JM Bullion

Storage Fees

Min. Investment

Our Rating

Established

- Overview

- Pros & Cons

- FAQ

Founded in 2011 and based in Dallas, Texas, JM Bullion operates entirely online, offering a wide selection of coins, bars, and rounds from reputable mints.

New customers will find JM Bullion easy to navigate, with transparent pricing that updates in real time based on market conditions.

Orders over $199 qualify for free shipping, and the company offers multiple payment methods, including credit/debit cards, PayPal, bank wires, checks, and even Bitcoin.

JM Bullion also offers Precious Metals IRAs, partnering with third-party custodians to help customers add gold and silver to their retirement portfolios.

- Wide Selection of Precious Metals

- No Commissions or Hidden Fees

- Free Shipping on Orders Over $199

- Flexible Payment Options

- Buyback Program for Easy Liquidity

- No International Shipping

- Limited Customer Support Hours

- No In-House Storage

- No Mobile App

Does JM Bullion offer discounts for bulk purchases?

Yes, JM Bullion provides tiered pricing, meaning you can get lower premiums when buying larger quantities of metals like gold and silver bars.

Does JM Bullion charge sales tax on purchases?

Sales tax depends on your state’s regulations. JM Bullion automatically calculates and applies sales tax during checkout if required in your location.

Can I cancel or change my order after placing it?

Once an order is confirmed, it cannot be canceled or modified due to market volatility. However, you can sell the metals back to JM Bullion if needed.

Products | Services | ||

|---|---|---|---|

Gold IRA Accounts | Transparent Pricing | ||

Silver IRA Accounts | Storage Options | ||

Direct Purchase | Free Shipping | ||

Buy Metals Online | International Shipping | ||

Physical Delivery | Mobile App | ||

Price Match Guarantee | Cryptocurrency Payment | ||

Buyback Guarantee | Live Chat |

Is JM Bullion Worth It? Reviews & Ratings Breakdown

JM Bullion holds strong ratings on Trustpilot and other platforms. While above average, it doesn’t rank among the top-rated gold brokers.

Platform | Rating |

|---|---|

Trustpilot

| 4.3 (1,493 reviews) |

Better Business Bureau (BBB) | A+ | Accredited Since 2014 |

Consumer Affairs | 4.5 (790 reviews) |

Positive reviews highlight JM Bullion's extensive selection of precious metals, competitive pricing, and efficient, discreet shipping. Customers appreciate the user-friendly website and the variety of payment options, including cryptocurrencies.

On the other hand, negative feedback often centers on order processing delays and communication issues. Some customers report challenges with payment methods and dissatisfaction with the resolution of disputes.

JM Bullion’s Gold IRA – What You Need to Know

JM Bullion offers Gold IRAs, allowing investors to hold physical gold in a tax-advantaged retirement account.

While the company itself does not act as a custodian, it partners with trusted IRA custodians to help set up and manage the account. Here’s how it works:

- Wide Selection of IRA-Approved Metals – JM Bullion offers IRS-approved gold, silver, platinum, and palladium products for IRAs.

- 3-Step Setup – Customers first open a self-directed IRA with a custodian, fund the account via transfer or rollover, and then purchase IRA-eligible metals from JM Bullion.

- Secure Storage Options – JM Bullion works with TDS Vaults for insured, fully allocated storage in locations like Las Vegas, Zurich, and Singapore.

- Assistance from IRA Specialists – The company provides support to help investors choose the right products and navigate the setup process.

While JM Bullion simplifies investing in a Gold IRA, it’s worth noting that the company does not manage IRA accounts directly, so investors must work with an external custodian for administration and compliance.

JM Bullion’s Great Product Range – Coins, Bars & More

JM Bullion offers a wide range of precious metals, catering to both investors and collectors.

Whether you're looking for gold, silver, platinum, or even copper, their selection includes coins, bars, and rounds from some of the most reputable mints worldwide.

Here’s a breakdown of their key product categories:

- Gold Products – Includes gold coins, bars, and rounds from top mints like the U.S. Mint, Royal Canadian Mint, and PAMP Suisse. Popular options include American Gold Eagles and Canadian Gold Maple Leafs, ideal for both investment and collection.

- Silver Products – Offers a diverse selection of silver coins, bars, and rounds. Customers can find American Silver Eagles, Austrian Silver Philharmonics, and silver bars in various weights from well-known refineries.

- Platinum & Palladium – Aimed at investors looking for portfolio diversification, JM Bullion carries platinum and palladium coins and bars from leading mints like Credit Suisse and Valcambi.

- Copper Products – A more affordable alternative for collectors, including copper bars and rounds in unique designs.

- Accessories – Includes storage tubes, coin capsules, and display cases to help protect and showcase investments.

With transparent pricing and live market updates, JM Bullion is definitely one of the best places to buy gold online quickly.

Can JM Bullion Store Your Precious Metals?

Unlike some competitors, JM Bullion does not offer in-house storage for purchased metals.

However, it partners with TDS Vaults (Transcontinental Depository Services) to provide secure, insured storage solutions for investors who don’t want to keep their metals at home.

Key Storage Features:

- Fully Allocated Storage – Your metals are stored under your name, not pooled with others.

- Global Vault Locations – Choose from Las Vegas, Toronto, Zurich, and Singapore.

- All-Risk Insurance Policy – Metals are covered against theft, damage, and loss.

- Direct Shipping – JM Bullion can ship directly to TDS Vaults, ensuring safe transfer.

Before making a purchase, it’s always a good idea to review and choose the right storage option.

How Much Does JM Bullion Really Charge?

JM Bullion is known for its transparent pricing, with real-time metal prices displayed on its website.

JM Bullion does not charge commissions or hidden fees – it makes money by adding a small spread over the spot price.

Fee | Cost |

|---|---|

Shipping Fee | $9.95 (Free for orders $199+) |

Storage Fees | Varies (Usually 0.5% – 1% annually) |

IRA Setup Fee | $50 – $100 |

IRA Admin Fees | $75- $300 |

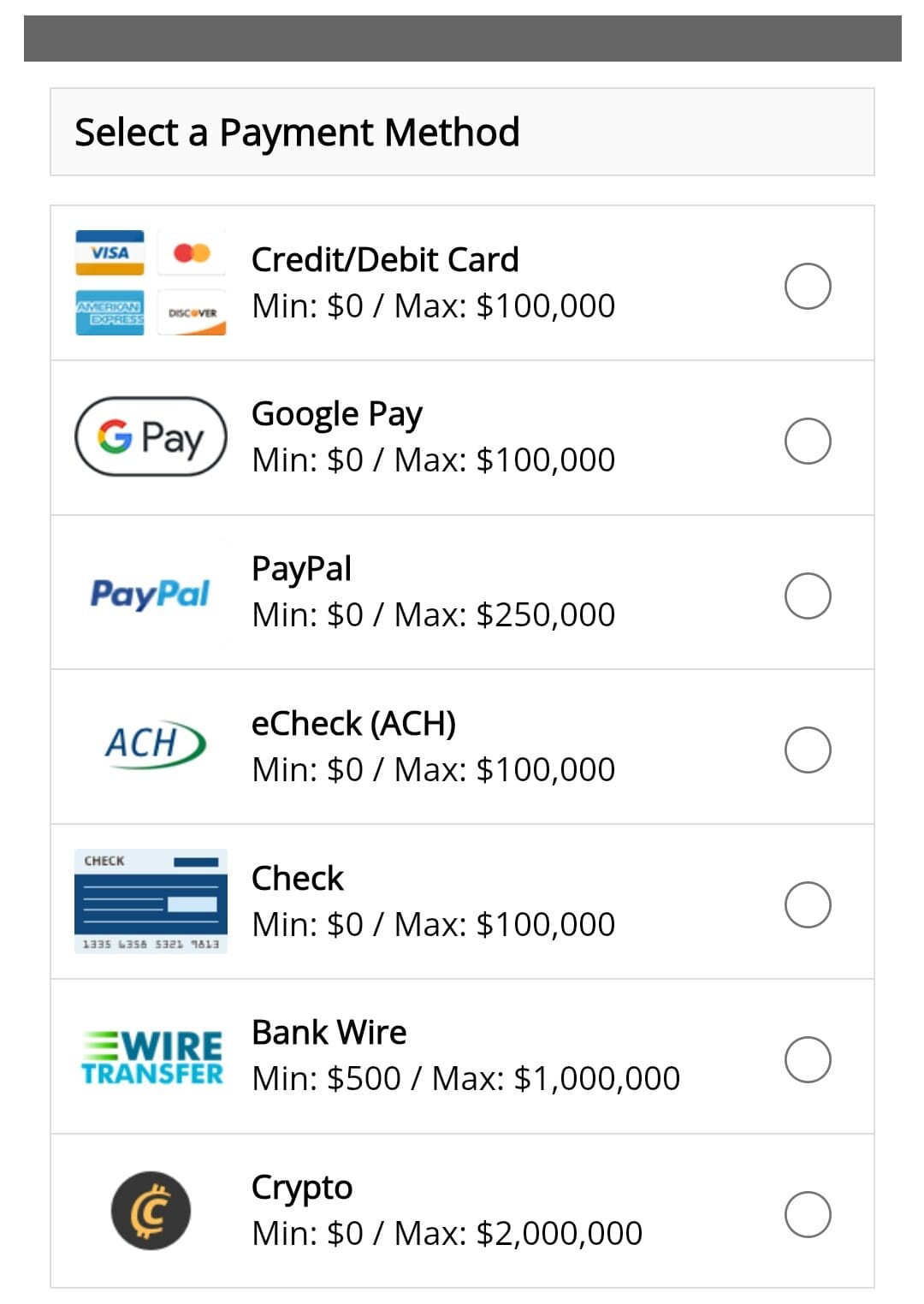

Payment Options

JM Bullion stands out for its flexible payment methods, making it easy for customers to buy precious metals. Accepted payment options include:

- Credit & Debit Cards – Visa, Mastercard, American Express, and Discover.

- Bank Wire Transfers – Ideal for larger orders ($2,500 minimum).

- PayPal & PayPal Credit – A rare offering among bullion dealers.

- Cryptocurrency – Supports Bitcoin for seamless digital transactions.

- Paper Checks & Money Orders – A budget-friendly option with cash discounts.

Most orders ship within 1-2 business days after payment clears. However, bank wire transfers and Bitcoin transactions often get priority processing.

AutoBuy Program

The AutoBuy feature is perfect for investors looking to automate their precious metals purchases.

Instead of manually placing orders, customers can:

- Select from eligible gold and silver products.

- Set a purchase frequency (weekly, biweekly, or monthly).

- Lock in orders automatically when the price hits a specific threshold.

This feature helps investors cost-average their purchases over time, reducing the impact of market volatility.

If you believe gold will continue to grow in value over time, this could be a good investment to consider for the long run.

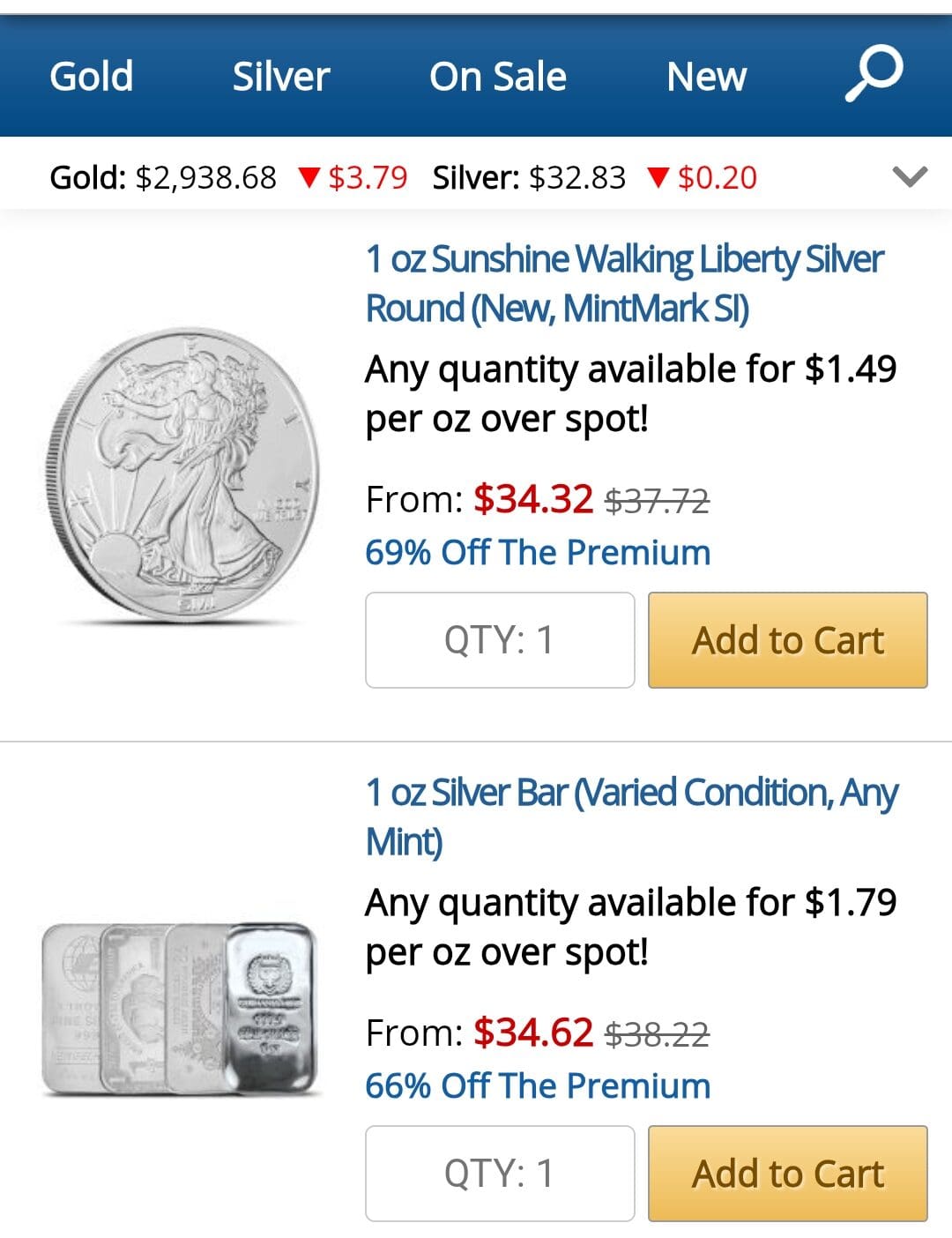

On-Sale & New Arrivals Sections

JM Bullion keeps its product catalog dynamic with on-sale deals and new arrivals:

- On-Sale Section – Weekly discounts on gold, silver, and other metals, often at the lowest markup over spot price.

- New Arrivals – Recently released coins, bars, and rounds from top mints worldwide, helping collectors and investors access the latest bullion.

These sections help buyers find great deals while keeping up with the newest investment opportunities.

Buyback Program: How to Sell Gold & Silver to JM Bullion

JM Bullion offers a buyback program, allowing customers to sell their precious metals back to the company at competitive rates. The process is straightforward and available online 24/7, making it convenient for investors to liquidate their holdings when needed.

The self-service buyback tool on their website lets customers lock in a price instantly without needing to call a representative.

However, for larger orders or those requiring assistance, phone-based buyback support is also available.

JM Bullion prides itself on offering some of the highest buyback prices in the industry, though final rates depend on market conditions and product demand.

Overall, JM Bullion is one of the better places to sell your gold, offering competitive buyback prices even if you didn’t purchase from them.

User Experience & Website: A Look at JM Bullion’s Features

JM Bullion’s website is designed for ease of use, making it simple for both new and experienced investors to buy and sell precious metals.

Some of the main features we liked:

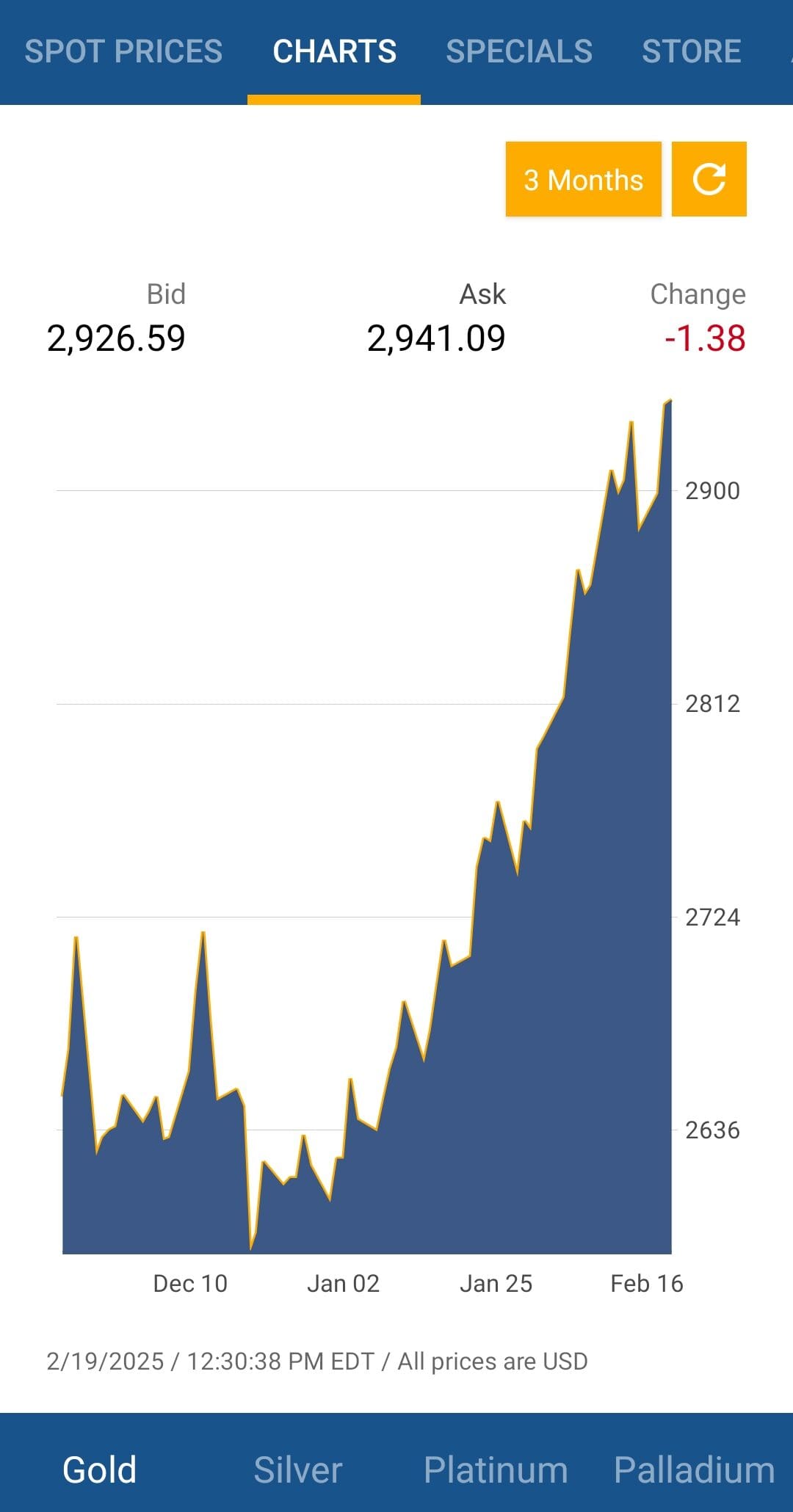

- Live metal price charts – Track gold, silver, platinum, and palladium prices in real-time.

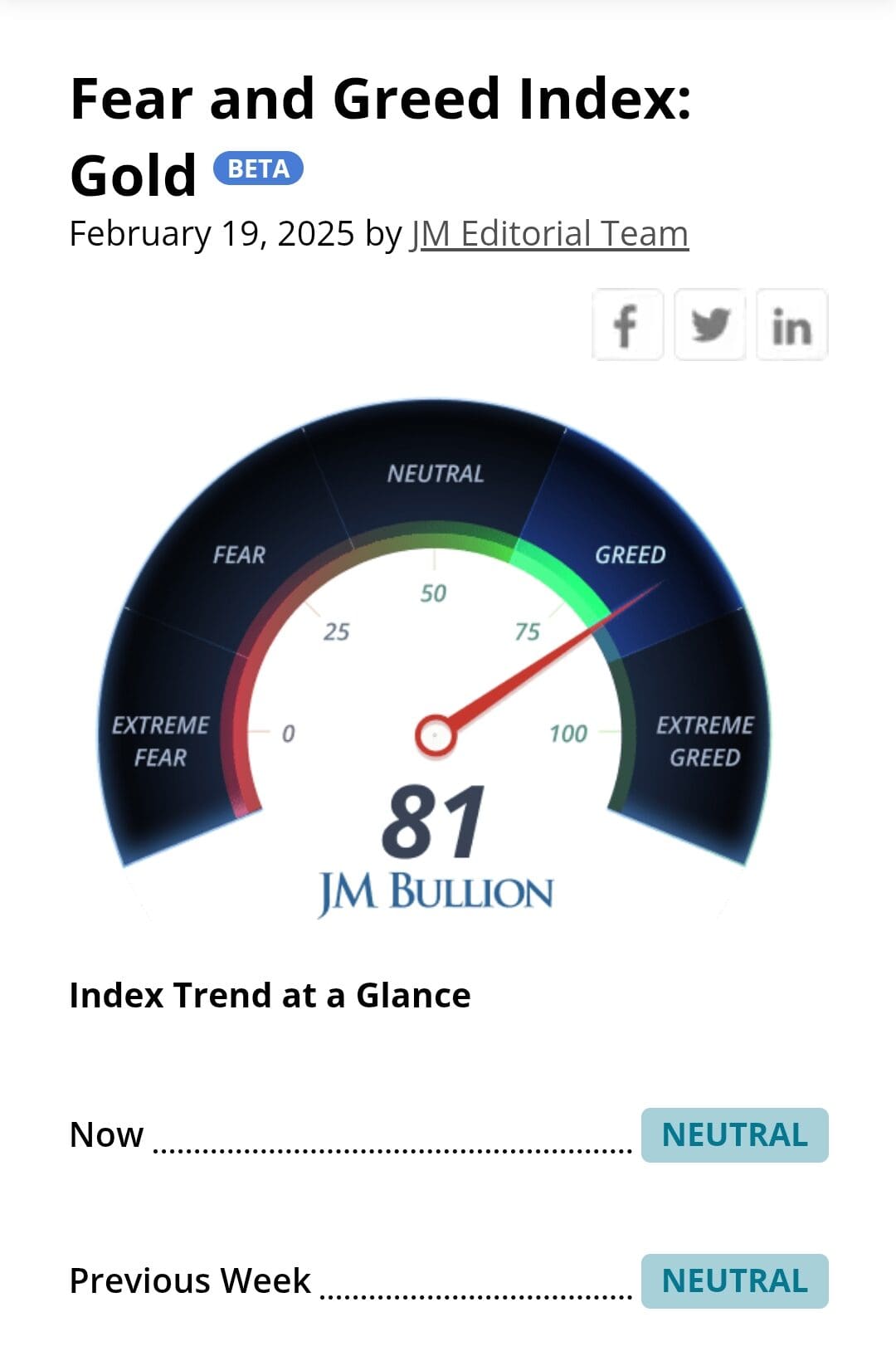

- Fear & Greed Index – Helps investors gauge market sentiment.

- Market insights & analysis – Provides useful data for decision-making.

- Transparent pricing – No hidden fees, with live spot prices displayed.

While the checkout process is smooth, some users have reported occasional slowdowns during high-traffic periods.

Additionally, JM Bullion does not have a mobile app, which could make investing more convenient for mobile users.

Precious Metals Price Charts & Market Insights

JM Bullion provides investors with real-time price charts and market tools to make informed decisions.

- Live Gold, Silver, Platinum & Palladium Price Charts – Tracks daily, weekly, and yearly price trends.

- Fear & Greed Index – Measures investor sentiment, showing whether the market is bullish or bearish.

- Technical Analysis & Dollar-Cost Averaging Tools – Helps traders and long-term investors strategize their purchases.

With these tools, both new and experienced investors can time their purchases and sales more effectively.

Support at JM Bullion – What You Can Expect

The support team is available Monday through Friday, 8 AM – 6 PM CST, via phone and email, but live chat is not offered.

JM Bullion also offers a self-service option for selling metals, allowing users to initiate sales without speaking to a representative.

Contact Option | Details |

|---|---|

Phone Support | 1-800-276-6508 |

Email Support | support@jmbullion.com |

Availability | Monday through Friday, 8:00 AM to 6:00 PM CST |

Additionally, their website provides FAQs, market insights, and price charts to help investors make informed decisions.

JM Bullion: What’s Good & What’s Not?

While JM Bullion offers notable benefits, there are also a few points to consider. Here’s an overview of what the company excels at and where it could improve.

- Wide Selection of Precious Metals

JM Bullion offers gold, silver, platinum, palladium, and copper in coins, bars, and rounds, catering to both investors and collectors.

- No Commissions or Hidden Fees

The company makes money through a small spread over the spot price, so you won’t face surprise charges when buying metals.

- Free Shipping on Orders Over $199

Customers enjoy free, insured shipping on larger orders, while smaller orders have a reasonable $9.95 shipping fee.

- Flexible Payment Options

Unlike many competitors, JM Bullion accepts credit/debit cards, PayPal, wire transfers, checks, and even Bitcoin for payments.

- Buyback Program for Easy Liquidity

The company makes it simple to sell metals back with an online buyback tool that locks in real-time pricing.

- No International Shipping

JM Bullion only ships within the U.S., limiting options for overseas investors.

- Limited Customer Support Hours

Support is only available Monday-Friday, 8 AM – 6 PM CST, with no live chat option.

- No In-House Storage

The company doesn’t provide direct storage, though it partners with TDS Vaults for third-party storage.

- No Mobile App

The company’s website is mobile-friendly, but there’s no dedicated app, which could make investing more convenient.

Buying Precious Metals? How to Begin at JM Bullion

Whether you're looking to establish a Gold IRA or purchase physical precious metals, JM Bullion offers a seamless investment process.

Here’s a detailed step-by-step guide to help you get started.

-

Gold IRA Investment

Investing in a Gold IRA with JM Bullion is a simple process, but it involves working with an IRA custodian since the company itself doesn’t directly manage IRA accounts. Here’s how it works:

- Open a Self-Directed IRA – You’ll need to set up a self-directed IRA (SDIRA) with an approved custodian. JM Bullion partners with trusted custodians, but you can choose your own.

- Fund Your Account – Transfer funds into your new IRA via bank transfer, rollover from an existing IRA, or 401(k) rollover.

- Select IRA-Eligible Metals – JM Bullion offers a wide selection of IRS-approved gold, silver, platinum, and palladium products for IRAs. Their specialists can help you choose.

- Purchase & Store Your Metals – Once you finalize your order, JM Bullion ships your metals directly to a secure, IRS-approved depository like TDS Vaults.

-

Physical Purchase of Precious Metals

Buying precious metals for direct ownership is even easier with JM Bullion:

- Browse & Select Products – Choose from gold, silver, platinum, palladium, and copper products, available as coins, bars, and rounds.

- Check Live Pricing & Add to Cart – Prices update in real-time based on market rates, ensuring transparency.

- Choose a Payment Method – Pay using credit/debit card, bank wire, PayPal, check, or Bitcoin.

- Confirm & Receive Secure Delivery – Orders ship discreetly and are fully insured, with free shipping on orders over $199.

FAQ

No, JM Bullion does not currently offer gift cards or store credit, but they do accept a variety of payment options, including PayPal and Bitcoin.

No, JM Bullion is an online-only dealer and does not have physical retail locations or in-person pick-up options.

Most products sold by JM Bullion are new from mints and refineries, but they also occasionally offer secondary market (pre-owned) bullion.

No, JM Bullion does not offer price alerts, but the AutoBuy feature lets you schedule purchases when metals reach a certain price.

Review Gold Dealers For Direct Purchase & Gold IRA

How We Rated Gold & Silver Dealers: Review Methodology

At The Smart Investor, we evaluated gold brokers & dealers based on their overall value, pricing transparency, and investment options compared to other leading alternatives. Our hands-on testing focused on key factors that matter most to precious metals investors, including fees, security, product selection, and IRA investment options. Each broker was rated based on the following criteria:

- Pricing & Fees (15%): We prioritized brokers with transparent pricing, low markups on gold and silver, and fair premiums. Some platforms had hidden costs, including storage and liquidation fees.

- User Experience & Buying Process (20%): A smooth, intuitive, and secure buying process scored highest. Some brokers had complex procedures, slow transactions, or unclear order processing.

- Reputation & Ratings (10%): We factored in customer reviews, industry ratings, and regulatory compliance. Highly rated brokers had strong reputations for reliability, trustworthiness, and investor protection. Some had mixed reviews or unresolved complaints.

- Customer Support & Service (15%): We tested response times, availability, and helpfulness of support via phone, chat, and email. The best brokers provided knowledgeable assistance with fast, professional service, while others were slow or unresponsive

- Security & Storage Options (10%): We favored brokers offering secure vault storage, insured holdings, and direct delivery options. Some lacked proper security measures, increasing investment risks.

- IRA & Retirement Investment Options (20%): The best brokers offered Gold & Silver IRA accounts with IRS-approved metals, simple setup, and rollover assistance. Some lacked IRA services or charged high fees.

- Precious Metals Selection (10%): We rated brokers higher if they offered a wide range of gold and silver products, including bullion, coins, and bars. Some had limited selections, restricting investment choices.