Chase Bank serves nearly half of the households in the United States, providing an extensive range of products, including a diverse selection of credit cards. The Chase card portfolio features enticing benefits, such as a robust points program, generous spending rewards, and enticing sign-up bonuses. Notably, Chase is a prominent issuer of renowned store, hotel, and airline credit cards.

Here are The Smart Investor Select’s picks for the top Chase credit cards:

Card | Rewards | Bonus | Annual Fee | Best For | Chase Sapphire Preferred® Card | 2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

| 60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| $95

| Value for Money |

|---|---|---|---|---|---|

| Chase Freedom Flex℠ Card | 1-5%

5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

| $200

$200 bonus after you spend $500 on purchases in the first 3 months from account opening

| $0 | Rotating Categories |

Chase Freedom Unlimited® | 1.5% – 5%

5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases

| $250

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

| $0 | No Annual Fee. | |

Chase Sapphire Reserve® | 1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| 60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

| $550 | Travel and Dining | |

Amazon Prime Rewards Visa Signature

| 1-5%

5% back on Amazon.com, Amazon Fresh, Whole Foods Market, and Chase Travel purchases. Plus, you’ll get 2% back at gas stations, restaurants, and on local transit, and 1% on all other purchases

| $200

$200

| $0 ($139 Amazon Prime subscription required) | Shoppers | |

Marriott Bonvoy Boundless® Credit Card | 1x – 6X

6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

| 125,000 points

Earn 125,000 Bonus Points after you spend $5,000 on purchases in your first 3 months from your account opening.

| $95 | Sign up Bonus | |

United Explorer Card | 1X – 2X

2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

| 50,000 miles

50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open.

| $95 ($0 first year) | Airline | |

The World of Hyatt Credit Card |

1X – 4X

4 Bonus Points per $1 spent on purchases at all Hyatt hotels. Plus, 5 Base Points from Hyatt per eligible $1 spent for being a World of Hyatt member. 2x Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airline, local transit and commuting as well as fitness club and gym memberships. Plus, earn 1 Bonus Point per $1 spent on all other purchases.

| 60,000 points

Earn up to 60,000 Bonus Points after qualifying purchases.

| $95 | Hotel Rewards |

Chase Sapphire Preferred® Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Chase Sapphire Preferred® Card is a travel rewards card issued by Chase Bank. This is a very popular travel rewards card because it offers a large sign-up bonus and the card is built around traveling. Many travel rewards cards have higher annual fees for the same kind of rewards. The card offers a sign-up bonus of 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

This card is on our top spot in regards to the best traveling and dining cards as they offer you more points compared to other cards – 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases. .

- Rewards Plan: 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

- APR: 20.99% – 27.99% variable APR

- Annual fee: $95

- Balance Transfer Fee: 5% or $5, whichever is greater

- Foreign Transaction Fee: $0

- Sign Up bonus: 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

- 0% APR Introductory Rate: N/A

- Point Sign-Up Bonus

- Bonus Points

- No Blackout Dates

- 25% More through Ultimate Chase Rewards

- No Foreign Transaction Fee

- $95 Annual Fee

- Low Merchandise Rewards

- No Introductory 0%

- Balance Transfer Fee – 5% or $5, whichever is greater

- Does the travel rewards points expire? Your points won’t expire once you keep the credit card account open.

- Does card Chase Sapphire Preferred offer pre-approval? Yes, you are able to pre-qualify for this card.

- What is the initial credit limit? The minimum credit limit that you can get with this card type is usually $5,000.

- How do I redeem cash back? You can redeem your points in a variety of ways through the Chase credit card reward portal. Some of the perks you can get include cash, travel credit, statement credit, and gift cards.

- What purchases don't earn cash back? All purchases will earn cashback through this card.

- Should You Move to Chase Sapphire Preferred card? If you travel frequently and do not want to pay a large annual fee.

- Why did the Chase deny me? You might not have met one of its requirements. You will usually find out where you fell short. You might be able to rectify the issue or you might have to look elsewhere.

- How hard is it to get a Chase Sapphire Preferred card? If you meet all of the requirements, then it is relatively straightforward to get a Chase Sapphire Preferred card. The requirements are easier compared to Chase Sapphire Reserve card.

- Is there a limit to rewards/cash back on the Chase Sapphire Preferred card? No limit

- Can I get car rental insurance with a Chase Sapphire Preferred card? how? Yes, you can get car rental insurance with this card if you decline the collision cover of the rental company and pay for the entire cost of the rental car with this card.

Chase Freedom Flex℠ Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

If you have a high credit score and want a card to capture your spending habits with no extra cost. The Chase Freedom Flex℠ Card has a $0 annual fee, and you can earn .

The sign up bonus includes .

- Rewards Plan: 5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

- APR: 19.99% – 28.74% variable

- Annual fee: $0

- Balance Transfer Fee: $5 or 5% (the greater)

- Foreign Transaction Fee: 3%

- Sign Up bonus: $200 bonus after you spend $500 on purchases in the first 3 months from account opening

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers

- Sign Up Bonus

- No Annual Fee

- 0% Intro APR

- Protection & Free Credit Score

- Higher cashback Bonuses has a Cap

- Balance Transfer Fee

- Foreign Transaction Fee

- Is there a limit to cashback? There is a cap on the bonus categories whereby it will cover up to $1,500 of relevant purchases per quarter.

- Can I get car rental insurance with a Chase Freedom Flex card? Yes, when you rent the car and pay for all of it with this card and do not accept coverage from the rental company.

- What are Chase Freedom Flex card income requirements? No specific income requirements and it does not usually ask for proof of income requirements.

- Does card Chase Freedom Flex offer pre approval? Yes, you can get pre-approval.

- What is the initial credit limit of the Freedom Flex? The initial credit limit varies, but can often be between $300 and $1,000. The average limit for this card is $3,000.

- How do I redeem cashback? You go to the Ultimate Rewards section that Chase offers and you can choose between the options as to how you utilize the rewards.

- What purchases don't earn cashback? All purchases earn cashback with this card.

- Should You Move to Chase Freedom Flex card? This is a good fit for people who are looking for good cashback rates, as well as getting access to quarterly bonus categories for enhanced rates.

- How hard is it to get it? It is not very hard to get this type of card once you meet all of the straightforward requirements.

- How to maximize rewards on Chase Freedom Flex card? You go to the Ultimate Rewards section that Chase offers and you can choose between the options as to how you utilize the rewards. To maximize rewards, you should make sure that you take advantage of the bonus categories and leave the other types of purchases that are not covered by an enhanced rate to another card. This is because you will only get 1% cashback on non-covered purchases.

- Top Reasons NOT to get the Chase Freedom Flex card? If you make a lot of purchases not covered by the respective categories and will only get 1% cashback on them. You may also travel a lot and not want to pay the 3% foreign exchange transaction charge that comes with this card.

Chase Freedom Unlimited®

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Chase Freedom Unlimited® card provides an enthralling combination of lavish rewards, including a 5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases. It offers a nice sign-up bonus of Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening..

Another benefit worth mentioning is the long 0% intro APR – 15 months on purchases and balance transfers (19.99 – 28.74% variable after that). Overall, Chase Freedom Unlimited is one of the best options in the market, especially for those who are looking to save the annual fee.

- APR: 19.99 – 28.74% variable

- Annual fee: $0

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: 3%

- Rewards Plan: 5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases

- Sign Up bonus: Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

- 0% APR Introductory Rate period: 15 months on purchases and balance transfers

- Cash Back Rewards + Sign Up Bonus

- 0% APR on Balance Transfers & Purchases

- No Annual Fee

- Protection & Free Credit Score

- Balance Transfer Fee

- Foreign Transaction Fee

- Less Relevant For Frequent Travelers

- Is there a limit to cashback rewards? There is no cap.

- Can I get car rental insurance with a Chase Freedom Unlimited card? Yes, when you rent the car and pay for all of it with this card and do not accept coverage from the rental company.

- Should You Move to Chase Freedom Unlimited card? This is a good fit for people who are looking for no annual fee card including good cashback rates that do not change.

- Why did Chase Freedom Unlimited card deny me? You might not have met one of the requirements for this card. You can talk with a member of the customer support team to see what the issue is and how you might be able to rectify it.

- How hard is it to get a Chase Freedom Unlimited card? It is not very hard to get this type of card once you meet all of the straightforward requirements.

- How to maximize rewards on the Chase Freedom Unlimited card?

- You can choose between the options as to how you utilize the rewards. To maximize rewards, you should make the most of the signup bonus and also be aware of which of your credit cards have the best cashback for a particular type of purchase.

- Top reasons NOT to get the Chase Freedom Unlimited card? If you are looking for higher flat cashback rates. You may also travel a lot and not want to pay the 3% foreign exchange transaction charge that comes with this card.

- Does Chase ask for proof of income? There is no specific income requirements and it does not usually ask for proof of income requirements.

- Does the card offer pre-approval? Yes, you can get pre-approval.

- What is the initial credit limit? The initial credit limit varies, but can often be between $1,000 and $5,000.

- How do I redeem cashback? Go to the Ultimate Rewards section that Chase offers and you can choose between the options as to how you utilize the rewards.

- What purchases don't earn cashback with the Freedom Unlimited card? All purchases earn cashback with this card.

Chase Sapphire Reserve®

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Card Features

- Pros & Cons

- FAQ

The Chase Sapphire Reserve® card is a premium travel card that offers many benefits that your average reward card does not. You'll receive , which is about $750 in travel rewards if booked through Chase Ultimate Rewards. Also, the Chase Reserve annual travel credit is one of the highest in the market.

In addition, you earn 5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

However, due to the high annual fee ($550) – you should make sure your regular spending habits fits to this card and you'll be able to cover the high annual cost. If that's not the case – the Chase Sapphire Preferred is a good alternative.

- APR: 21.99% – 28.99% variable APR

- Annual fee: $550

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: $0

- Rewards Plan: 5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

- Sign Up bonus: 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

- 0% APR Introductory Rate period: N/A

- Points Rewards

- Sign Up Bonus

- More Ultimate Chase Rewards

- No Foreign Transaction Fee

- Airport Lounge Access

- Annual Fee

- No 0% Introductory APR

- Balance Transfer Fee

- Chase Restrictions

- Can I get car rental insurance with a Sapphire Reserve card? Yes, you can get car rental insurance with this card if you decline the collision cover of the rental company and pay for the entire cost of the rental car with this card.

- What are Sapphire Reserve card income requirements? There are no transparent income requirements, but it is usually expected that your annual income is at least $30,000 and you may be asked for proof of income.

- How do I redeem cash back? You can redeem your points in a variety of ways through the Chase credit card reward portal. Some of the perks you can get include cash, travel credit, a statement credit, and gift cards.

- What purchases don't earn cash back with the Sapphire Reserve? All purchases will earn you cashback with this card.

- Should You Move to a Sapphire Reserve card? If you travel a lot then this is a great option for you. It's recommended to understand your spending habits and compare the Reserve card with other premium travel cards such as the Amex platinum card.

- Why did Chase deny me? What to Do Next? You might not have met one of its requirements. You will usually find out where you fell short. You might be able to rectify the issue or you might have to look elsewhere.

- How hard is it to get Sapphire Reserve card? It is harder to get this card than some of the other Chase credit cards. However, if you have a credit score of at least 720 then you will be in with a good chance of getting approval.

- How to Use Sapphire Reserve card Benefits? To maximize rewards, you should take advantage of the high dining and travel-related cashback redemption rates and generally use them for these types of expenses.

- Top Reasons NOT to get the Sapphire Reserve card? If you do not travel a lot or you don’t want to pay the large annual fee.

- Does travel rewards points expire? Your points won’t expire once you keep the credit card account open.

- Does it offer pre-approval? Yes, you can get pre-approved for this card.

- What is the initial credit limit? The usual minimum credit limit for this card is $10,000.

- Is there a limit to rewards? No limit

Amazon Prime Rewards Visa Signature

Reward Details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Amazon Prime Rewards Visa Signature Card is one of the best shopping cards available, especially if you're a frequent buyer on Amazon. This card offers an outstanding 5% back on Amazon.com, Amazon Fresh, Whole Foods Market, and Chase Travel purchases. Plus, you’ll get 2% back at gas stations, restaurants, and on local transit, and 1% on all other purchases, making it a suitable choice for commuters and a $0 fee on foreign transactions.

However, warehouse clubs and superstores are not included and you aren't eligible for 0% intro APR period. Overall, the Amazon card is suitable for individuals that buy or purchase their groceries at traditional supermarkets.

- Rewards Plan: 5% back on Amazon.com, Amazon Fresh, Whole Foods Market, and Chase Travel purchases. Plus, you’ll get 2% back at gas stations, restaurants, and on local transit, and 1% on all other purchases

- APR: 19.99% – 28.74% Variable

- Annual Fee: $0 ($139 Amazon Prime subscription required)

- Balance Transfer Fee: $5 or 5%, whichever is greater

- Foreign Transaction Fee: $0

- Sign Up bonus: Get a $200 Amazon Gift Card

- Sign-Up Bonus

- Cash Back at Supermarkets & Gas Stations

- No Annual Fee

- Extended Warranty on Purchases

- Amazon Prime subscription required

- Balance Transfer Fee

- Foreign Transaction Fee

- Minimum Redemption Amounts

Does the card have a rewards limit?

The Amazon card doesn't have a rewards limit, so you can earn cash back on all of your purchases. It has a tiered structure, so even purchases that are not on Amazon can still earn you some cash back.

Does anyone can get the Amazon card?

you’ll need good to excellent credit for the Amazon Prime Rewards card. Although your income will be one of the factors assessed during your application, your credit score will be a more important consideration.

Can you get pre approved

There is no pre approval option for the Amazon Prime Rewards card. This means that you’ll need to complete a full application and this will trigger a hard pull on your credit.

What’s the initial credit limit I'll get?

The Amazon Prime Rewards card has a minimum initial credit limit of $500. The exact amount can be much higher but it mainly depends on your credit score.

How long does approval take?

If you don’t get an instant decision after you submit the online application form for the Amazon Prime Rewards card, you may be waiting two to four weeks.

What are the top reason not to get the Amazon card?

The top reason not to get the Amazon Prime Rewards card is that you don’t tend to spend a lot with Amazon or Whole Foods.

Marriott Bonvoy Boundless® Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

If you're using Marriot frequently or looking for a decent hotel card, the Marriott Bonvoy Boundless® Credit Card may be a perfect match for your needs.

It offers 6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases. and a very attractive sign up bonus of Earn 125,000 Bonus Points after you spend $5,000 on purchases in your first 3 months from your account opening..

However, the card charges $95 annual fee and doesn't offer 0% intro.

- Rewards Plan: 6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases.

- APR: 21.49%–28.49% variable

- Annual fee: $95

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: $0

- Sign Up bonus: Earn 125,000 Bonus Points after you spend $5,000 on purchases in your first 3 months from your account opening.

- 0% APR Introductory Rate period: None

- Sign-up bonus of points:

- Sign-Up Bonus

- Annual Reward

- Ongoing Points Rewards

- Transfer to Airline Points

- Automatic Silver Status

- Chase Restrictions

- Confusing Rewards

- Annual Fee

- No 0% Intro

United Explorer Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The United Explorer Card is a Visa credit card issued by Chase that is an airline-branded card issued by United Airlines. This card is exclusively for United Airlines frequent fliers, and it comes with fantastic perks that make the cardholder's overall travel experience less expensive and much less stressful.

With the United Explorer card, you can earn 2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases. Miles accumulated through use of this card do not expire as long as the account is active. The card has an annual fee of $95 ($0 first year).

- Rewards Plan: 2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases

- APR: 21.49% – 28.49% variable APR

- Annual fee: $95 ($0 first year)

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: $0

- Sign Up bonus: 50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open.

- 0% APR Introductory Rate: N/A

- Free Checked Bag & Priority Boarding

- Annual United Club Passes

- No Foreign Transaction Fee

- Mileage Rewards & Sign-Up Bonus

- Annual Fee

- Balance Transfer Fee

- High APR for purchases

What are the card income requirements?

Chase does not disclose any minimum income requirements. However, Chase will use your income to determine your credit limit, which may require proof of income.

Should you move to the Explorer card?

If you’re a frequent flyer with United, the Explorer card will offer some great rewards. If you’re currently not getting good travel rewards and you want to make the most of your travels, these cards do represent a good option.

What's the rewards limit?

There is no cap on how many miles you can earn in any statement year.

What are the top reasons not to get it?

The Explorer card are specifically designed to offer great rewards for United travel. This does mean that there are not great rewards for other purchases. So, if you’re looking for an all round card for every day purchases, this card are not the right choice for you.

What is the initial credit limit?

The starting credit limit for the United Explorer is $3,000. However, depending on your credit limit and income, your initial credit limit may be higher

Chase Slate Edge

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Chase Slate Edge℠ is a no-annual-fee credit card designed to assist in debt repayment. It offers a 0% introductory APR for 18 month on purchases and balance transfer , with a variable APR of 16.49% – 25.24% Variable thereafter. Notably, cardholders can annually lower their interest rate by 2% by spending at least $1,000 and making timely payments. The My Chase Plan feature allows fixed monthly fee payments for purchases instead of accruing interest.

The card offers several advantages, including no annual fee, an extended 0% intro APR period, the option to reduce your interest rate annually, and credit-building tools like automatic credit limit reviews. However, it does have some drawbacks, such as the absence of a welcome bonus and rewards program. Additionally, it charges a 3% foreign transaction fee on purchases made outside the U.S.

- Rewards Plan: None

- APR: 16.49% – 25.24% Variable

- Annual fee: $0

- Balance Transfer Fee: $5 or 5%

- Foreign Transaction Fee: 3%

- Sign Up bonus: None

- 0% APR Introductory Rate: 18 month on purchases and balance transfer

- No Annual Fee

- Annual Interest Rate Reduction

- My Chase Plan

- Credit Building Tools

- No Welcome Bonus Or Rewards

- Foreign Transaction Fee

- Balance Transfer Fee

Can I lower my interest rate with the Chase Slate Edge℠?

Yes, you can reduce your interest rate by 2% annually by spending at least $1,000 and making timely payments.

Can the card help build credit?

Yes, the card offers credit-building tools, including automatic credit limit reviews.

How can I access credit monitoring services with the card?

Cardholders gain access to credit monitoring services as part of the card's features.

What are the eligibility criteria for an automatic credit limit review?

An automatic credit limit review occurs after spending $500 in the first six months and making timely payments.

Is the Chase Slate Edge℠ suitable for ongoing rewards?

No, the card is more focused on debt consolidation and repayment rather than earning ongoing rewards.

The World of Hyatt Credit Card

Reward details

Current Offer

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

If you like the Hyatt network or tend to visit places where its network covers, the World of Hyatt card is ideal for saving money on hotel accommodations.

Cardholders earn 4 Bonus Points per $1 spent on purchases at all Hyatt hotels. Plus, 5 Base Points from Hyatt per eligible $1 spent for being a World of Hyatt member. 2x Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airline, local transit and commuting as well as fitness club and gym memberships. Plus, earn 1 Bonus Point per $1 spent on all other purchases.. In addition, you can also get an early check-in and a late checkout. This makes hotel stays much more enjoyable, as well as a nice welcome bonus.

It's also a good card for people who want a card they can use anywhere to get free hotel stays and upgraded rooms. However, in order to offset the annual fee ($95) and receive the benefits advertised by the card, you must stay in Hyatt hotels several times per year.

- Rewards Plan: 4 Bonus Points per $1 spent on purchases at all Hyatt hotels. Plus, 5 Base Points from Hyatt per eligible $1 spent for being a World of Hyatt member. 2x Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airline, local transit and commuting as well as fitness club and gym memberships. Plus, earn 1 Bonus Point per $1 spent on all other purchases.

- APR: 21.49%–28.49% variable

- Annual fee: $95

- Balance Transfer Fee: $5 or 5% (whichever is greater)

- Foreign Transaction Fee: $0

- Sign Up bonus: Earn up to 60,000 Bonus Points after qualifying purchases.

- 0% APR Introductory Rate: N/A

- Travel Rewards & Welcome Bonus

- One Free Night Every Year

- Monthly Bonus Category

- Discoverist Status

- Annual Fee

- No Discounts For Multi-Night Stays

- Better For Off Season

Does the Hyatt card have a point rewards limit?

There is no points reward limit on either card, but there is an introductory offer with either card that requires you meet a spending limit to get bonus points.

Can I get car rental insurance?

No, the World of Hyatt card does not offer a car rental insurance.

Can I redeem for flights with airline partners?

World of Hyatt is partnered with 25 airlines including Delta SkyMiles, American Airlines AAdvantage, and British Airways Executive Club. Generally, the transfer rate is a 5:2 ratio. This means that 5,000 points is worth 2,000 of the airline miles, but this can vary depending on the airline miles program

Can I get pre approved?

Typically, Chase does not have pre approval for its cards including the World of Hyatt card. This means that when you complete the online application form, it will trigger a hard credit search.

Does it offer flight cancellation insurance?

No, the World of Hyatt card doesn't offer flight cancellation/interruption or delay insurance.

What are the top reasons not to get it?

If you don’t typically care what hotel you stay in when you are on vacation, you’ll find this card a bit restrictive. In this scenario, you would be better off with a miles or other type of rewards card that allows you to redeem your rewards for flights, hotel stays and other travel perks.

Southwest Rapid Rewards Premier

Reward details

3X points on Southwest® purchases,2X on Rapid Rewards® hotel and car partners, local transit and commuting, including rideshare, internet, cable, phone services, and select streaming and 1X points on all other purchases.

Current Offer

40,000 bonus points after spending $3,000 on purchases in the first 4 months.

Credit Rating

Annual Fee

0% Intro

APR

- Overview

- Features

- Pros & Cons

- FAQ

The Southwest Rapid Rewards Premier Credit Card occupies a mid-tier position within Southwest's credit card lineup. Despite the general limitations of airline credit cards, this particular card stands out for its absence of foreign transaction fees and a notableanniversary bonus points, which helps offset its $99 annual fee.

The card's earning structure earns 3X points on Southwest® purchases,2X on Rapid Rewards® hotel and car partners, local transit and commuting, including rideshare, internet, cable, phone services, and select streaming and 1X points on all other purchases.. The current welcome bonus includes 40,000 bonus points after spending $3,000 on purchases in the first 4 months..

The straightforward redemption process for Southwest Rapid Rewards points, along with no change or cancellation fees, makes this card particularly user-friendly. However, the Southwest Premier Card’s earning structure is heavily focused on Southwest purchases, which may limit its appeal. Additionally, it doesn’t offer the premium travel perks found on many general travel cards.

- APR: 20.99% – 27.99% variable APR

- Annual fee: $99

- Balance Transfer Fee: $5 or 5% (whichever is greater)

- Foreign Transaction Fee: $0

- Rewards Plan: 3X points on Southwest® purchases,2X on Rapid Rewards® hotel and car partners, local transit and commuting, including rideshare, internet, cable, phone services, and select streaming and 1X points on all other purchases.

- Sign Up bonus: 40,000 bonus points after spending $3,000 on purchases in the first 4 months.

- 0% APR Introductory Rate period: N/A

- Redemption Flexibility

- EarlyBird Check-Ins

- Companion Pass Eligibility

- Limited Perks

- Limited Bonus Categories Compared To Other Travel Cards

- Lack of Travel Protections

How does the Companion Pass work with this card?

Points earned on the card contribute towards the qualifying points needed to earn the Southwest Companion Pass.

Can points be redeemed for merchandise or gift cards?

Yes, although the best value typically comes from using points for Southwest flights.

Are there any restrictions on the welcome bonus?

You cannot earn the bonus if you currently have any personal Southwest card or have earned a sign-up bonus on a personal Southwest card in the past 24 months.

Does the card offer travel protections?

While it offers some benefits, it has fewer travel protections compared to other Chase cards.

The Different Chase Credit Card Types

Chase offers a number of card options in a variety of categories.

1. Rewards

Chase has numerous reward card options. These offer generous rewards for your every day spending. The options include:

Chase Sapphire Preferred (Best for value for money)

While the Chase Sapphire Preferred card has a $95 annual fee, it's one of the best travel cards available in the market that can be relevant mainly for everyday purchases but also for travel. You can also receive 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

The attractive rewards plan includes 5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases. .

Chase Sapphire Reserve (Best for travel)

The Chase Sapphire Reserve card has a higher annual fee ($550), but if you travel a lot – you may cover this fee since the card offers a lot of benefits and special perks for travelers.

You can earn 5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.. Additionally, new cardholders get 60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening.

2. Cash Back Cards

In addition to point rewards, Chase offers some great options for cash back cards:

Chase Freedom Flex℠ (Best for Rotating Categories)

This offers the same introductory bonus and 0% APR intro rate. However, the reward categories are a little more flexible.

You can earn .

Chase Freedom Unlimited (Best for everyday spending with no annual fee)

The Chase Freedom Unlimited card has no annual fee and provides 5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases.

There is also a introductory bonus of Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening. and 0% APR for 15 months on purchases and balance transfers. This makes it a great option for those who enjoy travel, but also want to earn rewards in other categories.

3. Airline Cards

Airline cards are a great option for frequent travelers. Chase is partnered with more airlines to provide some great rewards on your travel.

United℠ Explorer Card

The United℠ Explorer Card is a Visa credit card issued by Chase, an airline-branded card issued by United Airlines. This card is exclusively for United Airlines frequent fliers, and it comes with fantastic perks that make the cardholder's overall travel experience less expensive and much less stressful.

Cardholders earn 2x per $1 spent on United purchases, hotel accommodations, restaurants & eligible delivery services and 1x per $1 spent on all other purchases, as well as a sign up bonus of 50,000 miles after you spend $3,000 on purchases in the first 3 months your account is open.. There is no foreign transaction fee, but there is an annual fee of $95 ($0 first year).

Southwest Rapid Rewards Plus

The Southwest Rapid Rewards Plus offers 2X points on Southwest purchases, Southwesthotel and car rental partners, local transit and commuting (including ride-shares),internet, cable, phone and select streaming services, and 1X points on all other purchases.

New account holders can earn up to 40,000 points after spending $1,000 on purchases during the first three months. Also, cardholders get special perks such as free first two checked bags and two EarlyBird Check-In®s per year. The Annual fee is $69 .

United Club℠ Infinite Card

The United Club℠ Infinite Card is a luxury travel card for frequent United flyers and is considered the most premium card of United. There are many rewards and perks available, while the basic rewards model includes 4x miles on United Airlines purchases, 2x miles on all other travel purchases, dining and eligible delivery services and 1x miles on all other purchases.

Additional perks include automatic Platinum Elite status with the IHG portfolio of properties, access to United Club and Star Alliance Lounges, free first and second-checked bags on United flights, and a fee credit of up to $100 for Global Entry or TSA PreCheck. Also, there is a sign up bonus of 90,000 bonus miles after qualifying purchases.

However, potential cardholders should make sure they can cover the high annual fee ($525).

4. Hotel Cards:

If your travel is road based and involves hotel stays rather than flights, Chase has some great hotel card options.

Marriott Bonvoy Boundless

The Marriott Bonvoy Boundless card is one of the best hotel cards, especially if you're a Marriot fan. While it has $95 annual fee, it allows you to earn unlimited Marriott Bonvoy points to earn free stays. You’ll earn 6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases..

New cardholders can also accumulate .

World of Hyatt

Chase World of Hyatt card is another decent hotel card with many perks and options to earn free nights. The basic rewards model includes 4 Bonus Points per $1 spent on purchases at all Hyatt hotels. Plus, 5 Base Points from Hyatt per eligible $1 spent for being a World of Hyatt member. 2x Bonus Points per $1 spent at restaurants, on airline tickets purchased directly from the airline, local transit and commuting as well as fitness club and gym memberships. Plus, earn 1 Bonus Point per $1 spent on all other purchases.. The annual fee stands on $95.

Every year after your cardmember anniversary, you will receive one free night at any Category 1-4 Hyatt hotel or resort. In addition, if you spend $15,000 during your cardmember anniversary year, you will receive another free night. One of the most valuable perks offered by the best hotel credit cards is free night awards, and you can get up to two with this Hyatt card. Also, new cardholders get Earn up to 60,000 Bonus Points after qualifying purchases.

IHG One Rewards Premier

The IHG One Rewards Premier Credit Card offers a great rewards rate on all IHG purchases, as well as other fantastic benefits for IHG customers who travel frequently. IHG owns a large hotel chain that includes Holiday Inn, Crowne Plaza, StayBridge Suites, and others.

The card offers Up to 10X points from IHG® on stays for being an IHG One Rewards member. Up to 6X points from IHG® on stays with Platinum Elite Status. 5X total points on travel, dining, and at gas stations and 3X points per $1 spent on all other purchases., as well as a sign up bonus of 140,000 Bonus Points after spending $3,000 on purchases in the first 3 months from account opening. However, there is an annual fee of $99 .

5. Membership Shopping Cards

In addition to the categories above, you can find cards that can be relevant for specific shopping habit such as Disney fans, Amazon shoppers and Starbucks loyal customers:

Amazon Prime Rewards Visa

The Amazon Prime Rewards card is one of the best shopping cards available, and if you're a frequent buyer on Amazon – it can be a great fit for your needs.

Cardholders can enjoy 5% back on Amazon.com, Amazon Fresh, Whole Foods Market, and Chase Travel purchases. Plus, you’ll get 2% back at gas stations, restaurants, and on local transit, and 1% on all other purchases. Also, new cardholders can earn Get a $200 Amazon Gift Card. The annual fee is $0 ($139 Amazon Prime subscription required).

Disney® Premier Visa® Card

The Disney Premier Visa Card is designed for people who are passionate about Disney and want to receive benefits related to Disney locations and merchandise. The Disney Premier Visa may be a good card for those who want to redeem their rewards primarily for Disney properties such as Disney locations, movies, and merchandise.

The card offers

Earn 5% in Disney Rewards Dollars on card purchases made directly at DisneyPlus.com, Hulu.com or ESPNPlus.com. 2% in Disney Rewards Dollars on card purchases at grocery stores, restaurants, gas stations and most Disney locations, 1% on all your other card purchases

, while earned rewards can be applied to Disney vacations, Disney movies, and other purchases. The annual fee is $49, and new cardholders can get $400 Statement Credit after you spend $1000 on purchases in the first 3 months from account opening..Chase also offers a number of business card options.

Top Offers

Top Offers

Top Offers From Our Partners

What Credit Score Will You Need For Chase Credit Cards?

Your eligibility for any credit card hinges significantly on your credit score. Generally, the premier Chase credit cards, known for their lucrative rewards, necessitate a good or excellent credit score for approval, typically requiring a score of 690 or higher.

However, a notable exception to this rule is the Freedom Student card. Specifically tailored to assist students in establishing credit while enjoying rewards, this card boasts more lenient eligibility criteria. Although it often comes with an initially modest credit limit, diligent payment habits can lead to a credit limit increase after consistently making five monthly payments on time. Additionally, Chase provides a $20 bonus on each account anniversary for up to five years.

Setting Chase apart from many other credit card issuers is its provision of access to your free credit score. Through your account, you can log in at any time, day or night, gaining 24/7 access to monitor your credit score. This feature empowers you to make informed decisions about which credit cards are within your reach.

How Do Chase Points Reward Offers Work?

Some Chase cards offer points rewards rather than a percentage of cash back. This type of reward works on the same principle as cash back. You’ll receive a specific number of points for purchases in certain categories. So, you could earn 1 to 5 points for each $1 you spend.

In many cases, you can also redeem your points as statement credit or a check. However, the specialized cards typically offer greater incentives when spending your points. For example, the hotel cards allow you to exchange your points for free nights stays, while the airline cards allow you to claim free travel.

This can be more appealing for those who enjoy specific activities or brands. So, if your family loves Disney, the prospect of earning Disney dollars for your spending could be very attractive. Alternatively, if you can’t live without your daily Starbucks coffee, the Starbucks card allows you to earn bonus points on your Starbucks purchases. You’ll also earn Barista Picks at participating stores 8 times per year. So, you can enjoy specially chosen food and drink items.

Chase Redemption Options

Chase has a superb cash back program where you can earn a percentage back on your purchases. Depending on the card option, you could earn up to 5% on spending in certain categories. However, the lowest cash back tier is 1%. You can choose a card that maximizes your cash back benefits, so you can earn the most on your every day or frequent spending.

The rewards redemption is flexible. You can redeem it in a number of ways including:

- Credit on Your Statement: You can use your cash back to help to pay down the balance on your credit card. Once you accumulate credit, you can request a statement credit to be applied to your next bill.

- Online purchases: You can also use your cash back to help pay for purchases with online retailers or travel booking websites.

- Check: If you prefer, you can opt to receive your cash back as a check mailed to your home or a direct deposit into your bank account.

- Gift Card: You can also visit the rewards portal to exchange your cash back for gift cards for restaurants, department stores, or other popular brands.

Chase Rewards Program - What You Should Know?

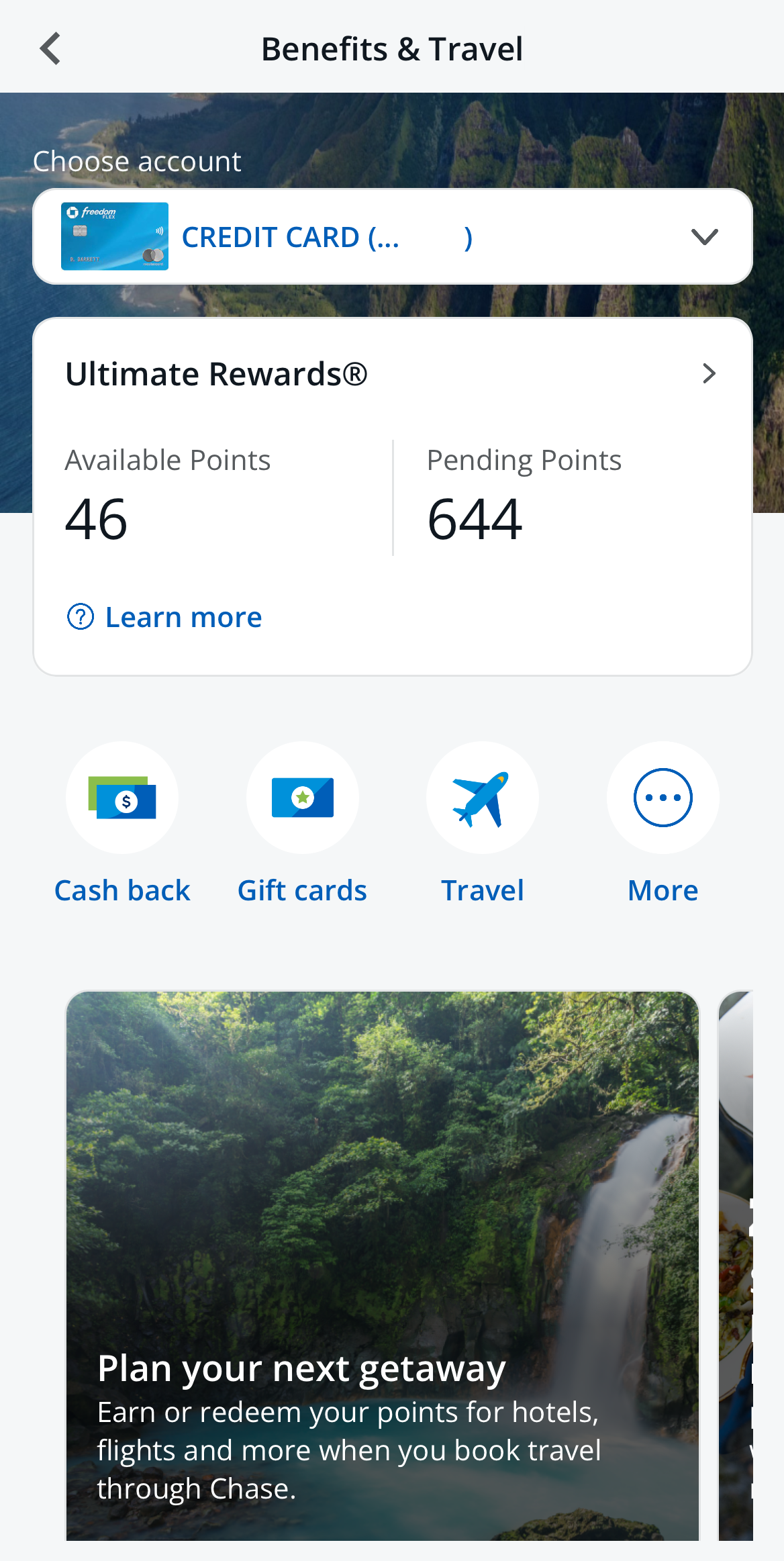

The Chase Ultimate Rewards Program allows you to maximize the benefits of the points you earn on your Chase credit card. You can earn bonus points on selected purchases or redeem your points for cash, gift cards, travel, and more.

So, even if you have not opened up a cash back card, you can transform your rewards into direct deposits into your bank account or statement credit. You can also transfer your points to travel partners with a 1:1 value.

However, the rewards program goes further. You can use your points and card to attend exclusive events that are tailored to your passions and interests. Alternatively, you can use your points to pay for part or all of your Amazon order, Apple purchase, or choose from more than 150 gift card options. There is even the possibility to earn up to 15 bonus points when you shop through Chase at over 350 stores.

Account holders can access the Ultimate Rewards portal on the Chase website or Chase mobile app. You’ll need to sign in using your username and password to see the available offers and deals. Once you’re logged in, you will see a drop down menu with the redemption offers.

This can make an interesting addition to your account, so you can tailor your rewards to your current interests and preferences.

Top Offers

Top Offers From Our Partners

Chase Redemption Options

Chase offers some great redemption options for your cash back and rewards. From statement credit and check payments to gift cards and online spending. There are even specific redemption options for specialist cards, to maximize your rewards. You can simply choose the redemption option that best suits your current requirements.

However, what makes Chase interesting is that the bank maintains a cash back calendar for cardholders to earn 5% cash back in certain categories each quarter. You’ll earn the cash back on eligible categories within rotating categories with a list of merchants that change each quarter.

The great thing is that you don’t have to activate the categories before the start of the quarter. You can activate quarter one from December 15 right up to March 14. All you need to do is click “Activate Now” on the categories page when you log into your account. Additionally, you can still earn 5% cash back even if you forgot to activate before you made a purchase, providing you activate before the quarter deadline.

How to Maximize Chase Rewards?

If you want to maximize your Chase rewards, one of the best options is to transfer your points to one of the list of travel partners. The list of Chase travel partners includes over a dozen hotel and airline programs. This includes:

- Aer Lingus AerClub

- British Airways Executive Club

- JetBlue TrueBlue

- Emirates Skywards

- Southwest Airlines Rapid Rewards

- Virgin Atlantic Flying Club

- United Airlines MileagePlus

- World of Hyatt

- IHG Rewards Club

- Marriott Bonvoy

You’ll receive a 1:1 ratio with increments of 1,000 points. While the value of the partner points will vary, generally, you may get 2 cents per point when you redeem for award flights.

For example, if a business class one way flight from LA to New York on United Airlines costs $725, you may be able to get the same flight for 38,000 points. This equates to 1.9 cents for each point if you transfer to United Miles.

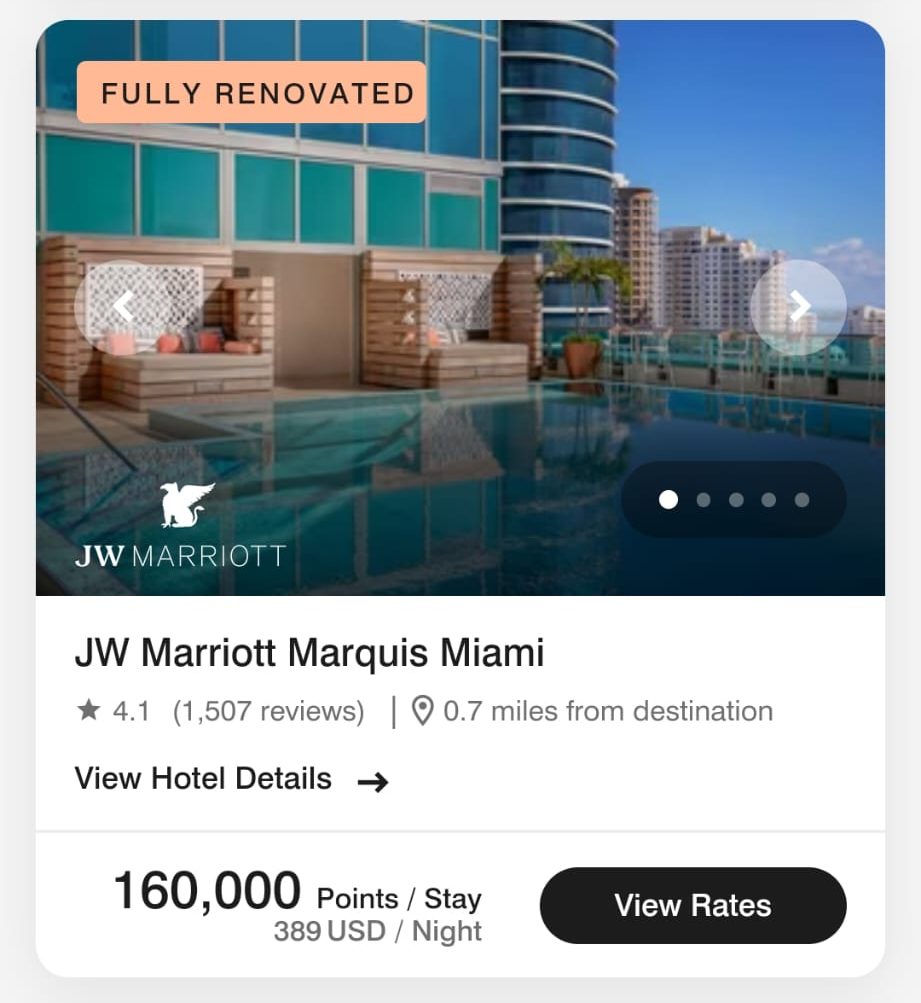

Another option to maximize your rewards is to use them to book hotels, rental cars, or experiences directly through the Ultimate Rewards portal. You can simply search for your dates to see the cash prices and corresponding cost in points for almost every major hotel group, car rental company, or major airline.

The per point value when you redeem through the portal will depend on your specific credit card, but you can get as much as 1.5 cents per point.

As an example, if a hotel room would cost you $199 in cash, you can book it for 15,920 points if you have a Chase Sapphire Preferred card.

You can also use your points for Apple or gift card purchases, but this may not be your best use of points. You’re likely to get a flat rate of 1 cent per point. However, if you’re not interested in travel, this can be a good way to get gift cards for your favorite brands.

Other Benefits of Having a Chase Card

In addition to offering rewards and the reassurance of the Chase brand name, there are some other benefits of having a Chase card. These include:

- Travel Insurance: Many Chase travel cards also offer you travel insurance. This can provide compensation for rental car collision damage, flight cancelations, and emergency care abroad. Check your cardmember agreement to check the redeeming protections practices and eligibility.

- Travel Upgrades: Some cards also offer flight and hotel room upgrades. You may also enjoy free checked bags, complimentary in flight meals, or hotel breakfasts.

- Theft and Damage Protection: While most retailers offer insurance, if this doesn’t apply to your purchase, you may be able to obtain theft and damage protection through your Chase credit card. You will need to have purchased the item using your credit card and meet the card requirements. However, Chase can provide information on eligibility and guide you through filing a claim.

- Fraud Protection: Fraud is a major concern for many people today, particularly when you are making online purchases. Many Chase cards offer fraud protection, so you can enjoy protection against unauthorized activity on your account.

- Price Protection: You may also enjoy price protection with your Chase card. This allows you to receive a reimbursement if an item you recently purchased is discounted in price.

- Return Protection: If a retailer does not offer reimbursement, you may be able to obtain return protection with your Chase card. However, there may be limitations or exclusions depending on your cardholder agreement.

How Many Chase Credit Cards Can I have at One Time?

Chase doesn’t actually publish their official rules on how many cards you can have at one time. There are a number of factors that will influence Chase’s decision. You may be restricted by the amount of credit Chase is willing to extend, your income, debt level and credit score.

It is not unusual for consumers to have five or six Chase cards. However, there are some unofficial rules that will influence whether you will receive approval for multiple cards. For example, it is unlikely that you will be approved for more than two Chase cards in 30 days. If you require a business card, you may only receive approval for one personal and one business card in a 90 day period.

Like most lenders, Chase is sensitive to multiple, recent applications. So, it is a good idea to space out your applications to every 3 to 6 months. Additionally, Chase may not approve your application if you’ve opened 5 or more cards from different banks within the last 24 months.

How Do I Cancel a Chase Credit Card?

Chase allows you to cancel your card by calling the Chase toll free number or signing on to your account online. Within your personal account, you can select the Credit card section and select the card you want to cancel. You will then need to fill in a brief reason why you would like to cancel the card.

Remember, you will need to pay any outstanding balance before you cancel the card. It is also a good idea to use or transfer all your current points, or you will lose them. Within a short time, you’ll receive a message confirmation, and you should have an email within 24 hours. This is usually a standard email letting you know Chase is sorry you want to close your card account and confirming your request has been actioned.

Then it’s done; your Chase credit card is canceled.

Top Offers

Top Offers

Top Offers From Our Partners

How We Picked The Best Chase Credit Cards: Methodology

To select the best Chase credit cards, our team thoroughly researched various offerings from Chase, analyzing their features and benefits across two key categories:

Rewards Program (50%): We evaluate the rewards structure, including the type of rewards offered (points, cash back, or miles), earning rates per dollar spent, bonus categories for accelerated rewards, and flexibility in redemption options. Chase cards with generous rewards rates, diverse redemption choices, and valuable sign-up bonuses receive higher scores in this category.

Card Features & Benefits (50%): This category assesses additional features that enhance the overall value of the card, such as introductory APR offers, absence of foreign transaction fees, complimentary airport lounge access, travel credits, purchase protection, and extended warranty coverage. Chase cards offering a wide range of benefits without excessive fees earn higher scores.

This comprehensive evaluation ensures that the best Chase credit cards offer valuable rewards, benefits, and a seamless user experience while maintaining a positive reputation, catering to the preferences of cardholders seeking Chase products.