Table Of Content

It’s always frustrating to find an amazing credit card offer only to have your application get turned down. Luckily, you can avoid this with Bank of America’s pre-approval process.

What this means is that Bank of America reviews your application details without doing a hard credit check. This allows them to see if you’re likely to be approved for the card in just a few simple steps.

Let’s dive into how the Bank of America pre-approval process works.

Getting Pre Approved for Bank of America Credit Cards

Fortunately, the Bank of America pre approval process is quite straightforward. There are several ways that you can apply for pre approval.

-

Via the Website

The main method to obtain pre approval is via the Bank of America website.

1. Find the Pre Approval Box on the Website: When you visit the Bank of America website, you will need to click the “Credit Cards” tab at the top of the page. Once you’re on the credit card page, you should see a pre approval box on the right hand side of the screen. It will offer for you to check personalized offers.

2. Sign In: If you’re already a Bank of America customer, you can sign into the site. This will allow you to skip filling in some of your details, which can be easier, but this is not a mandatory step.

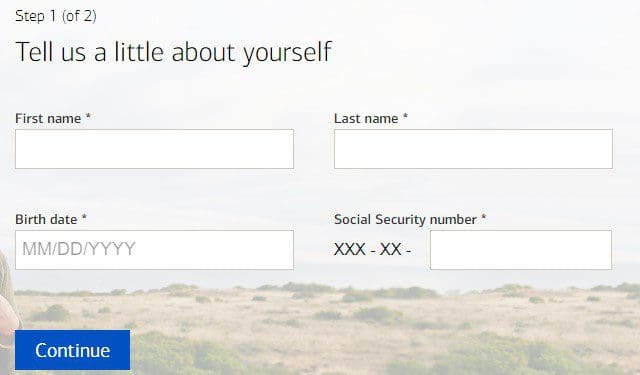

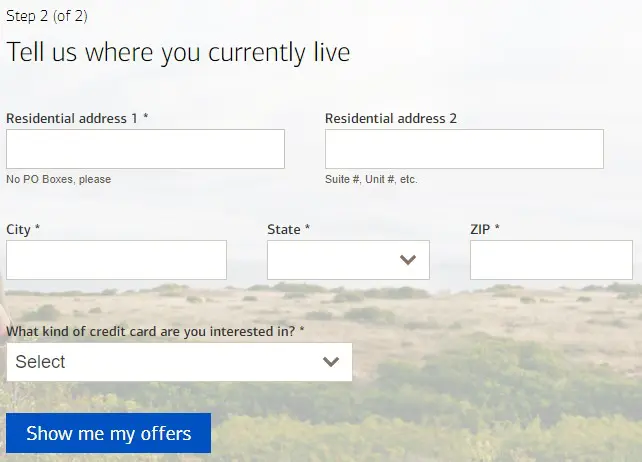

3. Complete the form: You’ll be directed to several screens, where you will need to provide basic details including your full name and address, Social Security Number and other financial information.

4. Check your card options: Once you submit your application, you’ll be able to see which cards you’re most likely to qualify for. From this page, you can also choose to move forward with a full application. To do this, you’ll need to create an account and give Bank of America permission to perform a hard credit pull.

-

Via the Mobile App

If you’re already a Bank of America customer and use the mobile account to manage your accounts, you may find that you’ll receive pre approval offers when you log in.

These offers are pre selected according to your client profile, so if you want to ensure that you receive appropriate offers, be sure to keep your profile details on your account up to date.

Tap on the “Credit Cards” tab on the bottom navigation bar and select the “Explore Credit Cards” option. Scroll through the available credit card options and choose the one that best suits your needs.

Tap on the “Apply Now” button for the selected credit card. Fill in the required information on the application form, including your personal details, income, and employment information. Review and submit the application.

You will receive a notification on your mobile device or email regarding the status of your application. If you are pre-approved, you will be prompted to complete the final application process and submit any additional required documentation.

Once your application is approved, you will receive your credit card in the mail and can start using it for purchases.

-

In Your Local Branch

You can also speak to a Bank of Representative in your local branch to discuss the card options and check if you’re pre approved.

-

Mail Offers

Bank of America, like many other credit issuers, also sends out direct mail pre selected offers. If you do receive a pre approval mailer, you can either apply online using the code or link provided or complete the attached application and mail it in.

Does Bank of America Pre Approval Affect Credit Scores?

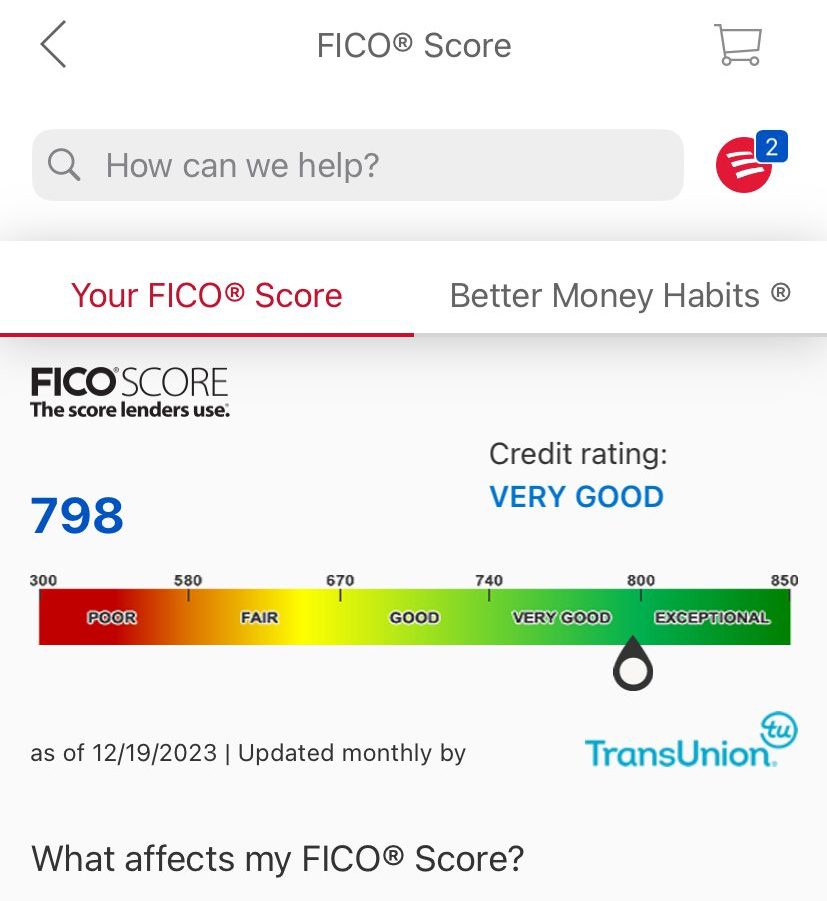

One of the most attractive reasons to consider Bank of America pre approval is that it has no impact on your credit score. The reason for this is that during pre approval, Bank of America will only use a soft credit pull. This provides the bank with an overview of your financial profile, but the search is not logged on your credit report.

The soft credit pull will offer Bank of America sufficient insight into whether you are likely to qualify for specific credit cards or any of the other Bank of America credit card products. The bank will only initiate a hard credit pull, which appears on your credit report, if you decide to proceed with a full credit card application.

Bank of America Minimum Requirements

Although the credit score requirements can vary for each Bank of America credit card, which we’ll go into in more detail below, there are other minimum requirements that you’ll need to qualify.

- Sufficient Income: Bank of America needs to feel confident that you have sufficient income to support your new credit card and any spending requirements. If there is any doubt that you may not have enough income to make future payments, your application is likely to be declined.

- Solid Credit History: While your credit score is important, Bank of America also considered other credit history factors including the types of accounts you hold, your payment history and the length of your credit history. Additionally, if your credit history shows a lot of inquiries recently, it may be a red flag.

What Credit Scores Do You Need for Bank of America Credit Cards?

As we touched on above, the credit score requirements for each Bank of America credit card varies. While there are no guarantees that if you have these credit scores your application will be approved, it provides a good indicator.

Card | Rewards | Bonus | Annual Fee |

| Bank of America® Customized Cash Rewards credit card

| 1-3%

3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%)

| $200

$200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening

| $0 |

|---|---|---|---|---|

| Bank of America® Travel Rewards credit card | 1.5X

1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points

| 25,000 points

25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases

| $0 |

| BankAmericard® credit card | N/A |

N/A

N/A

| $0 |

| Bank of America® Premium Rewards® credit card | 1.5X – 2X

Unlimited 2X points on travel and dining purchases. Unlimited 1.5X points on all other purchases

|

60,000 points

60,000 online bonus points after spending $4,000 on purchases in the first 90 days. | $95 |

| Bank of America Unlimited Cash Rewards credit card | 1.5%

unlimited 1.5% cash back on all purchases

|

$200

$200 online cash rewards bonus after you make at least $1,000 in purchases in the first 90 days of account opening.

| $95 |

- Bank of America Customized Cash Rewards: This is a generous rewards card with no annual fee. You need a good credit score of at least 690.

- Bank of America Unlimited Cash Rewards: This is another generous rewards BoA credit card with no annual fee, but the rewards are not as high as the Customized Cash. This is reflected in the minimum credit score needed, which is 670.

- BankAmericard: This no annual fee card has an extended 0% APR introductory rate. You’ll need a good minimum credit score of at least 690.

- Bank of America Travel Rewards: This card has a highly generous travel rewards structure, but it does have a more stringent credit score requirement of at least 690.

- Bank of America Premium Rewards: This card has a modest annual fee and impressive rewards. You’ll need a good to excellent credit score of at least 690.

- Bank of America Premium Rewards Elite: This is a premium card with a premium annual fee, and a higher spending expectation. The card has a long list of benefits, so Bank of America reserves this card for customers with excellent credit scores.

- Bank of America Co-Branded Cards: Bank of America offers a variety of co-branded credit cards including Alaska Airlines, Royal Caribbean, and Free Spirit. These cards require good to excellent credit.

How to Improve Bank of America Credit Card Approval Chances?

If you want to improve your Bank of America credit card approval chances, there are several tips that may help you.

- Maintain a good payment record: One of the most important factors that Bank of America will assess is your payment history. So, concentrate on making at least the minimum payment due on time every month.

- Pay down your debt: In addition to missed payments, your credit utilization is a significant factor for determining your approval. If you have a high credit utilization, it may indicate to Bank of America that you are not handling your credit responsibilities well. Ideally, aim to get your credit utilization under 10 percent, but if this is not possible, try for under 30 percent.

- Check for credit report inaccuracies: It is always worth requesting a copy of your latest credit report and checking for any errors. You can dispute these with the appropriate credit bureau, which could improve your credit score.

How Long Does Bank of America Pre Approval Take?

In most cases, you can receive a pre-approval decision in a matter of minutes after you submit your application.

However, there may be some scenarios when Bank of America needs more time to review your details. This means that you may need to wait a day or two for your pre-approval decision.

If you receive a pre-approval offer in the mail or via the Bank of America app, you are already pre-approved, so there is no delay. You simply need to decide if you want to proceed with an application.

Top Offers

Top Offers From Our Partners

How Long is Bank of America Pre Approval Good For?

If you receive a pre approval letter or application, this acts as your offer, but it is not a guarantee that you will receive the credit card. You will have 90 days to decide if you wish to proceed with a full application and try to obtain your new credit card.

Bank of America cannot provide a longer timeframe for pre approval to remain valid, as your credit report and financial circumstances may change significantly after three months.

FAQs

How do you check Bank Of America pre approval status?

You can check your pre approval status via the Bank of America website or by calling the customer support helpline.

Why did I get denied by Bank Of America ?

There could be any number of reasons why you may have had your credit card application declined by Bank of America. The most likely reason is that your credit score is not high enough, but it could also be that Bank of America has deemed that you have insufficient income to support the card.

What does pre approved mean for Bank Of America credit card?

Pre approval is not a guarantee that your credit card application will be approved, but the odds of approval are at least 90%.

What are the chances of getting denied after Bank Of America pre approval?

According to financial experts, there is a 10% chance of your application being denied once you are pre approved.

What credit bureau does Bank Of America use?

Bank of America can use all three credit bureaus, but usually it tends to rely on Experian.

Which Bank Of America credit card is the easiest to get?

Bank of America offers a variety of secured credit cards, which are the easiest to qualify for. If you don’t want a secured card, the Unlimited Cash Rewards card has the lowest minimum credit score requirement.