Rewards Plan

Sign up Bonus

Our Rating

0% Intro

Annual Fee

APR

- Membership benefits

- Fraud protection

- No Rewards & Sign Up Bonus

- Non-transferable debts

Rewards Plan

Sign up Bonus

Our Rating

PROS

- Impressive Credit Limit:

- Minimal Fees

CONS

- Limited Reporting

- No Instant Approval

APR

18.99%, 23.99%, or 28.99% Variable

Annual Fee

$0

0% Intro

15 months on purchases and qualifying balance transfers

Credit Requirements

Good - Excellent

Pros & Cons

Let’s take a closer look at the pros and cons of the Wells Fargo Active Cash Card:

Pros | Cons |

|---|---|

Unlimited Cashback | Need Wells Fargo Account |

Variety of Redemption Options | Foreign Transaction Fee |

0% APR Intro | Average Cashback Rate |

Visa Signature Perks | Limited Travel Redemption Options |

No Annual Fee | Balance Transfer Fees |

Cellphone Protection |

- Our Verdict

- FAQ

The Wells Fargo Active Cash Card stands out as one of the best flat rate cash back credit cards, offering a straightforward 2% cash back on all purchases without any limitations. The card's appeal lies in its simplicity, making it suitable for both primary and secondary card use.

The rewards program allows for unlimited 2% cash back on purchases, and new cardholders can earn a $200 cash rewards bonus when you spend $500 in purchases in the first 3 months. The introductory 0 percent APR for 15 months on purchases and qualifying balance transfers further adds to its attractiveness.

Cardholders have several options for redeeming their cash rewards, including statement credits, withdrawals from Wells Fargo ATMs, direct deposits, or choosing gift cards and travel through Wells Fargo Rewards. Additional perks include cellphone protection, Wells Fargo Deals rewards, and standard Visa Signature benefits.

However, for those who don’t spend much or are specifically looking for travel rewards, the rewards value may feel limited. There are other cards that offer higher cashback rates on specific bonus categories, which might be a better fit for some.

Does the card provide travel insurance benefits?

While it offers auto rental collision damage waiver coverage, it doesn't include extensive travel protections like some competitors.

Are there any restrictions on redeeming cash rewards at ATMs?

Rewards can be redeemed at Wells Fargo ATMs in $20 increments using a Wells Fargo ATM or debit card.

Can the card be used internationally?

Yes, it can be used globally; however, there is a foreign transaction fee.

What are the redemption options for cash rewards?

Rewards can be redeemed as statement credits, ATM withdrawals, direct deposits, or for gift cards or travel through Wells Fargo Rewards.

Can the cash rewards be used for travel?

Yes, cash rewards can be redeemed for travel through Wells Fargo Rewards.

How do I qualify for the intro APR on balance transfers?

Balance transfers made within 120 days from account opening qualify for the introductory APR.

- Unlimited Cashback

Wells Fargo Active Cash Card is a great choice for those who want to get a flat rate cash back rewards on all purchases.

This cashback is unlimited, unlike other cards that give you a cap and then a smaller amount of cash rewards.

- Variety of Redemption Options

The card offers diverse redemption options, including statement credits, ATM withdrawals, direct deposits, and travel or gift card options through Wells Fargo Rewards, providing flexibility in utilizing earned cash rewards.

- 0% APR Intro

You get 0% APR for 15 months on purchases and qualifying balance transfers. After that, the APR will be 18.99%, 23.99%, or 28.99% Variable , depends on your score and other factors.

This means you can save money on interest over the first year that you have the card. Make sure to pay down your balances before the APR starts after the introductory period.

- Visa Signature Perks

As a Visa Signature credit card, the Active Cash Card includes additional perks such as auto rental collision damage waiver coverage, Visa Signature Concierge service, and privileges at Luxury Hotel Collection properties, enhancing the overall cardholder experience.

- No Annual Fee

With no annual fee, the card is cost-effective, making it accessible for a wide range of users looking to maximize their cash back without incurring extra expenses.

- Cellphone Protection

Cardholders benefit from up to $600 per claim in cellphone protection against damage or theft when paying their monthly cellphone bill with the Active Cash Card, providing a practical perk for tech-savvy users.

- Need Wells Fargo Account

This card really only works if you have a Wells Fargo bank account. Otherwise, you won’t be able to use the ATM and the debit card options.

If you don’t have a Wells Fargo bank account, you have to use the statement credit option only which gives you much less flexibility.

- Foreign Transaction Fee

There’s also a 3% foreign transaction fee with this card which is unusual for credit cards.

If you travel often, you will definitely want to get another card because you don’t want to get charged every time you use the card in another country.

- Average Cashback Rate

There are also other cards on the market that earn more cashback if you are looking to maximize the cashback you can get.

Wells Fargo lacks bonus category cash back cards that complement the Active Cash Card's flat rate, limiting opportunities for users to enhance their rewards through a combination of cards.

- Limited Travel Redemption Options

Wells Fargo's travel rewards redemption options are limited compared to some competitors, potentially reducing the overall value for users seeking travel-related benefits.

- Balance Transfer Fees

Although the card offers a solid balance transfer option, users should be mindful of the intro 3% balance transfer fee for the first 120 days or $5 or 5% (the greater) after that, potentially affecting the cost-effectiveness of transferring balances.

Top Offers

Top Offers From Our Partners

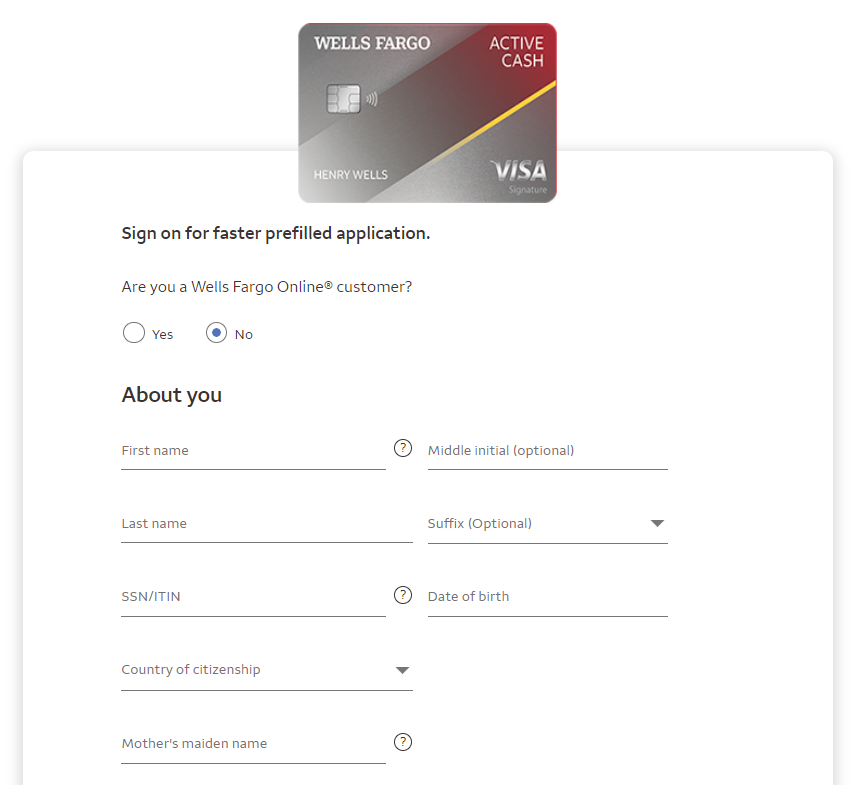

How To Apply?

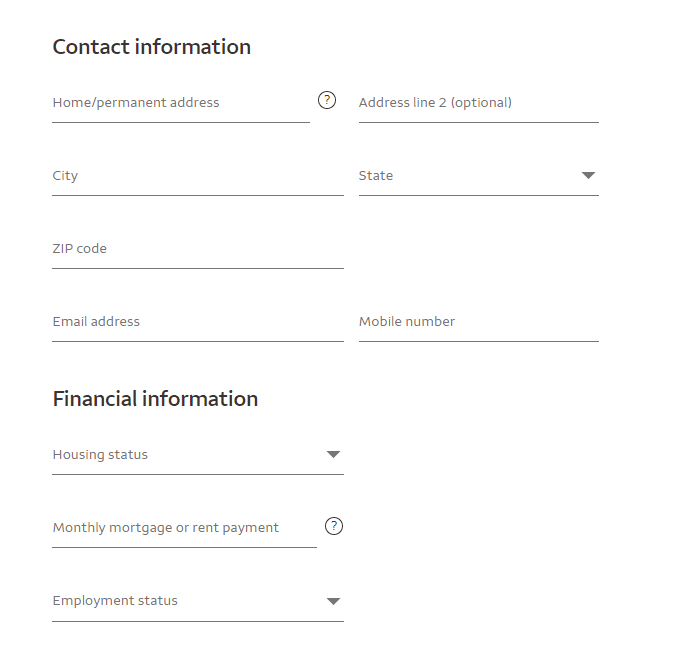

You will need to apply on the Wells Fargo website. The nice thing is that you need to fill out one single form.

Step 1: If you have a checking account or a savings account, you might be able to start the application quicker because your information will already be on file. If not, you will need to enter in all your personal information such as date of birth, address, phone number, email, and your full name.

Step 2: After putting in your basic information, it will ask for your social security number and other personal information such as income and proof of income. Make sure you have all these documents on file before starting the application to make the process much smoother.

Step 3: Now, you should review and approve the terms and conditions as well as additional important disclosures.

Wells Fargo Redemption Options

This card offers fewer redemption options compared to others, as you won’t be able to redeem points for travel or hotel stays like with many other cards. However, the good news is that no matter how you choose to redeem your points, you’ll get the same value. So, you can pick whatever option is most convenient for you.

A popular way to redeem the points is to get a statement credit. This lowers your balance that is due next time so you get some relief when it comes to payment. If you want cash right away, you can use the Wells Fargo ATMs and withdraw money in $20 increments.

If you have a Wells Fargo account, you can get a direct deposit into your checking or savings account. You can also get a mailed paper check if you aren’t in a rush to get the money.

How to Maximize Card Benefits?

As well as any other credit card, it's recommended to make the best to leverage the benefits as much as possible. Here are some tips to consider:

- Leverage 0% APR Intro: during this time, you don’t have an APR that you have to worry about paying back. You can payoff dent or fund a big purchase planned

- Get the sign-up bonus. There is a $200 sign-up bonus when you spend $1,000 in the first 3 months. If your budget requires you to spend $1,000 in 3 months, then make sure you are charging all your purchases to the credit card so that you can get the extra bonus.

- Make sure to use the freephone protection. Add the Wells Fargo card to your phone bill payment so that you get free cell phone insurance. Make sure it’s on auto-pay so get this benefit every month.

What Customers Think?

Satisfied customers love that there is no limit when it comes to the 2% cashback. Most other cards only give you 1% cashback after you have to spend a certain amount of money.

Of cashback is your only requirement when it comes to credit cards, this is a great choice for you. Users also love that the company credits your account as you make purchases and you don’t have to wait for the end of the month like you do with reimbursements.

The main complaint is that the only reward with this card is the cashback. There are no points or miles you can redeem like other cards. This is great for some, but less than ideal for those who want a card to give them travel and other perks.

When You Should Consider It?

You should consider this card if you want a flat-rate credit card with straightforward rewards. You don’t have to worry about redemption ratios or try to decide the best way to spend the points and miles you get from the cards.

You should also consider this card if you want to have another card to use in addition to the other cards you have. Combining the rewards will be very lucrative.

When It's Better To Skip?

You should skip this card if you want a card with many different redemption options such as being able to get airline miles or free hotel perks when you travel. The Wells Fargo card is not the best choice for those looking for a travel card.

How It Compared To Other Wells Fargo Cards?

The Wells Fargo Active Cash Card is the ultimate choice for Wells Fargo customers who want a cash-back card. However, there are other options for travelers and renters.

The main competitor is the Wells Fargo Autograph Card, which focuses on bonus categories and travel benefits. The Autograph offers 3X points on restaurants, travel, gas stations, transit, popular streaming services, and phone plans. Also, earn 1X points on other purchases. Also, it offers 0% intro APR and no foreign transaction fees.

In contrast to the Wells Fargo Reflect℠ Card, which emphasizes a lengthy 0% intro APR, the Active Cash Card strikes a balance by providing both a competitive rewards structure and a 0% intro APR on purchases for 15 months. While the Reflect℠ Card is tailored for those focusing on managing debt or planning significant purchases, the Active Cash Card caters to users seeking ongoing cash back rewards without sacrificing introductory APR benefits.

The Bilt World Elite Mastercard by Wells Fargo is designed to cater to renters, offering a unique rewards program centered around rent payments. Cardholders can earn points on their monthly rent payments, providing an opportunity to accumulate rewards through a common and essential expense. It offer 3X points on dining, 2X points on travel and 1X points on rent payments without the transaction fees and other purchases.

Compared to the Choice Privileges® Mastercard by Wells Fargo, which is geared towards hotel stays, the Active Cash Card provides more versatility in reward redemption. While the Choice Privileges® Mastercard® excels in its specific hotel-related bonus categories, the Active Cash Card's cash rewards can be used for various purposes, offering greater flexibility.

Compare The Alternatives

There are more cards with no annual fee worth mentioning that provide a good alternative to the Active Cash card:

|

|

| |

|---|---|---|---|

Wells Fargo Active Cash℠ Card | Chase Freedom Unlimited® | Bank of America® Customized Cash Rewards credit card | |

Annual Fee | $0

| $0

| $0

|

Rewards |

2%

2% cash rewards on purchases (unlimited)

|

1.5% – 5%

5% cash back on travel booked through Chase Ultimate Rewards, 3% on dining (including takeout and eligible delivery), 3% on drugstore purchases, and 1.5% on all other purchases

|

1% – 5%

3% cash back in the category of your choice: gas, online shopping, dining, travel, drug stores, or home improvement/furnishings, 2% cash back at grocery stores and wholesale clubs and 1% cash back on all other purchases. The 3% and 2% cash back available on the first $2,500 in combined choice category/grocery store/wholesale club purchases each quarter (then 1%)

|

Welcome bonus |

$200

$200 cash rewards bonus when you spend $500 in purchases in the first 3 months

|

$200

Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening.

|

$200

$200 cash rewards bonus after making at least $1,000 in purchases in the first 90 days of your account opening

|

Foreign Transaction Fee | 3%

| 3%

| 3%

|

Purchase APR | 18.99%, 23.99%, or 28.99% Variable

| 18.74%–28.24% variable

| 17.99% – 27.99% Variable APR on purchases and balance transfers

|

FAQ

There is no cap in place as to how much you are able to earn when it comes to the cashback rewards that you can get through the Wells Fargo Active Cash Card.

No out and out income requirements are required when you are applying for a Wells Fargo Active Cash Card and normally you will not have to provide proof of income.

Yes, it offers rental insurance for cars if you pay for the full cost with this credit card and you decline the rental company’s insurance. Please review the terms and conditions before to make sure you're covered.

Yes, you can get pre-approval. This provides you with a greater level of flexibility and you do not have to initially subject yourself to a hard credit check

The credit limit for this type of credit card is usually at least $500. The exact limit will depend on your personal financial situation that you have outlined in your application.

You are able to redeem the rewards in numerous ways. This includes as statement credit, as cash, withdrawn at an ATM, or redeemed as a gift card. You can also use the rewards when paying through PayPal at an online checkout.

All purchases will earn you cashback when you are using the Wells Fargo Active Cash Card. This means that you will not have any categories of purchases that are excluded.

Perhaps you did not meet all of the requirements. You can ask the customer service team what you need to do to get accepted or you can look at other card options.

Compare Wells Fargo Active Cash

Wells Fargo has recently launched a new set of credit cards, and these two are at the top of the list. Which of them offers more and is it worth it?

When both cards offer the same flat rate cashback, we should see beyond it. Which card is better? Here's The Smart Investor full analysis.

Citi Double Cash vs Wells Fargo Active Cash: Which Card Wins?

The Wells Fargo Active Cash is best for cashback and everyday spending, while the Autograph is a clear winner when it comes to travel rewards.

Wells Fargo Active Cash vs. Autograph Card: How They Compare?

The Active Cash card offers flat-rate cashback, while the Unlimited card is the winner for travel. Here's a side-by-side comparison.

While the Quicksilver card offers unlimited flat-rate cashback rewards, the Active Cash card offers a higher cashback ratio. Let's compare.

While Discover it Cash Back offers higher cashback rewards for some categories, the Active Cash card is our winner. Here's why.

Discover it Cash Back vs Wells Fargo Active Cash: Side By Side Comparison

Top Offers

Top Offers From Our Partners

Review Cash Back Credit Cards

Chase Freedom Flex