Table Of Content

A checking account makes it simple to access your money for daily transactions while keeping it safe. Typically, customers can pay their bills or make purchases using a debit card or a cheque.

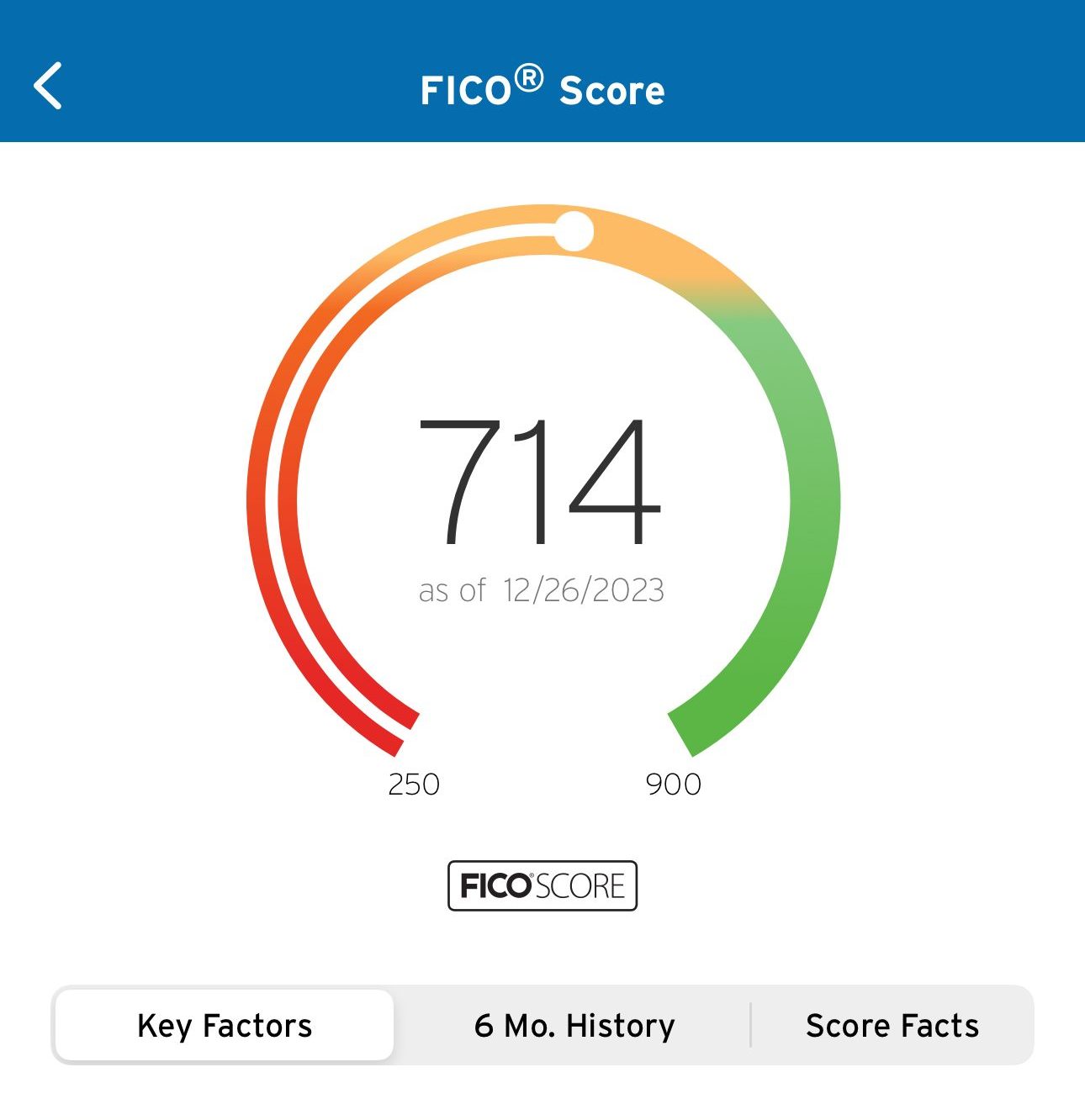

Effective account management lets you keep track of your account and prevents extra charges. If you have difficulties maintaining enough funds in your account to cover your payments and withdrawals, it may affect your credit if the bank closes your account.

Here are the eight tips for managing your checking account:

1. Avoid Monthly Fees

Monthly management fees or service fees are one of the most common banking fees in the past. However, during the last couple of years, we have seen more and more banks eliminate this fee.

It's mainly relevant for online banks since they don't need to operate branches and extra stuff. On the other hand, many banks charge monthly maintenance fees for checking accounts, which can be avoided if certain conditions are met

The monthly maintenance fees can be waived if you maintain the minimum monthly balance necessary. Here are examples of some of the largest banks in the US:

As we can see, traditional banks such as Bank of America, Chase, and Citi still charge a monthly maintenance fee. As discussed, one of the main benefits of online banks such as Capital One 380 and Discover is the low fees they can offer to the customers

Bank/institution | Monthly Fee | Bank Type |

|---|---|---|

Bank of America Advantage Plus Checking | $12

can be waived by maintaining an account balance of $1,500, qualifying deposit of $250+ per month or enrol in Preferred Rewards

| Traditional |

Chase Total Checking® | $12 ($15, effective 8/24/2025)

Can be waived if you maintain a $1,500 minimum daily balance, making direct deposits or Associated SnapDeposits of $500 or more per statement cycle, or holding $5,000 in combined deposit accounts with the same statement cycle date or having a Health Savings Account or investment account

| Traditional |

Citi Checking Account | $12

Can be waived if you make one qualifying direct deposit and one qualifying bill payment per statement period, maintain a combined balance of $1,500 per month across your eligible accounts or if you’re aged 62

| Traditional |

PNC Standard Checking | $7 – $25 per month

can be waived if you maintain $500+/$2,000/$5,000 direct deposit per month, $500+/$2,000/$5,000 monthly balance in savings or age 62+/$10,000 in all PNC consumer deposit accounts/$25,000 in all PNC consumer deposit accounts/

| Traditional |

U.S. Bank Checking | $6.95

Can be waived by maintaining an average account balance of $1,500, have $1,000+ in direct deposits per month or be aged 65+

| Traditional |

Wells Fargo Everyday Checking | $10

Related to Wells Fargo Everyday Checking. The fee can be waived if you maintain a minimum daily balance of $500 or receive at least $500 in qualifying direct deposits per month. The fee is also waived if you’re 17 to 24 and have a linked Wells Fargo Campus Debit Card or Campus ATM card linked to the checking account

| Traditional |

Capital One 360 Checking | $0 | Online Only |

Amex Rewards Checking | $0 | Online Only |

SoFi Bank | $0 | Online Only |

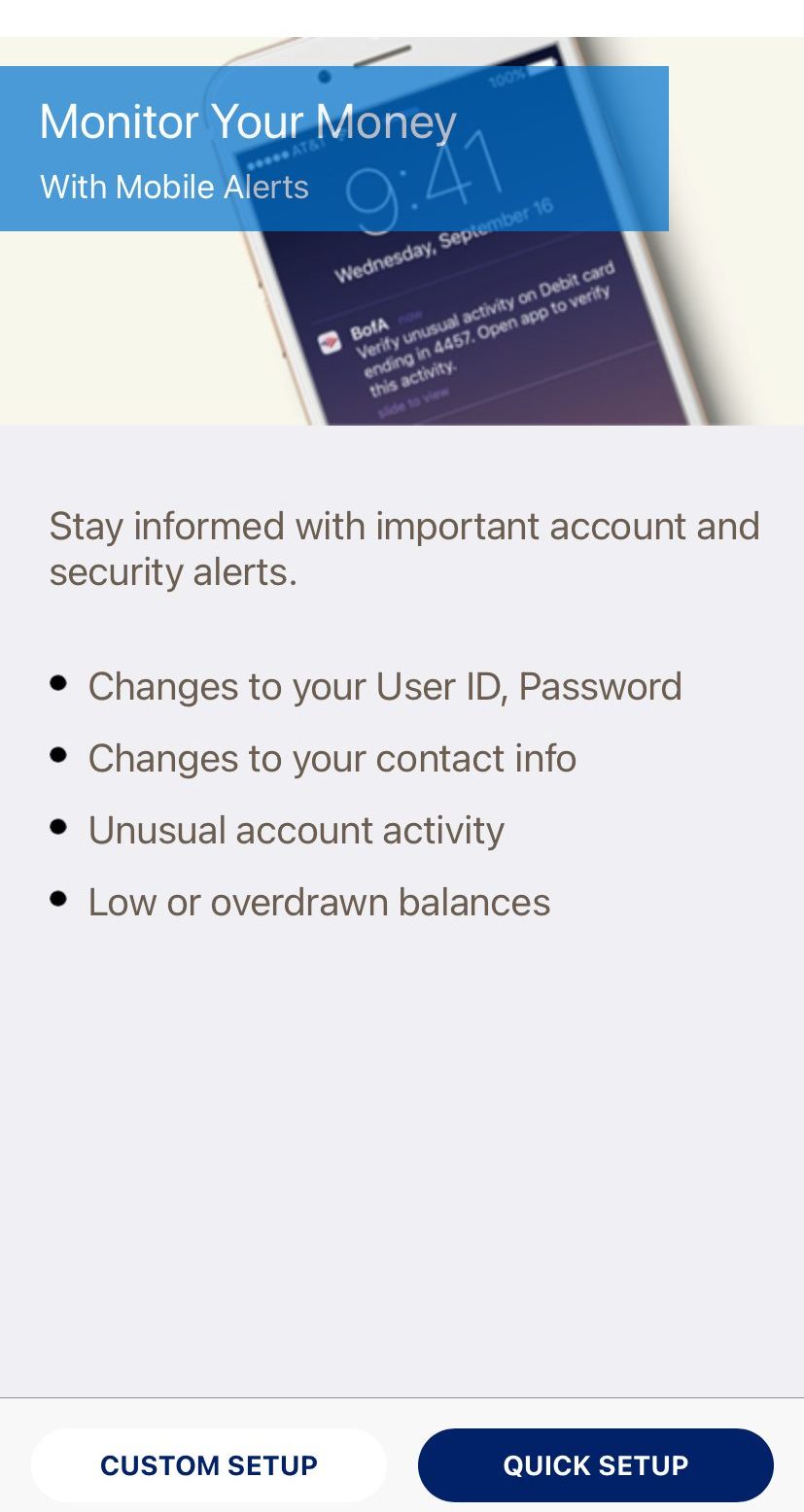

2. Leverage Mobile Banking

A mobile banking app is a convenient, safe option with many sophisticated features. If you use mobile banking, you may effortlessly monitor your bank account whenever and wherever you like. In addition, you may quickly pay bills, deposit checks, create notifications, and move money across accounts with just a few clicks.

The benefits of using the mobile app are:

- All-time access: You can always access your bank with internet banking or a mobile banking app, unlike a bank branch. Without any complications, you can transfer money at any time and from any location. It helps you save a tonne of time and work.

- Account history: You can see your bank account history in addition to carrying out financial activities using a mobile banking app. It can help you track your spending.

- Locate nearby ATM: Your mobile banking app can find the nearest ATM and branch. This feature can be extremely helpful if you need to get cash quickly, especially if you are in a neighborhood or city you don't know.

3. Use Automation to Avoid Fees & Save Money

Automating your finances is one of the fastest ways to keep track of your checking account. Setting up direct deposit with your employer, signing up for automatic transfers, and setting up bill-pay are all great ways to save time and stress.

Automatic transfers make it easier to save money instead of spending it, and bill-paying is a great way to know where your money is going. This gives you peace of mind since your bills will always be paid on time and accounted for.

For example: If you set up direct deposit, you will be eligible for various benefits, such as saving time, avoiding the hassle of dealing with your paychecks, enhancing the safety of your payments, and many more.

4. Monitor Your Balance

Keeping a constant eye on your balance is an excellent method to manage your checking account and a good strategy to secure your account.

This can assist you with activities such as budgeting for infrequent and unexpected costs. Monitoring your account might help you avoid additional penalties by keeping your balance from falling below zero.

Here are some ways to track your balance:

- Check online: You can check your bank balance on your mobile phone, online, or through your bank's app. You can quickly check your bank balance before writing a check or making a large payment.

- Alerts: Signing up for text or email transaction alerts will help you keep track of your transactions. Low balance warning alerts will assist you in avoiding additional fees.

- Physically visit: You can ask a bank teller at your bank to tell you your account balance. You can also check your account balance at an ATM nearby.

If your account balance suddenly drops or you notice any other unusual activity, it may be a sign of fraud. Alerting the bank immediately of any suspicious activity can reduce your potential loss and prevent further theft from occurring.

5. Take Advantage Of Checking Account Benefits

It may be worthwhile to sign up for an account that provides discounts if you are a customer of a particular retailer who makes frequent purchases from that store.

Or, if you make regular trips to deposit cash on ATMs or withdraw, it might be worthwhile to look for a checking account that would compensate you for the costs charged by third-party ATMs.

- Security: Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Association (NCUA) protects checking accounts. Safety features like Buyers Protection will help you with your purchases when you have a checking account.

- Save money: Fees for cashing checks, using ATMs, and not paying bills on time all add up. Fees can be avoided, and money can be saved using checking account services like direct deposit and automatic bill pay.

- Other products: When you open a checking account at a credit union or a bank, you are given access to other financial services offered by the institution. Discounts on loans, access to certificates of deposit accounts, and various tools for financial planning may all be included in the services.

6. Consolidate Multiple Accounts

Suppose you have multiple checking accounts opened for various reasons, such as rewards, school, and other reasons. In that case, it may be beneficial to simplify your financial situation by merging your checking accounts into a single primary checking account. In this manner, all you will need to do to keep track of your finances is log into a single checking account.

Managing your finances across various accounts may be a hassle, especially if you have a lot of online banking and bill-paying going on at once. You are additionally, having fewer account balances to monitor decreases the likelihood of incurring fees.

Other things, like reward redemptions, lower fees, and better rates, also affect the trend of banks merging. Sellers say that it's essential to bank with a place that will help you grow financially over time. After all, you want to put all your money in one bank that will make it work better.

7. Don't Maintain High Balance With Low Interest

When an account is carefully managed, checking can be an excellent location to keep the money for routine purchases (food, gas, entertainment, bills, etc.). While all of this is true, an account with the potential for interest and growth can also be a valuable resource for both short-term and long-term savings.

Moving money between your checking and savings accounts at the same bank is straightforward. If you're saving for a specific expense, such as a spring break vacation or the security deposit for your new apartment, consider setting up automatic transfers to your savings account each month when you know you have a certain amount of money in your checking account.

If you keep too much money in your checking account, you might miss out on the chance to get more out of your money with one of the high-rated savings accounts. In particular, you could have made more money with that money! You may find better ways to make your money work as you balance your bank account.

For example, here are some of the best rates you can get on savings or CDs:

Bank/institution | APY Savings | APY CDs | |

|---|---|---|---|

| Citizen Access | 3.50% | 3.45% – 5.00% |

| Capital One | 3.50% | 3.50% – 4.00%

|

| Discover | 3.50% | 2.00% – 4.00%

|

| American Express | 3.50% | Up to 4.00% |

| Ally Bank | 3.40%

| 2.90% – 3.90% |

| SoFi | up to 4.50%

| / |

8. Avoid Overdraft Fees

Overdraft fees are charged when you use more than your bank account has. If you don't take care of overdraft fees, they can quickly add up and hurt your finances. Most banks charge a fee per instance, which means you can be assigned multiple overdraft fees in a single day.

You can choose bank accounts that do not charge an overdraft fee and link your other accounts, so if your account drops below zero, an automatic payment will be made from the connected account.

When you use your associated debit card to withdraw cash from certain types of ATMs, it may assess an additional cost. Choose an ATM from your bank that doesn't impose additional fees if you can; using an out-of-network ATM can result in additional charges.

Bank/Institution | Overdraft Fee |

|---|---|

Chase | $34 |

PNC Bank | $36 |

Bank of America | $10 |

Capital One | $0 |

Wells Fargo | $34 |

Discover | $0 |

Citibank | $0 |

US Bank | $36 |

TD Bank | $35 |

Bottom Line

To be financially healthy, you must take good care of your checking account. Good account management helps you avoid fees you don't need and keeps your account in good shape.

Your bank or credit union may shut your account and file a report on you with a credit reporting firm if you have difficulties retaining enough money in your account to meet payments or withdrawals. You need to change the habits that are making you poor, and you need to look at your finances.

You can make a system that works for you and your money, whether you close accounts or open new ones.