Table Of Content

What is Capital One’s CreditWise?

CreditWise is a tool that allows users to monitor their VantageScore 3.0 credit score. Users are able to check their credit summary along with personalized details on the factors that may impact their score.

This could include the oldest credit line, how much available credit you have, and the percentage of your available credit you are using, and more. Furthermore, users may sign up for alerts to track when something meaningful on your TransUnion or Experian credit report changes.

In order for the website to provide you with updates on your credit score, CreditWise sources your credit information from your TransUnion credit report and then will be able to show your current VantageScore 3.0 credit score.

Similar to Chase Credit Journey and American Express’s MyCredit Journey, Capital One's CreditWise is completely free for consumers to use.

How to Enroll Capital One’s CreditWise?

It's easy and quick to join the Capital one Creditwise, here's how to make it:

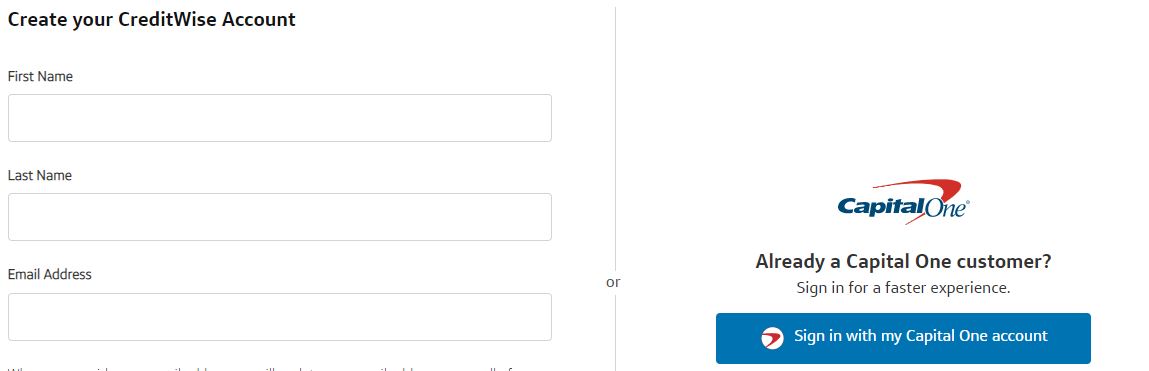

1. Create a CreditWise Account

The first step is to go to the website provided to start your account. You will need to provide your first and last name, and a valid email address. If you're a Capital One customer, you can sign in to your Capital One account to streamline the process.

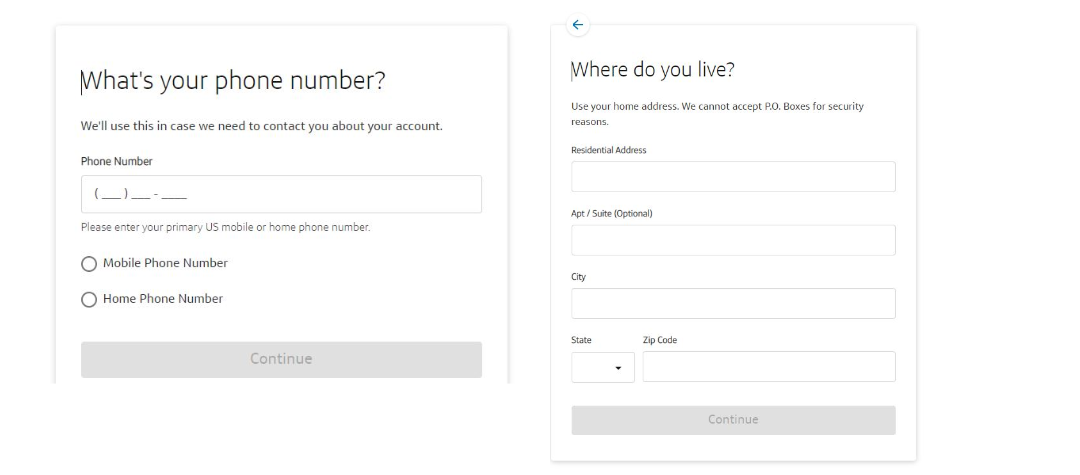

2. Provide Your Personal Details

- Provide Phone Number – You will then enter your primary US mobile or home phone number.

- Home Address – Provide your residential address, including city, state, and zip code. For security reasons, P.O. Boxes are not accepted.

- Verify Identity – Once you’ve completed the previous steps, you’ll need to input your birth date and social security number to verify your identity.

3. Review Terms And Confirm Identity

- Terms and Conditions – Before proceeding, make sure to check the box to confirm that you agree to the CreditWise Terms and Privacy Policy.

- Confirming Identity –After agreeing to the terms, you’ll need to verify your identity. This can be done by receiving a code sent to the phone number you provided earlier.

- Create Account – Once your identity is confirmed, you’ll need to create an account by selecting a username and password.

How To Use CreditWise?

In order to use the CreditWise website, you must first sign in with your account username and password. You do have the option to check the “remember me” box to make signing in easier the next time you go to sign in. Here are the main things you can do with your CreditWise account:

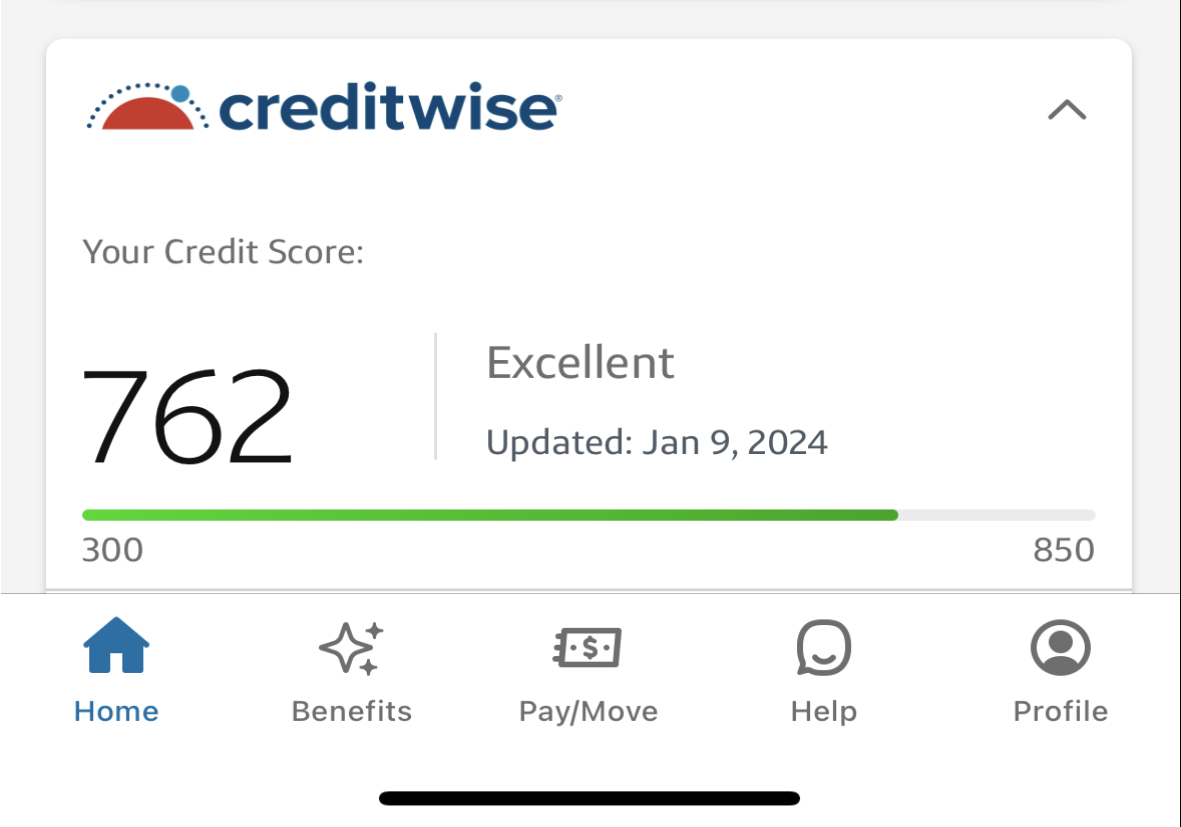

- Check your Vantage Score – Once signed in you should start by checking your Vantage Score. The score runs from 300 to 850, 300 being the lowest and 850 the highest.

- What affects your credit – If you are unsure why your score is where it is, you are able to scroll down to view what actually impacts your score. There are six total sections that impact your score: on-time payments, oldest credit line, credit used, recent inquiries, new accounts opened, and available credit.

- TransUnion Credit Report – After checking your Vantage Score, you are able to view your TransUnion Credit Report, which shows your recent report that includes the accounts and balances you currently have.

- Credit Simulator – Finally, the credit simulator allows users to see how everyday decisions may influence their credit score before they even make them to avoid mistakes that can hurt a score.

Does Capital One’s CreditWise Affect Credit Score?

The great news for potential users of CreditWise is that using CreditWise will not affect your credit score. Users are able to sign in as often as they want. T

his is due to the fact that using CreditWise is known as a soft inquiry to check your credit.

Is Capital One’s CreditWise Accurate?

CreditWise is an excellent free option to check your TransUnion credit report accurately. However, users should remember that CreditWise only updates once a week.

Capital One’s CreditWise Limitations

While CreditWise offers many different excellent features for users to use, there are a few limitations as well.

- Weekly Updates – One of the first limitations is that CreditWise only updates once a week. Because of this, if something major happens to your credit, you will not be notified until the following week.

- Official Credit Score – While CreditWise offers an insight to your credit score on a weekly basis, it is not an official score that may be used to qualify for a loan.

Should I Enroll in Capital One’s CreditWise?

Generally, there is no reason why not. It's free and having some valuable insights that can help you boost your score. Here are the main pros and cons we found:

Pros | Cons |

|---|---|

Free Credit Summary |

One Credit Bureau |

Credit Alerts |

Not FICO |

Dark Web Surveillance | |

- Credit Summary

User’s are able to check their credit score as often as they like to get weekly credit score updates.

They can look at details of factors that may impact their credit score, such as their oldest credit line, how much available credit you have, the percentage of your available credit you are using, and much more.

- Credit Alerts

Those who use CreditWise are able to have an alert created when something meaningful happens on their TransUnion or Experian credit report changes.

CreditWise will also create alerts for changes to public record, address or unemployment information on file with TransUnion and Experian.

- Dark Web Surveillance

A great feature offered by CreditWise is the surveillance of the dark web. It will continuously monitor if your email address or social security number shows up on the dark web.

- CreditWise Simulator

For those looking to boost their credit, or keep it where it is at, users are able to see how financial decisions are able to affect their credit.

- One Credit Bureau

Despite the low cost (free), there are a few limitations. First of all, CreditWise only gets their credit report and credit score from TransUnion.

- Not FICO

CreditWise uses a VantageScore 3.0 credit score, which is not typically the type of credit score that may be used to make lending decisions.

How To Reach Capital One’s CreditWise Customer Service

The easiest way to reach Capital One’s CreditWise customer service is through the phone number: 1-800-CAPITAL (1-800-227-4825). You must have an existing account with CreditWise in order to qualify for service.

FAQs

How to opt out of Capital One’s CreditWise

In order to cancel the CreditWise subscription, you will need to first log on to your Capital One CreditWise website. Once on the website, you will go to the menu section, and find a subscription. Select subscription and follow the prompts to cancel the subscription.

Does Capital One’s CreditWise count as a credit check

Most lenders will use Fico credit scores as opposed to a Vantage 3.0 Score. Because of this, it will be difficult for consumers to get approved for a loan using just a Vantage Score.

Can i get a full credit report from Capital One’s CreditWise

CreditWise allows users to get a full credit report.

What credit bureau does Capital One’s CreditWise use

CreditWise uses TransUnion Credit bureau to show your VantageScore 3.0 credit score.

How often does Capital One’s CreditWise update

CreditWise will update your credit report once a week.

Is CreditWise legitimate?

CreditWise is a legitimate site backed by Capital One to keep consumers updated on their credit reports and credit score.

is Capital One’s CreditWise safe to use

CreditWise is extremely safe to use as the service is backed by a major banking institution (Capital One) and has high safeguards in place.