Advantage Gold

Storage Fees

Min. Investment

Our Rating

Established

- Overview

- Pros & Cons

- FAQ

Advantage Gold is a Los Angeles-based company specializing in gold IRAs, helping customers roll over existing retirement accounts into precious metals.

Founded in 2014 by industry veterans, the company has quickly earned a strong reputation for its excellent customer service and educational approach.

For those new to investing in precious metals, Advantage Gold makes the process simple. You can open a self-directed gold IRA online, choosing between two custodians—STRATA Trust and Equity Institutional.

The company offers a wide range of IRS-approved gold, silver, platinum, and palladium coins, ensuring compliance with tax-advantaged retirement accounts.

However, pricing isn't clearly listed on their website, so customers need to speak with a representative to get details on fees and markups.

- Strong Customer Service & Reputation

- Extensive Educational Resources

- Wide Selection of IRS-Approved Metals

- Buyback Program

- Seamless IRA Rollover Process

- No Live Chat or Mobile App

- Shipping & Insurance Fees Apply

Can I transfer an existing gold IRA to Advantage Gold?

Yes, you can transfer an existing self-directed gold IRA to Advantage Gold, and their specialists will guide you through the process.

Are my precious metals insured while in storage?

Yes, all metals stored in Delaware Depository or Brink’s Global Services are fully insured, protecting against theft or loss.

What happens if Advantage Gold goes out of business?

Your IRA and metals are held by a third-party custodian and depository, meaning your investments remain safe even if Advantage Gold ceases operations.

Does Advantage Gold offer numismatic or collectible coins?

No, Advantage Gold focuses on IRA-approved bullion and coins, as collectible coins do not meet IRS standards for tax-advantaged retirement accounts.

Products | Services | ||

|---|---|---|---|

Gold IRA Accounts | Transparent Pricing | ||

Silver IRA Accounts | Storage Options | ||

Direct Purchase | Free Shipping | ||

Buy Metals Online | International Shipping | ||

Physical Delivery | Mobile App | ||

Price Match Guarantee | Cryptocurrency Payment | ||

Buyback Guarantee | Live Chat |

Advantage Gold Reputation: User Feedback & Ratings

Advantage Gold boasts excellent customer ratings across platforms like Trustpilot, Google Reviews, and BBB and has been recognized as one of the top-rated gold and silver dealers for several years.

Platform | Rating |

|---|---|

Trustpilot

| 4.9 (1,758 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 2014 |

Consumer Affairs | 5.0 (448 reviews) |

Google Reviews | 5.0 (914 reviews) |

Customers frequently praise Advantage Gold for its exceptional customer service, highlighting the knowledgeable and friendly staff who simplify complex investment processes.

Gold IRA Services: Secure Your Retirement with Gold

Advantage Gold specializes in Gold IRAs, helping investors roll over their existing retirement accounts into precious metals.

Their process is designed to be simple and educational, making it accessible to both beginners and experienced investors.

Key Offerings:

- Gold & Silver IRAs: Investors can open a self-directed IRA to hold IRS-approved gold, silver, platinum, and palladium.

- Rollover Assistance: Customers can roll over funds from eligible retirement accounts like 401(k), traditional IRA, Roth IRA, and others.

- Wide Selection of IRS-Approved Metals: Advantage Gold offers a variety of coins from the U.S. Mint and other international mints, ensuring compliance with IRS regulations.

- Storage Options: The company partners with Delaware Depository and Brink’s Global Services to store metals securely in IRS-approved vaults.

- Buyback Program: While not guaranteed, Advantage Gold offers to buy back metals at fair market prices.

Advantage Gold Storage: Safe, Insured, and IRS-Approved

When investing in precious metals through a Gold IRA, secure storage is essential.

The IRS requires that all IRA-held metals be stored in approved depositories, ensuring compliance and protection.

Advantage Gold partners with two leading storage providers to offer clients safe and fully insured vault storage.

- Delaware Depository: a high-security facility with 24/7 surveillance and comprehensive insurance coverage against theft, damage, or loss. It offers segregated storage, ensuring that each client’s metals are stored separately, with transparent audits and competitive storage rates.

- Brink’s Global Services: a world-renowned security provider specializing in precious metals storage and logistics for global investors. It operates multiple secure storage locations across the U.S., offering IRS-approved, fully insured vaults for maximum protection and flexibility.

These partnerships provide secure, fully insured storage solutions, giving investors confidence that their precious metals are protected and professionally managed.

How Much Does a Gold IRA Cost? Breakdown & Fees

In addition to these standard fees, investors should be aware of potential additional costs such as transaction fees when buying or selling metals, wire transfer fees, and possible insurance charges.

Here's a summary of the associated fees:

Fee | Cost |

|---|---|

Account Setup Fee | $50 |

Annual Maintenance Fee | $125 |

Storage Fee | $175 |

Note: These fees are based on available information and may vary. It's advisable to contact directly for the most current details.

Buyback Program

One of Advantage Gold’s standout features is its buyback program, which allows investors to sell their precious metals back to the company.

While not a guaranteed service, Advantage Gold states its intent to repurchase metals at fair market value. This provides liquidity for investors who may need to access funds or adjust their portfolios.

When selling back metals, clients can expect at least the current spot price, though Advantage Gold may pay more depending on wholesale market conditions.

Additionally, the buyback process is straightforward and hassle-free, with Advantage Gold handling the logistics of securely receiving the metals and processing the payment.

Educational Resources & One-on-One Consultation

Advantage Gold stands out for its strong commitment to investor education, making it a great choice for beginners in the precious metals market.

The company offers a comprehensive Learning Center on its website, featuring free guides, videos, and infographics that break down the complexities of investing in gold IRAs.

Customers can also schedule one-on-one consultations with investment specialists who explain the benefits and risks of gold IRAs, how to diversify a portfolio, and what to expect from market trends.

Additionally, Advantage Gold provides interactive charts that compare gold’s performance with other asset classes like stocks and oil.

User-Friendly or Complicated? Website Review

Advantage Gold's website is designed with user-friendliness in mind, offering a clean layout that's easy to navigate.

The site is rich in educational content, featuring resources such as retirement protection guides, tools, and informative videos.

Additionally, the website showcases client testimonials, reflecting the company's emphasis on customer satisfaction.

However, specific details like pricing information, are not readily available on the site. This omission may require potential clients to contact the company directly for comprehensive information.

Advantage Gold Support: Fast, Reliable, and Helpful

Advantage Gold customer service is very good. Their dedication to client satisfaction is evident through its high ratings and customer satisfaction across reviews platforms.

Clients can call for immediate assistance or use the online contact form for inquiries.

Contact Option | Details |

|---|---|

Phone Support | (888) 501-9001 |

Email Support | N/A – only contact form |

Advantage Gold maintains an active presence on major social media platforms, offering additional channels for engagement and updates.

Advantage Gold’s Strengths & Weaknesses

Below is a breakdown of the key benefits and considerations when choosing Advantage Gold for your Gold IRA or physical precious metals investment.

- Strong Customer Service & Reputation

Advantage Gold receives high ratings for customer service, with knowledgeable representatives providing one-on-one guidance throughout the investment process.

- Extensive Educational Resources

The company offers free gold IRA guides, investment videos, interactive charts, and a Learning Center, making it a great choice for beginners looking to understand precious metals investing.

- Wide Selection of IRS-Approved Metals

Investors can choose from a variety of gold, silver, platinum, and palladium coins, all meeting the purity requirements for IRA eligibility.

- Buyback Program

Advantage Gold allows customers to sell their metals back to the company at fair market value, adding flexibility for those who may need liquidity in the future.

- Seamless IRA Rollover Process

Investors can easily roll over funds from existing retirement accounts like 401(k)s and traditional IRAs, with step-by-step guidance from Advantage Gold specialists.

- No Live Chat or Mobile App

Customer support is only available via phone and email, and there is no mobile app for managing investments or checking account details.

- Shipping & Insurance Fees Apply

Customers are responsible for shipping and insurance costs, which can add extra expenses when purchasing or transferring metals.

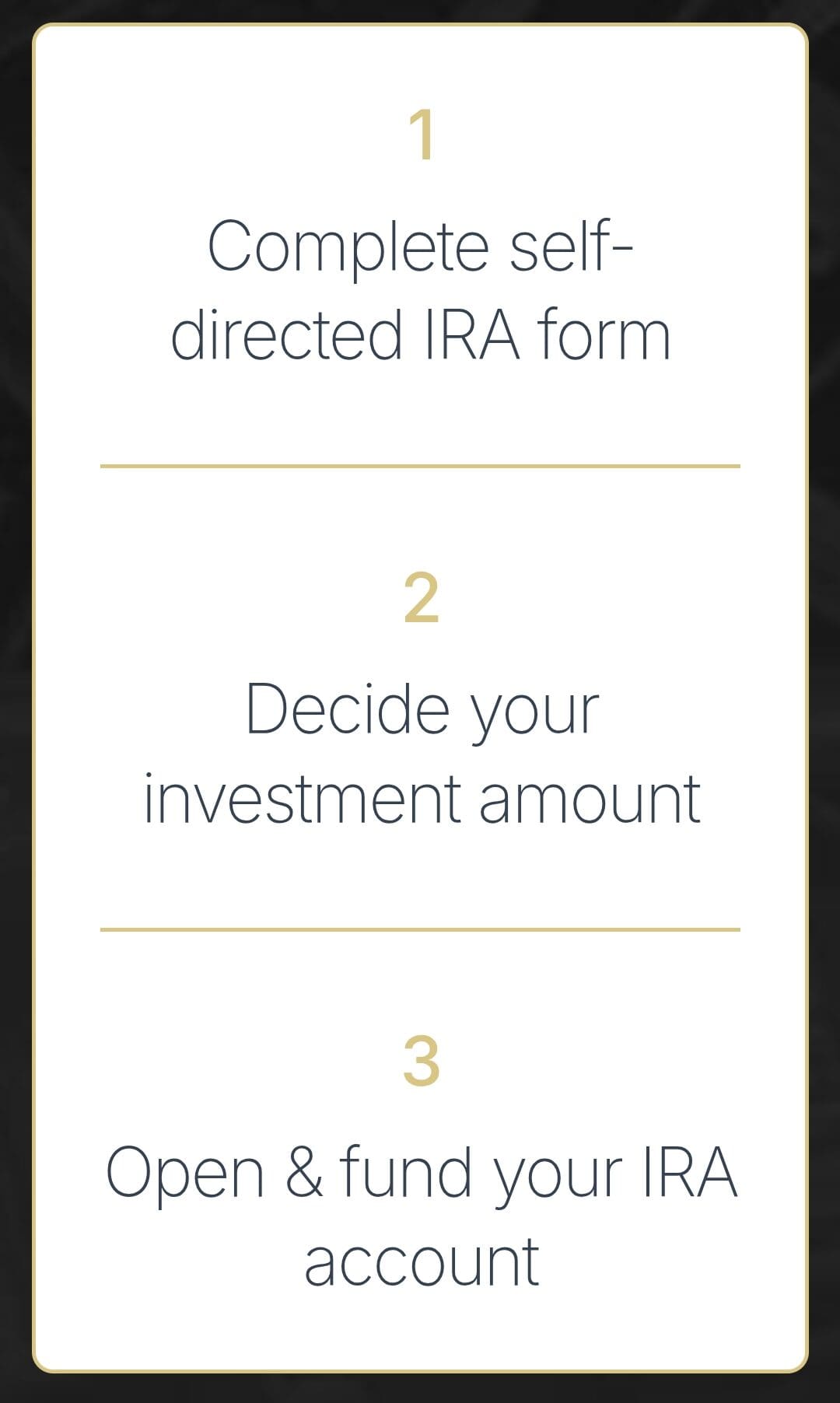

How to Invest with Advantage Gold?

Advantage Gold offers a structured approach for those looking to establish a Gold IRA:

-

Step 1: Open a Self-Directed IRA

To start investing with Advantage Gold, you first need to open a self-directed gold IRA. You can do this by visiting the company’s website and selecting the “Open a Gold IRA” option.

As part of the setup, you will choose between two IRA custodians—STRATA Trust or Equity Institutional—both IRS-approved for holding precious metals in retirement accounts.

Once you’ve made your selection, you’ll complete the online Self-Directed IRA Application, which requires personal details and financial information.

After submission, you may need to provide additional documents for verification before your account is officially opened.

-

Step 2: Fund Your Account

After setting up your IRA, you’ll need to fund the account before purchasing precious metals.

Advantage Gold allows rollovers from eligible retirement accounts, including 401(k)s, traditional IRAs, Roth IRAs, SEP IRAs, and others.

A specialist from the company will guide you through the process to ensure compliance with IRS regulations and help you complete the necessary paperwork.

Once the funds are successfully transferred to your Advantage Gold IRA, you can proceed with selecting your investments.

-

Step 3: Select Precious Metals

With your funds available, it’s time to choose the gold, silver, platinum, or palladium coins you want to hold in your IRA.

Advantage Gold offers a range of IRS-approved coins and bullion, ensuring compliance with retirement investment rules.

Their team of specialists will help you decide the best mix of metals based on your financial goals, risk tolerance, and market trends.

Once you finalize your selection, the company will lock in your purchase price and confirm your investment details.

-

Step 4: Secure Storage & Monitoring

Once your precious metals are purchased, they must be stored in an IRS-approved depository, as regulations do not allow personal possession of metals in a gold IRA.

Advantage Gold partners with Delaware Depository and Brink’s Global Services, both of which offer high-security, insured vault storage for your investments.

After your metals are securely stored, you will receive documentation confirming their location, and you can track their value using Advantage Gold’s online tools.

Your investment remains safely stored until you decide to sell, withdraw, or take distributions from your IRA.

FAQ

Yes, the minimum investment to open an Advantage Gold IRA is $5,000, ensuring clients can properly diversify their portfolios.

Some depositories allow in-person visits by appointment, but policies vary—contact your chosen storage facility for specific details.

The rollover process typically takes 2-4 weeks, depending on how quickly your current retirement account provider processes the transfer.

No, IRS regulations require gold IRA assets to be stored in an approved depository, meaning home storage is not allowed for tax-advantaged accounts.

Review Gold Dealers For Direct Purchase & Gold IRA

How We Rated Gold & Silver Dealers: Review Methodology

At The Smart Investor, we evaluated gold brokers & dealers based on their overall value, pricing transparency, and investment options compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to precious metals investors, including fees, security, product selection, and IRA investment options. Each broker was rated based on the following criteria:

- Pricing & Fees (15%): We prioritized brokers with transparent pricing, low markups on gold and silver, and fair premiums. Some platforms had hidden costs, including storage and liquidation fees.

- User Experience & Buying Process (20%): A smooth, intuitive, and secure buying process scored highest. Some brokers had complex procedures, slow transactions, or unclear order processing.

- Reputation & Ratings (10%): We factored in customer reviews, industry ratings, and regulatory compliance. Highly rated brokers had strong reputations for reliability, trustworthiness, and investor protection. Some had mixed reviews or unresolved complaints.

- Customer Support & Service (15%): We tested response times, availability, and helpfulness of support via phone, chat, and email. The best brokers provided knowledgeable assistance with fast, professional service, while others were slow or unresponsive

- Security & Storage Options (10%): We favored brokers offering secure vault storage, insured holdings, and direct delivery options. Some lacked proper security measures, increasing investment risks.

- IRA & Retirement Investment Options (20%): The best brokers offered Gold & Silver IRA accounts with IRS-approved metals, simple setup, and rollover assistance. Some lacked IRA services or charged high fees.

- Precious Metals Selection (10%): We rated brokers higher if they offered a wide range of gold and silver products, including bullion, coins, and bars. Some had limited selections, restricting investment choices.