The Hilton Honors American Express Card and the Hilton Honors American Express Surpass® Card are two credit cards that cater to Hilton loyalists, offering various perks and rewards within the Hilton Honors program.

Let's compare them side by side.

Hilton Honors vs. Hilton Surpass: General Comparison

The Surpass card boasts a notably higher average annual fee, justified by its superior rewards ratio and additional benefits compared to the Amex Hilton card. Despite being more expensive, it outperforms the Amex Hilton card in every aspect. Here's a side-by-side comparison:

|

| |

|---|---|---|

Hilton Honors American Express | Hilton Honors Amex Surpass | |

Annual Fee | $0 ( See Rates and Fees. ) | $150 ( See Rates and Fees. ) |

Rewards | 7X Hilton Honors Bonus Points for each dollar of eligible purchases charged directly with hotels and resorts within the Hilton portfolio, 5x points at U.S. restaurants (including takeout and delivery) U.S.supermarkets, U.S. gas stations and 3x points for each dollar on other eligible purchases . | Earn 12x Points on hotels & resorts at eligible purchases at hotels and resorts in the Hilton portfolio. Earn 6x Points on dining at U.S. restaurants , and for takeout and delivery in the U.S, on groceries at U.S. supermarkets and at U.S. gas stations. Earn 4X Points for each dollar on U.S. Online Retail Purchases and 3X Points on all other purchases |

Welcome bonus | 100,000 Hilton Honors Bonus Points with the Hilton Honors American Express Card after you spend $2,000 in purchases on the Card within your first 6 months of Card Membership.

| 155,000 Hilton Honors Bonus Points with the Hilton Honors American Express Surpass® Card after you spend $3,000 in purchases on the Card within your first 6 months of Card Membership.

|

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0. ( See Rates and Fees.) | $0. ( See Rates and Fees. ) |

Purchase APR | 19.99% – 28.99% variable

| 19.99% – 28.99% variable

|

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Hilton Amex vs. Hilton Surpass: Point Rewards Analysis

When comparing the points rewards of the two cards, the Surpass card clearly stands out, offering significantly more points than the standard Amex Hilton card.

Given that each Hilton point is worth about 0.6 cents, the Surpass card’s higher points earning potential more than makes up for the difference in annual fees for an average user spending similar amounts, as shown in our analysis.

|

| |

|---|---|---|

Spend Per Category | Hilton Honors Amex | Hilton Honors Amex Surpass |

$10,000 – U.S Supermarkets | 50,000 points | 60,000 points |

$4,000 – Restaurants

| 20,000 points | 24,000 points |

$4,000 – Airline | 12,000 points | 12,000 points |

$5,000 – Hotels | 35,000 points | 60,000 points |

$4,000 – Gas | 20,000 points | 24,000 points |

Total Points | 137,000 points | 180,000 points |

Redemption Value (Estimated) | 1 point = ~0.6 cent | 1 point = ~0.6 cent |

Estimated Annual Value | $822 | $1,080 |

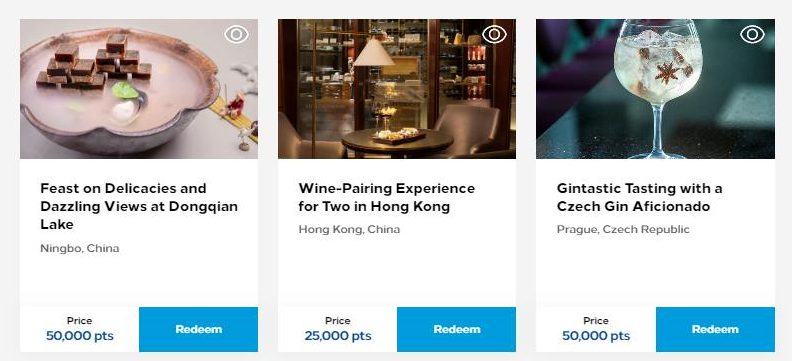

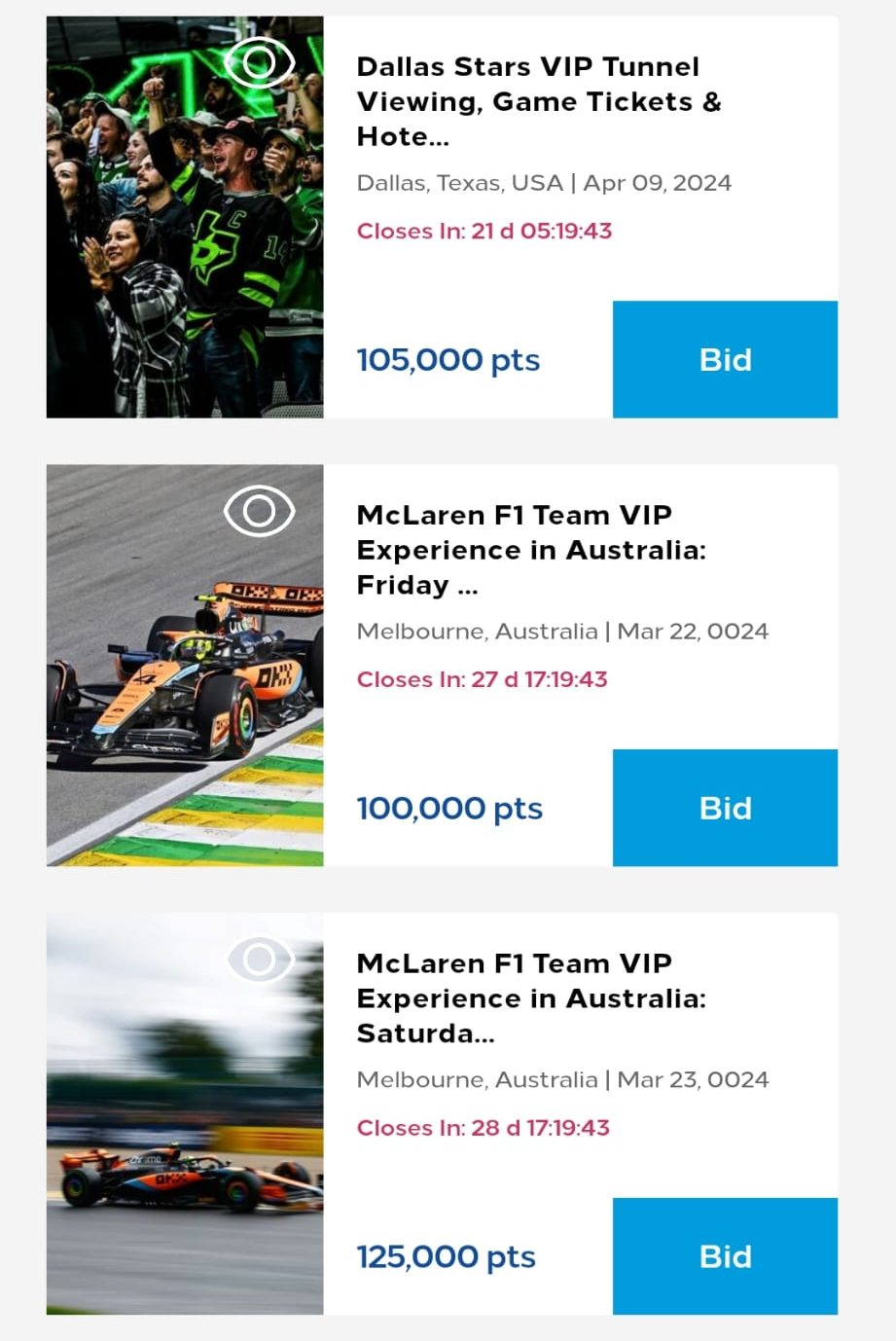

Hilton gives you plenty of options for redeeming the points you earn through their loyalty program. You can use points for free hotel stays, covering the cost of your room. Hilton also offers flexibility with the Points & Money option, letting you combine points and cash for bookings.

Beyond just hotel stays, you can redeem points for a variety of experiences, travel perks, shopping, and more through the Hilton Honors program.

Which Benefits Of You'll Get On Both Cards?

There are some additional types of perks that you will see with both of these cards:

Car Rental Loss and Damage Insurance: When using your eligible Card to reserve and pay for a rental vehicle, and declining the collision damage waiver, you're covered for damage or theft in a covered territory. Exclusions apply, and the coverage is secondary without liability coverage.

Global Assist® Hotline: As a Card Member, access the Global Assist® Hotline for travel assistance over 100 miles from home, providing services like lost passport replacement, translation, missing luggage, and emergency legal and medical referrals. Costs from third-party service providers are the Card Member's responsibility.

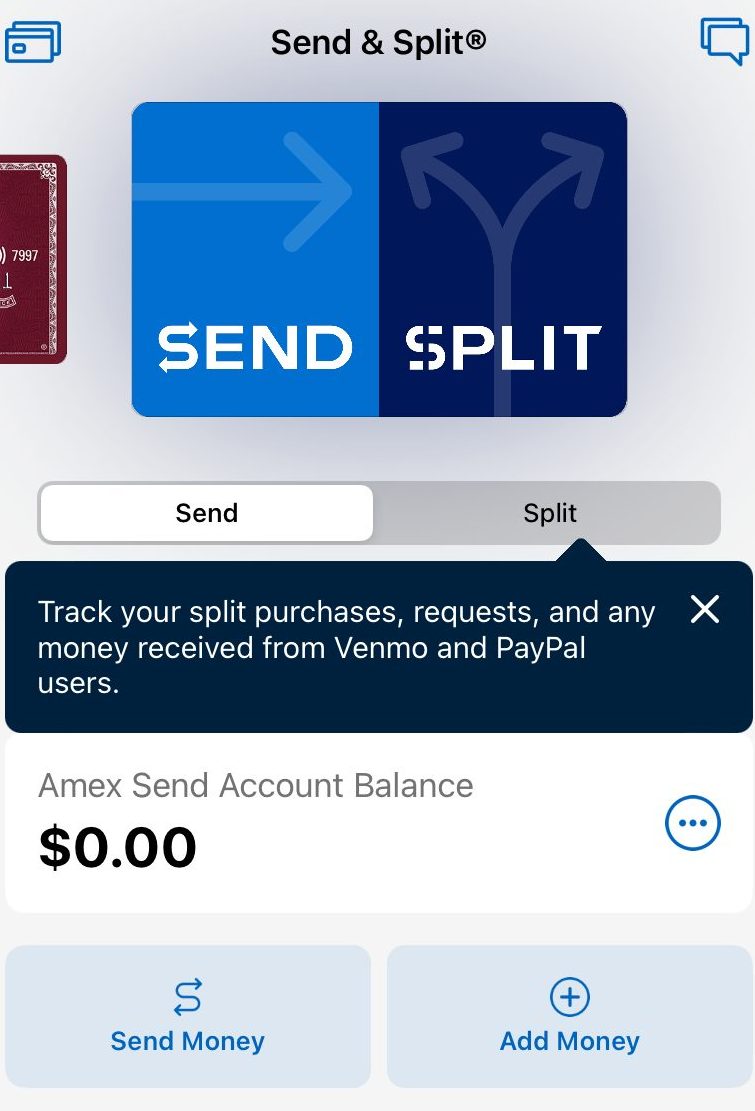

Send & Split®: In the American Express® App, Send & Split® lets you send money and split purchases with Venmo and PayPal users, paying friends without standard fees, and seamlessly splitting Amex purchases. Earn rewards for the split purchase, and enrollment is required with applicable terms.

- Dispute Resolution: If faced with unrecognized charges or billing issues, American Express collaborates with you and the merchant to resolve the problem promptly.

Purchase Protection: Covered Purchases made with your Eligible Card are protected for up to 90 days from the purchase date, covering theft or accidental damage, with limits of up to $1,000 per occurrence and $50,000 per calendar year.

ShopRunner: Enjoy complimentary membership with ShopRunner, providing free 2-day shipping on eligible items from a network of 100+ online stores, accessible by enrolling with your eligible Card at shoprunner.com/americanexpress.

Terms apply to American Express benefits and offers.

Benefits Of You'll Get Only With The Hilton Honors Card

- Hilton Honors Silver Status: Enjoy a 20% bonus on Base Points, expediting your journey to free nights. Spend $20,000 on eligible Card purchases in a calendar year to upgrade to Hilton Honors Gold status through the following calendar year.

Top Offers

Top Offers From Our Partners

Top Offers

Which Benefits Of You'll Get Only With The Surpass Card?

The Hilton Surpass offers some unique, premium benefits for cardholders that you won't be able to get with the Hilton Amex card:

$200 Hilton Credit: Enjoy up to $50 in statement credits per quarter, totaling $200 annually, for direct purchases with Hilton properties using your Hilton Honors American Express Surpass® Card.

- Hilton Honors Gold Status: Receive complimentary Gold Status, providing benefits such as a 5th night free on standard room stays of 5+ nights, and an 80% Bonus on all Base Points to accelerate your free night earnings.

National Car Rental® Status: Card Members get complimentary National Car Rental® Emerald Club Executive® status, offering perks like Executive Area Access in the USA and Canada for full-size reservations and above.

Hilton Honors™ Upgrade to Diamond Status: Achieve Hilton Honors Diamond status by spending $40,000 on eligible purchases in a calendar year, extending the status through the end of the next calendar year.

- Free Night Reward: Earn a Free Night Reward from Hilton Honors after spending $15,000 on eligible purchases on your Card in a calendar year.

- Extended Warranty: Use your Eligible Card for Covered Purchases and benefit from an extended warranty, matching the Original Manufacturer's Warranty for up to one additional year on warranties of 5 years or less in the United States or its territories.

Terms apply to American Express benefits and offers.

When You Might Want the Hilton Honors Card?

You Might Prefer the Hilton Honors Amex over the Hilton Amex Surpass if:

- You Don't Want To Pay An Annual Fee: If you prefer a credit card with a lower annual fee and are willing to sacrifice some premium benefits, the Hilton Amex may be the better choice, as it typically comes with a more budget-friendly fee compared to the Hilton Surpass.

- You're An Infrequent Traveler: If you don't travel frequently and don't anticipate maximizing the extra perks offered by the Surpass, sticking with the Hilton Amex might make more financial sense due to its lower annual fee.

When You Might Want the Hilton Surpass Card?

You Might Prefer the Hilton Surpass card over the Hilton Honors Amex card if:

- You Are A Frequent Traveler: The Hilton Surpass offers several benefits that are particularly valuable for frequent travelers, such as Hilton credit, free night award and extended warranty. These benefits can save you money and provide peace of mind when you are traveling abroad.

- You Want Premium Benefits: Opt for the Hilton Surpass if you frequently stay at Hilton properties and want to take advantage of elevated status benefits, such as room upgrades, 5th night free and more points, which come with the Surpass card's complimentary Gold Status.

Compare The Alternatives

If you're in search of a travel credit card offering hotel rewards, there are several compelling alternatives worth exploring:

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

175,000 points

175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership

|

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | See Pay Over Time APR | 19.99%–28.49% variable

| 19.99% – 28.99% (Variable)

|

Compare Hilton Honors American Express Card

If you're looking for an hotel card, a good one can provide exclusive benefits. Which card offers more perks and what are the differences?

Amex Hilton Honors vs World of Hyatt: Which Hotel Card Wins?

The Hilton Honors Amex is our winner with higher cashback value and great overall rating for a hotel card with no annual fee.

Hilton Honors American Express vs. Marriott Bonvoy Bold: Side By Side Comparison

Both Hilton Honors Amex and Wyndham Rewards Earner cards offer a decent point rewards ratio and basic extra hotel perks.

Hilton Honors American Express vs. IHG One Rewards Traveler: Side By Side Comparison

Compare Hilton Honors Amex Surpass Card

If you can maximize your points, rewards, and benefits, the Hilton Aspire is our winner. But, if your spend is not so high – the Surpass wins.

Hilton Honors Surpass vs. Hilton Aspire Card: How They Compare?

The Hilton Amex Surpass is our winner as it offers higher estimated total cashback than the Marriot Boundless card and additional hotel perks.

Marriott Bonvoy Boundless vs. Hilton Amex Surpass: Side By Side Comparison

The Hilton Honors Surpass wins at estimated cashback, while the Amex Gold card is the winner for everyday spending and extra benefits.

Despite having a higher annual fee, the Hilton Surpass card is our winner with higher estimated annual cashback and better extra hotel perks.

IHG One Rewards Premier vs. Hilton Amex Surpass: Side By Side Comparison

The Hilton Surpass and World of Hyatt card are two of the best medium tier hotel cards with great cash back rates and extra hotel perks.

World of Hyatt Card vs. Hilton Amex Surpass: Side By Side Comparison

Review Travel Credit Cards

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.