Rewards Plan

Welcome Bonus

Our Rating

0% Intro

Annual Fee

APR

- 0% Intro APR

- No Annual Fee

- No Transfer Partners

- No Bonus for Travel-related Spending

Rewards Plan

4x points at restaurants, take-outs & deliveries, 2x points at supermarkets, gas stations & streaming servicesm and 1 point for 1 dollar on all other purchases

Sign up Bonus

Our Rating

PROS

- 0% Intro APR

- No Annual Fee

CONS

- No Transfer Partners

- No Bonus for Travel-related Spending

APR

18.24% - 28.24% Variable

Annual Fee

$0

0% Intro

12 billing cycles on purchases and balance transfers

Credit Requirements

- Our Verdict

- FAQ

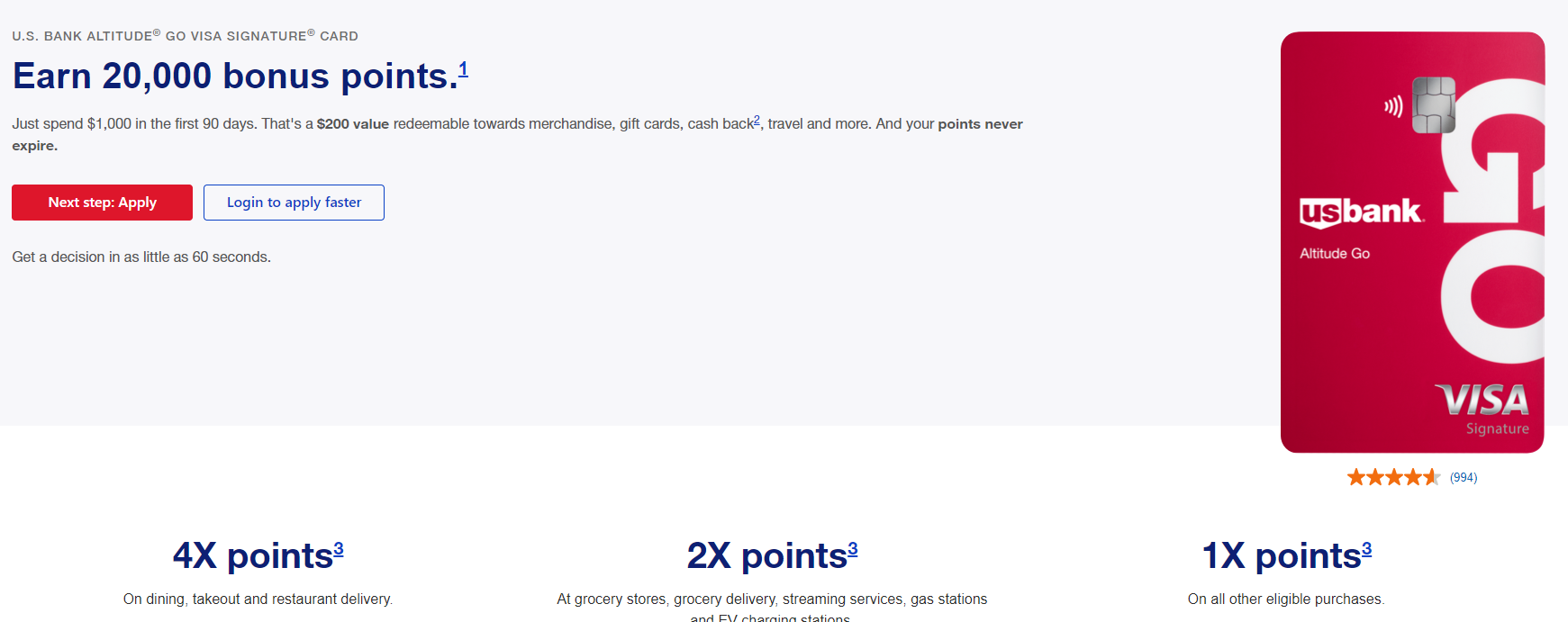

The U.S. Bank Altitude® Go Card is a no-annual-fee credit card that focuses on rewarding everyday spending, particularly in categories like dining, grocery stores, streaming services, and gas stations.

Cardholders can earn 4x points at restaurants, take-outs & deliveries, 2x points at supermarkets, gas stations & streaming servicesm and 1 point for 1 dollar on all other purchases . Also, new cardholders can get a nice sign up bonus of Earn 20,000 bonus points after spending $1,000 in the first 90 days of card opening.

There is a 0% introductory APR for 12 billing cycles on purchases and balance transfers, then 18.24% – 28.24% Variable. Lastly, cardholders do not have to worry about annual fees or charges for shopping from international merchants because both are fixed at zero dollars.

Despite its rewards, the card has limitations. While points can be redeemed for airfare, hotel rooms, gift cards, or statement credits, the lack of options like transferring points to airlines or hotels restricts its appeal to frequent travelers.

Cardholders enjoy perks like no foreign transaction fees, car rental discounts, and Visa Signature benefits. The welcome offer, rewards structure, and redemption options are assessed as typical, making it a decent choice for those who prioritize dining rewards and want a card with no annual fee. However, it may not be the best fit for those seeking more travel flexibility or premium perks.

How can I redeem the reward points earned with this card?

Points can be redeemed for airfare, hotel rooms, gift cards, or statement credits through the U.S. Bank rewards center.

Are there restrictions on how I can use my points for travel?

While points can be used for various travel expenses, there are no options for transferring points to airline or hotel loyalty programs.

Can I redeem points instantly after making a purchase?

Yes, with Real-Time Rewards, cardholders can be notified on their mobile device when they have enough points to cover a purchase and redeem them immediately.

How does the Rewards Center Earn Mall work?

The Rewards Center Earn Mall allows cardholders to boost rewards by shopping through the issuer's online portal, offering additional points based on current offers from retailers.

Is there a balance transfer fee for this card?

Yes, there is a balance transfer fee of 3%.

Can I combine rewards from the U.S. Bank Altitude Go Card with other U.S. Bank cards?

Rewards from the U.S. Bank Altitude Go card cannot be combined with the Altitude Reserve card but can be combined with the U.S. Bank Altitude® Connect Visa Signature® Card.

Do points earned with this card expire?

No, as long as your account is open, U.S. Bank Altitude Go card points do not expire, providing flexibility in redeeming them over time.

Pros & Cons

Let’s take a look at the pros and cons of the Altitude Go Card and see if it’s the right one for your wallet or not.

Pros | Cons |

|---|---|

No Annual Fee | No Transfer Partners |

0% Intro

| No Bonus for Travel-related Spending |

Dining, Gas & Grocery Rewards | Balance Transfer Fee |

Flexible Redemption Options | |

Real-Time Rewards | |

No Foreign Transaction Fees |

- No Annual Fee

The U.S. Bank Altitude® Go Card stands out for its lack of an annual fee, providing cardholders with unlimited rewards without an additional cost.

- 0% Intro

Purchases and balance transfers enjoy a zero percent rate on transactions during the first twelve billing cycles; however, balance transfers enjoy this rate for a maximum of sixty days. Then, the APR will be 18.24% – 28.24% Variable.

- Dining, Gas & Grocery Rewards

The card offers 4x points at restaurants, take-outs & deliveries, 2x points at supermarkets, gas stations & streaming servicesm and 1 point for 1 dollar on all other purchases

- Flexible Redemption Options

Cardholders can redeem points for airfare, hotel rooms, gift cards, or statement credits, providing flexibility in how they utilize their rewards.

- Real-Time Rewards

Cardholders can instantly redeem points for purchases using the Real-Time Rewards feature, offering immediate value and convenience.

- No Foreign Transaction Fees

For travelers, the absence of foreign transaction fees makes this card a cost-effective choice for international spending.

- No Transfer Partners

The absence of transfer partners for airline or hotel programs restricts options for those who prefer to leverage points across various loyalty programs.

- No Bonus for Travel-related Spending

Unlike some other travel cards, the U.S. Bank Altitude® Go Card does not offer bonus points for airfare purchases, hotel bookings, or other travel-related categories.

- Balance Transfer Fee

Although the card provides a 0% intro APR for balance transfers, a 3% applies, which may deter individuals seeking to transfer balances without additional costs.

Top Offers

Top Offers

Top Offers From Our Partners

Rewards Simulation: How Much You Can Earn?

The best way to determine if the Altitude card is a good fit for you is to calculate the rewards and benefits you expect to earn.

Remember, this is just a general breakdown, so be sure to adjust it based on your personal spending habits and preferences.

| |

|---|---|

Spend Per Category | Altitude® Go Visa Signature |

$15,000 – U.S Supermarkets | 30,000 points |

$3,000 – Restaurants

| 12,000 points |

$6,000 – Rotating Categories | 6,000 points |

$3,000 – Hotels | 3,000 points |

$4,000 – Gas | 8,000 points |

Total Points | $59,000 points |

Estimated Annual Value | ~ $885 |

Where to Redeem Your Rewards?

U.S Bank Altitude cardholders earn 4x points at restaurants, take-outs & deliveries, 2x points at supermarkets, gas stations & streaming servicesm and 1 point for 1 dollar on all other purchases .

With this card, you have several redemption options. The Real Time Mobile Rewards feature, which you can enable on your account, is one of the most adaptable.

When you make a qualifying purchase, you'll receive an SMS message asking if you want to redeem points for it. This is an excellent way to shop for the best deal while also putting your rewards to good use.

You can, however, use the US Bank Travel Portal to redeem your points for air travel, hotels, and car rentals. Finally, you have the option of receiving a statement credit or redeeming the points for cash into your US Bank account.

How to Leverage Rewards Smartly?

This card is pretty straightforward, so there aren't many ways to maximize your rewards. The highest rewards are earned on dining, restaurant delivery, or takeout, so focus your spending in these categories.

You should also consider charging your annual streaming services to the card. Not only will you earn two points per dollar spent, but you’ll also get a $15 credit.

To qualify for the introductory bonus, you’ll need to spend at least $1,000 in the first three months.

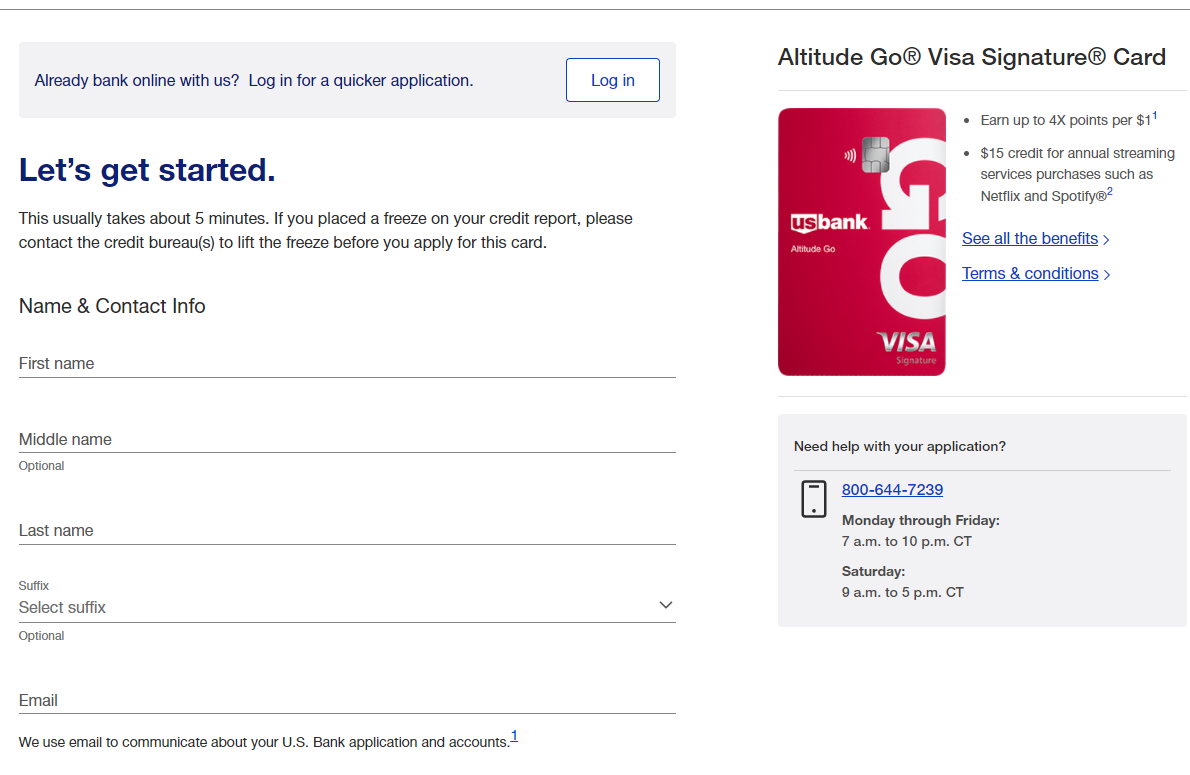

How To Apply For U.S. Bank Altitude Go Card?

- 1.

Visit the website at usbank.com and click the blue button that reads “Apply Now.”

- 2.

Fill in your nomenclature: first name, middle name, and suffix.“Continue” to proceed.

- 3.

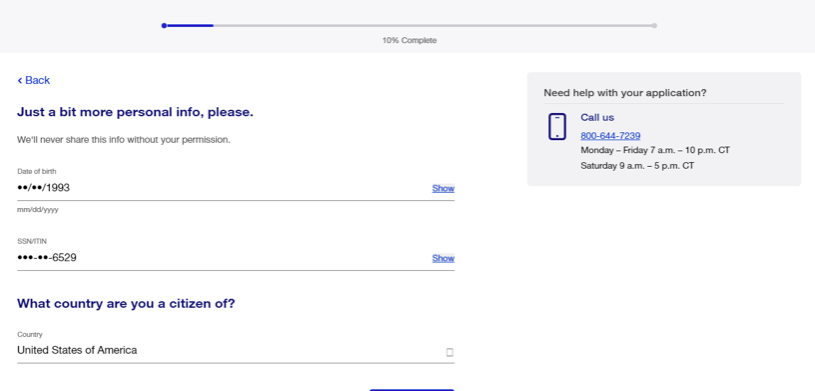

Now, fill in your date of birth, social security number, and country of citizenship. Click “Continue” to advance to the next step.

- 4.

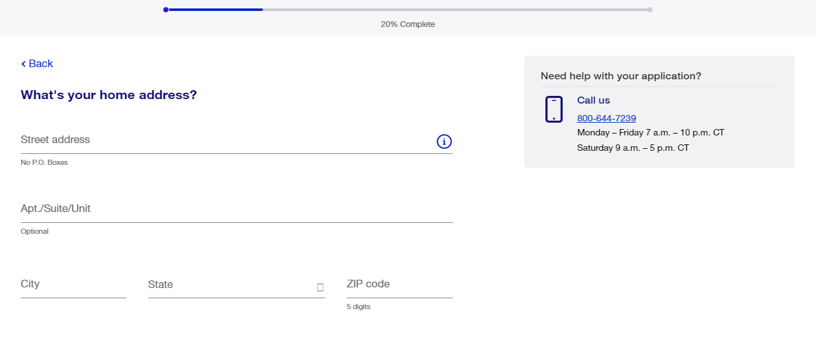

Fill in your home address: street, suite, city, state, and zip code. Click “Continue” to proceed.

- 5.

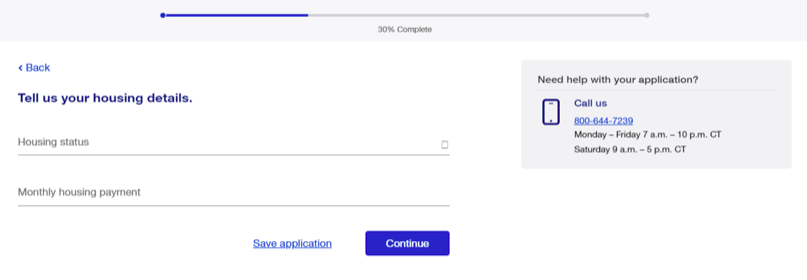

Now, provide your housing details: housing status and monthly fees. Click “Continue” to proceed.

- 6.

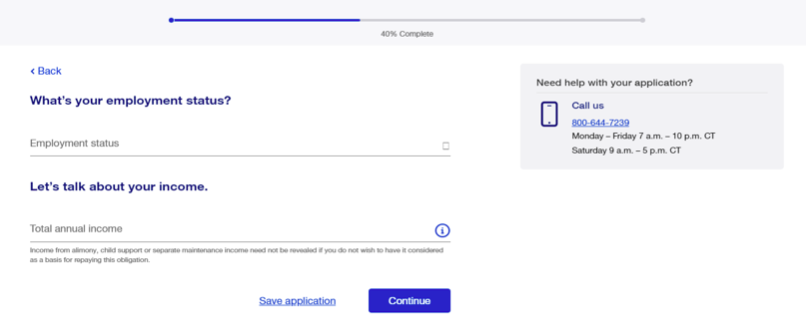

Fill in your employment status and annual income, then click “Continue” to move on to the next step.

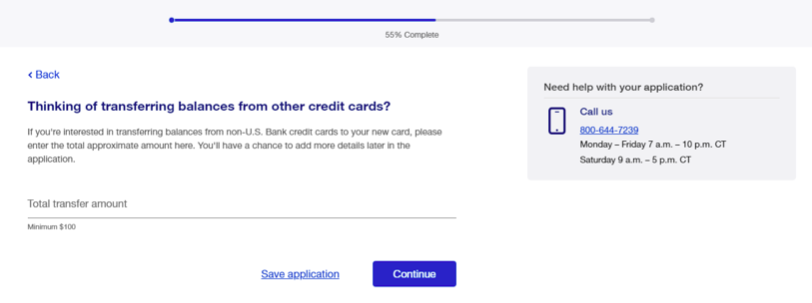

- 7.

Fill in your preferred total transfer balance amount. Click “Continue” to proceed.

- 8.

You will see a page to review all the details you’ve provided. Check for mistakes, make the necessary corrections, and then tap “Continue” to proceed with your application.

- 9.

Now, read the terms and conditions for using U.S. Bank Altitude ® Go Visa Signature Card, then click on “Submit Application” if you accept these terms.

- 10.

A notice will appear on your screen asking you to check your email or phone for a message confirming your application. Now, you wait for the bank to review your application.

How It Compared To Other Cards For Everyday Spending?

The U.S. Bank Altitude® Go Card is a strong choice for everyday spending, especially when you compare it to other credit cards that don't charge an annual fee.

If you look at cards like Capital One SavorOne and Blue Cash Everyday® from American Express, each card has its own strengths. For instance, SavorOne and Blue Cash Everyday give you higher rewards when you shop at U.S. supermarkets.

Then there are cards like Wells Fargo Active Cash and Citi Double Cash that keep it simple with a flat 2% cashback rate. While they're straightforward, the rewards rate is lower compared to the Altitude card, depending on how much you spend.

There are also other no-annual-fee cards like Citi Custom Cash, BofA Customized Cash Rewards, and Chase Freedom Flex. They often have categories with higher rewards than the Altitude card, but these categories change, so you can't always earn high rewards on the same type of purchases.

Is the U.S. Bank Altitude Go Right for You?

U.S. Bank Altitude ® Go Visa Signature Card is suitable for customers who prefer eating out than home-cooked meals. You earn points when you pay with your card at restaurants, cafes, take-outs, and for home deliveries, together with shopping for groceries at the supermarket and buying gas. It is also ideal for users that love to stream on partner platforms like Spotify, Netflix, Hulu, and Apple music.

Customers who look out for sign-up rewards will be happy to win the introductory bonus of Earn 20,000 bonus points after spending $1,000 in the first 90 days of card opening. All points are non-expiring and can be redeemed as cash backs, gift cards, or cash deposits into your credit card account.

Compare The Alternatives

There are other credit cards that do offer comparable cash back rewards – we’ve summarized the most popular cards which can use as an alternative to the Altitude Go card:

|

|

| |

|---|---|---|---|

Capital One Savor card | Chase Freedom Unlimited® card | Citi Simplicity® Card | |

Annual Fee | $0

| $0

| $0

|

Rewards |

1% – 8%

unlimited 3% cash back on dining, entertainment, popular streaming services, and grocery store purchases (excluding superstores like Walmart® and Target®). You’ll also earn 1% on all other purchases. Plus, you get 10% cash back on purchases through Uber and Uber Eats, 8% on Capital One Entertainment purchases, and 5% on hotels and rental cars booked through Capital One Travel

|

1.5% – 5%

5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases

|

N/A

None

|

Welcome bonus |

Earn $300 in welcome bonuses. Enjoy a $100 credit to use towards flights, stays and rental cars booked through Capital One Travel during your first cardholder year. Plus, earn a $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening

Earn $300 in welcome bonuses. Enjoy a $100 credit to use towards flights, stays and rental cars booked through Capital One Travel during your first cardholder year. Plus, earn a $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening

|

$200

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

|

N/A

None

|

Foreign Transaction Fee | $0

| 3%

| 3%

|

Purchase APR | 18.99% – 28.99% (Variable)

| 18.74%–28.24% variable

| 17.99% – 28.74% (Variable)

|

FAQ

The U.S Bank Altitude Go has no points limits, so you can accumulate any number of points per month.

However, the Altitude Go does have points, which are typically worth about 1.5 cents each. This means that 10,000 points could be worth about $150 depending on your redemption method.

The starting credit limit of the Altitude Go card can be as low as $1,000, but it is typically between $1,000 and $1,500 depending on a number of factors including your credit history, income and existing debt.

Considering that it has no annual fee, this card offer some decent rewards. If you’re looking for an everyday card without needing to worry about hefty annual fees, it's worthy of serious consideration.

U.S Bank does have pre approval but it is only for offers via email or mail. Additionally, if you’re an existing customer, you may receive a pre approved offer through your online account.

There is no online tool for interested potential customers to use to check pre approval status. When you complete the online application form, it is a complete application and this will involve a hard credit pull.

Compare U.S. Bank Altitude Go

While both cards offer great rewards and have no annual fee, the winner between the two depends on your goals. Here's our analysis.

The U.S. Bank Shopper Cash Rewards takes the lead as our winner. Despite being a bit more expensive, it offers significantly higher cashback.

U.S. Bank Shopper Cash Rewards vs. U.S. Bank Altitude Go: How They Compare?

While the Altitude Go is a great no-annual-fee card, the Altitude Connect is our winner with a great points rewards ratio and travel perks.

U.S. Bank Altitude Connect vs. U.S. Bank Altitude Go: How They Compare?

Top Offers

Top Offers