Money Metals Exchange

Storage Fees

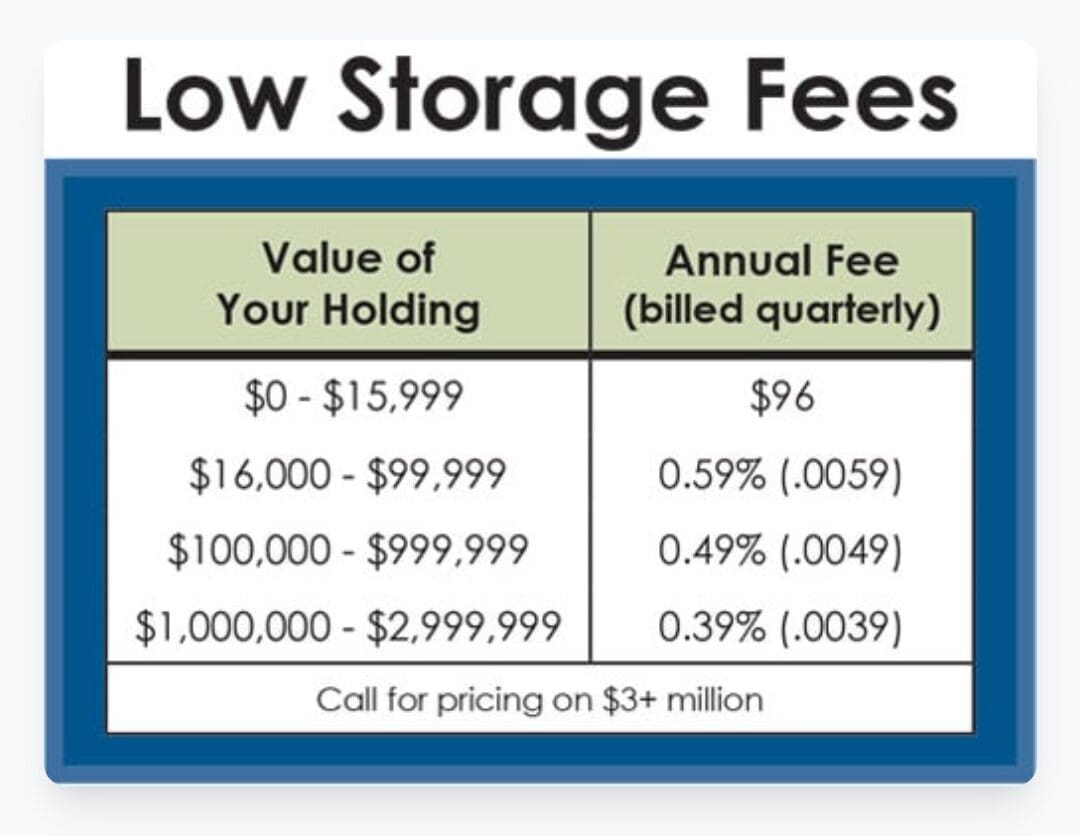

0.59% for assets between $16,000 and $99,000

0.49% for assets between $100,000 and $999,999

0.39% for assets over $1 million

Min. Investment

Our Rating

Established

- Overview

- Pros & Cons

- FAQ

Founded in 2010 by Stefan Gleason, Money Metals Exchange is a leading precious metals dealer in the U.S., offering a wide range of products and services for investors looking to buy, sell, or store precious metals.

For those looking to buy metals, Money Metals offers an easy-to-use online platform where customers can browse a variety of coins, bars, and rounds.

For those interested in secure storage, Money Metals Depository offers insured vault storage with segregated accounts to keep your holdings safe.

Additionally, Money Metals allows investors to set up a Precious Metals IRA, helping them diversify retirement portfolios with physical gold and silver.

- Wide Selection of Precious Metals

- Transparent Pricing & Live Updates

- Buyback Program

- Monthly Savings Plan

- IRA & Storage Options

- Limited IRA Custodian Options

- No International Shipping

- No Live Chat Support

- Mixed Customer Service Reviews

What are the minimum order amounts?

The minimum purchase amount depends on the product, but some options start as low as $100.

Can I visit a physical store to buy metals from Money Metals Exchange?

No, Money Metals Exchange operates entirely online and does not have a physical retail location for in-person purchases.

Does Money Metals Exchange offer discounts for bulk purchases?

Yes, the company provides discounted pricing for bulk orders, which means the more you buy, the lower the per-unit cost.

What happens if my shipment gets lost or stolen?

All shipments are fully insured, so if a package is lost or stolen in transit, Money Metals Exchange will work with the carrier to resolve the issue and potentially replace or refund the order.

Products | Services | ||

|---|---|---|---|

Gold IRA Accounts | Transparent Pricing | ||

Silver IRA Accounts | Storage Options | ||

Direct Purchase | Free Shipping | ||

Buy Metals Online | International Shipping | ||

Physical Delivery | Mobile App | ||

Price Match Guarantee | Cryptocurrency Payment | ||

Buyback Guarantee | Live Chat |

Reputation & Ratings Data

Overall, Money Metals Exchange ratings are higher than average but not among the top-tier, most reputable gold brokers.

Platform | Rating |

|---|---|

Trustpilot

| 3.3 (125 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 2011 | 4.4 (143 reviews) |

Consumer Affairs | 4.7 (168 reviews) |

Positive reviews frequently highlight Money Metals Exchange's professionalism, efficient service, and transparent pricing.

Negative feedback typically involves concerns about occasional shipping delays or issues with order processing.

Money Metals Exchange Gold IRA Services

Money Metals Exchange offers a Precious Metals IRA service, allowing investors to add physical gold and silver to their retirement portfolios.

This can be a great way to hedge against inflation and diversify investments. Here’s what they offer:

- Gold & Silver IRA Setup: Money Metals Exchange helps customers set up a self-directed IRA through a partnered custodian (such as New Direction Trust Company). Investors can also work with their preferred IRA custodian.

- Wide Range of IRA-Eligible Metals: The company offers IRS-approved gold, silver, platinum, and palladium coins and bars, including American Eagles, Canadian Maple Leafs, and gold bars of various weights.

- Storage Options: Investors can store their IRA metals at Money Metals Depository, an IRS-approved facility with segregated vault storage and insurance through Lloyd’s of London.

- Rollover & Transfer Assistance: Customers can transfer an existing 401(k) or IRA into a Gold IRA with guidance from Money Metals’ support team.

Physical Product Selection

Money Metals Exchange has a huge selection of physical precious metals for investors and collectors. Here’s a breakdown of what you can find:

Gold Products – They offer gold coins, bars, and rounds from well-known mints like the U.S. Mint and Royal Canadian Mint. Options include American Eagles, Canadian Maple Leafs, and smaller gold bars.

Silver Products – A popular choice for many investors, silver options include coins, rounds, bars, and even unique pieces like silver bullets and building blocks.

Platinum & Palladium – If you’re looking for portfolio diversification, they carry platinum and palladium coins and bars.

Rhodium Bars – A rare offering compared to other dealers, Money Metals sells rhodium bars for investors looking at more niche metals.

Gold and silver both offer strong investment potential, but gold is often seen as a long-term store of value, while silver provides more affordability and industrial demand.

Money Metals offers a wide selection of both.

Storage & Security Options

When it comes to storing your precious metals, Money Metals Exchange offers two main options of secure and insured options to meet your needs:

- Money Metals Depository: Located in Idaho, this state-of-the-art facility provides fully segregated storage, ensuring your assets are kept separate from others. The depository is fully insured, giving you peace of mind.

- VaultSecure Program: This cost-effective storage solution addresses the issue of higher premiums during periods of high demand.

Assets are stored separately, ensuring your metals are not commingled with others. Also, your stored metals are fully insured, providing an extra layer of protection.

Fees & Pricing

Here's a summary of the fees associated with Money Metals Exchange:

Fee | Cost |

|---|---|

Storage Fee | Annual fees based on asset value

$96 for assets up to $15,999 0.59% for assets between $16,000 and $99,000 0.49% for assets between $100,000 and $999,999 0.39% for assets over $1 million |

Shipping Fee | $7.95 (Free for orders $199+) |

Other Fees | 4% fee for PayPal & credit card, 2% fee for crypto payments. |

IRA Setup/Maintenance Fee | N/A |

Transparent and reasonable fees help identify legitimate brokers, as scams often hide excessive charges, inflate costs, or impose undisclosed fees to exploit investors.

Diverse Payment Options

Money Metals Exchange makes purchasing precious metals convenient and flexible by offering a variety of payment methods to suit different customer needs.

- Bank Transfers & ACH Debits – Customers can link their bank accounts and make direct payments using ACH transfers, which typically have lower fees than other payment methods.

- Money Orders & Paper Checks – For those who prefer traditional payment options, Money Metals accepts money orders and paper checks, ensuring accessibility for customers who don’t want to use online banking.

- Cryptocurrency Payments – Investors who prefer digital currency can use Bitcoin and other cryptocurrencies, though a 2% processing fee may apply.

- Credit Card & PayPal Payments – Convenient but subject to a 4% additional fee to cover transaction costs.

Monthly Savings Plan

Money Metals Exchange’s monthly savings plan is a great option for investors looking to build their holdings over time without making large one-time purchases.

- Flexible Investment Options – Customers can select specific metals (gold, silver, platinum, palladium) and set a custom monthly investment amount.

- Automatic & Hassle-Free Payments – Payments can be made automatically via ACH bank transfers, or customers can choose to send checks or money orders manually.

- Steady Accumulation Strategy – This plan allows investors to gradually grow their portfolio, reducing the risks of market timing and taking advantage of dollar-cost averaging.

- Discounted Pricing & Secure Storage – Participants may receive better pricing on bulk purchases, and they have the option to store metals securely in Money Metals Depository.

For those confident in gold’s long-term growth, this option may be worth considering.

Money Metals Exchange Website Experience

Money Metals Exchange offers a user-friendly website designed to make your precious metals investment journey straightforward.

The site features intuitive navigation, allowing you to easily explore various products and services.

Real-time pricing updates ensure you're always informed about the latest market rates.

Additionally, the platform provides educational resources, including articles and guides, to help both new and seasoned investors make informed decisions.

The streamlined purchasing process enables you to add items to your cart and complete transactions with ease.

Buyback Program

Money Metals Exchange offers a structured buyback program for customers who want to sell their precious metals.

Here’s how the process works:

Request a Quote: Contact Money Metals Exchange at 800-800-1865 during business hours to receive a repurchase price quote.

Lock in Your Price: If the quoted price is acceptable, you can lock in the pricing to secure the value of your sale.

Receive Purchase Order & Shipping Instructions: Once confirmed, you will receive a purchase order and shipping instructions via email.

Ship Your Metals: Send your metals to Money Metals Exchange following the provided shipping instructions.

Verification & Payment: The company will verify the authenticity and condition of the metals before issuing your payment.

Money Metals Exchange has specific criteria for the metals they accept:

- Rounds and bars must be labeled with weight and purity.

- Bars must display the manufacturer’s name.

- Metals must be clean, saleable, and consistent.

- Quarters and pre-1965 dimes must be minted.

Customer Service

Money Metals Exchange offers basic options for customers to connect with their support team.

There is no email for support (only website form) and no live chat for real-time assistance.

Contact Option | Details |

|---|---|

Phone Support | 1-800-800-1865 |

Email Support | Contact form available on their website |

Availability | Monday – Friday, 7:00 a.m. – 5:30 p.m. MT |

Money Metals Exchange Pros & Cons

Money Metals Exchange provides several strong features, but there are also factors worth considering.

Here’s a closer look at its strengths and areas that may need improvement.

- Wide Selection of Precious Metals

Money Metals Exchange offers gold, silver, platinum, palladium, and even rhodium in various forms, including coins, bars, and rounds, catering to different types of investors.

- Transparent Pricing & Live Updates

The platform provides real-time spot price tracking, allowing investors to make informed decisions without hidden fees or pricing surprises.

- Buyback Program

The company allows investors to sell back their metals at competitive rates, making liquidity easier for those who need to cash out.

- Monthly Savings Plan

Investors can automate purchases through the Monthly Savings Plan, making it easy to dollar-cost average into precious metals investments.

- IRA & Storage Options

Investors can set up a self-directed IRA with IRS-approved precious metals, segregated storage, high-security vaults, and full insurance.

- Limited IRA Custodian Options

While Money Metals supports Gold IRAs, they primarily recommend one custodian, which may not be ideal for investors wanting more flexibility.

- No International Shipping

The company only ships within the U.S., limiting accessibility for international investors.

- No Live Chat Support

Money Metals does not offer 24/7 live chat, meaning customers must call or email for inquiries.

- Mixed Customer Service Reviews

While some customers praise their service, others have reported slow responses, unhelpful reps, and order processing delays.

How to Start Investing With Money Metals Exchange?

Money Metals makes investing simple, whether you're opening a Gold IRA or buying physical precious metals. Below is a step-by-step guide for both options.

-

Investing in a Gold IRA

Money Metals offers a straightforward process for opening a Gold IRA

- Set Up a Self-Directed IRA: Choose a self-directed IRA custodian specializing in precious metals, and Money Metals Exchange can help connect you with a reputable option.

- Open Your Account: Complete the necessary paperwork to officially establish your self-directed IRA account.

- Fund Your Account: Transfer funds from an existing retirement account, such as a traditional IRA or 401(k), through a direct transfer or rollover to maintain tax advantages.

- Select Your Precious Metals: Work with Money Metals Exchange to choose IRS-approved gold, silver, platinum, or palladium coins and bars for your IRA.

- Purchase and Storage: Once your account is funded, instruct your custodian to purchase the selected metals, which will then be securely stored in an IRS-approved depository.

-

Investing in Physical Precious Metals

If you want to buy precious metals, Money Metals makes the process simple:

Browse & Select Your Metals: Visit the Money Metals Exchange website to explore a wide range of gold, silver, platinum, palladium, and rhodium products, including coins, bars, and specialty items.

Add to Cart & Checkout: Once you've made your selection, add items to your cart, enter shipping details, and select your preferred payment method (bank transfer, credit card, PayPal, cryptocurrency, or check).

Make Payment: Follow the provided instructions for payment, noting that credit card and PayPal transactions have additional fees, while orders over $199 qualify for free shipping.

Secure Shipping & Delivery: Once payment is confirmed, your metals are securely shipped and fully insured, with most orders requiring a signature upon delivery.

FAQ

Yes, once you place an order, the price is locked in for 10 minutes to protect against market fluctuations. You must complete your payment within the required time frame to maintain the locked-in price.

Yes, the Monthly Savings Plan allows customers to automate their purchases, helping them accumulate metals gradually without worrying about market timing.

No, Money Metals Exchange primarily sells bullion products rather than rare or graded numismatic coins, which makes it more suitable for investors than collectors.

Yes, while Money Metals offers its own secure depository storage, you can also choose a third-party vault or store metals at home if preferred.

Money Metals is competitive in pricing and selection, but it lacks international shipping, live chat, and a mobile app. Investors should compare it with alternatives like APMEX, JM Bullion, or SD Bullion to find the best fit for their needs.