The My Best Buy Visa Card offers unique advantages for shoppers and tech enthusiasts. Meanwhile, the Prime Visa Card leverages its connection to the e-commerce giant, providing unparalleled benefits for avid online shoppers.

Let's compare them side by side.

Best Buy vs. Amazon Card: General Comparison

The reward structure of both cards is quite similar, and both offer a welcome bonus and no annual fee (Amazon's card require membership).

|

| |

|---|---|---|

My Best Buy Visa Card | Prime Visa | |

Annual Fee | $0 | $0 ($139 Amazon Prime subscription required) |

Rewards | 5% back in rewards on shopping at BestBuy, 3% back in rewards on gas purchases, 2% back in rewards on dining, takeout and grocery purchases, 1% back in rewards on everyday purchases | 5% back on Amazon.com, Amazon Fresh, Whole Foods Market, and Chase Travel purchases. Plus, you’ll get 2% back at gas stations, restaurants, and on local transit, and 1% on all other purchases |

Welcome bonus | 20% back in rewards on your first day of purchases.

| Get a $150 Amazon Gift Card instantly upon approval exclusively for Prime members

|

0% Intro APR | N/A | N/A

|

Foreign Transaction Fee | N/A | $0 |

Purchase APR | 15.24% – 31.74% variable | 19.49% – 28.24% Variable |

Read Review | Read Review |

Top Offers

Top Offers

Top Offers From Our Partners

Cashback Analysis: Which Card Gives More?

In our analysis, the estimated annual cashback is quite similar between the cards – while the Best Buy card earns more in supermarkets, the Amazon card is better for travel purchases as long as they are done on Chase Travel.

|

| |

|---|---|---|

Spend Per Category | My Best Buy Visa Card | Prime Visa |

$15,000 – U.S Supermarkets | $300 | $150 |

$5,000 – Restaurants | $150 | $100 |

$4,000 – Best Buy/Amazon Products | $200 | $200 |

$4,000 – Travel

| $40 | $200 |

$4,000 – Gas | $120 | $80 |

Estimated Annual Cashback | $810 | $730 |

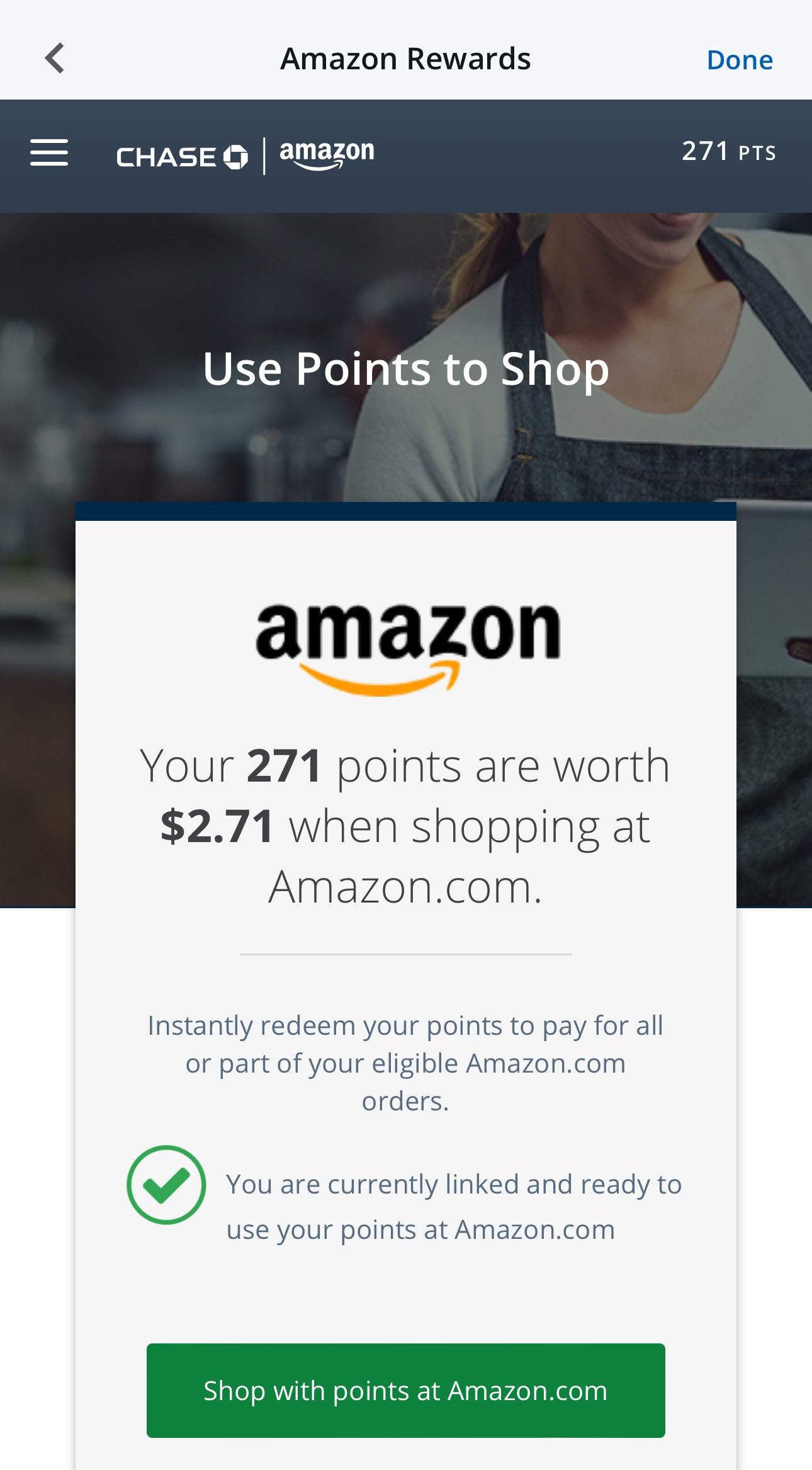

The Amazon card provides flexible redemption options, allowing you to use your rewards as a statement credit or automatically apply them each billing cycle.

You can also redeem points for eligible purchases on Amazon.com by linking your card and using the “”shop with points”” option at checkout.

On the other hand, Best Buy cashback is earned in Best Buy points, which can be redeemed for purchases and discounts at Best Buy.

Additional Benefits: Best Buy vs. Amazon Card

When it comes to extra benefits, each card has its own unique benefits. The Best Buy card offers financing options and free shipping, while the main advantages of the Amazon card are its variety of protections.

My Best Buy Visa Card

Financing Options: Instead of earning 5% cash back on Best Buy purchases, cardholders can opt for financing options. The My Best Buy® Credit Cards offer deferred interest financing, allowing users to make purchases without paying interest for a set period.

Free Shipping: Enjoy free shipping on eligible purchases at Best Buy.

No Foreign Transaction Fees: When traveling abroad, you won’t incur any foreign transaction fees on your purchases.

Amazon Prime Visa

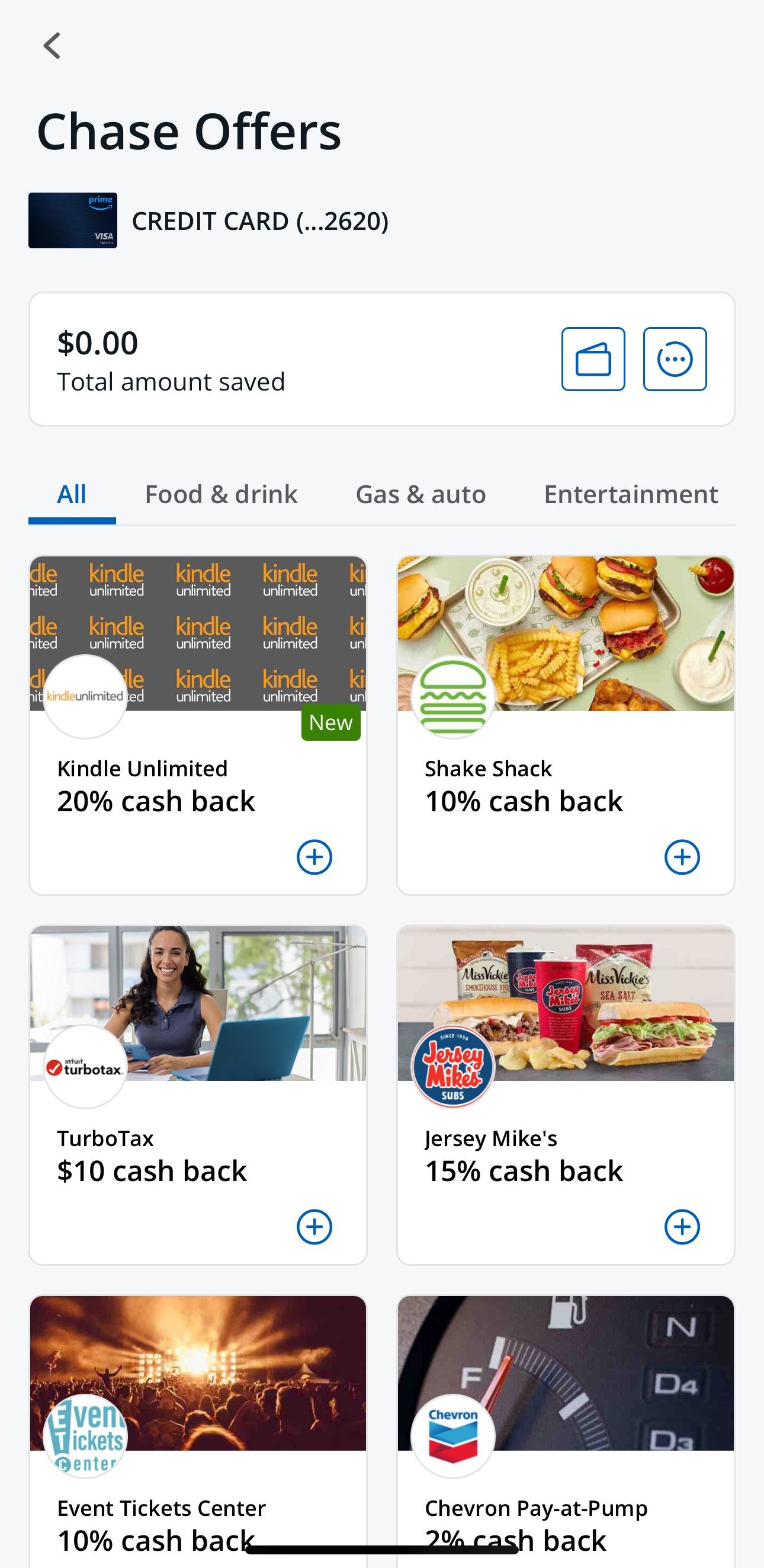

- Prime Card Bonus: Earn an impressive 10% back or more on select products, sweetening the deal for Amazon Prime members and making the card particularly rewarding for frequent shoppers.

Baggage Delay Insurance: In the unfortunate event of delayed baggage, this benefit helps cover essential expenses, ensuring a smoother travel experience.

Extended Warranty Protection: Purchases made with the card often receive extended warranty protection, providing added coverage beyond the manufacturer's warranty.

Lost Luggage Reimbursement: Should your luggage go astray during travel, the card offers reimbursement for essential items, alleviating the inconvenience of lost belongings.

Roadside Dispatch®: The card includes access to a 24/7 roadside assistance hotline, offering services like towing, tire changes, and more in case of vehicle breakdowns.

Travel Accident Insurance: Cardholders enjoy travel accident insurance, providing financial coverage in the event of accidental death or dismemberment while traveling.

Travel and Emergency Assistance: This feature offers access to a range of emergency services while traveling, providing support in unforeseen situations.

Purchase Protection: The card provides protection against damage or theft for eligible purchases made with the card, enhancing the security of your acquisitions.

When You Might Prefer The Prime Visa Card?

Here are some reasons why you might prefer the Amazon Prime Visa Card over the My Best Buy Visa Card:

- You Buy Frequently On Amazon: The Prime Visas Card offers 5% back on Amazon.com and Whole Foods purchases, which is a great benefit if you have an Amazon Prime membership and you freuqnely buy on Amazon

- If you prefer a more versatile rewards card: the Prime Visas Card can be used at a wider variety of stores than the My Best Buy Visa Card. This makes it a more versatile rewards card.

- You Want Travel Insurance Benefits: The Prime Visa Card provides various travel-related benefits, such as travel accident insurance, roadside assistance, and baggage delay insurance, making it suitable for individuals who value these perks for their travels.

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Prefer The Best Buy Visa Card?

Here are some reasons why you might prefer the My Best Buy Visa Card over the Prime Visa Card:

- You Frequently Shop at Best Buy: The My Best Buy Visa Card offers 5% cash back on eligible Best Buy purchases. This makes it a good choice if you are a regular Best Buy shopper.

- You Want to Finance a Large Purchase: The My Best Buy Visa Card offers financing options for a variety of products. This can be helpful if you are financing a large purchase, such as a new TV or appliance.

- In-Store Shopping: If you prefer shopping in physical stores rather than online, the My Best Buy Visa Card may be more appealing as it caters to in-store purchases at Best Buy and offers specialized financing options.

Compare The Alternatives

If you're looking for a store credit card with great rewards for online shopping – there are some good alternatives you may want to consider:

|

|

| |

|---|---|---|---|

Costco Anywhere Visa® Card by Citi | Apple Credit Card | Sam's Club® Mastercard® | |

Annual Fee | $0 ($60 Costco membership fee required)

| $0

| $0 ($50/$110 for Club/Plus membership – MUST)

|

Rewards |

1-4%

4% cash back on on eligible gas and EV charging purchases for the first $7,000 per year and then 1% thereafter, 3% cash back on restaurants and most travel purchases, 2% cash back at Costco and Costco.com, 1% cash back on all other purchases

| 1% – 3%

3% cash back at Apple and select Apple pay partners. 3% Daily Cash back at Ace Hardware, Duane Reade, Exxon, Mobil, Nike, Panera Bread, T-Mobile, Uber, Uber Eats, and Walgreens. 2% on other Apple pay purchases, and 1% on all other purchases

|

1-5%

5% cash back on gas anywhere Mastercard is accepted (on the first $6,000 per year, then 1% after), 3% cash back on Sam’s Club purchases for Plus members, 3% on dining and takeout and 1% on all other purchases

|

Welcome bonus |

None

None

| N/A |

None

$30 statement credit after making $30 in Sam’s Club purchases within the first 30 days

|

Foreign Transaction Fee | $0

| $0 | N/A

|

Purchase APR | 19.24% – 27.24% (Variable)

| 15.99% – 26.99% Variable

| 20.40% or 28.40% Variable

|

Compare Amazon Prime Visa Card

The Amazon Prime Visa card offers high cashback for avid online shoppers. However, Costco is the winner when it comes to everyday spending.

If you're a geek of both Amazon and Apple and not sure which card is better for your needs, we think we can help – there is a clear winner.

While Target RedCard offers a less attractive cashback rewards ratio than Amazon, it still may be a better option for some. Let's compare

The BJ's One+ Mastercard wins if you focus on groceries, but Amazon's card extra shopping perks and insurance are better.

Both the Prime Visa and the Capital One Walmart card offer similar cashback rewards ratios.

Here's why Walmart is our winner: Prime Visa vs: Capital One Walmart Rewards

Compare My Best Buy Visa Card

The Apple Card offers high cashback on Apple products, while the Best Buy card wins when it comes to gas and BestBuy purchases. Let's compare.

Costco is a clear winner when it comes to rewards for everyday spending, but the Best Buy Card wins for gadget lovers. Here's our comparison.

My Best Buy Visa vs Costco Anywhere Visa Card: How They Compare?