Table Of Content

Do I Have to Activate My Amex Credit Card?

After applying for an American Express card and receiving it, you become eager to use it to earn reward points. However, you must activate your Amex card before using it.

After receiving your Amex card, you can activate it and start using it immediately. There are different ways of activating the card, including on the American Express website, by phone, or on the Amex app.

The activation process involves providing personal information to verify your identity. The process helps to prevent credit card fraud. For example, if activation is unnecessary and you lose your card before getting it, it could be used to make fraudulent purchases.

How to Activate Your Amex Credit Card On Website?

There are different steps to follow to activate your Amex card on the Amex website.

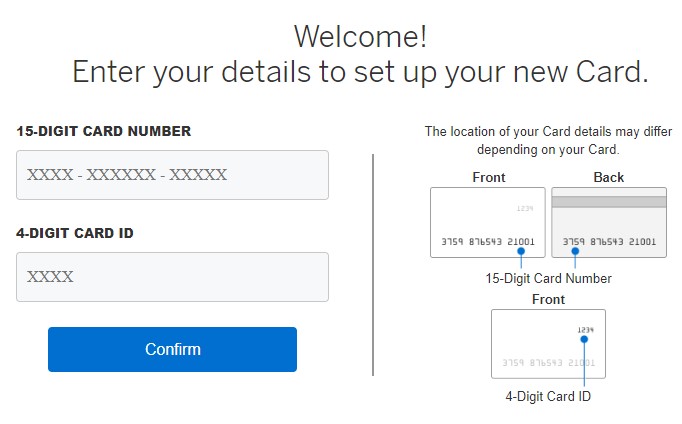

- Register: Before activating your American Express credit card, you must register for online services on the bank’s website. After registering, enter the card number and 4-digit card ID to verify your identity.

- Set a PIN. You will be prompted to set a PIN of your choice to secure your Amex card. It is always advisable to use a PIN that is unique and hard to guess. After setting your PIN, the bank allows you to change it anytime.

- Set up account preferences. After setting your preferred PIN, set up your account preferences to help you manage the account and monitor all card activities. After setting the preferences, complete the registration.

How to Activate A Credit Card On American Express App?

Apart from the Amex website, you can also activate your American Express card on the American Express app. Below are the steps to activate your Amex card on the app.

- Download the App. You can download it from Google Play or the App store.

- Create login details. After downloading the app, navigate to the ‘Activate Card and Online Account’ to create a user ID and password.

- Enter card details. After creating your user ID and password, you will be prompted to enter your Amex card details.

- Verify identity. Once you enter your card details, the app prompts you to verify your identity.

- Set PIN. After verifying your identity on the Amex app, set a unique PIN of your choice and activate the card.

Activating the card marks the end of the registration and card activation process.

How to Activate Your Amex Credit Card by Phone?

Activating the American Express card involves acknowledging with the bank that you have received your card. After receiving your Amex card, you can also acknowledge receipt or activate it over the phone.

Below are the steps for activating your Amex card by phone.

- Call the helpline number. After receiving your Amex card, call the number found on the back to begin the activation process. The number is the bank’s customer service. In most cases, the call is automated, and you will not have to wait to talk to a live human.

- Provide card details. After making the call, the prompts will require you to provide your Amex card number.

- Verify your identity. Follow the prompts to verify your identity and choose a PIN that is not easy to guess.

- Complete activation. Once you set a PIN, complete the process to activate your card.

Sign Up for

Our Newsletter

and special member-only perks.

Sign Up for

Our Newsletter

and special member-only perks.

How Do I Know if My Credit Card Is Activated?

Sometimes, there might be questions about whether your Amex card is active.

You can call the bank’s customer service or the number on the back of your card to ask about the status of your account.

Also, you can check your Amex card status on the Amex app or in your online account.

What Happens if I Decide Not to Activate an Amex Card?

If you don't activate your Amex card, you won't be able to use it. However, if you choose not to activate it because you no longer want the card, simply ignoring it isn't the same as closing the account.

The account remains open, whether you activate the card or not. This means that missing any fees or payments could negatively impact your credit score.

If you have not activated your American Express card after a certain period, representatives of the bank may contact you to confirm if you received the card.

A new card gives you a new credit limit, and if you decide not to activate and use your Amex card, the added limit can lower your credit utilization rate.

Things To Do After Activating Your Amex Credit Card?

After activating your Amex credit card, you can start using it. Amex offers various types of cards for various purposes and some of the best travel cards in the market. Below are things you can do to maximize your card’s benefits and security features.

- Set your PIN. If you skipped setting your PIN during the activation process, you could secure the account by choosing a unique PIN that is hard to guess.

- Download the American Express App. If you activated your Amex card without downloading the app, you could download it after activation to make it easier to access your account. You can set up notifications and alerts to monitor all your card activities.

- Read the terms and conditions. Reading the card member agreement gives you access to crucial information about your Amex card. Review the card’s interest rate, rates for rewards, and conditions to make an insurance claim.

- Add the card to your digital wallet. After activating your card, you can register it to your digital wallet to make contactless payments.

- Know the rules. Many Amex cards accumulate points or cash back and additional benefits if you use premium cards such as the Platinum Card From American Express or the American Express Gold Card.

There are different offers in the Amex ‘Offers’ section on your app. Click the offers that appeal to you and register.

How to Activate an Amex Debit/ATM Card?

American Express credit, debit, and ATM cards provide a convenient way to make purchases, similar to a credit card. However, with a debit card, the payment is deducted directly from your checking account.

You can activate your Amex ATM card by following the steps below.

- Set PIN. When your card arrives, you can change or view your PIN by logging into your account and navigating to the Card Management section.

- Call the bank. In some cases, you may not see your PIN. In such cases, you can call the bank’s helpline to request a PIN.

Top Offers

Top Offers

Top Offers From Our Partners

FAQs

What Information Do You Need to Activate an Amex Credit Card?

The information you need to activate your Amex card includes name, date of birth, zip code, card number, and security code.

You need to activate your Amex credit card before you can use it. The verification entails verification of your identity and setting a PIN.

What Number Do I Call to Activate My Amex Card?

It is recommended to call the number on the back of your Amex card to activate it.

However, you can also call the bank’s toll-free helpline, 800-528-4800 to route you to a channel that will assist you.

How Long Do You Have to Activate an Amex Credit Card?

You have 45 days to activate your Amex card. If you fail to activate it within the period, it may be deactivated, and you will have to request a replacement.

Therefore, if you already have your Amex card and you have not activated it, you have 45 days to do so.

Do I Have to Call?

Calling the number on the back of your Amex card is one way of activating it. The other ways are through the Amex app and on the bank website.

Before using your Amex card, you must activate it through either of the ways mentioned above.

Can I Activate My Amex Card at an ATM?

No. You cannot activate your Amex card at an ATM. You can either activate it online, on the Amex app or by calling the number on the back of the card or the bank’s helpline.

It is only after activating your Amex card that you can use it.