The Wells Fargo Autograph Card is renowned for its simplicity and transparency, offering a straightforward rewards program and a focus on travel and everyday rewards. On the other hand, the American Express® Gold Card is celebrated for its luxurious perks, extensive travel rewards, and exclusive access to events and experiences.

In this comparison, we'll delve deep into these two credit cards, dissecting their key features, rewards structures, annual fees, and additional benefits to help you make an informed decision.

Wells Fargo Autograph Vs. Amex Gold: General Comparison

The Wells Fargo Autograph Card is a straightforward cashback card with no annual fee, suited for those who prioritize simplicity and lower costs.

In contrast, the American Express Gold Card caters to individuals seeking premium travel rewards, dining perks, and exclusive experiences, making it an excellent choice for those willing to invest in a card with a higher annual fee in exchange for luxury benefits and rewards.

Wells Fargo Autograph℠ Card | American Express® Gold Card | |

Annual Fee | $0 | $250. See Rates and Fees. |

Rewards | 3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases | 4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases. Terms Apply. |

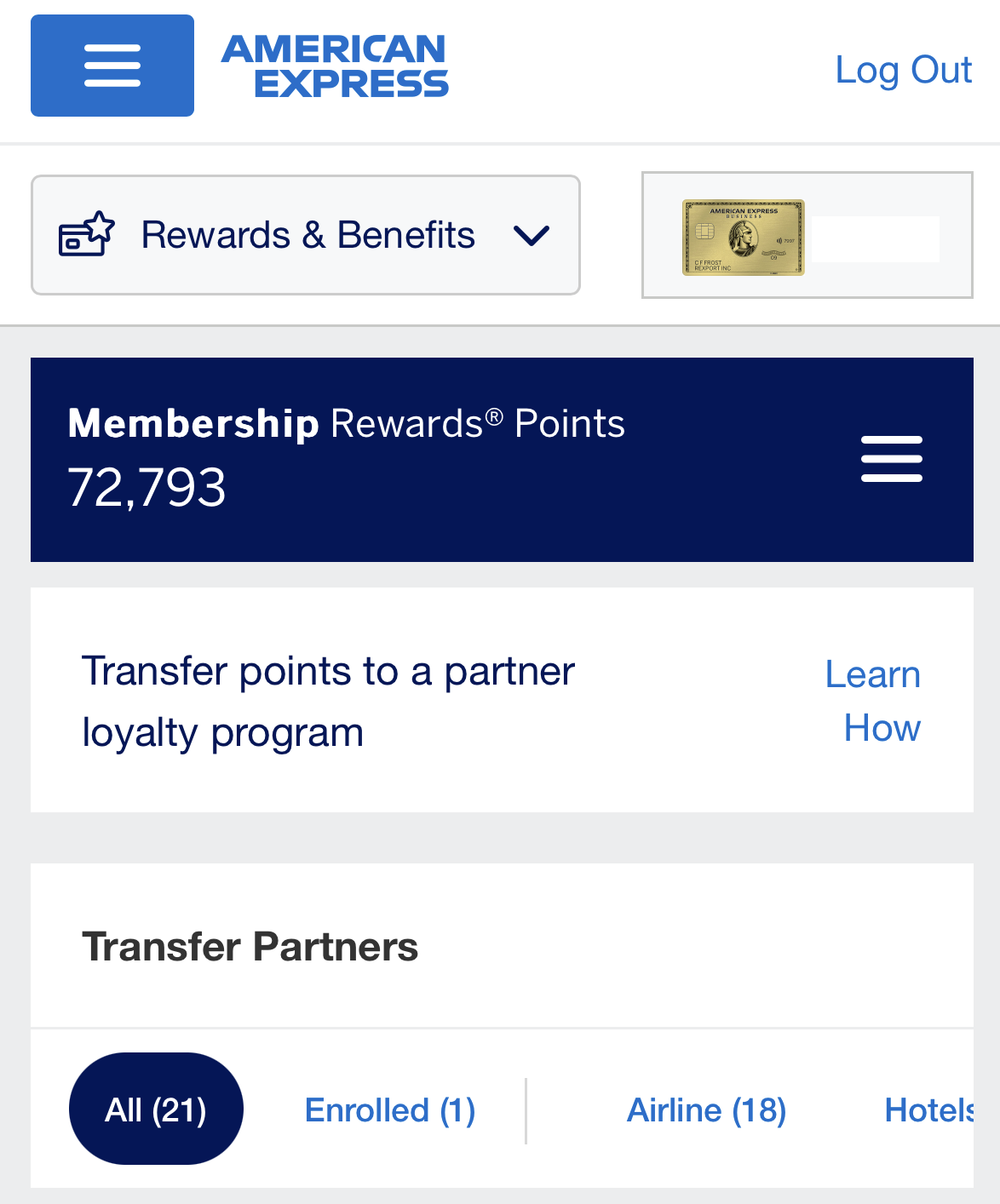

Welcome bonus | 20,000 bonus points when you spend $1,000 in purchases in the first 3 months | 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership. |

0% Intro APR | 12 months on purchases | N/A |

Foreign Transaction Fee | $0 | None. See Rates and Fees. |

Purchase APR | 20.24% – 29.99% variable | 21.24% – 29.24% Variable

|

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Point Rewards Clash: A Simple Card Comparison

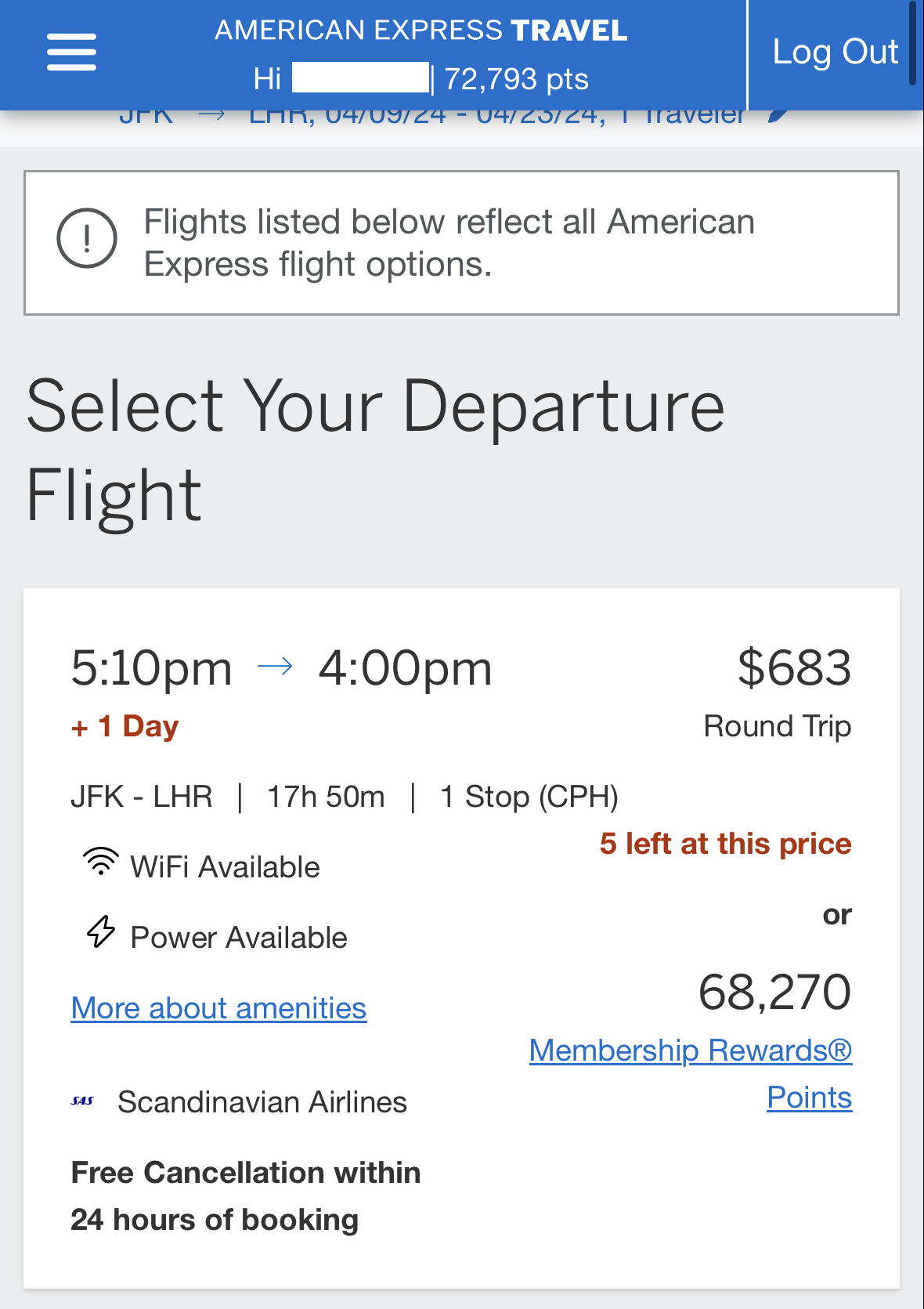

When comparing credit card rewards, the significant advantage of the Gold card is the high ratio of U.S. Supermarkets and groceries. When it comes to travel rewards, the Autograph card may be even a bit better.

Spend Per Category | Wells Fargo Autograph℠ Card | Amex Gold Card |

$15,000 – U.S Supermarkets | 15,000 points | 60,000 points |

$5,000 – Restaurants

| 15,000 points | 20,000 points |

$4,000 – Airline | 12,000 points | 12,000 points |

$3,000 – Hotels | 9,000 points | 3,000 points |

$4,000 – Gas | 12,000 points | 4,000 points |

Estimated Annual Value | 63,000 (About $630) | 99,000 points ( $600 – $1,600) |

Wells Fargo Autograph Vs. Amex Gold: Compare Perks

There are some additional types of perks that you will see with both of these cards.

Wells Fargo Autograph℠ Card

- Cellular Telephone Protection: Receive up to $600 in cell phone protection when paying your monthly cell phone bill with your Wells Fargo card, subject to a $25 deductible.

- Auto Rental Collision Damage Waiver: Coverage for theft, damage, loss-of-use charges, administrative fees, and towing charges when renting a vehicle.

- Travel and Emergency Services Assistance: Access to emergency assistance and referral services while traveling.

- Emergency Cash Disbursement and Card Replacement: Visa credit cardholders can obtain emergency cash advances or card replacements within one to three business days (fees and interest may apply).

- My Wells Fargo Deals: Access personalized deals and earn cashback as an account credit when using your Wells Fargo credit card for shopping, dining, or experiences.

- Zero Liability Protection: Protection against unauthorized transactions when promptly reported.

- Credit Close-Up℠: Provides tools and insights to understand, track, raise, or maintain your FICO® Score.

American Express Gold Card

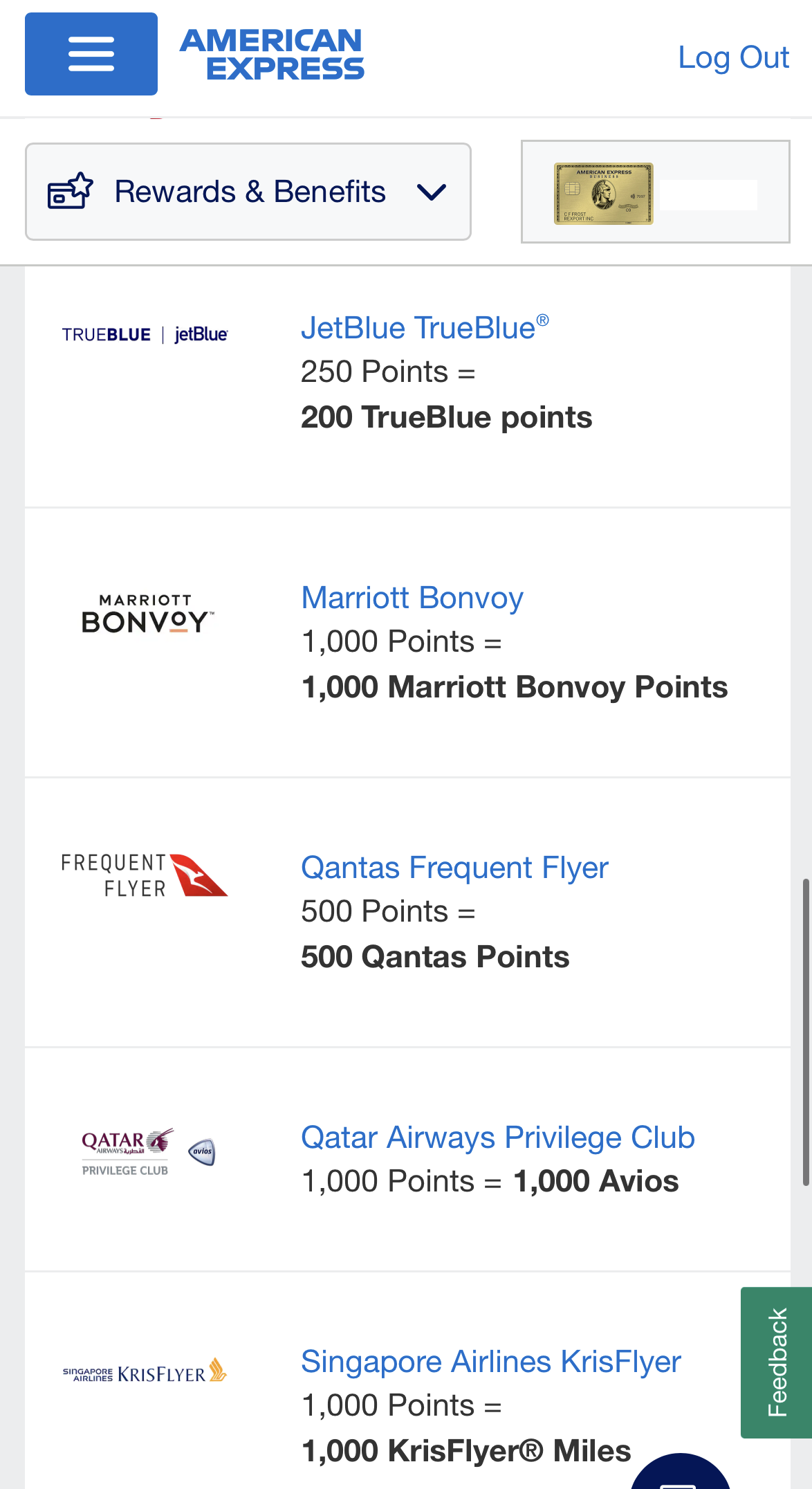

- Uber Credit: Link your new Gold Card to your Uber account to enjoy an automatic monthly Uber Cash credit of $10, which can be used for Uber rides or UberEats orders, up to a maximum annual value of $120.

- Dining Credit: When you use your Amex Gold Card to pay for dining out at select establishments, including The Cheesecake Factory, Wine.com, Goldbelly, Shake Shack, and Milk Bar locations, you can receive up to $10 in statement credit per month.

- $100 Experience Credit: Enjoy a $100 experience credit when you book The Hotel Collection through American Express Travel for a getaway of at least two nights. The value of the experience credit may vary based on your chosen property.

- No Foreign Transaction Fees: Travel worry-free with your American Express Gold Card, as it allows you to use your card abroad without incurring foreign transaction fees, making it a cost-effective choice for international trips.

- Baggage Insurance: When you purchase your entire fare for a Common Carrier Vehicle using your Gold card, you are eligible for baggage insurance.

- Car Rental Coverage: When you use your Gold Card to reserve and pay for your entire car rental, you can decline the rental company's collision damage waiver.

Terms apply to American Express benefits and offers.

Top Offers

Top Offers From Our Partners

Top Offers

Main Drawbacks: How They Compare?

Wells Fargo Autograph℠ Card

Limited Rewards: The Wells Fargo Autograph Card offers lower rewards ratio on supermarkets and restaurants and does not provide as much value as the American Express Gold Card's Membership Rewards program, especially for travelers and dining enthusiasts.

No Premium Travel Benefits: Unlike the American Express Gold Card, the Wells Fargo Autograph Card lacks premium travel benefits such as travel credits and extensive travel insurance.

Lack of Exclusive Experiences: The American Express Gold Card provides cardholders with access to exclusive events, experiences, and offers, while the Wells Fargo Autograph Card does not offer similar perks.

American Express Gold Card

Higher Annual Fee: The American Express Gold Card typically comes with a higher annual fee compared to the Wells Fargo Autograph Card, which has no annual fee. This can be a significant drawback for those looking to minimize credit card costs.

Less Good For Gas: If you're looking for higher rewards on Gas, the Autograph℠ Card may be better

Limited Acceptance: American Express cards may not be as widely accepted as Visa or Mastercard, which can be a drawback when traveling or making purchases in certain locations where merchants may not accept American Express.

When You Might Prefer the Wells Fargo Autograph Card?

You may prefer the Wells Fargo Autograph℠ Card over the American Express Gold Card in several situations:

- No Annual Fee: If you want a decent card without an annual fee, the Wells Fargo Autograph℠ Card is a more suitable choice.

- Limited Travel: If you don't travel frequently or don't prioritize premium travel benefits such as airport lounge access, the Autograph Card may be a more cost-effective and straightforward option.

- You Need 0% Intro APR: The Autograph card offers 0% intro APR for 12 months on purchases, so if you're looking for a large purchase soon, this may be a good idea.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer The Amex Gold Card?

You may prefer the American Express Gold Card over the Wells Fargo Autograph℠ Card in several situations:

- Dining and Travel Enthusiasts: If you frequently dine out and travel, the American Express Gold Card offers elevated rewards in these categories, making it a better choice to maximize your rewards and savings.

- Premium Travel Benefits: The American Express Gold Card provides premium travel benefits such as travel credits, and comprehensive travel insurance. If you value these perks, the Gold Card is a more suitable option. You can also add an authorized user to the Gold card.

- Exclusive Experiences: If you enjoy access to exclusive events, experiences, and offers.

- Groceries Spending: If your spending habits primarily involve everyday categories like groceries, the Gold Card's cashback benefits can provide more value than the Wells Fargo Autograph Card's specialized rewards.

Compare The Alternatives

If you're looking for a credit card with everyday purchase rewards or travel rewards – there are some excellent alternatives you may want to consider:

| |||

|---|---|---|---|

Capital One Quicksilver Cash Rewards Credit Card | Blue Cash Preferred® Card from American Express | Chase Sapphire Preferred® Card | |

Annual Fee | $0

| $95 ($0 intro for the first year)

| $95

|

Rewards |

1.5% – 5%

5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

|

1-6%

6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit

and U.S. gas stations, 1% cash back on other purchases

|

2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

Welcome bonus |

$200

$200 cash bonus once you spend $500 on purchases within 3 months from account opening

|

$250

$250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

|

60,000 points

60,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening

|

Foreign Transaction Fee | $0 | 2.70% | $0

|

Purchase APR | 19.99% – 29.99% variable

| 19.24% – 29.99% Variable

| 21.24%–28.24% variable APR

|

Compare American Express Gold Card

If you're looking for everyday spending rewards, the Amex Gold Card offers more. But for travel rewards benefits, there is a clear winner.

The Amex Gold Card may be more appealing if you dine out frequently and value premium travel perks than the Apple card.

While the Amex Gold Card is more expensive than the Blue Cash Preferred, its rewards program and other benefits are more lucrative.

If you're a dedicated Delta traveler, the Delta SkyMiles Gold may be your top pick, while the Amex Gold offers a broader range of benefits.

While Amex Gold Card offers statements credits and everyday spending benefits, the Venture card is cheaper and include decent travel perks.

The Venture X offers better travel rewards than the Amex Gold but is less appealing if you're looking for everyday spending rewards.

Amex Gold Card vs. Capital One Venture X : Which Premium Card Is Best?

The Amex Gold Card focused on everyday spending and general travel rewards, the Delta SkyMiles Reserve Card offer premium airline benefits.

Amex Gold Card vs. Delta SkyMiles Reserve: Side By Side Comparison

The Freedom Unlimited beckons with its cash-back rewards, but the Amex Gold exudes luxury, boasting robust rewards on dining and groceries.

Chase Freedom Unlimited vs. Amex Gold Card: Which Card Wins?

The Amex Gold Card focuses on everyday spending rewards, while the Delta SkyMiles Platinum is tailored for frequent Delta travelers.

Amex Gold Card vs. Delta SkyMiles Platinum: Side By Side Comparison

The Hilton Honors Surpass wins at estimated cashback, while the Amex Gold card is the winner for everyday spending and extra benefits.

If you're looking for travel rewards, there is a clear winner. But what about if you're looking for rewards on everyday spending?

American Express Gold Card vs Chase Sapphire Reserve: Which Premium Card Is Best?

While the Amex gold card is best for everyday spending, the Chase sapphire preferred may be better as a travel card. Here's our comparison.

American Express Gold Card Vs. Chase Sapphire Preferred: Which Is Best?

Compare Wells Fargo Autograph Card

The Chase Sapphire Preferred offers better travel perks and protections, but unlike the Autograph card – you'll need to pay an annual fee.

The Wells Fargo Active Cash is best for cashback and everyday spending, while the Autograph is a clear winner when it comes to travel rewards.

Wells Fargo Active Cash vs. Autograph Card: How They Compare?

The Autograph Card is best for earning rewards on common travel categories, while the Reflect Card is a better option for a long 0% intro APR.

Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.