all other purchases

|

Welcome bonus |

75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening |

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

| 125,000 miles

125,000 Bonus Miles after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Offer Ends 10/29/2025.

|

Foreign Transaction Fee | $0 | $0 | $0 |

Purchase APR | 19.99% – 28.99% (Variable)

| 19.99%–28.49% variable

| 19.99%-28.99% Variable

|

Compare American Express Platinum Card

If you're looking for everyday spending rewards, the Amex Gold Card offers more. But for travel rewards benefits, there is a clear winner.

When it comes to premium travel rewards, both may be the best cards in the market. But who is the winner between the two? Here's our analysis.

American Express Platinum vs Chase Sapphire Reserve: Which Luxury Card Is Best?

The Infinite Card is tailored for frequent United flyers, while the Amex Platinum offers a more lucrative, comprehensive rewards program.

While the Amex Platinum offers extensive travel perks and redemption options, the Marriott Brilliant Card has better hotel-specific perks.

While the Amex Platinum Card offers extensive travel perks and redemption options, the Delta Reserve Card has better airline-specific perks.

Amex Platinum Card vs. Delta SkyMiles Reserve: Which Luxury Card Is Best?

The Amex Platinum wins when it comes to redemption options and protections, but the Venture X is cheaper and offers great travel benefits.

Amex Platinum Card vs. Capital One Venture X: Which Luxury Card Is Best?

The Hilton Aspire is surprising with its higher estimated annual cashback value, but the Platinum card wins at premium travel perks.

Amex Platinum Card vs. Hilton Amex Aspire: Side By Side Comparison

If you need premium travel perks and versatility – the Amex Platinum wins. Need airline benefits and lower fees? Consider the Delta Platinum.

Amex Platinum Card vs. Delta SkyMiles Platinum: Which Luxury Card Is Best?

The AAdvantage Executive card offers higher cashback value, but when it comes to premium travel perks, the Amex Platinum is the winner.

Citi/AAdvantage Executive World Elite vs. Amex Platinum Card

The Amex Platinum is our winner due to its higher annual cashback value, redemption options, and better luxury perks than the Altitude Reserve.

U.S. Bank Altitude Reserve Visa Infinite vs. Amex Platinum Card: How They Compare?

Compare Emirates Premium World Elite Mastercard

The Chase Sapphire Reserve card stands out as the superior choice, delivering greater annual cashback value and luxurious travel benefits

Chase Sapphire Reserve vs. Emirates Skywards Premium World Elite Mastercard