Table Of Content

If you regularly fly United, you may be interested in the United Airlines Mileage Plus program. United is one of the largest airlines in America with domestic hubs in several major cities including Denver, Houston, Chicago, San Francisco, LA and Washington-Dulles.

United airlines operates approximately 4,500 flights daily to over 300 cities worldwide. United also has partnerships with numerous airlines, making the MileagePlus program even more attractive.

What Is The United Airlines' MileagePlus Program?

Essentially, MileagePlus is United Airlines frequent flyer loyalty program. You can earn MileagePlus miles in a variety of ways that can be accumulated and then redeemed for free flights in economy, business and first class on United flights or its partner airlines. You can also use your miles for flight upgrades.

The program operates in a similar way to many airline loyalty programs. You can keep track of the number of miles you’ve been awarded and check your balance at any time.

When you have sufficient points, you can simply book flights, using your miles as full or partial payment for your fares. This makes it a very attractive program for those who regularly fly United or are brand loyal to United airlines.

What Benefits Are Available With United MileagePlus Points?

You can use your MileagePlus miles or points in a number of ways. These include:

1. Booking United Flights

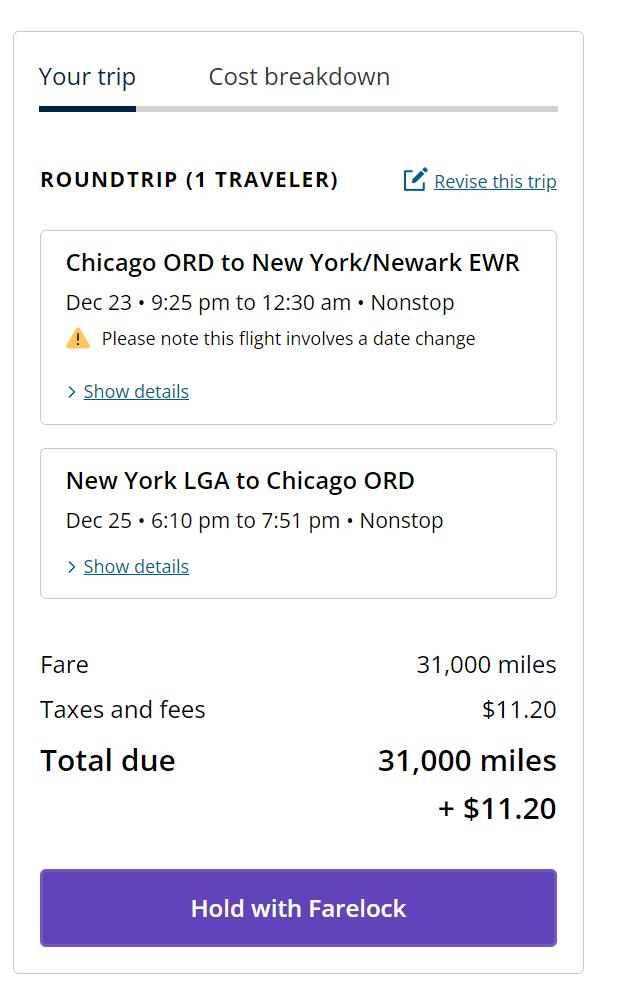

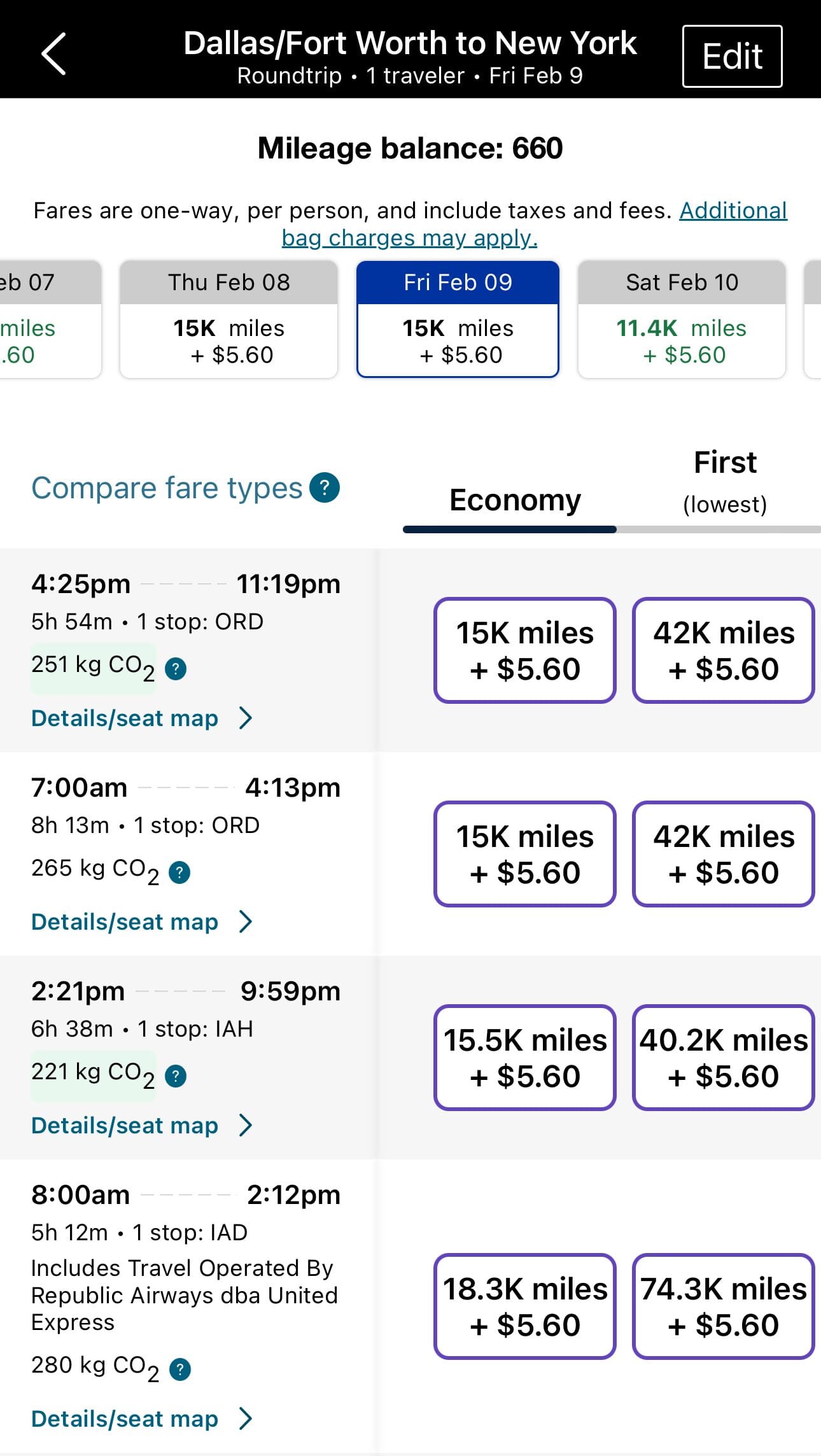

One of the best ways to redeem MileagePlus miles is by purchasing award tickets. You need to search for your flight origin, destination and flight dates and select “Book with Miles”.

You can find award flights in each fare class, but pay close attention to Saver and Everyday Awards. These are discounted tickets that allow you to maximize the value of your miles.

United uses dynamic pricing, so it makes it quite simple to find some great bargains, particularly if you are not bothered about flying during non peak periods. You can also view a 30 day calendar if your schedule is flexible, as you can see if there are particular days when flights are cheaper.

2. Book Partner Flights

United is a Star Alliance member, which is an airline network with 26 partners and it also has partnership deals with a further 14 airlines. This provides a fantastic selection of opportunities for partner flights. What’s really great is that United makes it simple to access its partner network to book partner flights via its website.

You don’t need to transfer your miles to a partner airline to book a flight, you can simply search for all award flights on the United booking tool. When you find an award flight with a partner airline, the booking process is exactly the same as it would be to book a United reward flight.

If you’re unsure which airline you want to use, United has an interactive award chart that shows any price differences. You just enter the region you’re flying from and to, and you can view the prices of award flights. This means that you can compare the United route to check which is the best deal.

3. Flight Upgrades

You can also use your miles for flight upgrades. You can enjoy upgrades on both United and Star Alliance partner airlines. Generally, the more expensive your paid fare class, the cheaper your upgrade cost.

But, the United website does allow you to check upgrade costs on specific flights, playing around with origin and destination regions to see which offers the best deal.

For Star Alliance upgrades, there are some restrictions and limitations for which fare classes can be upgraded. If you are flying on a Star Alliance partner airline, it is best to check the United website for its full list of partner airlines and their upgrade potential.

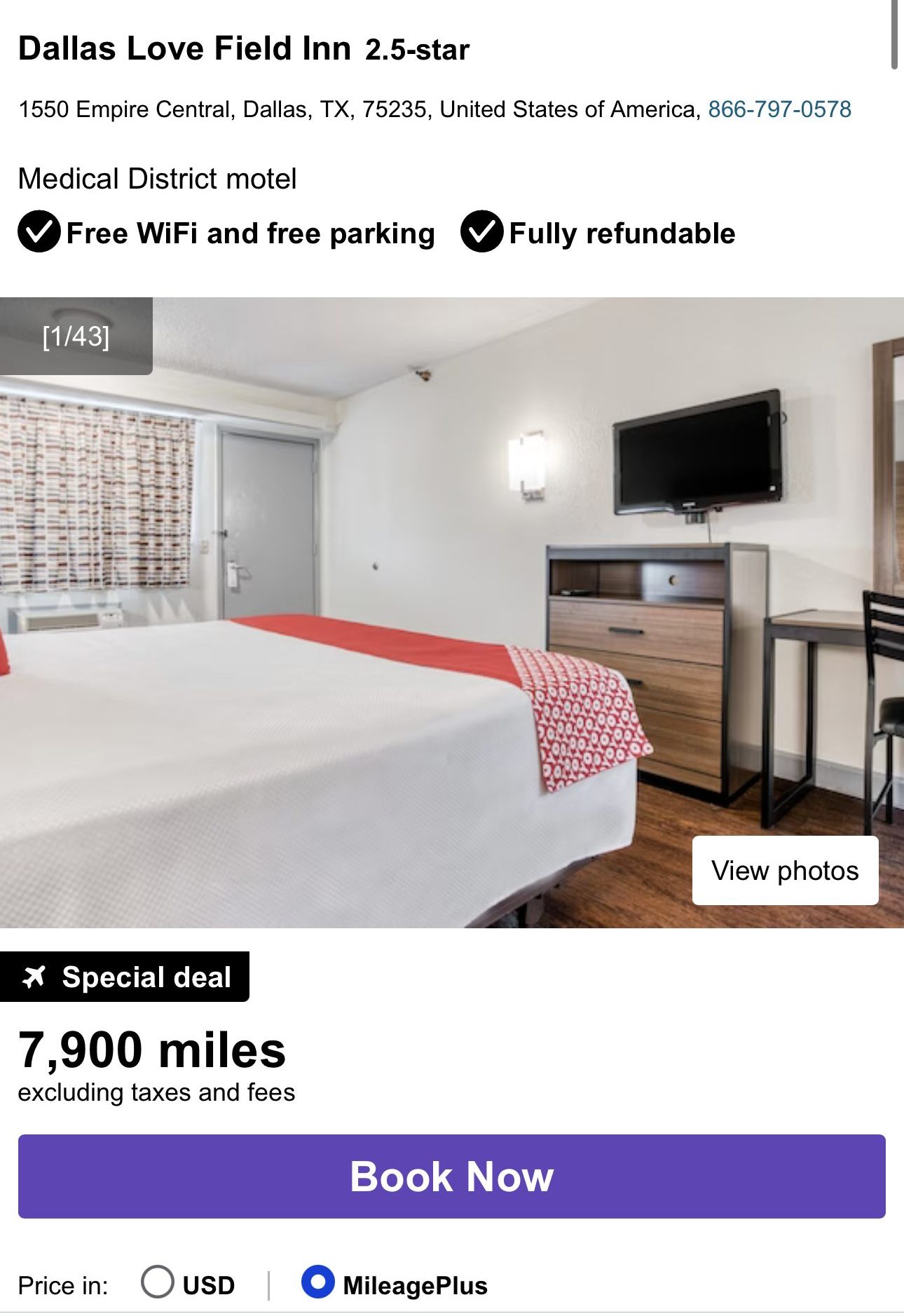

4. Hotels, Vacations and Cars

If you want to earn miles without flying, there are great ways to do it. For example, you can also use your MileagePlus miles for hotels, vacations, and car rentals. You can use the United portal to search for these offers. This allows you to pay for an entire vacation just using your rewards.

Just be aware that you won’t get the best redemption value for your miles with these types of rewards, which we’ll go into in more detail later.

5. Other Redemption Methods

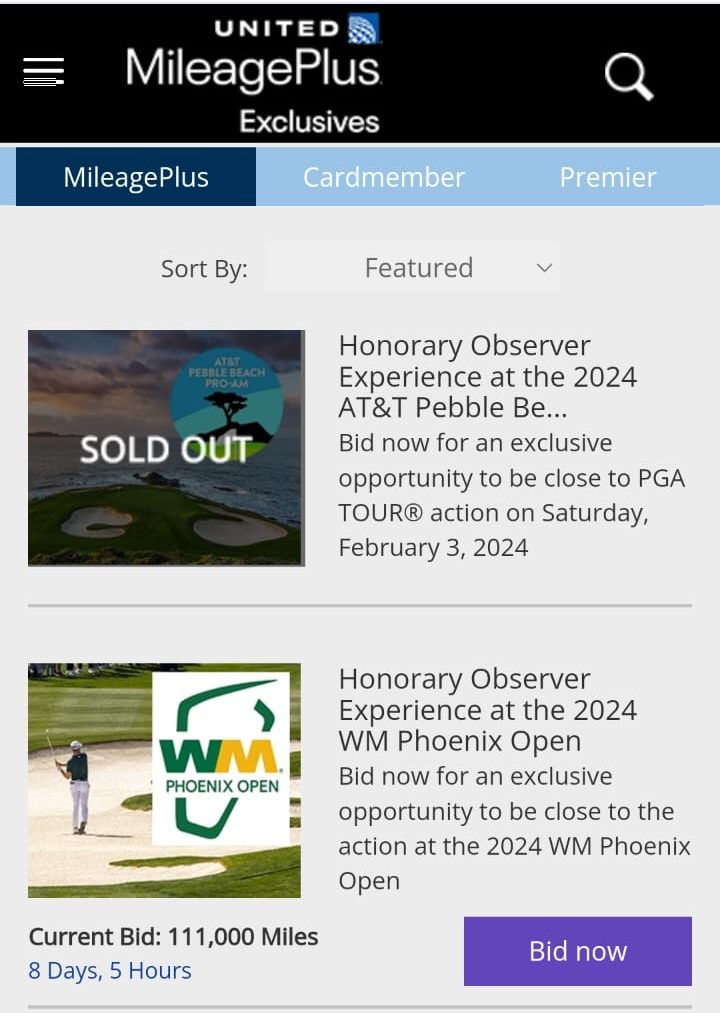

Although flights typically offer the best redemption value, if you can’t find a reward to suit your requirements, there are other redemption methods you may want to consider. These include:

- In Flight WiFi: If you regularly fly, using your miles for an in flight WiFi subscription may be a good idea. You can purchase a subscription, which has a cash value of $49 for 7,500 miles.

- United Club: The United Club global network has over 45 locations, so you can enjoy lounge access in most areas of the world. The current cost of an annual subscription is $650, but you can purchase one for 85,000 miles.

- TSA PreCheck: If you don’t get TSA PreCheck with your credit card, you could use your United miles to cover the cost. You will need 11,000 miles to pay for the $85 application fee.

- Airport Dining: In select locations, you can use MileagePlus miles to pay for your dining bill. You just need to scan your boarding pass and then select miles at check out when you pay your bill.

- Gift Cards: There is a selection of gift cards that you can purchase with your miles, just be aware that this type of redemption represents fairly low value. However, if you’re struggling to use your miles, it could be an option.

- Newspaper and Magazine Subscriptions: On the MileagePlus redemption website, there is selection of newspaper and magazine subscriptions. These typically have an above average redemption value, but you can also get some superb deals.

- Charity Donations: The United donations page has a list of charity campaigns. You can browse the page to find a cause you’d like to support with your miles.

- Statement Credit: If you have a United co-branded credit card, you can redeem your miles for statement credit. This can be used to offset the cost of purchasing United tickets.

How Much Are United Miles Worth?

The redemption value of United miles depends on how you use them. While the miles have a value of 1.2 cents each on average, some redemption methods offer far greater value than others. For example:

- Flights: You can get a value of 1.2 cents to 3 cents or more each, depending on your flight itinerary. You will need to calculate the value of your miles by dividing the cash value of the ticket by the number of miles needed.

- Hotels, Vacations and rental cars: Again, you’ll need to compare cash and miles cost to calculate the specific value, but you can expect approximately 0.6 cents per mile.

- United Club: A subscription works out to a value of 0.8 cents per mile.

- In flight WiFi: This works out at 0.7 cents per mile

- TSA PreCheck: With a cost of $85, using your miles for TSA PreCheck will work out at approximately 0.8 cents per mile.

- Gift Cards: Generally, using your miles for gift cards will work out at 0.3 cents per mile.

- Newspapers and Magazine Subscriptions: Although there are some better deals, the typical redemption value is 2.5 cents per mile.

How Can You Join the United Airlines MileagePlus Program?

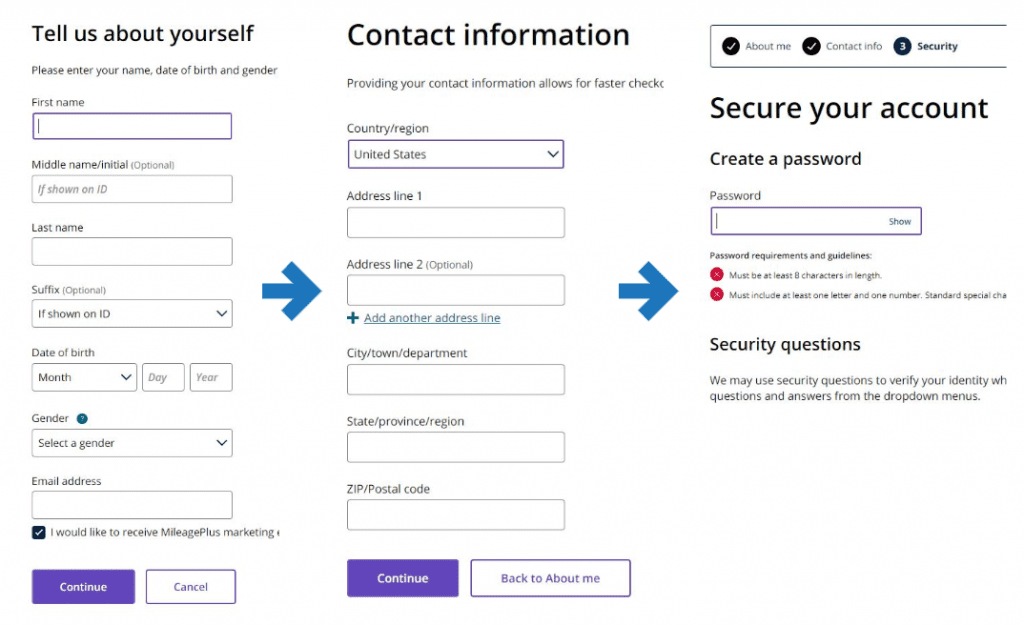

You can enroll in the MileagePlus program on the United website. The process is quite straightforward, as with any log in screen, you’ll see an option at the bottom to join the program. The process of joining requires just three steps:

- Provide Your Personal Details: You’ll need to provide your full name, date of birth and email. At this stage, you’ll also have the option to opt out of receiving marketing emails.

- Provide Your Contact Details: On the next page, you’ll need to provide your full postal address including zip code.

- Secure Your Account: The final stage of enrollment is to secure your account. You’ll need to provide a password and then set up five security questions and answers.

Before you can submit your application, you’ll need to agree to the terms and conditions. Then your application will be processed and United will email you with your MileagePlus details.

MileagePlus Program Limitations and Restrictions

The program has some limitations, but you can find the full terms and conditions on the United website.

Keep in mind that while reward flights can save you a lot of money, you’ll still need to pay taxes and surcharges. So, while your flight won't be completely free, it will be much more affordable than paying the full cash price.

How to Earn United MileagePlus Points

You can earn MileagePlus points or miles in a number of ways, so you can tailor the program to suit your preferences and typical habits.

1. Flights

You’ll earn miles whenever you fly with United or any of its partner airlines. The number of miles you earn will depend on your ticket price and your status level in the program.

Once you move beyond the basic membership level, you’ll start earning a bonus on your miles, which can help you reach the next tier more quickly.

Status | Miles | Bonus |

|---|---|---|

Basic (MileagePlus member) | 5 per $1 | none |

Premier Silver | 7 per $1 | 40% |

Premier Gold | 8 per $1 | 60% |

Premier Platinum | 9 per $1 | 80% |

Premier 1K | 11 per $1 | 120% |

Just bear in mind that you will only earn miles on your airfare and airline fees. Government imposed fees and taxes will not earn miles.

2. Partnership Purchases

You can also earn MileagePlus miles via United’s partners. This includes:

- Hotels: You’ll earn additional miles at most of the major hotel chains. This is typically one or two miles per dollar, but some hotels have a flat number of miles for each stay. You can find specific details on partner hotels on the United website.

- Dining: If you register a card with MileagePlus Dining, each time you use that card at participating bars, clubs or restaurants, you can earn up to five miles per dollar. There are over 11,000 participating MileagePlus Dining locations.

- Transportation: You can also earn miles via Hertz owned rental agencies, Amtrak rail service and other car service partners.

- Shopping: If you shop online using the MileagePlus Shopping Mall, you can access over 850 retailers and earn miles for each dollar that you spend.

- Financial Partners: United also has a number of lending and insurance partners, which allow you to earn additional miles.

3. Credit Cards

United has a number of co-branded credit cards which can help give your MileagePlus balance a significant boost. These include:

Card | Rewards | Annual Fee |

| United Club℠ Infinite Card | Up to 4x miles

4x miles on United Airlines purchases, 2x miles on all other travel purchases, dining and eligible delivery services and 1x miles on all other purchases

| $525 |

|---|---|---|---|

| United Quest℠ Card | Up to 3x miles

3 miles per $1 spent on United purchases immediately after earning your $125 annual United purchase credit, 2 miles on all other travel and select streaming services, 1 mile on all other purchases

| $250 |

| United Gateway℠ Card | 1X – 2X

2X per $1 spent on United® purchases, at gas stations and on local transit and commuting and 1X on all other purchases

| $0 |

| United℠ Business Card | 1X – 2X

2X per $1 spent on United® purchases, dining (including eligible delivery services), at gas stations, office supply stores, and on local transit and commuting and 1X on all other purchases

| $99 |

| United Explorer Card | 1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

| $95 ($0 first year) |

- United Explorer Card

This card has no annual fee for the first year, and it is a reasonable $95 for subsequent years. The card is a solid option for regular travelers as you’ll earn two miles per dollar on United purchases, hotel stays and dining.

There are also some nice travel perks including free checked bags, priority boarding and TSA Precheck or Global Entry reimbursement. You’ll also get a generous welcome bonus if you meet the reasonable spend requirement.

- United Quest℠ Card

This card also has a tiered reward structure weighted towards United purchases, dining and select streaming services.

The card does have a higher annual fee, but you’ll get anniversary awards and an impressive miles bonus with a reasonable spend in the first three months.

- United Club℠ Infinite Card

This is a premium United card with a premium annual fee. However, it is feature packed.

You’ll not only get free checked bags and TSA PreCheck or Global Entry reimbursement, but the tiered reward structure is most generous and there is a massive introductory miles bonus.

- United Gateway℠ Card

This is a more modest card that has a tiered reward structure weighted towards United purchases, local transit and gas stations, with a base reward level for all other purchases.

The card may lack the perks of some of the other United cards, but it has no annual fee and a nice introductory miles bonus.

- United℠ Business Card

If you’re a business owner, you don’t need to miss out with this card. The card has a reasonable annual fee, which is waived for the first year.

There is a tiered reward structure weighted towards United, gas station, dining and office supply purchases with a base rate for all other purchases. You can also get employee cards at no additional cost.

The perks include free checked bags, travel credit each anniversary, two United Club one time passes per year and priority boarding. There is also a generous miles bonus if you meet the spending requirement in the first three months.

United Airlines MileagePlus Elite Status

In addition to earning rewards, you can also qualify for elite status with the MileagePlus program. There are four tiers of United elite status within the program and you can qualify for these by earning points and flying with United or its partner airlines

Each tier provides different perks including:

Premier Silver

This level adds:

- Priority check in, screening and boarding

- Additional free checked bags

- Choose preferred seats when booking for free

- Complimentary economy plus seating access

- Increased economy award availability

- Day of departure upgrades confirmed

- Reduced fees for award changes or adjustments

- Hertz Gold Plus Status

- Discounted CLEAR membership

- Complimentary Avis Preferred Plus Status

Premier Gold

In addition to the benefits of the two previous tiers, Premier Gold provides:

- Group One priority boarding

- Two checked bags in economy for free

- Further reduced cancelation or change fees

- Complimentary Economy Plus or preferential seating at booking

- Complimentary upgrades up to 48 hours before you depart

- Complimentary Marriott Bonvoy Gold Status.

Premier Platinum

The Premier Platinum adds:

- More free checked bags in economy

- Discount on United Club annual membership

- 40 PlusPoints

- Complimentary Avis President’s Club Status

- Complimentary Economy plus

- Waived phone booking service fees

- Better award availability for premium cabins

Premier 1K

This is the top tier and in addition to the benefits of the lower tiers, you’ll get:

- Waived CLEAR membership fee

- Pre board priority boarding

- Discount on United Club membership

- 280 PlusPoints

- No fee for changing or canceling award flights

- Free Timeshifter annual subscription

- One free drink and one free drink in economy

Buying, Giving or Transferring United Airlines MileagePlus Points

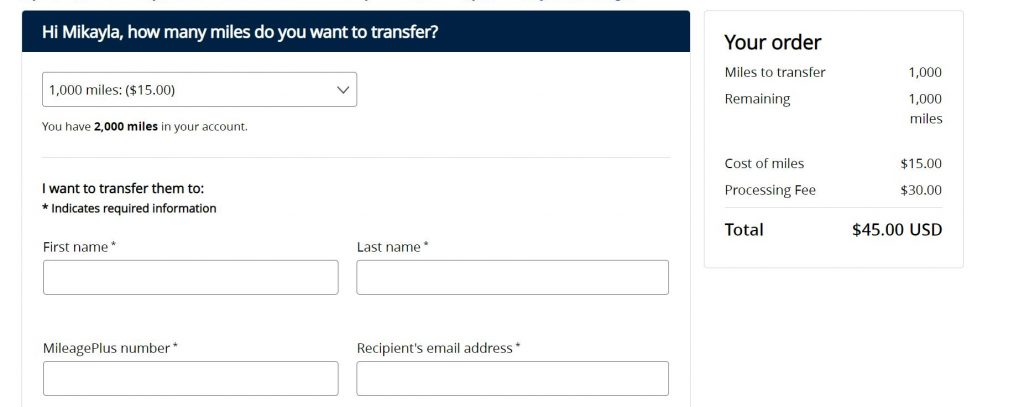

One of the most attractive aspects of MileagePlus is that you can buy, give or transfer your miles. You can buy miles via the official United website.

There are special offers periodically that offer better value, but generally, you’ll pay more than the average redemption value of miles. However, if you need an extra thousand miles to get a valuable award, this is a great option.

United also allows you to share miles with other program members. There is a transfer fee of $7.50 per 500 miles and a processing fee per transaction. However, periodically, United has promotional offers which waive the processing fee and offer discounts.

Which Credit Card Programs Allow Transferring Points to United?

There are a number of credit card programs that allow you to transfer points to the United MileagePlus program. These include:

- Amex Membership Club: Since American Express has no direct partnership with United, transferring Amex Membership Club points to MileagePlus miles is a little tricky.

Essentially, you’ll need to transfer your points to a Star Alliance partner program that is also a partner of United. Once the transfer is completed, you can log into the Star Alliance airline and either book travel or transfer the points again to MileagePlus.

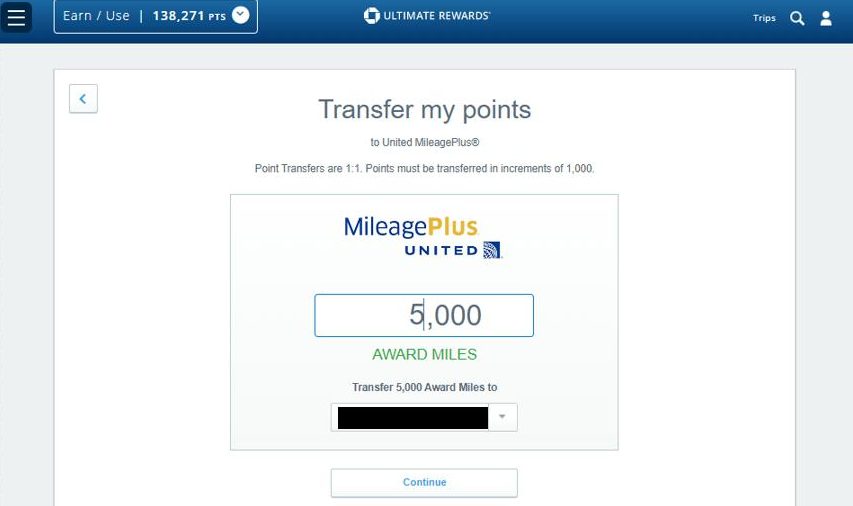

- Chase Ultimate Rewards: If you have a credit card that earns Chase Ultimate Rewards, you can transfer them to the United program at a 1:1 ratio. This means that if you have 20,000 Ultimate Rewards points, you can transfer them and receive 20,000 United MileagePlus miles.

- Citi ThankYou: Like American Express, there is no direct way to transfer Citi ThankYou points to MileagePlus miles, so you’ll need to transfer to a Star Alliance partner and then transfer on to United.

- Capital One Travel: Again, there is no direct way to transfer Capital One Travel miles to United. You’ll need to go via a Star Alliance partner. You can then book travel or complete a second transfer to the United program.

Review Airline Credit Cards

Delta SkyMiles Blue American Express