Rosland Capital

Storage Fees

Min. Investment

Our Rating

Established

- Overview

- Pros & Cons

- FAQ

Rosland Capital is a precious metals investment company specializing in gold, silver, platinum, and palladium products.

Founded in 2008 and headquartered in Los Angeles, the company offers two main ways to invest: buying physical metals for direct ownership or opening a Gold IRA for retirement savings.

For those interested in physical gold and silver, Rosland Capital provides a variety of coins and bars, with a minimum order of $2,000.

If you're looking to invest in a Gold IRA, Rosland helps set up an account through its preferred custodian, Equity Institutional, , with a minimum investment of $10,000.

You can’t open an account online, you’ll need to call a representative.

- Wide Range of Products

- Exclusive Coin Collections

- Transparent Fees

- A+ BBB Rating

- No Online Price Transparency

- Buyback Pricing Transparency

- Limited Self-Storage Options

- Shipping Fees & Time for Smaller Orders

Are the metals I purchase insured?

Yes, all precious metals purchased through Rosland Capital are insured during shipping and when stored in secure facilities.

Does Rosland Capital offer a price match guarantee?

No, Rosland Capital does not offer a price match guarantee on its precious metals or IRA products.

How do I track my Gold IRA investments?

After opening your Gold IRA, you can track your investment by contacting your representative or through the client portal provided.

How long does it take to receive my metals after purchasing?

Once your payment is processed, you can expect delivery within 10-14 business days, depending on your location and the size of the order.

Products | Services | ||

|---|---|---|---|

Gold IRA Accounts | Transparent Pricing | ||

Silver IRA Accounts | Storage Options | ||

Direct Purchase | Free Shipping | ||

Buy Metals Online | International Shipping | ||

Physical Delivery | Mobile App | ||

Price Match Guarantee | Cryptocurrency Payment | ||

Buyback Guarantee | Live Chat |

Reputation & Ratings Data

Rosland Capital customer reviews ratings is average, and lower compared to other gold brokers:

Platform | Rating |

|---|---|

Trustpilot

| 3.8 (170 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 2008 |

Positive reviews often highlight Rosland Capital's knowledgeable and professional customer service, while negative feedback primarily centers on communication issues and delays in product delivery.

Invest in a Gold IRA with Rosland Capital

Rosland Capital offers Gold IRA accounts as a way for investors to diversify their retirement savings with physical gold and other precious metals.

These IRAs function similarly to traditional retirement accounts but hold IRS-approved gold, silver, platinum, and palladium instead of stocks or bonds.

-

How It Works

- Investors can open a Gold IRA by rolling over funds from an existing retirement account (such as a 401(k) or traditional IRA) or by making a new contribution.

- The minimum investment for a Gold IRA is $10,000, and accounts must be set up through Rosland’s preferred custodian, Equity Institutional.

- Once the account is funded, investors can select from a range of IRA-eligible gold coins and bars, including American Eagles, Canadian Maple Leafs, and gold bullion bars.

-

Storage & Fees

- Precious metals purchased for a Gold IRA must be stored in an IRS-approved depository, not at home.

- Storage fees range from $100 to $150 per year, depending on the type of storage chosen.

- There is a $50 one-time account setup fee and a $100 annual maintenance fee.

Rosland Capital Physical Product Selection

Rosland Capital offers a variety of physical precious metals for collectors and investors.

Here’s a breakdown of what they offer:

Gold Products – Includes gold bars and bullion coins like American Eagles, Canadian Maple Leafs, and British Britannias. These are ideal for investors who want IRS-approved gold for a Gold IRA or simply to hold as a physical asset.

Silver Products – Offers a range of silver bars and coins, including Silver American Eagles and silver bullion bars. Silver is a lower-cost alternative to gold and a popular choice for investors looking to diversify.

Platinum & Palladium Products – Includes bars and coins made from platinum and palladium, such as Canadian Maple Leaf platinum coins and PAMP platinum bars.

Exclusive Collectible Coins – Rosland Capital has limited-edition coin collections, like the Formula 1 and PGA Tour series, featuring branded designs and commemorative themes.

Rosland Capital’s Secure Storage Solutions for Metals

Rosland Capital ensures that investors have secure storage options for their precious metals, especially for Gold IRAs, which require IRS-approved storage.

Rosland does not offer in-house storage, so all assets are managed through third-party custodians.

- IRS-Approved Depositories – Rosland Capital partners with Equity Institutional, which provides secure, insured storage options in Delaware, Texas, and other high-security vault locations.

- Segregated vs. Non-Segregated Storage – Customers can choose between segregated storage, where their metals are stored separately under their name, or non-segregated storage, where metals are stored collectively with other investors’ assets.

- Annual Storage Fees – Costs range from $100 to $150 per year, depending on the type of storage selected.

Home delivery is available for customers purchasing metals outside of an IRA.

Fees & Pricing

Rosland Capital offers a relatively transparent fee structure, especially compared to competitors.

Here’s a summary of some key fees:

Fee | Cost |

|---|---|

Account Setup Fee | $50 (One-time) |

Annual Maintenance Fee | $100 |

Storage Fee | $100-$150 (Varies by storage type) |

Shipping Fee | $49 (Waived for $10,000+ orders) |

Buyback Fees | Varies, depending on the product |

Although the fees are relatively low, the lack of online price transparency can be inconvenient for those who prefer a digital shopping experience.

Payment Options: How to Pay for Metals

Rosland Capital provides a few payment methods to accommodate different investor preferences, but online payments are not available.

Instead, customers must complete purchases through direct communication with a representative.

- Personal Checks – A traditional payment method for customers who prefer paper transactions. Processing times vary, but they are widely accepted.

- Bank Wires – Recommended for larger transactions and quicker processing times. Bank wire payments are a common choice for Gold IRA rollovers or bulk metal purchases.

- Credit Cards – Limited to certain transactions, primarily for smaller purchases rather than large bullion investments.

- Money Orders and Cashier’s Checks – Available for select transactions, but customers should confirm with a representative.

While Rosland Capital accepts multiple forms of payment, they do not accept cryptocurrency or PayPal transactions, which some competitors do.

Exclusive Specialty Coins

One of the standout features of Rosland Capital is its collection of exclusive specialty coins, designed in partnership with renowned organizations and events.

These coins are often limited edition, making them attractive for both collectors and investors.

- Formula 1® Collection – A series of gold and silver coins celebrating the history of Formula 1 racing. These are officially licensed and feature designs honoring iconic Grand Prix events.

- PGA Tour Series – A tribute to golf, this collection includes coins commemorating tournaments such as the Presidents Cup and Players Championship.

- British Museum Partnership – A unique coin line inspired by historical artifacts, bringing art and history into precious metal investments.

- Lady Liberty Series – Exclusive gold and silver proof coins minted specifically for Rosland Capital, featuring high-quality craftsmanship.

While these specialty coins can be aesthetically and historically valuable, they often come with higher premiums than standard bullion

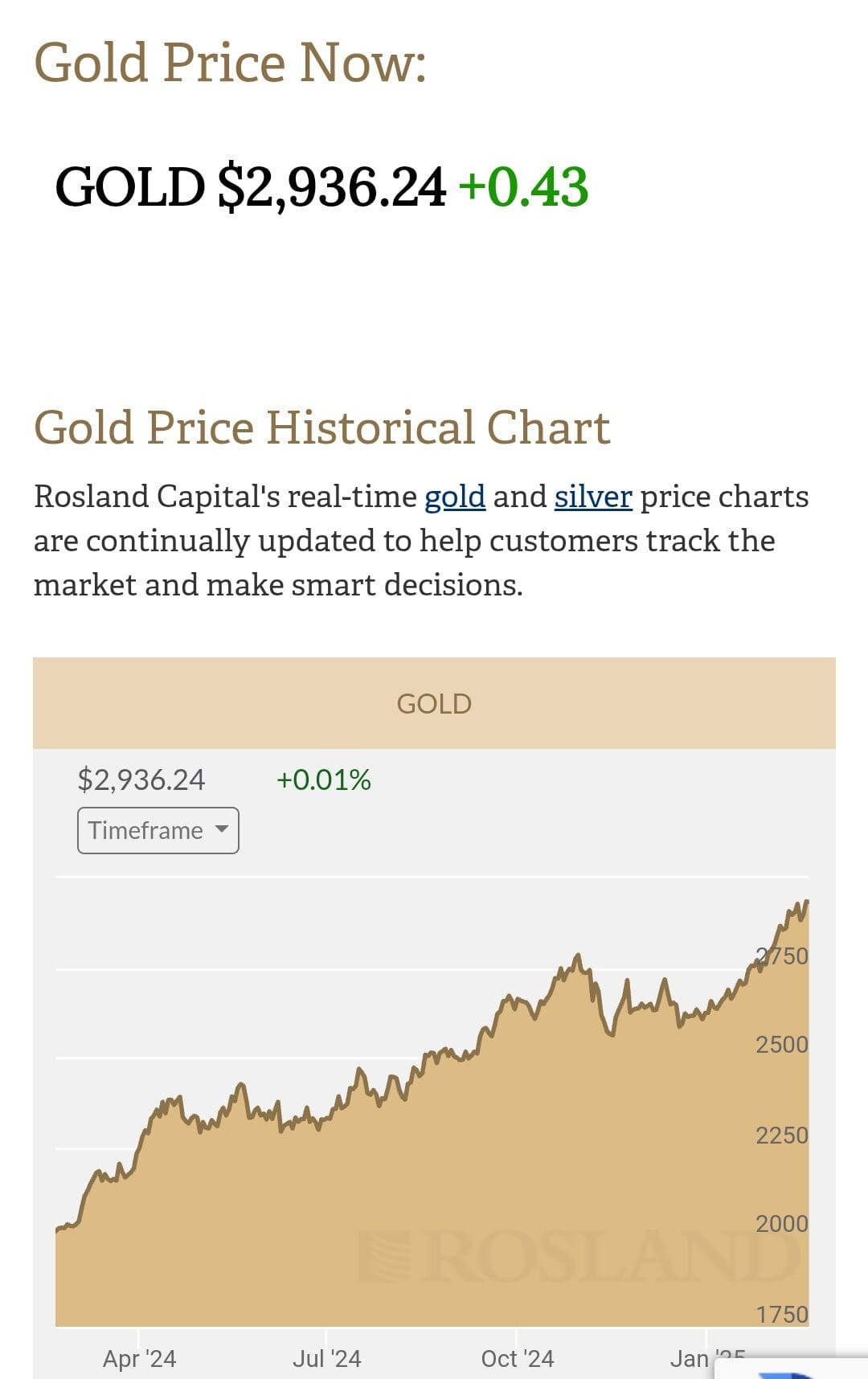

Rosland Capital’s Website: Features & User Experience

Rosland Capital’s website provides a decent experience, but it’s far from the most modern or user-friendly. The design is a bit outdated, with some users finding it cluttered and not as intuitive as other precious metals investment platforms.

New users might find it overwhelming because there’s a lot of information on the products but not enough on account management or pricing details.

Prices aren’t listed directly on the site, so customers have to call to get a quote, which can be inconvenient for those who prefer instant access to information.

The educational resources are a standout feature, offering guides on gold and silver investments, IRA options, and how to track precious metal prices.

Rosland Capital’s Customer Service: What to Expect

Rosland Capital emphasizes a personalized customer experience, but its accessibility is somewhat limited compared to competitors that offer digital account management.

Contact Option | Details |

|---|---|

Phone Support | Toll-Free: 1-866-942-2962 |

Email Support | services@roslandcapital.com |

Availability | Monday to Friday from 7 a.m. to 6 p.m |

Rosland does not offer real-time chat support or a dedicated mobile app for tracking investments.

Pros and Cons of Investing with Rosland Capital

Rosland Capital offers a range of advantages, but there are also some drawbacks to consider before making an investment.

Here's a breakdown:

- Wide Range of Products

Rosland Capital offers a diverse selection of precious metals, including gold, silver, platinum, and exclusive collectible coins, providing a broad array of investment options.

- Exclusive Coin Collections

Investors can purchase limited-edition coins, such as the Formula 1 and PGA Tour collections, adding uniqueness and value to their portfolios.

- Transparent Fees

The company offers clear fee structure for Gold IRAs, including setup and storage fees, making it easier for investors to understand the costs involved.

- A+ BBB Rating

The company boasts an A+ rating from the Better Business Bureau, showing a commitment to customer service and resolving complaints effectively.

- No Online Price Transparency

Prices for precious metals are not listed online, requiring potential buyers to call for quotes, which can be inconvenient for those who prefer immediate pricing information.

- Buyback Pricing Transparency

Buyback prices are not fully transparent, and investors may find themselves facing larger spreads when selling metals back to Rosland Capital.

- Limited Self-Storage Options

While Rosland Capital offers secure storage through third parties, investors cannot store their metals at home, which may not be appealing to all.

- Shipping Fees & Time for Smaller Orders

Shipping fees for smaller orders are higher than those of competitors, and delivery times can be slower.

How to Begin Investing with Rosland Capital

Whether you're interested in setting up a Gold IRA or purchasing physical precious metals, Rosland provides a straightforward way to get started.

Follow this step-by-step guide to navigate the process.

-

Investing In Gold IRA

Investing in a Gold IRA through Rosland Capital is a straightforward process, but it requires a bit of paperwork and coordination with both Rosland and the IRA custodian, Equity Institutional.

Here's a simple guide to getting started:

- Consult with a Representative

The first step is to contact a Rosland Capital representative to discuss your goals and the best strategy for your Gold IRA.

You'll discuss the minimum investment, which is typically $10,000 for a rollover IRA, and the types of precious metals you’d like to invest in.

Rosland’s representative will guide you through the IRA setup process.

- Fund Your Account

Once you've decided on the right metals for your IRA, you'll need to fund your account.

You can either roll over funds from an existing retirement account (like a 401(k) or traditional IRA) or contribute new funds directly.

If you choose to roll over, Rosland will provide the paperwork to initiate the transfer with your current custodian.

- Select Your Metals

After your account is funded, you can select the metals for your IRA. Rosland offers a variety of IRS-approved gold, silver, platinum, and palladium coins and bars.

Your metals will be purchased through Rosland and stored in a secure depository.

- Secure Storage

Rosland Capital will arrange for the storage of your precious metals at an IRS-approved facility.

This is important for compliance with IRS regulations, as you cannot store the metals at home. Storage fees typically range from $100 to $150 per year.

-

Physical Purchase

If you prefer to buy precious metals directly instead of through a Gold IRA, Rosland Capital also allows for direct purchases. The process is a bit simpler, as it doesn't involve the setup of an IRA.

Here’s how you can invest:

- Consult with a Representative

To begin, contact a Rosland Capital representative to discuss your options.

You'll provide details about the amount you want to invest and the types of metals you are interested in, whether it’s gold, silver, platinum, or exclusive coins.

- Choose Your Metals

Based on your preferences, you can select from a wide range of precious metals, including popular products like American Eagle coins, Canadian Maple Leafs, or special collections.

Rosland Capital offers exclusive collectible coins in addition to standard bullion products.

- Place Your Order

Once you've decided on your selection, the next step is to place your order. For purchases under $10,000, Rosland typically requires payment via check or wire transfer, and you will be given a quote for the purchase once you’ve selected your metals.

- Payment and Delivery

After your payment is processed, your precious metals will be shipped directly to your address.

There’s a $49 shipping fee, which can be waived for orders over $10,000. You will receive a tracking number to monitor the shipment's progress.

FAQ

Rosland Capital offers a range of gold, silver, platinum, and palladium products, including bars, bullion, and collectible coins.

For Gold IRAs, metals must be stored in IRS-approved depositories, but you can store physical metals at home if not part of an IRA.

Yes, Rosland Capital offers both Traditional and Roth Gold IRA options, allowing you to choose based on your retirement needs.

Yes, only IRS-approved gold, silver, platinum, and palladium coins and bars can be included in a Gold IRA, with purity requirements for each.

Review Gold Dealers For Direct Purchase & Gold IRA

How We Rated Gold & Silver Dealers: Review Methodology

At The Smart Investor, we evaluated gold brokers & dealers based on their overall value, pricing transparency, and investment options compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to precious metals investors, including fees, security, product selection, and IRA investment options. Each broker was rated based on the following criteria:

- Pricing & Fees (15%): We prioritized brokers with transparent pricing, low markups on gold and silver, and fair premiums. Some platforms had hidden costs, including storage and liquidation fees.

- User Experience & Buying Process (20%): A smooth, intuitive, and secure buying process scored highest. Some brokers had complex procedures, slow transactions, or unclear order processing.

- Reputation & Ratings (10%): We factored in customer reviews, industry ratings, and regulatory compliance. Highly rated brokers had strong reputations for reliability, trustworthiness, and investor protection. Some had mixed reviews or unresolved complaints.

- Customer Support & Service (15%): We tested response times, availability, and helpfulness of support via phone, chat, and email. The best brokers provided knowledgeable assistance with fast, professional service, while others were slow or unresponsive

- Security & Storage Options (10%): We favored brokers offering secure vault storage, insured holdings, and direct delivery options. Some lacked proper security measures, increasing investment risks.

- IRA & Retirement Investment Options (20%): The best brokers offered Gold & Silver IRA accounts with IRS-approved metals, simple setup, and rollover assistance. Some lacked IRA services or charged high fees.

- Precious Metals Selection (10%): We rated brokers higher if they offered a wide range of gold and silver products, including bullion, coins, and bars. Some had limited selections, restricting investment choices.