Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- Anniversary Points

- Travel Benefits

- Limited Bonus Categories

- Annual Fee

Rewards Plan

Sign up Bonus

Our Rating

PROS

- Anniversary Points

- Travel Benefits

CONS

- Limited Bonus Categories

- Annual Fee

APR

19.99%–28.49% variable

Annual Fee

$99

0% Intro

N/A

Credit Requirements

Good - Excellent

- Our Verdict

- FAQ

The Southwest Rapid Rewards® Premier Credit Card is a great choice for frequent Southwest flyers. With a fair earning rate, the card allows you to accumulate Southwest Rapid Rewards points at a good pace.

The card offers 3X points on Southwest® purchases,2X on Rapid Rewards® hotel and car partners, local transit and commuting, including rideshare, internet, cable, phone services, and select streaming and 1X points on all other purchases.. All points earned using the card will also count towards earning the highly-desirable Companion Pass, which lets a friend fly with you for free for an entire year.

While the Southwest Rapid Rewards® Premier Credit Card can be a great option for frequent Southwest flyers, there are some drawbacks to consider. The card doesn't offer rewards on everyday spending and comes with an annual fee of $99. Additionally, as with other co-branded airline credit cards, the rewards can primarily be redeemed for airline benefits.

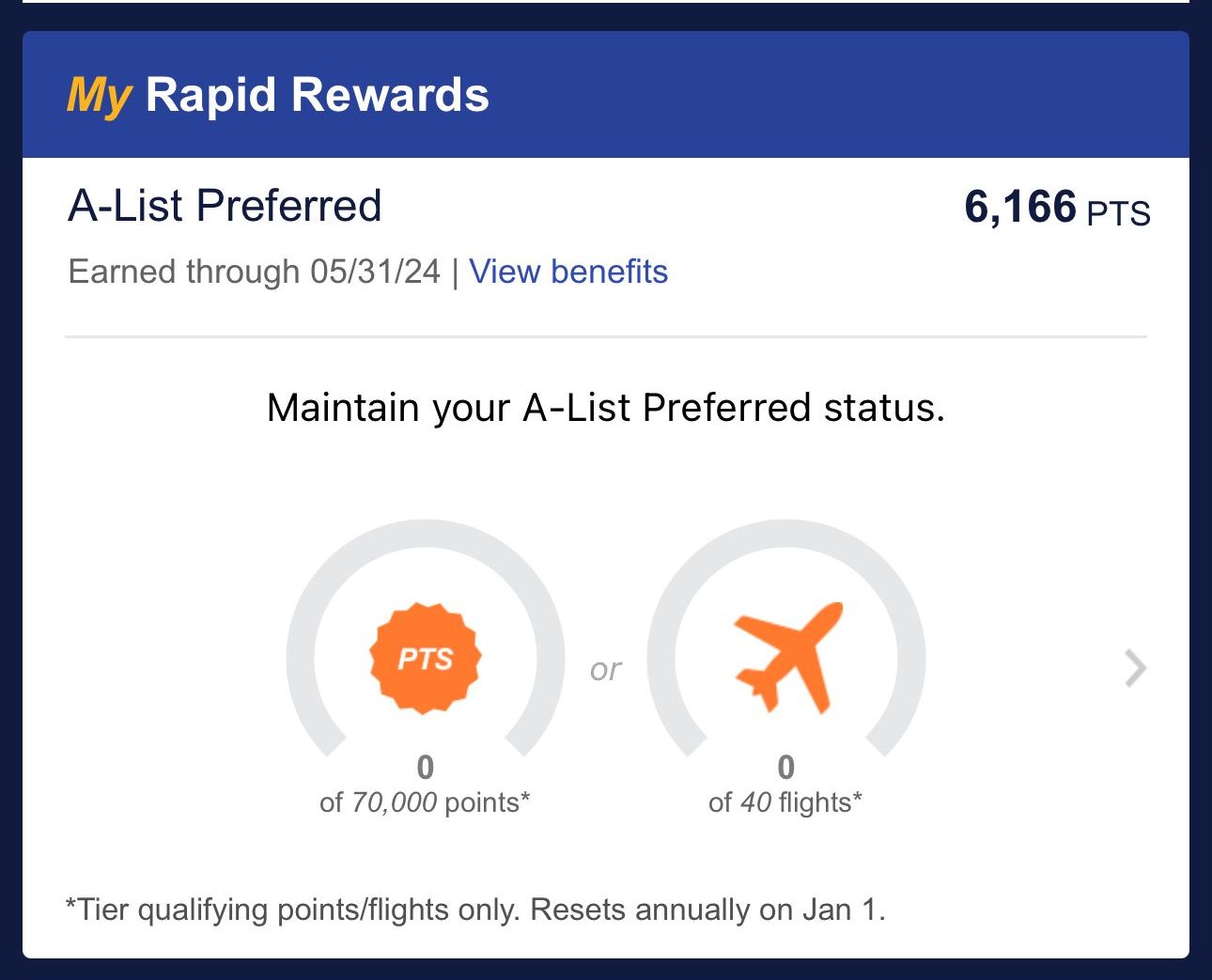

In addition to the standard benefits that come with every Southwest flight, such as free checked bags and no change fees, cardholders can enjoy unlimited tier qualifying points (TQPs), 6,000 anniversary points each year, no foreign transaction fee, and 2 EarlyBird Check-In® each year.

XX

In this Review

Estimating Your Rewards: A Practical Simulation

In the following table, you will find a simulation that provides an overview of the expected rewards for the Southwest Premier credit card.

This breakdown is based on both general usage and spending across various categories. By utilizing this table, you can gain a better understanding of the potential benefits that come with using this particular credit card.

It's important to note that the figures presented in this simulation are estimates, and actual rewards may vary depending on individual spending habits and other factors.

Spend Per Category | Southwest Rapid Rewards® Premier Credit Card |

$10,000 – U.S Supermarkets | 10,000 points |

$4,000 – Restaurants

| 4,000 points |

$5,000 – Airline | 15,000 points |

$3,000 – Hotels | 6,000 points |

$4,000 – Gas | 4,000 points |

Estimated Total Annual Points | 39,000 Points |

Pros and Cons

Just like any other credit card, the Southwest Rapid Rewards Premier has some advantages and disadvantages:

Pros | Cons |

|---|---|

Rewards Program | Limited Bonus Categories |

Sign-up Bonus | Southwest Co-branded |

Anniversary Points | Annual Fee |

Travel Benefits | Lacking International Routes |

Unlimited Tier Qualifying Points (TQPs) | |

25% Back On Inflight Purchases |

- Rewards Program

Southwest Rapid Rewards® Premier card offers 3X points on Southwest® purchases,2X on Rapid Rewards® hotel and car partners, local transit and commuting, including rideshare, internet, cable, phone services, and select streaming and 1X points on all other purchases..

- Sign-up Bonus

New cardholders can earn 100,000 bonus points after you spend $4,000 in the first 5 months from account opening.

- Unlimited Tier Qualifying Points (TQPs)

Cardholders earns 1,500 TQPs toward A-List status for every $10,000 spend.

- Anniversary Points

Cardholders receive 6,000 bonus points on their account anniversary.

- Travel Benefits

The card offers travel benefits, such as car rental loss and damage insurance, baggage insurance plan, and trip delay insurance.

- 25% Back On Inflight Purchases

Cardholders receive 25% back on inflight purchases.

- Limited Bonus Categories

While the card offers bonus points for Southwest purchases, it doesn't offer bonus points for popular spending categories like restaurants or gas stations.

- Southwest Co-branded

Like other Southwest cards, the Southwest Rapid Rewards Premier Credit Card is designed to provide benefits and rewards specific to Southwest Airlines.

Therefore, it is most useful for frequent Southwest flyers who can take advantage of these benefits. If you don't fly Southwest often, the card may not be as valuable to you.

- Annual Fee

The card charges an annual fee of $99.

- Lacking International Routes

Southwest Airlines offers many domestic destinations, but its international route network is more limited. This could create difficulty for some cardholders when trying to redeem their rewards.

Top Offers

Top Offers From Our Partners

Top Offers

How To Redeem My Points?

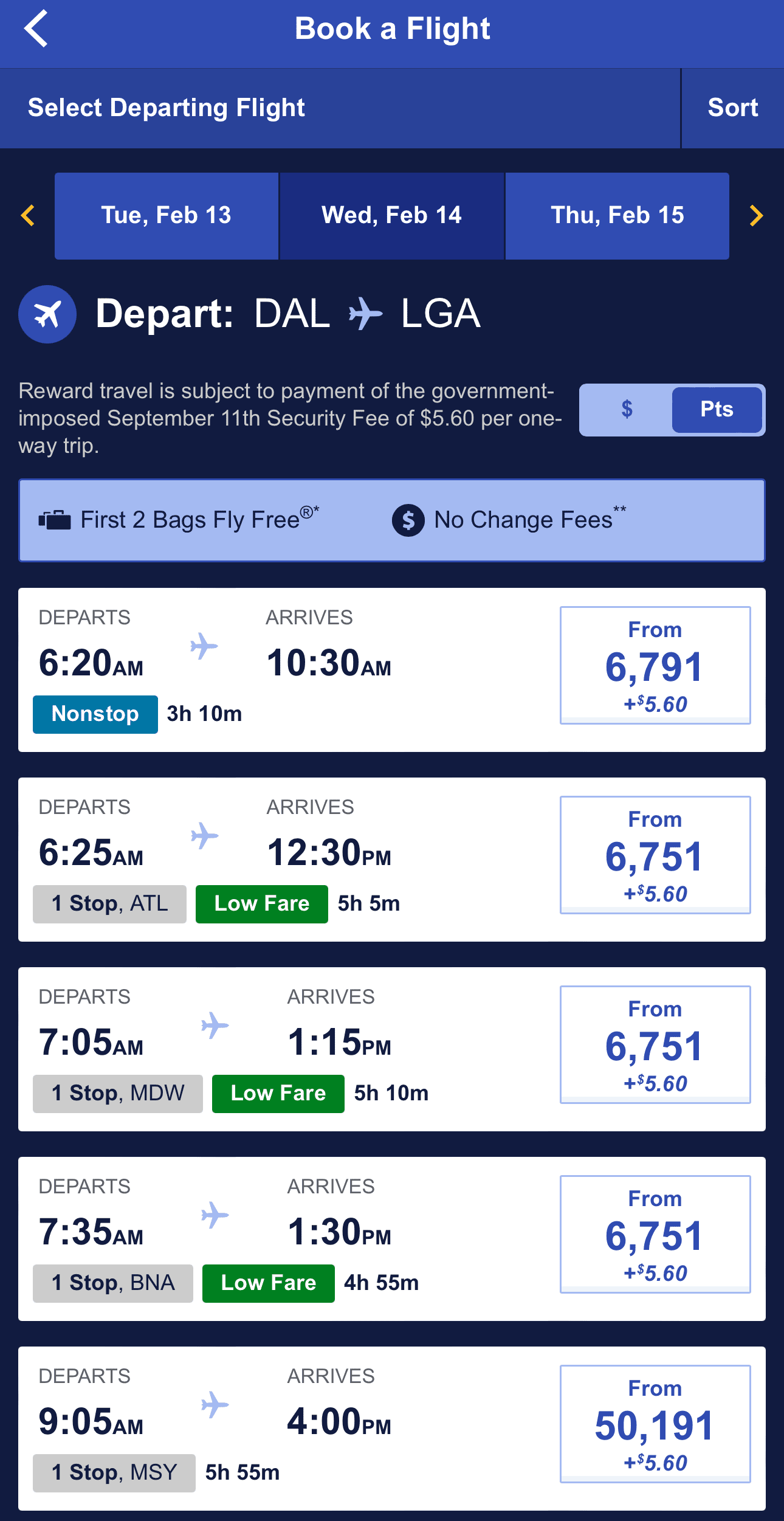

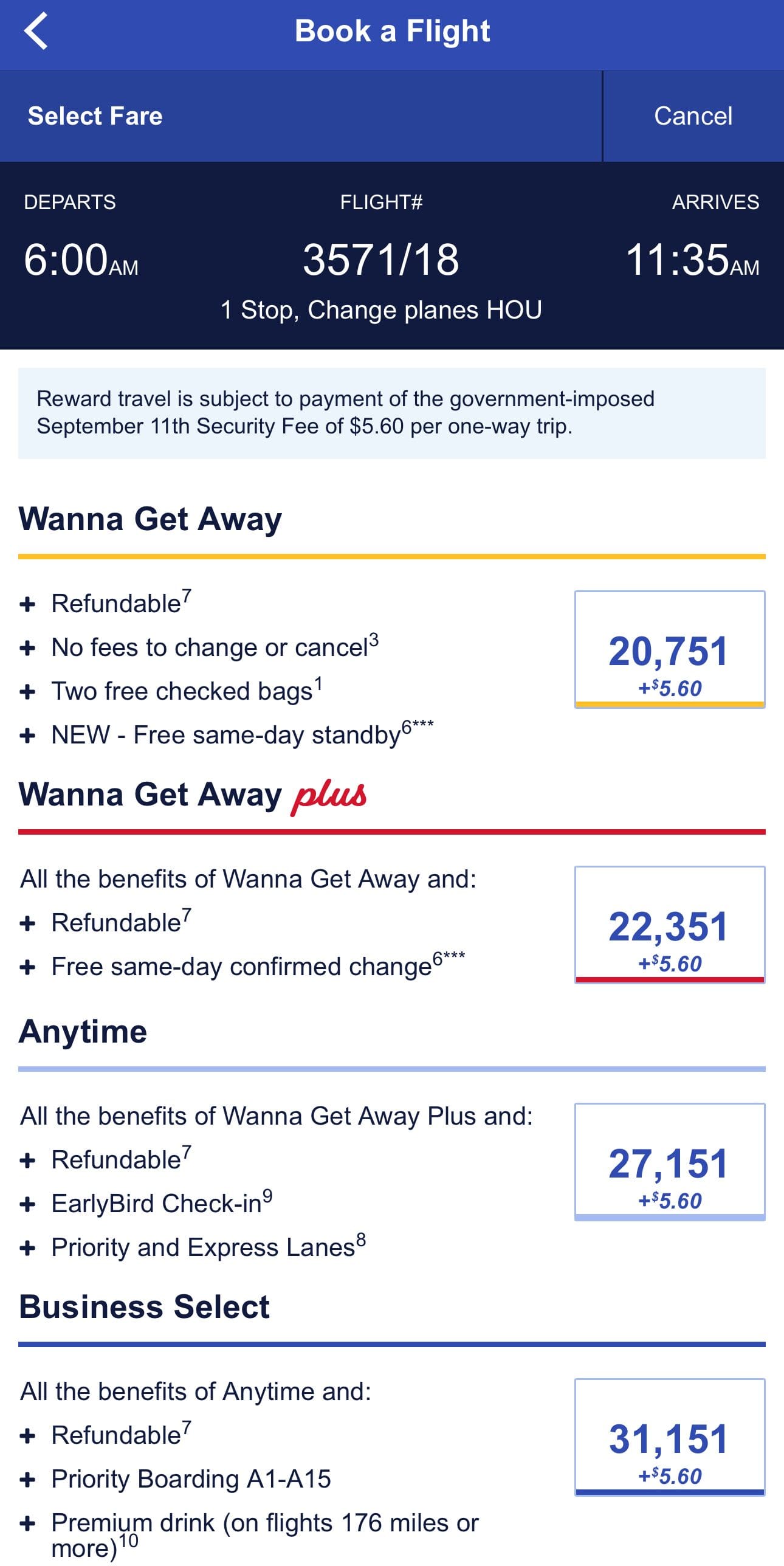

Redeeming your Southwest Rapid Rewards points is very straightforward compared to other programs. You don't have to worry about blackout dates or award availability. You can use your points to book any available seat on any flight. The number of points you need is directly linked to the cost of the ticket.

You can use your points to book international flights on partner airlines through the Southwest More Rewards program. This online portal offers a variety of options, including flights with non-Southwest airlines.

Unlike some other airlines that use distance-based award charts, Southwest bases its redemption rate on the cash price of the fare. This means that if the fare is more expensive, you’ll need more points to book it.

Southwest doesn't have a set redemption rate for their points, but usually, you can expect a value of around 1.4 cents per point for a Wanna Get Away Fare. However, the number of points required can vary slightly based on the route and whether you're traveling during peak or off-peak periods.

Southwest credit card holders can also use their points to exchange for gift cards to popular restaurants, department stores, retailers and more via the Southwest More Rewards portal. However, the redemption rates for these options tend to be poor, typically costing 15,000 points for a $100 gift card, which equals a value of 0.6 cents per point.

Buying physical items on the Southwest More Rewards platform using Rapid Rewards points is generally not recommended, as it tends to provide poor value. Items like electronics, home and garden tools, travel insurance, pet gifts, coffee, and sunglasses are not worth purchasing with points on this platform. It is better to redeem your points for Southwest flights or gift cards for better value.

When You May Want To Consider It?

Here are some situations when you may want to consider the Southwest Rapid Rewards® Priority Credit Card:

You use it only for airline purchases: if you have another card for everyday spending and you need another card for airline purchases, the Southwest Premier card can be a good option. If you plan to rely on this card as your primary card, it may not be a good idea to choose it.

- You usually fly domestic: Southwest international routes are limited. If you tend to fly domestic either for travel or business, this may be a right choice. If you tend to use internationally, United, Delta or American Airlines cards may offer better alternatives.

- You Prefer to Fly Southwest: If you fly with Southwest Airlines regularly, the Southwest Rapid Rewards® Premier Credit Card can help you earn rewards for your spending and enjoy a variety of travel-related benefits that can make your trips more comfortable and convenient.

Card | Rewards | Welcome Bonus | Annual Fee | |

|---|---|---|---|---|

Southwest Rapid Rewards Premier Credit Card | 1X – 3X

3X points on Southwest® purchases,2X on Rapid Rewards® hotel and car partners, local transit and commuting, including rideshare, internet, cable, phone services, and select streaming and 1X points on all other purchases.

| 100,000 Points

100,000 bonus points after you spend $4,000 in the first 5 months from account opening

| $99 | |

1x – 2x

2X points on Southwest purchases, Southwesthotel and car rental partners, local transit and commuting (including ride-shares),internet, cable, phone and select streaming services, and 1X points on all other purchases

| 100,000 points

Earn 100,000 bonus points after you spend $4,000 in the first 5 months from account opening

| $69 | ||

1X – 3X

3X points on Southwest purchases, 2X points on Southwest’s Rapid Rewards hotel and car rental partners, local transit and commuting (including rideshares) and internet, cable phone and select streaming services; 1X points on all other purchases

| 100,000 points

100,000 bonus points after you spend $4,000 in the first 5 months from account opening

| $149 | ||

Southwest Rapid Rewards Premier Business Credit Card | 1x – 4x

4X points on Southwest purchases, 3X points on participating hotel and rental car partners, 2X points on local transit, rideshares, commuting, 2X points on social media and search engine advertising as well as internet, cable and phone services; 1X points on all other purchases

| 80,000 points

80,000 points after you spend $5,000 on purchases in the first three months

| $199 | |

Southwest Rapid Rewards Performance Business | 1x – 4x

4X points on Southwest purchases, 3X points on participating hotel and rental car partners, 2X points on local transit, rideshares, commuting, 2X points on social media and search engine advertising as well as internet, cable and phone services; 1X points on all other purchases

| 80,000 points

80,000 points after you spend $5,000 on purchases in the first three months

| $199 |

How To Apply For The Southwest Premier Card?

Here's how you can apply for the Southwest Rapid Rewards® Premier Credit Card:

Go to the application page: Visit the Southwest Rapid Rewards® Premier Credit Card application page on the Chase website.

Fill out the application: Provide your personal information, including your name, address, and social security number, and answer questions about your income and employment status.

Review and submit: Read through the terms and conditions of the card to make sure you understand the terms. Once you've completed the application and reviewed the terms and conditions, submit your application online.

Wait for a decision: After you submit your application, Chase will review it and let you know if you've been approved or denied. If approved, you'll receive your new card in the mail within a week or two.

Note that you'll need to have a good to excellent credit score to be approved for the Southwest Rapid Rewards® Premier Credit Card. However, there are cases when you can get even if you fair credit score.

How It Compared To Other Southwest Cards?

Comparing the Southwest Rapid Rewards Premier Credit Card to other Southwest cards reveals distinct advantages and target audiences for each option.

The Southwest Rapid Rewards Premier Credit Card, with a $99 annual fee, stands out as a mid-tier choice. On the other hand, the Southwest Rapid Rewards Plus Credit Card, with a lower $69 annual fee, appeals to budget-conscious travelers. It lacks some Premier Card benefits, making it suitable for those who prioritize cost-effectiveness over additional perks.

For premium benefits and a higher annual fee of $149, the Southwest Rapid Rewards Priority Credit Card offers $75 in annual travel credit and up to four upgraded boardings, making it ideal for frequent travelers seeking enhanced privileges.

Overall, the Southwest Rapid Rewards Premier Credit Card, with its moderate annual fee and well-rounded benefits, seems geared towards a broad audience of Southwest enthusiasts.

Compare Southwest Rapid Rewards Premier

We think the Southwest Rapid Rewards Premier wins – it's cheaper and there is no significant difference in points rewards or airline perks.

Southwest Rapid Rewards Premier vs Priority: Side By Side Comparison

If you're a frequent flyer, the Premier card has the edge so that you can cover the annual fee difference. If not, the Plus card is enough.

Southwest Rapid Rewards Plus vs Premier: Side By Side Comparison

The AAdvantage Platinum Select and the Southwest Premier card share many common features.

Here's where each card shines: AAdvantage Platinum Select vs. Southwest Rapid Rewards Premier

The United Explorer and the Southwest Premier card have numerous shared features. Let's explore the distinctive strengths of each card.

Southwest Rapid Rewards Premier vs. United Explorer: Comparison

While the Southwest Premier card extra travel perks are better, the JetBlue Plus Card is our winner in this comparison. Here's why.

JetBlue Plus Card vs Southwest Rapid Rewards Premier: Side By Side Comparison

Both cards have similar annual cashback value and diverse airline benefits. While there is no clear winner, each card has its unique perks.

Frontier World Mastercard vs. Southwest Rapid Rewards Premier: Side By Side Comparison

Both Alaska and Southwest Premier have similar annual cashback values. While there is no clear winner, each card has its own unique perks.

Alaska Airlines Visa Signature vs Southwest Rapid Rewards Premier: Comparison

Related Posts

- Southwest Rapid Rewards Premier Business Credit Card

Top Offers

Top Offers From Our Partners

Top Offers

Review Airline Credit Cards

Delta SkyMiles Blue American Express