Table of Content

Bank of America is one of the most well-known financial institutions in the country, offering a wide range of credit card options. In this review, we’ll focus on two of their popular cards: the Bank of America® Travel Rewards credit card and the Bank of America® Customized Cash Rewards credit card.

Each card has its own unique benefits, along with some similarities. Read on to see which one might be the right fit for you.

General Comparison

|

| |

|---|---|---|

Bank of America Customized Cash Rewards | Bank of America Travel Rewards | |

Annual Fee | $0 | $0 |

Rewards | 3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%) | 1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points |

Welcome bonus | $200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening. | 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases. |

0% Intro APR | 15 billing cycles for purchases, and for any balance transfers made within the first 60 days of opening your account., then 17.99% – 27.99% Variable APR on purchases and balance transfers

APR | 15 billing cycles on purchases and balance transfers, then 17.99% – 27.99% Variable

APR |

Foreign Transaction Fee | 3% | $0 |

Purchase APR | 17.99% – 27.99% Variable APR on purchases and balance transfers

| 17.99% – 27.99% Variable

|

Read Review | Read Review |

Compare Rewards: Which Card Gives More?

It can be a useful exercise to work out what the breakdown of rewards will be when using different types of cards and covering varying expenses. Here is a look at what these two Bank of America cards have to offer in terms of rewards:

|

| |

|---|---|---|

Spend Per Category | Bank of America Customized Cash Rewards | Bank of America Travel Rewards |

$15,000 – U.S Supermarkets | $210 ** | 22,500 points |

$3,000 – Restaurants

| $30 | 4,500 points |

$1,500 – Airline | $15 | 2,250 points |

$1,500 – Hotels | $15 | 2,250 points |

$4,000 – Gas | $120 * | 6,000 points |

Estimated Redemption Value | 1 point ~ 0.6 – 1 cent | |

Estimated Annual Value | $490 | $225 – $375 |

* 3% On Gas ** 2% On Supermarkets up to $6,000

As you can see, if you are looking at cards purely for the cash that you can get from them, then the Bank of America Cash Rewards card is going to be a better all-around fit. However, you can get more bang for your buck out of the travel rewards points if you use them as statement credit for the likes of dining and travel-related purchases.

However, keep in mind to adjust the numbers to your regular spending categories, which may be different – so the exact calculation depends on your personal habits.

Welcome Bonus And Fees

With the Bank of America Travel Rewards card, you will get 25,000 online bonus points after you make at least $1,000 in purchases in the first 90 days of account opening – which can be redeemed for a $250 statement credit toward travel purchases. For the cash rewards card, you will get $200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening.

Neither of these cards carries an annual fee or any foreign transaction charges. There is a balance transfer fee of 3% or $10 (the greater). Both of these cards also have 0% intro APR for 15 billing cycles on purchases and balance transfers. After this time period has elapsed, then you will be looking at variable APR rates of 17.99% – 27.99% Variable .

Compare Perks

As well as the standard features that come with a lot of credit cards for good credit, there are also some types of features that stand out when you are dealing with certain issuers of these cards. Here are the similar perks between these two Bank of America credit cards, as well as any features that are unique to a given card.

Here are the additional benefits you'll get on both cards:

Overdraft Protection: You can get overdraft protection for both of these card types. You need to activate this option and need to link your Bank of America checking account.

Digital Wallet: You are able to link these cards to your mobile device and use the likes of Apple Pay and Google Play in-store.

FICO Score: You will be able to opt-in to get access to your FICO Score on a monthly basis.

Alerts on the Account: You can set up alerts that will inform you of upcoming due dates and your card balance.

Unique Perks

Bank of America Customized Cash Rewards

Extra Bonuses Available: If you have significant account balances in your Bank of America investment account or bank account, then you can get access to better cashback rates.

Bank of America Travel Rewards

Points-Based System: You will earn cashback points with this type of card as it is related to travel, as opposed to cash rewards.

Preferred Rewards Bonus: If you are a member of the Preferred Rewards program to Bank of America, you can get bonuses to your cashback of between 25% and 75%.

Cash back: The Bank of America Cash Rewards offers pure cash back and considered as one of the best cash back with no annual fee.

Compare The Drawbacks

Bank of America Customized Cash Rewards

- Caps on Rewards

There are caps in place on your earning of premium cashback rates.

- Excluded Supermarkets

The definitions of grocery stores is a bit up in the air, as the Bank of America Cash Rewards card will often not give you cashback when making purchases at certain multiple-category stores like Target and Walmart, as well as the likes of convenience stores.

Bank of America Travel Rewards

- Lack of Premium Travel Benefits

For a travel-related card, it was surprising to see that cardholders do not get access to the likes of complimentary lounges, free checked bags, and certain flight upgrades.

- Modest Rewards Rate

When compared to competing travel-related cards, the rewards with the Bank of America Travel Rewards are quite modest.

Top Offers

Top Offers

Top Offers From Our Partners

Compare Redemption Options

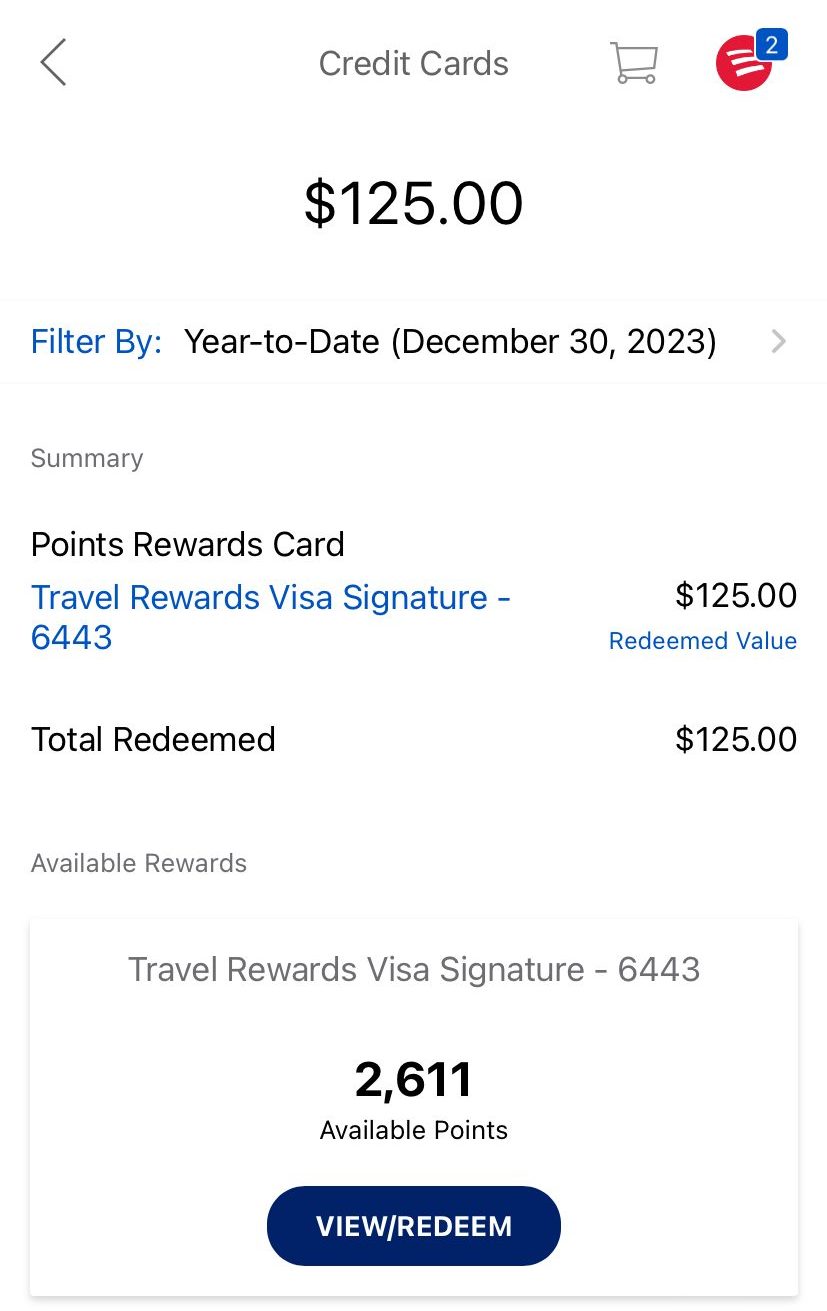

With the Bank of America Travel Rewards card, you will be able to earn 1.5 points for every $1 you spend on all purchases everywhere, every time and no expiration on points. There is no limit on the number of miles that you can earn and there is also no expiry. You are able to redeem these points as statement credit to pay for the likes of travel and dining purchases.

If you use these points as statement credit for these types of purchases, it works out as each point being worth $0.012. You can redeem the points for cash rewards, which usually sees each point being worth $0.006 each. Finally, you can get gift cards in exchange for these points, with the redemption rate varying depending on the gift card.

You can also donate your credit card points to charity with Bank of America through their portal, where you can choose your preferred charity organization..

How to Maximize Cards Benefits?

If you want to make the best use of your Cash Rewards card, there are some tips to help you:

Hit the Quarterly Cap: To get the most out of the premium cashback reward rates, you should make sure to hit the quarterly cap on purchases each month.

Be Aware of Exclusions: There are certain major grocery stores that are excluded from getting the premium cashback rates.

Maximize the Signup Offer: You should make sure to get the most out of the signup offer before it expires.

If you want to make the best use of your Travel Rewards Card, there are some tips to help you:

Use the Points for Travel and Dining: to get the most value from your points, use them for travel and dining purchases as statement credits instead of redeeming them for cash.

Maximize the Signup Offer: Be sure to take full advantage of the sign-up offer before it expires.

Become a Bank of America Preferred Rewards Member: As a member, you can earn 25%-75% more on your cashback rewards.

Customer Reviews: Which Card Wins?

Bank of America has outlined thousands of real customer ratings for each of these card options on its website. Those who enjoy the card hail the travel-related rewards, while the negative reviews refer to quality of the redeeming options.

Those who enjoy this card talk about how it rewards people on purchases that they make the most. The negative reviews often relate dot the equality of customer service experience.

When You Might Want the Cash Rewards Card?

The Bank of America Cash Rewards Card is a good choice if you:

Want a Card for Everyday Spending: This card offers some great cashback rates on the types of purchases that you will be making on a regular basis.

Good Rewards: There is generally a good range of rewards on offer for you, including the signup bonus.

Cost-Effective: There is no annual fee with this card and you also get 0% intro APR for the first 15 months of having an account.

Top Offers

Top Offers From Our Partners

When You Might Want the Cash Travel Card?

The Bank of America Travel Rewards Card is a good choice if you:

Travel Often: You can use your points to get a good rate on your travel-related and dining purchases.

Don’t Spend Travel in Luxury: There are not too many luxury travel-related perks on offer with this card.

Want Something Simple: The way that you earn rewards through this card is very simple and straightforward, remaining the same rates of cashback for every type of purchase.

Compare The Alternatives

These two Bank of America cards have their own uses. The Bank of America Travel Rewards is naturally going to be better suited for travel-related purchases, while the Cash Rewards card is going to be a better fit for everyday purchases.

However, there are some alternatives that you should know as well before making a decision of what's best choice for you.

|

|

| |

|---|---|---|---|

Capital One Quicksilver Cash Rewards Credit Card | Blue Cash Preferred® Card from American Express | Chase Sapphire Preferred® Card | |

Annual Fee | $0

| $95 ($0 intro for the first year)

| $95

|

Rewards |

1.5% – 5%

5% percent cash back on hotels and rental cars booked through Capital One Travel and 1.5% cash back on all purchases everyday.

|

1-6%

6% cash back at U.S. supermarkets (up to $6,000 per year in purchases, then 1%) and selected U.S. streaming subscriptions, 3% cash back on transit

and U.S. gas stations, 1% cash back on other purchases

|

2X – 5X

5x total points on travel purchased through Chase Travel, 3x points on dining, online grocery purchases and select streaming services. 2x on other travel purchases. Plus, earn 1 point per dollar spent on all other purchases.

|

Welcome bonus |

Earn $300 in welcome bonuses. Enjoy a $100 credit to use towards flights, stays and rental cars booked through Capital One Travel during your first cardholder year. Plus, earn a $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening.

Earn $300 in welcome bonuses. Enjoy a $100 credit to use towards flights, stays and rental cars booked through Capital One Travel during your first cardholder year. Plus, earn a $200 cash bonus once you spend $500 on purchases within the first 3 months from account opening.

|

$250

$250 statement credit after you spend $3,000 in purchases on your new Card within the first 6 months

|

75,000 points

75,000 bonus points after you spend $5,000 on purchases in the first 3 months from account opening

|

Foreign Transaction Fee | $0 | 2.70% | $0

|

Purchase APR | 18.99% – 28.99% (Variable)

| 19.99%-28.99% Variable

| 19.74%–27.99% variable

|

FAQ

There is no limit in place as to how many rewards points you are able to earn when you are using the Bank of America Travel Rewards Card to make purchases.

The Bank of America Travel Rewards Card rewards points will not expire if you are keeping this account open and not considering closing it.

The main way in which you are able to redeem the rewards that you earned through the Bank of America Cash Rewards Card will be by redeeming them for cash, statement credit or gift card.

It is not very hard for you to get your hands on a Bank of America Cash Rewards Card. You just need to fill out the application and make sure that you fit the bill in terms of its requirements.

Compare BofA Customized Cash Rewards

The BofA Customized Cash Rewards is more flexible, but the Chase Unlimited card will drive more rewards and benefits. Here's why.

Bank of America Customized Cash Rewards vs Chase Freedom Unlimited

The BofA Customized Cash Rewards and the Chase Freedom Flex have many features in common, but there is a clear winner when comparing them.

Citi Custom Cash Card and the BofA Customized Cash Rewards have similar reward structures but some significant differences. How they compare?

Compare Bank of America Travel Rewards

The BofA Premium Rewards is the winner when it comes to travel benefits, but there are cases when you'll prefer the BofA Travel Rewards.

Bank of America Premium Rewards vs. Travel Rewards: Comparison

If you're looking for an basic travel card, the Discover it Miles is better on our opinion. Here are our thoughts – and a full comparison.

The Capital One Venture offers a better points rewards ratio and travel benefits than the BofA Travel rewards. Is it worth the annual fee?

BofA Travel Rewards vs. Capital One Venture Card: How They Compare?

Top Offers

Top Offers