Table of Content

The United Club℠ Infinite Card and the Delta SkyMiles® Reserve American Express Card are two of the top airline travel cards, offering some of the best perks available.

In this comparison, we’ll take a closer look at both cards to see which one offers more and which might be the best fit for your needs. Let’s dive in.

General Comparison

|

| ||

|---|---|---|---|

Delta SkyMiles® Reserve American Express | United Club℠ Infinite | ||

Annual Fee | $650. See Rates and Fees. | $525 | |

Rewards | 3X miles per dollar on eligible Delta flights and Delta Vacations® with 1X miles on all other purchases. Terms Apply. | 4x miles on United Airlines purchases, 2x miles on all other travel purchases, dining and eligible delivery services and 1x miles on all other purchases | |

Welcome bonus | 125,000 Bonus Miles after you spend $6,000 in eligible purchases on your new Card in your first 6 months of Card Membership. Offer Ends 10/29/2025.

|

| |

0% Intro APR | N/A | N/A | |

Foreign Transaction Fee | $0. See Rates and Fees. | $0 | |

Purchase APR | 19.99%-28.99% Variable

| 20.24%–28.74% variable

| |

Read Review | Read Review |

Simulation: Which Card Gives More Rewards?

It's difficult to understand the actual reward potential without a scenario comparison.

While cardholders earn above average rewards on both cards, the benefits is not so high in terms of value. The real value of the cards comes from the luxury perks it offers such as global entry or TSA PreCheck, statement credit for inflight purchases, trip delay reimbursement etc, more about it in the next section

Also, keep in mind that when you compare cards, figures should be adjusted to your regular spending categories, which may differ – so the exact calculation is dependent on your personal habits.

|

| |

|---|---|---|

Spend Per Category | Delta SkyMiles® Reserve American Express | United Club℠ Infinite |

$15,000 – U.S Supermarkets | 15,000 miles | 15,000 miles |

$5,000 – Restaurants

| 5,000 miles | 10,000 miles |

$5,000 – Airline | 15,000 miles | 20,000 miles |

$4,000 – Hotels | 4,000 miles | 8,000 miles |

$4,000 – Gas | 4,000 miles | 4,000 miles |

Total Miles/Points | 43,000 miles | 57,000 miles |

Estimated Redemption Value (Flights) | 1 mile = ~1 point ~ 1.3 cents

| 1 mile = ~1.2 cents

|

Estimated Annual Value | $559 | $684 |

Editorial Note: Terms apply to American Express benefits and offers. Enrollments may be required for select benefits. Visit americanexpress.com to learn more

Compare The Perks

Delta SkyMiles® Reserve American Express

- Annual Companion Certificate: You’ll receive a round trip companion certificate for Domestic First Class, Main Cabin or Delta Comfort+ each year upon card renewal.

- $200 Delta Stays Credit: Every year, enjoy a $200 credit for eligible prepaid Delta Stays bookings on delta.com.

- Hertz President’s Circle Status: Join the Hertz Gold Plus Rewards program and enjoy the benefits of Hertz Five Star Status.

- $240 Resy Credit: Get a $240 credit for Resy, earning up to $20 in monthly credits on eligible Resy purchases.

- $120 Rideshare Credit: Get a $120 credit for rideshare services, with up to $10 back each month on U.S. rideshare purchases when using your Delta SkyMiles Reserve American Express Card. Enrollment is required.

- MQD Boost: Earn $2,500 Medallion Qualification Dollars each year, getting you closer to elite status with MQD Headstart.

- MQD on Purchases: Earn $1 Medallion Qualification Dollar for every $10 you spend on your Delta SkyMiles Reserve American Express Card in a calendar year, helping you reach a higher Medallion Status for the next year.

- Complimentary Access to Delta Centurion® Lounge – When you book your Delta flight with your Reserve Card, you will receive complimentary access to The Centurion® Lounge.

- Free First Checked Bag: When you book your Delta flights with your card, you can save up to $60 per round trip per person with free first checked bags.

- Upgrade Priority – When you use your Delta SkyMiles Reserve American Express Card, you will have priority over other Medallion members in the same Medallion level and fare class grouping.

- Free Global Entry or TSA PreCheck: You can receive up to $100 statement credit to reimburse you for Global Entry or TSA PreCheck fees when you pay with your card.

- Delta Sky Club® Access:

Get free entry to the Delta Sky Club when you fly on a Delta flight on the same day. You'll also get four guest passes each year. Effective 2/1/25, Reserve Card Members will receive 10 Visits per year to the Delta Sky Club; to earn an unlimited number of Visits each year starting on 2/1/25, the total eligible purchases on the Card must equal $75,000 or more between 1/1/24 and 12/31/24, and each calendar year thereafter.

- Baggage Insurance: You can enjoy up to $500 for checked bags and up to $1,250 for carry on baggage if your baggage is lost, stolen or damaged when you’ve purchased your fare with your card.

- Statement Credit for In Flight Purchases: You’ll get 20% back as statement credit when you use your card to pay for in flight purchases during your Delta trip including food, drinks and audio headsets.

- Trip Cancellation Insurance: If you pay for your trip entirely with your card and it is interrupted or canceled due to a covered reason, you can claim up to $10,000 per person for reimbursement of your non refundable travel expenses purchased with your card. There is a cap of $20,000 per card during any 12 consecutive month period.

- Access to Complimentary Upgrades – If you do not have Medallion Status, your Card automatically adds you to the Complimentary Upgrade list, which is prioritized over Medallion Members.

Terms apply to American Express benefits and offers.

United Club℠ Infinite

United Club Membership: This offers you a place to enjoy complimentary snacks and beverages, work or relax before you fly. You and your eligible travel companions can enjoy access across all United Club locations worldwide. This benefit has a value of up to $650 per year.

- Free Check Bags: The primary cardmember and a travel companion on the same reservation can receive their first and second standard bags checked for free. This represents savings of up to $320 per round trip.

- Statement Credit for United Inflight Purchases: You can get 25% back when you buy food, drinks, WiFi and other onboard purchases with your United Club Infinite on United operated flights.

- Premier Access Travel Services: You can get preferential treatment at the airport including priority check in, boarding, security screening and baggage handling.

- Global Entry or TSA PreCheck Reimbursement: You can get up to $100 statement credit every four years as a reimbursement for your application fee for Global Entry or TSA PreCheck when you charge your subscription to your card.

- Luxury Hotel & Resorts Collection: As with other Chase Travel cards, you can access the Luxury Hotel & Resorts Collection. This provides access to complimentary breakfasts, early check in, room upgrades and other amenities in over 1,000 luxury hotels and resorts around the world.

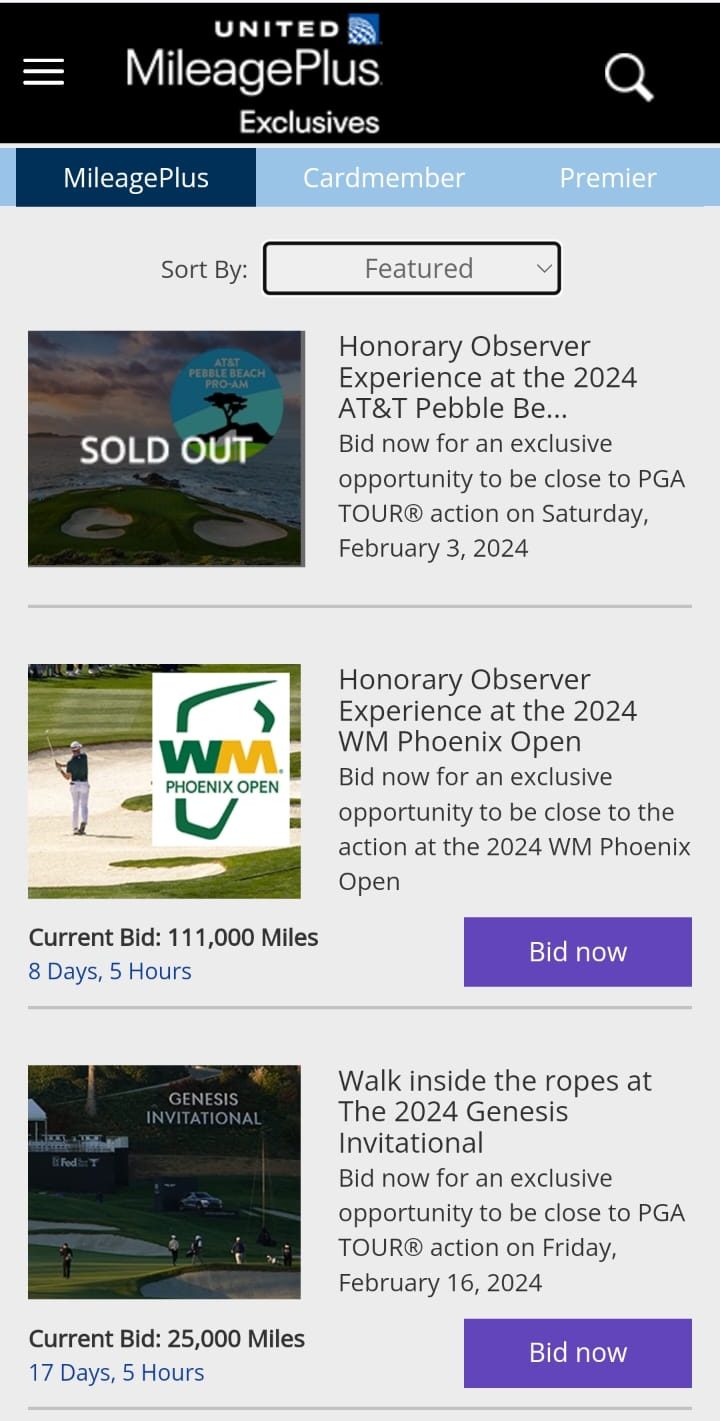

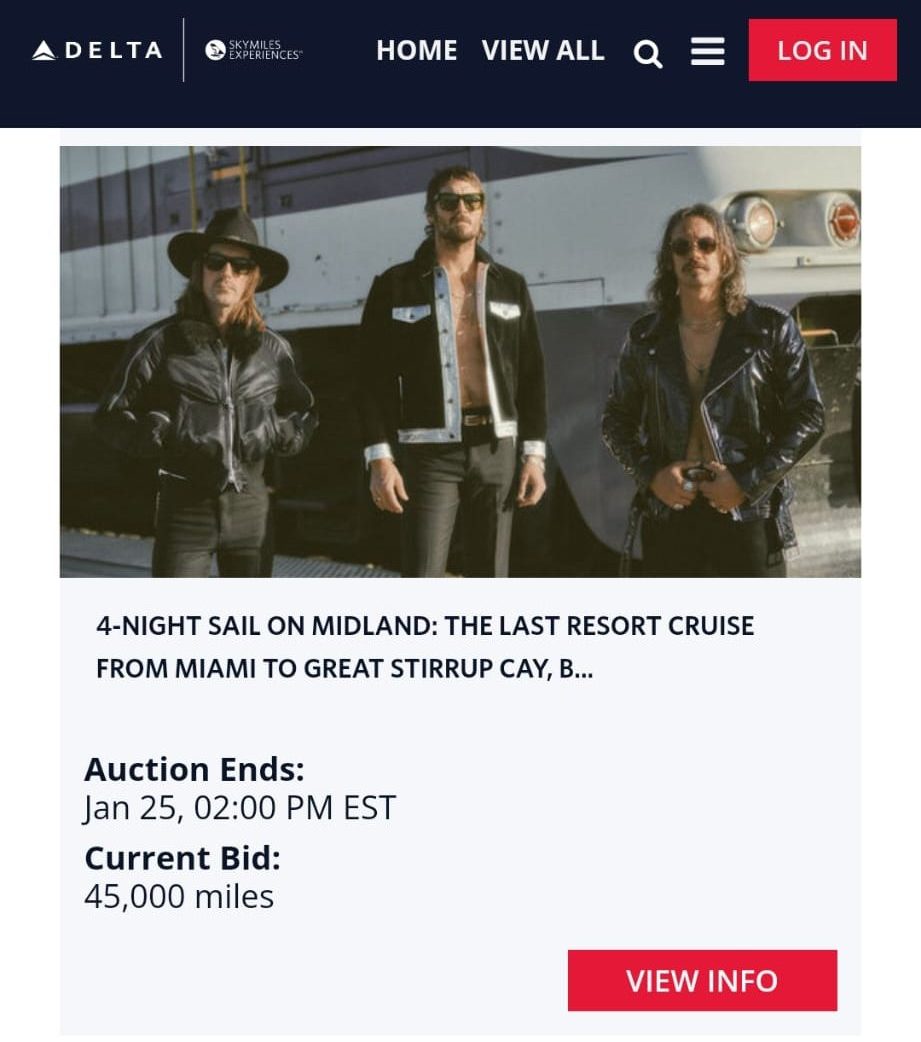

- Chase United Card Events: This allows you to purchase curated, private once in a lifetime experiences. These range from sporting events to celebrity meet and greets.

- Premier qualifying points: customers can earn 500 PQP for every $12,000 you spend on purchases with your United Club Card (up to 8,000 PQP in a calendar year) that can be applied toward your Premier status qualification, up to the Premier 1K® level

- Trip Interruption/Cancellation Insurance: If your trip is cut short or canceled due to severe weather, sickness or another covered situation, you have up to $20,000 per trip and up to $10,000 per person.

- Trip Delay Reimbursement: If your common carrier travel has a 12 hour plus delay, you’ll be covered for unreimbursed expenses such as meals and accommodation for up to $500 per ticket.

- Baggage Insurance: If your baggage is delayed by your passenger carrier for over six hours, you can get reimbursement for essential purchases up to $100 per day for three days.

- Visa Infinite Concierge Service: This provides complimentary access to 24 hour concierge services to help you send gifts, find tickets to top events or make restaurant reservations.

- Auto Rental Collision Damage Waiver: If you charge the full rental cost to your card and decline the rental company collision insurance, you’ll enjoy primary coverage for collision damage or theft for most rental cars here and abroad.

- Purchase Protections: New purchases are covered for 120 days for up to $50,000 per year against theft or damage. You can also receive reimbursement for eligible items that cannot be returned to the store within 90 days of purchase.

Compare The Drawbacks

Of course, the Delta SkyMiles Reserve and the United Club Infinite, like all credit cards, have potential drawbacks that may influence whether they are a good fit for you.

So, to help you make a smart decision, we'll highlight potential drawbacks here.

Delta SkyMiles® Reserve American Express

- Rewards Are Front Loaded

While the introductory bonuses are far more generous compared to the United Club Infinite, you may find other airline cards have more to offer in the long term.

- Lower Rewards Compared to Other Delta Cards

Since this is one of the most expensive Delta American Express cards, it is a little disappointing that there are more generous rewards in some categories with sibling cards such as the Delta SkyMiles® Gold American Express Card or the Delta SkyMiles® Blue American Express.

United Club℠ Infinite

- Weighted Towards United Airfares

While there is a tiered reward structure, it is heavily weighted towards United Airlines purchases. This is not as generous as other travel cards that offer two or three miles across the board.

- Limited Non United Flying Redemptions

While one of the advantages of this card is that it does offer great rewards for United Flyers, but if you want greater flexibility, you may find this card a little frustrating.

- No Anniversary Awards

While American Express does offer some awards on your card anniversary, this is not offered with the United Club Infinite.

Compare Redemption Options

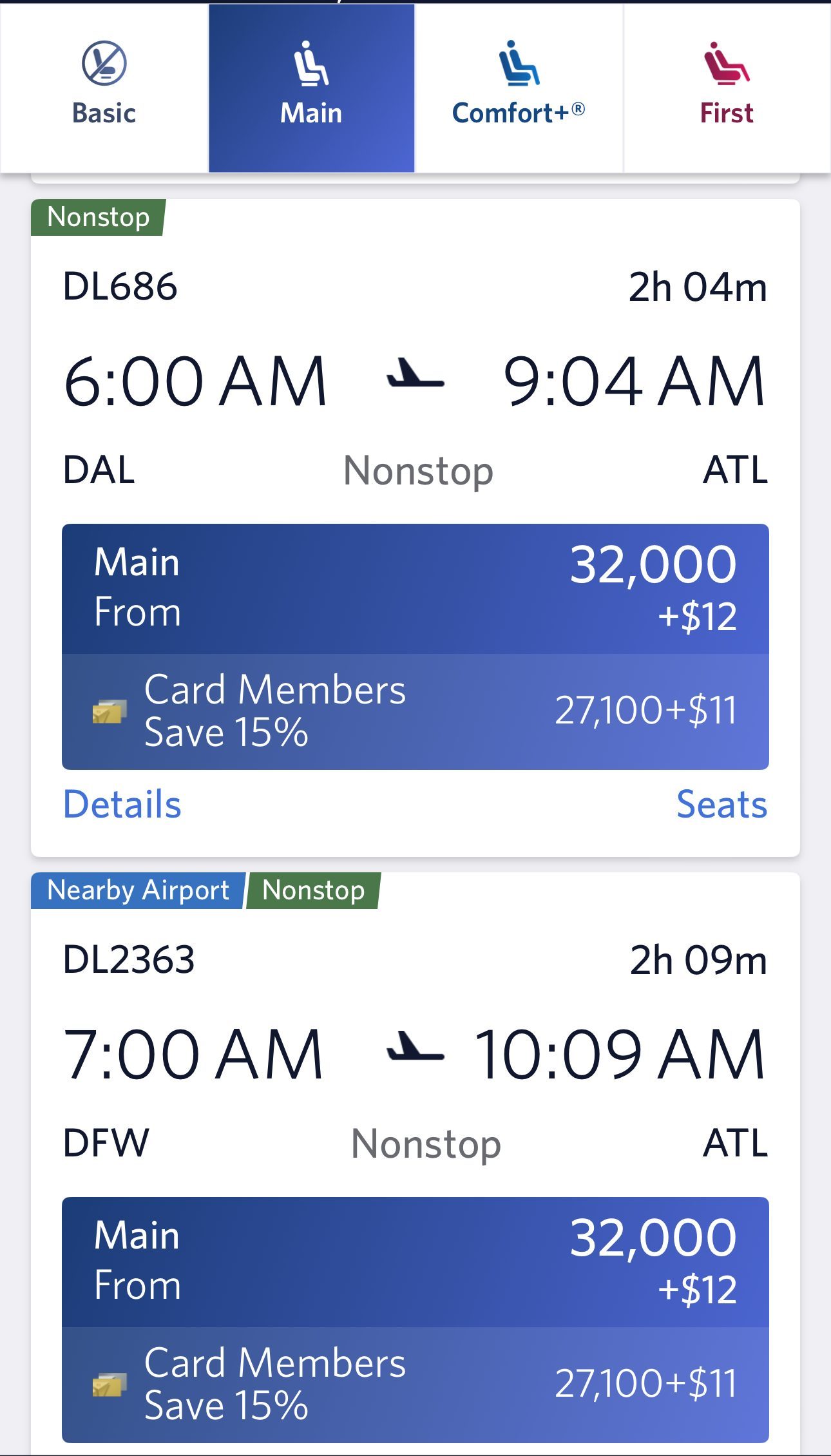

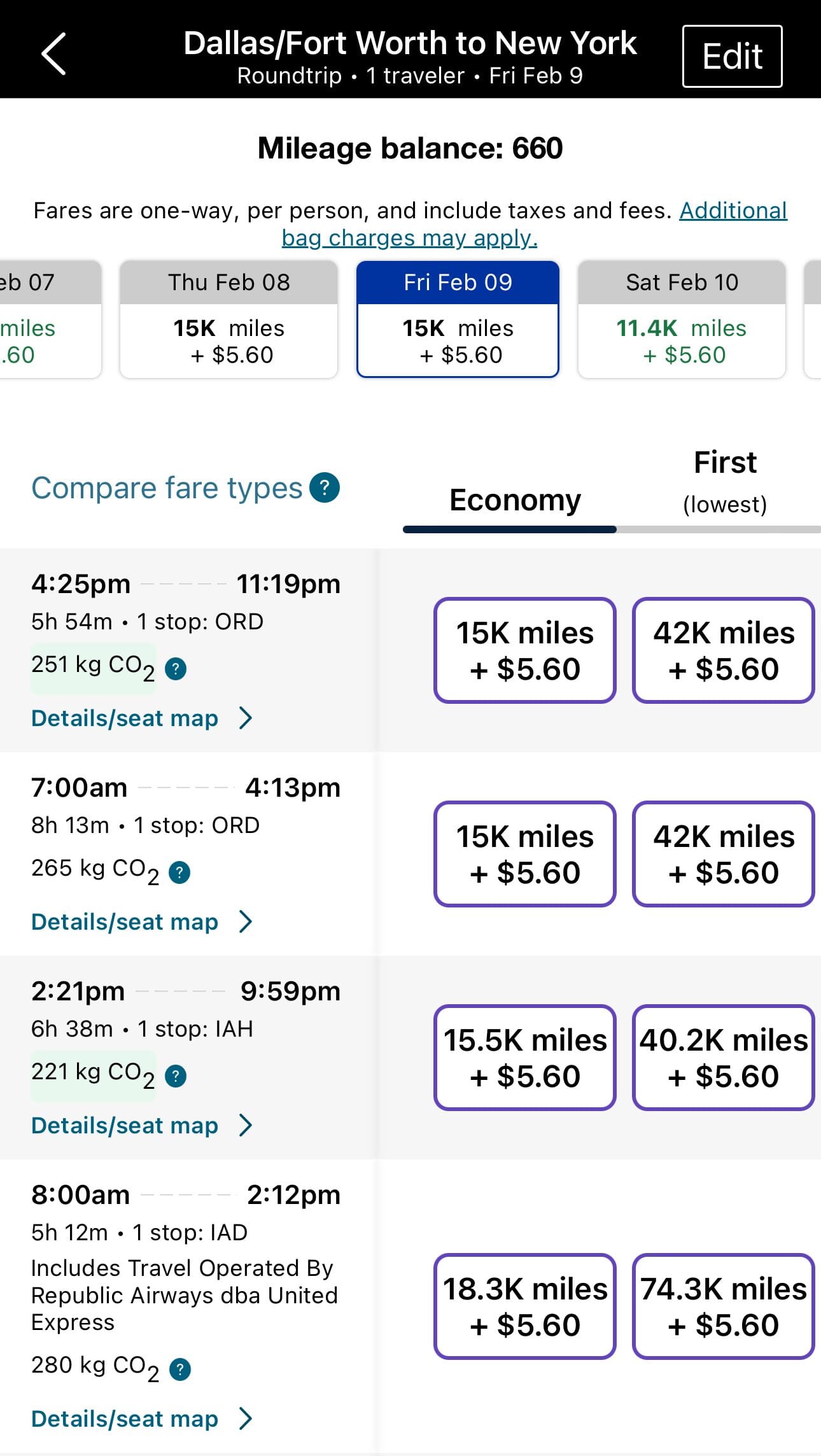

Chase offers several ways to redeem your miles, but if you want the best rewards, you should aim to book United flights or flights with its 35+ partner airlines.

The average value for miles used in this way is just over 2 cents per mile, but if you are not bothered about getting the highest redemption rates you can also use your miles for hotel stays, rental cars, merchandise, event and show tickets, or retail gift cards.

You can use your Delta SkyMiles for Delta flights, seat upgrades, merchandise, experiences and gift cards. You do need to enrol in the Delta SkyMiles rewards program, which then allows you to redeem your miles via website, by phone or through a Delta ticket counter.

It is also possible to transfer your points to one of Delta’s partners including IHG, Hilton Honors, Marriott Bonvoy, and Radisson Rewards, but a transfer fee may apply.

How to Maximize Cards Benefits?

To maximize the rewards from your Delta SkyMiles Reserve card, you will need to aim to do the bulk of your spending during the first three months. Many of the reward benefits for this card have a limited timeframe, so plan your spending ahead of time while you’re waiting to receive your card.

In the longer term, you will need to consider your MQMs, which determine your badge status. If you reach 25,000 MQMs, you’ll have Silver SkyMiles status, which increases the points you’ll earn on Delta purchases.

You can make the most of your card benefits by using the annual companion certificate. This allows you to bring a companion on a round trip, with only taxes and fees on their ticket. Even if you book a main cabin flight, this could save you hundreds of dollars.

If you want to maximize your United Club Infinite rewards you will need to research your United flight options carefully. If you simply use the miles to book any trip, you may only get a rate of 1 cent per mile.

However, if you research the flight options and are flexible with your travel dates, you can get a far better redemption rate.

Customer Reviews: Which Card Wins?

Delta SkyMiles® Reserve American Express

Satisfied borrowers report that the initial bonuses and perks for this card are extremely attractive, particularly when compared with other cards in this segment.

However, negative reviews highlight frustration that after the initial period, there are lower rewards in many categories compared to other Delta cards.

United Club℠ Infinite

Satisfied borrowers report that they are happy with the premium rewards offered with this card. In addition to getting miles for your United purchases, you can also get some very nice travel perks.

Negative reviews highlight a lack of opportunities to earn Premier qualifying miles, which would help to qualify for United Premier elite status.

Top Offers

Top Offers From Our Partners

Why You Might Want the Delta SkyMiles® Reserve?

The Delta SkyMiles® Reserve American Express is a great option that could be good if:

- You are more likely to travel with a companion: Some of the travel perks extend to your travel companions including lounge access and the annual companion certificates.

- You’re planning a busy three months: In addition to the welcome bonus, you can earn statement credit for restaurant purchases in eligible venues during the first three months. So, if you’re planning a busy quarter, you could maximize your rewards.

- You want the reassurance of a hotline if you’re away from home. The Premium Global Assist Hotline offers a variety of help resources when you travel away over 100 miles from home.

When You Might Want the United Club℠ Infinite?

The United Club℠ Infinite is a solid choice if:

- You want decent rewards for non United purchases: You’ll get up to two miles per dollar on non United purchases, which makes this a more well rounded travel card.

- You want access to a place to work or relax before you fly. This card does offer United Club membership for you and eligible travel companions.

- You tend to travel with more than one bag: You and a travel companion can receive both first and second standard bags checked for free, with potential savings of up to $320 per round trip

Compare The Alternatives

If you're looking for a premium travel credit card with airline rewards – there are some good alternatives you may want to consider:

|

|

| |

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

175,000 points

175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership

|

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

Earn 125,000 points after you spend $6,000 in purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | See Pay Over Time APR | 19.99%–28.49% variable

| 19.99% – 28.99% (Variable)

|

Compare United Club Infinite Card

In this comparison, we will delve into the key features, benefits, and considerations of both the United Explorer and Infinite Card.

The United Infinite card offers luxury benefits that the Quest card doesn't, but for most consumers, it is not worth the higher annual fee.

When it comes to premium travel cards, these two offer nice perks and benefits. But who is the winner between the two? Here's our analysis.

United Club Infinite vs AAdvantage Executive Elite Mastercard: Which Card Is Best?

The Infinite Card is tailored for frequent United flyers, while the Amex Platinum offers a more lucrative, comprehensive rewards program.

Compare Delta SkyMiles Reserve Card

While the Delta SkyMiles Reserve card has a high annual fee, it offers better airline and travel benefits than the Platinum card.

While the Amex Platinum Card offers extensive travel perks and redemption options, the Delta Reserve Card has better airline-specific perks.

Amex Platinum Card vs. Delta SkyMiles Reserve: Which Luxury Travel Card Is Best?

The Chase Sapphire Reserve offers more versatile travel rewards and redemption options. But if you need airline perks, the Delta Reserve wins.

Chase Sapphire Reserve vs. Delta SkyMiles Reserve: Which Luxury Travel Card Is Best?

The Amex Gold Card focused on everyday spending and general travel rewards, the Delta SkyMiles Reserve Card offer premium airline benefits.

Amex Gold Card vs. Delta SkyMiles Reserve: Side By Side Comparison

The AAdvantage Executive is a clear winner when it comes to cashback value. But the Delta SkyMiles Reserve wins at premium airline perks

Citi/AAdvantage Executive World Elite vs. Delta SkyMiles Reserve: Which Luxury Airline Card Is Best?

Review Airline Credit Cards

Delta SkyMiles Blue American Express