The Marriott Bonvoy Bevy™ American Express® Card and the Marriott Bonvoy Boundless® Credit Card are two popular credit cards for travelers who love to stay at Marriott hotels.

Both cards offer valuable rewards and benefits, but there are some key differences to consider when choosing between the two.

General Comparison: Marriott Boundless vs. Bevy Card

The Marriott Bevy card has a higher annual fee than the Boundless card, but the extra cost comes with enhanced travel perks like Platinum Elite status, Priority Pass access, statement credits, and other added benefits.

In terms of points rewards and welcome bonuses, both cards offer similar terms and advantages.

|

| |

|---|---|---|

Marriott Bonvoy Boundless | Marriott Bonvoy Bevy | |

Annual Fee | $95 | $250 See Rates and Fees. |

Rewards | 6X points for every $1 spent at over 7,000 hotels participating in Marriott Bonvoy® with the Marriott Bonvoy Boundless® credit card. Plus, earn up to 10X points from Marriott for being a Marriott Bonvoy® member. Plus, earn up to 1X point from Marriott with Silver Elite Status. Earn 3X points for every $1 on the first $6,000 spent in combined purchases each year on grocery stores, gas stations, and dining. Earn 2X points for every $1 you spend on all other purchases. | 6X points on purchases at hotels participating in Marriott Bonvoy, 4X points at restaurants worldwide (including takeout and delivery in the U.S.) and U.S. supermarkets (up to $15,000 in combined purchases per year, then 2X points), 2X points on all other purchases. Terms Apply. |

Welcome bonus | Earn 3 Free Night Awards

after spending $3,000 on eligible purchases within 3 months of account opening.* Each Free Night Award valued up to 50,000 points – that's a total value of up to 150,000 points! Certain hotels have resort fees. | Earn 155,000 Marriott Bonvoy® bonus points after you use your new Card to make $5,000 in purchases within the first 6 months of Card Membership. |

0% Intro APR | N/A | N/A |

Foreign Transaction Fee | $0 | |

Purchase APR | 21.49%–28.49% variable | 20.24% – 29.24% Variable |

Read Review | Read Review |

Top Offers

Top Offers From Our Partners

Top Offers

Compare Rewards: Which Card Gives More?

Based on our evaluation, although the Marriott Bevy card carries a higher annual fee when compared to the Boundless card, the disparity in points rewards is relatively insignificant.

|

| |

|---|---|---|

Spend Per Category | Marriott Bonvoy Boundless | Marriott Bonvoy Bevy |

$10,000 – U.S Supermarkets | 22,000 points | 40,000 points |

$5,000 – Restaurants | 10,000 points | 20,000 points |

$6,000 – Hotels | 36,000 points | 36,000 points |

$8,000 – Airline

| 16,000 points | 16,000 points |

$4,000 – Gas | 8,000 points | 8,000 points |

Total Points | 92,000 points | 120,000 points |

* Marriot Boundless Card: 3X on the first $6,000 spent on supermarkets

Marriott cards let you accumulate and redeem points for complimentary stays at Marriott hotels, unique travel experiences, and exclusive events. Additionally, points can be transferred to airlines or utilized for car rentals, merchandise, or booking experiences through Marriott Moments.

Travel Benefits: Marriott Boundless vs. Bevy Card

There are some additional types of perks that you will see with both of these cards. The Bevy card offers a higher elite status as well as bonus points and free premium wi-fi.

Marriott Bonvoy Boundless

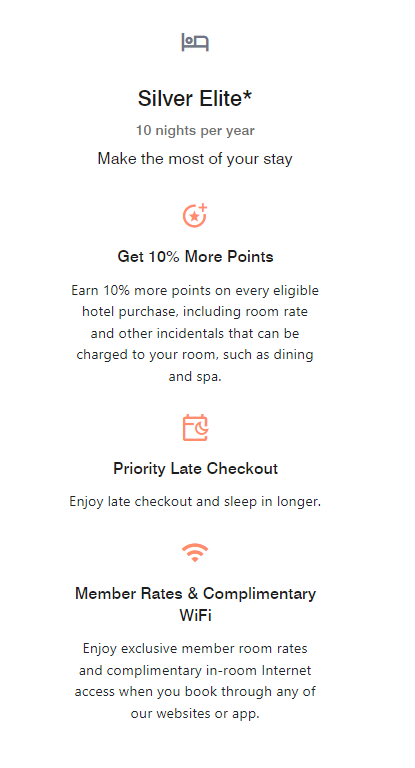

- Marriott Bonvoy Silver Elite Status:Enjoy Silver Elite Status automatically each account anniversary year as a cardmember.

Elevate Your Status: Earn 1 Elite Night Credit for every $5,000 spent, helping you achieve higher elite status.

15 Elite Night Credits: Receive 15 Elite Night Credits annually, contributing to your elite status. Some restrictions apply.

1 Free Night Award: The Boundless card offers a free night award after spending $35,000 in a calendar year.

Path to Gold Status: Spend $35,000 on purchases in a calendar year to progress towards Gold Status.

DoorDash: Receive one year of complimentary DashPass, granting unlimited deliveries with $0 delivery fees and reduced service fees on eligible order

- Visa Concierge: Enjoy complimentary 24/7 Visa Signature® Concierge Service, providing assistance with various tasks, including finding event tickets, making restaurant reservations, and helping you select the perfect gift.

Marriott Bonvoy Bevy

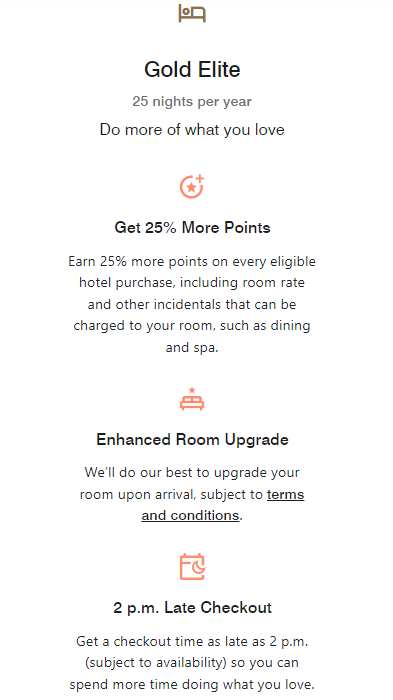

- Marriott Bonvoy Gold Elite: The Bevy card grants Gold Elite status,.

- 15 Elite Night Credits: With the Marriot Bevy card, you can earn 15 elite night credits each calendar year, helping you progress in Marriott Bonvoy Elite status.

- 1 Free Night Award: The Bevy card provides 1 free night award after spending $15,000 in a calendar year.

- 1,000 Bonus Points: Earn 1,000 bonus points for each eligible stay booked directly with Marriott using both cards.

- Amex Offers: Access Amex Offers to earn rewards on qualifying purchases directly through the AmericanExpress® App.

- Free Premium Wi-Fi: Enjoy complimentary in-room, premium Wi-Fi at participating Marriott Bonvoy hotels.

ShopRunner: ShopRunner offers complimentary membership to eligible cardholders, providing access to free 2-day shipping at over 100 online stores

Terms apply to American Express benefits and offers.

Insurance Benefits: Comparison

Both cards offer a variety of insurance benefits. Most of them are quite similar, but there are some differences in coverage between them.

Marriott Bonvoy Boundless

Baggage Delay Insurance: Reimburses up to $100 per day for essential purchases like toiletries and clothing when your baggage is delayed by a passenger carrier for more than 6 hours, up to a total of 5 days.

Lost Luggage Reimbursement: Provides coverage of up to $3,000 per passenger for damaged or lost luggage checked or carried on by you or an immediate family member when traveling.

Trip Delay Reimbursement: If your travel is delayed for more than 12 hours or requires an overnight stay, this benefit covers unreimbursed expenses like meals and lodging, up to $500 per ticket.

Purchase Protection: This protects your new purchases from damage or theft for 120 days, offering coverage up to $500 per claim, with a maximum of $50,000 per account.

Marriott Bonvoy Bevy

- Car Rental Loss and Damage Insurance: When you reserve and pay for a rental vehicle with your Eligible Card, declining the rental counter's collision damage waiver, you can be protected against damage or theft in specific regions, subject to certain exclusions and limitations.

- Baggage Insurance Plan: When you purchase a common carrier vehicle ticket with your Eligible Card, you can receive coverage for lost, damaged, or stolen baggage.

- Trip Cancellation and Interruption Insurance: Buying a round-trip with your Marriott Bonvoy Brilliant American Express Card can provide assistance in the event of trip cancellation or interruption, following the specified terms and conditions.

- Trip Delay Insurance: If your trip faces a delay of more than 6 hours due to a covered reason and you paid for the round-trip with your Eligible Card.

- Purchase Protection: Eligible purchases made with your card can be protected for up to 90 days from the purchase date, offering coverage for theft, accidental damage, or loss.

- Extended Warranty: When you use your Eligible Card for eligible purchases, you can receive an extra year of warranty coverage for warranties lasting 5 years or less in the United States or its territories.

- Cell Phone Protection: This embedded benefit provides reimbursement for repair or replacement costs after cell phone damage or theft.

Terms apply to American Express benefits and offers.

When You Might Want the Marriot Bonvoy Bevy?

You might prefer the Marriott Bonvoy Bevy card over the Marriott Bonvoy Boundless card if:

You want Gold Elite Status: The Brilliant card grants Gold Elite status, offering even more significant hotel perks and upgrades compared to the Silver Elite status provided by the Boundless card.

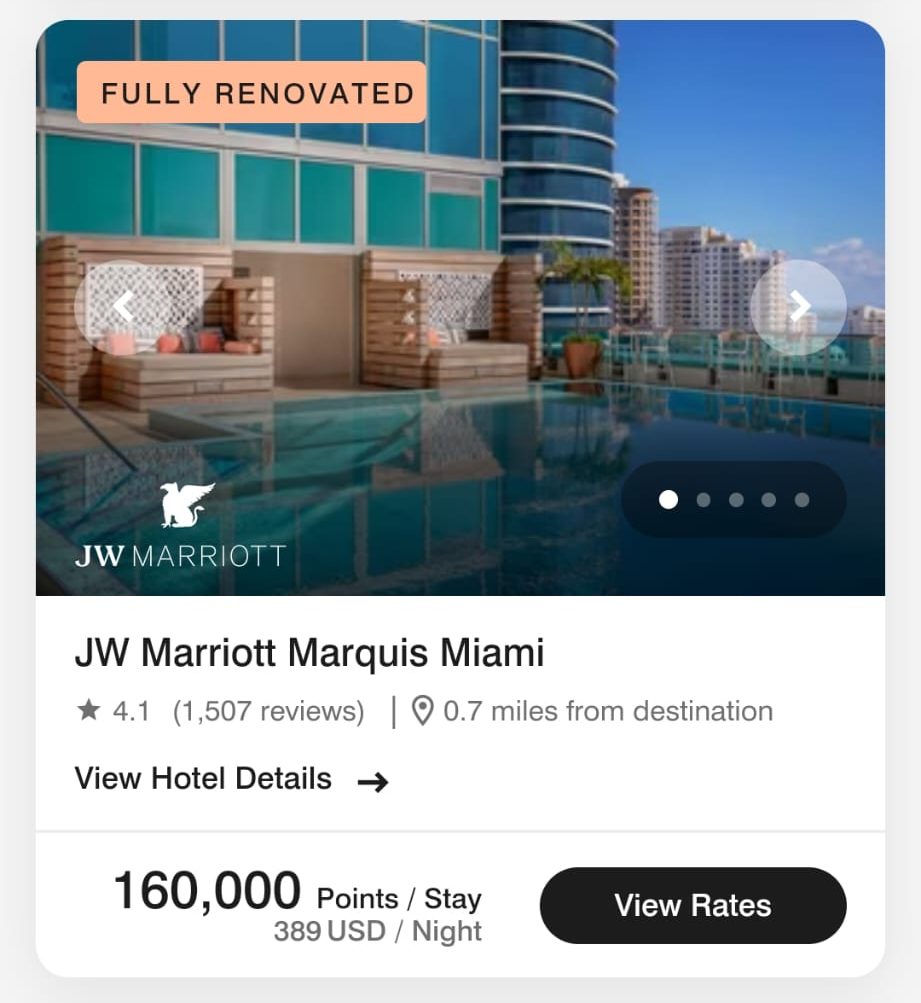

- Frequent Travelers: The Marriott Bonvoy Bevy card is an ideal choice for those who frequently stay at upscale Marriott properties. If you frequently seek premium accommodations and better points rewrads ratio, the Bevy card's higher annual fee may be justified.

- Everyday Spending: If you use your card for everyday spending, you can get much better rewards on supermarkets and groceries. While the Boundless card limit is $6,000 (combined with gas), the Bevy card offers high rewards ratio up to $15,000 (combined with restaurants).

Top Offers

Top Offers From Our Partners

Top Offers

When You Might Want the Marriot Bonvoy Boundless?

You might prefer the Marriott Bonvoy Boundless card over the Marriott Bonvoy Brilliant card in the following situations:

- You are on a budget: If you need and hotel card but cannot afford the $250 annual fee for the Bevy card, the Boundless card has a much lower annual fee of $95

- Solely Focused on Points: If your primary goal is to earn Marriott Bonvoy points through your everyday spending and you do not require the premium perks offered by the Bevy card, the Boundless card provides a straightforward way to accumulate points for future stays.

- Infrequent Marriott Guests: For travelers who stay at Marriott properties less frequently, the Boundless card may be a more suitable choice as it provides Marriott Bonvoy benefits without the need for an invitation or the higher commitment of the Bevy card.

Compare The Alternatives

If you're looking for a travel rewards credit card– there are some excellent alternatives you may want to consider:

| |||

|---|---|---|---|

The Platinum Card® from American Express | Chase Sapphire Reserve® | Capital One Venture X Rewards | |

Annual Fee | $695. See Rates & Fees | $550 | $395 |

Rewards |

1X – 5X

5X points on up to $500,000 spent on directly-booked airfare and flights and prepaid hotels booked through American Express Travel (per calendar year), 2X points on prepaid car rentals through American Express Travel and 1X points on all other purchases

|

1X – 10X

5X total points on air travel and 10X total points on hotels, car rentals and dining when you purchase through Chase Ultimate Rewards®, immediately after earning your $300 annual travel credit. Also, earn 3x points on dining at restaurants and travel (after meeting the $300 travel credit), then 1x points per dollar spent on all other purchases.

| 1X – 10X

10 miles per dollar on hotels and rental cars when booking via Capital One Travel, 5 miles per dollar on flights and 2 miles per dollar on all eligible purchases

|

Welcome bonus |

175,000 points

175,000 Membership Rewards® Points after spending $8,000 in eligible purchases on your new Card in your first 6 months of Membership

|

100,000 points + $500 Chase Travel℠ promo credit

100,000 points + $500 Chase Travel℠ promo credit After you spend $5,000 in purchases in the first 3 months from account opening

| 75,000 miles

75,000 bonus miles once you spend $4,000 on purchases within the first 3 months from account opening

|

Foreign Transaction Fee | $0. See Rates & Fees | $0 | $0

|

Purchase APR | See Pay Over Time APR | 21.99% – 28.99% variable APR | 19.99% – 29.74% (Variable) |

Compare Marriott Bonvoy Boundless Card

While there is no big difference when it comes to points rewards, the Brilliant offers lounge access, credit statements, and Platinum status.

In our opinion, the new Marriott Bountiful isn't worth the higher annual fee compared to the traditional Boundless card. Here's why.

Marriott Bonvoy Bountiful vs Boundless: Side By Side Comparison

The Marriott Boundless offers great perks for Marriot lovers, while the Preferred card wins when it comes to general travel-related rewards.

Marriott Bonvoy Boundless vs. Chase Sapphire Preferred: Comparison

The Hilton Amex Surpass is our winner as it offers higher estimated total cashback than the Marriot Boundless card and additional hotel perks.

Marriott Bonvoy Boundless vs. Hilton Amex Surpass: Side By Side Comparison

Both cards offer similar rewards ratio and hotel perks, so overall it comes down to which hotel chain you like better – IHG or Marriot?

IHG One Rewards Premier vs. Marriott Bonvoy Boundless: Side By Side Comparison

The World of Hyatt Card is our winner – it offers a significantly higher annual cash back for the average consumer than Marriott Boundless.

World of Hyatt Card vs. Marriott Bonvoy Boundless: Which Hotel Card Is Best?

Surprisingly, despite having no annual fee – the Wyndham Rewards Earner offers higher estimated cash back, which is why it's our winner.

Wyndham Rewards Earner vs. Marriott Bonvoy Boundless: Which Hotel Card Is Best?

Compare Marriott Bonvoy Bevy Card

The Brilliant is more expensive than the Bevy card but offers more premium perks such as dining credit, lounge access, and TSA PreCheck.

Both Marriott Bonvoy Bountiful and Bevy offer the same cashback rates but different hotel and travel perks. How do you decide between them?