In this comparison, we'll delve into the key differences and similarities between the Apple Card and the American Express® Gold Card, helping you make an informed decision about which card aligns better with your financial goals and lifestyle.

Apple Card vs. Amex Gold: General Comparison

The choice between the two cards largely depends on your spending habits, lifestyle, and affinity for Apple products. The Amex Gold Card may be more appealing if you dine out frequently and value premium travel perks.

Conversely, the Apple Card's minimal fees and simplicity could be a draw for those who prefer a straightforward cashback program and easy digital management.

American Express® Gold Card | Apple Credit Card | |

Annual Fee | $250. See Rates and Fees. | $0 |

Rewards | 4X points at restaurants (including Uber Eats purchases in the U.S.) and U.S. supermarkets (up to $25,000 per year in purchases, then 1X points), 3X points on flights booked directly with airlines or on amextravel.com, 2X points on rental cars through amextravel.com and 1X points on all other purchases. Terms Apply. | 3% cash back at Apple and select Apple pay partners. 3% Daily Cash back at Ace Hardware, Duane Reade, Exxon, Mobil, Nike, Panera Bread, T-Mobile, Uber, Uber Eats, and Walgreens. 2% on other Apple pay purchases, and 1% on all other purchases |

Welcome bonus | 60,000 Membership Rewards® Points after you spend $6,000 on eligible purchases with your new Card within the first 6 months of Card Membership. | N/A |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | None. See Rates and Fees. | $0 |

Purchase APR | 21.24% – 29.24% Variable

| 15.99% – 26.99% Variable |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Apple or Amex Gold : Which Card Gives More Rewards?

In the simulation, we assumed all purchases had been made with Apple Pay if you use an Apple card. Still, the Amex card point rewards are more attractive compared to Apple, which is make sense due to the nature of the card and its higher annual fee.

Spend Per Category | American Express® Gold Card | Apple Credit Card |

$15,000 – U.S Supermarkets | 60,000 points | $300 |

$5,000 – Restaurants | 20,000 points | $100 |

$4,000 – Apple Products | 4,000 points | $120 |

$3,000 – Airline

| 9,000 points | $60 |

$4,000 – Gas | 4,000 points | $40 |

Total Points/Cashback | 97,000 points | $620 |

Estimated Redemption Value | 1 point ~ 0.6 – 1.6 cents | / |

Estimated Annual Value | $582 – $1,552 | $620 |

What Can You Do With Cashback And Points?

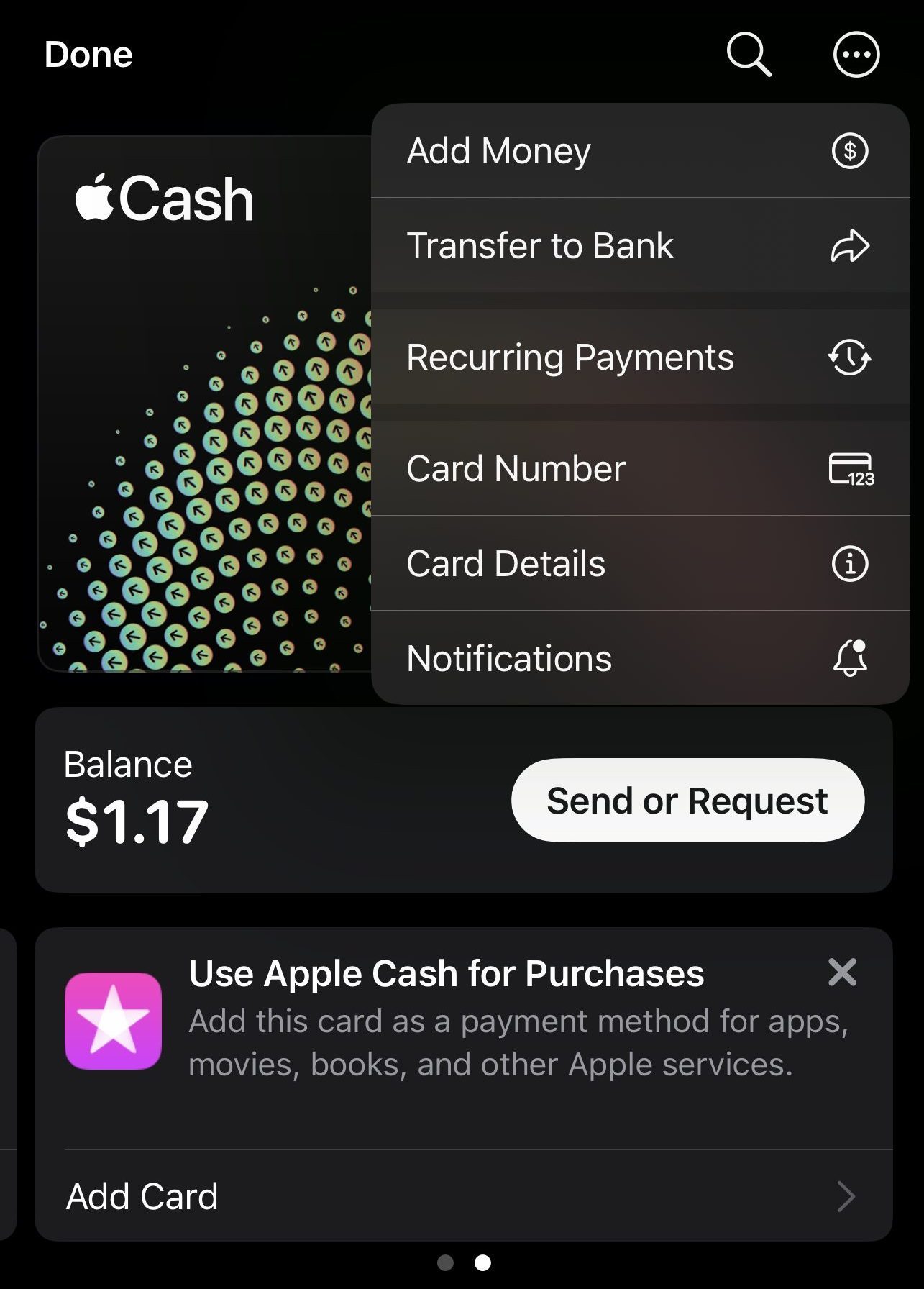

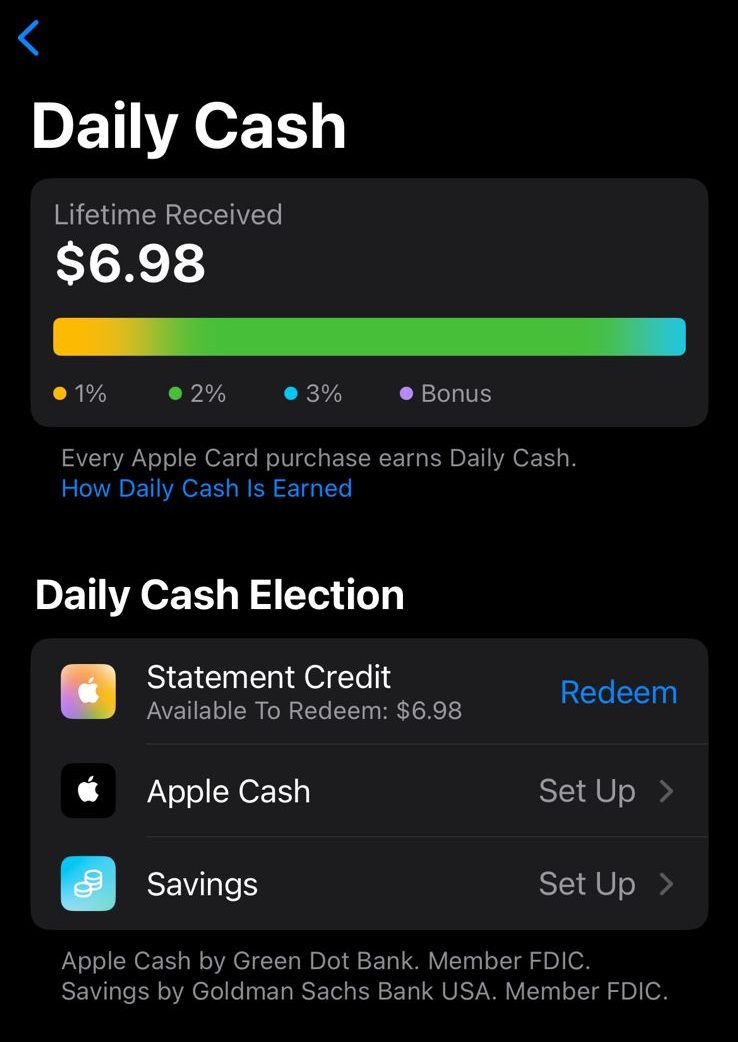

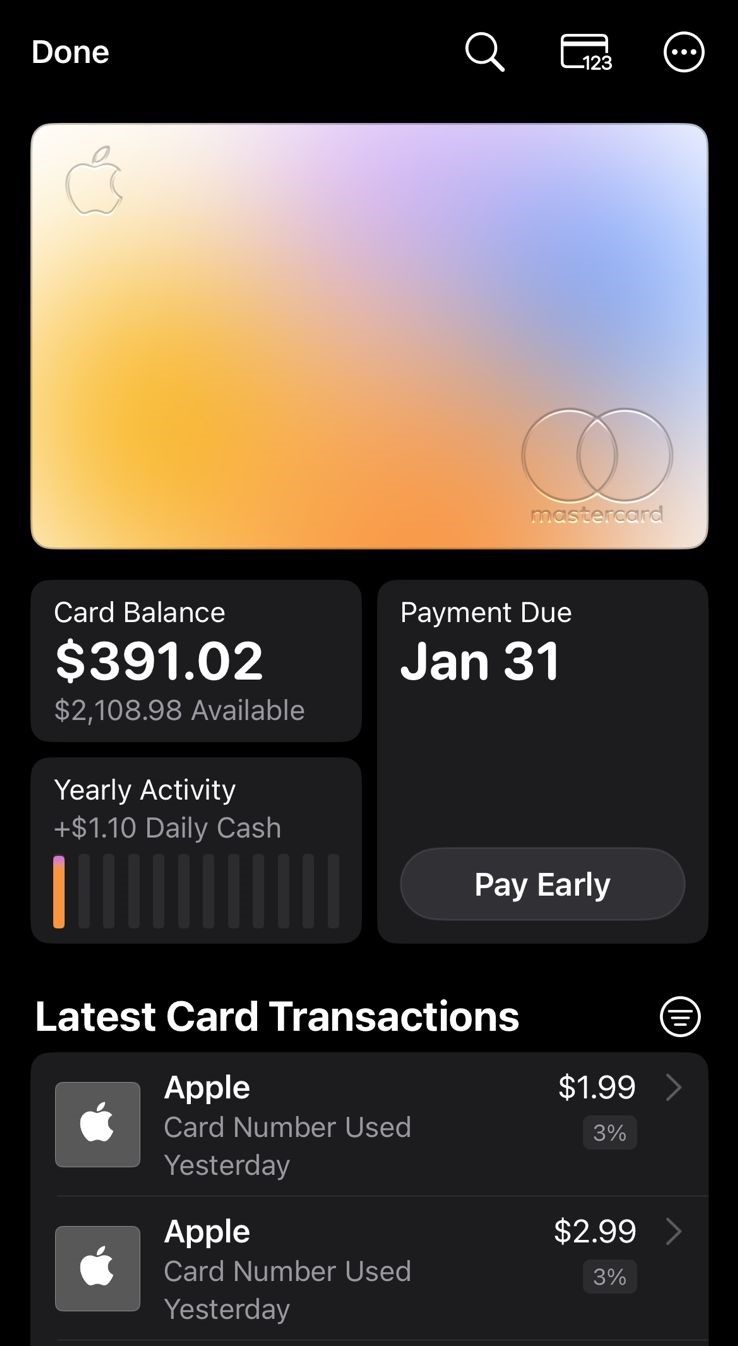

Apple Card presents a variety of flexible and rewarding options for redeeming your Daily Cash earnings. Seamlessly use your Daily Cash for Apple Pay purchases wherever accepted, ensuring a frictionless spending experience. For immediate relief and simplified finances, apply Daily Cash as a Statement Credit directly to your Apple Card balance.

Alternatively, enhance your savings growth by routing Daily Cash to your Apple Savings account, earning high-yield interest. Spread generosity by sharing Daily Cash with friends and family through Apple Pay Cash, adding a generous touch to your interactions and extending the benefits of your reward

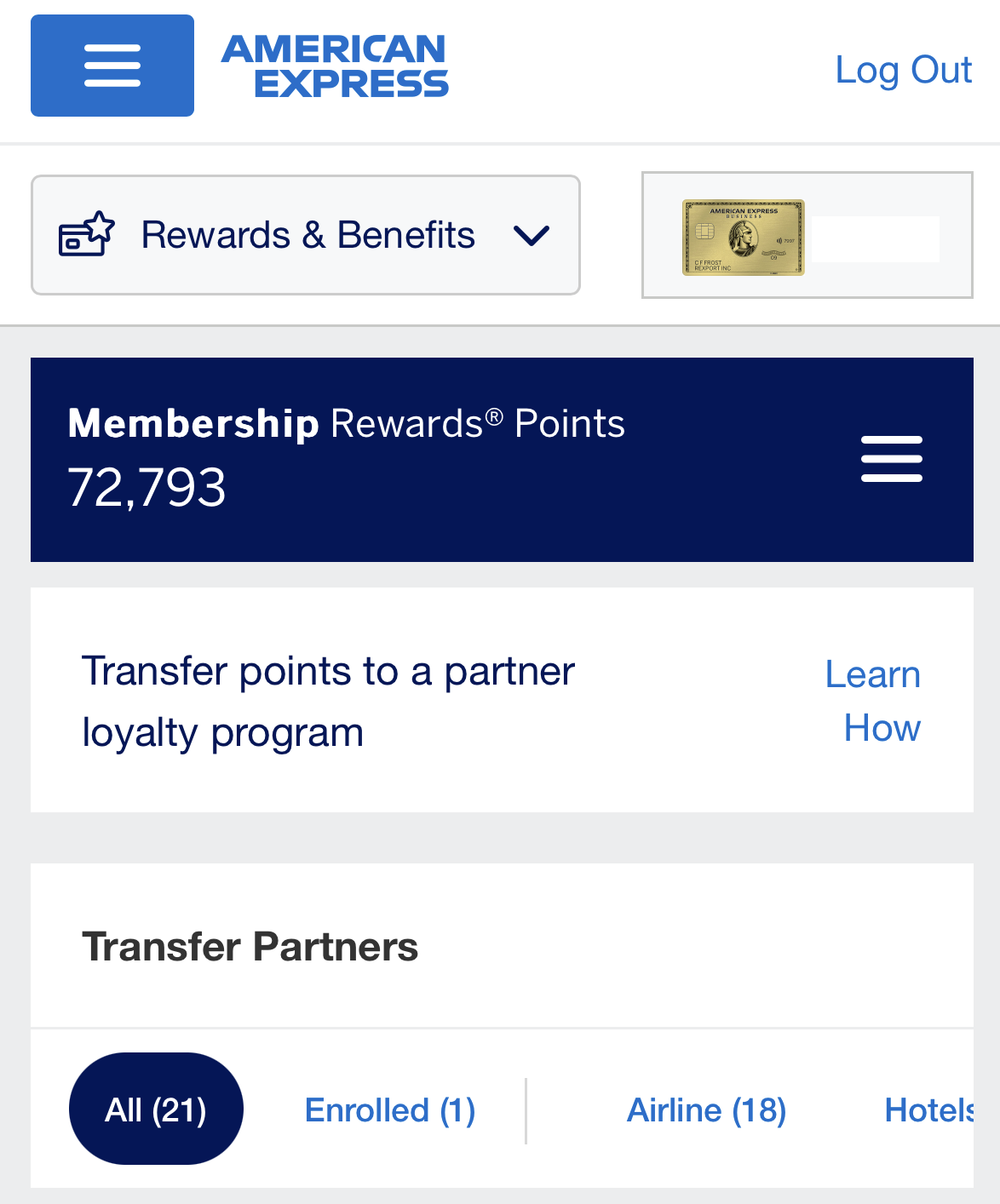

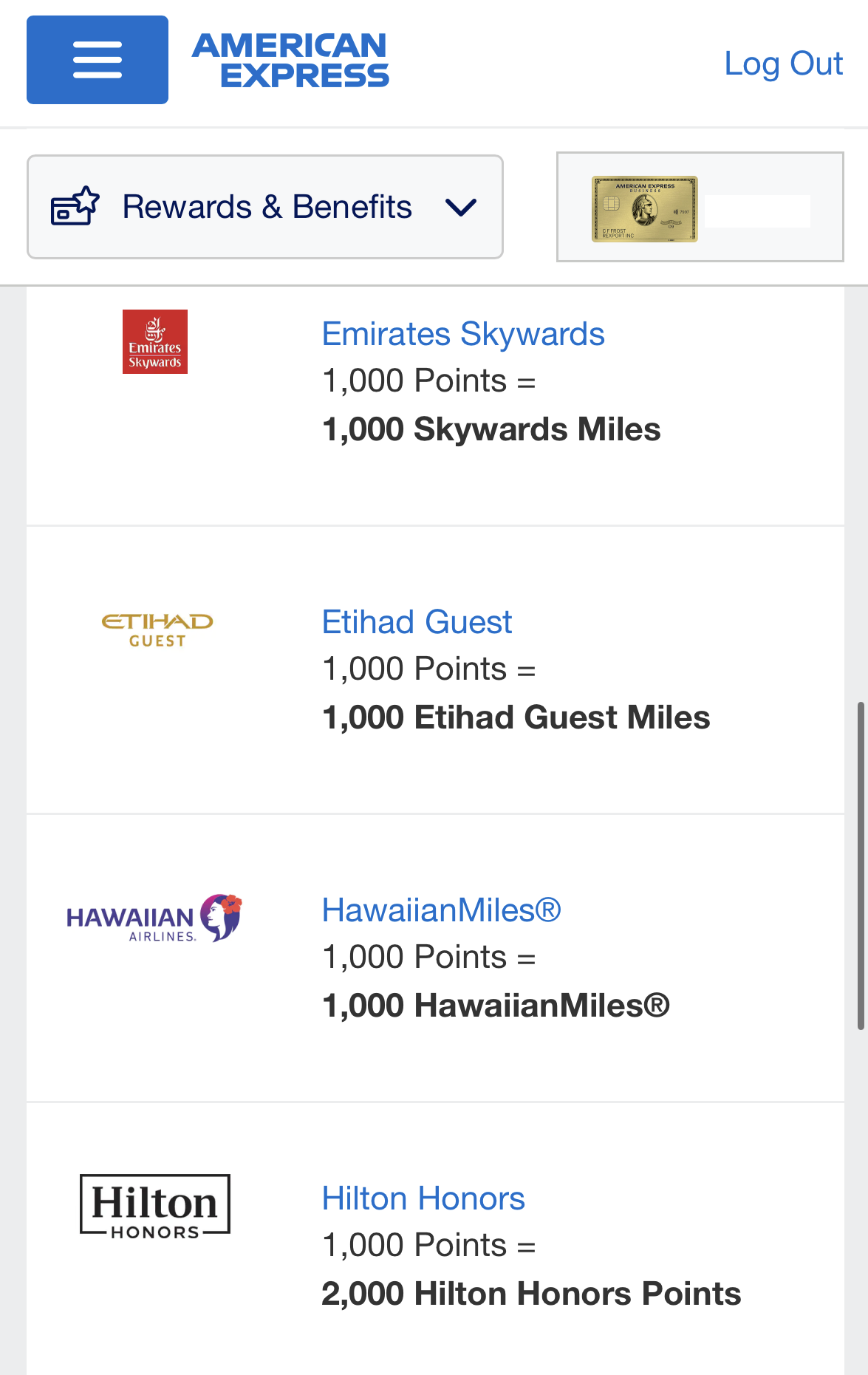

The American Express® Gold Card presents a versatile range of redemption options for Membership Rewards® points, catering to diverse travel and lifestyle preferences. Opt to Pay with Points, covering travel expenses through American Express Travel at a base rate of 1 cent per point for flexibility and convenience.

Alternatively, Transfer Points to over 14 airline and hotel loyalty programs, including Delta, Marriott Bonvoy, and Hilton Honors, at a 1:1 ratio, potentially offering higher value.

Additional Benefits: Apple Card vs. Amex Gold

There are some additional types of perks that you will see with both of these cards.

American Express Gold Card

- Get up to $120 Uber Credit: Connect your Amex Gold Card to your Uber account for a monthly $10 Uber Cash bonus. Use it for Uber rides or UberEats orders, with a maximum yearly value of $120.

- Up to $120 Dining Credit: Elevate your dining with the Amex Gold Card. Get up to $10 in statement credit monthly when dining at places like The Cheesecake Factory, Wine.com, Goldbelly, Shake Shack, and Milk Bar.

- Score $100 Experience Credit: Book The Hotel Collection through Amex Travel for a getaway of at least two nights and get a $100 experience credit. The value varies based on your chosen property.

- Amex Entertainment: Dive into exclusive experiences and get presale tickets for concerts, sports, and theater events through the Amex Gold Card Entertainment Access program. Availability varies.

- Travel Easy with Global Entry or TSA PreCheck® Credit: Get up to $100 for Global Entry or up to $85 for TSA PreCheck to breeze through airport security.

- Luxury Hotel Perks: Enjoy premium stays with the Amex Fine Hotels & Resorts program. Get perks like room upgrades, complimentary nights, and daily breakfast for two at participating hotels.

- Top-Notch Concierge Service: Access the Amex Gold Card's concierge service for help with travel and dining reservations, though availability may limit its ability to fulfill all requests.

Terms apply to American Express benefits and offers.

Apple Credit Card

- No Fees: One of the standout benefits of the Apple Card is its fee structure. There are no annual fees, penalty fees, transaction fees, or any other hidden charges associated with the card. This transparency makes it an attractive option for those looking to avoid unnecessary costs while enjoying the benefits of a credit card.

- Access to Apple Savings Account: cardholders can open an Apple savings account and direct Daily Cash to a Savings account.

Security: The Apple Card offers cutting-edge security features, including a unique card number for each purchase, biometric authentication (Face ID or Touch ID), and transaction alerts.

Great Wallet App: The Apple Card provides robust tools for managing your debt and spending. The Wallet app offers a clear overview of your transactions, organizes them by category, and provides insights into your spending habits. It also offers payment suggestions to help you pay off your balance faster and more efficiently.

Main Drawbacks: Comparison

American Express Gold Card

Annual Fee: The Amex Gold Card comes with an annual fee, which is not present with the Apple Card. This fee can be a significant expense for cardholders, especially if they don't take full advantage of the card's benefits.

Complexity: The Amex Gold Card offers a variety of benefits and features, which can be complex to navigate and fully utilize. This complexity might not be appealing to individuals seeking a straightforward credit card experience.

Eligibility Requirements: American Express often has stringent eligibility requirements for its Amex premium cards, including credit score and income criteria, which may limit access for some potential cardholders.

Terms apply to American Express benefits and offers.

Apple Credit Card

Limited Rewards Categories: The Apple Card primarily focuses on cashback rewards, with an emphasis on Apple-related purchases. In contrast, the Amex Gold Card offers more diverse and lucrative rewards in categories like dining and groceries, potentially providing higher value for certain cardholders.

Lack of Travel Benefits: The Apple Card does not offer the extensive travel benefits and perks provided by the Amex Gold Card, such as travel credits, airport lounge access, and travel insurance. This can be a significant disadvantage for frequent travelers.

No Sign-Up Bonus: The Apple Card typically does not offer a sign-up bonus, whereas many premium credit cards, including the Amex Gold Card, often provide substantial welcome bonuses that can offset the annual fee or provide immediate value.

When You Might Prefer the Amex Gold Card?

You might want to consider the American Express Gold Card over the Apple Card in several scenarios:

- Dining and Grocery Spending: If you frequently dine out or spend a significant amount on groceries, the Amex Gold Card offers substantial rewards in these categories. It can provide better value in terms of Membership Rewards points for these expenses compared to the Apple Card's cashback rewards.

- Travel Enthusiasts: If you travel frequently, the Amex Gold Card offers various travel benefits, including airline fee credits, airport lounge access, and travel insurance, making it a more attractive option for those seeking travel perks and protection.

- International Travel: The Amex Gold Card is more widely accepted internationally compared to the Apple Card, which can be advantageous when traveling abroad where Apple Pay and the Apple Card may have limited acceptance.

- Luxury and Lifestyle Perks: The Amex Gold Card offers access to various luxury and lifestyle perks, such as the Hotel Collection and dining credits, enhancing your overall experience.

- Higher Credit Limit: If you need a higher credit limit for significant purchases or expenses, the Amex Gold Card may provide a more substantial credit line compared to the Apple Card.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer to Choose The Apple Card?

You might want to consider the Apple Card over the American Express Gold Card in several scenarios:

- No Annual Fee: If you want to avoid paying an annual fee, the Apple Card has the advantage as it does not charge any annual fees, whereas the Amex Gold Card does.

- Simplicity and Digital Integration: If you prefer a straightforward and digitally integrated credit card experience, the Apple Card is designed with a user-friendly app and seamless integration with Apple Wallet, making it convenient for Apple device users.

- Transparent Fee Structure: The Apple Card is known for its transparent fee structure, with no penalty fees, transaction fees, or other hidden charges, providing clarity and predictability for cardholders.

- You Want A Build-In Savings Account: if you want to use an Apple savings account, enjoy a high rate, and be able to get cashback to your account, an Apple card may be a better option.

Bottom Line

In essence, the American Express Gold Card is well-suited for individuals who prioritize dining and groceries, travel frequently, value premium travel and lifestyle perks, and are willing to pay the annual fee for these benefits.

It is a robust option for those seeking a card with a focus on rewards and travel benefits, while the Apple Card may be more appealing to those who prefer a no-fee, straightforward cashback card with a digital-first approach. Your choice should align with your spending habits, lifestyle, and financial goals.

Compare The Alternatives

If you're looking for a credit card with everyday purchase rewards – there are some good alternatives you may want to consider:

Chase Freedom Flex℠ Card | Capital One Venture Rewards Credit Card | American Express EveryDay® Card | |

Annual Fee | $0

| $95

| $0

|

Rewards |

1-5%

5% cash back on up to $1,500 in combined purchases on selected categories each quarter and 5% cash back on travel purchased through Chase Ultimate Rewards®. Also, you can earn 3% cash back on dining at restaurants (including takeout and eligible delivery services), drugstore purchases , and 1% on all other purchases

|

2X – 5X

2X miles per dollar on every purchase, plus 5X miles on hotels and rental cars booked through Capital One Travel

|

1X – 2X

2X points at U.S. supermarkets (up to $6,000 per year, then 1X), 2X points on prepaid rental cars booked through American Express Travel and 1X points on all other purchases

|

Welcome bonus |

$200

$200 bonus after you spend $500 on purchases in the first 3 months from account opening

|

75,000 miles

75,000 miles once they spend $4,000 on purchases within 3 months from account opening

|

10,000 points

10,000 points after you spend $1,000 in purchases on your new card within the first 3 months

|

Foreign Transaction Fee | 3%

| $0

| 2.7%

|

Purchase APR | 20.49%–29.24% variable

| 19.99% – 29.99% (Variable)

| 18.24% – 28.24% Variable

|

Compare American Express Gold Card

If you're looking for everyday spending rewards, the Amex Gold Card offers more. But for travel rewards benefits, there is a clear winner.

While the Amex Gold Card is more expensive than the Blue Cash Preferred, its rewards program and other benefits are more lucrative.

The Autograph is great for travelers who want to stay on budget, while Amex Gold provides premium travel benefits and redemption options.

If you're a dedicated Delta traveler, the Delta SkyMiles Gold may be your top pick, while the Amex Gold offers a broader range of benefits.

While Amex Gold Card offers statements credits and everyday spending benefits, the Venture card is cheaper and include decent travel perks.

The Venture X offers better travel rewards than the Amex Gold but is less appealing if you're looking for everyday spending rewards.

Amex Gold Card vs. Capital One Venture X : Which Premium Card Is Best?

The Amex Gold Card focused on everyday spending and general travel rewards, the Delta SkyMiles Reserve Card offer premium airline benefits.

Amex Gold Card vs. Delta SkyMiles Reserve: Side By Side Comparison

The Freedom Unlimited beckons with its cash-back rewards, but the Amex Gold exudes luxury, boasting robust rewards on dining and groceries.

Chase Freedom Unlimited vs. Amex Gold Card: Which Card Wins?

The Amex Gold Card focuses on everyday spending rewards, while the Delta SkyMiles Platinum is tailored for frequent Delta travelers.

Amex Gold Card vs. Delta SkyMiles Platinum: Side By Side Comparison

The Hilton Honors Surpass wins at estimated cashback, while the Amex Gold card is the winner for everyday spending and extra benefits.

If you're looking for travel rewards, there is a clear winner. But what about if you're looking for rewards on everyday spending?

American Express Gold Card vs Chase Sapphire Reserve: Which Premium Card Is Best?

While the Amex gold card is best for everyday spending, the Chase sapphire preferred may be better as a travel card. Here's our comparison.

American Express Gold Card Vs. Chase Sapphire Preferred: Which Is Best?

Compare Apple Card

If you're a geek of both Amazon and Apple and not sure which card is better for your needs, we think we can help – there is a clear winner.

The Apple Card offers competitive cashback rewards on Apple purchases and services – but if you travel frequently, the Unlimited card wins.

The Costco card stands out with substantial cashback rewards on gas, dining, and Costco shopping. In which cases the Apple card may be better?

The Apple Card offers high cashback on Apple products, while the Best Buy card wins when it comes to gas and BestBuy purchases. Let's compare.

- Eligibility and Benefit level varies by Card. Terms, Conditions, and Limitations Apply. Please visit americanexpress.com/benefitsguide for more details. Underwritten by Amex Assurance Company.