Reward cards are nothing new, as they have been around for years. Essentially, travel credit cards have rewards and benefits geared towards travel purchases. This means that you typically earn the highest level of rewards when you purchase flights, accommodation, or other travel purchases.

You can also enjoy travel themed perks, such as lounge access, free checked bags, and other benefits that enhance your travel experience.

There are general travel credit cards that provide rewards for broad categories of travel and others are brand specific to particular airlines or hotel chains.

In some cases, you can also earn rewards for non travel purchases, but these are usually at a lower tier level.

Card | Rewards | Bonus | Annual Fee |

| 2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| 75,000 points

75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

| $95

| Review |

|---|---|---|---|---|---|

| 1X – 4X

4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases

| 100,000 points

100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership

| $325 (Rates & Fees) | Review | |

| 1X – 3X

3X First Class miles on travel and dining purchases and 1X First Class miles on all other purchases

| 25,000 miles

25,000 miles on $3,000 spent in first 6 cycles

| $89 (waived first year) | Review | |

| 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

| $395 | Review | |

| 1X – 4X

4 Bonus Points per $1 spent on purchases at all Hyatt hotels. Plus, 5 Base Points from Hyatt per eligible $1 spent for being a World of Hyatt member. 2x Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airline, local transit and commuting as well as fitness club and gym memberships. Plus, earn 1 Bonus Point per $1 spent on all other purchases.

| 2 free nights + 25,000 Points

2 free nights at any Category 1–4 Hyatt hotel or resort after you spend $4,000 on purchases in the first 3 months from the account opening. Plus, 25,000 Bonus Points after you spend $12,000 on purchases in the first 6 months from account opening

| $95 | Review | |

| 1X – 2X

2 AAdvantage miles per dollar on grocery stores and eligible American Airlines purchases, and 1 mile per dollar on other purchases

| 15,000 miles

15,000 bonus miles after spending $1,000 on purchases within the first three months

| $0 | Review | |

| 1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| 100,000 points + $500 Chase Travel℠ promo credit

100,000 points + $500 Chase Travel℠ promo credit After you spend $5,000 in purchases in the first 3 months from account opening

| $550 | Review | |

| 1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

| 175,000 points

175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership

| $695 (Rates & Fees) | Review |

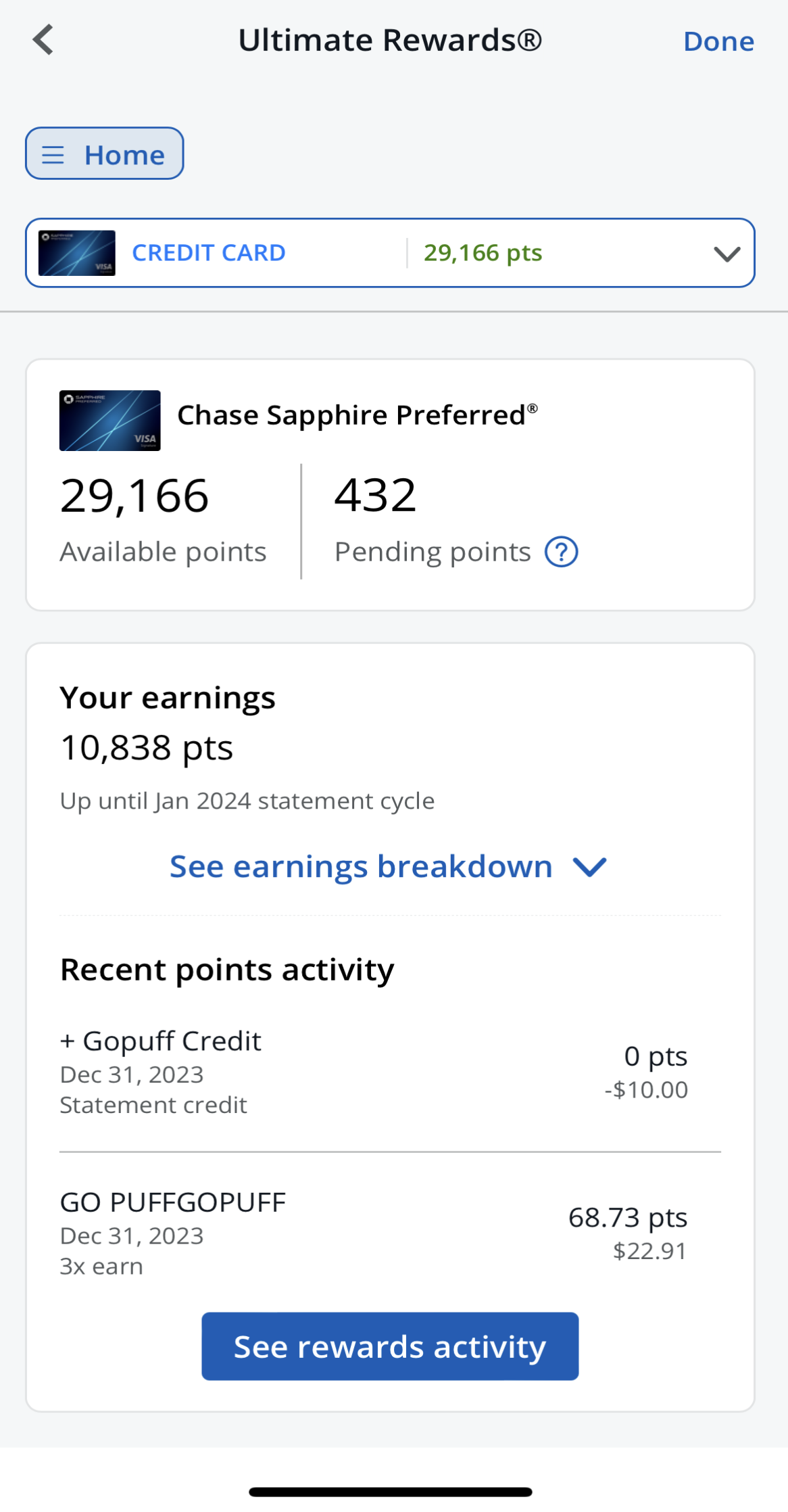

Chase Sapphire Preferred® Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Chase Sapphire The Chase Sapphire Preferred® Card is a popular travel rewards card from Chase Bank, known for its generous sign-up bonus and travel-focused benefits.

Unlike many other travel cards with high annual fees, this one offers great rewards without the extra cost. You can earn 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening.

This card is on top of our list for the best traveling and dining cards as they offer you more points than other cards.

Customers earn 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases. .

- Rewards Plan: 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

- APR: 19.99% – 28.24% variable APR

- Annual fee: $95

- Balance Transfer Fee: 5% or $5, whichever is greater

- Foreign Transaction Fee: $0

- Sign Up bonus: 75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

- 0% APR Introductory Rate: N/A

- Point Sign-Up Bonus

- Bonus Points

- No Blackout Dates

- 25% More through Ultimate Chase Rewards

- No Foreign Transaction Fee

- $95 Annual Fee

- Low Merchandise Rewards

- No Introductory 0%

- Balance Transfer Fee – 5% or $5, whichever is greater

- Does the travel rewards points expire? Your points won’t expire once you keep the credit card account open.

- Does card Chase Sapphire Preferred offer pre-approval? Yes, you are able to pre-qualify for this card.

- What is the initial credit limit? The minimum credit limit that you can get with this card type is usually $5,000.

- How do I redeem cash back? You can redeem your points in a variety of ways through the Chase credit card reward portal. Some of the perks you can get include cash, travel credit, statement credit, and gift cards.

- What purchases don't earn cash back? All purchases will earn cashback through this card.

- Should You Move to Chase Sapphire Preferred card? If you travel frequently and do not want to pay a large annual fee.

- Why did the Chase deny me? You might not have met one of its requirements. You will usually find out where you fell short. You might be able to rectify the issue or you might have to look elsewhere.

- How hard is it to get a Chase Sapphire Preferred card? If you meet all of the requirements, then it is relatively straightforward to get a Chase Sapphire Preferred card. The requirements are easier compared to Chase Sapphire Reserve card.

- Is there a limit to rewards/cash back on the Chase Sapphire Preferred card? No limit

- Can I get car rental insurance with a Chase Sapphire Preferred card? how? Yes, you can get car rental insurance with this card if you decline the collision cover of the rental company and pay for the entire cost of the rental car with this card.

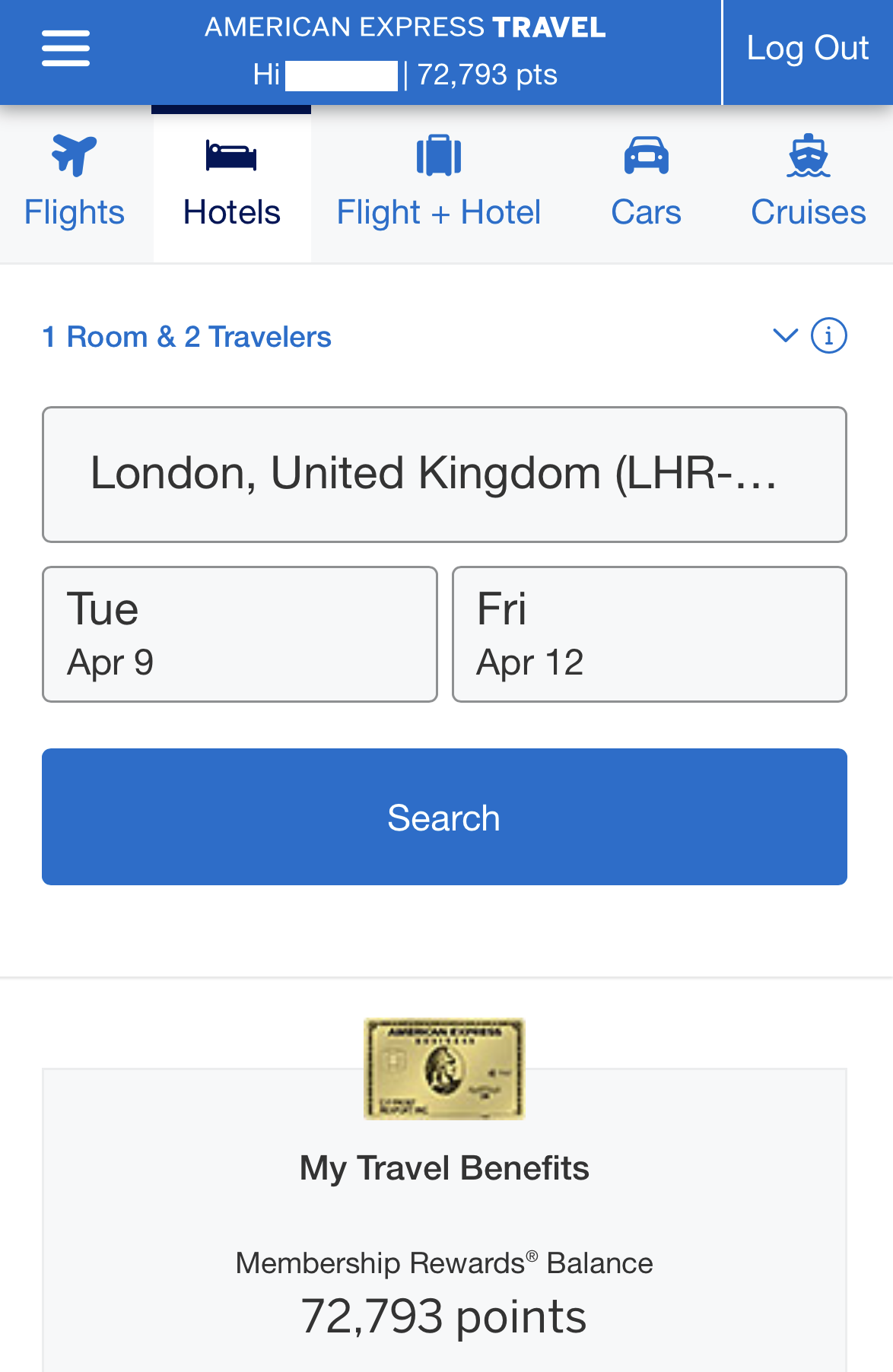

American Express® Gold Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

Rates & Fees, Terms Apply

- Overview

- Card Features

- Pros & Cons

- FAQ

The American Express® Gold Card is a credit account that offers a myriad of benefits to clients.

First-timers stand a chance to earn 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership.

In terms of rewards, you can earn 4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases.

Other premium benefits include a dedicated service team, up to $120 in Uber Cash (enrollment required) or preferred seating at sporting and cultural events.

If you're a freuqent traveler, check out the comparison between Amex gold to platinum to understand which is better for you.

- APR: See Pay Over Time APR

- Annual fee: $325

- Balance Transfer Fee: N/a

- Foreign Transaction Fee: None

- Rewards Plan: 4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases

- Welcome bonus: 100,000 Membership Rewards® Points after spending $6,000 in eligible purchases on your new Card in your first 6 months of Membership

- 0% APR Introductory Rate: N/A

- Welcome Bonus + Premium Point Rewards Rate

- No Foreign Transaction Fees

- Special Gold Status Perks

- $325 Annual Fee

- High Requirements

- Is there a limit to rewards? There is a cap on getting the premium rate of cashback on certain types of purchases.

- Can I get car rental insurance with Amex Gold Card? Yes, you will get it automatically once you decline the car insurance from the rental company and you pay the full rental charge using this card.

- What are Amex Gold Card income requirements? There is no out and out income requirement outlined by Amex when it comes to the Gold card.

- Does card Amex Gold points expire? They do not have an expiration date.

- How do I redeem cash back on Amex? There is a points-based system. You can redeem the points for a variety of rewards that are showcased on the Amex website. These include statement credit, gift cards, paying for certain services etc.

- What purchases don't earn rewards? The minimum rate is 1 point for every $1 spent.

- Should You Move to Amex Gold Card? If you need a versatile card that covers a wide range of purchases, with a main focus on travel-related purchases and perks.

- Why did Amex deny me? You might not have met one of the requirements. You can ask the customer support team if there is something you can do to change this eventuality. Otherwise, you can look for an alternative card.

- How to maximize rewards on Amex Gold Card? Use it for a versatile range of purchases, make sure you are aware of the different perks and credit that you get with this card.

- Top Reasons NOT to get the Gold Card? If you do not travel a lot.

- Can I get pre-approved? Yes, you can get pre-approval.

- What is the initial credit limit? The credit limit will usually be at least $5,000.

TD First Class Visa Signature

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

The TD First Class Visa Signature Credit Card gives you access to exclusive events, a 24/7 concierge service, and special shopping perks.

It also includes Visa Zero Liability protection, just like many other cards. Plus, there are no extra fees for international purchases. To apply, you'll need to have a good credit score.

Cardholders who do not like to track categories when they shop, on the other hand, will find the TD First Class quite limiting if they value rewards.

Otherwise, when compared to similar rewards cards, the card provides a good but not exceptional value. It's also worth noting that the rewards earned on this credit card aren't transferable to other cards or partner programs.

- APR: 17.99% variable APR

- Annual fee: $89 (waived first year)

- Balance Transfer Fee: $5 or 3%

- Foreign Transaction Fee: $0

- Rewards Plan: 3X First Class miles on travel and dining purchases and 1X First Class miles on all other purchases

- Sign Up bonus: 25,000 miles on $3,000 spent in first 6 cycles

- 0% APR Introductory Rate period: 12 billing cycles on balance transfers

- Signup Bonus & Miles Reward

- Low APR

- 0% Intro APR

- No Foreign Transaction Fee

- Annual Fee

- Rewards Are Not Transferable

- 0% Intro Only on Balance Transfers

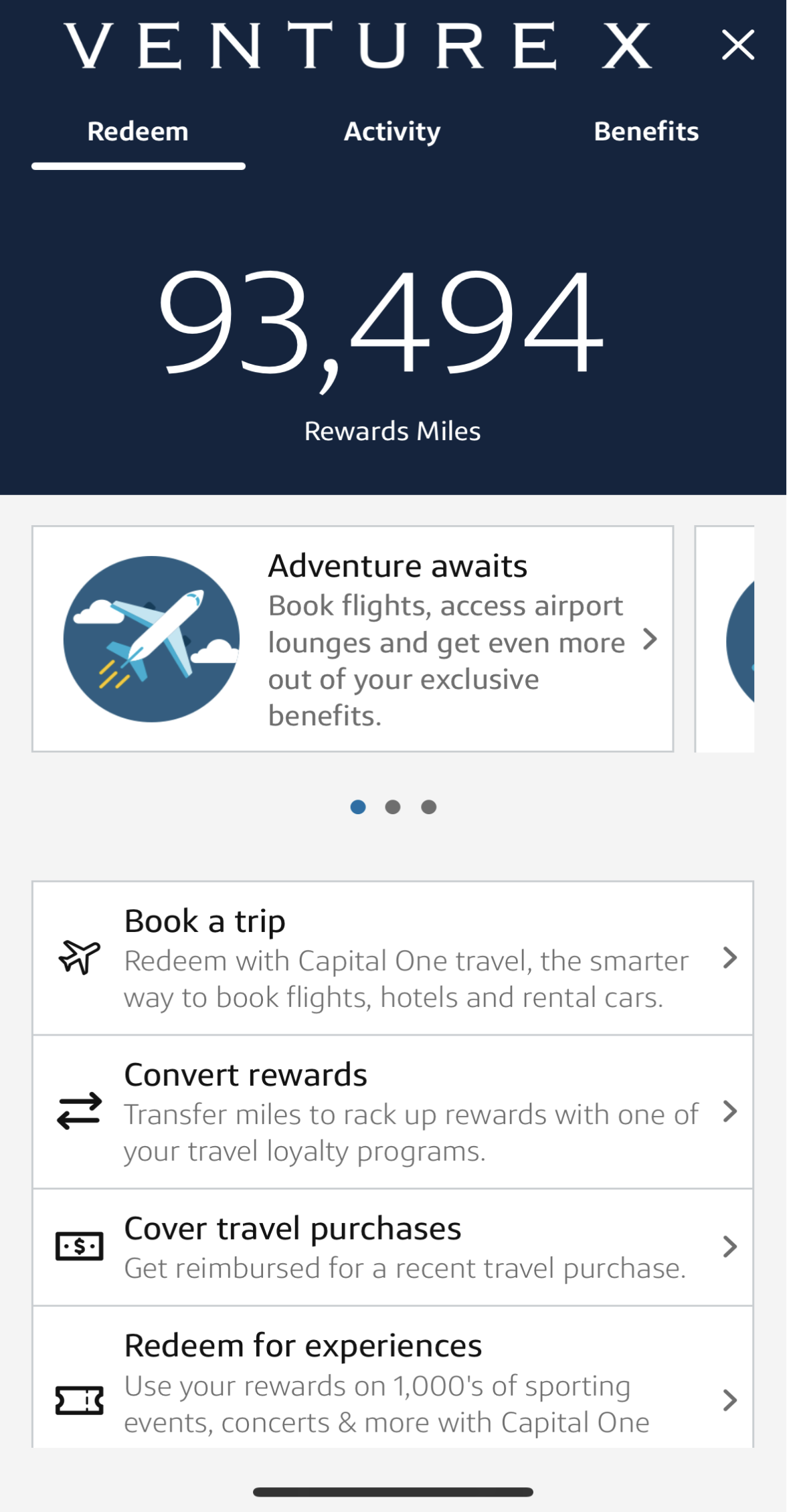

Capital One Venture X Rewards

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Capital One Venture X Rewards Credit Card is a premium travel card that can be a good fit for travelers who want extra travel perks like airport lounge access, travel insurance protection, and special rental car privileges, in addition to better rewards rates. It has quite high annual fee ($395)

When booking hotels and rental cars through Capital One Travel, the Venture X earns 10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases.

In addition, new applicants can earn 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening, and there is no foreign transaction fee.

If you're looking for more basic card, check out the Capital one Venture benefits.

- Rewards Plan: 10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

- APR: 19.99% – 29.74% (Variable)

- Annual fee: $395

- Balance Transfer Fee: 3% for promotional APR offers, none for balances transferred at regular APR

- Foreign Transaction Fee: $0

- Sign Up bonus: 75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

- 0% APR Introductory Rate: N/A

- Statement Credit For Travel

- Better Rewards Rate, Sign-Up Bonus

- Capital One Travel Portal

- No Foreign Transaction Fee

- $395 Annual Fee

- No Upgrading or Elite Status

- Smaller Network

What are the income requirements?

Neither issuer specifies a minimum income, but you will need excellent credit for the Venture X. Your income will be a factor for consideration, but it will not be the sole factor. If proof of income is required to support your application, the card issuers will contact you with a list of acceptable documents.

Can you get pre approval?

Capital One requires that you complete a full application for the Venture X, which will involve a hard credit pull.

What is the initial credit limit?

You can expect an initial credit limit of $5,000 to $30,000 with the Capital One Venture X.

How much is 10,000 miles worth?

The average value of Capital One miles is one cent per mile. This means that 10,000 miles would be worth $100. However, it may be possible to get a higher redemption rate with partner programs.

How’s the card customer service availability?

Capital One has a customer service line that is available 24/7, so you can access help at any time of the day or night

How long does it take for approval?

Capital One aims to give an approval decision within a few minutes, unless additional information is required to support your application. In this case, it can take a further 7 to 10 days. After approval, you should receive your card within 10 days.

The World of Hyatt Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

If you like the Hyatt network or tend to visit places where its network covers, the World of Hyatt card is ideal for saving money on hotel accommodations.

Cardholders earn 4 Bonus Points per $1 spent on purchases at all Hyatt hotels. Plus, 5 Base Points from Hyatt per eligible $1 spent for being a World of Hyatt member. 2x Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airline, local transit and commuting as well as fitness club and gym memberships. Plus, earn 1 Bonus Point per $1 spent on all other purchases..

In addition, you can also get an early check-in and a late checkout. This makes hotel stays much more enjoyable, as well as a nice welcome bonus.

It's also a good card for people who want a card they can use anywhere to get free hotel stays and upgraded rooms. However, in order to offset the annual fee ($95) and receive the benefits advertised by the card, you must stay in Hyatt hotels several times per year.

- Rewards Plan: 4 Bonus Points per $1 spent on purchases at all Hyatt hotels. Plus, 5 Base Points from Hyatt per eligible $1 spent for being a World of Hyatt member. 2x Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airline, local transit and commuting as well as fitness club and gym memberships. Plus, earn 1 Bonus Point per $1 spent on all other purchases.

- APR: 21.49%–28.49% variable

- Annual fee: $95

- Balance Transfer Fee: $5 or 5% (whichever is greater)

- Foreign Transaction Fee: $0

- Sign Up bonus: 2 free nights at any Category 1–4 Hyatt hotel or resort after you spend $4,000 on purchases in the first 3 months from the account opening. Plus, 25,000 Bonus Points after you spend $12,000 on purchases in the first 6 months from account opening

- 0% APR Introductory Rate: N/A

- Travel Rewards & Welcome Bonus

- One Free Night Every Year

- Monthly Bonus Category

- Discoverist Status

- Annual Fee

- No Discounts For Multi-Night Stays

- Better For Off Season

Does the Hyatt card have a point rewards limit?

There is no points reward limit on either card, but there is an introductory offer with either card that requires you meet a spending limit to get bonus points.

Can I get car rental insurance?

No, the World of Hyatt card does not offer a car rental insurance.

Can I redeem for flights with airline partners?

World of Hyatt is partnered with 25 airlines including Delta SkyMiles, American Airlines AAdvantage, and British Airways Executive Club. Generally, the transfer rate is a 5:2 ratio. This means that 5,000 points is worth 2,000 of the airline miles, but this can vary depending on the airline miles program

Can I get pre approved?

Typically, Chase does not have pre approval for its cards including the World of Hyatt card. This means that when you complete the online application form, it will trigger a hard credit search.

Does it offer flight cancellation insurance?

No, the World of Hyatt card doesn't offer flight cancellation/interruption or delay insurance.

What are the top reasons not to get it?

If you don’t typically care what hotel you stay in when you are on vacation, you’ll find this card a bit restrictive. In this scenario, you would be better off with a miles or other type of rewards card that allows you to redeem your rewards for flights, hotel stays and other travel perks.

Wells Fargo Autograph Card

Reward details

3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Wells Fargo Autograph Card offers a compelling option for those seeking a no-annual-fee rewards card with a diverse range of bonus categories

The card offers 3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchasess. However, it lacks travel perks compared to traditional travel rewards cards, and its travel redemption options are limited.

Cellphone protection, My Wells Fargo Deals, and Auto Rental Collision Damage Waiver coverage are among the card's notable perks.

Despite not offering transfer partners, the card's flexibility in redeeming points for cash rewards or travel, along with the ability to withdraw rewards from an ATM, adds to its appeal.

- Rewards Plan: 3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases

- APR: 21.49%–28.49% variable

- Annual fee: 19.49% – 29.49% Variable APR

- Balance Transfer Fee: $5 or 3% (the greater)

- Foreign Transaction Fee: $0

- Sign Up bonus: 20,000 bonus points when you spend $1,000 in purchases in the first 3 months

- 0% APR Introductory Rate: 12 months on purchases

- Everyday & Travel Rewards

- My Wells Fargo Deals

- 0% Intro APR

- No Foreign Transaction Fee

- Wells Fargo Credit Close-Up

- Basic Card

- No Transfer Partners

- No 0% APR On Balance Transfer

What makes the Wells Fargo Autograph Card stand out?

The Autograph Card stands out with its broad range of reward categories, including restaurants, gas stations, transit, travel, and more, making it suitable for those with diverse spending patterns.

What perks come with the Autograph Card?

The card offers cellphone protection, My Wells Fargo Deals reward opportunities, auto rental collision damage waiver, and Visa Signature perks such as concierge service and Luxury Hotel Collection privileges.

Can you redeem Wells Fargo Autograph points for travel?

While the card offers various redemption options, including travel, the value of points for travel is limited to 1 cent per point.

Can I use the Autograph Card's points for cash back?

Yes, you can redeem your points for cash back as a statement credit or a deposit to your Wells Fargo savings, checking, or money market account at a value of 1 cent per point.

What makes the Autograph Card's redemption options flexible?

The card provides flexibility in redemption, allowing points to be redeemed for various options, including cash rewards, travel, or withdrawal from an ATM, making it convenient for cardholders with different preferences.

U.S. Bank Altitude Connect

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

This U.S. Bank Altitude Connect Visa Signature Card caters to a diverse range of spending categories, such as groceries, dining, and travel, making it versatile for different lifestyles.

It offers 5X points on prepaid hotels and car rentals booked directly in the Altitude Rewards Center; 4X points on travel, gas stations, and EV charging stations; 2X points on grocery stores, grocery delivery, dining, and streaming services; and 1X points on all other eligible purchases.

Noteworthy perks of the U.S. Bank Altitude Connect include an annual streaming credit, airport lounge access, cellphone protection, and reimbursement for TSA PreCheck® or Global Entry® application fees.

While the card excels in various aspects, it does come with a $95 annual fee after the introductory period, and it lacks the option to transfer points for maximized value.

- APR: 20.24% – 28.24% (Variable)

- Annual fee: $95 (waived first year)

- Rewards Plan: 5X points on prepaid hotels and car rentals booked directly in the Altitude Rewards Center; 4X points on travel, gas stations, and EV charging stations; 2X points on grocery stores, grocery delivery, dining, and streaming services; and 1X points on all other eligible purchases

- Balance Transfer Fee: 3% or $5, whichever is greater

- Foreign Transaction Fee: $0

- Sign Up bonus: 60,000 points after spending $6,000 in eligible purchases on the account owner's card within the first 180 days from account opening.

- 0% APR Introductory Rate period: N/A

- High Rewards Ratio

- Airport Lounge Access

- Redemption Options

- Cell phone protection

- Annual Fee

- No Point Transfers

How can I redeem the points earned with the U.S. Bank Altitude Connect?

Points can be redeemed for travel, cash back, merchandise, and gift cards, with each point worth a penny.

What is the cell phone protection offered by the card?

The card offers cellphone protection with reimbursement of up to $600 for damage, theft, or involuntary parting with the eligible cellphone.

Is there a credit for TSA PreCheck® or Global Entry® application fees?

Yes, cardholders can receive up to $100 in statement credits every four years for reimbursement toward TSA PreCheck® or Global Entry® application fees.

Is there a limit on the number of points I can earn?

There is no specified cap on the amount of points you can earn, providing potential for unlimited rewards accumulation.

Can I transfer points from the U.S. Bank Altitude Connect Visa Signature Card to other loyalty programs?

No, the card does not allow the transfer of points to other loyalty programs, limiting redemption options.

Chase Sapphire Reserve®

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

The Chase Sapphire Reserve® card is a premium travel card that offers many benefits that your average reward card does not. You'll receive , which is about $750 in travel rewards if booked through Chase Ultimate Rewards.

In addition, customers earn 5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

However, due to the high annual fee ($550) – you should make sure your regular spending habits fits to this card and you'll be able to cover the high annual cost.

If that's not the case – the Chase Sapphire Preferred is a good alternative, check out our comparison between the Reserve and the Preferred card.

- APR: 21.99% – 28.99% variable APR

- Annual fee: $550

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: $0

- Rewards Plan: 5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

- Sign Up bonus: 100,000 points + $500 Chase Travel℠ promo credit After you spend $5,000 in purchases in the first 3 months from account opening

- 0% APR Introductory Rate period: N/A

- Points Rewards

- Sign Up Bonus

- More Ultimate Chase Rewards

- No Foreign Transaction Fee

- Airport Lounge Access

- Annual Fee

- No 0% Introductory APR

- Balance Transfer Fee

- Chase Restrictions

- Can I get car rental insurance with a Sapphire Reserve card? Yes, you can get car rental insurance with this card if you decline the collision cover of the rental company and pay for the entire cost of the rental car with this card.

- What are Sapphire Reserve card income requirements? There are no transparent income requirements, but it is usually expected that your annual income is at least $30,000 and you may be asked for proof of income.

- How do I redeem cash back? You can redeem your points in a variety of ways through the Chase credit card reward portal. Some of the perks you can get include cash, travel credit, a statement credit, and gift cards.

- What purchases don't earn cash back with the Sapphire Reserve? All purchases will earn you cashback with this card.

- Should You Move to a Sapphire Reserve card? If you travel a lot then this is a great option for you. It's recommended to understand your spending habits and compare the Reserve card with other premium travel cards such as the Amex platinum card.

- Why did Chase deny me? What to Do Next? You might not have met one of its requirements. You will usually find out where you fell short. You might be able to rectify the issue or you might have to look elsewhere.

- How hard is it to get Sapphire Reserve card? It is harder to get this card than some of the other Chase credit cards. However, if you have a credit score of at least 720 then you will be in with a good chance of getting approval.

- How to Use Sapphire Reserve card Benefits? To maximize rewards, you should take advantage of the high dining and travel-related cashback redemption rates and generally use them for these types of expenses.

- Top Reasons NOT to get the Sapphire Reserve card? If you do not travel a lot or you don’t want to pay the large annual fee.

- Does travel rewards points expire? Your points won’t expire once you keep the credit card account open.

- Does it offer pre-approval? Yes, you can get pre-approved for this card.

- What is the initial credit limit? The usual minimum credit limit for this card is $10,000.

- Is there a limit to rewards? No limit

The Platinum Card® from American Express

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

Rates & Fees, Terms Apply

- Overview

- Special Perks

- Pros & Cons

- FAQ

The Platinum Card® from American Express is one of the best luxury cards available, offering extra ordinary benefits especially when it comes to travel.

The card offers 5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases.

Also, you can enjoy a welcome bonus of 175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership

Thera are many extra premium perks such as a dedicated service team, up to $200 in Uber Cash (enrollment required), and baggage insurance for up to $500 for checked baggage and $1,250 for carry-on*.

If you're looking for a premium luxury card, compare the Amex Platinum cards with the Chase Reserve card.

- Up to $200 hotel credit per year when you book select prepaid hotels using your Platinum card via American Express Travel. Enrollment Required.

- Up to $240 or $20 per month in Digital Entertainment Credit when you pay for one or more The New York Times, Peacock, SiriusXM or Audible products with your card. Enrollment Required.

- Up to $155 in Walmart+ credit. When you use your card to pay for your monthly Walmart+ membership, you’ll get the full cost back every month. Enrollment Required.

- Up to $200 in Airline fee credit per year when you charge incidental travel fees from selected airlines on your card. Enrollment Required.

- Up to $300 back every year for eligible Equinox memberships when you enroll and pay using your card.

- Up to $189 back per year when you use your card to pay for a CLEAR® membership. Enrollment Required.

- Welcome Bonus + Premium Point Rewards Rate (Terms Apply)

- No Foreign Transaction Fees

- Special Premium Status Perks

- High Annual Fee

- High Requirements

- Why did Amex Platinum Card deny me? What to Do Next? You might not have met one of the requirements. You can ask the customer support team if there is something you can do to change this eventuality. Otherwise, you can look for an alternative card.

- How hard is it to get Amex Platinum Card? You need to meet the credit score and income requirements, which are higher than a lot of other cards.

- What is the initial credit limit? The minimum credit limit you will get with this card will be $5,000.

- How do I redeem cash back? There is a points-based system. You can redeem the points for a variety of rewards that are showcased on the Amex website. These include statement credit, gift cards, paying for certain services etc.

- What purchases don't earn cash back? Every type of purchase through this card will earn cashback points.

- Should You Move to Amex Platinum Card? It is a good fit if you spend a lot of money on travel-related expenses and want to avail yourself of some great travel perks.

Hilton Honors American Express Surpass Card

Hilton Honors American Express Surpass Card

Reward details

Earn 12x Points on hotels & resorts at eligible purchases at hotels and resorts in the Hilton portfolio. Earn 6x Points on dining at U.S. restaurants , and for takeout and delivery in the U.S, on groceries at U.S. supermarkets and at U.S. gas stations. Earn 4X Points for each dollar on U.S. Online Retail Purchases and 3X Points on all other purchases

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

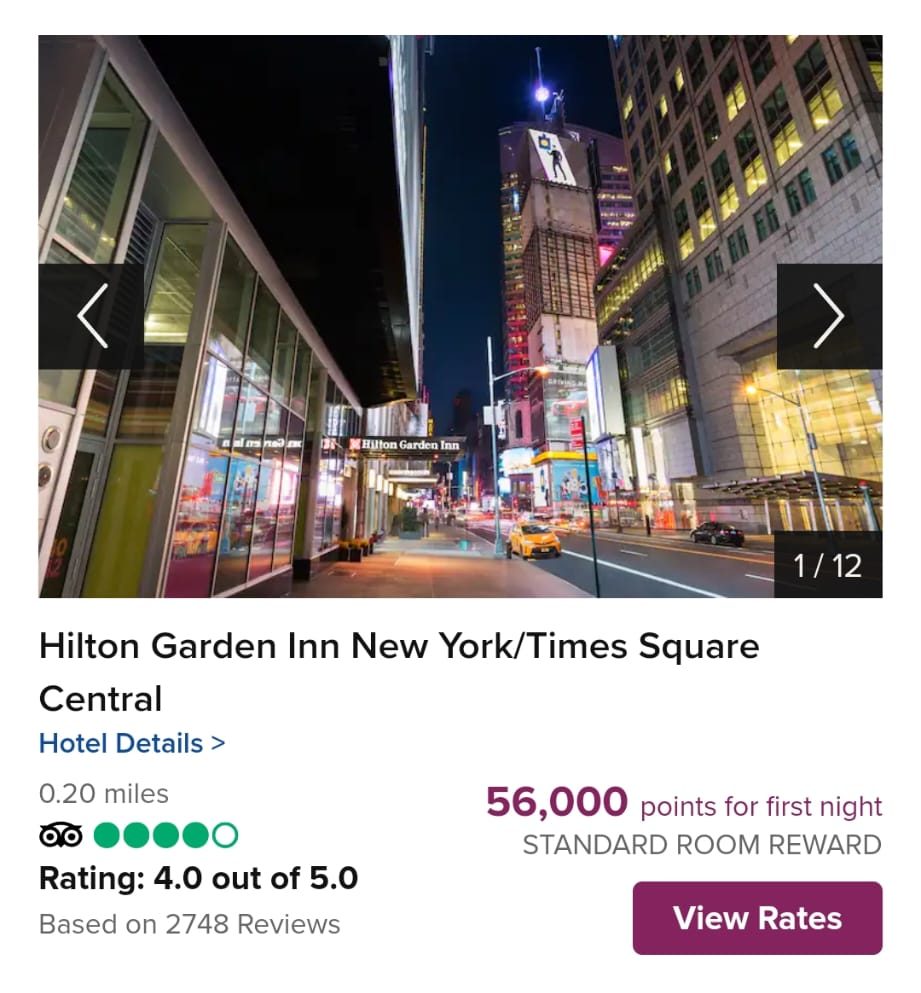

The Hilton Honors American Express Surpass® Card is a co-branded credit card tailored for regular Hilton guests seeking valuable perks without the high annual fee of the premium Aspire Card.

The ongoing benefits include automatic Hilton Gold elite status, providing perks such as complimentary breakfast, increased points earnings, and space-available upgrades at Hilton properties.

The annual fee of $150 is justified by these benefits, including up to $200 in Hilton statement credits, a free night reward for $15,000 in annual spending, and complimentary National Car Rental Emerald Club Executive status.

While the card has advantages like automatic Gold elite status and a solid earning rate, its drawbacks include the lower value of Hilton points, an annual fee, and limited travel protections.

- APR: 20.24% – 29.24% variable APR

- Annual fee: $150

- Balance Transfer Fee: N/A

- Foreign Transaction Fee: $0

- Rewards Plan: Earn 12x Points on hotels & resorts at eligible purchases at hotels and resorts in the Hilton portfolio. Earn 6x Points on dining at U.S. restaurants , and for takeout and delivery in the U.S, on groceries at U.S. supermarkets and at U.S. gas stations. Earn 4X Points for each dollar on U.S. Online Retail Purchases and 3X Points on all other purchases

- Welcome Bonus: 165,000 Hilton Honors Bonus Points after you spend $3,000 in purchases on the Hilton Honors American Express Surpass® Card in your first 6 months of Card Membership

- 0% APR Introductory Rate period: N/A

- Automatic Hilton Gold Elite Status

- Statement Credits

- No Foreign Transaction Fees

- Hilton Points Value Is Low

- Annual Fee

- Low Ratio When Tranferring To Airline

Who is the ideal candidate for the Hilton Honors American Express Surpass Card?

The card is best suited for regular Hilton guests seeking a balance of benefits and rewards without the high annual fee of premium cards.

What is the spending requirement for earning Hilton Diamond status with this card?

Cardholders can achieve Hilton Diamond status by spending $40,000 on the Hilton Surpass card within a calendar year.

What is the primary drawback of the Hilton Surpass card?

The perceived lower value of Hilton Honors points compared to other loyalty programs is a notable drawback.

Can I pool Hilton Honors points with other members?

Yes, Hilton allows cardholders to pool points with up to 10 other members, providing flexibility for combining points for award stays.

How can I earn a free night reward with the Hilton Surpass card?

Spending $15,000 on eligible purchases in a calendar year qualifies cardholders for a free night reward that can be used at any Hilton property.

Pros and Cons of a Travel Card

As with all financial products, there are both positives and potential negatives of travel credit cards. It is important to be aware of both so you can make an informed decision about the card that is the right product for you.

Pros | Cons |

|---|---|

Rewards and Benefits | Credit Score Requirements |

Travel Insurance | Annual Fees |

Airport Lounge Access | Not For Everyday Spending |

No Foreign Transaction Fees | Complex Rewards Programs |

Exclusive Perks | |

Travel Partnerships |

- Rewards and Benefits

Travel cards often offer rewards such as airline miles, hotel points, or cashback on travel-related expenses, providing financial incentives for frequent travelers.

- Travel Insurance

Many travel cards include insurance coverage, such as trip cancellation, rental car insurance, and travel accident insurance, offering protection during your journeys.

- Airport Lounge Access

Premium travel cards may grant access to airport lounges, providing a more comfortable and relaxing experience during layovers.

- No Foreign Transaction Fees

Travel cards often waive foreign transaction fees, making them cost-effective for international travelers who frequently use their cards abroad.

- Exclusive Perks

Premium travel cards come with exclusive perks like concierge services, priority boarding, and room upgrades at hotels, enhancing the overall travel experience.

- Travel Partnerships

Many travel cards have partnerships with airlines and hotels, allowing cardholders to leverage their points or miles within a broader network for increased flexibility.

- Credit Score Requirements

Travel cards typically require a good to excellent credit score for approval, limiting accessibility for individuals with lower credit scores.

- Annual Fees

Premium travel cards often come with high annual fees, potentially offsetting the value of the rewards and benefits, particularly for infrequent travelers.

- Not For Eeveryday Spending

The best rewards on travel cards are often earned through travel-related expenses, making them less advantageous for individuals who spend less in this category.

- Complex Rewards Programs

Understanding and maximizing the rewards on travel cards can be complex, with varying redemption options and point valuations.

How to Compare Travel Rewards Cards

As you may already be aware there is an abundance of travel reward cards on the market from dozens of different card issuers.

While this choice is superb, it can make finding the right card for you a little challenging. This means that you need to be aware of how to compare and evaluate travel rewards cards. Fortunately, we have some pointers for you.

Does it Support Your Preferred Brands?

This is the first thing you need to look at, as there is no point in getting a higher rate of rewards if the card requires you to use an airline you rarely fly with. If you are brand loyal, a brand specific card makes sense. If you always fly American Airlines or always choose to stay in a Marriott hotel, there are cards to support your spending patterns.

However, if you tend to look for the best travel packages regardless of the airline or hotel chain, a more general travel card that offers a high tier of rewards for all travel purchases is a better option for you.

What Travel Perks Do You Want or Need?

Many travel credit cards have a long list of travel perks and these can vary significantly from card to card. So, you’ll need to think about what travel perks you want or need.

For example, if you rarely travel with more than one bag, getting two checked bags free is not something you will particularly use. However, if you love the idea of getting lounge access to relax or work as you wait for your flight, this is a feature you will need to look for in your potential card options.

Foreign Transaction Fees

It may seem sensible to assume that all travel cards have no foreign transaction fees, but this is not the case. Some travel credit cards still charge foreign transaction fees and if you frequently travel abroad, this can quickly add up.

However, if you tend to only travel domestically, this will not be an issue for you and you may overlook the fees if the card offers appealing benefits.

Miles, Points or Cash Back?

Another point of comparison is whether the card offers miles, points or cash back. This is a matter of personal preference, but if you don’t like complicated redemption rates, you may prefer a card that offers a simple percentage cash back reward scheme.

On the other hand, if you like to save for superb future travel plans, you may prefer the thought of accumulating miles or points to use later.

Top Offers

Top Offers From Our Partners

Top Offers

7 Things You Can Get In a Good Travel Rewards Card

The feature set of travel reward cards can vary a great deal, so it can make choosing the best travel credit card a little tricky. Fortunately, there are seven things you can get in a good card, which we’ll break down in more detail here.

- A Reasonable Rate: While your rate will depend on your specific credit score, it should still be reasonable. There are travel cards on the market that have a far higher rate to offset the card benefits. So, you should look for cards that not only offer a great benefits package, but have a competitive rate.

- Multiple Ways to Earn Rewards: Although you may want to use your credit card for travel purchases, it is still nice if you can earn rewards with other types of spending. Good travel rewards cards will still offer points, miles or cash back on every day spending such as gas or grocery shopping. This means that if there is a situation where you are unable to travel, such as the 2020 Covid Pandemic, you can continue to earn rewards.

- Appropriate Travel Perks: This sounds obvious, but the best travel credit cards offer great travel perks. What you consider great will depend on your needs and preferences, but there are card options to suit everyone. For example, your top priority might be lounge access, while someone else may look for the potential for room upgrades. Think about what you would like and look for cards that can meet your preferred requirements.

- Non Travel Perks: As we touched on above, there may be times when you are unable to travel, so it is nice when your travel credit card also offers non travel perks. There are a number of cards that offer free subscriptions or memberships to get access to streaming services or food delivery, which can be a nice perk.

- An Easy to Understand Reward Structure: Credit rewards can become extremely complicated, so if you can’t follow how to earn rewards, you’ll not make the most of the scheme. If you’re prepared to manage card categories, there are travel credit cards that allow you to designate primary and secondary reward categories. However, if you want a simple to use card, the best options will simply provide a set percentage of cash back or points for each category of spending.

- Minimal Fees: This is a factor which is common to all good credit card options, including travel cards. This is why it is important to check the terms and conditions carefully before you complete your card application. This will allow you to double check that you are comfortable with the fee structure and will not face any unpleasant surprises in the future.

- Good Customer Support: Finally, you can’t overlook the value of good customer support from your credit card provider. Whether you have a transaction query or need to report a lost or stolen card, you need to feel confident that a representative will quickly resolve any problems

How to Maximize the Benefits of Travel Reward Cards

Even if you carefully choose the best card for you, there are still strategies that you can make to maximize the benefits of your new travel reward card.

Activate any Promotions: The first thing that you need to do is activate any promotions for the card. Some cards have limited time offers such as a free subscription or service, but you need to activate them and link them to your new credit card. So you don’t forget about these, activate them as soon as you receive your card.

Meet the Intro Bonus Criteria: This is standard for most credit cards, but there are terms and conditions attached to your welcome bonus. This is usually a minimum spend, but you’ll need to check how long you have to meet this amount. When you only have a limited timeframe, it would be very frustrating to miss it by a few dollars and miss out on a hefty bonus.

Book all Fares, Accommodation and Reservations with Your Card: While your card may offer free travel insurance or other perks, this is usually contingent on paying for the entire expense with your card. So, you’ll only get trip delay insurance if your airfare was purchased using your card, or free collision damage waiver insurance if you reserve and pay for your car rental with the card.

Max Out Other Spending Categories: If your card offers rewards on other spending categories, make sure you max out your spending up to any caps. It is quite common for one secondary category to have a higher reward rate compared to the others, so prioritize this type of spending after your travel purchases.

Explore Your Redemption Options: Finally, don’t assume that one particular redemption method is best. If you have a points or miles card, there are likely to be varying redemption rates, so look at which one gives you the best return. This can also apply to travel dates and carriers, which means that you may need to play around with flights and stays when you want to book a trip.

Top Offers

Top Offers

Top Offers From Our Partners

How Do the Travel Rewards Portals Work?

Once you start to explore different travel credit cards, you’re likely to see that each card issuer has a travel rewards portal. These portals allow you to get a higher redemption rate for your rewards and allow you to book flights, hotels and other vacation packages. However, each issuer portal works in a slightly different way.

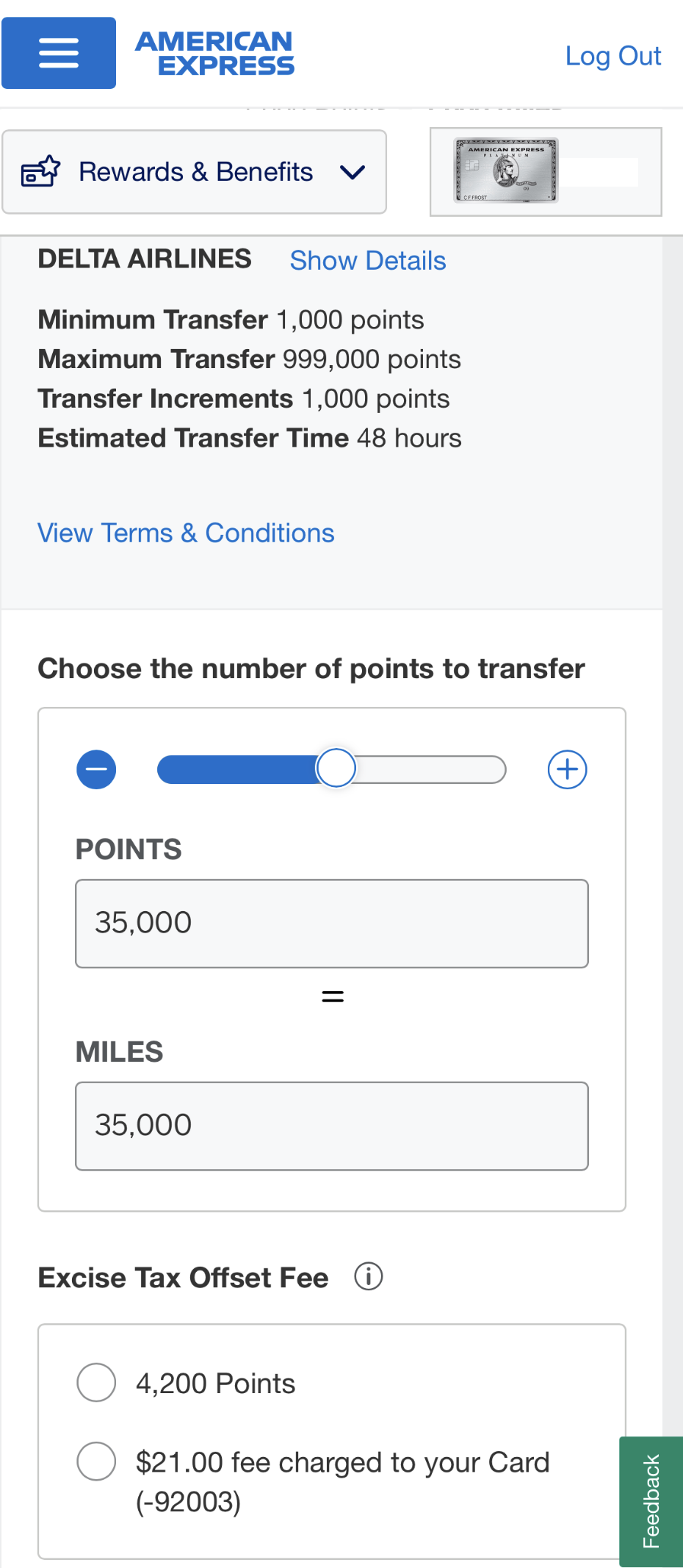

The Amex Travel Portal allows you to book travel and redeem your reward points for travel reservations and other activities. The layout is similar to popular online booking sites. You can enter a departure date and destination airport or city. If a city has more than one airport, this is a good way to compare your options.

The portal will bring up a list of results for different flights and each will display a dollar amount. However, on the right hand side, there is an option to use your Membership Rewards points. You can also use the filters on the left hand side to narrow down the search according to preferred airlines, departure and arrival times and number of stops.

You can also use the portal to upgrade your flights using dollars or points. This means that you can upgrade an economy ticket, but be aware that this tends to be at a far lower redemption rate.

The Chase Travel Rewards Portal is an online booking platform that provides access to flights, hotels, cruises, vacation rentals, rental cars and activities. It works like an online travel agency and you can do searches for hotels, flights or any other travel package you’re interested in.

When you log into your Chase account, you’ll see an option to access the travel portal. You can then enter your search criteria and explore the results. You’ll have the option to book using your points or cash. There are no blackout dates to worry about, so you can check which packages and deals offer the best value for your reward points.

Once you’re signed up for online account management, you’ll see an option for the Capital One travel portal. This will allow you to easily book flights, hotels, or rental cars online.

You can search using your travel dates and check the available options. When you find something you want to book, you’ll have the option to use your rewards or pay with your card.

What’s nice is that the top right hand corner of the portal displays your current rewards balance and their value. The prices of each option are displayed in rewards and cash, so you can decide which is the better option for you.

The Citi rewards travel portal is a little different as you need to visit thankyou.com. You can log in with your Citi banking details, but you can’t get there through your online banking desktop.

You can search for flights, cruises, hotel rooms, car rentals and activities. You’ll see a tab for each category and you can narrow down the results with various criteria. You’ll then have the option to pay for your preferred deal with points, cash or a combination of the two.

Discover has a flexible rewards program, which works a little differently compared to the platforms above. This issuer allows you to redeem your points for statement credit against travel purchases.

When a travel purchase has been posted to your account, you can request a statement credit for that charge. All you need to do is log into your account, click “Redeem Miles” and “Travel Credit”, then select which purchase you wish to select.

Can I Get a Travel Card With a 600 Credit Score?

Travel credit cards with the best rewards tend to be reserved for those with good to excellent credit. This makes sense as there is the potential to earn thousands of miles or hundreds of dollars of rewards. So, credit card companies tend to want these cards in the hands of people who have proven to be highly financially responsible.

However, this does not mean that if you have less than perfect credit, you won’t be able to enjoy a travel credit card. There are still some options available for those with fair credit.

For example, the Capital One Platinum credit card may not offer reward points, but you can enjoy some excellent travel benefits. There are no foreign transaction fees and you’ll get auto rental collision damage waiver, travel accident insurance, and a 24 hour travel assistance helpline when you purchase your fare and car rental using your card.

Best Travel Cards With No Annual Fee

Generally, most travel cards require an annual fee. However, if you're only looking for a basic card, there are a variety of options for those who would like to skip the annual fee – here are two cards to consider:

American Airlines AAdvantage MileUp℠ Card

This is a great card option for those who are loyal to the American Airlines brand but don’t want to pay a fee. You’ll still earn loyalty points towards your AAdvantage Status as you can with other AAdvantage cards. You’ll earn one point for every dollar, which can help you on your way to AAdvantage Gold status.

You can also earn a 25% saving on your inflight purchases. So, if you like to have snacks and drinks on your American Airlines flights, make sure you pay with your MileUp card to enjoy savings.

Discover it® Miles credit card

The Discover it® Miles credit card offers decent earning of miles on all purchases even though it may not be the most rewarding travel card available.

Cardholders can earn unlimited 1.5x miles for every dollar spent on all purchases. Also, there is a welcome bonus of Discover matches your first year miles automatically..

The Discover it® Miles credit card is a good choice for budget-conscious customers who want to earn miles on all transactions without having to remember to track bonus categories or turn on quarterly bonuses.

Best Travel Cards for Fair Credit

If you have a fair credit, it may be difficult to get one of the premium travel cards. Here are some decent cards for those who have fair credit:

Capital One VentureOne Rewards Credit Card

The Capital One VentureOne Rewards Credit Card suits occasional travelers seeking a no-annual-fee option.

While offering a modest rewards rate and a welcome bonus, it falls short compared to the upgraded Capital One Venture Rewards card for enhanced benefits and long-term value. The card provides unlimited 5X miles on hotels and rental cars booked through Capital One Travel and 1.25X miles on all other purchases.

Its welcome bonus includes 20,000 bonus miles once you spend $500 on purchases within the first 3 months from account opening, and 0% intro APR for 18 months on purchases and balance transfers make it appealing. However, lacking premium travel insurances and featuring a higher APR range, it may not be ideal for those with high balances.

Citi AAdvantage Platinum

This is a miles credit card that is more suited to those with fair approaching good credit, as it offers far more perks. You can save money on American Airlines baggage fees and enjoy preferred boarding on American Airlines flights.

There are no foreign transaction fees and you’ll get an American Airlines discount certificate each year on renewal if you spent $20,000 in the previous year.

Best Travel Cards for Flights

When it comes to airline travel card, there are many options available. If you're looking for an airline card with some general travel benefits, these two can be a good option:

Delta SkyMiles® Reserve American Express

This is a good choice for those loyal to Delta, as it can help you to reach elite status goals. There are also some nice Delta Reserve flight perks including first checked bag free, access to Delta Sky Club and an annual companion pass.

American Express will also reimburse you for your Global Entry or TSA PreCheck subscription if you pay with your card (up to $100).

Citi® / AAdvantage® Executive World Elite Mastercard®

This is an excellent card if you like to fly American Airlines and want to have Admirals Club lounge access for you and up to two guests traveling with you.

It can also help you to earn elite status. There are no foreign transaction fees and you and up to eight travel companions can enjoy a free first checked bag on domestic American Airlines flights.

Top Offers

Top Offers

Top Offers From Our Partners

Should I Get an Airline or Travel Credit Card?

Contrary to common belief, a travel credit card doesn't necessarily have to be tied to a specific airline. While there are impressive airline-specific options, excellent general travel credit cards also exist. The choice between them depends on individual preferences and travel patterns.

If you're devoted to a particular airline like Delta or American Airlines, an affiliated credit card can offer elevated points on travel spending and accumulate rewards for future flights. On the other hand, if your loyalty is flexible, a general travel credit card ensures top-tier rewards across all travel purchases, perfect for those prioritizing the best flight deals, regardless of the carrier.

Consideration should also be given to whether you predominantly travel domestically or internationally. Some airline cards may limit perks to domestic flights, unlike general travel cards that often provide broader benefits applicable to both domestic and international travel.

Should I Get a Cash Back or Travel Credit Card?

This will depend on your typical habits. If you’re a serious traveler and tend to be regularly purchasing flights and hotel accommodation, a travel credit card is likely to offer the best possible rewards.

However, the compromise on these cards is that they tend to offer little or no rewards on other types of purchases. While there are some exceptions, if you want a card that offers rewards for groceries, gas and other purchases, you may find many travel cards frustrating.

If you tend to travel less frequently, a reward card with flexible categories may be better suited to your needs. For example, if you have travel plans on the horizon, you can designate travel as your primary reward category, but use it for groceries, electronics or other spending the rest of the year.

Another consideration is how you will receive your rewards. Travel cards tend to be heavily weighted towards redeeming rewards for travel. So, while you can accumulate your rewards for future travel plans, if you only travel once a year, this will take some time.

You will need to think about your typical spending practices and how often you travel. This will help you to determine which type of card is best suited to your circumstances.

When Shouldn’t You Pick a Travel Rewards Card?

- You’re an Infrequent Traveler: This may sound obvious, but while it is appealing to earn far more rewards on flights and hotel stays, if you only travel once a year, you’ll not earn the most rewards in the long term.

- You Don’t Have Set Spending Patterns: Another reason not to pick a travel rewards card is that you tend to have periods where you travel more and then don’t travel at all. In this scenario, you would be better suited with a revolving category rewards card.

- You Want Rewards On All Your Spending: While there are some exceptions, travel cards tend to offer little or no rewards on basic everyday spending purchases. So, if you want to earn rewards on all your spending, a more general rewards card is likely to be more appealing.

What Should I Look for in My Card If I Travel Abroad?

As we touched on above, many cards offer benefits that are better suited to those who travel domestically. However, if you tend to travel abroad, there are a number of things you should look for in your new card.

No Foreign Transaction Fees: Don’t assume that your travel card will have no foreign transaction fees, as many do. However, even a small fee can quickly add up if you tend to spend a lot of time abroad.

Free Checked Bags: Some airline cards only offer free checked bags on domestic flights, so you won’t be able to use this perk when you travel abroad. So, double check the small print and make sure you can enjoy free checked bags on all your flights.

Trip Delay/Interruption Insurance: Travel can always be a little uncertain, but when you’re outside the US, it can be even more complicated. If your trip is delayed or interrupted, this coverage will kick in to reimburse you for any essentials you need to purchase.

Travel Miles or Points?

Another consideration for the best travel credit cards is whether your rewards are in the form of travel miles or points. While these may appear similar, there are some crucial differences that may influence which is the better option for you.

Miles are brand specific, but are typically used for paying for flights or hotel stays. Some schemes do allow you to redeem for statement credit or gift cards, but these tend to be at a far lower redemption rate.

Points tend to be a little more flexible. While they are currency for your specific card issuer, there are often partner programs, where you can exchange your points for miles for an appropriate airline. However, you can also usually exchange your points for statement credit, cash and other rewards.

Which is best for you will depend on your habits and preferences. If you tend to be brand loyal to a specific airline, it makes sense to choose a card offering miles for this airline’s program. However, if you prefer more flexibility, a points based travel rewards card may be more suitable.

Top Offers

Top Offers From Our Partners

How We Picked The Best Travel Credit Cards: Methodology

To identify top travel rewards credit cards, our team researched extensively among numerous offerings from major banks, airlines, hotel chains, and financial institutions. Independently, our experts meticulously analyzed data to rate these cards based on four key categories tailored for travel enthusiasts:

- Travel Rewards (40%): We evaluate the rewards structure, including points or miles earned per dollar spent on travel-related purchases, bonus categories such as dining or airfare, and redemption options such as free flights, hotel stays, or statement credits. Cards offering higher rewards rates, versatile redemption choices, and valuable travel perks like lounge access or travel insurance score higher.

- Travel-Friendly Features (30%): This category assesses features crucial for frequent travelers, such as no foreign transaction fees, airport lounge access, TSA PreCheck or Global Entry fee reimbursement, and complimentary travel insurance. Cards offering significant travel benefits without exorbitant annual fees and competitive introductory rates receive higher scores.

- User Experience for Travelers (20%): We examine application ease, travel-related customer service quality, and online account management tools tailored for travelers. Cards with user-friendly mobile apps, dedicated travel customer support lines, and travel-related resources such as trip planning assistance or destination guides receive higher ratings.

- Issuer Reputation in Travel (10%): We scrutinize each issuer's reputation in the travel credit card market, considering feedback from frequent travelers, financial stability, and the issuer's partnership network with airlines and hotels. Issuers with positive reviews from travel enthusiasts and a track record of providing excellent travel rewards and customer service receive higher ratings.

* Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.